444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States automotive air filters market represents a critical component of the nation’s automotive aftermarket and original equipment manufacturing sectors. This dynamic market encompasses various filtration technologies designed to protect vehicle engines and enhance cabin air quality for millions of American drivers. Market dynamics indicate robust growth driven by increasing vehicle registrations, stringent emission regulations, and growing consumer awareness about air quality and engine protection.

Technological advancement continues to reshape the automotive air filters landscape, with manufacturers developing innovative materials and designs to meet evolving performance standards. The market benefits from the expanding vehicle parc in the United States, which currently exceeds 280 million registered vehicles, creating substantial demand for replacement filters across passenger cars, commercial vehicles, and specialty automotive applications.

Regional distribution shows concentrated activity in major automotive manufacturing hubs, including Michigan, Ohio, Tennessee, and Texas, where both OEM production and aftermarket distribution networks maintain strong presence. The market experiences steady growth patterns with projected CAGR of 6.2% through the forecast period, supported by regulatory compliance requirements and increasing consumer focus on vehicle maintenance and air quality improvement.

The United States automotive air filters market refers to the comprehensive ecosystem of manufacturing, distribution, and sales of air filtration systems specifically designed for automotive applications within the American market. This market encompasses both engine air filters that protect internal combustion systems from contaminants and cabin air filters that ensure clean air circulation within vehicle interiors.

Market scope includes original equipment manufacturer (OEM) filters installed during vehicle production and aftermarket replacement filters sold through various retail channels. The market serves diverse vehicle categories, from passenger cars and light trucks to heavy-duty commercial vehicles and specialty automotive equipment, each requiring specific filtration performance characteristics.

Industry participants range from global automotive suppliers and filter manufacturers to regional distributors and local retailers, creating a complex supply chain that ensures widespread product availability across the United States. The market operates within regulatory frameworks established by environmental agencies and automotive industry standards organizations, driving continuous innovation in filtration technology and materials science.

Market leadership in the United States automotive air filters sector demonstrates strong competitive dynamics with established global players maintaining significant market presence alongside emerging technology innovators. The market benefits from consistent replacement demand cycles, typically ranging from 12,000 to 15,000 miles for engine air filters and 15,000 to 25,000 miles for cabin air filters, creating predictable revenue streams for industry participants.

Growth drivers include increasing vehicle miles traveled, which reached approximately 3.2 trillion miles annually, stringent emission control regulations, and rising consumer awareness about air quality impacts on health and vehicle performance. The market experiences particular strength in premium filter segments, where consumers increasingly invest in high-performance filtration solutions offering extended service intervals and superior protection capabilities.

Technology trends favor advanced filtration media, including synthetic materials, electrostatic filtration, and multi-layer designs that provide enhanced particle capture efficiency while maintaining optimal airflow characteristics. The market shows resilience against economic fluctuations due to the essential nature of air filter replacement in vehicle maintenance protocols and regulatory compliance requirements.

Market segmentation reveals distinct patterns across vehicle categories, with passenger car applications representing the largest volume segment while commercial vehicle filters command premium pricing due to specialized performance requirements. The following key insights characterize current market dynamics:

Regulatory compliance serves as a primary market driver, with federal and state environmental agencies implementing increasingly stringent emission control standards that require advanced air filtration systems. The Environmental Protection Agency’s emission regulations mandate specific filtration efficiency levels, creating consistent demand for compliant filter technologies across all vehicle categories.

Vehicle parc expansion continues driving market growth as American consumers maintain vehicles for longer periods, with average vehicle age reaching 12.2 years. This trend increases replacement filter demand while creating opportunities for premium aftermarket products that extend vehicle life and maintain optimal performance throughout extended ownership periods.

Consumer health awareness increasingly influences purchasing decisions, particularly for cabin air filters that directly impact passenger air quality. Growing understanding of airborne pollutants, allergens, and particulate matter drives demand for advanced filtration technologies capable of removing microscopic contaminants and improving interior air quality.

Technological advancement in filtration media and manufacturing processes enables development of superior products that offer enhanced performance, extended service life, and improved cost-effectiveness. Innovation in synthetic materials, pleating techniques, and multi-stage filtration systems creates competitive advantages and supports premium pricing strategies across market segments.

