444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States agricultural biologicals market represents a transformative sector within the broader agricultural industry, focusing on naturally derived products that enhance crop productivity, soil health, and sustainable farming practices. This dynamic market encompasses a comprehensive range of biological solutions including biopesticides, biofertilizers, biostimulants, and soil amendments that are revolutionizing modern agriculture across the nation.

Market dynamics indicate robust growth driven by increasing demand for sustainable farming practices and organic food production. The sector is experiencing unprecedented expansion as farmers seek alternatives to synthetic chemicals, with adoption rates showing significant acceleration across various agricultural segments. Key drivers include environmental regulations, consumer preferences for organic produce, and the proven efficacy of biological solutions in improving crop yields while reducing environmental impact.

Regional distribution shows concentrated activity in major agricultural states including California, Iowa, Illinois, Nebraska, and Texas, where large-scale farming operations are increasingly integrating biological products into their crop management strategies. The market demonstrates strong penetration rates in specialty crops, with growing adoption in row crops and horticultural applications.

Technology advancement continues to drive innovation, with companies developing sophisticated formulations that enhance product stability, efficacy, and application convenience. The integration of precision agriculture technologies with biological products is creating new opportunities for targeted application and improved return on investment for farmers.

The United States agricultural biologicals market refers to the comprehensive ecosystem of naturally derived agricultural inputs that utilize living organisms, their metabolites, or naturally occurring compounds to enhance crop production, protect plants from pests and diseases, and improve soil health. This market encompasses products derived from bacteria, fungi, viruses, plants, animals, and minerals that provide sustainable alternatives to conventional synthetic agricultural chemicals.

Agricultural biologicals function through various mechanisms including biological pest control, nutrient solubilization, plant growth promotion, stress tolerance enhancement, and soil microbiome improvement. These products work in harmony with natural ecosystems, offering farmers effective solutions while minimizing environmental impact and supporting long-term agricultural sustainability.

Market scope includes four primary categories: biopesticides for pest and disease management, biofertilizers for nutrient enhancement, biostimulants for plant growth promotion, and soil amendments for soil health improvement. Each category addresses specific agricultural challenges while contributing to overall farm productivity and environmental stewardship.

Strategic analysis reveals the United States agricultural biologicals market as a rapidly evolving sector characterized by innovation, sustainability focus, and strong growth momentum. The market benefits from favorable regulatory frameworks, increasing farmer awareness, and growing consumer demand for sustainably produced food products.

Key market drivers include environmental sustainability concerns, regulatory pressure on synthetic chemicals, organic farming expansion, and proven economic benefits of biological solutions. The sector demonstrates resilience and adaptability, with companies continuously developing new formulations and application technologies to meet diverse agricultural needs.

Competitive landscape features a mix of established multinational corporations, specialized biotechnology companies, and emerging startups, creating a dynamic environment for innovation and market expansion. Strategic partnerships between technology providers and agricultural companies are accelerating product development and market penetration.

Future prospects indicate continued strong growth driven by technological advancement, regulatory support, and increasing adoption across diverse crop types and farming systems. The market is positioned to play a crucial role in addressing global food security challenges while promoting environmental sustainability.

Market intelligence reveals several critical insights that define the current state and future trajectory of the United States agricultural biologicals market:

Environmental sustainability serves as the primary driver propelling the United States agricultural biologicals market forward. Growing awareness of environmental impact from synthetic chemicals is motivating farmers to adopt biological alternatives that maintain productivity while reducing ecological footprint. This shift aligns with broader sustainability goals and corporate responsibility initiatives across the agricultural value chain.

Regulatory developments continue to favor biological products through expedited registration processes and reduced regulatory barriers compared to synthetic alternatives. The Environmental Protection Agency’s supportive stance on biological pesticides and the USDA’s organic certification requirements are creating favorable market conditions for biological product adoption.

Consumer demand for organic and sustainably produced food is driving agricultural transformation throughout the supply chain. Retailers and food processors are increasingly requiring suppliers to demonstrate sustainable farming practices, creating market pull for biological solutions that support these requirements while maintaining product quality and yield.

Economic benefits demonstrated by biological products are convincing farmers to integrate these solutions into their crop management programs. Improved soil health, enhanced nutrient efficiency, and reduced input costs over time provide compelling economic justification for adoption, particularly when combined with premium pricing for sustainably produced crops.

Technological advancement in product formulation, delivery systems, and application methods is expanding the practical utility of biological products. Enhanced stability, extended shelf life, and improved field performance are addressing historical concerns about biological product reliability and effectiveness.

