444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom surveillance analog camera market represents a significant segment within the broader security and surveillance industry, demonstrating remarkable resilience despite the growing dominance of digital technologies. Analog surveillance systems continue to maintain substantial market presence across various sectors including retail, manufacturing, transportation, and residential applications throughout the UK. The market has experienced steady growth, with adoption rates increasing by approximately 4.2% annually as organizations seek cost-effective security solutions.

Traditional analog cameras remain particularly popular among small to medium-sized enterprises and budget-conscious consumers who require reliable surveillance capabilities without the complexity of advanced digital systems. The UK market benefits from strong infrastructure development, increasing security concerns, and government initiatives promoting enhanced surveillance measures across public and private sectors. Regional distribution shows London and surrounding metropolitan areas accounting for approximately 35% of total market share, while industrial regions in the North contribute significantly to overall demand.

Market dynamics indicate that while digital IP cameras dominate high-end applications, analog systems maintain competitive advantages in terms of simplicity, reliability, and cost-effectiveness. The integration of hybrid systems combining analog and digital technologies has created new opportunities for market expansion, with hybrid adoption rates growing at approximately 6.8% annually across various industry verticals.

The United Kingdom surveillance analog camera market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, installation, and maintenance of traditional analog-based video surveillance systems throughout the UK territory. Analog surveillance cameras utilize conventional video transmission methods, converting visual information into electrical signals that are transmitted through coaxial cables to recording and monitoring equipment.

These systems operate on established CCTV (Closed-Circuit Television) principles, where cameras capture video footage and transmit analog signals directly to digital video recorders (DVRs) or monitoring stations. Unlike their digital counterparts, analog cameras do not process or compress video data at the source, instead relying on centralized recording equipment for signal processing and storage. This fundamental characteristic makes analog systems particularly suitable for applications requiring straightforward installation and operation.

The market encompasses various camera types including dome cameras, bullet cameras, PTZ (Pan-Tilt-Zoom) units, and specialized variants designed for specific environmental conditions. Supporting infrastructure includes DVR systems, monitors, cables, power supplies, and mounting equipment, creating a comprehensive surveillance ecosystem that serves diverse security requirements across the United Kingdom.

The United Kingdom surveillance analog camera market demonstrates sustained growth momentum driven by increasing security awareness, regulatory compliance requirements, and cost-effective technology adoption across multiple industry sectors. Market penetration remains strong in traditional applications while expanding into emerging segments through technological innovations and hybrid system integration.

Key market drivers include rising crime rates in urban areas, mandatory surveillance requirements in certain industries, and the need for reliable security solutions in budget-constrained environments. The market benefits from approximately 78% customer satisfaction rates with analog systems, primarily due to their proven reliability and ease of maintenance. Small and medium enterprises represent the largest customer segment, accounting for substantial market share through their preference for straightforward, cost-effective surveillance solutions.

Technological advancements in analog camera technology, including improved image quality, enhanced low-light performance, and weather-resistant designs, continue to strengthen market position against digital alternatives. The integration of analog systems with modern recording and monitoring technologies has created hybrid solutions that combine traditional reliability with contemporary features, driving adoption rates up by 5.3% among existing analog users.

Regional analysis reveals strong market concentration in England, particularly around major metropolitan areas, industrial zones, and commercial districts. Scotland, Wales, and Northern Ireland contribute meaningfully to overall market demand, with specific emphasis on industrial and public sector applications requiring robust, reliable surveillance capabilities.

Critical market insights reveal several fundamental trends shaping the United Kingdom surveillance analog camera landscape. The following key observations provide strategic understanding of market dynamics:

These insights demonstrate that despite technological advancement toward digital solutions, analog surveillance cameras maintain substantial market relevance through specific advantages that address real-world customer needs and constraints.

Several key factors drive sustained growth in the United Kingdom surveillance analog camera market, creating favorable conditions for continued expansion and market development. Primary drivers include increasing security consciousness among businesses and individuals, regulatory requirements mandating surveillance systems in specific industries, and the economic advantages of analog technology in cost-sensitive applications.

