444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States airframe MRO market represents a critical component of the aviation industry, encompassing comprehensive maintenance, repair, and overhaul services for aircraft structural components. This dynamic sector has experienced substantial growth driven by increasing air traffic, aging aircraft fleets, and stringent regulatory requirements. The market demonstrates remarkable resilience with projected growth rates of 4.2% CAGR through the forecast period, reflecting the essential nature of airframe maintenance services in ensuring aviation safety and operational efficiency.

Market dynamics indicate that the United States maintains its position as the world’s largest aviation market, with over 5,000 commercial aircraft requiring regular maintenance services. The airframe MRO segment specifically focuses on structural repairs, modifications, and compliance inspections that are mandatory for aircraft certification. Commercial aviation accounts for approximately 68% of total airframe MRO activities, while military and general aviation segments contribute the remaining market share.

Technological advancement continues to reshape the airframe MRO landscape, with predictive maintenance technologies and digital inspection tools gaining significant traction. The integration of artificial intelligence and machine learning algorithms has improved maintenance scheduling efficiency by 25-30%, reducing aircraft downtime and operational costs. Regulatory compliance remains a primary driver, with the Federal Aviation Administration (FAA) implementing increasingly stringent safety standards that require specialized maintenance capabilities.

The United States airframe MRO market refers to the comprehensive ecosystem of maintenance, repair, and overhaul services specifically focused on aircraft structural components, including fuselage, wings, empennage, and landing gear systems. This specialized sector encompasses both scheduled and unscheduled maintenance activities performed by certified maintenance organizations, airlines’ internal maintenance departments, and independent service providers.

Airframe maintenance involves complex procedures ranging from routine inspections and component replacements to major structural repairs and modifications. The market includes various service categories such as line maintenance, base maintenance, component overhaul, and engineering services. Regulatory oversight by the FAA ensures that all airframe MRO activities comply with strict safety standards and certification requirements, making this market highly specialized and technically demanding.

Service providers in this market range from original equipment manufacturers (OEMs) offering authorized maintenance services to independent MRO organizations specializing in specific aircraft types or maintenance categories. The market structure reflects the critical importance of maintaining aircraft structural integrity throughout their operational lifecycle, typically spanning 20-30 years for commercial aircraft.

Strategic analysis of the United States airframe MRO market reveals a robust and expanding sector driven by fundamental industry trends and regulatory requirements. The market benefits from the world’s largest commercial aircraft fleet, with over 7,200 active aircraft requiring regular maintenance services. Growth drivers include increasing flight frequencies, aging aircraft requiring more intensive maintenance, and the introduction of new aircraft technologies requiring specialized service capabilities.

Market segmentation shows commercial aviation dominating with 68% market share, followed by military applications at 22% and general aviation at 10%. The competitive landscape features a mix of established players including major airlines’ maintenance divisions, independent MRO providers, and OEM service organizations. Technological innovation continues to drive efficiency improvements, with digital maintenance platforms reducing inspection times by 20-25%.

Regional concentration remains significant, with major maintenance hubs located in states with substantial aviation activity including California, Texas, Florida, and Georgia. The market demonstrates strong resilience to economic fluctuations due to the non-discretionary nature of safety-critical maintenance requirements. Future prospects indicate continued growth supported by fleet expansion, regulatory evolution, and technological advancement in maintenance methodologies.

Market intelligence reveals several critical insights shaping the United States airframe MRO landscape. The sector demonstrates remarkable stability due to mandatory maintenance requirements, with demand remaining consistent regardless of economic conditions. Fleet demographics show that approximately 35% of commercial aircraft in the United States are over 15 years old, driving increased maintenance intensity and frequency.

Key market insights include:

Primary market drivers propelling the United States airframe MRO market include fundamental industry trends and regulatory requirements that create sustained demand for maintenance services. The most significant driver remains the mandatory nature of aircraft maintenance, with FAA regulations requiring specific maintenance intervals regardless of economic conditions. Fleet expansion continues as airlines add new routes and increase flight frequencies, directly correlating with maintenance service demand.