Product variability remains a significant challenge in the agricultural biologicals market, as biological products can exhibit inconsistent performance under different environmental conditions. Weather patterns, soil types, and application timing can significantly impact product efficacy, creating uncertainty for farmers accustomed to more predictable synthetic alternatives.

Higher initial costs associated with biological products compared to conventional alternatives can deter adoption, particularly among price-sensitive farmers operating on thin margins. While long-term economic benefits may justify the investment, the upfront cost differential presents a barrier to widespread adoption across all farming segments.

Limited shelf life of many biological products creates logistical challenges for distribution and storage, requiring specialized handling and storage conditions that increase supply chain complexity and costs. This constraint particularly affects smaller distributors and retailers who may lack appropriate storage facilities.

Knowledge gaps among farmers regarding proper application techniques, timing, and integration with existing crop management practices can limit effective utilization of biological products. The learning curve associated with biological products requires education and technical support that may not be readily available in all regions.

Regulatory complexity surrounding biological product registration and labeling can create confusion and delays in product availability. While generally more favorable than synthetic chemical regulations, the biological product approval process still requires significant time and investment from manufacturers.

Precision agriculture integration presents substantial opportunities for biological product companies to develop targeted solutions that optimize application timing, placement, and dosing. The convergence of biological products with digital agriculture technologies enables more precise and effective use of biological inputs, potentially improving both efficacy and economic returns.

Specialty crop expansion offers significant growth potential as high-value crops provide better economic justification for biological product adoption. Fruits, vegetables, nuts, and specialty grains represent attractive market segments where biological solutions can command premium pricing while delivering superior performance.

Organic farming growth creates expanding demand for approved biological inputs as organic acreage continues to increase nationwide. The limited options available to organic farmers for pest control and fertility management make biological products essential components of organic production systems.

International market development provides opportunities for U.S. companies to export biological products and technologies to global markets where sustainable agriculture adoption is accelerating. Export potential exists in both developed and developing agricultural markets seeking sustainable intensification solutions.

Product innovation in areas such as seed treatments, post-harvest applications, and novel delivery systems represents untapped market potential. Companies investing in research and development of next-generation biological solutions are positioned to capture emerging market opportunities.

Supply chain evolution is reshaping the agricultural biologicals market as companies develop specialized distribution networks and storage facilities to handle biological products effectively. The unique requirements of biological products are driving innovation in packaging, transportation, and storage solutions that maintain product viability throughout the supply chain.

Competitive intensity is increasing as both established agricultural companies and specialized biotechnology firms compete for market share. This competition is driving innovation, improving product quality, and reducing costs, ultimately benefiting farmers through better product options and competitive pricing.

Partnership strategies are becoming increasingly important as companies seek to combine complementary capabilities in research, manufacturing, and distribution. Strategic alliances between biotechnology companies and established agricultural firms are accelerating product development and market penetration.

Market consolidation trends are evident as larger companies acquire specialized biological product manufacturers to expand their portfolios and capabilities. This consolidation is creating more comprehensive product offerings while potentially reducing the number of independent players in the market.

Technology convergence with digital agriculture, precision application equipment, and data analytics is creating new value propositions for biological products. The integration of biological solutions with smart farming technologies is enhancing product effectiveness and farmer adoption rates.

Comprehensive analysis of the United States agricultural biologicals market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, farmers, and regulatory experts, providing firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, academic publications, regulatory filings, and company financial statements to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and competitive landscape factors.

Data triangulation methods are employed to cross-verify information from multiple sources, ensuring reliability and accuracy of market insights. Quantitative data is validated through multiple independent sources to provide confidence in statistical findings and projections.

Expert consultation with agricultural scientists, industry analysts, and market specialists provides technical validation and strategic perspective on market developments. These consultations help interpret complex market dynamics and identify emerging trends that may impact future market evolution.

Field research includes on-farm visits and farmer surveys to understand practical application challenges and benefits of biological products in real-world agricultural settings. This grassroots perspective provides valuable insights into adoption barriers and success factors.

California leads the United States agricultural biologicals market with the highest adoption rates, driven by extensive specialty crop production and strong environmental regulations. The state’s diverse agricultural landscape, including fruits, vegetables, nuts, and wine grapes, provides ideal conditions for biological product utilization. Market penetration in California exceeds national averages, with particularly strong adoption in organic and premium crop segments.