Rising crime rates in urban areas have intensified demand for reliable surveillance solutions, with analog cameras providing proven effectiveness in crime deterrence and evidence collection. Government initiatives promoting enhanced security measures in public spaces, transportation hubs, and critical infrastructure have created substantial market opportunities. The retail sector continues driving significant demand, with approximately 68% of small retail businesses preferring analog systems due to their simplicity and cost-effectiveness.

Industrial applications represent another major driver, as manufacturing facilities, warehouses, and logistics centers require robust surveillance systems capable of operating reliably in challenging environments. Analog cameras excel in these conditions due to their proven durability and minimal maintenance requirements. The residential market also contributes meaningfully, with homeowners seeking affordable security solutions that provide reliable monitoring without complex installation or ongoing technical support.

Economic factors play a crucial role, as businesses facing budget constraints find analog systems attractive due to lower initial investment requirements and reduced ongoing operational costs. The ability to leverage existing coaxial cable infrastructure provides additional cost savings, making analog cameras particularly appealing for retrofit applications and system expansions.

Despite sustained market presence, the United Kingdom surveillance analog camera market faces several significant restraints that limit growth potential and market expansion. Primary constraints include technological limitations compared to digital alternatives, image quality restrictions, and limited scalability for large-scale applications.

Image quality limitations represent a fundamental constraint, as analog cameras cannot match the resolution and clarity provided by modern IP cameras. This limitation becomes particularly pronounced in applications requiring detailed facial recognition, license plate identification, or forensic-quality evidence collection. Digital migration trends in the broader surveillance industry create competitive pressure, with many customers eventually transitioning to IP-based systems for enhanced capabilities.

Scalability challenges limit analog system deployment in large facilities or complex installations requiring extensive camera networks. The point-to-point wiring requirements of analog systems create installation complexity and cost escalation in multi-camera deployments. Integration limitations with modern security management systems and network-based monitoring platforms restrict analog cameras’ compatibility with contemporary security ecosystems.

Technological obsolescence concerns affect long-term market viability, as manufacturers increasingly focus development resources on digital technologies. This shift potentially limits future innovation in analog camera technology and may impact component availability over time. Professional perception within the security industry sometimes favors digital solutions, influencing customer preferences and consultant recommendations toward IP-based alternatives.

Significant opportunities exist within the United Kingdom surveillance analog camera market, driven by evolving customer needs, technological innovations, and emerging application areas. Hybrid system integration presents the most substantial opportunity, allowing analog cameras to benefit from digital recording, remote monitoring, and advanced analytics capabilities while maintaining cost advantages.

Retrofit market expansion offers considerable potential, as many existing analog installations require camera replacement or system upgrades. Modern analog cameras with enhanced features, improved image quality, and better environmental resistance can capture this replacement demand while preserving customer investment in existing infrastructure. Specialized applications in harsh environments, outdoor installations, and industrial settings continue favoring analog technology due to proven reliability and durability.

Small business market growth represents another significant opportunity, as the UK’s vibrant SME sector increasingly recognizes security system importance. Analog solutions perfectly match small business requirements for affordable, reliable surveillance without complex technical requirements. The residential security market also presents expansion opportunities, particularly in suburban and rural areas where homeowners seek cost-effective monitoring solutions.

Government and public sector applications offer substantial opportunities, especially in local authority installations, public housing, and community safety initiatives where budget constraints favor cost-effective analog solutions. Export opportunities to developing markets where analog technology remains preferred due to infrastructure limitations and cost considerations could provide additional revenue streams for UK-based manufacturers and suppliers.

The United Kingdom surveillance analog camera market operates within a complex dynamic environment characterized by competing technological forces, evolving customer preferences, and shifting industry standards. Market dynamics reflect the ongoing tension between traditional analog reliability and emerging digital capabilities, creating a unique competitive landscape where both technologies coexist and serve different market segments.

Competitive dynamics show established analog camera manufacturers adapting their strategies to maintain market relevance while digital specialists expand into traditional analog territories. This competition has driven innovation in analog technology, resulting in improved image quality, enhanced durability, and better integration capabilities. Price competition remains intense, with manufacturers leveraging economies of scale and manufacturing efficiency to maintain cost advantages.

