444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States additive manufacturing market represents one of the most dynamic and rapidly evolving sectors within the advanced manufacturing landscape. This transformative technology, commonly known as 3D printing, has revolutionized production processes across multiple industries, from aerospace and automotive to healthcare and consumer goods. The market demonstrates remarkable growth momentum, with industry analysts projecting a compound annual growth rate (CAGR) of 18.2% through the forecast period.

Market penetration has accelerated significantly as organizations recognize the strategic advantages of additive manufacturing technologies. The sector encompasses various printing technologies including stereolithography (SLA), selective laser sintering (SLS), fused deposition modeling (FDM), and electron beam melting (EBM). These technologies serve diverse applications ranging from rapid prototyping to end-use part production, driving widespread adoption across manufacturing verticals.

Regional distribution shows concentrated activity in technology hubs including California, Texas, Michigan, and the Northeast corridor, where established manufacturing bases combine with innovative research institutions. The market benefits from substantial government support through initiatives promoting advanced manufacturing capabilities and domestic production resilience.

The United States additive manufacturing market refers to the comprehensive ecosystem of technologies, materials, services, and applications that enable layer-by-layer construction of three-dimensional objects from digital designs. This market encompasses hardware systems, specialized materials, software solutions, and professional services that collectively support the production of components and products through additive processes rather than traditional subtractive manufacturing methods.

Additive manufacturing fundamentally differs from conventional manufacturing by building objects incrementally, adding material only where needed according to digital specifications. This approach eliminates many constraints associated with traditional manufacturing, enabling complex geometries, customized products, and reduced material waste. The technology spans multiple processes including powder bed fusion, material extrusion, vat photopolymerization, and directed energy deposition.

Market scope includes industrial-grade systems for production applications, desktop printers for prototyping and small-scale manufacturing, specialized materials ranging from polymers to metals and ceramics, and comprehensive software platforms for design optimization and production management.

Strategic positioning of the United States additive manufacturing market reflects its critical role in reshoring manufacturing capabilities and enhancing supply chain resilience. The sector has transitioned from primarily prototyping applications to encompass full-scale production across multiple industries, with aerospace applications representing approximately 32% of market adoption due to the technology’s ability to produce lightweight, complex components.

Technology advancement continues to drive market expansion, with significant improvements in printing speeds, material properties, and surface finishes. Multi-material printing capabilities and hybrid manufacturing systems that combine additive and subtractive processes are expanding application possibilities. The integration of artificial intelligence and machine learning for process optimization and quality control represents a key growth driver.

Investment landscape shows robust capital deployment across the value chain, from equipment manufacturers to material suppliers and service providers. Venture capital and private equity investments focus on innovative startups developing next-generation technologies, while established manufacturers expand capabilities through strategic acquisitions and partnerships.

Regulatory environment increasingly supports additive manufacturing adoption through updated standards and certification processes, particularly in highly regulated industries such as aerospace and medical devices. Government initiatives promote domestic manufacturing capabilities and technology leadership in strategic sectors.

Technology evolution demonstrates clear progression toward production-scale applications, with industrial systems achieving throughput rates and quality levels suitable for end-use part manufacturing. The following insights highlight critical market developments:

Technological advancement serves as the primary catalyst for market growth, with continuous improvements in printing speeds, resolution, and material properties expanding application possibilities. Multi-material printing capabilities enable the production of complex assemblies in single build processes, reducing assembly requirements and improving part integration.

Supply chain resilience concerns, particularly highlighted during recent global disruptions, drive organizations to adopt distributed manufacturing strategies. Additive manufacturing enables local production of critical components, reducing dependence on complex global supply chains and improving response times to market demands.

Customization demands across industries create significant opportunities for additive manufacturing technologies. Healthcare applications benefit from patient-specific implants and prosthetics, while aerospace and automotive sectors leverage mass customization for optimized performance characteristics. Consumer goods manufacturers utilize the technology for personalized products and limited-edition releases.

Sustainability initiatives increasingly favor additive manufacturing due to its material efficiency and reduced waste generation. The technology’s ability to produce components with optimized material distribution and reduced weight contributes to environmental goals while maintaining or improving performance characteristics.

