444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States animal feed additives market represents a dynamic and rapidly evolving sector within the broader agricultural industry, driven by increasing demand for enhanced livestock productivity and animal health optimization. Feed additives encompass a diverse range of substances including vitamins, minerals, amino acids, enzymes, probiotics, and antimicrobials that are incorporated into animal feed to improve nutritional value, promote growth, and maintain animal welfare standards.

Market dynamics indicate robust expansion driven by the growing livestock population, rising consumer demand for high-quality animal protein, and increasing awareness of sustainable farming practices. The sector is experiencing significant growth at a CAGR of 4.8%, reflecting the industry’s commitment to improving feed efficiency and reducing environmental impact through innovative additive solutions.

Technological advancement continues to reshape the landscape, with manufacturers developing sophisticated formulations that address specific nutritional requirements across different animal species. The integration of precision nutrition concepts and data-driven feed management systems is creating new opportunities for targeted additive applications, particularly in poultry, swine, and cattle production systems.

Regulatory frameworks play a crucial role in shaping market development, with the FDA and AAFCO establishing comprehensive guidelines for feed additive approval and usage. These regulatory standards ensure product safety while encouraging innovation in areas such as natural alternatives to traditional growth promoters and environmentally sustainable additive solutions.

The United States animal feed additives market refers to the comprehensive ecosystem of specialized nutritional and functional substances that are systematically incorporated into animal feed formulations to enhance livestock performance, health, and productivity across various agricultural production systems.

Feed additives encompass multiple categories of bioactive compounds designed to optimize animal nutrition beyond basic feed ingredients. These substances include essential vitamins and minerals that support metabolic functions, amino acids that enhance protein synthesis, enzymes that improve digestibility, probiotics that promote gut health, and various performance enhancers that contribute to improved feed conversion ratios and overall animal welfare.

Market scope extends across diverse livestock sectors including poultry, swine, cattle, aquaculture, and companion animals, with each segment requiring specialized additive formulations tailored to specific physiological needs and production objectives. The industry serves both commercial livestock operations and smaller-scale farming enterprises, providing solutions that address varying scales of production and management practices.

Strategic positioning of the United States animal feed additives market reflects a mature yet innovative industry characterized by continuous technological advancement and evolving consumer preferences toward sustainable and natural solutions. The sector demonstrates resilience through diversified product portfolios and strong research and development capabilities that drive competitive differentiation.

Market leadership is concentrated among established multinational corporations that leverage extensive distribution networks, comprehensive product lines, and significant investment in innovation. These industry leaders maintain competitive advantages through strategic partnerships with feed manufacturers, livestock producers, and research institutions, creating integrated value chains that enhance market penetration and customer loyalty.

Growth drivers include increasing livestock production efficiency requirements, rising consumer awareness of animal welfare standards, and growing demand for antibiotic alternatives in animal nutrition. The market benefits from 65% adoption rate of specialized additives in commercial livestock operations, indicating strong industry acceptance and integration of advanced nutritional solutions.

Innovation trends focus on developing natural and organic alternatives to synthetic additives, precision nutrition technologies, and sustainable production methods that align with environmental stewardship goals. These developments position the market for continued expansion while addressing evolving regulatory requirements and consumer preferences for responsible agricultural practices.

Market intelligence reveals several critical insights that shape strategic decision-making and investment priorities within the United States animal feed additives sector:

Primary growth drivers propelling the United States animal feed additives market encompass multiple interconnected factors that create sustained demand for innovative nutritional solutions across livestock production systems.

Livestock productivity optimization represents the fundamental driver, as producers seek to maximize feed conversion efficiency and animal performance through scientifically formulated additive programs. The industry’s focus on achieving optimal growth rates while maintaining animal health standards creates consistent demand for specialized nutritional supplements that deliver measurable performance improvements.

Consumer protein demand continues to escalate, driven by population growth, dietary preferences, and increasing per capita consumption of animal-derived products. This sustained demand pressure requires livestock producers to optimize production efficiency through advanced nutrition strategies, creating expanded market opportunities for feed additive manufacturers.

Regulatory evolution toward reduced antibiotic usage in livestock production creates significant opportunities for alternative solutions including probiotics, prebiotics, organic acids, and immune-supporting additives. The industry’s transition toward antibiotic-free production systems drives innovation and adoption of functional feed additives that maintain animal health without traditional antimicrobial interventions.

Technological advancement in animal nutrition science enables development of more sophisticated and targeted additive solutions. Research breakthroughs in nutrigenomics, microbiome science, and precision nutrition create opportunities for highly specialized products that address specific physiological pathways and metabolic processes.

