444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom telecom towers market represents a critical infrastructure backbone supporting the nation’s rapidly evolving telecommunications landscape. Telecom towers serve as essential platforms for wireless communication equipment, enabling mobile network operators to deliver comprehensive coverage across urban, suburban, and rural areas throughout the UK. The market encompasses various tower types including monopoles, lattice towers, guyed towers, and stealth installations designed to blend with environmental surroundings.

Market dynamics indicate robust growth driven by the accelerating deployment of 5G networks, increasing data consumption patterns, and government initiatives promoting digital connectivity. The UK’s commitment to achieving nationwide 5G coverage by 2027 has intensified infrastructure development activities. Network densification requirements for 5G technology necessitate significantly more tower installations compared to previous generation networks, creating substantial opportunities for tower companies and infrastructure providers.

Regional distribution shows concentrated development in metropolitan areas including London, Manchester, Birmingham, and Edinburgh, while rural coverage expansion remains a strategic priority. The market benefits from supportive regulatory frameworks encouraging infrastructure sharing and streamlined planning processes. Tower sharing initiatives have gained momentum as operators seek cost-effective solutions for network expansion while minimizing environmental impact and community concerns.

The United Kingdom telecom towers market refers to the comprehensive ecosystem of telecommunications infrastructure comprising tower structures, supporting equipment, and related services that enable wireless communication networks across the UK. This market encompasses the design, construction, deployment, maintenance, and operation of various tower types including traditional lattice structures, monopoles, concealed installations, and innovative small cell solutions.

Telecom towers function as elevated platforms housing antennas, transmitters, receivers, and other radio frequency equipment essential for mobile network operations. These structures facilitate signal transmission and reception across designated coverage areas, enabling voice communications, data services, and emerging technologies like Internet of Things applications. The market includes both macro towers serving large geographic areas and small cell installations providing targeted coverage enhancement in high-density locations.

Infrastructure sharing represents a fundamental aspect of the modern telecom towers market, where multiple network operators utilize common tower structures to reduce deployment costs and accelerate network rollout timelines. This collaborative approach has become increasingly important as operators balance coverage expansion requirements with capital efficiency objectives and environmental sustainability goals.

Strategic analysis reveals the United Kingdom telecom towers market experiencing unprecedented transformation driven by 5G network deployment requirements and evolving consumer connectivity demands. The market demonstrates strong growth momentum with network operators investing heavily in infrastructure modernization and capacity expansion initiatives. Tower companies are capitalizing on increased colocation opportunities as multiple operators seek efficient solutions for network densification.

Technology evolution toward 5G networks requires substantially more tower installations compared to 4G infrastructure, with network densification becoming a critical success factor. Small cell deployments are experiencing rapid adoption in urban areas where traditional macro towers cannot provide adequate coverage density. The integration of edge computing capabilities into tower infrastructure represents an emerging trend creating additional revenue opportunities for tower operators.

Regulatory support through streamlined planning processes and infrastructure sharing mandates has accelerated market development. Government initiatives promoting digital inclusion and rural connectivity have created favorable conditions for tower deployment across previously underserved areas. Environmental considerations increasingly influence tower design and placement decisions, driving innovation in concealed and aesthetically integrated solutions.

Market consolidation trends show established tower companies expanding their portfolios through strategic acquisitions and partnerships. International tower operators are recognizing the UK market’s growth potential and establishing local presence through joint ventures and direct investments. MarkWide Research analysis indicates strong investor confidence in the sector’s long-term growth prospects.

Network transformation initiatives across major UK mobile operators are driving unprecedented demand for tower infrastructure. The transition from 4G to 5G networks requires significantly higher tower density to achieve optimal coverage and performance characteristics. Spectrum efficiency improvements through advanced antenna technologies are enabling operators to maximize existing tower utilization while planning strategic expansion.

5G network deployment represents the primary growth catalyst for the United Kingdom telecom towers market. Mobile network operators are investing substantially in infrastructure upgrades to support 5G technology requirements, including higher frequency spectrum utilization and increased network density. Consumer demand for enhanced mobile broadband services, ultra-low latency applications, and emerging technologies like augmented reality drives continuous network capacity expansion.

Government initiatives promoting digital connectivity and rural broadband access create favorable market conditions for tower deployment. The UK government’s commitment to achieving comprehensive 5G coverage by 2027 includes significant public investment in infrastructure development. Shared Rural Network programs specifically target coverage gaps in rural areas, requiring extensive tower construction and upgrade activities.

