444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom satellite communications market represents a dynamic and rapidly evolving sector that serves as a critical backbone for the nation’s telecommunications infrastructure. This market encompasses a comprehensive range of satellite-based communication services, including broadband internet, television broadcasting, mobile communications, and specialized applications for government, defense, and commercial sectors. Market dynamics indicate robust growth driven by increasing demand for high-speed connectivity, particularly in remote and underserved areas where terrestrial infrastructure remains limited.

Technological advancement continues to reshape the landscape, with next-generation satellite constellations offering enhanced capabilities and reduced latency. The market benefits from the UK’s strategic position as a global financial and technological hub, driving demand for reliable satellite communications across various industries. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 8.2% over the forecast period, supported by increasing adoption of satellite internet services and growing investment in space technology infrastructure.

Key market segments include fixed satellite services, mobile satellite services, and earth observation services, each contributing to the overall market expansion. The integration of satellite communications with 5G networks and Internet of Things (IoT) applications presents significant opportunities for market participants. Regional coverage extends across England, Scotland, Wales, and Northern Ireland, with particular emphasis on connecting rural and remote communities to high-speed digital services.

The United Kingdom satellite communications market refers to the comprehensive ecosystem of satellite-based communication services, infrastructure, and technologies operating within the UK’s territorial boundaries and serving British consumers, businesses, and government entities. This market encompasses the provision of voice, data, video, and internet services through satellite networks, including both geostationary and low Earth orbit satellite systems.

Core components of this market include satellite operators, ground station infrastructure, user terminals, and service providers who collectively deliver connectivity solutions across various applications. The market serves multiple sectors including telecommunications, broadcasting, maritime, aviation, defense, and emergency services. Service delivery occurs through various satellite technologies, from traditional geostationary satellites to modern low Earth orbit constellations that offer improved performance and coverage capabilities.

Market participants range from global satellite operators and equipment manufacturers to local service providers and system integrators. The ecosystem includes both commercial and government-funded initiatives, reflecting the strategic importance of satellite communications for national infrastructure and security. Regulatory oversight by Ofcom ensures fair competition and service quality while promoting innovation and investment in next-generation satellite technologies.

Strategic analysis reveals the United Kingdom satellite communications market as a vital component of the nation’s digital infrastructure, experiencing sustained growth driven by technological innovation and increasing connectivity demands. The market demonstrates resilience and adaptability, with traditional satellite services evolving to meet modern requirements for high-speed, low-latency communications. Market penetration continues to expand, particularly in rural areas where satellite solutions provide essential connectivity options.

Competitive dynamics feature a mix of established global operators and emerging players leveraging new satellite technologies. The market benefits from strong government support for space technology development and digital inclusion initiatives. Investment flows into next-generation satellite constellations and ground infrastructure indicate confidence in long-term market prospects. Consumer adoption rates show steady improvement, with residential satellite internet adoption growing by 15.3% annually as service quality and affordability improve.

Future trajectory points toward increased integration with terrestrial networks and expanded applications in emerging technologies. The market’s evolution reflects broader trends in digitalization and the growing importance of ubiquitous connectivity for economic and social development. Strategic positioning of the UK as a space technology hub further enhances market prospects and attracts international investment in satellite communications infrastructure.

Market intelligence reveals several critical insights that define the current state and future direction of the UK satellite communications sector:

Primary growth drivers propelling the United Kingdom satellite communications market forward include the increasing demand for ubiquitous connectivity and the government’s commitment to digital inclusion. The UK’s ambitious broadband coverage targets, including the goal to provide gigabit-capable broadband to 85% of premises by 2025, create substantial opportunities for satellite service providers to serve hard-to-reach areas where fiber deployment remains economically challenging.

Technological innovation serves as a fundamental driver, with next-generation satellite constellations offering dramatically improved performance characteristics. These systems provide lower latency, higher throughput, and more competitive pricing compared to traditional satellite services. Commercial sector adoption accelerates as businesses recognize the strategic value of satellite communications for business continuity, remote operations, and global connectivity requirements.

