444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States analog integrated circuits market represents a cornerstone of the nation’s semiconductor industry, driving innovation across multiple sectors including automotive, telecommunications, consumer electronics, and industrial automation. Analog integrated circuits serve as the critical interface between the real world and digital systems, converting continuous signals into processable digital information and vice versa. The market demonstrates robust growth momentum, with industry analysts projecting a compound annual growth rate (CAGR) of 6.2% through the forecast period.

Market dynamics indicate strong demand driven by the proliferation of Internet of Things (IoT) devices, electric vehicle adoption, and advanced telecommunications infrastructure development. The United States maintains its position as a global leader in analog semiconductor design and manufacturing, with domestic companies commanding approximately 45% of the global analog IC market share. This dominance stems from decades of technological innovation, substantial research and development investments, and strategic partnerships between industry leaders and academic institutions.

Regional distribution shows concentrated activity in technology hubs including Silicon Valley, Texas, and the Northeast corridor, where major semiconductor companies have established design centers and manufacturing facilities. The market benefits from strong government support for semiconductor manufacturing through initiatives like the CHIPS Act, which aims to strengthen domestic production capabilities and reduce dependence on foreign suppliers.

The United States analog integrated circuits market refers to the domestic ecosystem encompassing the design, manufacturing, distribution, and application of analog semiconductor devices that process continuous signals. Analog integrated circuits are electronic components that handle real-world signals such as sound, light, temperature, and pressure, converting them into formats suitable for digital processing systems.

These circuits differ fundamentally from digital integrated circuits by processing continuously variable signals rather than discrete binary values. They include operational amplifiers, voltage regulators, analog-to-digital converters, digital-to-analog converters, power management ICs, and radio frequency circuits. The market encompasses both the supply chain from raw materials to finished products and the demand side spanning multiple end-use industries.

Market participants include integrated device manufacturers (IDMs), fabless design companies, foundries, assembly and test service providers, and distributors. The ecosystem also involves equipment suppliers, materials providers, and software companies that support the design and manufacturing processes. This comprehensive market structure enables the United States to maintain technological leadership in analog semiconductor innovation.

The United States analog integrated circuits market demonstrates exceptional resilience and growth potential, driven by accelerating digitization across industries and the increasing sophistication of electronic systems. Key market drivers include the automotive industry’s transition to electric and autonomous vehicles, which require advanced power management and sensor interface circuits, representing approximately 28% of total analog IC demand.

Telecommunications infrastructure modernization, particularly 5G network deployment, creates substantial demand for high-frequency analog circuits and power amplifiers. The consumer electronics sector continues to drive innovation in power management ICs, with smartphones and wearable devices requiring increasingly efficient and compact analog solutions. Industrial automation and IoT applications contribute significantly to market expansion, with industrial segment growth rates exceeding 8% annually.

Competitive landscape features established leaders including Texas Instruments, Analog Devices, Maxim Integrated, and Linear Technology, alongside emerging players focusing on specialized applications. The market benefits from strong intellectual property protection, advanced manufacturing capabilities, and close collaboration between industry and academia. Supply chain resilience has become increasingly important, with companies investing in domestic manufacturing capacity and diversified supplier networks.

Market segmentation reveals distinct growth patterns across different analog IC categories, with power management ICs representing the largest segment due to universal demand across all electronic applications. Signal conditioning circuits show robust growth driven by sensor proliferation in automotive and industrial applications. The following key insights characterize the market landscape:

MarkWide Research analysis indicates that the market’s resilience stems from the fundamental nature of analog circuits as essential components in virtually all electronic systems, creating sustained demand regardless of economic fluctuations.

Automotive electrification serves as a primary growth catalyst, with electric vehicles requiring sophisticated power management systems, battery monitoring circuits, and motor control electronics. The transition from internal combustion engines to electric powertrains creates unprecedented demand for high-voltage analog ICs capable of handling kilowatt-level power conversion with exceptional efficiency and reliability.