Regulatory complexity presents significant challenges for market participants, as the approval process for new feed additives requires extensive safety and efficacy documentation, creating barriers to entry and extending product development timelines. The stringent regulatory environment, while ensuring product safety, can limit innovation speed and increase development costs for smaller companies.

Cost sensitivity among livestock producers creates pressure on additive pricing, particularly during periods of volatile feed commodity prices or challenging economic conditions. The need to demonstrate clear return on investment for additive programs can limit adoption of premium products, especially among cost-conscious producers operating on tight margins.

Technical complexity in formulation and application requires specialized knowledge and expertise, creating challenges for both manufacturers and end-users. The need for proper storage, handling, and mixing procedures can complicate adoption, particularly among smaller operations with limited technical resources or infrastructure.

Supply chain vulnerabilities affect raw material availability and pricing stability, particularly for specialized ingredients sourced from limited suppliers or specific geographic regions. These dependencies can create production disruptions and cost fluctuations that impact market stability and profitability.

Consumer perception challenges regarding synthetic additives and processing aids can influence market acceptance, particularly as consumer awareness of food production practices increases. The need to balance performance benefits with consumer preferences for natural and minimally processed products creates ongoing challenges for product positioning and marketing strategies.

Natural alternatives development presents substantial growth opportunities as consumer preferences shift toward organic and naturally-derived products. The expanding market for plant-based additives, essential oils, and botanical extracts creates opportunities for companies that can develop effective natural solutions while maintaining performance standards comparable to synthetic alternatives.

Precision nutrition technologies offer significant potential for market expansion through personalized feeding strategies that optimize additive usage based on individual animal needs, environmental conditions, and production objectives. The integration of sensors, data analytics, and artificial intelligence enables more sophisticated and efficient additive applications.

Aquaculture expansion represents an emerging opportunity as fish and seafood production continues to grow rapidly. The development of specialized additives for aquatic species creates new market segments with distinct nutritional requirements and regulatory frameworks, offering diversification opportunities for established manufacturers.

Companion animal nutrition presents premium market opportunities driven by increasing pet ownership and willingness to invest in high-quality nutrition products. The pet food industry’s focus on functional ingredients and health-promoting additives creates opportunities for specialized formulations targeting specific health conditions and life stages.

Export market development offers growth potential as international demand for high-quality feed additives increases. The reputation of United States manufacturers for quality and innovation creates opportunities for expansion into emerging markets with growing livestock industries and evolving regulatory frameworks.

Competitive dynamics within the United States animal feed additives market reflect a complex interplay of established multinational corporations, specialized niche players, and emerging technology companies. The market structure demonstrates both consolidation trends among major players and continued innovation from smaller specialized firms that focus on specific additive categories or application areas.

Innovation cycles drive continuous product development and market evolution, with companies investing heavily in research and development to maintain competitive positioning. The industry demonstrates 12% annual investment in R&D activities, reflecting the critical importance of innovation in maintaining market leadership and addressing evolving customer needs.

Supply chain integration strategies enable companies to optimize cost structures and ensure quality control throughout the production process. Vertical integration initiatives, strategic partnerships, and long-term supplier relationships create competitive advantages while reducing supply chain risks and improving operational efficiency.

Market segmentation continues to evolve as companies develop increasingly specialized products for specific animal species, production systems, and performance objectives. This specialization trend creates opportunities for premium pricing while requiring more sophisticated marketing and technical support capabilities.

Digital transformation influences market dynamics through enhanced customer engagement, improved supply chain visibility, and data-driven product development processes. Companies that successfully integrate digital technologies into their operations and customer relationships gain competitive advantages in market responsiveness and operational efficiency.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. The research approach combines quantitative data analysis with qualitative industry expertise to provide a complete understanding of market dynamics and competitive positioning.

Primary research activities include extensive interviews with industry executives, technical specialists, and key stakeholders across the value chain. These interactions provide insights into market trends, competitive strategies, and emerging opportunities that may not be apparent through secondary data sources alone.

Secondary research encompasses analysis of industry publications, regulatory filings, company reports, and academic research to establish market baselines and validate primary research findings. This comprehensive approach ensures that market analysis reflects both current conditions and historical trends that influence future development.

Data validation processes employ multiple verification methods to ensure accuracy and consistency of market information. Cross-referencing data sources, statistical analysis, and expert review procedures maintain high standards of research quality and reliability.

Market modeling techniques utilize sophisticated analytical frameworks to project future market conditions and identify key growth drivers and constraints. These models incorporate multiple variables including regulatory changes, technological developments, and economic factors that influence market evolution.