Digital transformation initiatives across various industries create sustained demand for reliable, high-capacity communication services. The growing importance of remote work, cloud computing, and digital services drives requirements for robust backup connectivity solutions. Emergency preparedness considerations also contribute to market growth, as organizations seek resilient communication systems that remain operational during terrestrial network disruptions. Maritime and aviation sectors increasingly rely on satellite communications for operational efficiency and passenger services, further expanding market opportunities.

Cost considerations represent a significant restraint for the UK satellite communications market, particularly for consumer applications where price sensitivity remains high. Traditional satellite services often carry premium pricing compared to terrestrial alternatives, limiting adoption among price-conscious consumers and small businesses. Initial equipment costs for satellite terminals and installation services can create barriers to entry, especially for residential users in rural areas who may have limited disposable income.

Technical limitations of certain satellite technologies continue to impact market growth, including latency issues with geostationary satellites and weather-related service interruptions. Regulatory complexities surrounding spectrum allocation and international coordination requirements can slow the deployment of new satellite services and increase operational costs for market participants. Competition from terrestrial networks intensifies as fiber and 5G infrastructure expands, potentially reducing the addressable market for satellite services in previously underserved areas.

Space debris concerns and orbital congestion create operational challenges and increase insurance costs for satellite operators. Skills shortages in specialized satellite technology fields limit the industry’s ability to scale operations and develop new capabilities. Environmental considerations and sustainability requirements add complexity to satellite system design and deployment, potentially increasing costs and development timelines for new services.

Emerging opportunities in the UK satellite communications market center around the convergence of satellite and terrestrial networks, creating hybrid solutions that optimize performance and coverage. The development of satellite-5G integration presents substantial opportunities for service providers to offer seamless connectivity experiences that automatically switch between satellite and terrestrial networks based on availability and performance requirements.

IoT applications represent a rapidly expanding opportunity segment, with satellite connectivity enabling remote monitoring and control systems across agriculture, energy, transportation, and environmental sectors. Edge computing integration with satellite networks opens new possibilities for distributed processing and reduced latency applications. The growing demand for earth observation data creates opportunities for specialized satellite services supporting climate monitoring, disaster response, and resource management applications.

Government contracts and public sector initiatives provide stable revenue opportunities for satellite service providers, particularly in areas such as emergency services, defense communications, and rural development programs. International expansion opportunities exist for UK-based satellite companies to leverage their technological expertise and regulatory experience in global markets. Vertical market specialization allows companies to develop tailored solutions for specific industries, commanding premium pricing and building long-term customer relationships.

Market dynamics in the UK satellite communications sector reflect a complex interplay of technological advancement, regulatory evolution, and changing customer expectations. The transition from traditional satellite services to next-generation systems creates both opportunities and challenges for established market participants. Competitive intensity increases as new entrants leverage advanced satellite technologies to challenge incumbent providers with improved service offerings and competitive pricing.

Customer behavior patterns show increasing sophistication in satellite service selection, with users demanding higher performance, better reliability, and more flexible service options. Service bundling trends emerge as providers seek to differentiate their offerings and increase customer lifetime value through integrated communication solutions. Technology convergence drives market consolidation as companies seek to build comprehensive portfolios spanning satellite, terrestrial, and hybrid connectivity solutions.

Investment patterns indicate strong confidence in market growth prospects, with private investment in UK space technology increasing by 23.7% over the past two years. Partnership strategies become increasingly important as companies collaborate to share risks and combine complementary capabilities. Regulatory developments continue to shape market structure and competitive dynamics, with policy makers balancing innovation promotion with consumer protection and national security considerations.

Comprehensive research methodology employed for analyzing the UK satellite communications market combines primary and secondary research approaches to ensure accuracy and depth of insights. Primary research includes structured interviews with industry executives, technology experts, regulatory officials, and end-users across various market segments. This approach provides firsthand insights into market trends, challenges, and opportunities from multiple stakeholder perspectives.

Secondary research encompasses analysis of industry reports, government publications, regulatory filings, company financial statements, and academic research papers. Data triangulation methods ensure consistency and reliability of findings by cross-referencing information from multiple sources. Market modeling techniques incorporate historical data analysis, trend extrapolation, and scenario planning to develop robust market forecasts and projections.

Quantitative analysis includes statistical modeling of market size, growth rates, and segment performance using econometric methods and time-series analysis. Qualitative assessment provides context and interpretation for quantitative findings through expert opinion synthesis and thematic analysis of interview data. Validation processes involve peer review and expert consultation to ensure research findings meet high standards of accuracy and relevance for market participants and stakeholders.

