444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom SLI battery market represents a critical component of the automotive and industrial sectors, encompassing starting, lighting, and ignition applications across diverse vehicle categories. SLI batteries serve as the primary power source for engine starting systems, electrical lighting components, and ignition mechanisms in conventional and hybrid vehicles throughout the UK. The market demonstrates robust growth potential driven by increasing vehicle production, technological advancements in battery chemistry, and evolving consumer preferences for reliable automotive power solutions.

Market dynamics indicate substantial expansion opportunities as the UK automotive industry continues modernizing its fleet composition. The integration of advanced electrical systems in modern vehicles necessitates high-performance SLI battery solutions capable of supporting enhanced power requirements. Growth projections suggest the market will experience a 6.2% CAGR over the forecast period, reflecting strong demand from both original equipment manufacturers and aftermarket segments.

Regional distribution across England, Scotland, Wales, and Northern Ireland showcases varying adoption patterns influenced by industrial concentration, vehicle density, and infrastructure development. The market encompasses multiple battery technologies including conventional lead-acid, enhanced flooded batteries, and advanced absorbed glass mat variants, each serving specific performance requirements and cost considerations within the UK automotive ecosystem.

The United Kingdom SLI battery market refers to the comprehensive ecosystem of starting, lighting, and ignition battery systems designed, manufactured, distributed, and serviced within the UK automotive and industrial sectors. SLI batteries represent specialized energy storage devices engineered to deliver high-current bursts for engine starting while maintaining consistent power supply for vehicle lighting systems and ignition components throughout operational cycles.

Battery functionality encompasses three primary applications: starting systems that provide initial cranking power for internal combustion engines, lighting circuits supporting headlights, taillights, and interior illumination, and ignition systems enabling spark plug operation and fuel injection timing. These applications require distinct performance characteristics including rapid discharge capability, deep cycling resistance, and sustained voltage stability under varying environmental conditions.

Market scope includes original equipment manufacturing partnerships with automotive producers, aftermarket replacement sales through retail channels, and specialized industrial applications requiring reliable starting power. The definition encompasses various battery chemistries, form factors, and performance specifications tailored to meet diverse vehicle requirements from compact passenger cars to heavy-duty commercial vehicles operating throughout the United Kingdom.

Strategic analysis of the United Kingdom SLI battery market reveals a dynamic landscape characterized by technological innovation, evolving consumer preferences, and increasing vehicle electrification trends. The market benefits from strong automotive production within the UK, supported by major manufacturing facilities and a robust aftermarket distribution network serving millions of registered vehicles across the country.

Key market drivers include rising vehicle ownership rates, increasing average vehicle age requiring battery replacement, and growing demand for enhanced electrical systems in modern automobiles. Technology advancement in battery chemistry and manufacturing processes enables improved performance characteristics, extended service life, and enhanced reliability under challenging operating conditions. The market experiences seasonal demand fluctuations with peak replacement activity during winter months when battery performance typically declines.

Competitive dynamics feature established international battery manufacturers alongside regional suppliers, creating a diverse ecosystem of product offerings and price points. Market segmentation spans passenger vehicles, commercial transportation, agricultural equipment, and marine applications, each requiring specialized battery solutions. Future growth prospects remain positive despite electrification trends, as hybrid vehicles continue requiring traditional SLI batteries for auxiliary systems and engine starting functions.

Market intelligence reveals several critical insights shaping the United Kingdom SLI battery landscape. Consumer behavior patterns indicate increasing preference for premium battery solutions offering extended warranties and enhanced performance characteristics, particularly among fleet operators and commercial vehicle owners seeking to minimize downtime and maintenance costs.

Primary growth drivers propelling the United Kingdom SLI battery market include expanding vehicle parc, technological advancement requirements, and evolving automotive electrical system complexity. Vehicle registration data indicates steady growth in the UK automotive fleet, creating sustained demand for both original equipment and replacement battery applications across diverse vehicle categories.

Technological evolution in modern vehicles necessitates advanced battery solutions capable of supporting increased electrical loads from infotainment systems, advanced driver assistance features, and climate control systems. Start-stop technology adoption in new vehicles requires specialized battery chemistries designed to handle frequent cycling operations while maintaining reliable starting performance throughout extended service intervals.

