444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom public relation services market represents a dynamic and rapidly evolving sector within the broader communications industry. Public relations agencies and consultancies across the UK are experiencing unprecedented demand as businesses recognize the critical importance of strategic communication in today’s digital-first landscape. The market encompasses traditional PR services, digital communications, crisis management, and integrated marketing communications solutions.

Market growth in the UK PR sector has been particularly robust, with the industry expanding at a compound annual growth rate (CAGR) of 6.2% over recent years. This growth trajectory reflects the increasing sophistication of communication strategies and the growing recognition among UK businesses that effective public relations is essential for brand reputation, stakeholder engagement, and competitive positioning in both domestic and international markets.

Digital transformation has fundamentally reshaped the UK public relations landscape, with agencies investing heavily in social media management, influencer relations, content marketing, and data analytics capabilities. The integration of artificial intelligence and automation tools has enhanced campaign effectiveness while enabling more precise measurement of PR outcomes and return on investment.

The United Kingdom public relation services market refers to the comprehensive ecosystem of professional communication services designed to manage and enhance the reputation, visibility, and stakeholder relationships of organizations across various sectors. This market encompasses strategic communication planning, media relations, crisis communication, digital PR, content creation, and reputation management services delivered by specialized agencies, consultancies, and in-house teams.

Public relations services in the UK context include traditional media outreach, digital communication strategies, social media management, influencer partnerships, corporate communications, investor relations, and crisis management. The market serves diverse client segments including multinational corporations, SMEs, government agencies, non-profit organizations, and individual executives seeking to build and maintain their public profile.

The UK public relations services market demonstrates remarkable resilience and adaptability, driven by the increasing complexity of modern communication landscapes and the growing importance of reputation management in business success. Digital integration has become a cornerstone of contemporary PR strategies, with approximately 78% of UK PR agencies now offering comprehensive digital communication services alongside traditional media relations.

Market consolidation continues to shape the industry structure, with larger agencies acquiring specialized boutique firms to expand their service capabilities and geographic reach. The rise of in-house PR teams has created both challenges and opportunities for external agencies, leading to more collaborative partnership models and specialized service offerings.

Client expectations have evolved significantly, with businesses demanding measurable outcomes, real-time reporting, and integrated communication strategies that align with broader marketing and business objectives. This shift has prompted PR agencies to invest heavily in analytics platforms, measurement tools, and cross-functional expertise to deliver comprehensive communication solutions.

Strategic insights reveal several critical trends shaping the UK public relations services market:

Several key factors are propelling growth in the UK public relations services market. Digital transformation remains the primary catalyst, as businesses recognize the need for sophisticated online reputation management and social media engagement strategies. The proliferation of digital platforms has created new opportunities for brand storytelling while simultaneously increasing the complexity of communication management.

Regulatory changes and increased scrutiny of corporate behavior have heightened the importance of proactive communication strategies. UK businesses are investing more heavily in PR services to navigate complex regulatory environments, manage stakeholder expectations, and maintain transparent communication with various audiences including customers, investors, and regulatory bodies.

Competitive market dynamics continue to drive demand for professional PR services as companies seek to differentiate themselves in crowded marketplaces. The rise of purpose-driven marketing and the growing importance of corporate social responsibility have created new opportunities for PR agencies to help clients articulate their values and social impact initiatives effectively.

Crisis communication preparedness has become a critical driver following several high-profile corporate crises that demonstrated the importance of rapid, effective communication response. Organizations are increasingly investing in crisis communication planning and retainer relationships with PR agencies to ensure they can respond quickly and effectively to potential reputation threats.

Budget constraints represent a significant challenge for the UK public relations services market, particularly among smaller businesses and startups that may view PR as a discretionary expense rather than a strategic necessity. Economic uncertainty and fluctuating business conditions can lead to reduced marketing and communication budgets, directly impacting demand for external PR services.

In-house capability development poses an ongoing challenge as larger organizations build internal PR teams and capabilities, potentially reducing their reliance on external agencies. This trend has forced agencies to evolve their service offerings and demonstrate unique value propositions that complement rather than compete with in-house resources.

Measurement and ROI challenges continue to constrain market growth as clients demand more sophisticated metrics and clear demonstration of PR impact on business outcomes. The intangible nature of many PR benefits makes it difficult to establish direct correlations between PR activities and business results, leading some organizations to question the value of PR investments.

Talent acquisition and retention challenges affect agency operations and growth potential. The competitive job market for skilled PR professionals, combined with the demanding nature of agency work, creates ongoing staffing challenges that can limit agencies’ ability to take on new clients or expand service offerings.

