444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom remote patient monitoring market represents a transformative segment within the nation’s healthcare technology landscape, experiencing unprecedented growth driven by digital health initiatives and evolving patient care paradigms. Remote patient monitoring technologies have emerged as critical infrastructure supporting the UK’s National Health Service (NHS) modernization efforts, enabling healthcare providers to deliver continuous care while reducing hospital readmissions and improving patient outcomes.

Market dynamics indicate robust expansion across multiple healthcare sectors, with adoption rates accelerating significantly following the COVID-19 pandemic. The integration of Internet of Things (IoT) devices, artificial intelligence, and cloud-based platforms has revolutionized how healthcare professionals monitor chronic conditions, manage post-operative care, and provide preventive health services. Growth projections suggest the market will continue expanding at a compound annual growth rate of 12.8% through the forecast period, driven by increasing prevalence of chronic diseases and government investments in digital health infrastructure.

Healthcare transformation initiatives across England, Scotland, Wales, and Northern Ireland have prioritized remote monitoring solutions as essential components of integrated care systems. The market encompasses diverse technologies including wearable devices, mobile health applications, telehealth platforms, and sophisticated monitoring equipment designed for home-based patient care. Regional adoption varies significantly, with urban areas demonstrating higher penetration rates of 68% compared to rural regions, highlighting opportunities for expanded market development.

The United Kingdom remote patient monitoring market refers to the comprehensive ecosystem of healthcare technologies, devices, and services that enable continuous monitoring of patient health parameters outside traditional clinical settings. This market encompasses digital health solutions that collect, transmit, and analyze patient data remotely, facilitating real-time healthcare delivery and clinical decision-making across the UK’s healthcare system.

Remote patient monitoring fundamentally transforms the patient-provider relationship by leveraging connected devices, mobile applications, and cloud-based platforms to maintain continuous health surveillance. These solutions enable healthcare professionals to track vital signs, medication adherence, symptom progression, and treatment responses without requiring physical patient visits. The technology integrates seamlessly with electronic health records and clinical workflows, supporting evidence-based care delivery and population health management initiatives.

Market scope includes various technological components such as biosensors, wearable devices, smartphone applications, telehealth platforms, and data analytics software specifically designed for the UK healthcare environment. The solutions address diverse medical specialties including cardiology, diabetes management, respiratory care, mental health, and post-surgical monitoring, providing comprehensive support for both acute and chronic condition management.

Strategic market analysis reveals the United Kingdom remote patient monitoring sector as a rapidly evolving healthcare technology domain characterized by strong government support, increasing clinical adoption, and significant technological innovation. The market benefits from substantial NHS investment in digital transformation initiatives, creating favorable conditions for sustained growth and market expansion across all UK regions.

Key market drivers include the aging population demographic, rising prevalence of chronic diseases, healthcare cost containment pressures, and accelerated digital health adoption following pandemic-driven healthcare delivery changes. Technology advancement in artificial intelligence, machine learning, and IoT connectivity has enhanced solution capabilities, improving patient engagement rates by 45% and clinical outcome measurements significantly.

Competitive landscape features a diverse mix of international technology companies, UK-based healthcare innovators, and established medical device manufacturers. Market participants are focusing on interoperability, regulatory compliance, and integration with NHS systems to capture market share. Investment activity remains robust, with venture capital funding increasing by 38% year-over-year, supporting innovation and market expansion initiatives.

Future outlook indicates continued market growth driven by expanding clinical applications, improved reimbursement frameworks, and enhanced patient acceptance of digital health solutions. The market is positioned to play an increasingly critical role in UK healthcare delivery, supporting value-based care models and population health management strategies.

Market intelligence reveals several critical insights shaping the United Kingdom remote patient monitoring landscape. Primary growth factors include demographic shifts, technological advancement, regulatory support, and changing patient expectations regarding healthcare delivery methods.

Demographic transformation serves as the primary catalyst driving United Kingdom remote patient monitoring market expansion. The UK’s aging population, with individuals over 65 representing an increasing percentage of the total population, creates substantial demand for continuous health monitoring solutions. Chronic disease prevalence continues rising, with conditions such as diabetes, cardiovascular disease, and respiratory disorders requiring ongoing management and monitoring.