Regional distribution across the United Kingdom reveals distinct patterns in satellite communications adoption and market development. England dominates market activity with approximately 68% of total market share, driven by high population density, concentrated business activity, and significant government and commercial demand. London and the Southeast represent the largest regional market segment, benefiting from financial services sector requirements and high-value commercial applications.

Scotland accounts for roughly 15% of market activity, with particular strength in offshore energy sector communications and rural connectivity initiatives. The Scottish government’s digital inclusion programs drive satellite adoption in remote Highland and Island communities. Wales represents approximately 8% of the market, with growth driven by rural broadband initiatives and agricultural sector applications. Northern Ireland contributes about 9% of market share, with cross-border connectivity requirements and rural development programs supporting satellite service adoption.

Rural versus urban dynamics show satellite communications playing a more critical role in remote areas where terrestrial infrastructure limitations create opportunities for satellite service providers. Coastal regions demonstrate higher adoption rates due to maritime industry requirements and offshore energy sector applications. Regional investment patterns reflect government priorities for digital inclusion and economic development, with targeted funding supporting satellite infrastructure deployment in underserved areas.

Market leadership in the UK satellite communications sector features a diverse mix of global operators, regional service providers, and specialized technology companies. The competitive environment reflects both established satellite industry players and innovative new entrants leveraging next-generation satellite technologies.

Competitive strategies focus on technology differentiation, service quality improvement, and market segment specialization. Partnership approaches enable companies to combine complementary capabilities and expand market reach through collaborative service offerings.

Market segmentation analysis reveals distinct categories based on service type, end-user applications, and technology platforms. By Service Type, the market divides into fixed satellite services, mobile satellite services, and earth observation services, each serving different customer requirements and market dynamics.

By Application:

By Technology Platform:

Broadband internet services represent the fastest-growing category within the UK satellite communications market, driven by increasing demand for high-speed connectivity in underserved areas. Residential adoption accelerates as next-generation satellite systems offer performance comparable to terrestrial broadband at competitive pricing. Business applications focus on backup connectivity and remote site communications, with enterprise adoption growing at 12.4% annually as companies recognize the strategic value of satellite-based business continuity solutions.

Broadcasting services undergo significant transformation as traditional satellite TV adapts to streaming and on-demand content delivery models. Content distribution evolves to support multi-platform delivery strategies, with satellite infrastructure serving as a backbone for content delivery networks. Maritime communications experience robust growth driven by offshore energy sector expansion and increasing demand for crew welfare services aboard commercial vessels.

Government and defense applications maintain steady growth supported by national security requirements and emergency services communications needs. Earth observation services expand rapidly as demand increases for climate monitoring, agricultural applications, and disaster response capabilities. Technology platform preferences shift toward low Earth orbit systems, with LEO constellation adoption increasing by 28.6% as performance advantages become apparent to end users.

Service providers benefit from expanding market opportunities driven by increasing connectivity demands and government support for digital inclusion initiatives. Revenue diversification opportunities emerge through vertical market specialization and value-added service offerings. Technology advancement enables providers to offer improved service quality and competitive pricing, expanding their addressable market and customer base.

End users gain access to reliable, high-performance connectivity solutions that enable digital participation and economic opportunities. Rural communities particularly benefit from satellite communications as a means to access education, healthcare, and economic opportunities previously limited by geographic isolation. Businesses achieve improved operational resilience and global connectivity capabilities that support growth and competitiveness.

Government stakeholders advance digital inclusion objectives and national connectivity goals through satellite communications deployment. Economic development benefits include job creation in technology sectors and improved productivity across various industries. Technology suppliers and equipment manufacturers benefit from growing demand for satellite infrastructure and user terminals. Investment community gains access to a growing market with strong fundamentals and government policy support.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence emerges as a dominant trend, with satellite and terrestrial networks increasingly integrated to provide seamless connectivity experiences. Low Earth orbit deployment accelerates as operators launch next-generation constellations offering improved performance characteristics. Service personalization becomes more sophisticated as providers leverage data analytics to optimize service delivery and customer experience.