Government support through research funding, tax incentives, and procurement programs accelerates technology adoption and development. Federal initiatives promoting advanced manufacturing capabilities and domestic production capacity create favorable conditions for market growth.

High initial investment requirements for industrial-grade additive manufacturing systems present significant barriers for many organizations. Equipment costs, facility modifications, and workforce training represent substantial capital commitments that may deter adoption, particularly among smaller manufacturers.

Material limitations continue to constrain application possibilities, despite ongoing development efforts. Limited availability of certified materials for critical applications, particularly in aerospace and medical sectors, restricts market expansion. Material costs often exceed those of traditional manufacturing inputs, impacting economic viability for certain applications.

Production speed limitations affect competitiveness for higher-volume applications. While suitable for complex, low-volume parts, additive manufacturing processes generally require longer cycle times compared to traditional manufacturing methods for simple geometries or large quantities.

Quality consistency challenges, including surface finish variations, dimensional accuracy limitations, and potential defects, require extensive post-processing and quality control measures. These factors increase total production costs and complexity, particularly for critical applications requiring stringent quality standards.

Skilled workforce shortages limit adoption rates as organizations struggle to find personnel with appropriate technical expertise. The interdisciplinary nature of additive manufacturing, requiring knowledge of materials science, process engineering, and digital design, creates training and recruitment challenges.

Healthcare applications present exceptional growth opportunities, with personalized medicine driving demand for patient-specific devices and implants. Bioprinting technologies show promise for tissue engineering and regenerative medicine applications, potentially revolutionizing treatment approaches for various medical conditions.

Aerospace sector expansion offers substantial market potential as manufacturers seek to reduce component weight and improve fuel efficiency. The technology’s ability to produce complex internal geometries and consolidated assemblies aligns perfectly with aerospace performance requirements and sustainability goals.

Automotive industry transformation creates opportunities for both prototyping and production applications. Electric vehicle development particularly benefits from additive manufacturing’s design freedom and rapid iteration capabilities, while traditional automotive manufacturers explore applications for customized components and tooling.

Construction industry adoption represents an emerging opportunity with large-scale 3D printing systems capable of producing building components and entire structures. This application addresses housing shortages and construction labor challenges while enabling architectural designs previously impossible with traditional methods.

Space exploration initiatives drive demand for additive manufacturing capabilities both on Earth and in space environments. The technology’s potential for in-space manufacturing and repair capabilities supports long-duration missions and reduces launch payload requirements.

Competitive landscape evolution shows increasing consolidation as established manufacturers acquire innovative startups to expand technology portfolios. This trend accelerates technology development while providing startups with resources for scaling operations and market penetration.

Technology convergence with other advanced manufacturing technologies creates synergistic opportunities. Integration with robotics, artificial intelligence, and Internet of Things (IoT) systems enables automated production workflows and predictive maintenance capabilities, improving overall system efficiency by approximately 25-30%.

Market maturation demonstrates shifting focus from technology development to application optimization and cost reduction. Organizations increasingly evaluate additive manufacturing based on total cost of ownership rather than initial equipment costs, considering factors such as material efficiency, labor requirements, and inventory reduction benefits.

Standards development accelerates as industry organizations and regulatory bodies establish certification processes and quality standards. This standardization reduces adoption barriers and enables broader market acceptance, particularly in regulated industries requiring stringent compliance.

Global competition intensifies as international manufacturers expand capabilities and market presence. Domestic manufacturers respond through innovation, strategic partnerships, and government support programs designed to maintain technological leadership and manufacturing competitiveness.

Data collection encompasses comprehensive primary and secondary research methodologies to ensure accurate market assessment and forecasting. Primary research includes structured interviews with industry executives, technology developers, end-users, and market participants across the additive manufacturing value chain.

Industry surveys capture quantitative data on adoption rates, investment plans, technology preferences, and market challenges from manufacturing organizations across multiple sectors. Survey participants include companies ranging from small job shops to large multinational corporations, providing diverse perspectives on market dynamics.

Secondary research incorporates analysis of company financial reports, patent filings, government databases, trade publications, and academic research to validate primary findings and identify emerging trends. This approach ensures comprehensive coverage of market developments and technological advances.