Healthcare system pressures including capacity constraints, staffing shortages, and cost containment requirements are accelerating adoption of remote monitoring technologies. The NHS faces increasing demand for services while managing budget limitations, making remote patient monitoring an attractive solution for improving efficiency and reducing hospital readmissions. Clinical evidence demonstrates that remote monitoring can reduce emergency department visits by 32% while improving patient satisfaction and health outcomes.

Technological advancement in connected devices, mobile health applications, and cloud computing infrastructure has made remote monitoring solutions more accessible, reliable, and cost-effective. The proliferation of smartphones, wearable devices, and IoT sensors has created an ecosystem supporting comprehensive health data collection and analysis. Artificial intelligence and machine learning capabilities enable predictive analytics and personalized care recommendations, enhancing clinical decision-making and patient engagement.

Regulatory support from government agencies and healthcare authorities has created favorable market conditions through streamlined approval processes, reimbursement frameworks, and digital health strategy initiatives. The UK government’s commitment to healthcare digitization, including substantial investment in NHS technology infrastructure, provides strong foundation for market growth and innovation.

Implementation challenges present significant barriers to widespread remote patient monitoring adoption across the United Kingdom healthcare system. Integration complexity with existing NHS IT systems, electronic health records, and clinical workflows requires substantial technical expertise and financial investment. Many healthcare organizations struggle with interoperability issues, data standardization requirements, and system compatibility challenges that slow deployment timelines.

Digital divide concerns affect market penetration, particularly among elderly populations and rural communities where internet connectivity and digital literacy may be limited. Patient acceptance varies significantly across demographic groups, with some individuals expressing reluctance to adopt new technologies or concerns about privacy and data security. These factors can limit the effectiveness of remote monitoring programs and reduce overall market growth potential.

Regulatory compliance requirements, while supportive of market development, also create complexity for solution providers. GDPR compliance, MHRA medical device regulations, and NHS data governance standards require significant investment in compliance infrastructure and ongoing monitoring. Smaller companies may struggle to meet these requirements, potentially limiting innovation and market competition.

Cost considerations remain challenging for both healthcare providers and patients. While remote monitoring can reduce overall healthcare costs, initial implementation requires substantial capital investment in technology infrastructure, staff training, and system integration. Reimbursement uncertainty for some remote monitoring services may limit adoption among healthcare providers concerned about financial sustainability.

Expansion opportunities within the United Kingdom remote patient monitoring market are substantial, driven by evolving healthcare delivery models and increasing recognition of digital health benefits. Mental health monitoring represents a particularly promising growth area, with increasing awareness of mental health issues and the effectiveness of remote psychological support and monitoring solutions.

Rural healthcare delivery presents significant opportunities for remote monitoring solutions to address healthcare access challenges in underserved areas. Telemedicine integration with remote monitoring capabilities can provide comprehensive care solutions for patients in remote locations, potentially improving health outcomes while reducing travel requirements and healthcare costs.

Artificial intelligence and machine learning applications offer opportunities for advanced predictive analytics, personalized treatment recommendations, and automated clinical decision support. MarkWide Research analysis indicates that AI-powered remote monitoring solutions demonstrate superior clinical outcomes and patient engagement rates compared to traditional monitoring approaches.

Partnership opportunities between technology companies, healthcare providers, and pharmaceutical companies are creating new business models and market segments. Clinical trial support, medication adherence monitoring, and post-market surveillance applications represent emerging opportunities for remote monitoring solution providers to expand their market presence and revenue streams.

Market forces shaping the United Kingdom remote patient monitoring landscape reflect complex interactions between technological innovation, healthcare policy, clinical practice evolution, and patient expectations. Supply chain dynamics have evolved significantly, with increased focus on local manufacturing and supply chain resilience following global disruptions experienced during the pandemic period.

Competitive dynamics are intensifying as established healthcare technology companies compete with innovative startups and digital health specialists. Market consolidation trends are emerging as larger companies acquire specialized remote monitoring capabilities and smaller firms seek partnerships to access broader market opportunities. This consolidation is driving standardization efforts and improving interoperability across different solution providers.

Innovation cycles are accelerating, with new product launches and feature enhancements occurring more frequently. Customer expectations continue evolving, with healthcare providers and patients demanding more sophisticated analytics, better user experiences, and seamless integration with existing healthcare workflows. These expectations are driving continuous product development and market differentiation efforts.