Emerging technologies present significant opportunities for UK PR agencies to enhance their service offerings and operational efficiency. Artificial intelligence and machine learning applications in media monitoring, sentiment analysis, and content optimization enable agencies to deliver more sophisticated and effective campaigns while improving measurement capabilities.

Sector specialization offers substantial growth opportunities as agencies develop deep expertise in specific industries such as healthcare, technology, financial services, and sustainability. Specialized knowledge enables agencies to command premium pricing while delivering more targeted and effective communication strategies for sector-specific challenges and opportunities.

International expansion represents a major growth avenue for established UK PR agencies, particularly in serving British businesses expanding globally or international companies entering the UK market. The UK’s reputation for communication excellence and creative industries provides a strong foundation for international service delivery.

Digital innovation continues to create new service categories and revenue streams, including social media management, influencer relations, content marketing, and digital crisis management. Agencies that successfully integrate these capabilities with traditional PR services can capture larger shares of client communication budgets.

The competitive landscape of the UK public relations services market is characterized by intense competition among agencies of varying sizes and specializations. Large multinational agencies compete with boutique specialists and regional firms, creating a diverse ecosystem that serves different client needs and budget requirements. This competition drives innovation and service quality improvements across the industry.

Client relationship dynamics have evolved significantly, with businesses seeking more strategic partnerships rather than traditional vendor relationships. Agencies are responding by developing account management approaches that emphasize strategic consultation, proactive communication, and long-term relationship building rather than purely transactional service delivery.

Technology integration has become a critical differentiator, with successful agencies investing in advanced analytics platforms, automation tools, and digital communication technologies. The ability to demonstrate measurable results and provide real-time campaign insights has become essential for maintaining competitive advantage and client satisfaction.

Market consolidation trends continue to reshape the industry structure, with larger agencies acquiring specialized firms to expand capabilities and market reach. This consolidation creates opportunities for remaining independent agencies to differentiate themselves through specialized expertise or personalized service approaches.

Comprehensive market analysis of the UK public relations services sector employs multiple research methodologies to ensure accuracy and depth of insights. Primary research includes extensive interviews with industry executives, agency leaders, and client organizations to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and trade publication data to establish market parameters and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and provides historical context for trend analysis.

Quantitative analysis involves statistical examination of market data, including agency revenues, client spending patterns, and service category performance. This data-driven approach enables identification of growth patterns, market share distributions, and emerging opportunities within specific market segments.

Qualitative assessment includes evaluation of industry best practices, case study analysis, and expert opinion synthesis to provide strategic insights beyond purely numerical market analysis. This methodology ensures that research findings reflect both quantitative trends and qualitative market dynamics that influence business decisions.

London dominates the UK public relations services market, accounting for approximately 65% of total market activity due to its concentration of multinational corporations, financial institutions, and media organizations. The capital’s status as a global business hub ensures continued demand for sophisticated PR services across multiple industry sectors.

Regional markets including Manchester, Birmingham, Edinburgh, and Bristol demonstrate strong growth potential as businesses outside London seek local PR expertise combined with national reach capabilities. These regional hubs offer cost advantages while maintaining access to skilled professionals and diverse client bases.

Scotland’s PR market shows particular strength in sectors such as energy, tourism, and financial services, with Edinburgh serving as a key hub for both domestic and international PR activities. The region’s distinct cultural and business environment creates opportunities for specialized service offerings.

Northern England presents significant growth opportunities, particularly in Manchester and Leeds, where thriving business communities and lower operational costs attract both clients and agencies. The region’s strong media presence and diverse economy support sustained demand for PR services across multiple sectors.

