444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom facility management market represents a dynamic and rapidly evolving sector that encompasses comprehensive property and infrastructure management services across diverse industries. This market has experienced substantial transformation driven by technological advancement, sustainability initiatives, and changing workplace dynamics. Facility management services in the UK span across commercial real estate, healthcare facilities, educational institutions, government buildings, and industrial complexes, providing integrated solutions that optimize operational efficiency and enhance occupant experience.

Market growth in the UK facility management sector has been particularly robust, with the industry demonstrating resilience and adaptability in response to evolving business requirements. The sector encompasses various service categories including hard services such as mechanical and electrical maintenance, cleaning, security, and catering, alongside soft services covering landscaping, waste management, and space planning. Digital transformation has emerged as a key driver, with organizations increasingly adopting smart building technologies and IoT-enabled solutions to streamline facility operations.

Regional dynamics within the UK show concentrated activity in major metropolitan areas, particularly London, Manchester, Birmingham, and Edinburgh, where commercial real estate density drives significant demand for professional facility management services. The market exhibits strong growth potential with an estimated CAGR of 6.2% projected over the forecast period, reflecting increasing outsourcing trends and growing emphasis on operational efficiency across various sectors.

The United Kingdom facility management market refers to the comprehensive ecosystem of professional services designed to ensure optimal functionality, safety, and efficiency of built environments across commercial, institutional, and industrial properties. This market encompasses integrated service delivery models that combine strategic planning, operational management, and maintenance services to support organizational objectives while enhancing occupant satisfaction and asset value preservation.

Facility management in the UK context involves the coordination of physical workplace environments with human resources and organizational activities, integrating principles of business administration, architecture, behavioral science, and engineering. The market includes both in-house facility management operations and outsourced service provision, with increasing emphasis on strategic partnerships that deliver measurable business outcomes through optimized facility performance and cost management.

Strategic market positioning within the UK facility management sector reflects a mature industry undergoing significant modernization driven by technological innovation and evolving client expectations. The market demonstrates strong fundamentals with diversified service offerings spanning traditional maintenance and cleaning services to advanced smart building management and sustainability consulting. Digital integration has become a critical differentiator, with leading providers investing heavily in IoT platforms, predictive maintenance technologies, and data analytics capabilities.

Competitive landscape analysis reveals a fragmented market structure with numerous regional players alongside established multinational corporations offering comprehensive facility management solutions. The sector benefits from stable demand drivers including regulatory compliance requirements, workplace safety standards, and increasing focus on environmental sustainability. Market consolidation trends indicate growing preference for integrated service delivery models that combine multiple facility management disciplines under unified contracts.

Growth trajectory projections suggest continued expansion driven by outsourcing adoption rates reaching 78% among large enterprises, reflecting strategic focus on core business activities while leveraging specialized facility management expertise. The market exhibits particular strength in healthcare, education, and government sectors where complex regulatory environments and operational requirements drive demand for professional facility management services.

Technology adoption represents the most significant transformation factor within the UK facility management market, with organizations increasingly implementing integrated building management systems and mobile workforce management platforms. Smart building technologies have achieved penetration rates of approximately 42% in commercial properties, driving operational efficiency improvements and enabling predictive maintenance strategies that reduce overall facility operating costs.

Sustainability initiatives have emerged as critical market drivers, with facility management providers developing specialized capabilities in energy management, carbon footprint reduction, and environmental compliance. The following key insights characterize current market dynamics:

Operational efficiency requirements continue to drive significant demand for professional facility management services across the UK market. Organizations increasingly recognize that effective facility management directly impacts productivity, employee satisfaction, and overall business performance. Cost reduction initiatives have led to widespread adoption of outsourcing models, with companies achieving operational savings while accessing specialized expertise and advanced technologies.

Regulatory compliance represents a fundamental market driver, particularly in healthcare, education, and government sectors where stringent safety, security, and environmental standards require specialized knowledge and continuous monitoring. The complexity of building regulations, fire safety requirements, and accessibility standards necessitates professional facility management services to ensure full compliance and risk mitigation.

Technological advancement has created new opportunities for facility management providers to deliver enhanced value through smart building solutions, predictive maintenance, and data-driven optimization strategies. The integration of artificial intelligence and machine learning capabilities enables proactive facility management approaches that prevent issues before they impact operations. Sustainability mandates from both regulatory bodies and corporate social responsibility initiatives drive demand for energy management, waste reduction, and environmental monitoring services.

Workplace transformation accelerated by remote work trends has created demand for flexible facility management solutions that can adapt to changing occupancy patterns and space utilization requirements. Organizations require dynamic space management capabilities that optimize real estate portfolios while maintaining operational efficiency across distributed work environments.