Midwest region represents the largest potential market for agricultural biologicals, encompassing major corn and soybean producing states including Iowa, Illinois, Indiana, and Ohio. While adoption rates have historically lagged behind specialty crop regions, recent years show accelerating growth as row crop farmers recognize the benefits of biological solutions for soil health and sustainable intensification.

Texas demonstrates strong market growth across diverse agricultural sectors, from cotton and grain production to specialty crops and livestock operations. The state’s large agricultural economy and progressive farming community contribute to robust market expansion in biological products across multiple crop categories.

Southeast region shows increasing adoption of biological products in cotton, peanuts, fruits, and vegetables. States including Georgia, Florida, North Carolina, and South Carolina are experiencing growing market penetration as farmers seek sustainable solutions for pest management and crop enhancement in challenging growing conditions.

Pacific Northwest markets, including Washington and Oregon, demonstrate strong adoption rates in tree fruits, berries, and specialty crops. The region’s focus on sustainable agriculture and export markets drives premium product adoption and innovative biological solutions.

Market leadership in the United States agricultural biologicals sector is characterized by a diverse mix of established multinational corporations and specialized biotechnology companies. The competitive environment fosters innovation while providing farmers with comprehensive product options across all biological categories.

Strategic positioning varies among competitors, with some focusing on broad portfolio approaches while others specialize in specific biological categories or application methods. Innovation capabilities, distribution networks, and farmer relationships serve as key competitive differentiators in this dynamic market.

Product type segmentation divides the United States agricultural biologicals market into four primary categories, each addressing specific agricultural needs and applications:

By Product Type:

By Crop Type:

By Application Method:

Biopesticides category represents the most established segment within the agricultural biologicals market, with proven efficacy in managing various pest challenges while meeting environmental and regulatory requirements. This category benefits from strong farmer familiarity and demonstrated return on investment across diverse crop systems. Growth momentum continues as resistance management concerns drive adoption of biological alternatives to synthetic pesticides.

Biofertilizers segment shows rapid expansion as farmers recognize the dual benefits of nutrient supply and soil health improvement. Microbial inoculants and organic fertilizers are gaining traction in both conventional and organic farming systems, with particular strength in nitrogen fixation and phosphorus solubilization applications. Market penetration is accelerating in regions with intensive agriculture and sustainability focus.

Biostimulants category represents the fastest-growing segment, driven by proven benefits in stress tolerance, yield enhancement, and crop quality improvement. These products appeal to farmers seeking competitive advantages through improved plant performance under challenging growing conditions. Innovation activity is particularly strong in this category, with new formulations and application methods continuously entering the market.

Soil amendments segment addresses growing farmer interest in soil health and long-term productivity sustainability. Products in this category provide foundation benefits that support overall farm productivity and environmental stewardship goals. Adoption rates are increasing as farmers recognize the connection between soil health and long-term profitability.

Farmers benefit from agricultural biologicals through multiple value propositions including reduced environmental impact, improved soil health, enhanced crop quality, and potential premium pricing for sustainably produced crops. The long-term benefits of biological products often exceed initial cost investments through improved soil fertility, reduced input requirements, and enhanced crop resilience.

Manufacturers gain competitive advantages through biological product portfolios that address growing market demand for sustainable solutions. Companies investing in biological technologies position themselves for long-term growth while meeting evolving customer needs and regulatory requirements. Innovation opportunities in biologicals provide pathways for differentiation and market leadership.

Distributors and retailers benefit from biological products through expanded product portfolios, higher margins, and growing customer demand. The specialized nature of biological products creates opportunities for value-added services including technical support and application guidance that strengthen customer relationships.

Consumers receive benefits through access to food products produced with reduced synthetic chemical inputs, supporting health and environmental preferences. The growing availability of sustainably produced food options meets evolving consumer demands while supporting agricultural sustainability goals.

Environmental stakeholders benefit from reduced chemical runoff, improved soil health, enhanced biodiversity, and lower environmental impact from agricultural production. Biological products support ecosystem health while maintaining agricultural productivity, contributing to sustainable food system development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision application technologies are transforming how biological products are delivered to crops, with smart sprayers, variable rate application, and targeted delivery systems improving efficacy while reducing waste. These technologies enable farmers to optimize biological product performance through precise timing, placement, and dosing based on real-time field conditions and crop needs.

Microbiome research is driving development of sophisticated biological products that work synergistically with plant and soil microbiomes. Companies are investing heavily in understanding microbial interactions to develop products that enhance beneficial microbial communities while suppressing harmful organisms. This research is leading to more effective and reliable biological solutions.