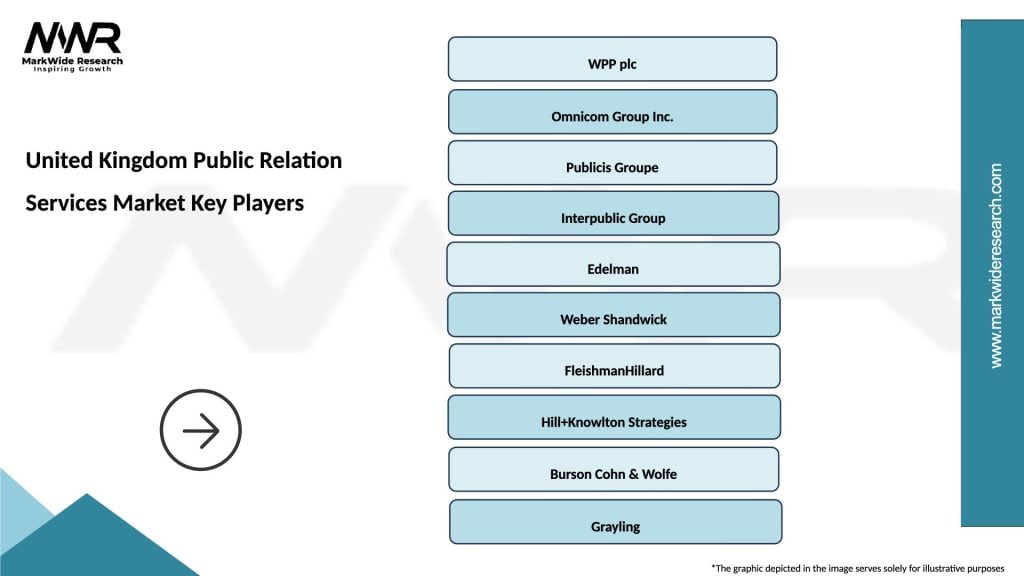

The UK public relations services market features a diverse competitive landscape encompassing global networks, national agencies, and specialized boutique firms. Market leadership is distributed among several categories of service providers, each serving different client segments and service requirements.

Major market participants include:

Competitive differentiation occurs through sector specialization, service innovation, geographic coverage, and client relationship quality. Agencies compete on their ability to demonstrate measurable results, provide strategic insights, and adapt to evolving client needs in an increasingly complex communication environment.

Service-based segmentation reveals distinct categories within the UK public relations services market:

By Service Type:

By Client Industry:

Digital PR services represent the fastest-growing segment within the UK market, with agencies reporting annual growth rates exceeding 15% in digital-focused service offerings. This category encompasses social media management, influencer relations, content marketing, and online reputation management services that have become essential components of modern communication strategies.

Crisis communications has emerged as a critical service category, with demand increasing significantly following high-profile corporate incidents and the growing importance of rapid response capabilities. Agencies specializing in crisis communication report strong client retention rates and premium pricing for their specialized expertise.

Financial communications remains a stable and lucrative segment, particularly in London’s financial district, where regulatory requirements and investor relations needs drive consistent demand for specialized PR services. This category typically commands higher fees due to the technical expertise required and the critical nature of financial communications.

Healthcare communications shows strong growth potential, driven by increased public interest in health topics and the complex regulatory environment surrounding pharmaceutical and medical device marketing. Agencies with healthcare expertise report strong demand for both consumer and professional communication services.

For PR agencies, the evolving UK market presents opportunities to expand service offerings, develop specialized expertise, and build stronger client relationships through strategic partnership approaches. Digital transformation enables agencies to offer more comprehensive services while improving operational efficiency and campaign measurement capabilities.

Client organizations benefit from access to specialized expertise, advanced technology platforms, and strategic insights that would be difficult to develop internally. Professional PR services enable businesses to navigate complex communication challenges while focusing on their core operations and strategic objectives.

Industry professionals enjoy diverse career opportunities across agency and in-house roles, with growing demand for digital skills, data analysis capabilities, and sector-specific expertise. The market’s growth creates advancement opportunities and competitive compensation packages for skilled practitioners.

Technology providers find significant opportunities in serving the PR industry’s growing need for analytics platforms, automation tools, and digital communication technologies. The industry’s willingness to invest in technology solutions creates a robust market for specialized software and service providers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming how UK PR agencies deliver services, with approximately 42% of agencies now using AI tools for media monitoring, content creation, and campaign optimization. This technological adoption enables more efficient operations while providing clients with enhanced insights and faster response times.

Purpose-driven communications has become a dominant trend as businesses increasingly focus on sustainability, social responsibility, and stakeholder capitalism. PR agencies are developing specialized capabilities to help clients articulate their purpose and social impact effectively while avoiding accusations of greenwashing or superficial messaging.

Influencer relations continue to evolve beyond traditional celebrity endorsements to include micro-influencers, thought leaders, and employee advocacy programs. Agencies are developing sophisticated influencer identification and management capabilities to help clients build authentic relationships with key opinion leaders.

Data-driven storytelling combines traditional narrative skills with advanced analytics to create more compelling and measurable communication campaigns. This approach enables agencies to demonstrate clear connections between PR activities and business outcomes while optimizing campaign performance in real-time.

Recent mergers and acquisitions have reshaped the competitive landscape, with several major agencies expanding their capabilities through strategic acquisitions of specialized firms. These transactions reflect the industry’s evolution toward integrated service offerings and the importance of digital expertise in modern PR practice.

Regulatory developments including GDPR implementation and evolving social media regulations have created new compliance requirements for PR agencies and their clients. Agencies have invested significantly in training and systems to ensure compliance while maintaining effective communication strategies.

Technology partnerships between PR agencies and software providers have accelerated, enabling agencies to offer more sophisticated analytics and automation capabilities. These partnerships allow agencies to focus on strategic and creative work while leveraging technology for operational efficiency.

