444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States apparel logistics market represents a critical component of the nation’s retail infrastructure, encompassing the complex network of supply chain operations that move clothing and fashion products from manufacturers to consumers. This sophisticated ecosystem includes warehousing, distribution, inventory management, and last-mile delivery services specifically tailored to the unique demands of the fashion industry. Market dynamics indicate robust growth driven by e-commerce expansion, consumer demand for faster delivery, and the increasing complexity of omnichannel retail strategies.

Digital transformation has fundamentally reshaped apparel logistics operations, with companies investing heavily in automation, artificial intelligence, and advanced analytics to optimize their supply chains. The market experiences significant seasonal fluctuations, with peak demand periods during back-to-school seasons, holidays, and major fashion launches requiring sophisticated capacity planning and flexible logistics solutions. Growth rates in the sector have accelerated, with industry analysts projecting a compound annual growth rate of 8.2% through the forecast period.

Regional distribution patterns show concentrated activity in major metropolitan areas and coastal regions, where both consumer populations and port facilities create logistics hubs. The integration of sustainable practices has become increasingly important, with companies implementing green logistics initiatives to reduce environmental impact while maintaining operational efficiency. Technology adoption rates continue to climb, with approximately 73% of major apparel retailers implementing advanced warehouse management systems to enhance operational visibility and control.

The United States apparel logistics market refers to the comprehensive network of supply chain services, infrastructure, and technologies dedicated to the storage, handling, transportation, and distribution of clothing, footwear, and fashion accessories throughout the domestic market. This specialized logistics sector encompasses everything from raw material sourcing coordination to final consumer delivery, including warehousing operations, inventory management systems, order fulfillment processes, and reverse logistics for returns processing.

Core components of this market include third-party logistics providers specializing in fashion retail, dedicated apparel distribution centers, cross-docking facilities, and sophisticated inventory management systems designed to handle the unique challenges of seasonal merchandise, size variations, and style obsolescence. The market also encompasses technology solutions such as warehouse management systems, transportation management platforms, and demand forecasting tools specifically calibrated for apparel industry requirements.

Operational complexity distinguishes apparel logistics from general retail logistics due to factors such as seasonal demand volatility, extensive SKU proliferation, size and color variations, fashion trend sensitivity, and high return rates characteristic of online apparel sales. The market serves various stakeholders including fashion brands, retailers, e-commerce platforms, and consumers, facilitating the efficient flow of products through increasingly complex omnichannel distribution networks.

Strategic positioning within the United States apparel logistics market reveals a dynamic landscape characterized by rapid technological advancement, evolving consumer expectations, and increasing operational complexity. The market has experienced substantial transformation driven by e-commerce growth, with online apparel sales now representing a significant portion of total fashion retail activity. Digital integration has become essential, with companies leveraging advanced analytics, automation, and artificial intelligence to optimize operations and enhance customer satisfaction.

Key performance indicators demonstrate strong market momentum, with logistics efficiency improvements of approximately 34% over the past three years as companies implement next-generation technologies. The sector benefits from robust consumer spending on apparel and accessories, supported by demographic trends favoring convenience and speed in product delivery. Omnichannel strategies have emerged as critical differentiators, requiring sophisticated logistics capabilities to support seamless integration between online and offline retail channels.

Competitive dynamics feature both established logistics giants and specialized apparel-focused service providers competing on service quality, technology capabilities, and cost efficiency. Market consolidation trends have accelerated as companies seek to achieve scale advantages and expand service offerings. Investment patterns show significant capital allocation toward automation technologies, with warehouse robotics adoption increasing by 45% annually among major market participants.

Fundamental market insights reveal several critical trends shaping the United States apparel logistics landscape:

Technology adoption patterns indicate accelerating digital transformation across the sector, with cloud-based logistics platforms and mobile applications becoming standard operational tools. Market maturation has led to increased specialization, with service providers developing expertise in specific apparel categories or customer segments to differentiate their offerings.

Primary growth drivers propelling the United States apparel logistics market include the explosive expansion of e-commerce retail, which has fundamentally altered consumer shopping behaviors and expectations. Digital commerce now accounts for a substantial portion of apparel sales, requiring sophisticated logistics infrastructure to support direct-to-consumer fulfillment, rapid delivery, and efficient returns processing. The shift toward online shopping has accelerated significantly, creating unprecedented demand for specialized apparel logistics services.