Aging aircraft fleets represent a critical growth driver, as older aircraft require more frequent and intensive maintenance interventions. Aircraft over 15 years old typically require 40-50% more maintenance than newer aircraft, creating substantial service opportunities. Technological complexity of modern aircraft systems necessitates specialized maintenance capabilities, driving demand for advanced service providers with appropriate certifications and equipment.

Safety regulations continue evolving, with the FAA implementing enhanced inspection requirements and maintenance standards. These regulatory changes often require additional maintenance procedures and specialized training, expanding service scope and market opportunities. Operational efficiency demands from airlines drive adoption of predictive maintenance technologies and optimized maintenance scheduling, creating new service categories and revenue streams for MRO providers.

Economic factors including increased air travel demand and cargo transportation growth directly impact aircraft utilization rates, leading to accelerated maintenance cycles. The growing emphasis on aircraft availability and operational reliability creates pressure for efficient maintenance execution and minimal downtime, favoring established MRO providers with proven capabilities.

Significant market restraints challenge the United States airframe MRO sector, primarily centered around capacity limitations and resource constraints. The most pressing restraint involves the shortage of certified aviation maintenance technicians, with current demand exceeding supply by approximately 15-20%. This skills gap limits service capacity and drives up labor costs, impacting overall market growth potential.

Regulatory complexity creates substantial barriers to entry, requiring extensive certifications, specialized equipment, and ongoing compliance investments. The FAA certification process for new MRO facilities can take 18-24 months, limiting rapid capacity expansion. Capital intensity of airframe MRO operations requires significant investments in specialized tools, equipment, and facility infrastructure, creating financial barriers for new market entrants.

Competition from OEMs presents ongoing challenges for independent MRO providers, as aircraft manufacturers expand their service offerings and leverage warranty relationships. Technology obsolescence risks require continuous investment in new diagnostic equipment and training programs, straining operational budgets. The cyclical nature of aircraft retirement and replacement cycles can create temporary overcapacity in specific market segments.

Supply chain constraints for specialized aircraft parts and components can delay maintenance completion, impacting customer satisfaction and operational efficiency. Insurance and liability costs continue rising due to the critical safety nature of airframe maintenance, adding to operational expenses and market entry barriers.

Substantial market opportunities exist within the United States airframe MRO sector, driven by evolving industry needs and technological advancement. The growing trend toward outsourced maintenance services creates significant opportunities for independent MRO providers, as airlines focus on core operations and seek cost-effective maintenance solutions. Smaller carriers and regional airlines increasingly prefer outsourcing arrangements, expanding the addressable market for specialized service providers.

Digital transformation presents numerous opportunities for innovation and service enhancement. Implementation of predictive maintenance technologies, artificial intelligence-driven diagnostics, and automated inspection systems can improve efficiency by 25-30% while reducing operational costs. Data analytics services represent emerging revenue streams, helping airlines optimize maintenance scheduling and reduce unplanned maintenance events.

Geographic expansion opportunities exist in underserved regions, particularly in the southeastern and southwestern United States where aviation activity is growing rapidly. The development of specialized service capabilities for new aircraft types and advanced materials creates differentiation opportunities and premium pricing potential. Sustainability initiatives including green maintenance practices and waste reduction programs align with industry environmental goals and regulatory trends.

Military and government contracts offer stable revenue opportunities with long-term service agreements. The growing cargo and freight aviation segment requires specialized maintenance services, particularly for converted passenger aircraft and dedicated freighters. Training and certification services represent additional revenue opportunities as the industry addresses the technician shortage through enhanced education programs.

Complex market dynamics shape the United States airframe MRO landscape, reflecting the interplay between regulatory requirements, technological advancement, and competitive pressures. The market exhibits strong defensive characteristics due to the mandatory nature of aircraft maintenance, providing stability during economic downturns. Demand patterns correlate directly with aircraft utilization rates, flight frequencies, and fleet age demographics.

Competitive dynamics involve multiple player categories including airline-owned maintenance organizations, independent MRO providers, and OEM service divisions. Each category offers distinct advantages, with airlines’ internal operations providing cost control and scheduling flexibility, while independent providers offer specialized capabilities and economies of scale. Pricing dynamics reflect the balance between cost pressures from airlines and the specialized nature of airframe maintenance services.