Customer behavior patterns indicate a pragmatic approach to technology selection, with buyers prioritizing total cost of ownership, reliability, and ease of use over cutting-edge features. This behavior supports continued analog market viability, particularly in price-sensitive segments. Supply chain dynamics have evolved to support both analog and digital technologies, with distributors and installers maintaining expertise in both domains to serve diverse customer needs.

Regulatory dynamics influence market development through standards, compliance requirements, and government procurement policies. The UK’s regulatory environment generally supports technology-neutral approaches, allowing analog systems to compete effectively in many applications. Innovation dynamics focus on enhancing analog camera capabilities while maintaining core advantages of simplicity and cost-effectiveness, with performance improvements achieving approximately 15% better image quality in recent product generations.

Comprehensive research methodology employed for analyzing the United Kingdom surveillance analog camera market combines quantitative data analysis with qualitative market insights to provide accurate, actionable intelligence. Primary research involves direct engagement with key market participants including manufacturers, distributors, installers, and end-users across various industry sectors and geographic regions throughout the UK.

Data collection methods encompass structured interviews with industry executives, technical surveys of installation professionals, and customer satisfaction assessments across different user segments. Secondary research incorporates analysis of industry reports, government statistics, trade association data, and regulatory documentation to establish comprehensive market context and validate primary findings.

Market sizing methodology utilizes multiple approaches including top-down analysis based on overall security market data, bottom-up calculations from manufacturer and distributor information, and cross-validation through industry expert consultations. Trend analysis employs historical data examination, current market observation, and forward-looking projections based on identified drivers and constraints.

Quality assurance measures include data triangulation from multiple sources, expert review panels, and statistical validation of key findings. Geographic coverage ensures representation from all UK regions, with particular attention to regional variations in market characteristics and customer preferences. The methodology incorporates MarkWide Research analytical frameworks to ensure consistency and reliability in market assessment and forecasting approaches.

Regional analysis of the United Kingdom surveillance analog camera market reveals significant geographic variations in demand patterns, customer preferences, and market characteristics across England, Scotland, Wales, and Northern Ireland. England dominates overall market activity, accounting for approximately 82% of total market share, driven by high population density, extensive commercial activity, and concentrated industrial operations.

London and the Southeast represent the largest regional market, with strong demand from retail, commercial, and residential sectors. The region’s high crime rates and dense urban environment drive substantial surveillance system adoption, though digital systems compete strongly in premium applications. The Midlands shows robust industrial demand, with manufacturing facilities and logistics centers favoring analog cameras for their reliability and cost-effectiveness in harsh operating environments.

Northern England demonstrates strong analog camera adoption in industrial applications, with traditional manufacturing regions maintaining preference for proven analog technology. Scotland accounts for approximately 8% of market share, with demand concentrated in central belt urban areas and industrial installations. The Scottish market shows particular strength in public sector applications and rural security installations where analog systems provide reliable, cost-effective solutions.

Wales contributes approximately 6% of market activity, with demand driven by industrial operations, tourism-related security needs, and rural applications. Northern Ireland represents approximately 4% of market share, with unique security requirements and strong preference for reliable, proven surveillance technologies supporting continued analog camera adoption across various sectors.

The competitive landscape of the United Kingdom surveillance analog camera market features a diverse mix of international manufacturers, regional suppliers, and specialized distributors serving various market segments. Market leadership is distributed among several key players, each leveraging distinct competitive advantages to maintain market position and customer loyalty.

Competitive strategies focus on cost optimization, reliability enhancement, and integration capabilities to maintain analog camera relevance in an increasingly digital marketplace. Distribution networks play crucial roles in market success, with established relationships between manufacturers, distributors, and installation professionals determining market access and customer reach.

Innovation competition centers on improving analog camera performance while maintaining cost advantages, with manufacturers investing in enhanced image sensors, improved low-light capabilities, and better environmental resistance to differentiate their offerings in competitive markets.