Geographic distribution of the United States animal feed additives market reveals significant regional variations in demand patterns, regulatory environments, and competitive dynamics. The Midwest region dominates market consumption with approximately 38% market share, driven by concentrated livestock production in states such as Iowa, Illinois, and Nebraska.

Southern states represent the second-largest market segment, accounting for 28% of total consumption, with significant poultry and cattle operations in Texas, Georgia, and Arkansas driving demand for specialized additive solutions. The region’s focus on integrated poultry production creates opportunities for comprehensive additive programs that optimize performance across multiple production stages.

Western regions demonstrate growing market importance, particularly in California’s dairy industry and the expanding aquaculture sector along coastal areas. The region’s emphasis on sustainable production practices and organic farming creates demand for natural and environmentally-friendly additive solutions.

Northeastern markets show steady demand driven by dairy operations and specialty livestock production. The region’s proximity to major population centers creates opportunities for premium products targeting high-value market segments and specialty applications.

Regional specialization reflects local livestock concentrations and production practices, with different regions showing varying preferences for specific additive categories. This geographic diversity requires tailored marketing strategies and distribution approaches that address regional needs and preferences effectively.

Market leadership is characterized by a combination of large multinational corporations and specialized companies that focus on specific additive categories or market segments. The competitive environment demonstrates both scale advantages and niche specialization strategies.

Competitive strategies emphasize differentiation through innovation, technical support, and comprehensive solution offerings. Companies invest heavily in research and development while building strong relationships with feed manufacturers and livestock producers to maintain market position and drive growth.

Product category segmentation reveals diverse market composition with distinct growth patterns and competitive dynamics across different additive types:

By Product Type:

By Animal Type:

Vitamin additives represent a mature market segment with steady demand driven by essential nutritional requirements across all livestock species. The category demonstrates stable growth of 3.2% annually, with opportunities for innovation in delivery systems and bioavailability enhancement technologies.

Amino acid supplements show strong growth potential driven by precision nutrition trends and increasing focus on protein efficiency optimization. The segment benefits from growing understanding of amino acid requirements for specific production stages and environmental conditions.

Probiotic solutions represent the fastest-growing category, driven by antibiotic reduction initiatives and increasing focus on gut health optimization. The segment demonstrates significant innovation in strain selection, delivery mechanisms, and multi-species formulations.

Enzyme technologies continue to evolve with development of more sophisticated and targeted enzyme systems. The category shows strong growth in feed processing applications and digestibility enhancement solutions that improve feed conversion efficiency.

Mineral supplements maintain steady demand with innovation focusing on bioavailability improvement and organic mineral alternatives. The segment benefits from increasing understanding of mineral interactions and optimal supplementation strategies.

Specialty additives including antioxidants, flavor enhancers, and performance modifiers represent emerging opportunities for companies with specialized technical capabilities and innovative formulation approaches.

Livestock producers benefit from improved animal performance, enhanced feed efficiency, and reduced production costs through strategic additive utilization. The implementation of comprehensive additive programs can result in 8-15% improvement in feed conversion ratios and overall production efficiency.

Feed manufacturers gain competitive advantages through value-added product offerings that differentiate their feeds in the marketplace. Partnership with additive suppliers enables development of specialized formulations that address specific customer needs and market segments.

Additive manufacturers benefit from growing market demand, opportunities for premium pricing, and potential for international expansion. The industry’s focus on innovation and technical support creates sustainable competitive advantages for companies with strong research capabilities.

Consumers benefit indirectly through improved food safety, enhanced nutritional quality of animal products, and more sustainable production practices. The industry’s focus on natural alternatives and reduced antibiotic usage aligns with consumer preferences for responsible food production.

Regulatory agencies benefit from industry collaboration in developing safety standards and monitoring systems that ensure product efficacy while protecting animal and human health. The industry’s commitment to transparency and compliance supports effective regulatory oversight.

Research institutions benefit from industry partnerships that fund innovative research projects and provide practical applications for scientific discoveries. These collaborations accelerate technology transfer and commercialization of new additive solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic solutions represent the dominant trend shaping product development and market positioning strategies. Companies are investing heavily in plant-based alternatives, essential oil formulations, and naturally-derived functional ingredients that meet consumer preferences while maintaining performance standards.

Precision nutrition technologies are transforming how additives are formulated and applied in livestock production systems. The integration of data analytics, sensors, and artificial intelligence enables more targeted and efficient additive usage that optimizes animal performance while minimizing environmental impact.