5G infrastructure deployment drives demand for high-frequency analog circuits, including power amplifiers, low-noise amplifiers, and frequency synthesizers. Base station equipment requires analog circuits capable of operating at millimeter-wave frequencies while maintaining linearity and efficiency. The rollout of 5G networks across the United States creates a multi-year growth opportunity for specialized analog semiconductor companies.

Industrial automation and Industry 4.0 initiatives fuel demand for sensor interface circuits, data acquisition systems, and industrial communication ICs. Smart factories require precise analog circuits for process control, monitoring, and optimization. The integration of artificial intelligence and machine learning in industrial systems creates new requirements for high-speed, high-precision analog-to-digital converters.

Consumer electronics innovation continues driving demand for power management ICs, audio circuits, and display drivers. Smartphones, tablets, and wearable devices require increasingly sophisticated analog circuits to achieve longer battery life, better performance, and smaller form factors. The emergence of augmented reality and virtual reality devices creates new market opportunities for specialized analog components.

Design complexity presents significant challenges as analog circuits require specialized expertise and longer development cycles compared to digital circuits. The shortage of experienced analog design engineers constrains industry growth, with companies competing intensely for limited talent pools. Educational institutions struggle to keep pace with industry needs, creating a persistent skills gap that affects innovation capacity.

Manufacturing costs continue rising due to advanced process requirements and specialized fabrication equipment. Analog circuits often require mature process nodes that may not benefit from the same cost reductions as digital circuits on leading-edge nodes. The need for precise matching and low noise performance demands expensive manufacturing techniques and extensive testing procedures.

Supply chain vulnerabilities became apparent during recent global disruptions, highlighting dependence on international suppliers for raw materials and specialized components. Geopolitical tensions create uncertainty around trade relationships and technology transfer, potentially affecting access to critical materials and manufacturing capabilities. Companies must balance cost optimization with supply chain resilience.

Regulatory compliance requirements add complexity and cost to product development, particularly for automotive and medical applications. Safety standards and environmental regulations require extensive documentation and testing, extending time-to-market and increasing development costs. The evolving regulatory landscape creates ongoing compliance challenges for market participants.

Emerging applications in renewable energy systems create substantial growth opportunities for power management and grid-tie inverter circuits. Solar and wind energy installations require sophisticated analog circuits for maximum power point tracking, grid synchronization, and power quality management. The expansion of distributed energy resources drives demand for smart inverters and energy storage system controllers.

Healthcare technology advancement opens new markets for biomedical analog circuits, including wearable health monitors, implantable devices, and diagnostic equipment. The aging population and focus on preventive healthcare create sustained demand for medical electronics incorporating precise analog signal processing capabilities. Telemedicine growth accelerates demand for portable diagnostic devices requiring low-power, high-precision analog circuits.

Edge computing proliferation creates opportunities for specialized analog circuits optimized for artificial intelligence and machine learning applications. Edge devices require efficient analog front-ends for sensor data acquisition and processing. The trend toward distributed computing drives demand for power-efficient analog circuits capable of supporting local intelligence processing.

Space and defense applications offer high-value market segments requiring radiation-hardened and extreme-environment analog circuits. Government investment in space exploration and national security creates sustained demand for specialized analog semiconductors. The commercial space industry expansion provides additional growth opportunities for companies capable of meeting stringent reliability requirements.

Technology convergence between analog and digital domains creates new product categories and market opportunities. Mixed-signal ICs combining analog and digital functions on single chips offer improved performance and reduced system costs. This convergence requires companies to develop expertise across both analog and digital design disciplines, creating competitive advantages for integrated solutions providers.

Customer consolidation in key end markets affects supplier relationships and pricing dynamics. Large original equipment manufacturers (OEMs) increasingly prefer working with suppliers capable of providing comprehensive analog solutions rather than point products. This trend favors companies with broad product portfolios and strong customer support capabilities.

Innovation cycles in analog circuits differ significantly from digital semiconductors, with longer product lifecycles and emphasis on performance optimization rather than node scaling. Successful analog companies focus on architectural innovation and process optimization to achieve competitive advantages. The ability to maintain product relevance over extended periods creates stable revenue streams and customer relationships.