Consumer behavior evolution represents another critical driver, with shoppers increasingly expecting fast, reliable, and convenient delivery options. The rise of same-day and next-day delivery expectations has compelled logistics providers to establish distributed fulfillment networks closer to major population centers. Omnichannel retail strategies have become essential, requiring logistics capabilities that seamlessly integrate online and offline inventory management, order fulfillment, and customer service.

Technological advancement serves as a fundamental catalyst, with innovations in warehouse automation, artificial intelligence, and data analytics enabling more efficient and cost-effective operations. Supply chain visibility has improved dramatically through IoT sensors, blockchain technology, and advanced tracking systems, allowing for better inventory management and customer communication. The integration of machine learning algorithms for demand forecasting has enhanced inventory optimization and reduced stockouts.

Market consolidation trends among apparel retailers have created opportunities for logistics providers to serve larger, more complex accounts requiring sophisticated service capabilities. Globalization effects continue influencing the market, with international sourcing patterns necessitating coordinated logistics solutions spanning multiple countries and transportation modes.

Operational challenges present significant constraints within the United States apparel logistics market, particularly the inherent complexity of managing seasonal demand fluctuations that can strain capacity and resources. Peak season management during holidays and back-to-school periods requires substantial temporary workforce scaling and facility expansion, creating cost pressures and operational inefficiencies. The unpredictable nature of fashion trends adds another layer of complexity, making demand forecasting particularly challenging.

Labor market constraints have emerged as persistent challenges, with warehouse and transportation worker shortages affecting service quality and operational costs. Wage inflation in logistics roles has pressured profit margins, while competition for skilled workers has intensified across the sector. The physical demands of apparel handling, including size sorting and quality inspection, require trained personnel that can be difficult to recruit and retain.

Infrastructure limitations in certain regions constrain market expansion, particularly in areas lacking adequate transportation networks or modern warehouse facilities. Real estate costs in prime logistics locations have increased substantially, making it challenging for companies to establish optimal distribution networks. Urban congestion and delivery restrictions in major metropolitan areas create additional operational complexities and cost pressures.

Regulatory compliance requirements, including labor regulations, environmental standards, and safety protocols, add operational complexity and costs. Return processing challenges associated with high online apparel return rates strain reverse logistics capabilities and impact profitability. The need for specialized handling of different fabric types and garment categories requires additional training and equipment investments.

Emerging opportunities within the United States apparel logistics market center on the continued expansion of e-commerce and the growing sophistication of consumer expectations. Technology integration presents substantial growth potential, with artificial intelligence, machine learning, and robotics offering pathways to enhanced operational efficiency and reduced costs. Companies investing in advanced automation technologies can achieve competitive advantages through improved accuracy, speed, and scalability.

Sustainability initiatives represent a significant opportunity area, as environmentally conscious consumers and corporate sustainability mandates drive demand for green logistics solutions. Carbon-neutral delivery options, sustainable packaging materials, and energy-efficient warehouse operations can differentiate service providers while addressing growing environmental concerns. The circular economy trend creates opportunities for enhanced reverse logistics and garment recycling services.

Geographic expansion opportunities exist in underserved markets and emerging metropolitan areas experiencing population and economic growth. Rural market penetration through innovative last-mile delivery solutions can unlock new customer segments while addressing the digital divide in retail access. The development of micro-fulfillment centers and local distribution hubs can improve service levels while reducing transportation costs.

Partnership opportunities with fashion brands, retailers, and technology companies can create integrated service offerings that address complex supply chain challenges. Data analytics services represent a growing opportunity, with logistics providers leveraging their operational data to offer valuable insights on consumer behavior, demand patterns, and inventory optimization to their clients.

Dynamic market forces shaping the United States apparel logistics landscape reflect the complex interplay between technological innovation, consumer behavior evolution, and competitive pressures. Digital transformation continues accelerating across the sector, with companies implementing sophisticated warehouse management systems, transportation optimization platforms, and customer communication tools to enhance operational efficiency and service quality.

Competitive intensity has increased significantly as traditional logistics providers compete with specialized apparel-focused companies and technology-enabled startups. Service differentiation has become crucial, with companies developing unique capabilities in areas such as same-day delivery, sustainable logistics, or specialized handling of luxury goods. The market rewards innovation and operational excellence while penalizing companies that fail to adapt to changing requirements.