Regulatory dynamics continue evolving as authorities adapt to rapid technological advancement and changing healthcare delivery models. Policy changes regarding data privacy, medical device classification, and reimbursement frameworks significantly impact market development and competitive positioning strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United Kingdom remote patient monitoring market. Primary research includes extensive interviews with healthcare professionals, technology vendors, regulatory experts, and patient advocacy groups to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of government publications, NHS reports, clinical studies, industry publications, and company financial statements to validate primary research findings and provide comprehensive market context. Data triangulation methods ensure research accuracy by comparing multiple information sources and identifying consistent trends and patterns.

Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and competitive dynamics. Market sizing methodologies incorporate bottom-up and top-down approaches to ensure comprehensive coverage of all market segments and applications. Trend analysis examines historical data patterns to identify emerging opportunities and potential market disruptions.

Expert validation processes involve review by industry specialists, clinical experts, and regulatory professionals to ensure research findings accurately reflect market realities and provide actionable insights for stakeholders. Continuous monitoring of market developments ensures research remains current and relevant to evolving market conditions.

Geographic distribution of remote patient monitoring adoption across the United Kingdom reveals significant regional variations influenced by healthcare infrastructure, population demographics, and local policy initiatives. England represents the largest market segment, accounting for approximately 84% of total market activity, driven by population density, NHS England digital health initiatives, and concentration of healthcare technology companies.

London and Southeast England demonstrate the highest adoption rates and market maturity, benefiting from advanced healthcare infrastructure, higher digital literacy rates, and proximity to technology innovation centers. Northern England regions show strong growth potential, supported by government investment in healthcare modernization and industrial digitization initiatives.

Scotland presents unique opportunities through NHS Scotland’s integrated approach to digital health implementation and strong government support for healthcare innovation. Scottish market characteristics include emphasis on rural healthcare delivery solutions and integration with existing telehealth infrastructure. Market penetration rates in Scotland have reached 58% among eligible patient populations.

Wales and Northern Ireland represent emerging markets with significant growth potential, particularly in rural healthcare delivery and chronic disease management applications. Regional healthcare policies in these areas increasingly prioritize remote monitoring solutions to address geographic healthcare access challenges and improve population health outcomes.

Market competition within the United Kingdom remote patient monitoring sector features diverse participants ranging from global healthcare technology leaders to specialized UK-based innovators. Competitive positioning strategies focus on clinical efficacy, NHS system integration capabilities, regulatory compliance, and comprehensive patient support services.

Innovation strategies among leading competitors emphasize artificial intelligence integration, improved patient user experiences, and enhanced clinical decision support capabilities. Partnership approaches with NHS trusts, private healthcare providers, and pharmaceutical companies are becoming increasingly important for market access and solution validation.

Market segmentation analysis reveals distinct categories within the United Kingdom remote patient monitoring market, each characterized by specific technology requirements, clinical applications, and growth dynamics. Technology-based segmentation provides insights into device types, connectivity solutions, and data management platforms driving market development.

By Technology:

By Application:

Cardiovascular monitoring represents the most mature and largest segment within the UK remote patient monitoring market, driven by high prevalence of heart disease and established clinical evidence supporting remote cardiac care. Technology advancement in this category includes AI-powered arrhythmia detection, predictive analytics for heart failure management, and integrated medication adherence monitoring.

Diabetes management solutions demonstrate strong growth momentum, particularly continuous glucose monitoring systems that provide real-time blood sugar data and trend analysis. Patient adoption in this category has reached 72% among eligible Type 1 diabetes patients, with expanding use among Type 2 diabetes populations. Integration with insulin delivery systems and lifestyle management applications enhances clinical outcomes and patient engagement.

Respiratory care monitoring has gained significant attention following COVID-19, with increased focus on home-based oxygen monitoring, sleep apnea management, and chronic obstructive pulmonary disease surveillance. MWR data indicates this segment is experiencing rapid growth of 18.5% annually, driven by aging population demographics and increased awareness of respiratory health importance.

Mental health monitoring represents an emerging category with substantial growth potential, incorporating mood tracking, medication adherence monitoring, and behavioral pattern analysis. Digital therapeutics integration with remote monitoring capabilities is creating new treatment paradigms for depression, anxiety, and other mental health conditions.