Combination products that integrate multiple biological modes of action are gaining popularity as farmers seek comprehensive solutions that address multiple challenges simultaneously. These products combine pest control, plant nutrition, and growth enhancement benefits in single formulations, simplifying application while improving overall effectiveness.

Sustainable intensification trends are driving adoption of biological products that enable farmers to maintain or increase productivity while reducing environmental impact. This approach aligns with global sustainability goals while meeting growing food demand, positioning biological products as essential tools for future agriculture.

Digital integration with farm management systems is enabling better decision-making regarding biological product application timing, rates, and combinations. Data-driven approaches help farmers optimize biological product performance while tracking return on investment and environmental benefits.

Strategic acquisitions continue to reshape the competitive landscape as major agricultural companies acquire specialized biological product manufacturers to expand their portfolios and capabilities. Recent acquisitions have focused on companies with innovative technologies, strong product pipelines, and established market positions in specific biological categories.

Research partnerships between universities, government agencies, and private companies are accelerating biological product development and validation. These collaborations combine academic research expertise with commercial development capabilities to bring innovative solutions to market more efficiently.

Regulatory streamlining initiatives by the EPA and USDA are reducing approval timelines for biological products while maintaining safety standards. These improvements support faster market entry for innovative products and encourage continued investment in biological product development.

Manufacturing capacity expansion by leading companies reflects growing market demand and confidence in long-term growth prospects. New production facilities and expanded manufacturing capabilities are improving product availability while reducing costs through economies of scale.

Technology licensing agreements are enabling broader access to innovative biological technologies while allowing specialized companies to focus on research and development. These partnerships accelerate market penetration of new technologies while providing sustainable business models for innovation companies.

MarkWide Research analysis suggests that companies should prioritize investment in product stability and shelf-life improvement technologies to address key adoption barriers. Enhanced formulation technologies that extend product viability under field conditions will significantly improve farmer confidence and market penetration rates.

Market positioning strategies should emphasize economic benefits and return on investment rather than solely focusing on environmental advantages. Farmers need clear evidence of financial benefits to justify adoption of premium-priced biological products, particularly in commodity crop segments where margins are constrained.

Distribution network development requires specialized capabilities for biological product handling, storage, and technical support. Companies should invest in training programs for distributors and retailers to ensure proper product handling and provide farmers with necessary technical guidance for successful implementation.

Research and development focus should prioritize products that address specific regional challenges and crop needs rather than pursuing broad-spectrum solutions. Targeted products that solve specific problems are more likely to achieve strong adoption and command premium pricing in competitive markets.

Partnership strategies with precision agriculture technology providers offer opportunities to create integrated solutions that optimize biological product performance. These partnerships can differentiate products while providing farmers with comprehensive solutions that justify premium pricing through improved results.

Long-term growth prospects for the United States agricultural biologicals market remain highly favorable, driven by continued sustainability focus, regulatory support, and technological advancement. The market is positioned to capture an increasing share of total agricultural input spending as farmers recognize the value proposition of biological solutions for sustainable intensification.

Technology evolution will continue to address current limitations in product stability, efficacy consistency, and application convenience. Next-generation formulations incorporating nanotechnology, controlled-release mechanisms, and enhanced delivery systems will improve product performance while reducing application complexity and costs.

Market expansion into row crop segments represents the largest growth opportunity, with MWR projecting significant adoption acceleration as product performance improves and economic benefits become more apparent. The vast acreage in corn and soybean production provides substantial market potential for companies that successfully develop cost-effective biological solutions.

Integration trends with digital agriculture and precision farming technologies will create new value propositions and market opportunities. The convergence of biological products with smart farming systems will enable optimized application strategies that maximize benefits while minimizing costs and environmental impact.

Global expansion opportunities for U.S. companies will grow as international markets adopt sustainable agriculture practices and seek proven biological solutions. Export potential exists in both developed and developing markets where agricultural sustainability is becoming increasingly important for market access and consumer acceptance.

The United States agricultural biologicals market stands at a pivotal point in its evolution, with strong fundamentals supporting continued growth and market expansion. The convergence of environmental sustainability requirements, technological advancement, and proven economic benefits creates a compelling value proposition for biological products across diverse agricultural applications.

Market dynamics favor continued adoption acceleration, particularly as product performance improvements address historical limitations and cost-effectiveness becomes more apparent through long-term use. The regulatory environment remains supportive, while consumer demand for sustainably produced food provides market pull throughout the agricultural value chain.