Data consumption growth continues accelerating as consumers increasingly rely on mobile devices for work, entertainment, and communication needs. Video streaming services, cloud applications, and remote working trends generate substantial bandwidth demands requiring network capacity enhancements. The proliferation of Internet of Things devices across industrial, commercial, and residential applications further intensifies infrastructure requirements.

Infrastructure sharing mandates from regulatory authorities encourage efficient tower utilization while reducing deployment costs for network operators. Planning policy reforms have streamlined approval processes for tower installations, particularly for 5G-related infrastructure. Environmental sustainability objectives promote tower sharing as a means to minimize visual impact and reduce overall infrastructure footprint.

Planning permission challenges continue affecting tower deployment timelines despite regulatory improvements. Local community opposition to tower installations, particularly in residential areas, creates delays and increases project costs. Visual impact concerns and health-related objections from community groups require extensive consultation processes and design modifications.

High capital investment requirements for 5G-compatible tower infrastructure present financial challenges for smaller operators and new market entrants. Site acquisition costs in prime locations, particularly urban areas, have increased substantially due to limited availability and competitive demand. The complexity of 5G technology requires specialized equipment and skilled technical personnel, increasing operational expenses.

Environmental regulations impose strict requirements on tower construction and operation, including wildlife protection measures and landscape preservation mandates. Aviation safety considerations limit tower heights and locations near airports and flight paths. Heritage site restrictions and conservation area designations further constrain tower placement options in historically significant locations.

Technology obsolescence risks require continuous infrastructure upgrades and equipment replacements. Spectrum allocation uncertainties and changing regulatory requirements create planning challenges for long-term infrastructure investments. Economic uncertainties and potential changes in government policies may impact public sector support for rural connectivity initiatives.

5G network densification creates substantial opportunities for tower companies and infrastructure providers. The requirement for significantly more cell sites compared to 4G networks opens new revenue streams through increased colocation demand. Small cell deployment opportunities in urban areas complement traditional macro tower installations, enabling comprehensive coverage solutions.

Edge computing integration represents an emerging opportunity for tower operators to diversify revenue sources. Data center colocation at tower sites enables low-latency applications and supports the growing demand for distributed computing resources. The convergence of telecommunications and cloud computing creates new business models for infrastructure providers.

Rural connectivity programs supported by government funding provide opportunities for tower deployment in previously uneconomical locations. Agricultural IoT applications and smart farming initiatives require extensive rural network coverage, creating demand for specialized tower solutions. Tourism and recreational area connectivity improvements offer additional market segments for tower operators.

International expansion opportunities exist for UK-based tower companies leveraging their expertise in other markets. Technology export potential includes innovative tower designs, deployment methodologies, and operational best practices. Strategic partnerships with international operators can facilitate market entry and knowledge transfer initiatives.

Competitive dynamics in the United Kingdom telecom towers market reflect increasing consolidation among major players and growing interest from international investors. Tower companies are expanding their portfolios through strategic acquisitions while network operators focus on core service delivery rather than infrastructure ownership. This trend toward infrastructure specialization creates opportunities for dedicated tower operators to achieve economies of scale.

Technology convergence influences market dynamics as tower infrastructure supports multiple wireless technologies simultaneously. Multi-tenancy models enable efficient resource utilization while reducing per-operator deployment costs. The integration of renewable energy solutions and smart grid technologies transforms towers into multi-purpose infrastructure assets.

Regulatory evolution continues shaping market dynamics through policy changes affecting planning processes, infrastructure sharing requirements, and spectrum allocation procedures. Local authority approaches to tower approvals vary significantly across different regions, creating complexity for national deployment strategies. Standardization efforts aim to streamline processes while maintaining local community input opportunities.

Investment patterns show increasing interest from pension funds, infrastructure funds, and international investors recognizing the stable, long-term revenue characteristics of tower assets. Sale-and-leaseback transactions between network operators and tower companies continue restructuring industry ownership patterns. MWR data suggests sustained investor confidence in the sector’s growth trajectory.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United Kingdom telecom towers market. Primary research includes extensive interviews with industry executives, network operators, tower companies, equipment manufacturers, and regulatory officials. Survey data collection from market participants provides quantitative insights into deployment plans, investment priorities, and technology adoption trends.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and government policy documents. Market data validation through cross-referencing multiple sources ensures accuracy and reliability of presented information. Historical trend analysis provides context for current market conditions and future growth projections.