Healthcare providers benefit significantly from remote patient monitoring implementation through improved clinical outcomes, reduced hospital readmissions, and enhanced care coordination capabilities. Operational efficiency gains include optimized resource allocation, reduced emergency department visits, and improved chronic disease management protocols. Clinical staff can monitor larger patient populations while focusing on high-risk individuals requiring immediate intervention.

Patients experience enhanced convenience, improved health outcomes, and greater engagement in their healthcare management through remote monitoring solutions. Quality of life improvements include reduced travel requirements for routine monitoring, earlier detection of health issues, and personalized care recommendations. Patient empowerment through access to their own health data promotes better self-management and adherence to treatment protocols.

Healthcare systems achieve cost savings through reduced hospitalizations, optimized resource utilization, and improved population health management. NHS benefits include better capacity management, reduced waiting times, and enhanced ability to deliver care to underserved populations. System-wide implementation supports value-based care models and improved health equity across different demographic groups.

Technology companies benefit from expanding market opportunities, recurring revenue models, and opportunities for innovation and differentiation. Market access through NHS partnerships provides validation and scalability for solution providers. Data insights generated through remote monitoring create opportunities for advanced analytics services and personalized healthcare solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the United Kingdom remote patient monitoring market. Machine learning algorithms are increasingly sophisticated in analyzing patient data patterns, predicting health deterioration, and providing personalized treatment recommendations. AI-powered solutions demonstrate improved accuracy rates of 89% in early detection of clinical deterioration compared to traditional monitoring methods.

Interoperability standardization is gaining momentum as healthcare providers demand seamless integration between different monitoring devices and electronic health record systems. FHIR compliance and NHS-specific integration standards are becoming requirements for market success. Industry collaboration on data standardization is reducing implementation complexity and improving solution adoption rates.

Patient-centric design trends emphasize user experience, accessibility, and engagement features that improve long-term adherence to monitoring protocols. Gamification elements, social support features, and personalized feedback mechanisms are becoming standard components of successful remote monitoring solutions. Patient satisfaction scores have improved by 43% with enhanced user interface design and engagement features.

Value-based care models are driving demand for remote monitoring solutions that demonstrate measurable improvements in clinical outcomes and cost reduction. Outcome-based contracts between technology providers and healthcare organizations are becoming more common, aligning financial incentives with patient health improvements and system efficiency gains.

Recent industry developments highlight the dynamic nature of the United Kingdom remote patient monitoring market, with significant announcements regarding technology partnerships, regulatory approvals, and clinical validation studies. NHS England has announced expanded funding for digital health initiatives, including specific allocations for remote monitoring infrastructure development across integrated care systems.

Technology partnerships between major healthcare providers and remote monitoring solution vendors are accelerating market development. Several NHS trusts have announced comprehensive remote monitoring deployments covering thousands of patients with chronic conditions. These partnerships demonstrate the scalability and clinical effectiveness of remote monitoring solutions in real-world healthcare delivery environments.

Regulatory developments include updated MHRA guidance on software as medical devices and remote monitoring applications, providing clearer pathways for solution approval and market entry. Data governance frameworks have been enhanced to address privacy concerns while enabling innovation in remote monitoring capabilities.

Clinical research continues demonstrating the effectiveness of remote monitoring in various therapeutic areas. Recent studies published in leading medical journals provide evidence of improved patient outcomes, reduced healthcare utilization, and enhanced quality of life for patients using remote monitoring solutions. These findings support broader adoption and reimbursement decisions across the UK healthcare system.

Strategic recommendations for stakeholders in the United Kingdom remote patient monitoring market emphasize the importance of comprehensive integration planning, patient engagement strategies, and outcome measurement frameworks. Healthcare providers should prioritize solutions that demonstrate clear clinical benefits and integrate seamlessly with existing workflows and IT systems.

Technology companies should focus on developing NHS-specific integration capabilities, ensuring regulatory compliance, and building strong clinical evidence for their solutions. Partnership strategies with established healthcare providers and clinical research institutions can accelerate market acceptance and validation. Investment in user experience design and patient support services is critical for long-term success.