Sustainability initiatives within the PR industry itself have gained momentum, with agencies implementing environmental policies and helping clients develop authentic sustainability communication strategies. This trend reflects both client demands and the industry’s recognition of its role in promoting responsible business practices.

MarkWide Research recommends that UK PR agencies prioritize digital capability development and data analytics investments to remain competitive in the evolving market landscape. Agencies should focus on demonstrating measurable value to clients while developing specialized expertise in high-growth sectors such as technology and healthcare.

Strategic partnerships with technology providers and complementary service firms can help agencies expand their capabilities without significant internal investment. These collaborations enable agencies to offer comprehensive solutions while maintaining focus on their core communication expertise.

Talent development initiatives should emphasize digital skills, data analysis capabilities, and sector-specific knowledge to meet evolving client needs. Agencies investing in employee development and retention strategies will be better positioned to deliver consistent service quality and maintain competitive advantage.

International expansion opportunities should be carefully evaluated, with agencies considering partnerships or acquisitions to enter new markets rather than organic expansion. The UK’s reputation for communication excellence provides a strong foundation for international growth when properly leveraged.

The UK public relations services market is projected to maintain steady growth over the next five years, with digital services continuing to drive expansion at an estimated CAGR of 7.1%. MWR analysis indicates that agencies successfully integrating artificial intelligence and automation tools will capture disproportionate market share while improving operational efficiency.

Sector specialization will become increasingly important as clients seek agencies with deep industry knowledge and proven track records in specific verticals. Healthcare, technology, and sustainability communications are expected to show particularly strong growth, driven by regulatory requirements and public interest in these areas.

International opportunities will expand as UK businesses increase global operations and international companies seek UK market entry support. Agencies with strong digital capabilities and cultural understanding will be best positioned to capitalize on these cross-border communication needs.

Technology integration will continue to reshape service delivery, with successful agencies balancing automation efficiency with human creativity and strategic insight. The ability to demonstrate clear ROI through advanced measurement and analytics will become a critical competitive differentiator in client acquisition and retention.

The United Kingdom public relations services market stands at a pivotal juncture, characterized by digital transformation, evolving client expectations, and increasing demand for measurable communication outcomes. The industry’s ability to adapt to technological change while maintaining its creative and strategic strengths positions it well for continued growth and evolution.

Success factors for market participants include digital capability development, sector specialization, talent retention, and the ability to demonstrate clear value through advanced measurement and analytics. Agencies that successfully navigate these challenges while maintaining high service quality will capture the greatest opportunities in this dynamic market.

Future growth will be driven by continued digital adoption, international expansion opportunities, and the growing recognition of professional communication’s strategic importance in business success. The UK’s position as a global communication hub ensures continued relevance and growth potential for the public relations services sector.

What is Public Relation Services?

Public Relation Services encompass a range of activities aimed at managing communication between organizations and their target audiences. This includes media relations, crisis management, and strategic communication planning.

What are the key players in the United Kingdom Public Relation Services Market?

Key players in the United Kingdom Public Relation Services Market include WPP, Omnicom Group, and Edelman, among others. These companies provide various PR services, including digital marketing, brand management, and public affairs.

What are the growth factors driving the United Kingdom Public Relation Services Market?

The growth of the United Kingdom Public Relation Services Market is driven by the increasing importance of digital communication, the rise of social media, and the need for effective crisis management strategies. Additionally, businesses are focusing on enhancing their brand reputation and customer engagement.

What challenges does the United Kingdom Public Relation Services Market face?

The United Kingdom Public Relation Services Market faces challenges such as the rapid evolution of technology, which requires constant adaptation, and the increasing competition among PR firms. Additionally, maintaining transparency and trust in communications is becoming more complex.

What opportunities exist in the United Kingdom Public Relation Services Market?

Opportunities in the United Kingdom Public Relation Services Market include the growing demand for integrated communication strategies and the expansion of influencer marketing. Companies are also exploring new platforms for engagement, such as podcasts and live streaming.

What trends are shaping the United Kingdom Public Relation Services Market?

Trends shaping the United Kingdom Public Relation Services Market include the rise of data-driven PR strategies, increased focus on sustainability in communications, and the integration of artificial intelligence in media monitoring and analysis. These trends are influencing how PR firms operate and engage with audiences.

United Kingdom Public Relation Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Media Relations, Crisis Management, Event Management, Digital PR |

| End User | Corporations, Nonprofits, Government Agencies, Startups |

| Industry Vertical | Technology, Healthcare, Education, Finance |

| Delivery Mode | Online, Offline, Hybrid, Social Media |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Public Relation Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at