Global competition intensifies as international companies invest in analog circuit capabilities. However, the United States maintains advantages in high-performance applications requiring advanced design expertise and close customer collaboration. Market differentiation increasingly depends on application-specific optimization and system-level understanding rather than pure component specifications.

Primary research methodology encompasses comprehensive interviews with industry executives, design engineers, and market participants across the analog integrated circuits value chain. Data collection involves structured surveys of semiconductor companies, OEMs, distributors, and end-users to gather quantitative and qualitative insights on market trends, competitive dynamics, and future outlook.

Secondary research incorporates analysis of company financial reports, industry publications, patent filings, and regulatory documents to validate primary findings and identify market patterns. Technical literature review includes academic papers, conference proceedings, and standards documents to understand technology evolution and performance benchmarks.

Market modeling utilizes bottom-up and top-down approaches to estimate market size and growth projections. Bottom-up analysis aggregates demand from individual application segments, while top-down analysis validates findings against broader semiconductor market trends. Statistical analysis ensures data reliability and identifies significant correlations between market variables.

Expert validation involves consultation with industry thought leaders, academic researchers, and technology analysts to verify research findings and assumptions. This validation process ensures accuracy and completeness of market analysis while identifying potential blind spots or emerging trends not captured through conventional research methods.

Silicon Valley maintains its position as the epicenter of analog IC innovation, hosting headquarters and design centers for major industry players. The region benefits from proximity to leading universities, venture capital funding, and a deep talent pool of experienced analog designers. Technology clusters facilitate knowledge transfer and collaboration between companies, universities, and research institutions.

Texas represents a significant manufacturing and design hub, with Texas Instruments leading domestic analog IC production. The state offers favorable business conditions, skilled workforce, and established semiconductor infrastructure. Dallas and Austin serve as major centers for analog circuit design and manufacturing, with approximately 35% of domestic analog IC production concentrated in Texas facilities.

Northeast corridor including Massachusetts, New York, and New Jersey hosts numerous analog IC companies focusing on specialized applications such as aerospace, defense, and medical devices. The region benefits from proximity to major universities and research institutions, fostering innovation in advanced analog circuit technologies. Government contracts and defense spending provide stable revenue sources for regional companies.

Pacific Northwest emerges as a growing center for analog IC design, particularly for applications in renewable energy, industrial automation, and telecommunications. The region’s focus on clean technology and sustainable manufacturing aligns with industry trends toward energy-efficient analog circuits. Regional growth rates exceed national averages, driven by technology company expansion and favorable business environment.

Market leadership remains concentrated among established players with decades of analog design expertise and comprehensive product portfolios. The competitive landscape features both large integrated device manufacturers and specialized analog companies focusing on specific market segments or applications.

Competitive strategies emphasize innovation, customer relationships, and application-specific optimization. Companies invest heavily in research and development to maintain technology leadership and develop next-generation analog circuits. Acquisition activity remains active as companies seek to expand capabilities and enter new market segments.

By Product Type: The market segments into distinct categories based on circuit function and application requirements. Power management ICs represent the largest segment, encompassing voltage regulators, power controllers, and battery management systems. This segment benefits from universal demand across all electronic applications and growing emphasis on energy efficiency.

By Application: Market segmentation by end-use application reveals distinct growth patterns and requirements. Automotive applications show the highest growth rates, driven by vehicle electrification and advanced driver assistance systems. Each application segment has unique performance requirements and qualification standards.

Power Management ICs dominate market revenue due to their presence in virtually every electronic system. This category shows consistent growth driven by increasing power efficiency requirements and battery-powered device proliferation. Advanced power management techniques including dynamic voltage scaling and multi-rail power systems create opportunities for sophisticated analog circuits with integrated digital control.

Data Converters experience strong growth driven by sensor proliferation and high-resolution requirements in automotive and industrial applications. High-speed ADCs for 5G infrastructure and precision ADCs for industrial measurement systems represent key growth areas. The trend toward higher resolution and faster sampling rates drives continuous innovation in converter architectures.

RF and Microwave ICs benefit from 5G deployment and satellite communication expansion. These circuits require specialized design expertise and advanced manufacturing processes, creating barriers to entry and supporting premium pricing. Millimeter-wave frequencies present both opportunities and challenges for analog circuit designers.