Expert consultation with telecommunications industry specialists, infrastructure engineers, and regulatory experts enhances research depth and accuracy. Technology assessment includes evaluation of emerging trends, equipment capabilities, and deployment methodologies. Regional analysis incorporates local market conditions, regulatory variations, and demographic factors affecting tower deployment patterns.

Data triangulation methods verify findings through multiple independent sources and analytical approaches. Market modeling techniques project future scenarios based on current trends, regulatory changes, and technology evolution patterns. Quality assurance processes ensure research methodology adherence and result reliability throughout the analysis process.

London and Southeast England dominate the United Kingdom telecom towers market with approximately 35% market share due to high population density and intensive business activity. Metropolitan areas require extensive small cell deployments complementing traditional macro tower installations. The region benefits from advanced fiber backhaul infrastructure and streamlined planning processes in many local authorities.

Northern England including Manchester, Liverpool, and Leeds represents significant growth opportunities with expanding urban populations and industrial development. Tower sharing initiatives are particularly active in these regions as operators seek cost-effective coverage solutions. Government investment in northern connectivity improvements supports infrastructure development across previously underserved areas.

Scotland presents unique challenges and opportunities with diverse geographic conditions ranging from dense urban areas to remote highlands. Rural coverage initiatives receive substantial government support through dedicated funding programs. The Scottish government’s digital strategy emphasizes comprehensive connectivity, creating favorable conditions for tower deployment.

Wales and Southwest England benefit from rural connectivity programs addressing coverage gaps in agricultural and tourism-dependent regions. Coastal areas require specialized tower solutions due to environmental conditions and planning restrictions. Tourism industry demands for enhanced mobile coverage drive infrastructure investment in recreational areas.

Northern Ireland shows strong growth potential with government support for digital infrastructure development. Cross-border connectivity considerations influence tower placement and technology choices. The region’s compact size enables efficient network planning and resource allocation strategies.

Market leadership in the United Kingdom telecom towers market reflects a combination of established infrastructure companies, network operator subsidiaries, and emerging independent tower operators. Competitive positioning depends on factors including portfolio size, geographic coverage, technology capabilities, and customer relationships.

Strategic partnerships between tower companies and network operators are reshaping competitive dynamics. Technology differentiation through advanced antenna systems, edge computing capabilities, and renewable energy integration creates competitive advantages. Market consolidation trends continue as companies seek scale benefits and operational efficiencies.

Technology-based segmentation reveals distinct market categories serving different coverage requirements and deployment scenarios. Macro towers provide wide-area coverage for suburban and rural regions, while small cells address high-density urban requirements. Each technology segment demonstrates unique growth patterns and investment characteristics.

By Tower Type:

By Application:

Macro tower installations continue representing the largest market segment, providing essential wide-area coverage for mobile network operations. 5G deployment requirements are driving significant upgrades to existing macro tower infrastructure, including antenna system replacements and capacity enhancements. Rural coverage expansion programs particularly rely on macro tower solutions due to their extensive coverage capabilities.

Small cell deployments demonstrate the fastest growth rate as network operators address urban coverage challenges and capacity constraints. Dense urban environments require numerous small cell installations to achieve 5G performance objectives. Integration with street furniture, building facades, and existing infrastructure reduces deployment costs and community impact.

Stealth tower solutions gain increasing importance in environmentally sensitive areas and locations with strict planning restrictions. Innovative designs including tree-concealed towers, building-integrated installations, and architectural integration minimize visual impact while maintaining technical performance. Premium pricing for stealth solutions reflects specialized design and installation requirements.

Distributed antenna systems serve specialized applications including indoor coverage, transportation hubs, and large venue connectivity. Hybrid solutions combining multiple technologies optimize coverage and capacity while managing deployment costs. The convergence of different wireless technologies creates opportunities for integrated infrastructure solutions.

Network operators benefit from improved coverage quality, enhanced network capacity, and reduced operational costs through infrastructure sharing arrangements. 5G deployment capabilities enable operators to offer advanced services including ultra-low latency applications, enhanced mobile broadband, and massive IoT connectivity. Operational efficiency improvements through tower sharing reduce both capital and operational expenditures.

Tower companies enjoy stable, long-term revenue streams through multi-year tenant agreements with network operators. Portfolio diversification across multiple operators and technologies reduces business risk while maximizing asset utilization. Opportunities for value-added services including edge computing, renewable energy, and smart city applications create additional revenue sources.