Price sensitivity among cost-conscious consumers creates challenges for premium filter manufacturers, particularly in economic downturns when vehicle owners may defer maintenance or choose lower-cost alternatives. This dynamic pressures profit margins and limits market expansion for high-performance filtration solutions despite their superior technical benefits.

Extended service intervals promoted by some vehicle manufacturers to reduce maintenance costs can negatively impact replacement filter demand frequency. While beneficial for consumers, longer service intervals reduce market volume and require manufacturers to focus on value-added features and premium positioning to maintain revenue growth.

Counterfeit products pose significant challenges to legitimate manufacturers, particularly in online marketplaces where substandard filters may be sold at artificially low prices. These products can damage vehicle engines and compromise air quality while undermining consumer confidence in aftermarket filtration solutions.

Supply chain complexities involving raw material sourcing, manufacturing logistics, and distribution networks create operational challenges and cost pressures. Fluctuating material costs, transportation expenses, and inventory management requirements impact profitability and market competitiveness across the industry.

Electric vehicle adoption creates new opportunities for cabin air filtration systems as EVs require sophisticated air quality management without traditional engine air filtration needs. This transition opens markets for specialized HVAC filtration solutions and creates differentiation opportunities for innovative manufacturers.

Smart filtration technologies incorporating sensors, monitoring systems, and connectivity features represent emerging opportunities for value-added products. These advanced systems can provide real-time filter condition monitoring, predictive maintenance alerts, and integration with vehicle telematics systems.

Subscription service models offer opportunities to create recurring revenue streams while providing convenience for consumers through automated filter replacement programs. These services can leverage data analytics to optimize replacement timing and enhance customer relationships through personalized maintenance solutions.

Commercial fleet expansion driven by e-commerce growth and logistics sector development creates substantial opportunities for specialized filtration solutions. Fleet operators prioritize vehicle uptime and maintenance efficiency, creating demand for premium filters that extend service intervals and reduce total cost of ownership.

Competitive intensity characterizes the United States automotive air filters market, with established global suppliers competing against regional manufacturers and private label brands. Market dynamics favor companies that can demonstrate superior filtration performance, cost-effectiveness, and reliable supply chain capabilities across diverse customer segments.

Innovation cycles drive continuous product development as manufacturers seek competitive advantages through advanced materials, improved designs, and enhanced performance characteristics. Research and development investments focus on extending filter life, improving efficiency ratings, and developing specialized solutions for emerging vehicle technologies.

Distribution evolution reflects changing consumer purchasing behaviors, with traditional automotive parts retailers competing against e-commerce platforms and direct-to-consumer sales channels. This shift requires manufacturers to adapt marketing strategies and distribution partnerships to reach customers across multiple touchpoints effectively.

Seasonal variations influence market demand patterns, with spring and fall periods typically showing increased filter replacement activity as consumers perform routine vehicle maintenance. Understanding these cyclical patterns enables manufacturers and retailers to optimize inventory management and promotional strategies for maximum market impact.

Primary research methodologies employed in analyzing the United States automotive air filters market include comprehensive surveys of industry participants, in-depth interviews with key stakeholders, and direct engagement with manufacturers, distributors, and end-users. This approach provides firsthand insights into market trends, competitive dynamics, and consumer preferences that shape industry development.

Secondary research encompasses analysis of industry publications, regulatory filings, patent databases, and trade association reports to establish comprehensive market understanding. Data sources include automotive industry statistics, environmental compliance documentation, and economic indicators that influence market performance and growth trajectories.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop accurate market forecasts and identify emerging opportunities. These methodologies account for various factors including economic conditions, regulatory changes, technological advancement, and consumer behavior patterns that impact market dynamics.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review panels, and market participant feedback. This comprehensive approach provides reliable market intelligence that supports strategic decision-making for industry participants and stakeholders across the automotive air filters value chain.

Geographic distribution of the United States automotive air filters market shows significant concentration in major automotive manufacturing regions, with the Midwest leading in both OEM and aftermarket activity. Michigan maintains the largest market share at approximately 16% due to its automotive industry concentration, followed by Ohio, Indiana, and Illinois forming a robust manufacturing corridor.