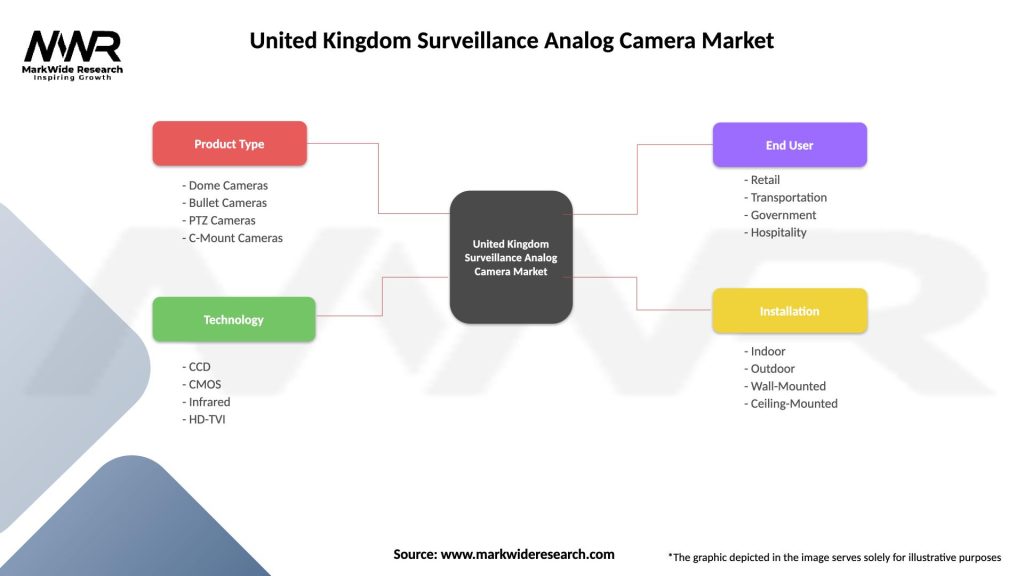

Market segmentation of the United Kingdom surveillance analog camera market reveals distinct customer groups, application areas, and product categories that drive demand patterns and purchasing decisions. Segmentation analysis provides crucial insights for understanding market dynamics and identifying growth opportunities across different market dimensions.

By Technology:

By Application:

By End-User:

Category-wise analysis provides detailed understanding of specific market segments within the United Kingdom surveillance analog camera market, revealing unique characteristics, growth patterns, and competitive dynamics across different product and application categories.

Standard Definition Analog Cameras continue serving price-sensitive applications where basic surveillance capabilities meet customer requirements. This category maintains strong position in small retail, residential, and budget-conscious commercial applications. Market share for standard definition cameras remains substantial at approximately 45% of total analog camera sales, driven by cost advantages and proven reliability in straightforward surveillance applications.

High Definition Analog Cameras represent the fastest-growing category, offering enhanced image quality while preserving analog system advantages. These cameras appeal to customers seeking improved performance without transitioning to digital infrastructure. Adoption rates for HD analog cameras show strong growth at approximately 12% annually, particularly in commercial and industrial applications where image quality improvements justify modest price premiums.

Dome Cameras dominate indoor applications due to their discrete appearance and vandal-resistant design, while bullet cameras remain popular for outdoor installations requiring visible deterrent effects. PTZ analog cameras serve specialized applications requiring active monitoring and camera control capabilities, though this segment faces strong competition from digital alternatives.

Industrial-grade cameras designed for harsh environments maintain strong market position due to proven reliability and durability in challenging conditions. These specialized cameras command premium pricing while delivering superior performance in extreme temperatures, high humidity, and corrosive environments common in UK industrial applications.

Industry participants and stakeholders in the United Kingdom surveillance analog camera market realize substantial benefits through continued engagement with this established technology segment. Manufacturers benefit from stable demand patterns, established production processes, and mature supply chains that enable efficient operations and predictable revenue streams.

Cost advantages throughout the value chain create opportunities for competitive pricing and healthy profit margins. Distributors and resellers benefit from strong customer loyalty, repeat business, and lower technical support requirements compared to complex digital systems. The established nature of analog technology reduces training requirements and technical expertise needs, enabling broader participation in the market.

Installation professionals appreciate analog systems’ straightforward installation processes, reduced complexity, and minimal ongoing maintenance requirements. This simplicity enables faster project completion, lower labor costs, and higher customer satisfaction rates. End-users benefit from reliable, cost-effective surveillance solutions that meet security requirements without excessive complexity or ongoing technical challenges.

