444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Kingdom whey protein market is a thriving sector within the broader sports nutrition industry. Whey protein is derived from milk and has gained significant popularity among fitness enthusiasts, athletes, and health-conscious individuals due to its numerous health benefits and ability to support muscle growth and recovery. The market for whey protein in the UK has witnessed substantial growth in recent years, driven by increasing consumer awareness regarding the importance of protein in maintaining a healthy lifestyle.

Meaning

Whey protein is a high-quality protein source obtained as a byproduct of cheese production. It contains all the essential amino acids required by the human body, making it a complete protein. Whey protein is easily digestible and is quickly absorbed by the body, making it an ideal choice for athletes and individuals seeking to build or repair muscle tissue.

Executive Summary

The United Kingdom whey protein market has experienced remarkable growth in recent years, fueled by factors such as increasing health consciousness, growing fitness trends, and rising consumer demand for protein-rich dietary supplements. The market is highly competitive, with both domestic and international players vying for market share. Key market participants are focusing on product innovation, expanding distribution networks, and engaging in strategic partnerships to gain a competitive edge in the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United Kingdom whey protein market is characterized by intense competition among players striving to differentiate their products and gain a competitive edge. Companies are investing in research and development activities to enhance product quality, taste, and nutritional profiles. Furthermore, marketing and promotional efforts play a crucial role in creating brand awareness and attracting consumers.

The market is also witnessing a shift toward clean label and transparent products, with consumers preferring natural and organic whey protein formulations. Sustainability and ethical sourcing practices are becoming increasingly important, with consumers showing a preference for brands that prioritize environmentally friendly and socially responsible practices.

Additionally, partnerships and collaborations between whey protein manufacturers and fitness influencers, athletes, and nutritionists are becoming prevalent. These collaborations help companies expand their reach and influence, leveraging the credibility and following of such individuals to promote their products.

Regional Analysis

The United Kingdom whey protein market is segmented into various regions, including England, Scotland, Wales, and Northern Ireland. England accounts for the largest market share, driven by factors such as a higher population density, urbanization, and a greater concentration of fitness centers and health clubs. Scotland and Wales also contribute to the market, with consumers in these regions showing a growing interest in fitness and health-related activities.

Competitive Landscape

Leading Companies in the United Kingdom Whey Protein Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

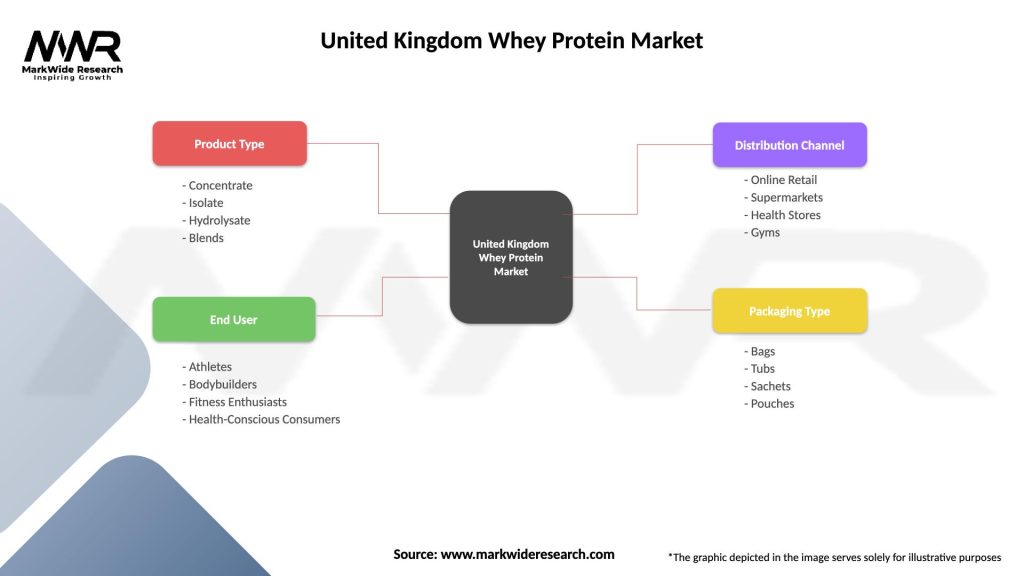

The United Kingdom whey protein market can be segmented based on product type, distribution channel, and end-use applications.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the United Kingdom whey protein market. Initially, the market experienced a surge in demand as consumers stocked up on essential items, including protein supplements. However, the closure of gyms, fitness centers, and other recreational facilities during lockdowns resulted in a temporary decline in demand.