Sensor Interface Circuits grow rapidly with IoT device proliferation and automotive sensor integration. These circuits must handle diverse sensor types while providing high accuracy and low power consumption. Multi-sensor interfaces that can condition signals from different sensor types on single chips offer system-level advantages and cost reductions.

Design Companies benefit from strong intellectual property protection and access to advanced manufacturing capabilities through foundry partnerships. The United States provides a favorable environment for analog IC innovation with robust patent systems and skilled engineering talent. Venture capital availability supports startup companies developing specialized analog solutions for emerging applications.

Manufacturing Partners gain access to high-value analog IC production with longer product lifecycles compared to digital semiconductors. Analog circuits often require specialized processes and extensive testing, creating opportunities for differentiated manufacturing services. Capacity utilization remains stable due to consistent demand patterns and longer design cycles.

End-User Industries benefit from continuous innovation in analog circuit performance and integration. Advanced analog ICs enable new product capabilities and improved system efficiency across automotive, industrial, and consumer applications. System-level optimization through integrated analog solutions reduces design complexity and time-to-market for OEMs.

Investors find attractive opportunities in the analog IC market due to stable demand patterns, high barriers to entry, and strong cash flow generation. Successful analog companies typically maintain higher gross margins than digital semiconductor companies due to specialized expertise and customer relationships. Market stability provides predictable returns for long-term investment strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

System-on-Chip Integration drives demand for mixed-signal ICs combining analog and digital functions on single chips. This trend reduces system cost and complexity while improving performance and reliability. Advanced packaging technologies enable higher levels of integration and better thermal management for complex analog systems.

Artificial Intelligence integration in analog circuits creates new product categories and capabilities. AI-enhanced analog circuits can adapt to changing conditions and optimize performance in real-time. Machine learning algorithms embedded in analog ICs enable predictive maintenance and autonomous system optimization.

Sustainability Focus influences analog circuit design with emphasis on energy efficiency and environmental responsibility. Green electronics initiatives drive demand for low-power analog circuits and environmentally friendly manufacturing processes. Companies increasingly consider lifecycle environmental impact in product development decisions.

Customization Trend toward application-specific analog circuits rather than general-purpose solutions. Customers seek optimized performance for specific applications, driving demand for customized analog ICs. Configurable analog circuits provide flexibility while maintaining the benefits of custom optimization.

Strategic Acquisitions continue reshaping the competitive landscape as companies seek to expand capabilities and enter new markets. Recent consolidation activity includes major transactions aimed at combining complementary technologies and customer bases. Integration synergies from acquisitions enable companies to offer more comprehensive solutions to customers.

Manufacturing Investments in domestic production capacity respond to supply chain concerns and government incentives. Several major companies announced plans to expand US manufacturing facilities for analog ICs. Advanced packaging facilities co-located with wafer fabrication enable better integration and shorter supply chains.

Technology Partnerships between analog IC companies and system integrators accelerate innovation and market adoption. Collaborative development programs focus on next-generation applications in automotive, industrial, and communications markets. University partnerships support research in advanced analog circuit technologies and talent development.

Standards Development for emerging applications ensures interoperability and accelerates market adoption. Industry organizations work to establish standards for automotive functional safety, industrial communication, and wireless charging applications. Standardization efforts reduce development costs and enable broader market acceptance of new technologies.

Investment Focus should prioritize companies with strong positions in high-growth application segments such as automotive electrification and 5G infrastructure. MWR analysis suggests that companies with broad analog portfolios and strong customer relationships will outperform specialized players in the current market environment.

Technology Development emphasis should be placed on mixed-signal integration and AI-enhanced analog circuits. Companies that successfully combine analog expertise with digital capabilities will capture the largest share of future market growth. R&D investments in advanced process technologies and novel circuit architectures will drive competitive differentiation.

Supply Chain Strategy requires balancing cost optimization with resilience and security considerations. Companies should diversify supplier bases while investing in domestic manufacturing capabilities where economically viable. Strategic partnerships with suppliers and customers can improve supply chain visibility and reduce risks.