Economic uncertainty poses significant challenges for the UK facility management market, particularly regarding long-term contract commitments and capital investment in advanced technologies. Organizations may defer facility management investments during economic downturns, impacting market growth and service provider revenue streams. Budget constraints in public sector organizations, which represent substantial market segments, can limit expansion opportunities for facility management providers.

Skills shortage within the facility management industry represents a persistent challenge, with increasing demand for technologically skilled professionals outpacing available talent supply. The complexity of modern building systems and digital facility management platforms requires specialized expertise that may be difficult to recruit and retain. Training costs associated with keeping workforce capabilities current with technological developments can strain service provider resources.

Client resistance to outsourcing certain facility management functions, particularly in organizations with established in-house capabilities, can limit market penetration. Some companies prefer maintaining direct control over critical facility operations, viewing outsourcing as potential risk to operational continuity. Contract complexity and service level agreement negotiations can create barriers to market entry, particularly for smaller facility management providers lacking extensive legal and commercial resources.

Technology integration challenges within existing building infrastructure can complicate implementation of advanced facility management solutions, requiring significant capital investment and operational disruption during transition periods.

Digital transformation initiatives across UK organizations present substantial opportunities for facility management providers to develop and deploy innovative technology solutions. The growing adoption of Internet of Things devices, artificial intelligence, and predictive analytics creates demand for specialized facility management services that can leverage these technologies to optimize building performance and reduce operational costs.

Sustainability consulting represents a rapidly expanding opportunity segment, with organizations seeking expertise in carbon footprint reduction, energy efficiency optimization, and environmental compliance. Green building certifications and corporate sustainability commitments drive demand for specialized facility management services that can deliver measurable environmental improvements while maintaining operational efficiency.

Healthcare sector expansion offers significant growth potential, particularly with aging infrastructure requiring modernization and increasing regulatory requirements demanding specialized facility management expertise. The complexity of healthcare facility operations creates opportunities for providers offering integrated solutions combining clinical support services with traditional facility management capabilities.

Smart city initiatives across UK municipalities create opportunities for facility management providers to participate in large-scale infrastructure projects requiring comprehensive building management and maintenance services. Public-private partnerships in infrastructure development offer long-term contract opportunities with stable revenue streams. Data center management represents another high-growth opportunity segment driven by digital transformation and cloud computing adoption across industries.

Competitive intensity within the UK facility management market has increased significantly as providers differentiate through technology adoption, service integration, and specialized sector expertise. Market consolidation trends indicate larger organizations acquiring specialized providers to expand service capabilities and geographic coverage, creating more comprehensive facility management solutions for enterprise clients.

Client expectations have evolved substantially, with organizations demanding greater transparency, real-time reporting, and measurable performance outcomes from facility management providers. The shift toward outcome-based contracts requires providers to demonstrate tangible business value rather than simply delivering prescribed services. Service level agreements increasingly incorporate sustainability metrics, energy efficiency targets, and occupant satisfaction measures.

Technology disruption continues reshaping market dynamics, with traditional facility management providers investing heavily in digital capabilities to remain competitive. Startup companies entering the market with innovative technology solutions create pressure on established providers to accelerate digital transformation initiatives. According to MarkWide Research analysis, organizations implementing comprehensive facility management technologies report operational efficiency improvements of 23% on average.

Regulatory evolution impacts market dynamics through changing compliance requirements, safety standards, and environmental regulations that create both challenges and opportunities for facility management providers. Brexit implications continue influencing market dynamics through regulatory alignment questions and potential labor mobility impacts affecting service delivery capabilities.

Comprehensive market analysis for the UK facility management sector employs multiple research methodologies to ensure accurate and reliable market intelligence. Primary research activities include structured interviews with facility management executives, client organization decision-makers, and industry experts across various sectors including commercial real estate, healthcare, education, and government.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market sizing, growth trends, and competitive positioning. Data triangulation methods validate findings across multiple sources to ensure research accuracy and reliability.

Market segmentation analysis utilizes both top-down and bottom-up approaches to establish accurate market sizing and growth projections across service categories, end-user sectors, and geographic regions. Statistical modeling techniques project future market trends based on historical data patterns, economic indicators, and industry-specific growth drivers.

Expert validation processes involve review of research findings by industry practitioners and academic experts to ensure conclusions accurately reflect market realities and emerging trends. Continuous monitoring of market developments ensures research findings remain current and relevant for strategic decision-making purposes.

London metropolitan area dominates the UK facility management market, accounting for approximately 35% of total market activity driven by high concentration of commercial real estate, financial services organizations, and government facilities. The region benefits from advanced infrastructure, skilled workforce availability, and strong demand for premium facility management services across diverse sectors.