System integrators find analog cameras valuable for hybrid installations, retrofit projects, and budget-conscious applications where digital systems may be excessive. The compatibility of analog cameras with existing infrastructure provides flexibility and cost savings in system design and implementation. Service providers benefit from stable, predictable maintenance requirements and long product lifecycles that support sustainable business models.

Investment opportunities exist throughout the value chain, from manufacturing and distribution to installation and service provision, supported by consistent market demand and established customer relationships that provide business stability and growth potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Several key trends shape the evolution of the United Kingdom surveillance analog camera market, reflecting changing customer needs, technological developments, and competitive dynamics. Hybrid system adoption represents the most significant trend, with approximately 23% of new installations incorporating both analog cameras and digital recording/monitoring capabilities.

Enhanced analog technology continues evolving, with manufacturers developing improved image sensors, better low-light performance, and enhanced durability to maintain competitive advantages. HD analog cameras gain increasing acceptance as customers seek improved image quality without infrastructure changes. This trend shows strong momentum with growth rates exceeding 15% annually in commercial applications.

Cost optimization trends drive continued analog camera adoption, particularly among price-sensitive customer segments. Small business security represents a growing trend, with increasing numbers of SMEs implementing surveillance systems for the first time. These customers typically prefer analog solutions due to lower costs and simpler operation.

Retrofit and replacement trends create substantial market opportunities as existing analog installations require camera updates or system expansions. Environmental compliance trends influence product development, with manufacturers focusing on energy efficiency and sustainable materials in analog camera production.

Integration trends show analog cameras increasingly combined with modern recording systems, remote monitoring capabilities, and basic analytics functions, creating hybrid solutions that preserve analog advantages while adding digital benefits.

Recent industry developments in the United Kingdom surveillance analog camera market demonstrate continued innovation and adaptation within this established technology segment. Product development initiatives focus on enhancing analog camera capabilities while maintaining core advantages of simplicity and cost-effectiveness.

Major manufacturers have introduced new HD analog camera lines offering significantly improved image quality while preserving compatibility with existing coaxial cable infrastructure. These developments address customer demands for better performance without requiring complete system replacement. Technology partnerships between analog camera manufacturers and digital system providers have created integrated solutions combining the best aspects of both technologies.

Distribution network expansions have improved market coverage and customer access to analog camera solutions throughout the UK. Several major distributors have strengthened their analog product portfolios and technical support capabilities to serve growing demand in specific market segments. Training and certification programs have been developed to ensure installation professionals maintain expertise in analog system deployment and maintenance.

Regulatory developments have generally supported continued analog camera viability, with UK standards and compliance requirements remaining technology-neutral in most applications. Industry consolidation has occurred among smaller manufacturers, while major players have maintained strong analog product lines alongside digital offerings.

MarkWide Research analysis indicates that recent industry developments position analog cameras for continued market relevance through technological improvements and strategic positioning in cost-sensitive applications.

Strategic recommendations for United Kingdom surveillance analog camera market participants emphasize leveraging core technology advantages while adapting to evolving customer needs and competitive pressures. Market positioning should focus on specific applications where analog cameras provide clear advantages over digital alternatives, particularly in cost-sensitive and reliability-critical installations.

Product development strategies should prioritize enhancing analog camera performance through improved image quality, better environmental resistance, and enhanced integration capabilities with digital systems. Manufacturers should invest in HD analog technology development while maintaining cost advantages that differentiate analog solutions from digital alternatives.

Distribution strategies should emphasize strong relationships with installation professionals and system integrators who understand analog technology advantages and can effectively communicate these benefits to end customers. Training and support programs should be expanded to ensure channel partners maintain expertise in analog system design and installation.

Market expansion opportunities exist in underserved segments such as small businesses, residential applications, and specialized industrial installations. Hybrid system development represents a crucial strategic direction, enabling analog cameras to benefit from digital recording and monitoring capabilities while preserving cost and simplicity advantages.

Competitive strategies should focus on total cost of ownership advantages, reliability benefits, and simplicity of operation rather than attempting to match digital system capabilities. Customer education initiatives should highlight appropriate applications for analog technology and demonstrate long-term value propositions.