Talent Development initiatives are critical for sustaining long-term growth in the analog IC market. Companies should invest in university partnerships, internship programs, and continuing education for existing engineers. Knowledge transfer from experienced designers to younger engineers ensures continuity of specialized analog design expertise.

Market growth is expected to accelerate over the next decade, driven by continued digitization and the proliferation of intelligent systems across all industries. Automotive electrification will remain a primary growth driver, with electric vehicle adoption rates projected to reach 50% of new vehicle sales by 2030. This transition creates sustained demand for power management ICs, battery monitoring systems, and motor control circuits.

5G infrastructure deployment will continue driving demand for high-frequency analog circuits throughout the decade. The evolution toward 6G wireless systems will create new requirements for even higher frequency operation and improved efficiency. Satellite communication expansion, including low-earth orbit constellations, provides additional growth opportunities for RF and microwave analog circuits.

Industrial automation and Industry 4.0 initiatives will accelerate, creating demand for sensor interface circuits, data acquisition systems, and industrial communication ICs. The integration of artificial intelligence in industrial systems requires high-performance analog circuits for sensor data processing and control applications. Edge computing proliferation drives demand for power-efficient analog circuits optimized for distributed intelligence applications.

Technology evolution will focus on higher levels of integration, improved energy efficiency, and enhanced functionality. Mixed-signal ICs combining analog and digital functions will become increasingly prevalent, requiring companies to develop expertise across both domains. Advanced packaging technologies will enable new levels of system integration and performance optimization. MarkWide Research projects that the market will maintain strong growth momentum with expanding applications and continued innovation driving sustained demand for analog integrated circuits.

The United States analog integrated circuits market stands at the forefront of technological innovation, driven by transformative trends in automotive electrification, telecommunications infrastructure, and industrial automation. The market’s fundamental strength lies in the essential nature of analog circuits as the interface between the physical world and digital systems, ensuring sustained demand across diverse applications and economic cycles.

Competitive advantages including technological leadership, strong intellectual property portfolios, and deep customer relationships position US companies favorably for continued market dominance. The combination of established industry leaders and innovative startups creates a dynamic ecosystem capable of addressing emerging market opportunities while maintaining excellence in traditional applications.

Future success will depend on companies’ ability to navigate evolving market dynamics, invest in next-generation technologies, and develop the specialized talent required for analog circuit innovation. The market’s trajectory toward higher integration, improved efficiency, and enhanced functionality creates opportunities for companies that can successfully combine analog expertise with digital capabilities and system-level understanding. With strong fundamentals and expanding applications, the United States analog integrated circuits market is positioned for sustained growth and continued global leadership in this critical technology sector.

What is Analog Integrated Circuits?

Analog Integrated Circuits are electronic circuits that process continuous signals. They are widely used in applications such as audio processing, signal amplification, and sensor interfacing.

