444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom payment gateway market represents a dynamic and rapidly evolving sector within the broader financial technology landscape. Payment gateways serve as critical infrastructure components that facilitate secure online transactions between merchants, customers, and financial institutions. The UK market has experienced remarkable transformation driven by increasing digital commerce adoption, regulatory changes, and evolving consumer payment preferences.

Digital transformation initiatives across various industries have accelerated the demand for sophisticated payment processing solutions. The market demonstrates robust growth potential with a projected CAGR of 12.8% through the forecast period, reflecting the increasing digitization of payment processes and the growing preference for contactless transactions. E-commerce expansion continues to drive market growth, with online retail penetration reaching 28.5% of total retail sales in the UK.

Regulatory compliance requirements including PCI DSS standards and Strong Customer Authentication (SCA) under PSD2 have shaped market dynamics significantly. These regulations have created opportunities for advanced payment gateway providers while establishing higher barriers to entry. The market landscape features both established international players and innovative domestic fintech companies competing for market share across various industry verticals.

The United Kingdom payment gateway market refers to the comprehensive ecosystem of technology platforms and services that enable secure electronic payment processing between merchants and customers within the UK financial system. Payment gateways act as intermediary services that authorize and process digital transactions, ensuring secure data transmission and compliance with financial regulations while facilitating seamless payment experiences across multiple channels.

Core functionality encompasses transaction authorization, fraud detection, currency conversion, and settlement processing. These platforms integrate with various payment methods including credit cards, debit cards, digital wallets, bank transfers, and alternative payment solutions. Modern payment gateways provide comprehensive APIs, real-time reporting, and advanced analytics capabilities that enable merchants to optimize their payment processes and enhance customer experiences.

Market participants include traditional payment processors, fintech innovators, banking institutions, and specialized technology providers. The ecosystem supports diverse business models ranging from small online retailers to large enterprise organizations, each requiring tailored payment solutions that address specific operational requirements and customer preferences.

Market dynamics in the United Kingdom payment gateway sector reflect a mature yet rapidly evolving landscape characterized by intense competition and continuous innovation. The market benefits from strong regulatory frameworks, advanced digital infrastructure, and high consumer adoption of digital payment methods. Key growth drivers include the expansion of e-commerce, increasing mobile commerce adoption, and the growing demand for omnichannel payment solutions.

Technology advancement remains a critical differentiator, with providers investing heavily in artificial intelligence, machine learning, and blockchain technologies to enhance security, reduce fraud, and improve transaction processing efficiency. The integration of open banking initiatives has created new opportunities for innovative payment solutions while increasing competitive pressure on traditional providers.

Market consolidation trends continue to shape the competitive landscape, with larger players acquiring specialized fintech companies to expand their service offerings and geographic reach. According to MarkWide Research analysis, the market demonstrates strong resilience and adaptability, with 73% of businesses planning to upgrade their payment processing capabilities within the next two years to meet evolving customer expectations and regulatory requirements.

Strategic insights reveal several critical trends shaping the United Kingdom payment gateway market landscape:

Emerging technologies including artificial intelligence and machine learning are revolutionizing fraud detection and risk management capabilities. These innovations enable payment gateways to provide more accurate transaction scoring and reduce false positive rates, improving both security and customer experience.

E-commerce expansion continues to serve as the primary catalyst for payment gateway market growth in the United Kingdom. The sustained shift toward online shopping, accelerated by changing consumer behaviors and digital transformation initiatives, has created unprecedented demand for reliable and secure payment processing solutions. Retail digitization efforts across traditional brick-and-mortar establishments have further expanded the addressable market.

Regulatory support through initiatives such as Open Banking and PSD2 has fostered innovation while maintaining high security standards. These regulatory frameworks have created opportunities for new market entrants while encouraging existing players to enhance their service offerings. Government digitization programs have also contributed to increased adoption of electronic payment methods across public sector organizations.

Consumer preference evolution toward contactless and digital payment methods has accelerated market growth. The increasing adoption of smartphones and digital wallets has created demand for payment gateways that support multiple payment methods and provide seamless user experiences. Generational shifts in payment preferences continue to drive innovation in user interface design and payment flow optimization.

Business efficiency requirements have prompted organizations to seek integrated payment solutions that streamline operations and reduce manual processing costs. The demand for automated reconciliation, real-time reporting, and comprehensive analytics capabilities has become increasingly important for business decision-making processes.

Regulatory complexity presents significant challenges for payment gateway providers operating in the United Kingdom market. Compliance with multiple regulatory frameworks including PCI DSS, GDPR, and PSD2 requires substantial investment in security infrastructure and ongoing monitoring capabilities. Regulatory changes can create uncertainty and require rapid adaptation of existing systems and processes.