Technology adoption continues reshaping market dynamics, with early adopters of digital maintenance platforms gaining competitive advantages through improved efficiency and reduced costs. Regulatory evolution creates both challenges and opportunities, as new requirements may increase service demand while requiring additional investments in capabilities and certifications.

Supply chain dynamics significantly impact service delivery, with parts availability and lead times affecting maintenance scheduling and completion rates. The market demonstrates increasing consolidation trends as smaller providers seek scale advantages and larger organizations pursue geographic expansion. Customer relationship dynamics emphasize long-term partnerships and service reliability over purely cost-based selection criteria.

Comprehensive research methodology employed in analyzing the United States airframe MRO market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, maintenance managers, regulatory officials, and technology providers to gather firsthand insights into market trends and challenges. Survey data from over 150 industry participants provides quantitative insights into market dynamics and growth projections.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and trade association publications. MarkWide Research analysts conducted detailed examination of FAA databases, aircraft registration records, and maintenance facility certifications to establish comprehensive market baseline data. Historical trend analysis covers the past five years to identify patterns and growth trajectories.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert panel reviews to ensure accuracy and consistency. Market modeling incorporates econometric analysis, regression modeling, and scenario planning to develop growth projections and market forecasts. Industry expert validation ensures that research findings align with practical market realities and operational constraints.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and competitive positioning analysis to provide comprehensive market understanding. Regional analysis incorporates state-level data on aircraft registrations, maintenance facility locations, and aviation activity levels to identify geographic trends and opportunities.

Regional distribution of the United States airframe MRO market reflects the geographic concentration of aviation activity and maintenance infrastructure. California leads the market with approximately 18% market share, driven by major airports, airline headquarters, and extensive general aviation activity. The state’s diverse aviation ecosystem includes commercial carriers, cargo operators, and military installations requiring comprehensive maintenance services.

Texas represents the second-largest regional market with 16% market share, benefiting from major airline hubs in Dallas and Houston, significant military aviation presence, and growing cargo operations. Florida captures 14% market share through its position as a major tourism destination, extensive general aviation activity, and strategic location for Latin American aviation services.

Georgia maintains 12% market share primarily through Atlanta’s position as the world’s busiest airport and Delta Air Lines’ major maintenance operations. Illinois accounts for 10% market share with Chicago serving as a major aviation hub and United Airlines’ significant maintenance presence. New York represents 8% market share despite high operational costs, driven by extensive commercial aviation activity and proximity to major population centers.

Regional growth patterns show the fastest expansion in southeastern and southwestern states, driven by population growth, economic development, and increasing aviation activity. Emerging markets in states like North Carolina, Arizona, and Nevada demonstrate strong growth potential as aviation infrastructure expands and new maintenance facilities are established.

Competitive landscape of the United States airframe MRO market features diverse participants ranging from major airline maintenance divisions to specialized independent service providers. The market structure reflects the complex requirements of airframe maintenance, with different players focusing on specific aircraft types, service categories, or geographic regions.

Major market participants include:

Competitive differentiation focuses on service quality, turnaround times, cost effectiveness, and specialized capabilities. Market leaders leverage economies of scale, advanced technologies, and comprehensive service offerings to maintain competitive advantages.

Market segmentation of the United States airframe MRO sector reveals distinct categories based on aircraft type, service category, and customer segments. By aircraft type, commercial aviation dominates with 68% market share, encompassing narrow-body and wide-body aircraft maintenance. Military aviation accounts for 22% market share, while general aviation represents 10% market share.

By service category, the market segments into:

By customer segment, major airlines represent 55% of market demand, regional carriers account for 25%, cargo operators comprise 12%, and government/military customers represent 8%. Service provider types include airline-owned facilities capturing 40% market share, independent MRO providers with 35% share, and OEM service organizations holding 25% market share.

Geographic segmentation reflects aviation activity concentration, with major maintenance hubs located in states with significant airline operations and favorable business environments.