Customer expectations continue evolving rapidly, with consumers demanding faster delivery, greater transparency, and more flexible return policies. Omnichannel integration has become table stakes, requiring logistics providers to seamlessly support multiple fulfillment channels while maintaining inventory accuracy and cost efficiency. According to MarkWide Research analysis, companies achieving superior omnichannel integration report 28% higher customer satisfaction rates.

Economic factors including fuel costs, labor rates, and real estate prices significantly impact operational costs and pricing strategies. Seasonal volatility remains a defining characteristic, with companies requiring flexible capacity management strategies to handle demand fluctuations efficiently. The integration of predictive analytics and demand sensing technologies helps companies better anticipate and respond to market dynamics.

Comprehensive research methodology employed in analyzing the United States apparel logistics market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, logistics managers, technology providers, and retail professionals to gather firsthand insights on market trends, challenges, and opportunities. Survey methodologies capture quantitative data on operational metrics, technology adoption rates, and performance indicators.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, and trade association publications to establish market context and validate primary findings. Data triangulation techniques ensure consistency across multiple information sources while identifying potential discrepancies or biases in individual data sets. Market sizing methodologies utilize bottom-up and top-down approaches to establish comprehensive market scope and segmentation.

Analytical frameworks include competitive landscape mapping, SWOT analysis, and market dynamics assessment to provide strategic context for market participants. Technology assessment methodologies evaluate the impact of emerging technologies on operational efficiency, cost structures, and competitive positioning. Trend analysis techniques identify patterns in consumer behavior, regulatory changes, and technological advancement that influence market evolution.

Quality assurance processes include peer review, expert validation, and cross-referencing with established industry benchmarks to ensure research accuracy and reliability. Continuous monitoring of market developments ensures research findings remain current and relevant to market participants and stakeholders.

Regional market distribution across the United States reveals distinct patterns influenced by population density, economic activity, and infrastructure development. West Coast markets including California, Washington, and Oregon represent approximately 32% of total market activity, driven by major metropolitan areas, port facilities, and high concentrations of technology companies and fashion retailers. The region benefits from proximity to Asian manufacturing centers and strong e-commerce adoption rates.

East Coast regions encompassing New York, New Jersey, Pennsylvania, and surrounding states account for significant market share due to dense population centers, established fashion industry presence, and extensive transportation infrastructure. New York metropolitan area serves as a critical hub for fashion logistics, with specialized facilities supporting both domestic distribution and international trade operations.

Southeast markets have experienced rapid growth, with states like Florida, Georgia, and North Carolina developing into important logistics corridors. Atlanta’s strategic location and transportation infrastructure make it a preferred distribution hub for companies serving national markets. The region offers cost advantages in real estate and labor while maintaining good access to major population centers.

Midwest regions including Illinois, Ohio, and Michigan provide central distribution advantages for companies serving national markets. Chicago’s logistics infrastructure and transportation connectivity support efficient distribution to both coasts and major metropolitan areas. Texas markets have emerged as significant growth areas, with major cities like Dallas, Houston, and Austin developing sophisticated logistics capabilities to serve both domestic and international markets.

Market leadership within the United States apparel logistics sector features a diverse mix of global logistics giants, specialized apparel-focused providers, and innovative technology-enabled companies. Competitive positioning varies based on service capabilities, geographic coverage, technology sophistication, and customer relationships.

Competitive strategies focus on technology differentiation, service quality enhancement, and geographic expansion to capture market share. Innovation leadership has become crucial, with companies investing heavily in automation, artificial intelligence, and data analytics to improve operational efficiency and customer service. Partnership strategies with fashion brands and retailers create competitive moats while generating recurring revenue streams.