Equipment manufacturers benefit from increased demand for 5G-compatible infrastructure equipment, advanced antenna systems, and specialized installation hardware. Technology innovation opportunities include development of more efficient, compact, and environmentally sustainable equipment solutions. Long-term partnerships with tower operators provide stable demand for maintenance and upgrade services.

Local communities gain improved mobile connectivity, enhanced emergency services communication, and better access to digital services. Economic development benefits include job creation during construction phases and ongoing operational employment. Improved connectivity supports local business development and attracts investment in previously underserved areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Network densification emerges as the dominant trend driving United Kingdom telecom towers market evolution. 5G technology requirements necessitate significantly more cell sites compared to previous generation networks, creating unprecedented demand for tower infrastructure. Small cell integration with existing macro tower networks enables comprehensive coverage solutions optimizing both performance and cost efficiency.

Infrastructure sharing expansion continues gaining momentum as operators recognize the benefits of collaborative deployment strategies. Multi-tenant tower utilization rates are increasing as operators seek to minimize individual infrastructure investments while accelerating network rollout timelines. Regulatory support for sharing initiatives encourages further adoption across the industry.

Sustainable infrastructure development becomes increasingly important as environmental considerations influence tower design and operation decisions. Renewable energy integration including solar panels and wind generation reduces operational costs while supporting sustainability objectives. Green building certifications and environmentally responsible construction practices gain importance in project evaluation criteria.

Edge computing convergence with tower infrastructure creates new opportunities for distributed data processing capabilities. Low-latency applications including autonomous vehicles, industrial automation, and augmented reality require computing resources positioned close to end users. Tower sites provide ideal locations for edge data centers supporting these emerging applications.

Smart city integration transforms towers into multi-purpose infrastructure assets supporting various urban services. Environmental monitoring sensors, traffic management systems, and public Wi-Fi capabilities add value beyond traditional telecommunications functions. MarkWide Research analysis indicates growing interest in comprehensive smart infrastructure solutions.

Strategic acquisitions continue reshaping the United Kingdom telecom towers market as companies seek scale advantages and portfolio expansion opportunities. International operators are establishing UK presence through acquisition of local tower companies and infrastructure assets. These transactions reflect confidence in long-term market growth prospects and stable revenue characteristics.

Technology partnerships between tower companies and equipment manufacturers accelerate innovation in infrastructure solutions. 5G-ready installations incorporating advanced antenna systems, fiber connectivity, and edge computing capabilities represent significant technological advancement. Collaborative development programs focus on improving deployment efficiency and reducing total cost of ownership.

Government policy initiatives including the Shared Rural Network program provide substantial public investment in tower infrastructure development. Coverage obligations for mobile network operators create additional demand for tower installations in previously uneconomical locations. Planning policy reforms aim to streamline approval processes while maintaining community consultation requirements.

Sustainability initiatives across the industry emphasize renewable energy adoption, carbon footprint reduction, and circular economy principles. Green tower designs incorporating sustainable materials and energy-efficient systems become standard practice. Industry commitments to net-zero emissions drive innovation in tower operation and maintenance practices.

International expansion by UK-based companies leverages domestic market expertise in global opportunities. Technology export potential includes innovative tower designs, deployment methodologies, and operational best practices developed in the competitive UK market. Strategic partnerships facilitate knowledge transfer and market entry initiatives.

Strategic focus on 5G infrastructure deployment should prioritize network densification requirements while optimizing existing asset utilization. Tower companies should invest in advanced antenna systems and fiber backhaul capabilities to support multiple operator requirements. Proactive planning for small cell integration ensures comprehensive coverage solutions meeting diverse customer needs.

Infrastructure sharing initiatives should expand beyond traditional colocation models to include active network sharing and spectrum coordination. Operational efficiency improvements through shared maintenance, security, and power systems reduce costs for all participants. Standardization of technical interfaces and operational procedures facilitates seamless multi-operator deployments.

Regulatory engagement remains critical for addressing planning challenges and community concerns affecting tower deployment. Stakeholder consultation programs should emphasize economic benefits, improved connectivity, and environmental responsibility. Proactive communication strategies help build community support for necessary infrastructure development.

Technology diversification beyond traditional telecommunications applications creates additional revenue opportunities and market resilience. Edge computing services, IoT connectivity, and smart city applications leverage existing infrastructure investments. Strategic partnerships with technology companies facilitate service expansion and capability development.