Microbiome research is driving innovation in probiotic and prebiotic solutions that support gut health and immune function. Advanced understanding of microbial communities in different animal species creates opportunities for more sophisticated and effective microbial-based additives.

Sustainability initiatives influence product development toward environmentally-friendly formulations and production processes. Companies are focusing on reducing carbon footprint, minimizing waste, and developing circular economy approaches that align with environmental stewardship goals.

Antibiotic alternatives continue to drive innovation as the industry transitions toward reduced antimicrobial usage in livestock production. The development of immune-supporting additives, antimicrobial peptides, and other functional ingredients addresses this critical market need.

Digital integration enables enhanced customer engagement, improved supply chain management, and data-driven product development processes. Companies are leveraging digital platforms to provide technical support, monitor product performance, and optimize additive applications.

Regulatory evolution continues to shape industry development through updated safety standards, new approval processes, and enhanced monitoring requirements. Recent FDA initiatives focus on strengthening oversight while encouraging innovation in areas such as natural alternatives and precision nutrition applications.

Strategic partnerships between additive manufacturers, feed companies, and livestock producers are creating integrated value chains that optimize product development and market penetration. These collaborations enable more effective solution development and customer support capabilities.

Technology investments in manufacturing capabilities, quality control systems, and research facilities demonstrate industry commitment to innovation and operational excellence. Companies are modernizing production facilities to improve efficiency and accommodate new product formulations.

Market consolidation activities include strategic acquisitions and mergers that strengthen competitive positioning and expand product portfolios. These transactions enable companies to achieve scale advantages while accessing new technologies and market segments.

International expansion initiatives focus on emerging markets with growing livestock industries and evolving regulatory frameworks. Companies are establishing local partnerships and production capabilities to serve international customers effectively.

Research collaborations with universities and research institutions accelerate innovation in areas such as nutrigenomics, precision nutrition, and sustainable production technologies. These partnerships provide access to cutting-edge research while supporting practical application development.

MarkWide Research analysis suggests that companies should prioritize investment in natural and organic product development to capture growing market demand for sustainable solutions. The shift toward plant-based alternatives and naturally-derived functional ingredients represents a significant opportunity for differentiation and premium positioning.

Innovation focus should emphasize precision nutrition technologies that enable personalized feeding strategies and optimized additive applications. Companies that successfully integrate data analytics and digital technologies into their product offerings will gain competitive advantages in market responsiveness and customer value creation.

Strategic partnerships with feed manufacturers, livestock producers, and technology companies can accelerate market penetration and product development capabilities. These collaborations enable companies to leverage complementary strengths while sharing development costs and market risks.

Regulatory preparation requires proactive engagement with evolving safety standards and approval processes. Companies should invest in regulatory expertise and compliance capabilities to navigate complex requirements while maintaining innovation momentum.

Market diversification strategies should consider emerging segments such as aquaculture and companion animal nutrition that offer growth potential and reduced competitive intensity compared to traditional livestock markets.

Sustainability integration should encompass both product formulations and production processes to address environmental concerns while meeting performance requirements. Companies that successfully balance sustainability with effectiveness will capture growing market demand for responsible solutions.

Market trajectory indicates continued expansion driven by growing livestock production, increasing focus on animal welfare, and evolving consumer preferences for sustainable and natural products. The industry is positioned for sustained growth with projected CAGR of 5.2% over the next five years, reflecting strong fundamentals and emerging opportunities.

Technology advancement will continue to reshape the competitive landscape through precision nutrition applications, advanced delivery systems, and innovative formulation approaches. Companies that successfully integrate digital technologies and data analytics into their operations will gain significant competitive advantages.

Regulatory evolution toward enhanced safety standards and environmental protection will create both challenges and opportunities for market participants. Companies with strong regulatory expertise and sustainable product portfolios will be better positioned to navigate these changes successfully.

Market consolidation trends are expected to continue as companies seek scale advantages and expanded capabilities through strategic acquisitions and partnerships. This consolidation will create opportunities for specialized companies while intensifying competition among major players.

International expansion will become increasingly important as domestic markets mature and growth opportunities shift toward emerging economies with expanding livestock industries. Companies with global capabilities and local market expertise will capture the greatest share of international growth.

MWR projections indicate that natural and organic additives will represent 35% of total market volume within the next decade, reflecting the industry’s transition toward sustainable and consumer-preferred solutions. This shift will require significant investment in research, development, and production capabilities to meet evolving market demands.