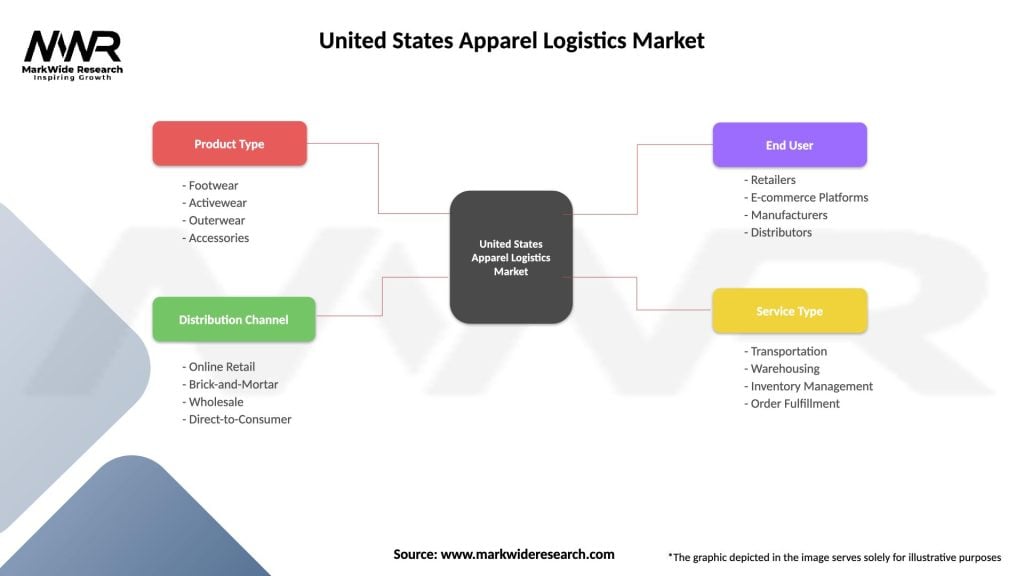

Market segmentation within the United States apparel logistics sector reveals distinct categories based on service type, customer segment, and operational characteristics. By Service Type segmentation includes warehousing and distribution, transportation management, inventory optimization, order fulfillment, and reverse logistics services. Each segment addresses specific operational requirements and customer needs within the apparel supply chain.

By Customer Segment analysis distinguishes between fashion brands, traditional retailers, e-commerce platforms, and specialty apparel companies. Fashion brands typically require sophisticated inventory management and global distribution capabilities to support their seasonal product launches and international market presence. E-commerce platforms prioritize rapid fulfillment, returns processing, and integration with their technology systems.

By Product Category segmentation encompasses women’s apparel, men’s clothing, children’s wear, footwear, and accessories. Women’s apparel represents the largest segment due to higher purchase frequency and greater style variation. Footwear logistics requires specialized handling due to size variations, seasonal patterns, and specific storage requirements.

By Technology Integration categories include traditional manual operations, semi-automated systems, and fully automated facilities. Automation adoption varies significantly across market segments, with larger companies typically implementing more sophisticated technology solutions. Geographic segmentation reflects regional market characteristics, infrastructure capabilities, and customer concentration patterns across different areas of the United States.

Warehousing and Distribution represents the largest category within the apparel logistics market, encompassing specialized storage facilities designed to handle the unique requirements of clothing and fashion products. Modern distribution centers feature climate-controlled environments, automated sorting systems, and sophisticated inventory management capabilities to maintain product quality while optimizing operational efficiency. The category benefits from increasing demand for regional distribution networks that support faster delivery times.

Transportation Management services have evolved to address the complex routing and scheduling requirements of apparel logistics, including seasonal capacity planning and multi-modal transportation coordination. Last-mile delivery optimization has become particularly important as consumers expect faster and more convenient delivery options. The integration of route optimization software and real-time tracking capabilities enhances service quality while reducing transportation costs.

Order Fulfillment services encompass the complete process from order receipt to customer delivery, including picking, packing, quality control, and shipping coordination. E-commerce fulfillment requires specialized capabilities to handle individual consumer orders efficiently while maintaining accuracy and speed. The category has experienced significant growth driven by online apparel sales expansion and increasing consumer expectations for rapid delivery.

Reverse Logistics has emerged as a critical category due to high return rates characteristic of online apparel sales. Returns processing requires efficient systems for product inspection, refurbishment, restocking, and disposition decisions. Companies developing superior reverse logistics capabilities can achieve competitive advantages through improved customer satisfaction and inventory recovery rates.

Operational efficiency represents the primary benefit for companies utilizing specialized apparel logistics services, with professional providers offering expertise, technology, and scale advantages that individual retailers cannot achieve independently. Cost optimization occurs through shared infrastructure, optimized transportation routes, and efficient inventory management practices that reduce overall supply chain expenses while improving service levels.

Technology access enables smaller and mid-sized apparel companies to leverage sophisticated warehouse management systems, transportation optimization platforms, and data analytics tools without significant capital investments. Scalability benefits allow companies to expand their distribution capabilities rapidly during peak seasons or growth periods without long-term infrastructure commitments.

Risk mitigation advantages include reduced exposure to operational disruptions, labor shortages, and capacity constraints through diversified service provider relationships. Expertise access provides companies with specialized knowledge of apparel logistics best practices, regulatory compliance, and industry-specific operational requirements.