Manchester and surrounding areas represent the second-largest regional market, with significant growth driven by commercial development, manufacturing facilities, and expanding healthcare infrastructure. The region demonstrates particular strength in integrated facility management services and technology adoption among client organizations.

Birmingham and West Midlands show robust market activity supported by manufacturing sector presence, educational institutions, and government facilities requiring comprehensive facility management services. The region exhibits growing demand for sustainability-focused facility management solutions and energy optimization services.

Scotland, particularly Edinburgh and Glasgow, demonstrates strong market fundamentals with significant public sector presence driving demand for facility management services. The region shows increasing adoption of smart building technologies and integrated service delivery models. Regional distribution analysis indicates the following market share breakdown:

Market leadership within the UK facility management sector is characterized by a mix of international corporations and specialized regional providers offering comprehensive service portfolios. Competitive differentiation increasingly focuses on technology capabilities, sustainability expertise, and sector-specific knowledge rather than traditional price-based competition.

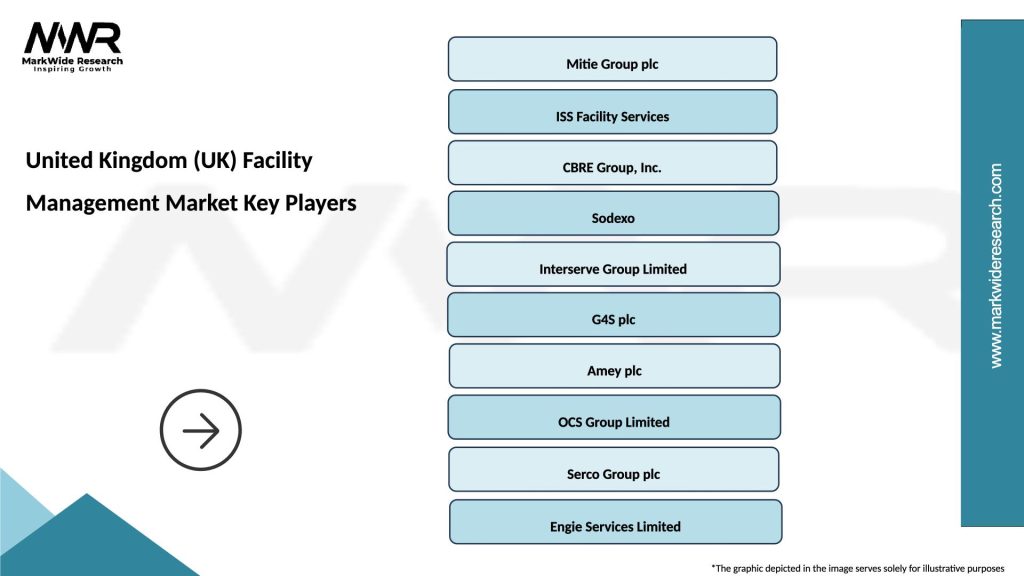

Leading market participants include established organizations with strong track records in integrated facility management delivery:

Competitive strategies emphasize digital transformation, sustainability leadership, and development of specialized sector expertise to differentiate service offerings and command premium pricing. Strategic partnerships with technology providers enable facility management companies to offer advanced solutions while maintaining focus on core service delivery capabilities.

Service-based segmentation within the UK facility management market reveals distinct categories with varying growth trajectories and client requirements. Hard services including mechanical and electrical maintenance, HVAC systems management, and building fabric maintenance represent the largest segment by revenue, driven by critical infrastructure requirements and regulatory compliance needs.

By Service Type:

By End-User Sector:

By Contract Type:

Hard services category demonstrates consistent demand driven by critical infrastructure maintenance requirements and regulatory compliance obligations. This segment benefits from predictable revenue streams and long-term contract structures, with mechanical and electrical maintenance representing the largest subsegment. Technology integration within hard services enables predictive maintenance approaches that reduce emergency repair costs and extend equipment lifecycle.

Soft services category shows increasing sophistication with clients demanding higher service standards and specialized capabilities. Cleaning services have evolved beyond basic maintenance to include specialized sanitization, infection control, and environmentally sustainable practices. Security services increasingly incorporate advanced technology including access control systems, surveillance analytics, and integrated threat management capabilities.

Energy management services represent the fastest-growing category segment, driven by sustainability mandates and cost optimization objectives. Organizations seek facility management providers capable of delivering measurable energy efficiency improvements through smart building technologies, renewable energy integration, and comprehensive energy monitoring systems. MWR data indicates that specialized energy management services achieve average energy cost reductions of 18% for client organizations.