Sustainability focus drives development of environmentally responsible satellite systems and end-of-life disposal solutions. Edge computing integration with satellite networks enables distributed processing capabilities and reduced latency applications. Artificial intelligence applications improve network optimization, predictive maintenance, and automated service provisioning. Software-defined networking approaches increase service flexibility and enable rapid deployment of new capabilities.

Partnership strategies become increasingly important as companies collaborate to share risks and combine complementary capabilities. Vertical market specialization allows providers to develop deep expertise in specific industry applications and command premium pricing. Subscription model adoption grows as customers prefer flexible, scalable service options over traditional fixed-term contracts. According to MarkWide Research analysis, these trends collectively drive market evolution toward more flexible, efficient, and customer-centric service delivery models.

Recent developments in the UK satellite communications market reflect rapid technological advancement and increasing market maturity. OneWeb’s constellation deployment represents a significant milestone in low Earth orbit satellite services, with the UK-headquartered company launching hundreds of satellites to provide global broadband coverage. Government investment in space technology through the UK Space Agency and other initiatives demonstrates strong policy support for sector development.

Regulatory modernization efforts by Ofcom streamline licensing processes and promote competition while ensuring service quality and consumer protection. International partnerships expand as UK companies collaborate with global operators to develop comprehensive service offerings. Technology demonstrations showcase advanced capabilities including satellite-5G integration and edge computing applications.

Merger and acquisition activity increases as companies seek to build comprehensive portfolios and achieve operational synergies. Research and development investments focus on next-generation satellite technologies, ground systems, and user terminals. Commercial contract awards for government and enterprise customers validate market demand and service provider capabilities. Infrastructure investments in ground stations and network operations centers support service expansion and quality improvement initiatives.

Strategic recommendations for market participants emphasize the importance of technology investment and market positioning for long-term success. Service providers should focus on developing differentiated offerings that combine satellite and terrestrial capabilities to address diverse customer requirements. Investment in next-generation technologies remains critical for maintaining competitive advantage and meeting evolving customer expectations.

Market expansion strategies should prioritize vertical market specialization and international growth opportunities. Partnership development enables companies to access complementary capabilities and share market development costs. Customer experience optimization through service personalization and proactive support becomes increasingly important for customer retention and growth.

Regulatory engagement remains essential as policy developments continue to shape market structure and competitive dynamics. Sustainability initiatives should be integrated into business strategies to address environmental concerns and stakeholder expectations. MWR analysis suggests that companies investing in technology innovation and customer-centric service delivery will be best positioned for long-term success in the evolving market landscape.

Market projections indicate continued strong growth for the UK satellite communications sector, driven by technological advancement and expanding application areas. Next-generation satellite systems will enable new service categories and improve performance across existing applications. Integration with 5G networks creates opportunities for hybrid connectivity solutions that optimize performance and coverage.

Rural connectivity initiatives will continue to drive satellite service adoption as government programs target digital inclusion objectives. Commercial sector growth accelerates as businesses recognize the strategic value of satellite communications for operational resilience and global connectivity. IoT applications represent a significant growth opportunity, with satellite IoT connections projected to grow by 35.8% annually over the next five years.

Technology evolution toward software-defined systems and artificial intelligence integration will improve service efficiency and enable new capabilities. International expansion opportunities exist for UK companies to leverage their technological expertise in global markets. Investment outlook remains positive as strong fundamentals and government support attract continued capital investment. MarkWide Research forecasts sustained market growth supported by technological innovation and expanding customer demand across multiple sectors.

The United Kingdom satellite communications market stands at a pivotal point in its evolution, characterized by rapid technological advancement and expanding opportunities across multiple sectors. Market fundamentals remain strong, supported by government policy initiatives, increasing connectivity demands, and continuous innovation in satellite technologies. The transition from traditional geostationary systems to next-generation low Earth orbit constellations represents a transformative shift that will reshape service capabilities and market dynamics.

Growth prospects appear robust across all major market segments, with particular strength in broadband internet services, IoT applications, and specialized vertical markets. Competitive dynamics continue to evolve as new entrants challenge established players with innovative technologies and service models. The increasing integration of satellite and terrestrial networks creates opportunities for comprehensive connectivity solutions that address diverse customer requirements.