Policy makers should continue supporting remote monitoring adoption through favorable reimbursement policies, regulatory clarity, and infrastructure investment. Digital inclusion initiatives addressing the digital divide will be essential for ensuring equitable access to remote monitoring benefits across all population groups.

Investment considerations should focus on companies demonstrating strong clinical outcomes, robust regulatory compliance, and scalable technology platforms. MarkWide Research analysis suggests that companies with comprehensive patient engagement strategies and proven NHS integration capabilities represent the most attractive investment opportunities in the current market environment.

Long-term market prospects for the United Kingdom remote patient monitoring sector remain highly positive, supported by demographic trends, technological advancement, and healthcare system transformation initiatives. Market expansion is expected to continue at a sustained growth rate of 11.2% annually, driven by increasing clinical adoption and expanding application areas.

Technology evolution will likely focus on enhanced artificial intelligence capabilities, improved interoperability, and more sophisticated patient engagement features. 5G connectivity deployment across the UK will enable more advanced remote monitoring applications, including real-time video consultation integration and high-bandwidth data transmission capabilities.

Healthcare delivery models will increasingly incorporate remote monitoring as a standard component of chronic disease management, post-acute care, and preventive health services. Integration with social care services and community health programs will expand the scope and impact of remote monitoring solutions.

Market maturation will likely result in consolidation among solution providers, standardization of technology platforms, and development of comprehensive outcome measurement frameworks. The focus will shift from technology adoption to optimization of clinical outcomes and healthcare system efficiency through sophisticated data analytics and personalized care delivery models.

The United Kingdom remote patient monitoring market represents a transformative force in healthcare delivery, offering substantial opportunities for improved patient outcomes, enhanced care accessibility, and healthcare system efficiency. Market dynamics indicate sustained growth driven by demographic trends, technological innovation, and strong government support for digital health initiatives.

Key success factors for market participants include clinical validation, NHS system integration capabilities, patient engagement excellence, and regulatory compliance. The market’s evolution toward value-based care models and outcome-focused solutions creates opportunities for providers who can demonstrate measurable improvements in patient health and healthcare system performance.

Future development will likely emphasize artificial intelligence integration, enhanced interoperability, and comprehensive patient support services. The United Kingdom remote patient monitoring market is positioned to play an increasingly critical role in addressing healthcare challenges while supporting the NHS’s mission to provide high-quality, accessible healthcare services to all UK residents.

What is Remote Patient Monitoring?

Remote Patient Monitoring refers to the use of technology to monitor patients’ health data outside of traditional clinical settings. This includes tracking vital signs, managing chronic conditions, and facilitating communication between patients and healthcare providers.

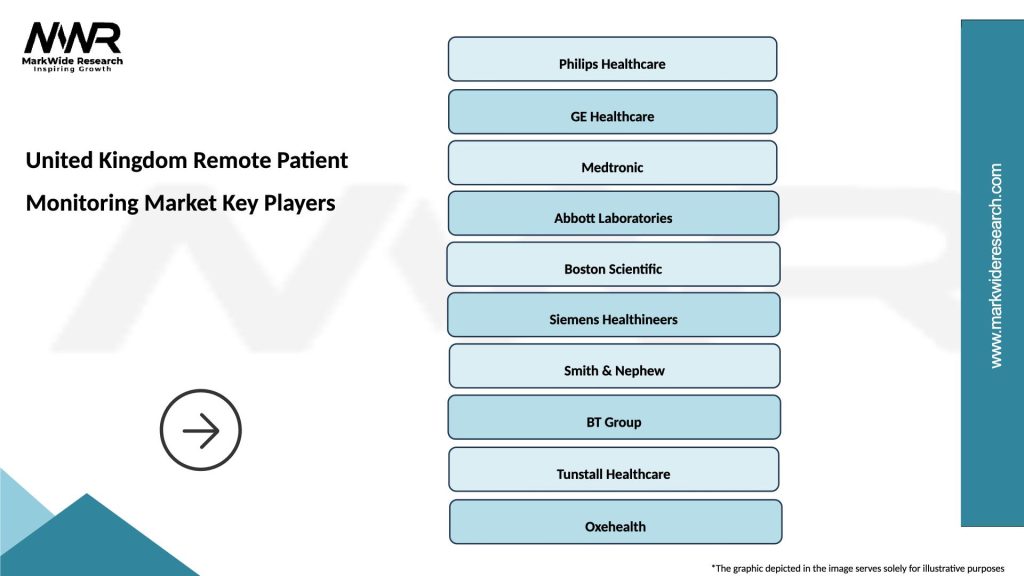

What are the key players in the United Kingdom Remote Patient Monitoring Market?