Sustainability integration should encompass entire project lifecycles from design through decommissioning. Renewable energy adoption reduces operational costs while supporting environmental objectives. Circular economy principles including equipment recycling and sustainable materials usage enhance long-term viability.

Long-term growth prospects for the United Kingdom telecom towers market remain exceptionally positive driven by continuing 5G deployment requirements and emerging technology applications. Network evolution toward 6G technology in the next decade will likely require even greater infrastructure density, sustaining demand for tower installations and upgrades. The market is projected to maintain robust growth with compound annual growth rates exceeding industry averages.

Technology convergence will transform towers into multi-purpose infrastructure assets supporting telecommunications, computing, and smart city applications. Edge computing integration represents a significant growth opportunity as latency-sensitive applications proliferate across various industries. The convergence of telecommunications and cloud computing creates new business models and revenue streams for infrastructure providers.

Rural connectivity initiatives will continue expanding as government policies emphasize digital inclusion and economic development in underserved areas. Agricultural technology adoption including precision farming and livestock monitoring requires extensive rural network coverage. Tourism and recreational area connectivity improvements offer additional market opportunities for specialized tower solutions.

International expansion opportunities exist for UK companies leveraging their expertise in global markets experiencing similar infrastructure development needs. Technology leadership in areas including sustainable tower design, deployment efficiency, and operational optimization creates export potential. Strategic partnerships and joint ventures facilitate market entry and knowledge transfer initiatives.

Investment attractiveness will continue drawing capital from infrastructure funds, pension funds, and international investors seeking stable, long-term returns. Asset recycling through sale-and-leaseback transactions enables network operators to focus on core service delivery while unlocking infrastructure value. The sector’s defensive characteristics and predictable cash flows support continued investor interest despite broader economic uncertainties.

The United Kingdom telecom towers market stands at a pivotal moment characterized by unprecedented growth opportunities driven by 5G deployment requirements and evolving connectivity demands. Market dynamics favor continued expansion as network operators invest heavily in infrastructure modernization and capacity enhancement initiatives. The combination of supportive regulatory frameworks, government investment in rural connectivity, and strong investor interest creates favorable conditions for sustained market development.

Technology evolution toward 5G networks necessitates fundamental changes in infrastructure deployment strategies, requiring significantly higher tower density and advanced technical capabilities. Infrastructure sharing initiatives continue gaining momentum as operators recognize the benefits of collaborative approaches to network development. The integration of emerging technologies including edge computing and IoT applications transforms towers into multi-purpose assets supporting diverse revenue streams.

Strategic positioning for market participants requires focus on operational efficiency, technology innovation, and sustainable development practices. Competitive advantages increasingly depend on portfolio scale, geographic coverage, and capability to support multiple operators and technologies. The market’s evolution toward specialized infrastructure providers creates opportunities for companies with appropriate expertise and capital resources.

Future success in the United Kingdom telecom towers market will depend on adaptability to changing technology requirements, effective stakeholder management, and commitment to environmental sustainability. Long-term growth prospects remain exceptionally positive as digital transformation trends continue driving demand for enhanced connectivity infrastructure across all sectors of the economy.

What is Telecom Towers?

Telecom towers are structures that support antennas and other equipment for telecommunications, enabling wireless communication services such as mobile phone networks and internet connectivity.