Strategic success in this market will depend on companies’ ability to adapt to technological change, develop customer-centric service offerings, and build sustainable competitive advantages through innovation and operational excellence. The UK’s position as a global technology hub and its supportive regulatory environment provide a strong foundation for continued market development and international expansion opportunities.

What is Satellite Communications?

Satellite communications refer to the use of satellite technology to transmit data, voice, and video across long distances. This technology is essential for various applications, including television broadcasting, internet services, and military communications.

What are the key players in the United Kingdom Satellite Communications Market?

Key players in the United Kingdom Satellite Communications Market include Inmarsat, SES S.A., and Eutelsat Communications, among others. These companies provide a range of satellite services, including broadband connectivity and satellite television.

What are the growth factors driving the United Kingdom Satellite Communications Market?

The growth of the United Kingdom Satellite Communications Market is driven by increasing demand for high-speed internet in remote areas, the expansion of IoT applications, and advancements in satellite technology. These factors are enhancing connectivity and enabling new services.

What challenges does the United Kingdom Satellite Communications Market face?

The United Kingdom Satellite Communications Market faces challenges such as regulatory hurdles, high operational costs, and competition from terrestrial communication technologies. These factors can impact market growth and service delivery.

What opportunities exist in the United Kingdom Satellite Communications Market?

Opportunities in the United Kingdom Satellite Communications Market include the growing demand for satellite-based services in sectors like agriculture, disaster management, and maritime operations. Additionally, the rise of low Earth orbit satellites presents new avenues for service expansion.

What trends are shaping the United Kingdom Satellite Communications Market?

Trends in the United Kingdom Satellite Communications Market include the shift towards smaller, more efficient satellites, the integration of AI for network management, and the increasing use of satellite technology in 5G networks. These trends are transforming how satellite services are delivered.

United Kingdom Satellite Communications Market

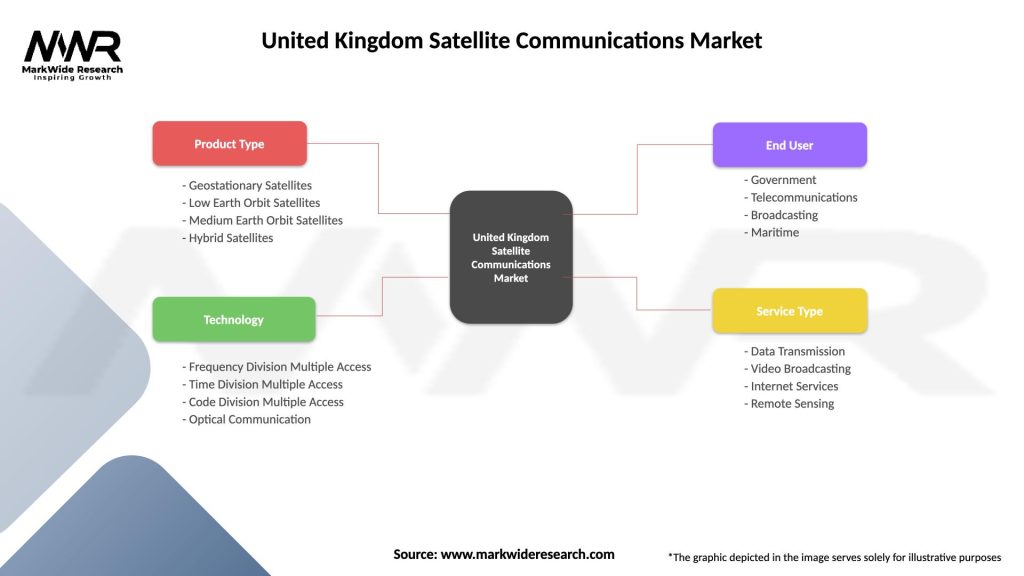

| Segmentation Details | Description |

|---|---|

| Product Type | Geostationary Satellites, Low Earth Orbit Satellites, Medium Earth Orbit Satellites, Hybrid Satellites |

| Technology | Frequency Division Multiple Access, Time Division Multiple Access, Code Division Multiple Access, Optical Communication |

| End User | Government, Telecommunications, Broadcasting, Maritime |

| Service Type | Data Transmission, Video Broadcasting, Internet Services, Remote Sensing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Satellite Communications Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at