The United States animal feed additives market demonstrates robust growth potential driven by fundamental industry trends including livestock production optimization, regulatory evolution toward antibiotic alternatives, and increasing consumer demand for sustainable and natural solutions. The market’s maturity provides stability while ongoing innovation creates opportunities for differentiation and premium positioning.

Strategic success in this dynamic market requires balanced investment in traditional product categories and emerging opportunities such as precision nutrition, natural alternatives, and specialty applications. Companies that effectively combine innovation capabilities with strong customer relationships and regulatory expertise will capture the greatest share of future growth opportunities.

Industry evolution toward sustainability, digitalization, and precision nutrition will reshape competitive dynamics while creating new value propositions for livestock producers and feed manufacturers. The market’s future development will be characterized by continued consolidation among major players, increased specialization in niche segments, and growing importance of international expansion strategies that address global livestock industry growth.

What is Animal Feed Additives?

Animal feed additives are substances added to animal feed to enhance its nutritional value, improve growth rates, and promote health. These additives can include vitamins, minerals, amino acids, and probiotics, among others.

What are the key players in the United States Animal Feed Additives Market?

Key players in the United States Animal Feed Additives Market include Cargill, ADM, and BASF, which are known for their extensive product offerings and innovations in feed formulations, among others.

What are the growth factors driving the United States Animal Feed Additives Market?

The growth of the United States Animal Feed Additives Market is driven by increasing demand for high-quality animal protein, rising awareness of animal health, and advancements in feed technology. Additionally, the growing trend of sustainable farming practices is influencing the market.

What challenges does the United States Animal Feed Additives Market face?

The United States Animal Feed Additives Market faces challenges such as regulatory compliance issues, fluctuating raw material prices, and concerns over the safety and efficacy of certain additives. These factors can impact market stability and growth.

What opportunities exist in the United States Animal Feed Additives Market?

Opportunities in the United States Animal Feed Additives Market include the development of natural and organic additives, increasing investments in research and development, and the expansion of the aquaculture sector. These trends are expected to create new avenues for growth.

What trends are shaping the United States Animal Feed Additives Market?

Trends shaping the United States Animal Feed Additives Market include the rising popularity of plant-based feed ingredients, the integration of technology in feed production, and a growing focus on animal welfare. These trends are influencing consumer preferences and industry practices.

United States Animal Feed Additives Market

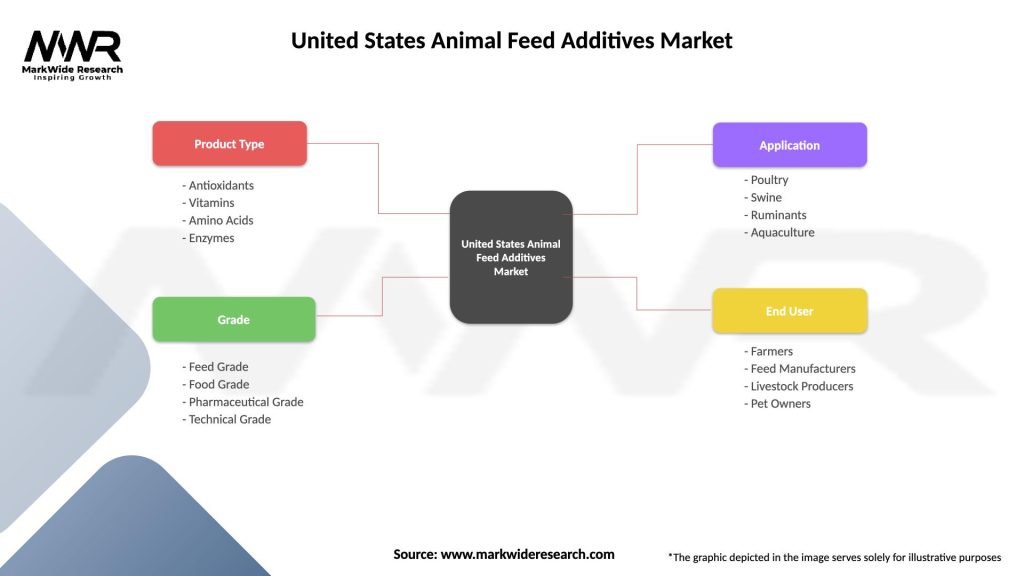

| Segmentation Details | Description |

|---|---|

| Product Type | Antioxidants, Vitamins, Amino Acids, Enzymes |

| Grade | Feed Grade, Food Grade, Pharmaceutical Grade, Technical Grade |

| Application | Poultry, Swine, Ruminants, Aquaculture |

| End User | Farmers, Feed Manufacturers, Livestock Producers, Pet Owners |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Animal Feed Additives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at