444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Kingdom real-time payments market has experienced significant growth in recent years. Real-time payments refer to the immediate transfer of funds from one bank account to another, enabling users to send and receive payments instantaneously, 24/7. This technology has revolutionized the way people conduct financial transactions, providing convenience, speed, and security.

Meaning

Real-time payments, also known as instant payments, enable individuals and businesses to transfer funds quickly and securely. Unlike traditional payment methods that take several hours or even days to complete, real-time payments offer near-instantaneous transfer of funds, ensuring that recipients have immediate access to the funds. This technology has transformed various sectors, including banking, e-commerce, and retail, by streamlining payment processes and enhancing customer experiences.

Executive Summary

The United Kingdom real-time payments market has witnessed remarkable growth due to the increasing demand for fast, secure, and convenient payment solutions. The advent of advanced technology and the rise of digitalization have propelled the adoption of real-time payment systems across various industries. This report aims to provide a comprehensive analysis of the market, including key insights, market drivers, restraints, opportunities, and future trends.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The United Kingdom real-time payments market is projected to experience substantial growth in the coming years. Factors such as the growing emphasis on digital transactions, increasing smartphone penetration, and the need for instant payments have fueled the market’s expansion. Additionally, the rise of e-commerce and the growing preference for contactless payments have further contributed to market growth.

Market Drivers

Several key drivers are propelling the growth of the United Kingdom real-time payments market. Firstly, the rising demand for instant payments has been driven by the need for faster and more efficient transaction processing. Consumers and businesses alike are seeking seamless payment experiences that save time and eliminate the hassle of traditional payment methods.

Secondly, the proliferation of smartphones and mobile banking applications has facilitated the adoption of real-time payment systems. With the increasing number of individuals using smartphones for financial transactions, the demand for instant payment solutions has surged.

Furthermore, the shift towards a cashless society has played a significant role in driving the real-time payments market. Consumers are increasingly opting for digital payment methods, and real-time payments provide a secure and convenient alternative to cash transactions.

Market Restraints

Despite the positive growth prospects, the United Kingdom real-time payments market faces certain challenges. One of the key restraints is the potential security risks associated with instant payment systems. As cyber threats evolve, ensuring the security and integrity of real-time payment transactions becomes crucial. Market players need to invest in robust security measures and fraud detection systems to mitigate these risks.

Moreover, the integration of real-time payment systems with existing infrastructure can be complex and time-consuming. Many financial institutions and organizations face challenges in implementing and upgrading their systems to support real-time payments. This can slow down the adoption rate and hinder market growth.

Market Opportunities

The United Kingdom real-time payments market presents several opportunities for industry participants. The integration of real-time payments with emerging technologies such as blockchain and artificial intelligence (AI) can unlock new possibilities for innovation and efficiency. These technologies can enhance the security, speed, and transparency of real-time payment transactions, opening doors to new business models and revenue streams.

Furthermore, the increasing adoption of real-time payments in sectors such as healthcare, government, and transportation offers significant growth opportunities. By leveraging real-time payment systems, these industries can streamline their operations, improve customer service, and reduce administrative costs.

Market Dynamics

The United Kingdom real-time payments market is dynamic and driven by various factors. The increasing digitalization and changing consumer preferences have fueled the demand for instant payment solutions. Additionally, regulatory initiatives and industry collaborations aimed at promoting faster payments have further accelerated market growth.

Financial technology (fintech) companies and payment service providers are playing a crucial role in shaping the market dynamics. These players are continually innovating and introducing new payment solutions to meet the evolving needs of consumers and businesses. The competition among market players has intensified, leading to improved offerings and enhanced customer experiences.

Regional Analysis

The United Kingdom real-time payments market exhibits regional variations in terms of adoption and market dynamics. Major cities such as London, Manchester, and Birmingham have witnessed a higher adoption rate of real-time payment systems due to their concentration of businesses and tech-savvy population. These regions serve as innovation hubs and are at the forefront of embracing new payment technologies.

However, the adoption of real-time payments is gradually spreading across the entire country, driven by the growing awareness and benefits associated with instant payment solutions. Financial institutions and businesses in smaller towns and rural areas are also recognizing the value of real-time payments in facilitating faster and more efficient transactions.

Competitive Landscape

Leading Companies in the United Kingdom Real Time Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

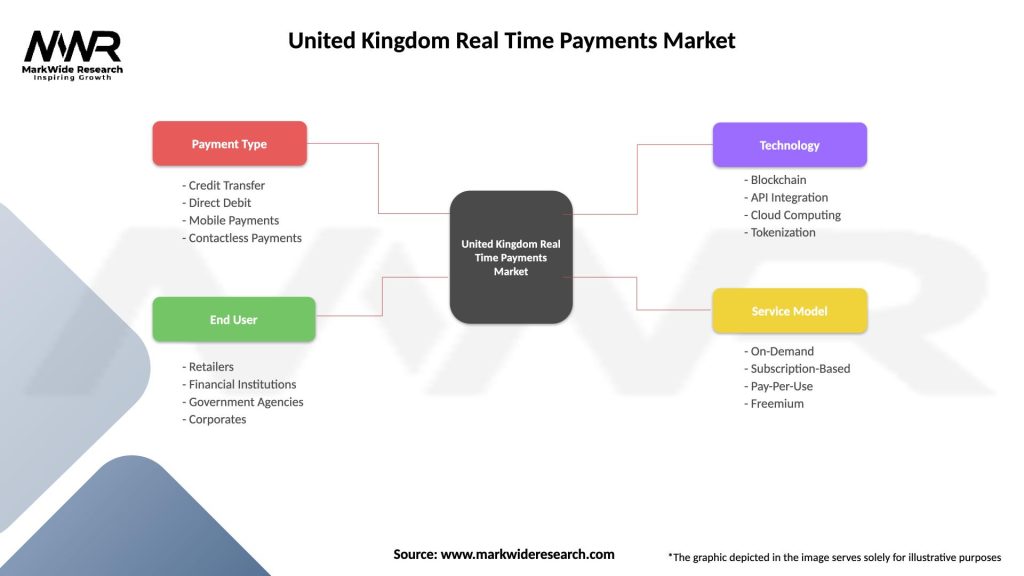

Segmentation

The United Kingdom real-time payments market can be segmented based on the type of payment system, end-user industry, and payment channel.