Commercial aviation category dominates the United States airframe MRO market, driven by the extensive fleet of passenger aircraft requiring regular maintenance services. This segment benefits from consistent demand patterns tied to flight schedules and regulatory requirements. Narrow-body aircraft maintenance represents the largest subsegment due to fleet size and utilization rates, while wide-body aircraft maintenance commands premium pricing due to complexity and specialized requirements.

Military aviation category provides stable, long-term revenue streams through government contracts and specialized maintenance requirements. This segment requires unique capabilities including security clearances, specialized certifications, and expertise in military-specific aircraft systems. Contract duration typically spans multiple years, providing revenue predictability and planning stability for service providers.

General aviation category encompasses diverse aircraft types from small private planes to corporate jets, requiring flexible service capabilities and geographic distribution. This segment demonstrates strong growth potential driven by increasing business aviation activity and aircraft ownership trends. Service requirements vary significantly based on aircraft size, complexity, and utilization patterns.

Cargo aviation category shows robust growth driven by e-commerce expansion and global trade requirements. Freighter aircraft often require specialized maintenance due to unique operational profiles and cargo handling systems. The conversion of passenger aircraft to cargo configuration creates additional maintenance opportunities and specialized service requirements.

Industry participants in the United States airframe MRO market realize substantial benefits through participation in this essential aviation sector. Airlines benefit from reliable maintenance services that ensure fleet availability, operational safety, and regulatory compliance. Outsourcing maintenance activities allows airlines to focus on core operations while accessing specialized expertise and achieving cost efficiencies.

MRO service providers benefit from:

Stakeholder benefits extend to passengers through enhanced safety and reliability, regulatory authorities through improved compliance, and the broader economy through aviation industry support. Equipment manufacturers benefit from parts sales and service revenue, while technology providers gain opportunities to develop and deploy innovative maintenance solutions.

Regional economies benefit from high-skilled employment opportunities, infrastructure development, and economic multiplier effects from aviation maintenance activities. The sector provides career advancement opportunities for skilled technicians and contributes to the United States’ position as a global aviation leader.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the United States airframe MRO market, with service providers increasingly adopting advanced technologies to improve efficiency and reduce costs. Predictive maintenance systems utilizing artificial intelligence and machine learning algorithms are becoming standard practice, enabling proactive maintenance scheduling and reducing unplanned aircraft groundings by 20-25%.

Sustainability initiatives are gaining prominence as environmental regulations tighten and industry stakeholders prioritize carbon footprint reduction. MRO providers are implementing green maintenance practices, waste reduction programs, and sustainable material usage. Circular economy principles are being applied to component refurbishment and recycling, creating new revenue streams while supporting environmental objectives.

Consolidation trends continue as smaller MRO providers seek scale advantages and larger organizations pursue geographic expansion and capability enhancement. Strategic partnerships between airlines and independent MRO providers are becoming more common, combining operational expertise with specialized capabilities. Vertical integration trends see some providers expanding into component manufacturing and parts distribution.

Workforce development initiatives address the critical technician shortage through enhanced training programs, apprenticeships, and technology-assisted maintenance procedures. Remote diagnostic capabilities and augmented reality systems are reducing the need for specialized on-site expertise while improving maintenance accuracy. Data analytics applications are expanding beyond maintenance scheduling to include performance optimization and cost management.

Recent industry developments highlight the dynamic nature of the United States airframe MRO market and ongoing evolution in service delivery methods. Technology partnerships between MRO providers and software companies are accelerating digital transformation initiatives, with several major providers implementing comprehensive maintenance management platforms that integrate scheduling, inventory management, and regulatory compliance.

Facility expansions continue across key markets, with several major MRO providers announcing significant capacity additions to meet growing demand. Geographic diversification strategies see established providers entering new regional markets through facility development and strategic acquisitions. Certification achievements for new aircraft types expand service capabilities and addressable market opportunities.

Regulatory developments include updated FAA guidance on digital maintenance records, remote inspection procedures, and enhanced safety management systems. Training program enhancements address workforce development needs through partnerships with educational institutions and expanded apprenticeship opportunities. Sustainability certifications are becoming more common as providers demonstrate environmental responsibility and compliance with emerging regulations.