Innovation momentum in product development, application technologies, and integration with precision agriculture systems positions the market for sustained growth and expanded applications. Companies that successfully navigate the challenges of product consistency, cost optimization, and farmer education will capture significant market opportunities in this transformative sector.

Strategic success in the agricultural biologicals market requires balanced focus on technological innovation, market education, and economic value demonstration. As the market matures, companies that provide comprehensive solutions addressing farmer needs while delivering measurable benefits will establish leadership positions in this dynamic and growing industry.

What is Agricultural Biologicals?

Agricultural Biologicals refer to products derived from natural materials, including microorganisms, plant extracts, and other organic substances, used to enhance agricultural productivity and sustainability. They play a crucial role in pest management, soil health, and crop protection.

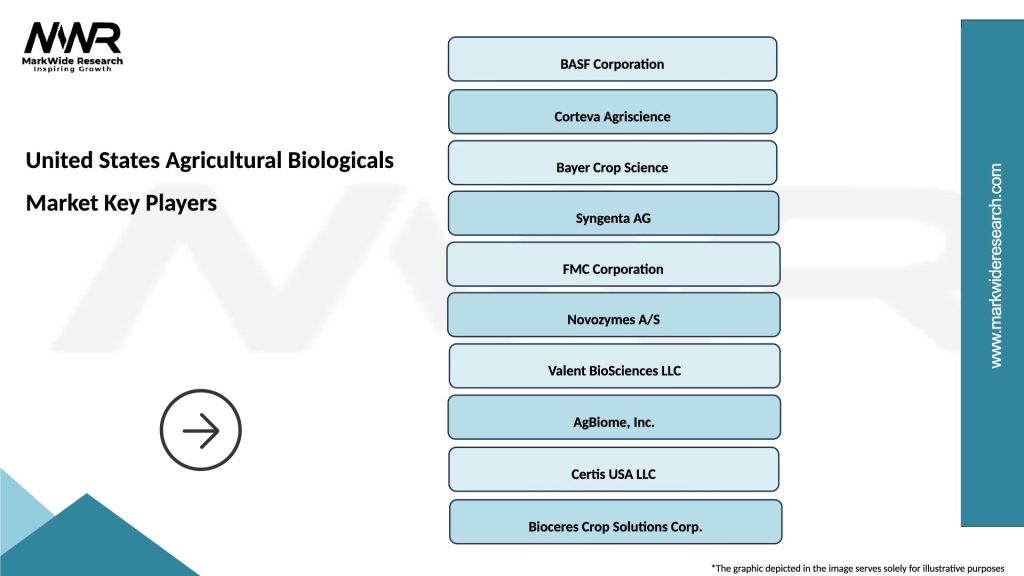

What are the key players in the United States Agricultural Biologicals Market?

Key players in the United States Agricultural Biologicals Market include companies like Bayer AG, BASF SE, and Syngenta AG, which are known for their innovative biological products and solutions for agriculture. These companies focus on developing sustainable practices and enhancing crop yields, among others.

What are the main drivers of the United States Agricultural Biologicals Market?

The main drivers of the United States Agricultural Biologicals Market include the increasing demand for sustainable farming practices, the need for effective pest control solutions, and the growing awareness of environmental impacts associated with chemical fertilizers. Additionally, regulatory support for organic farming is also contributing to market growth.

What challenges does the United States Agricultural Biologicals Market face?

The United States Agricultural Biologicals Market faces challenges such as the limited shelf life of biological products, variability in efficacy due to environmental conditions, and competition from synthetic chemicals. These factors can hinder adoption rates among traditional farmers.

What opportunities exist in the United States Agricultural Biologicals Market?

Opportunities in the United States Agricultural Biologicals Market include the development of new formulations that enhance product stability and effectiveness, as well as the expansion into new crop segments. Additionally, increasing consumer demand for organic produce presents a significant growth avenue.

What trends are shaping the United States Agricultural Biologicals Market?

Trends shaping the United States Agricultural Biologicals Market include the rise of precision agriculture technologies, the integration of biologicals with digital farming solutions, and a growing focus on biopesticides and biofertilizers. These trends reflect a shift towards more sustainable and efficient agricultural practices.

United States Agricultural Biologicals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Biofertilizers, Biopesticides, Biostimulants, Microbial Inoculants |

| Application | Crop Protection, Soil Health, Seed Treatment, Plant Growth |

| End User | Farmers, Agricultural Cooperatives, Research Institutions, Crop Consultants |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Agricultural Supply Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Agricultural Biologicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at