Security concerns remain a persistent challenge, with increasing sophistication of cyber threats requiring continuous investment in advanced security measures. The cost of maintaining robust fraud detection systems and ensuring data protection compliance can be substantial, particularly for smaller market participants. Cybersecurity incidents can result in significant financial and reputational damage.

Market saturation in certain segments has intensified competitive pressure and reduced profit margins. The presence of numerous established players and new market entrants has created pricing pressure that can impact profitability. Customer acquisition costs have increased as competition for merchant relationships intensifies.

Technical integration challenges can create barriers to adoption, particularly for businesses with legacy systems or complex IT infrastructures. The need for specialized technical expertise and ongoing system maintenance can be prohibitive for some organizations. Integration complexity may result in extended implementation timelines and increased project costs.

Open Banking implementation has created substantial opportunities for innovative payment solutions that leverage direct bank-to-bank transfers and account-to-account payments. These initiatives enable payment gateways to offer lower-cost alternatives to traditional card-based transactions while providing enhanced security and faster settlement times. API-driven innovation continues to unlock new business models and service offerings.

Small and medium enterprise (SME) digitization represents a significant growth opportunity as businesses seek to modernize their payment processing capabilities. Many SMEs are transitioning from cash-based operations to digital payment acceptance, creating demand for user-friendly and cost-effective payment gateway solutions. Vertical-specific solutions tailored to industry requirements present additional market expansion opportunities.

International expansion opportunities exist for UK-based payment gateway providers seeking to leverage their expertise in regulated markets. The experience gained in navigating complex regulatory environments provides competitive advantages in other jurisdictions with similar requirements. Cross-border payment facilitation services can address the needs of businesses engaged in international trade.

Emerging payment methods including cryptocurrency integration, buy-now-pay-later solutions, and central bank digital currencies (CBDCs) present opportunities for early movers. Payment gateways that successfully integrate these alternative payment methods can capture market share from traditional providers and attract innovative merchants seeking competitive differentiation.

Competitive intensity in the United Kingdom payment gateway market continues to drive innovation and service enhancement across all market segments. Established international players compete with domestic fintech innovators, creating a dynamic environment that benefits merchants through improved service offerings and competitive pricing. Market consolidation trends have resulted in larger players acquiring specialized capabilities to enhance their competitive positioning.

Technology evolution remains a critical factor influencing market dynamics, with artificial intelligence and machine learning capabilities becoming standard requirements for competitive payment gateway solutions. Providers investing in advanced analytics and predictive modeling capabilities can offer superior fraud detection and risk management services. Cloud-native architectures enable greater scalability and flexibility in service delivery.

Customer expectations continue to evolve toward seamless, omnichannel payment experiences that integrate across multiple touchpoints. Payment gateways must provide consistent functionality across web, mobile, and in-store environments while maintaining high security standards. User experience optimization has become a key differentiator in merchant selection processes.

Regulatory evolution continues to shape market dynamics through new requirements and standards that influence technology development priorities. Payment gateway providers must maintain agility in adapting to regulatory changes while ensuring continuous compliance across multiple jurisdictions. Industry collaboration with regulatory bodies helps shape future requirements and standards.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United Kingdom payment gateway market. Primary research involves extensive interviews with industry executives, technology providers, merchants, and regulatory experts to gather firsthand perspectives on market trends and challenges. Quantitative surveys collect statistical data on adoption rates, spending patterns, and technology preferences across various market segments.

Secondary research encompasses analysis of industry reports, regulatory filings, financial statements, and technology documentation to validate primary research findings and identify emerging trends. Market data is cross-referenced across multiple sources to ensure accuracy and completeness. Regulatory analysis examines the impact of current and proposed legislation on market dynamics and competitive positioning.

Technology assessment involves evaluation of payment gateway platforms, security capabilities, and integration requirements to understand competitive differentiation factors. Performance benchmarking compares processing speeds, uptime statistics, and feature capabilities across major market participants. Innovation tracking monitors patent filings, technology partnerships, and product development announcements.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. Scenario analysis examines potential market developments under different regulatory and economic conditions. Validation processes ensure research findings align with observed market behaviors and industry expert opinions.

London and Southeast England dominate the United Kingdom payment gateway market, accounting for approximately 45% of market activity due to the concentration of financial services companies, fintech startups, and e-commerce businesses. The region benefits from proximity to regulatory bodies, access to skilled talent, and established financial infrastructure. Innovation hubs in London continue to drive technology advancement and attract international investment.

Northern England represents a growing market segment with 22% market share, driven by the expansion of digital commerce and manufacturing sector digitization. Cities such as Manchester and Leeds have emerged as important technology centers with increasing demand for payment processing solutions. Regional development initiatives support the growth of local fintech companies and technology adoption.

Scotland maintains a significant presence in the payment gateway market with 18% market share, supported by a strong financial services sector and growing technology industry. Edinburgh and Glasgow serve as key commercial centers with established payment processing infrastructure. Cross-border payment capabilities are particularly important for Scottish businesses engaged in international trade.