Customer satisfaction improvements result from enhanced delivery speed, accuracy, and reliability enabled by professional logistics services. Market expansion opportunities emerge as companies can serve new geographic markets and customer segments through established logistics networks. Focus enhancement allows apparel companies to concentrate on their core competencies in design, marketing, and brand management while outsourcing complex logistics operations to specialized providers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration represents the most significant trend transforming the United States apparel logistics market, with companies implementing robotics, artificial intelligence, and machine learning technologies to enhance operational efficiency. Warehouse robotics adoption has increased substantially, with automated picking systems, sorting equipment, and inventory management robots becoming standard in modern distribution facilities. The trend toward lights-out operations continues gaining momentum as technology capabilities improve and labor costs increase.

Sustainability integration has emerged as a critical trend, with logistics providers implementing green initiatives including electric vehicle fleets, renewable energy systems, and sustainable packaging materials. Carbon footprint reduction has become a competitive differentiator, with companies offering carbon-neutral delivery options and environmentally responsible supply chain solutions. The circular economy concept is driving innovation in reverse logistics and garment recycling services.

Omnichannel sophistication continues evolving as retailers demand seamless integration between online and offline channels. Inventory visibility across all channels has become essential, requiring real-time synchronization between e-commerce platforms, retail stores, and distribution centers. Buy-online-pickup-in-store and ship-from-store capabilities require sophisticated logistics coordination and technology integration.

Micro-fulfillment expansion reflects the trend toward distributed inventory networks that position products closer to consumers. Urban fulfillment centers and automated micro-warehouses enable same-day and next-day delivery while reducing transportation costs. MWR data indicates that companies implementing micro-fulfillment strategies achieve 42% faster delivery times in major metropolitan areas.

Technology partnerships have accelerated across the industry, with logistics providers collaborating with software companies, robotics manufacturers, and AI specialists to develop next-generation capabilities. Strategic alliances between apparel brands and logistics providers have deepened, creating integrated supply chain solutions that enhance efficiency and customer service while reducing costs.

Facility expansion projects continue throughout major metropolitan areas, with companies investing in modern distribution centers equipped with advanced automation and sustainability features. Acquisition activity has intensified as companies seek to achieve scale advantages and expand their service capabilities through strategic purchases of specialized providers and technology companies.

Sustainability initiatives have gained prominence, with major logistics providers announcing carbon neutrality commitments and implementing comprehensive environmental programs. Electric vehicle adoption for last-mile delivery has accelerated, particularly in urban markets where environmental regulations and consumer preferences favor clean transportation options.

Workforce development programs have expanded as companies address labor shortages through enhanced training, improved working conditions, and career advancement opportunities. Technology training initiatives help existing workers adapt to automated systems while attracting new talent with technical skills. Diversity and inclusion programs have become standard practice as companies recognize the importance of representative workforces in serving diverse customer bases.

Strategic recommendations for market participants emphasize the critical importance of technology investment and operational excellence in maintaining competitive positioning. Automation implementation should be prioritized, with companies developing phased deployment plans that balance capital requirements with operational improvements. Focus areas should include warehouse robotics, transportation optimization, and predictive analytics capabilities that enhance decision-making and operational efficiency.

Partnership strategies represent essential growth pathways, with companies encouraged to develop deeper relationships with apparel brands and retailers through integrated service offerings and technology platforms. Sustainability initiatives should be accelerated, as environmental considerations increasingly influence customer selection criteria and regulatory requirements. Companies should develop comprehensive carbon reduction strategies and communicate their environmental commitments effectively.

Geographic expansion opportunities should be evaluated carefully, with focus on underserved markets and emerging metropolitan areas experiencing population and economic growth. Workforce development investments are crucial for addressing labor shortages and preparing for increased automation. Companies should implement comprehensive training programs and create attractive career pathways to recruit and retain talent.

Customer experience enhancement should remain a top priority, with companies investing in visibility tools, communication systems, and service quality improvements that differentiate their offerings. Data analytics capabilities should be developed to provide valuable insights to customers while optimizing internal operations. According to MarkWide Research projections, companies implementing comprehensive analytics programs achieve 26% better operational performance compared to traditional approaches.