Southern states demonstrate rapid growth in automotive air filter demand, driven by expanding vehicle assembly operations and growing population centers. Tennessee, Kentucky, Alabama, and South Carolina benefit from foreign automotive manufacturer investments, creating substantial OEM filter demand while supporting regional aftermarket distribution networks.

Western markets show unique characteristics with California leading in premium filter adoption due to stringent environmental regulations and high consumer awareness of air quality issues. The state accounts for approximately 12% of national market activity despite representing a smaller percentage of vehicle manufacturing, indicating strong aftermarket demand and premium product preferences.

Texas represents a significant growth market with diverse automotive applications ranging from passenger vehicles to commercial trucks and specialty equipment. The state’s expanding population, robust economy, and extensive transportation networks support sustained market growth across all filter categories, with particular strength in heavy-duty commercial applications.

Market leadership in the United States automotive air filters sector features a combination of global automotive suppliers and specialized filtration companies, each leveraging distinct competitive advantages to serve diverse market segments. The competitive landscape demonstrates ongoing consolidation trends alongside emerging technology innovators.

Product segmentation within the United States automotive air filters market encompasses multiple categories based on application, technology, and vehicle type. Each segment demonstrates distinct characteristics in terms of performance requirements, pricing dynamics, and replacement cycles that influence market strategies and competitive positioning.

By Filter Type:

By Vehicle Category:

By Technology:

Engine air filters represent the largest market category by volume, driven by universal application across all internal combustion vehicles and relatively frequent replacement cycles. This segment shows steady growth with increasing adoption of high-efficiency filtration media that provide superior engine protection while maintaining optimal airflow characteristics essential for performance and fuel economy.

Cabin air filters demonstrate the fastest growth rate at approximately 8.5% annually, reflecting increased consumer awareness of interior air quality and health concerns. This segment benefits from growing understanding of allergen filtration, odor control, and particulate matter removal, driving demand for premium filtration solutions with activated carbon and multi-stage designs.

Performance filters constitute a specialized but profitable market segment serving automotive enthusiasts and racing applications. These products command premium pricing through superior airflow characteristics, reusable designs, and performance enhancement claims that appeal to consumers seeking maximum engine efficiency and power output.

Commercial vehicle filters show robust growth driven by expanding logistics and transportation sectors. Fleet operators prioritize total cost of ownership, creating demand for filters that extend service intervals, reduce maintenance downtime, and provide reliable protection under severe operating conditions including high mileage and harsh environmental exposures.

Manufacturers benefit from consistent replacement demand cycles that provide predictable revenue streams and opportunities for product innovation. The essential nature of air filtration in vehicle operation creates stable market conditions while regulatory requirements drive continuous technology advancement and premium product development opportunities.

Distributors and retailers enjoy attractive profit margins on air filter sales combined with high inventory turnover rates. These products serve as traffic drivers for automotive parts retailers while offering cross-selling opportunities for related maintenance items and services that enhance customer relationships and transaction values.

Vehicle owners gain significant benefits through improved engine protection, enhanced fuel economy, and better interior air quality. Quality air filters extend engine life, reduce maintenance costs, and provide health benefits through superior contaminant removal, creating strong value propositions that support premium pricing strategies.

Fleet operators achieve operational advantages through optimized maintenance schedules, reduced vehicle downtime, and improved total cost of ownership. Advanced filtration solutions enable extended service intervals while maintaining regulatory compliance and protecting valuable commercial vehicle assets from premature wear and contamination damage.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives increasingly influence automotive air filter development, with manufacturers investing in recyclable materials, reduced packaging, and environmentally responsible manufacturing processes. These trends align with broader automotive industry sustainability goals while appealing to environmentally conscious consumers who prioritize eco-friendly products.

Digital integration emerges as a significant trend with smart filters incorporating sensors and connectivity features that monitor filter condition, track replacement intervals, and integrate with vehicle telematics systems. This technology enables predictive maintenance scheduling and provides valuable data for optimizing filter performance and service timing.