The future outlook for the United Kingdom surveillance analog camera market indicates continued viability within specific market segments, supported by enduring technology advantages and evolving customer needs. Market projections suggest sustained demand growth at approximately 3.8% annually over the next five years, driven primarily by cost-conscious applications and hybrid system adoption.

Technology evolution will likely focus on enhancing analog camera capabilities while preserving core advantages of simplicity and cost-effectiveness. HD analog technology adoption is expected to accelerate, with penetration rates potentially reaching 65% of new analog installations within three years. This trend will help analog cameras maintain competitive relevance against improving digital alternatives.

Market segmentation will likely become more pronounced, with analog cameras concentrating in specific applications where their advantages are most pronounced. Small business adoption is projected to increase significantly as security awareness grows and cost-effective solutions become more accessible. Hybrid system integration will expand, creating new opportunities for analog camera deployment in modern security installations.

Competitive dynamics will continue evolving, with successful participants focusing on niche markets, specialized applications, and value-added services rather than competing directly with digital systems on advanced features. MWR analysis suggests that companies emphasizing total solution value and customer-specific benefits will achieve the strongest market positions.

Long-term sustainability depends on continued innovation in analog technology, strategic positioning in appropriate applications, and effective integration with evolving security system architectures. The market will likely stabilize around core customer segments that prioritize cost-effectiveness, reliability, and simplicity over advanced digital capabilities.

The United Kingdom surveillance analog camera market demonstrates remarkable resilience and continued relevance despite the broader industry trend toward digital technologies. Market analysis reveals that analog cameras maintain substantial competitive advantages in specific applications, particularly where cost-effectiveness, reliability, and simplicity are prioritized over advanced digital capabilities.

Key success factors for market participants include strategic positioning in appropriate customer segments, continued technology innovation within analog frameworks, and effective integration with modern security system components. The hybrid system trend offers particularly promising opportunities for combining analog camera advantages with digital recording and monitoring capabilities.

Market sustainability depends on recognizing and serving customer segments that value analog technology benefits, including small businesses, industrial applications, and cost-sensitive installations. Future growth will likely concentrate in these specific areas rather than broad market expansion, requiring focused strategies and specialized expertise.

The United Kingdom surveillance analog camera market will continue serving important security needs while adapting to evolving customer requirements and competitive pressures. Success in this market requires understanding its unique characteristics, leveraging inherent technology advantages, and positioning analog solutions appropriately within the broader security technology landscape.

What is Surveillance Analog Camera?

Surveillance Analog Camera refers to a type of video camera that transmits analog signals for security and monitoring purposes. These cameras are commonly used in various settings, including retail, transportation, and public safety, to enhance security measures.

What are the key players in the United Kingdom Surveillance Analog Camera Market?

Key players in the United Kingdom Surveillance Analog Camera Market include Hikvision, Dahua Technology, and Axis Communications, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the United Kingdom Surveillance Analog Camera Market?

The growth of the United Kingdom Surveillance Analog Camera Market is driven by increasing security concerns, advancements in camera technology, and the rising demand for surveillance in public spaces. Additionally, the integration of smart technologies is enhancing the functionality of these cameras.

What challenges does the United Kingdom Surveillance Analog Camera Market face?

The United Kingdom Surveillance Analog Camera Market faces challenges such as privacy concerns, regulatory compliance issues, and the competition from digital surveillance solutions. These factors can hinder market growth and adoption rates.

What opportunities exist in the United Kingdom Surveillance Analog Camera Market?

Opportunities in the United Kingdom Surveillance Analog Camera Market include the growing trend of smart city initiatives and the increasing adoption of IoT technologies. These developments are expected to create new avenues for innovation and market expansion.

What trends are shaping the United Kingdom Surveillance Analog Camera Market?

Trends shaping the United Kingdom Surveillance Analog Camera Market include the shift towards high-definition video quality, the integration of artificial intelligence for enhanced analytics, and the growing demand for remote monitoring solutions. These trends are influencing product development and consumer preferences.

United Kingdom Surveillance Analog Camera Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, C-Mount Cameras |

| Technology | CCD, CMOS, Infrared, HD-TVI |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Wall-Mounted, Ceiling-Mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Surveillance Analog Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at