Market modeling utilizes statistical analysis and forecasting techniques to project market growth and segment performance. Models incorporate multiple variables including technology adoption curves, economic indicators, regulatory changes, and competitive dynamics to generate reliable projections.

Expert validation involves consultation with industry specialists, technology researchers, and market analysts to verify findings and refine conclusions. This validation process ensures research accuracy and provides additional insights into market developments and future trends.

California maintains market leadership with approximately 28% of national market share, driven by strong aerospace and technology sectors. The state’s concentration of innovative companies, research institutions, and venture capital creates a favorable ecosystem for additive manufacturing development and adoption.

Texas represents a rapidly growing market segment, benefiting from aerospace manufacturing, energy sector applications, and favorable business climate. The state’s strategic location and logistics infrastructure support both domestic and international market access for additive manufacturing companies.

Michigan leverages its automotive manufacturing heritage to drive additive manufacturing adoption across transportation sectors. The state’s established supplier base and engineering expertise facilitate technology integration and application development for automotive applications.

Northeast corridor including Massachusetts, Connecticut, and New York demonstrates strong growth in medical device and precision manufacturing applications. The region’s concentration of healthcare institutions and research universities supports innovation in biomedical additive manufacturing applications.

Southeast region shows increasing activity in aerospace and defense applications, with states like North Carolina, South Carolina, and Georgia attracting manufacturing investments. Government support and competitive operating costs drive market expansion in these emerging markets.

Market leadership reflects a diverse ecosystem of equipment manufacturers, material suppliers, and service providers competing across multiple technology segments. The competitive landscape includes both established industrial companies and innovative startups developing next-generation solutions.

Strategic partnerships increasingly characterize competitive dynamics as companies collaborate to expand capabilities and market reach. Equipment manufacturers partner with material suppliers, software developers, and service providers to offer comprehensive solutions addressing customer requirements.

By Technology:

By Material:

By Application:

Industrial Systems dominate market activity with approximately 65% market share, reflecting the technology’s transition from prototyping to production applications. These systems offer high throughput, consistent quality, and material versatility required for manufacturing environments.

Desktop Systems serve educational institutions, small businesses, and design studios requiring accessible additive manufacturing capabilities. While representing smaller market share by value, desktop systems drive technology awareness and skill development across broader user communities.

Materials Segment shows rapid growth as expanded material options enable new applications and improve part performance. MarkWide Research analysis indicates that specialized materials command premium pricing while driving higher-value applications across industries.

Services Sector encompasses design optimization, production services, and post-processing capabilities. Service providers enable organizations to access additive manufacturing benefits without significant capital investment, particularly beneficial for smaller companies and specialized applications.

Software Solutions increasingly integrate with manufacturing execution systems and enterprise resource planning platforms, enabling seamless workflow integration and production management. Advanced software capabilities include topology optimization, support generation, and quality prediction algorithms.

Manufacturers benefit from reduced time-to-market through rapid prototyping capabilities and elimination of tooling requirements for low-volume production. Design freedom enables product optimization and consolidation of assemblies, reducing complexity and improving performance characteristics.

Supply Chain Partners leverage distributed manufacturing capabilities to reduce inventory requirements and improve responsiveness to demand fluctuations. Local production capabilities reduce transportation costs and delivery times while improving supply chain resilience.

End Users access customized products and improved performance characteristics through optimized designs impossible with traditional manufacturing. Healthcare patients benefit from personalized medical devices, while aerospace operators achieve weight reduction and improved fuel efficiency.

Technology Developers participate in rapidly growing market with substantial innovation opportunities across materials, processes, and applications. Strong intellectual property protection and patent landscapes provide competitive advantages for innovative solutions.

Investors access high-growth market with diverse investment opportunities spanning equipment manufacturers, material suppliers, software developers, and service providers. Government support and favorable regulatory environment reduce investment risks while supporting market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Production Scale Transition represents the most significant trend as additive manufacturing moves beyond prototyping to full-scale production applications. Organizations increasingly evaluate the technology for end-use part manufacturing, driven by improvements in speed, quality, and economics.

Multi-Material Integration enables production of complex assemblies with varying material properties in single build processes. This capability reduces assembly requirements while enabling new design possibilities and improved part integration.