Innovation initiatives include development of automated inspection systems, advanced materials for structural repairs, and enhanced diagnostic equipment. Customer service improvements focus on reducing turnaround times, improving communication, and providing real-time maintenance status updates. Supply chain optimization efforts address parts availability challenges through strategic partnerships and inventory management improvements.

Strategic recommendations for United States airframe MRO market participants emphasize the importance of technology adoption, workforce development, and operational efficiency improvements. MWR analysis suggests that service providers should prioritize digital transformation initiatives to remain competitive and meet evolving customer expectations. Investment in predictive maintenance technologies and data analytics capabilities will become essential for long-term success.

Capacity expansion strategies should focus on high-growth regions and underserved market segments, particularly in the southeastern and southwestern United States. Workforce development initiatives require immediate attention, with recommendations for enhanced training programs, competitive compensation packages, and technology-assisted maintenance procedures to address the technician shortage.

Customer relationship management should emphasize long-term partnerships and value-added services beyond basic maintenance activities. Diversification strategies may include expansion into adjacent services such as aircraft modifications, component overhaul, and maintenance training. Sustainability initiatives will become increasingly important for regulatory compliance and customer preference alignment.

Financial management recommendations include careful capacity planning to avoid overcapacity during market downturns, strategic inventory management to optimize working capital, and investment in automation technologies to reduce labor dependency. Risk management strategies should address regulatory changes, technology obsolescence, and competitive pressures through diversified service offerings and flexible operational models.

Future prospects for the United States airframe MRO market remain positive, supported by fundamental industry drivers and evolving market dynamics. Growth projections indicate continued expansion at 4.2% CAGR through the forecast period, driven by fleet growth, aging aircraft requiring more intensive maintenance, and increasing regulatory requirements. The market is expected to benefit from recovery in commercial aviation activity and sustained growth in cargo operations.

Technology evolution will continue reshaping service delivery methods, with artificial intelligence, machine learning, and automated systems becoming standard practice. Digital maintenance platforms are projected to achieve 75% adoption rates among major MRO providers within five years, significantly improving operational efficiency and customer service quality. Predictive maintenance capabilities will expand beyond current applications to include comprehensive fleet health monitoring and optimization.

Market structure evolution may see increased consolidation as smaller providers seek scale advantages and larger organizations pursue geographic expansion. Service differentiation will become increasingly important as competition intensifies, with providers focusing on specialized capabilities, superior customer service, and innovative solutions. Sustainability requirements will drive adoption of green maintenance practices and circular economy principles.

Workforce development initiatives will be critical for market growth, with industry stakeholders collaborating on training programs and technology solutions to address the technician shortage. Regional growth patterns will favor states with favorable business environments, growing aviation activity, and infrastructure development support. The market will continue benefiting from the United States’ position as the global aviation leader and the mandatory nature of aircraft maintenance requirements.

The United States airframe MRO market represents a critical and resilient sector within the aviation industry, characterized by steady growth prospects and evolving service delivery methods. Market fundamentals remain strong, supported by the mandatory nature of aircraft maintenance, growing fleet sizes, and increasing regulatory requirements. The sector demonstrates remarkable stability due to safety-critical service requirements that persist regardless of economic conditions.

Key success factors for market participants include technology adoption, workforce development, operational efficiency, and customer relationship management. The ongoing digital transformation presents both opportunities and challenges, requiring strategic investments in advanced maintenance technologies while addressing the critical shortage of skilled technicians. Competitive advantages will increasingly depend on service quality, turnaround times, and innovative solutions rather than purely cost-based competition.

Future growth will be driven by fleet expansion, aircraft aging trends, and evolving maintenance requirements as new technologies are integrated into aircraft systems. The market’s geographic distribution will continue evolving as aviation activity grows in emerging regions and established hubs expand their capabilities. Sustainability initiatives will become increasingly important as environmental regulations tighten and industry stakeholders prioritize carbon footprint reduction.