As restrictions eased and people adapted to home workouts and personal fitness routines, the market gradually recovered. The pandemic also highlighted the importance of maintaining good health and immunity, leading to increased interest in protein supplementation and overall wellness. The market witnessed a shift toward online purchases and home deliveries, as consumers sought convenience and safety.

Key Industry Developments

Analyst Suggestions

Future Outlook

The United Kingdom whey protein market is expected to continue its growth trajectory in the coming years. Factors such as increasing health consciousness, rising fitness trends, and the growing demand for protein-rich dietary supplements are likely to drive market expansion. Product innovation, strategic partnerships, and online retail channels will play a crucial role in shaping the future of the market. Consumer preferences for clean label, sustainable, and personalized products are expected to influence market dynamics. Companies that can adapt to these trends, cater to specific consumer needs, and invest in marketing and promotional activities are likely to experience sustained growth and success in the United Kingdom whey protein market.

Conclusion

The United Kingdom whey protein market is witnessing significant growth, driven by factors such as increasing health consciousness, rising fitness trends, and growing consumer demand for protein-rich dietary supplements. Despite challenges related to price sensitivity and the availability of alternative protein sources, the market offers ample opportunities for industry participants and stakeholders. By focusing on product innovation, expanding distribution channels, and leveraging strategic partnerships, companies can gain a competitive edge in the market. The future outlook remains optimistic, with continued growth expected as consumers increasingly prioritize health and wellness and seek nutritional solutions to support their fitness goals and overall well-being in the United Kingdom.

What is Whey Protein?

Whey protein is a high-quality protein derived from milk during the cheese-making process. It is commonly used as a dietary supplement to support muscle growth, recovery, and overall health.

What are the key players in the United Kingdom Whey Protein Market?

Key players in the United Kingdom Whey Protein Market include companies like Optimum Nutrition, MyProtein, and Bulk Powders, among others. These companies offer a variety of whey protein products catering to different consumer needs.

What are the growth factors driving the United Kingdom Whey Protein Market?

The growth of the United Kingdom Whey Protein Market is driven by increasing health consciousness among consumers, the rise in fitness activities, and the growing demand for protein-rich diets. Additionally, the popularity of whey protein among athletes and bodybuilders contributes to market expansion.

What challenges does the United Kingdom Whey Protein Market face?

The United Kingdom Whey Protein Market faces challenges such as the presence of alternative protein sources, fluctuating raw material prices, and regulatory scrutiny regarding health claims. These factors can impact market growth and consumer trust.

What opportunities exist in the United Kingdom Whey Protein Market?

Opportunities in the United Kingdom Whey Protein Market include the development of innovative products, such as plant-based protein blends, and the expansion of online retail channels. Additionally, increasing awareness of the benefits of whey protein among non-athletic consumers presents a significant growth avenue.

What trends are shaping the United Kingdom Whey Protein Market?

Trends in the United Kingdom Whey Protein Market include the rise of clean label products, the incorporation of functional ingredients, and the growing popularity of flavored whey protein options. These trends reflect changing consumer preferences towards healthier and more diverse protein sources.

United Kingdom Whey Protein Market

| Segmentation Details | Description |

|---|---|

| Product Type | Concentrate, Isolate, Hydrolysate, Blends |

| End User | Athletes, Bodybuilders, Fitness Enthusiasts, Health-Conscious Consumers |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Gyms |

| Packaging Type | Bags, Tubs, Sachets, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United Kingdom Whey Protein Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at