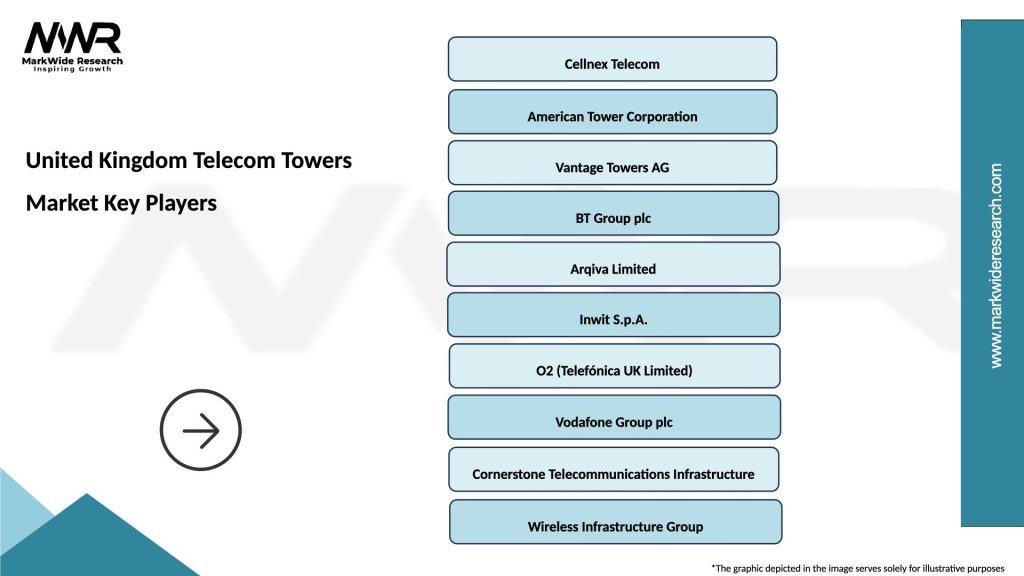

What are the key players in the United Kingdom Telecom Towers Market?

Key players in the United Kingdom Telecom Towers Market include companies like BT Group, Cellnex, and Arqiva, which are involved in the development and management of telecom infrastructure, among others.

What are the main drivers of growth in the United Kingdom Telecom Towers Market?

The growth of the United Kingdom Telecom Towers Market is driven by the increasing demand for mobile data services, the expansion of 5G networks, and the rising need for improved connectivity in urban areas.

What challenges does the United Kingdom Telecom Towers Market face?

Challenges in the United Kingdom Telecom Towers Market include regulatory hurdles, the high cost of infrastructure development, and competition among telecom operators for tower space.

What opportunities exist in the United Kingdom Telecom Towers Market?

Opportunities in the United Kingdom Telecom Towers Market include the potential for partnerships between telecom companies and tower operators, the growth of smart city initiatives, and advancements in tower technology.

What trends are shaping the United Kingdom Telecom Towers Market?

Trends in the United Kingdom Telecom Towers Market include the increasing adoption of small cell technology, the integration of renewable energy sources in tower operations, and the focus on enhancing network resilience.

United Kingdom Telecom Towers Market

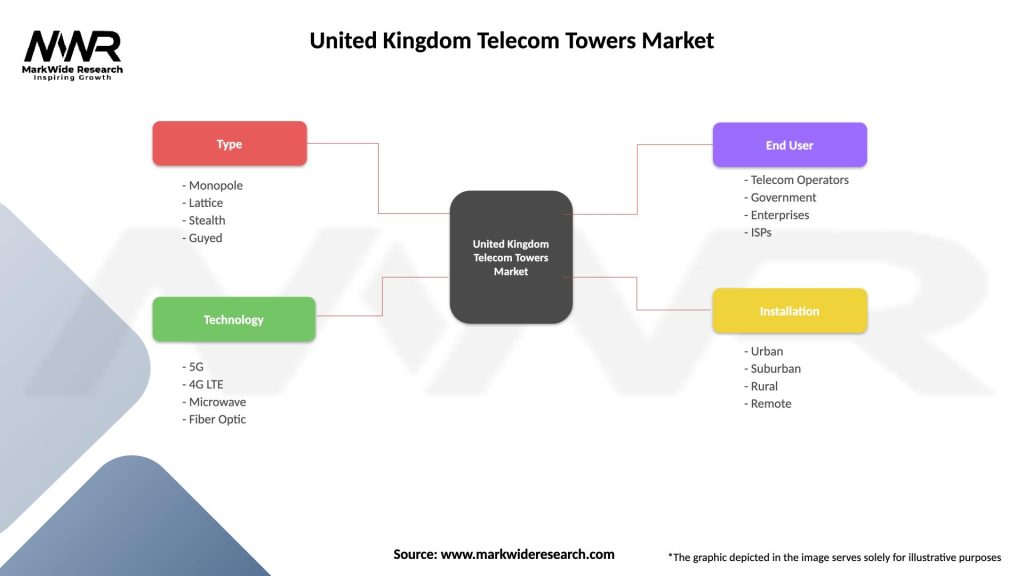

| Segmentation Details | Description |

|---|---|

| Type | Monopole, Lattice, Stealth, Guyed |

| Technology | 5G, 4G LTE, Microwave, Fiber Optic |

| End User | Telecom Operators, Government, Enterprises, ISPs |

| Installation | Urban, Suburban, Rural, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Telecom Towers Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at