Premium market expansion reflects growing consumer willingness to invest in high-performance filtration solutions that offer superior protection, extended service life, and enhanced air quality benefits. This trend supports margin improvement while driving innovation in advanced materials and multi-stage filtration designs.

E-commerce growth continues reshaping distribution channels as consumers increasingly purchase automotive filters online. According to MarkWide Research analysis, online sales now represent approximately 28% of aftermarket filter purchases, requiring manufacturers to adapt marketing strategies and distribution partnerships for digital channels.

Manufacturing expansion initiatives by major filter producers include new production facilities and capacity increases to serve growing market demand. Recent investments focus on advanced manufacturing technologies that improve product quality while reducing production costs and environmental impact through efficient resource utilization.

Strategic partnerships between filter manufacturers and automotive OEMs create opportunities for integrated filtration solutions and co-developed products that meet specific vehicle requirements. These collaborations enable customized filtration systems while providing manufacturers with direct access to OEM supply chains and technical specifications.

Technology acquisitions drive industry consolidation as larger companies acquire specialized filtration technology firms to expand product portfolios and technical capabilities. These transactions enable rapid market entry into emerging segments while providing acquired companies with resources for scaled production and global distribution.

Regulatory compliance developments include updated emission standards and air quality requirements that influence filter design specifications and performance criteria. Industry participants must continuously adapt products to meet evolving regulatory requirements while maintaining cost competitiveness and market accessibility.

Innovation investment should focus on developing next-generation filtration technologies that address emerging market needs including electric vehicle applications, smart connectivity features, and enhanced air quality management. Companies that successfully innovate in these areas will capture premium market segments and establish competitive advantages.

Distribution diversification becomes critical as consumer purchasing behaviors continue evolving toward digital channels. Manufacturers should develop comprehensive omnichannel strategies that serve traditional retail partners while building direct-to-consumer capabilities and optimizing e-commerce presence for maximum market reach.

Sustainability integration should become a core business strategy rather than an ancillary consideration, as environmental concerns increasingly influence consumer purchasing decisions and regulatory requirements. Companies that proactively address sustainability will benefit from enhanced brand reputation and market positioning.

Market segmentation strategies should recognize distinct consumer preferences across different vehicle categories and applications. Tailored product development and marketing approaches for passenger cars, commercial vehicles, and performance applications will optimize market penetration and customer satisfaction across diverse segments.

Market evolution over the next decade will be significantly influenced by the automotive industry’s transition toward electrification, autonomous vehicles, and connected car technologies. While traditional engine air filter demand may decline with electric vehicle adoption, opportunities will emerge in specialized cabin filtration and air quality management systems.

Growth projections indicate continued market expansion at approximately 6.2% CAGR through 2030, driven by vehicle parc growth, regulatory requirements, and increasing consumer awareness of air quality benefits. MWR data suggests that premium filter segments will outperform the overall market with growth rates exceeding 8% annually as consumers increasingly prioritize performance and health benefits.

Technology advancement will focus on smart filtration systems, advanced materials, and integrated air management solutions that provide superior performance while enabling predictive maintenance and connectivity features. These innovations will create new revenue streams and competitive differentiation opportunities for forward-thinking manufacturers.

Market consolidation trends are expected to continue as larger companies acquire specialized technology firms and regional manufacturers to expand capabilities and market reach. This consolidation will create more comprehensive product portfolios while potentially reducing competitive intensity in certain market segments.

The United States automotive air filters market demonstrates robust fundamentals supported by essential product characteristics, regulatory requirements, and growing consumer awareness of air quality benefits. Market dynamics favor companies that can successfully balance innovation with cost competitiveness while adapting to evolving distribution channels and consumer preferences.

Strategic success in this market requires comprehensive understanding of diverse customer segments, from cost-conscious consumers seeking reliable basic filtration to performance enthusiasts demanding premium solutions. Companies that develop targeted product portfolios and distribution strategies for these distinct segments will achieve optimal market penetration and profitability.

Future opportunities lie in embracing technological advancement, sustainability initiatives, and emerging market segments created by automotive industry evolution. While traditional applications will remain important, growth will increasingly come from innovative products that address new vehicle technologies and changing consumer expectations for air quality and convenience.