Hybrid Manufacturing combines additive and subtractive processes to optimize production efficiency and part quality. These systems leverage the geometric freedom of additive manufacturing while achieving the surface finish and dimensional accuracy of traditional machining.

Artificial Intelligence Integration optimizes process parameters, predicts quality outcomes, and enables predictive maintenance. AI-driven systems improve first-pass yield rates and reduce waste while minimizing operator intervention requirements.

Sustainability Focus drives adoption through material efficiency, reduced waste generation, and local production capabilities. Organizations increasingly consider environmental impact in manufacturing decisions, favoring additive manufacturing’s sustainability advantages.

Mass Customization enables economical production of personalized products across industries from healthcare to consumer goods. This trend creates new business models and revenue opportunities while improving customer satisfaction.

Technology Partnerships accelerate development through collaboration between equipment manufacturers, material suppliers, and end users. These partnerships focus on application-specific solutions and integrated workflows addressing specific industry requirements.

Acquisition Activity consolidates market participants as larger companies acquire innovative startups to expand technology portfolios and market reach. This trend accelerates technology commercialization while providing startups with scaling resources.

Standards Development progresses through industry organizations and regulatory bodies establishing certification processes and quality standards. Recent developments include updated aerospace standards and medical device regulations supporting additive manufacturing adoption.

Government Initiatives expand support through research funding, procurement programs, and tax incentives. The CHIPS and Science Act includes provisions supporting advanced manufacturing technologies including additive manufacturing.

International Expansion sees United States companies establishing global operations while international competitors enter domestic markets. This globalization increases competition while expanding market opportunities for technology leaders.

Investment Focus should prioritize companies developing production-scale technologies and materials addressing specific industry requirements. MWR analysis suggests that organizations with strong intellectual property portfolios and established customer relationships offer the best growth prospects.

Technology Adoption strategies should emphasize pilot programs and gradual scaling rather than wholesale technology replacement. Organizations benefit from starting with applications offering clear economic advantages while building internal capabilities and expertise.

Partnership Development enables access to complementary technologies and market expertise while sharing development costs and risks. Strategic alliances between equipment manufacturers, material suppliers, and end users accelerate application development and market penetration.

Workforce Development requires proactive investment in training and education programs to address skill shortages. Organizations should partner with educational institutions and industry associations to develop specialized curricula and certification programs.

Quality Systems implementation becomes critical as applications transition from prototyping to production. Investment in process monitoring, quality control, and certification capabilities ensures consistent results and regulatory compliance.

Market expansion continues with projected growth rates of 15-20% annually through the next decade, driven by technology improvements and expanding applications. Production applications increasingly dominate market activity as economic advantages become apparent for suitable applications.

Technology convergence with artificial intelligence, robotics, and IoT systems creates integrated manufacturing solutions offering unprecedented capabilities. These developments enable lights-out production and predictive quality management while reducing operational costs.

Material innovation expands application possibilities through development of high-performance polymers, metal alloys, and composite materials. Recycled and bio-based materials address sustainability concerns while maintaining performance characteristics required for demanding applications.

Geographic expansion sees technology adoption spreading beyond traditional manufacturing centers to emerging markets and developing regions. Distributed manufacturing capabilities enable local production and reduced transportation requirements.

Industry transformation accelerates as additive manufacturing becomes integral to product development and manufacturing strategies. Organizations increasingly design products specifically for additive manufacturing, maximizing technology advantages and creating competitive differentiation.

The United States additive manufacturing market stands at a pivotal transformation point, evolving from a prototyping technology to a comprehensive manufacturing solution addressing diverse industry requirements. Market dynamics reflect strong growth momentum driven by technological advancement, expanding applications, and increasing recognition of strategic advantages including design freedom, customization capabilities, and supply chain resilience.

Technology maturation enables production-scale applications across aerospace, healthcare, automotive, and emerging sectors, while continued innovation in materials, processes, and integration capabilities expands market opportunities. The competitive landscape demonstrates healthy diversity with established manufacturers and innovative startups contributing to rapid technological progress and market expansion.