Technology-enabled services emerge as a distinct category with significant growth potential, encompassing IoT implementation, data analytics, and digital workplace solutions. This category attracts premium pricing due to specialized expertise requirements and measurable business value delivery through operational optimization and enhanced occupant experience.

Client organizations benefit significantly from professional facility management services through improved operational efficiency, cost reduction, and enhanced focus on core business activities. Outsourcing facility management enables organizations to access specialized expertise, advanced technologies, and economies of scale that would be difficult to achieve through in-house operations. Risk mitigation represents another key benefit, with professional providers assuming responsibility for regulatory compliance, safety management, and operational continuity.

Facility management providers benefit from stable, long-term revenue streams through multi-year contracts and opportunities for service expansion within existing client relationships. Technology investment enables providers to differentiate service offerings and command premium pricing while improving operational efficiency and service delivery quality. Market consolidation opportunities allow providers to expand geographic coverage and service capabilities through strategic acquisitions.

Technology vendors benefit from growing demand for smart building solutions, IoT platforms, and facility management software systems. The facility management market provides a substantial customer base for innovative technologies that optimize building performance and enhance operational efficiency. Partnership opportunities with facility management providers enable technology vendors to access enterprise clients and demonstrate solution value through real-world implementations.

Property owners and investors benefit from professional facility management through enhanced asset value preservation, improved tenant satisfaction, and optimized operational costs. Sustainability initiatives supported by facility management providers can improve property ESG ratings and attract environmentally conscious tenants. Professional facility management also reduces property owner liability through comprehensive compliance management and risk mitigation strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has emerged as the dominant trend shaping the UK facility management market, with providers developing comprehensive environmental management capabilities including carbon footprint monitoring, energy optimization, and waste reduction programs. Green building certifications increasingly influence facility management service requirements, driving demand for specialized sustainability expertise and measurement capabilities.

Artificial intelligence adoption represents a transformative trend enabling predictive maintenance, automated space optimization, and intelligent resource allocation across facility operations. Machine learning algorithms analyze building performance data to identify optimization opportunities and prevent equipment failures before they impact operations. This trend enables facility management providers to deliver measurable value improvements while reducing operational costs.

Workplace flexibility trends continue reshaping facility management requirements as organizations adapt to hybrid work models and dynamic space utilization patterns. Flexible space management solutions enable real-time space allocation, occupancy monitoring, and adaptive facility services that respond to changing workplace demands. This trend creates opportunities for technology-enabled facility management providers offering dynamic service delivery capabilities.

Health and wellness focus has intensified following pandemic experiences, with facility management providers developing specialized capabilities in air quality monitoring, sanitization protocols, and wellness program support. Indoor environmental quality management becomes increasingly important for occupant satisfaction and productivity optimization, driving demand for advanced building systems monitoring and management services.

Technology partnerships between facility management providers and software companies have accelerated, enabling comprehensive digital transformation of facility operations. Strategic alliances focus on developing integrated platforms that combine IoT sensors, data analytics, and mobile workforce management to optimize facility performance and enhance client value delivery.

Acquisition activity within the UK facility management market has intensified as larger providers seek to expand service capabilities and geographic coverage through strategic acquisitions of specialized companies. Market consolidation trends indicate growing preference for comprehensive service providers capable of delivering integrated facility management solutions across multiple sectors and regions.

Sustainability certifications have become increasingly important for facility management providers, with leading companies achieving ISO 14001 environmental management certification and developing carbon-neutral service delivery capabilities. Environmental reporting requirements drive investment in sustainability measurement and management systems that demonstrate tangible environmental improvements for client organizations.

Regulatory compliance developments include enhanced building safety requirements, updated accessibility standards, and strengthened environmental regulations that impact facility management service delivery. Professional certification programs for facility management practitioners continue expanding to ensure industry expertise keeps pace with evolving regulatory and technology requirements.

Technology investment should remain a strategic priority for facility management providers seeking to maintain competitive advantage and deliver enhanced client value. Digital transformation initiatives should focus on integrated platforms that combine multiple facility management functions while providing comprehensive data analytics and reporting capabilities. Organizations should prioritize IoT implementation and predictive maintenance technologies that demonstrate measurable operational improvements.

Sustainability expertise development represents a critical success factor for facility management providers, with clients increasingly demanding environmental optimization services and carbon footprint reduction capabilities. MarkWide Research recommends that providers invest in specialized sustainability certifications and develop comprehensive environmental management service offerings that address evolving regulatory requirements and corporate sustainability mandates.