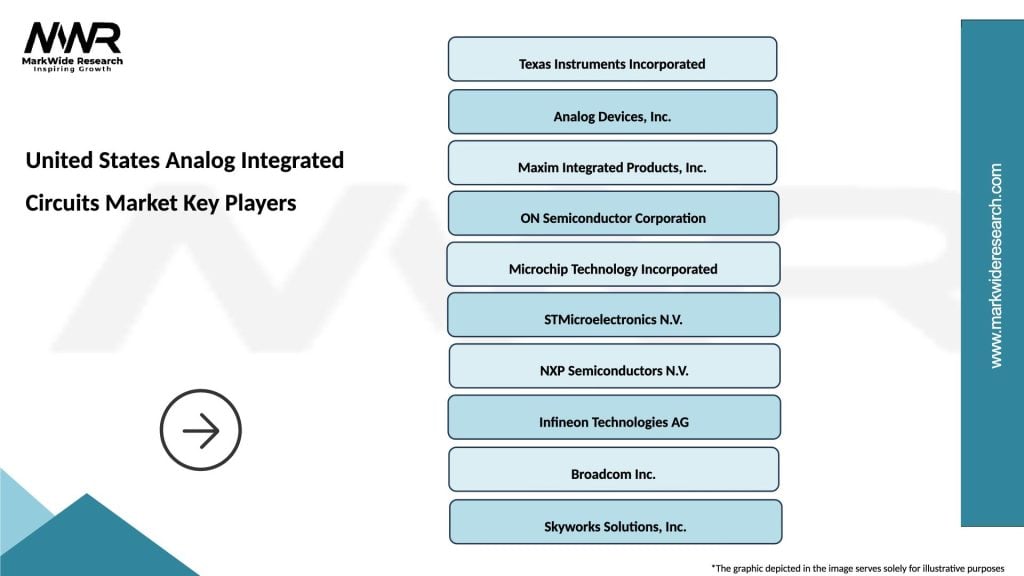

What are the key players in the United States Analog Integrated Circuits Market?

Key players in the United States Analog Integrated Circuits Market include Texas Instruments, Analog Devices, and Maxim Integrated, among others.

What are the growth factors driving the United States Analog Integrated Circuits Market?

The growth of the United States Analog Integrated Circuits Market is driven by the increasing demand for consumer electronics, advancements in automotive electronics, and the rise of IoT applications.

What challenges does the United States Analog Integrated Circuits Market face?

Challenges in the United States Analog Integrated Circuits Market include the complexity of circuit design, the need for high precision, and competition from digital circuits.

What opportunities exist in the United States Analog Integrated Circuits Market?

Opportunities in the United States Analog Integrated Circuits Market include the growing adoption of electric vehicles, the expansion of renewable energy systems, and innovations in wireless communication technologies.

What trends are shaping the United States Analog Integrated Circuits Market?

Trends in the United States Analog Integrated Circuits Market include the miniaturization of components, the integration of mixed-signal circuits, and the increasing use of AI in circuit design.

United States Analog Integrated Circuits Market

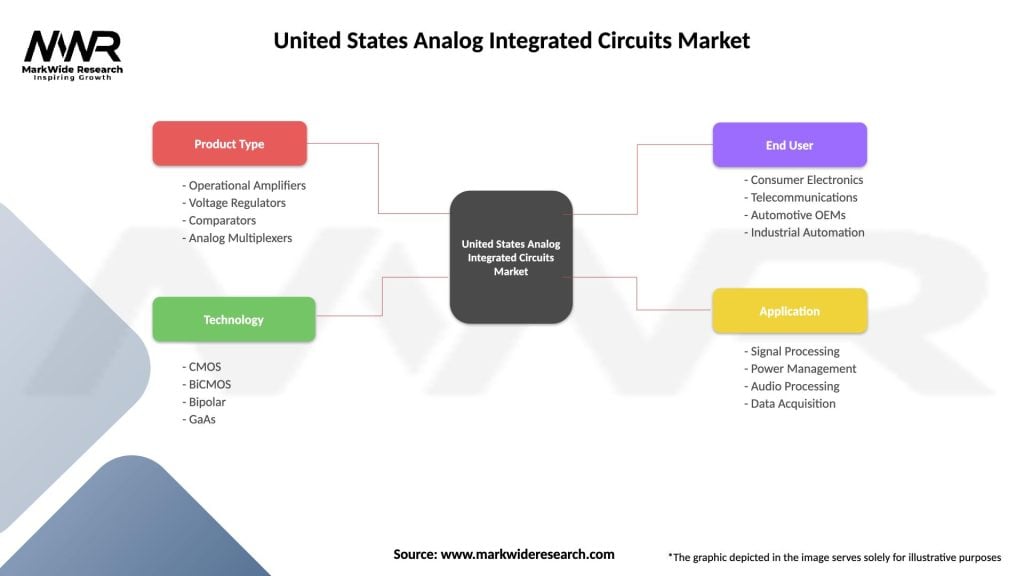

| Segmentation Details | Description |

|---|---|

| Product Type | Operational Amplifiers, Voltage Regulators, Comparators, Analog Multiplexers |

| Technology | CMOS, BiCMOS, Bipolar, GaAs |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Signal Processing, Power Management, Audio Processing, Data Acquisition |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Analog Integrated Circuits Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at