Market evolution over the next decade will be characterized by continued technological advancement, sustainability integration, and operational sophistication as companies adapt to changing consumer expectations and competitive pressures. Automation adoption will accelerate significantly, with fully automated distribution centers becoming standard for major market participants. The integration of artificial intelligence and machine learning will enable predictive capabilities that optimize inventory management, demand forecasting, and operational planning.

E-commerce growth will continue driving market expansion, with online apparel sales projected to maintain strong growth rates supported by improving technology, expanding product selection, and enhanced customer experiences. Same-day delivery will become increasingly common in major metropolitan areas, requiring continued investment in local fulfillment networks and last-mile optimization capabilities.

Sustainability requirements will intensify, with environmental considerations becoming mandatory rather than optional for market participants. Circular economy principles will drive innovation in reverse logistics, product lifecycle management, and waste reduction initiatives. Companies failing to implement comprehensive sustainability programs may face competitive disadvantages and regulatory challenges.

Market consolidation trends will continue as companies seek scale advantages and expanded capabilities through strategic acquisitions and partnerships. Technology integration will deepen, with logistics providers becoming more sophisticated data and analytics companies that offer strategic insights alongside traditional operational services. The market is projected to maintain robust growth rates, with industry analysts forecasting sustained expansion of 7-9% annually through the forecast period.

The United States apparel logistics market represents a dynamic and rapidly evolving sector that plays a crucial role in the nation’s retail ecosystem. Market fundamentals remain strong, supported by continued e-commerce growth, technological advancement, and increasing consumer expectations for fast, reliable, and convenient delivery services. The sector has demonstrated remarkable resilience and adaptability, successfully navigating challenges while capitalizing on emerging opportunities.

Technology transformation will continue serving as the primary catalyst for market evolution, with automation, artificial intelligence, and data analytics enabling unprecedented levels of operational efficiency and customer service. Sustainability integration has emerged as a critical success factor, with environmental considerations increasingly influencing customer decisions and regulatory requirements. Companies that successfully balance operational excellence with environmental responsibility will achieve competitive advantages in the evolving marketplace.

Future success in the United States apparel logistics market will require continued investment in technology, workforce development, and customer experience enhancement. Strategic partnerships and operational excellence will differentiate market leaders from competitors, while companies that fail to adapt to changing requirements may face significant challenges. The market outlook remains positive, with strong growth prospects supported by fundamental trends in retail, technology, and consumer behavior that favor specialized apparel logistics services.

What is Apparel Logistics?

Apparel logistics refers to the processes involved in the supply chain management of clothing and fashion products, including transportation, warehousing, and distribution. It encompasses the movement of goods from manufacturers to retailers and ultimately to consumers, ensuring timely delivery and inventory management.

What are the key players in the United States Apparel Logistics Market?

Key players in the United States Apparel Logistics Market include companies like DHL Supply Chain, XPO Logistics, and FedEx, which provide comprehensive logistics solutions tailored for the apparel industry. These companies focus on optimizing supply chain efficiency and enhancing customer service, among others.

What are the main drivers of growth in the United States Apparel Logistics Market?

The main drivers of growth in the United States Apparel Logistics Market include the increasing demand for fast fashion, the rise of e-commerce, and advancements in technology that improve supply chain efficiency. Additionally, consumer preferences for quick delivery options are pushing logistics providers to innovate.

What challenges does the United States Apparel Logistics Market face?

The United States Apparel Logistics Market faces challenges such as fluctuating transportation costs, supply chain disruptions, and the need for sustainable practices. These factors can complicate logistics operations and impact overall efficiency.

What opportunities exist in the United States Apparel Logistics Market?

Opportunities in the United States Apparel Logistics Market include the integration of automation and AI technologies to streamline operations, as well as the growing trend of sustainability in logistics practices. Companies are increasingly looking to adopt eco-friendly solutions to meet consumer demands.

What trends are shaping the United States Apparel Logistics Market?

Trends shaping the United States Apparel Logistics Market include the rise of omnichannel retailing, increased use of data analytics for inventory management, and the adoption of blockchain technology for enhanced transparency. These trends are transforming how apparel logistics operates and responds to market demands.

United States Apparel Logistics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Footwear, Activewear, Outerwear, Accessories |

| Distribution Channel | Online Retail, Brick-and-Mortar, Wholesale, Direct-to-Consumer |

| End User | Retailers, E-commerce Platforms, Manufacturers, Distributors |

| Service Type | Transportation, Warehousing, Inventory Management, Order Fulfillment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Apparel Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at