Workforce development initiatives should address skills shortages in technical and digital facility management capabilities through comprehensive training programs and strategic recruitment efforts. Professional development investments enable providers to maintain service quality while expanding into higher-value service segments requiring specialized expertise.

Strategic partnerships with technology vendors, sustainability consultants, and specialized service providers can enable facility management companies to expand service capabilities without significant capital investment. Collaborative approaches allow providers to offer comprehensive solutions while maintaining focus on core competencies and client relationship management.

Market growth projections for the UK facility management sector remain positive, with continued expansion expected across all major service segments and end-user sectors. Technology adoption will accelerate as organizations recognize the value of data-driven facility optimization and predictive maintenance approaches. The market is projected to achieve a compound annual growth rate of 6.2% over the next five years, driven by increasing outsourcing adoption and growing demand for specialized facility management expertise.

Digital transformation will fundamentally reshape service delivery models, with successful providers developing comprehensive technology platforms that integrate multiple facility management functions. Artificial intelligence and machine learning capabilities will become standard components of facility management service offerings, enabling proactive maintenance strategies and optimized resource allocation.

Sustainability requirements will continue driving market evolution, with facility management providers developing increasingly sophisticated environmental management capabilities. Carbon neutrality objectives and ESG reporting requirements will create substantial opportunities for providers offering comprehensive sustainability consulting and implementation services. The integration of renewable energy systems and smart building technologies will become standard practice across commercial and institutional facilities.

Workplace transformation trends will create ongoing demand for flexible facility management solutions that can adapt to changing occupancy patterns and space utilization requirements. Hybrid work models will require dynamic facility services that optimize space allocation and resource utilization based on real-time demand patterns. This evolution will favor technology-enabled facility management providers capable of delivering responsive and adaptive service solutions.

The United Kingdom facility management market represents a dynamic and rapidly evolving sector characterized by strong growth fundamentals, technological innovation, and increasing client sophistication. Market expansion continues across all major segments, driven by outsourcing adoption, sustainability mandates, and workplace transformation trends that create substantial opportunities for service providers offering comprehensive and technology-enabled solutions.

Competitive differentiation increasingly depends on technology capabilities, sustainability expertise, and specialized sector knowledge rather than traditional price-based competition. Organizations that invest strategically in digital transformation, workforce development, and sustainability capabilities will be best positioned to capitalize on emerging market opportunities and deliver enhanced client value.

Future success in the UK facility management market will require providers to embrace technological innovation, develop comprehensive sustainability expertise, and maintain flexibility to adapt to evolving workplace requirements. The sector’s strong growth trajectory and expanding service scope create substantial opportunities for organizations committed to delivering measurable business value through professional facility management excellence.

What is Facility Management?

Facility Management refers to the integrated approach to maintaining and managing buildings, infrastructure, and services that support the core business activities of an organization. It encompasses various functions such as maintenance, security, cleaning, and space management.

What are the key players in the United Kingdom (UK) Facility Management Market?

Key players in the United Kingdom (UK) Facility Management Market include companies like Mitie Group, ISS Facility Services, and CBRE Group, among others. These companies provide a range of services from property management to integrated facilities solutions.

What are the growth factors driving the United Kingdom (UK) Facility Management Market?

The growth of the United Kingdom (UK) Facility Management Market is driven by increasing demand for efficient building management, the rise of smart technologies, and the need for cost-effective operational solutions. Additionally, the focus on sustainability and regulatory compliance is also contributing to market expansion.

What challenges does the United Kingdom (UK) Facility Management Market face?

The United Kingdom (UK) Facility Management Market faces challenges such as the need for skilled labor, fluctuating demand due to economic conditions, and the complexity of integrating new technologies. These factors can hinder operational efficiency and service delivery.

What opportunities exist in the United Kingdom (UK) Facility Management Market?

Opportunities in the United Kingdom (UK) Facility Management Market include the adoption of digital solutions, the growth of green building initiatives, and the increasing trend towards outsourcing facility services. These factors present avenues for innovation and service diversification.

What trends are shaping the United Kingdom (UK) Facility Management Market?

Trends shaping the United Kingdom (UK) Facility Management Market include the rise of smart building technologies, increased emphasis on sustainability practices, and the integration of data analytics for improved decision-making. These trends are transforming how facilities are managed and optimized.

United Kingdom (UK) Facility Management Market

| Segmentation Details | Description |

|---|---|

| Service Type | Cleaning, Security, Maintenance, Landscaping |

| End User | Commercial, Residential, Educational, Healthcare |

| Technology | IoT Solutions, Building Management Systems, Energy Management, Automation |

| Industry Vertical | Retail, Hospitality, Manufacturing, Government |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom (UK) Facility Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at