Key players in the United Kingdom Remote Patient Monitoring Market include Philips Healthcare, Medtronic, and BioTelemetry, among others. These companies are known for their innovative solutions that enhance patient care and streamline healthcare delivery.

What are the main drivers of the United Kingdom Remote Patient Monitoring Market?

The main drivers of the United Kingdom Remote Patient Monitoring Market include the increasing prevalence of chronic diseases, the growing demand for cost-effective healthcare solutions, and advancements in telehealth technologies. These factors contribute to the rising adoption of remote monitoring systems.

What challenges does the United Kingdom Remote Patient Monitoring Market face?

Challenges in the United Kingdom Remote Patient Monitoring Market include concerns over data privacy and security, the need for regulatory compliance, and potential resistance from healthcare professionals. These issues can hinder the widespread adoption of remote monitoring technologies.

What opportunities exist in the United Kingdom Remote Patient Monitoring Market?

Opportunities in the United Kingdom Remote Patient Monitoring Market include the integration of artificial intelligence for better data analysis, the expansion of wearable health devices, and the increasing focus on personalized medicine. These trends can enhance patient engagement and improve health outcomes.

What trends are shaping the United Kingdom Remote Patient Monitoring Market?

Trends shaping the United Kingdom Remote Patient Monitoring Market include the rise of mobile health applications, the growing use of Internet of Things (IoT) devices, and the shift towards value-based care models. These innovations are transforming how healthcare is delivered and monitored.

United Kingdom Remote Patient Monitoring Market

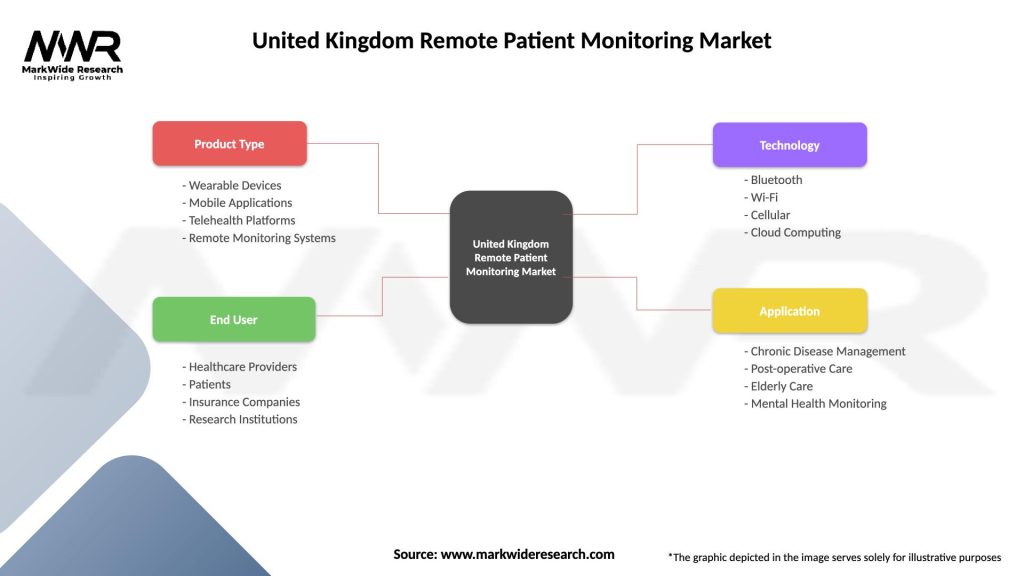

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Mobile Applications, Telehealth Platforms, Remote Monitoring Systems |

| End User | Healthcare Providers, Patients, Insurance Companies, Research Institutions |

| Technology | Bluetooth, Wi-Fi, Cellular, Cloud Computing |

| Application | Chronic Disease Management, Post-operative Care, Elderly Care, Mental Health Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Remote Patient Monitoring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at