Strategic positioning of the United States market benefits from strong research infrastructure, government support, and access to capital markets, maintaining global leadership despite increasing international competition. Organizations successfully implementing additive manufacturing strategies focus on specific applications offering clear economic advantages while building internal capabilities and expertise for future expansion. The market’s trajectory toward mainstream manufacturing adoption creates substantial opportunities for participants across the value chain, from technology developers to end users seeking competitive advantages through advanced manufacturing capabilities.

What is Additive Manufacturing?

Additive Manufacturing refers to a process of creating objects by adding material layer by layer, often using techniques such as 3D printing. This technology is widely used in various industries, including aerospace, automotive, and healthcare.

What are the key players in the United States Additive Manufacturing Market?

Key players in the United States Additive Manufacturing Market include companies like Stratasys, 3D Systems, and HP, which are known for their innovative technologies and solutions in the field of additive manufacturing, among others.

What are the growth factors driving the United States Additive Manufacturing Market?

The growth of the United States Additive Manufacturing Market is driven by factors such as the increasing demand for customized products, advancements in 3D printing technologies, and the need for rapid prototyping in various sectors.

What challenges does the United States Additive Manufacturing Market face?

Challenges in the United States Additive Manufacturing Market include high material costs, limited production speed compared to traditional methods, and regulatory hurdles that can affect the adoption of new technologies.

What opportunities exist in the United States Additive Manufacturing Market?

Opportunities in the United States Additive Manufacturing Market include the potential for innovation in bioprinting for medical applications, the expansion of materials used in printing, and the growing interest in sustainable manufacturing practices.

What trends are shaping the United States Additive Manufacturing Market?

Trends in the United States Additive Manufacturing Market include the integration of artificial intelligence in design processes, the rise of on-demand manufacturing, and the increasing use of additive manufacturing in the production of complex geometries and lightweight structures.

United States Additive Manufacturing Market

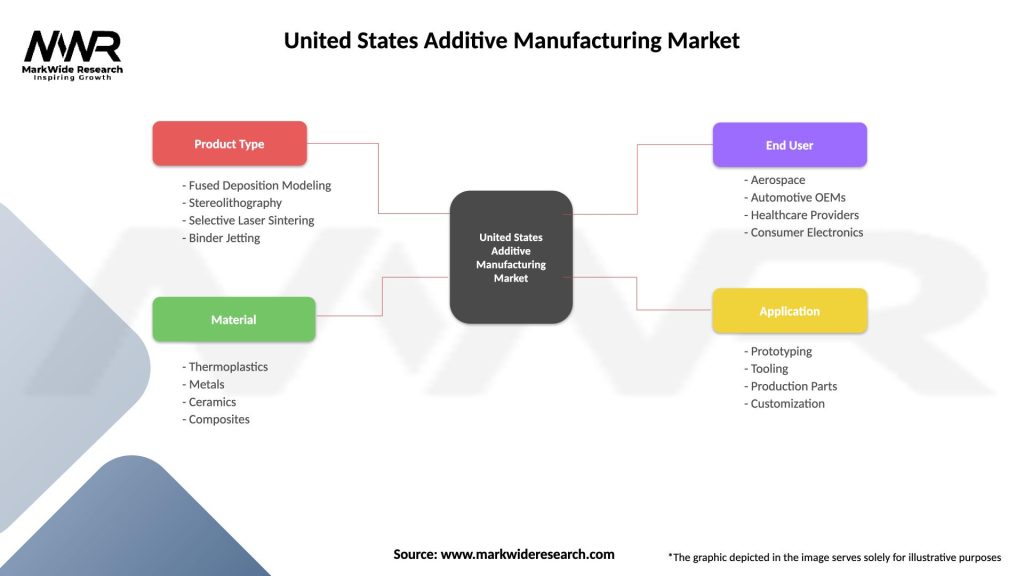

| Segmentation Details | Description |

|---|---|

| Product Type | Fused Deposition Modeling, Stereolithography, Selective Laser Sintering, Binder Jetting |

| Material | Thermoplastics, Metals, Ceramics, Composites |

| End User | Aerospace, Automotive OEMs, Healthcare Providers, Consumer Electronics |

| Application | Prototyping, Tooling, Production Parts, Customization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Additive Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at