Economic factors including rising disposable income levels and vehicle financing accessibility contribute to increased new vehicle sales and fleet modernization initiatives. Commercial transportation growth driven by e-commerce expansion and logistics optimization creates substantial demand for reliable SLI battery solutions in delivery vehicles, trucks, and specialized commercial equipment. Aftermarket expansion benefits from aging vehicle populations requiring battery replacement services, supported by comprehensive distribution networks and professional installation capabilities throughout the United Kingdom.

Market challenges facing the United Kingdom SLI battery sector include increasing vehicle electrification trends, raw material cost volatility, and competitive pricing pressures from international manufacturers. Electric vehicle adoption represents a long-term structural challenge as battery electric vehicles eliminate traditional SLI battery requirements, potentially reducing overall market demand over extended timeframes.

Cost pressures from fluctuating lead prices and other raw materials impact manufacturing economics and retail pricing strategies. Supply chain disruptions experienced during recent global events highlight vulnerability to international sourcing dependencies and transportation logistics challenges affecting product availability and delivery schedules across UK distribution networks.

Regulatory compliance requirements including environmental standards, safety certifications, and recycling mandates increase operational complexity and compliance costs for market participants. Competitive intensity from low-cost imports and private label products creates margin pressure throughout the value chain, particularly affecting smaller regional suppliers and independent retailers. Consumer price sensitivity in certain market segments limits premium product adoption and constrains revenue growth opportunities for advanced battery technologies despite superior performance characteristics.

Emerging opportunities within the United Kingdom SLI battery market encompass technological innovation, market segment expansion, and service enhancement initiatives. Hybrid vehicle growth creates new demand categories as these vehicles require traditional SLI batteries for engine starting while incorporating electric propulsion systems, representing a bridge market between conventional and fully electric vehicles.

Premium segment expansion offers significant revenue growth potential as consumers increasingly prioritize reliability, extended warranties, and enhanced performance characteristics. Smart battery technologies incorporating monitoring systems, connectivity features, and predictive maintenance capabilities represent emerging product categories with higher value propositions and improved customer engagement opportunities.

Service integration including mobile installation, battery testing, and fleet management solutions creates additional revenue streams while enhancing customer convenience and loyalty. Export opportunities to European markets leverage UK manufacturing capabilities and quality reputation, potentially expanding market reach beyond domestic boundaries. Circular economy initiatives including advanced recycling programs and remanufacturing capabilities align with sustainability trends while creating new business models and revenue opportunities throughout the battery lifecycle.

Market dynamics within the United Kingdom SLI battery sector reflect complex interactions between supply chain factors, consumer behavior patterns, and technological evolution trends. Demand seasonality creates predictable market cycles with peak activity during autumn and winter months when battery failures increase due to cold weather conditions and increased electrical system usage.

Competitive positioning varies significantly across market segments, with premium brands commanding higher margins in quality-focused applications while value-oriented products compete primarily on price in cost-sensitive segments. Distribution channel evolution includes growing online sales penetration alongside traditional retail networks, creating omnichannel strategies that combine digital convenience with professional installation services.

Technology adoption rates demonstrate varying acceptance patterns across consumer segments, with commercial fleet operators typically leading adoption of advanced battery technologies due to total cost of ownership considerations. Regulatory influences including environmental standards and safety requirements shape product development priorities and market entry strategies for both domestic and international suppliers. Economic sensitivity affects replacement timing decisions as consumers may defer battery replacement during economic uncertainty, creating demand volatility that requires flexible inventory and production planning strategies.

Comprehensive research methodology employed for analyzing the United Kingdom SLI battery market incorporates multiple data collection approaches, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, battery manufacturers, distributors, and end-users across diverse market segments to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial disclosures to establish market sizing, competitive positioning, and historical trend analysis. Data triangulation methods combine quantitative market data with qualitative insights to develop comprehensive understanding of market dynamics and future growth prospects.

Market segmentation analysis utilizes statistical modeling techniques to identify key market segments, growth drivers, and competitive dynamics across different application areas and geographic regions. Forecasting methodologies incorporate econometric modeling, trend analysis, and scenario planning to project future market development under various economic and technological conditions. Quality assurance processes include peer review, expert validation, and cross-referencing with multiple data sources to ensure research findings meet professional standards for accuracy and reliability.