By type of payment system:

By end-user industry:

By payment channel:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The United Kingdom real-time payments market presents several benefits for industry participants and stakeholders, including:

SWOT Analysis

The SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the United Kingdom real-time payments market is as follows:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The United Kingdom real-time payments market is witnessing several key trends that are shaping its trajectory:

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on the United Kingdom real-time payments market. The restrictions imposed during the pandemic, such as lockdowns and social distancing measures, accelerated the shift towards digital payments. Consumers and businesses turned to real-time payment solutions to minimize physical contact and ensure the continuity of essential financial transactions.

The pandemic also highlighted the importance of reliable and efficient payment systems in times of crisis. Real-time payments enabled individuals to send money to friends and family quickly, businesses to receive payments promptly, and government agencies to distribute financial assistance efficiently.

The COVID-19 pandemic served as a catalyst for the adoption of real-time payment systems, pushing businesses and consumers to embrace digital payment alternatives and reducing their reliance on cash transactions.

Key Industry Developments

The United Kingdom real-time payments market has witnessed several key developments in recent years:

Analyst Suggestions

Based on the analysis of the United Kingdom real-time payments market, analysts suggest the following:

Future Outlook

The future outlook for the United Kingdom real-time payments market is highly promising. The market is expected to witness substantial growth as the demand for fast, secure, and convenient payment solutions continues to rise. The increasing digitalization, smartphone penetration, and the shift towards a cashless society will be the key drivers of market expansion. Moreover, the integration of real-time payment systems with emerging technologies and the expansion into untapped industries present significant growth opportunities. Collaboration between financial institutions and fintech firms will foster innovation and drive the development of new payment solutions.

However, challenges related to security, infrastructure integration, and regulatory compliance need to be addressed to ensure the sustainable growth of the market. Market players should remain agile and adaptive to the evolving needs and expectations of consumers and businesses to stay ahead in this dynamic landscape.

Conclusion

The United Kingdom real-time payments market is experiencing rapid growth, driven by the increasing demand for fast, secure, and convenient payment solutions. Real-time payments enable individuals and businesses to transfer funds instantaneously, enhancing transaction speed and efficiency. The market offers significant benefits for industry participants and stakeholders, including improved customer experiences, faster settlements, cost savings, increased security, and expanded market reach.

While the market presents several growth opportunities, challenges such as security risks and infrastructure integration need to be addressed. However, with advancements in technology, collaboration among industry players, and supportive regulatory frameworks, the future outlook for the United Kingdom real-time payments market is promising. The market is poised for further expansion, fueled by the ongoing digital transformation and the growing preference for contactless and digital payment methods.

What is Real Time Payments?

Real Time Payments refer to payment systems that allow for the immediate transfer of funds between bank accounts, providing instant confirmation of the transaction. This system enhances the efficiency of financial transactions across various sectors, including retail, e-commerce, and services.

What are the key players in the United Kingdom Real Time Payments Market?

Key players in the United Kingdom Real Time Payments Market include Pay.UK, which operates the Faster Payments Service, and various banks such as Barclays and Lloyds Banking Group. These companies are pivotal in facilitating real-time transactions and enhancing payment infrastructure, among others.

What are the growth factors driving the United Kingdom Real Time Payments Market?

The growth of the United Kingdom Real Time Payments Market is driven by increasing consumer demand for instant payment solutions, the rise of e-commerce, and advancements in digital banking technologies. Additionally, regulatory support for faster payment systems is also contributing to market expansion.

What challenges does the United Kingdom Real Time Payments Market face?

The United Kingdom Real Time Payments Market faces challenges such as cybersecurity threats, the need for robust infrastructure, and regulatory compliance issues. These factors can hinder the adoption and efficiency of real-time payment systems.

What opportunities exist in the United Kingdom Real Time Payments Market?

Opportunities in the United Kingdom Real Time Payments Market include the potential for innovation in payment technologies, the integration of artificial intelligence for fraud detection, and the expansion of services to underserved sectors. These developments can enhance user experience and broaden market reach.

What trends are shaping the United Kingdom Real Time Payments Market?

Trends shaping the United Kingdom Real Time Payments Market include the increasing adoption of mobile payment solutions, the rise of open banking, and the growing emphasis on contactless transactions. These trends are transforming how consumers and businesses engage in financial transactions.

United Kingdom Real Time Payments Market

| Segmentation Details | Description |

|---|---|

| Payment Type | Credit Transfer, Direct Debit, Mobile Payments, Contactless Payments |

| End User | Retailers, Financial Institutions, Government Agencies, Corporates |

| Technology | Blockchain, API Integration, Cloud Computing, Tokenization |

| Service Model | On-Demand, Subscription-Based, Pay-Per-Use, Freemium |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United Kingdom Real Time Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at