The market’s essential nature ensures continued demand while providing platforms for innovation and premium positioning. Success will depend on companies’ ability to adapt to changing market conditions while maintaining focus on core filtration performance and customer value creation across all market segments.

What is Automotive Air Filters?

Automotive air filters are components in vehicles that remove contaminants from the air entering the engine and cabin. They play a crucial role in maintaining engine performance and ensuring clean air for passengers.

What are the key players in the United States Automotive Air Filters Market?

Key players in the United States Automotive Air Filters Market include companies like ACDelco, Mann+Hummel, and K&N Engineering, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the United States Automotive Air Filters Market?

The growth of the United States Automotive Air Filters Market is driven by increasing vehicle production, rising consumer awareness about air quality, and the growing trend of vehicle maintenance. Additionally, advancements in filter technology are enhancing performance and efficiency.

What challenges does the United States Automotive Air Filters Market face?

The United States Automotive Air Filters Market faces challenges such as the increasing competition from aftermarket products and the need for regular maintenance. Additionally, fluctuating raw material prices can impact production costs.

What opportunities exist in the United States Automotive Air Filters Market?

Opportunities in the United States Automotive Air Filters Market include the growing demand for electric vehicles, which require specialized air filtration systems, and the potential for smart filters that monitor air quality. Furthermore, increasing regulations on emissions are driving innovation in filter technology.

What trends are shaping the United States Automotive Air Filters Market?

Trends in the United States Automotive Air Filters Market include the shift towards eco-friendly materials, the integration of advanced filtration technologies, and the rise of subscription-based filter replacement services. These trends are aimed at improving sustainability and enhancing user convenience.

United States Automotive Air Filters Market

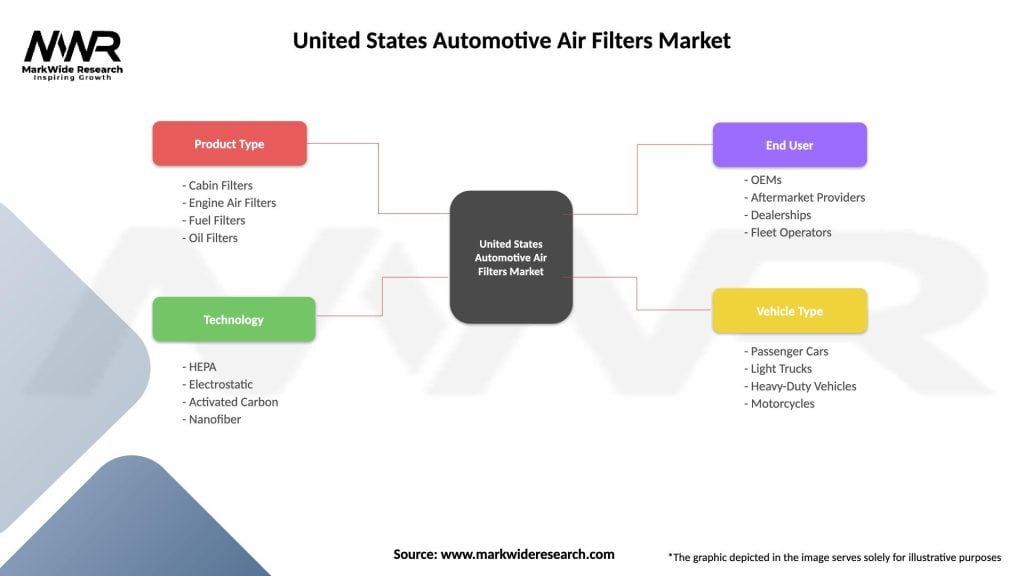

| Segmentation Details | Description |

|---|---|

| Product Type | Cabin Filters, Engine Air Filters, Fuel Filters, Oil Filters |

| Technology | HEPA, Electrostatic, Activated Carbon, Nanofiber |

| End User | OEMs, Aftermarket Providers, Dealerships, Fleet Operators |

| Vehicle Type | Passenger Cars, Light Trucks, Heavy-Duty Vehicles, Motorcycles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Automotive Air Filters Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at