Regional market distribution across the United Kingdom reveals distinct patterns influenced by population density, industrial concentration, and climatic conditions affecting battery performance and replacement requirements. England dominates market share with approximately 75% of total demand, reflecting its large population base, extensive automotive manufacturing presence, and concentrated commercial activity in major metropolitan areas including London, Birmingham, and Manchester.

Scotland represents a significant regional market characterized by harsh winter conditions that accelerate battery degradation and increase replacement frequency. Commercial applications including fishing fleets, agricultural equipment, and offshore energy support vehicles create specialized demand patterns requiring robust battery solutions capable of reliable performance under challenging environmental conditions.

Wales and Northern Ireland contribute meaningful market shares with distinct characteristics including rural applications, agricultural equipment requirements, and cross-border trade considerations. Regional distribution networks adapt to geographic challenges including remote locations and seasonal accessibility issues that affect product availability and service delivery capabilities. Climate variations across regions influence battery performance expectations and replacement cycles, with northern regions typically experiencing 15-20% higher replacement rates due to temperature-related performance degradation during winter months.

Competitive dynamics within the United Kingdom SLI battery market feature a diverse ecosystem of international manufacturers, regional suppliers, and specialized distributors serving various market segments with distinct value propositions and competitive strategies. Market leadership positions are established through combination of product quality, brand recognition, distribution reach, and customer service capabilities.

Competitive strategies encompass product differentiation through advanced technologies, comprehensive warranty programs, and specialized applications targeting specific market niches. Distribution partnerships with automotive retailers, independent garages, and online platforms create multiple pathways to market while supporting diverse customer preferences and purchasing behaviors.

Market segmentation within the United Kingdom SLI battery sector encompasses multiple classification approaches including battery technology, application type, distribution channel, and end-user category. Technology-based segmentation distinguishes between conventional flooded lead-acid batteries, enhanced flooded batteries, and absorbed glass mat technologies, each serving specific performance requirements and price points.

By Technology:

By Application:

By Distribution Channel:

Passenger vehicle segment represents the largest category within the UK SLI battery market, driven by extensive private vehicle ownership and diverse model ranges requiring different battery specifications. Compact and mid-size vehicles typically utilize conventional lead-acid batteries due to cost considerations and adequate performance for standard electrical systems, while luxury and premium vehicles increasingly adopt AGM technology to support advanced electrical features and start-stop functionality.

Commercial vehicle applications prioritize reliability and total cost of ownership over initial purchase price, creating opportunities for premium battery solutions with extended warranties and enhanced performance characteristics. Fleet operators demonstrate strong preference for standardized battery specifications across vehicle types to simplify inventory management and maintenance procedures while negotiating volume pricing agreements with suppliers.

Agricultural and industrial segments require specialized battery solutions capable of reliable performance under harsh operating conditions including extreme temperatures, vibration, and seasonal usage patterns. Marine applications demand corrosion-resistant designs and deep-cycle capabilities to support both starting and auxiliary power requirements in challenging saltwater environments. Seasonal demand patterns across categories create inventory management challenges requiring sophisticated forecasting and distribution planning to ensure product availability during peak replacement periods.

Industry participants within the United Kingdom SLI battery market realize substantial benefits through strategic positioning, operational efficiency, and customer relationship development. Manufacturers benefit from stable demand patterns, established distribution networks, and opportunities for product differentiation through technological innovation and quality enhancement initiatives.

Distributors and retailers enjoy recurring revenue streams from replacement sales, seasonal demand peaks, and opportunities for service integration including installation, testing, and warranty programs. Cross-selling opportunities with related automotive products and services create additional revenue potential while enhancing customer relationships and loyalty.

End-users benefit from improved product reliability, extended service intervals, and comprehensive warranty coverage that reduces total cost of ownership and minimizes unexpected failures. Fleet operators realize operational advantages through predictable maintenance schedules, bulk purchasing agreements, and specialized technical support services. Environmental stakeholders benefit from advanced recycling programs achieving high recovery rates and supporting circular economy principles throughout the battery lifecycle. Economic benefits include job creation in manufacturing, distribution, and service sectors while supporting UK industrial competitiveness in automotive supply chains.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological advancement trends within the United Kingdom SLI battery market focus on enhanced performance characteristics, extended service life, and integration with vehicle electrical systems. Smart battery technologies incorporating monitoring systems and connectivity features enable predictive maintenance capabilities and real-time performance tracking, creating new value propositions for fleet operators and technology-conscious consumers.