The United States airframe MRO market is well-positioned for continued growth and evolution, supported by strong industry fundamentals, technological advancement, and the critical importance of aviation safety. Success in this market will require strategic planning, operational excellence, and continuous adaptation to changing industry requirements and customer expectations.

What is Airframe MRO?

Airframe MRO refers to the maintenance, repair, and overhaul services for the airframe of an aircraft, which includes the fuselage, wings, and tail. These services are essential for ensuring the safety, reliability, and performance of aircraft throughout their operational life.

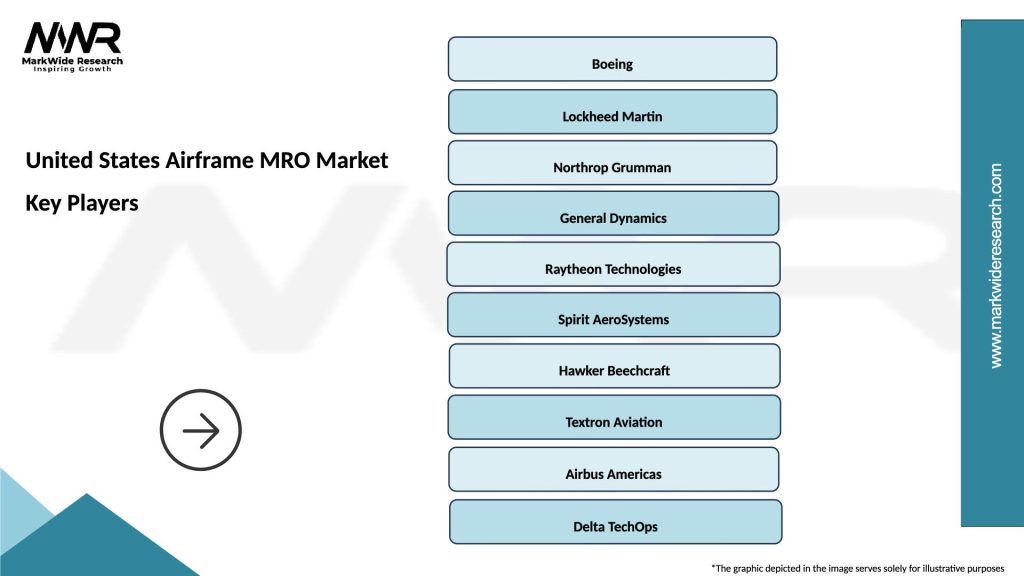

What are the key players in the United States Airframe MRO Market?

Key players in the United States Airframe MRO Market include Boeing, Lockheed Martin, and Northrop Grumman, among others. These companies provide a range of services from routine maintenance to extensive overhauls and modifications.

What are the growth factors driving the United States Airframe MRO Market?

The growth of the United States Airframe MRO Market is driven by increasing air travel demand, the aging fleet of aircraft, and advancements in maintenance technologies. Additionally, regulatory requirements for safety and efficiency are pushing airlines to invest in MRO services.

What challenges does the United States Airframe MRO Market face?

The United States Airframe MRO Market faces challenges such as skilled labor shortages, high operational costs, and the complexity of modern aircraft systems. These factors can impact the efficiency and availability of MRO services.

What opportunities exist in the United States Airframe MRO Market?

Opportunities in the United States Airframe MRO Market include the adoption of digital technologies for predictive maintenance and the expansion of MRO services to support new aircraft models. Additionally, the growing focus on sustainability presents avenues for eco-friendly MRO practices.

What trends are shaping the United States Airframe MRO Market?

Trends in the United States Airframe MRO Market include the increasing use of automation and artificial intelligence in maintenance processes, as well as a shift towards more integrated service offerings. There is also a growing emphasis on sustainability and reducing the environmental impact of MRO activities.

United States Airframe MRO Market

| Segmentation Details | Description |

|---|---|

| Service Type | Maintenance, Repair, Overhaul, Inspection |

| End User | Commercial Airlines, Cargo Operators, Military, Private Operators |

| Component | Airframe, Engine, Avionics, Landing Gear |

| Technology | Predictive Maintenance, Digital Twin, IoT Solutions, Automation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Airframe MRO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at