Sustainability trends drive increased focus on recycling programs, environmental impact reduction, and circular economy principles throughout the battery lifecycle. Manufacturers invest in cleaner production processes, reduced packaging materials, and enhanced recycling capabilities to meet evolving environmental standards and consumer expectations for sustainable products.

Distribution channel evolution includes growing online sales penetration, mobile installation services, and omnichannel customer experiences combining digital convenience with professional service delivery. Customer service trends emphasize extended warranties, comprehensive technical support, and value-added services that differentiate premium offerings from commodity products. Market consolidation trends feature strategic partnerships, vertical integration initiatives, and regional expansion strategies as companies seek to optimize operational efficiency and market coverage across the United Kingdom.

Recent industry developments within the United Kingdom SLI battery market reflect ongoing innovation, strategic partnerships, and market adaptation to evolving automotive trends. Technology partnerships between battery manufacturers and automotive OEMs focus on developing specialized solutions for start-stop systems, hybrid applications, and advanced electrical architectures requiring enhanced performance characteristics.

Manufacturing investments in UK production facilities demonstrate industry confidence in long-term market prospects despite electrification trends. Distribution network expansions include new retail partnerships, online platform development, and mobile service capabilities designed to enhance customer accessibility and convenience across diverse market segments.

Sustainability initiatives encompass advanced recycling facility development, closed-loop manufacturing processes, and environmental impact reduction programs aligned with UK climate goals and circular economy objectives. Product launches featuring enhanced battery chemistries, extended warranty programs, and smart monitoring capabilities address evolving customer requirements for reliability, performance, and technological integration. Strategic acquisitions and partnerships enable market participants to expand product portfolios, enhance distribution capabilities, and strengthen competitive positioning within the dynamic UK automotive supply chain ecosystem.

Strategic recommendations for United Kingdom SLI battery market participants emphasize diversification, innovation, and customer-centric approaches to navigate evolving industry dynamics. MarkWide Research analysis suggests focusing on premium product segments where differentiation opportunities and margin potential remain strong despite competitive pressures from commodity offerings.

Technology investment priorities should emphasize smart battery solutions, enhanced monitoring capabilities, and integration with vehicle telematics systems to create new value propositions and customer engagement opportunities. Service expansion strategies including mobile installation, fleet management solutions, and predictive maintenance programs offer revenue diversification and customer loyalty enhancement potential.

Distribution optimization requires omnichannel approaches combining traditional retail strength with digital platform capabilities and mobile service delivery. Partnership strategies with automotive retailers, fleet operators, and technology companies create market access opportunities and competitive advantages through collaborative value creation. Sustainability positioning becomes increasingly important for brand differentiation and regulatory compliance, requiring investment in recycling capabilities, environmental impact reduction, and circular economy initiatives. Geographic expansion within the UK and potential export opportunities should focus on underserved market segments and regions with growth potential.

Future market prospects for the United Kingdom SLI battery sector remain positive despite long-term electrification trends, with continued demand from hybrid vehicles, commercial applications, and replacement market requirements. Market evolution will likely favor premium products offering enhanced performance, extended warranties, and advanced features that justify higher price points and improve customer satisfaction.

Technology development will continue advancing battery chemistry, manufacturing processes, and smart integration capabilities to meet evolving vehicle requirements and customer expectations. Growth projections indicate the market will maintain steady expansion at approximately 5-7% annually through the medium term, supported by vehicle parc growth and increasing electrical system complexity in modern automobiles.

Competitive dynamics will intensify as market participants seek differentiation through innovation, service excellence, and strategic partnerships. Sustainability requirements will drive industry transformation toward more environmentally responsible manufacturing, distribution, and end-of-life management practices. Digital transformation will reshape customer interactions, distribution channels, and service delivery models throughout the value chain. MWR forecasts suggest successful market participants will be those adapting quickly to changing customer needs while maintaining operational excellence and competitive cost structures in an evolving automotive landscape.

The United Kingdom SLI battery market represents a mature yet dynamic sector characterized by stable demand fundamentals, technological innovation opportunities, and evolving competitive dynamics. Market resilience stems from essential automotive applications, predictable replacement cycles, and diverse end-user requirements spanning passenger vehicles, commercial fleets, and specialized industrial applications.

Strategic success factors include technology leadership, distribution excellence, customer service differentiation, and sustainability positioning that align with evolving market requirements and regulatory expectations. Future growth opportunities exist in premium product segments, service integration, smart battery technologies, and export market development despite long-term structural challenges from vehicle electrification trends.

Industry participants positioned for success will demonstrate adaptability, innovation capability, and customer-centric approaches while maintaining operational efficiency and competitive cost structures. The market outlook remains positive for companies embracing technological advancement, sustainability principles, and strategic partnerships that create value for customers and stakeholders throughout the United Kingdom automotive ecosystem.

What is SLI Battery?

SLI Battery refers to Starting, Lighting, and Ignition batteries, which are primarily used in automotive applications to start engines, power lights, and support ignition systems.

What are the key players in the United Kingdom SLI Battery Market?

Key players in the United Kingdom SLI Battery Market include Exide Technologies, Johnson Controls, and Yuasa Battery, among others.

What are the growth factors driving the United Kingdom SLI Battery Market?

The growth of the United Kingdom SLI Battery Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and the rising need for reliable automotive power sources.

What challenges does the United Kingdom SLI Battery Market face?

Challenges in the United Kingdom SLI Battery Market include the high cost of advanced battery technologies, competition from alternative energy sources, and environmental regulations affecting battery disposal.

What opportunities exist in the United Kingdom SLI Battery Market?

Opportunities in the United Kingdom SLI Battery Market include the growing trend towards renewable energy integration, the expansion of electric vehicle infrastructure, and innovations in battery recycling technologies.

What trends are shaping the United Kingdom SLI Battery Market?

Trends in the United Kingdom SLI Battery Market include the shift towards lithium-ion batteries, increased focus on sustainability, and the development of smart battery management systems.

United Kingdom SLI Battery Market

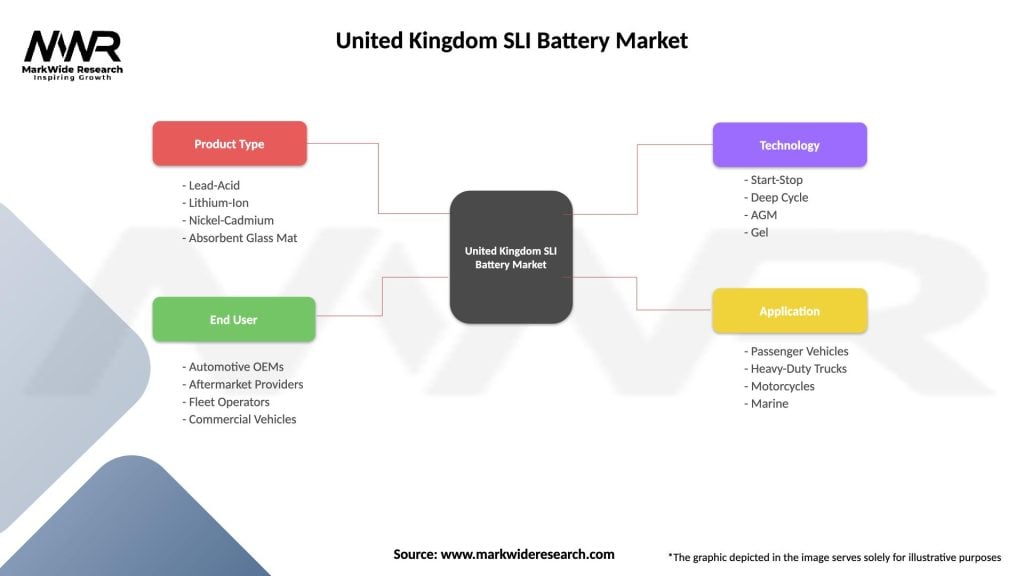

| Segmentation Details | Description |

|---|---|

| Product Type | Lead-Acid, Lithium-Ion, Nickel-Cadmium, Absorbent Glass Mat |

| End User | Automotive OEMs, Aftermarket Providers, Fleet Operators, Commercial Vehicles |

| Technology | Start-Stop, Deep Cycle, AGM, Gel |

| Application | Passenger Vehicles, Heavy-Duty Trucks, Motorcycles, Marine |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom SLI Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at