Wales and Northern Ireland collectively represent 15% of market activity, with growing adoption of digital payment solutions across retail and service sectors. Government digitization initiatives and EU trade relationships influence payment gateway requirements in these regions. Rural connectivity improvements continue to expand market opportunities in previously underserved areas.

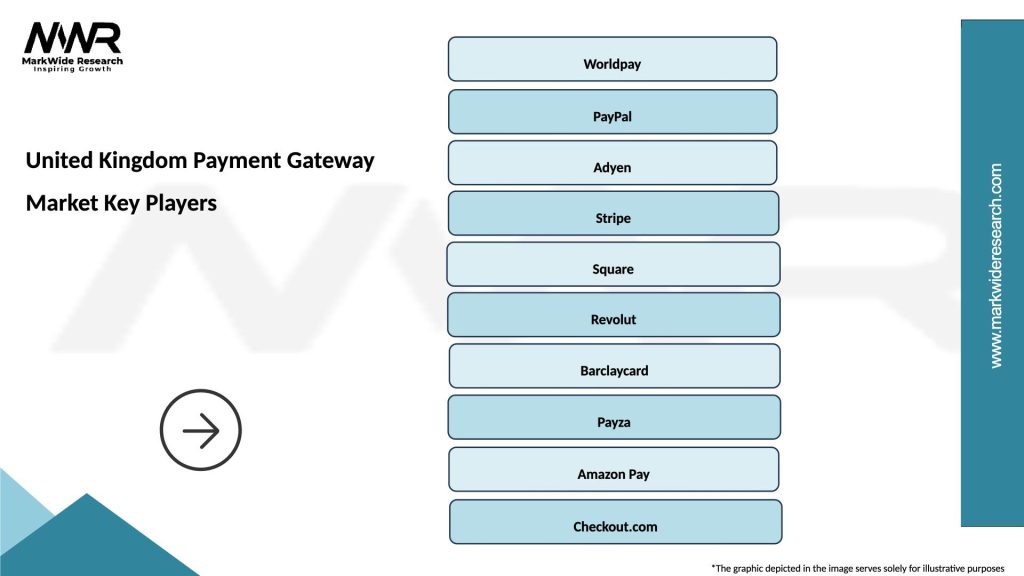

Market leadership in the United Kingdom payment gateway sector is distributed among several key players, each offering distinct competitive advantages and specialized capabilities:

Competitive differentiation occurs through technology innovation, pricing strategies, customer service quality, and specialized industry expertise. Market participants continue to invest in advanced features such as artificial intelligence-powered fraud detection, real-time analytics, and seamless integration capabilities to maintain competitive advantages.

By Deployment Model:

By Business Size:

By Industry Vertical:

Traditional Card Processing remains the foundation of the payment gateway market, though its relative importance is declining as alternative payment methods gain adoption. Credit and debit card transactions still represent the majority of payment volume, but growth rates are moderating as consumers explore digital alternatives. Contactless card adoption has reached 82% penetration among UK consumers, driving demand for NFC-enabled payment solutions.

Digital Wallet Integration has emerged as a critical capability for modern payment gateways, with services such as Apple Pay, Google Pay, and Samsung Pay becoming standard requirements. These solutions offer enhanced security through tokenization and biometric authentication while providing improved user experiences. Wallet adoption rates continue to accelerate across all demographic segments.

Bank Transfer Solutions are gaining significant traction following Open Banking implementation, offering lower transaction costs and faster settlement times compared to traditional card payments. Account-to-account payments provide enhanced security and reduced fraud risk while enabling new business models. Direct bank integration capabilities are becoming increasingly important for competitive positioning.

Buy-Now-Pay-Later (BNPL) integration has become essential for e-commerce focused payment gateways, with services such as Klarna, Clearpay, and Laybuy driving increased conversion rates and average order values. These solutions appeal particularly to younger consumers and enable merchants to offer flexible payment options without assuming credit risk.

Cryptocurrency Payment Support represents an emerging category with growing merchant interest, though adoption remains limited by regulatory uncertainty and price volatility. Payment gateways offering cryptocurrency integration can attract innovative merchants and early adopters while positioning for future market expansion.

Merchants benefit from comprehensive payment gateway solutions through increased sales conversion rates, reduced operational complexity, and enhanced customer experiences. Modern payment platforms provide real-time transaction monitoring, automated reconciliation, and detailed analytics that enable data-driven business decisions. Revenue optimization occurs through support for multiple payment methods and currencies, expanding addressable customer bases.

Consumers experience improved convenience, security, and choice through advanced payment gateway capabilities. Seamless checkout processes, stored payment methods, and fraud protection features enhance the overall shopping experience while reducing transaction friction. Payment flexibility enables consumers to select preferred payment methods based on individual preferences and circumstances.

Financial Institutions leverage payment gateway partnerships to expand their service offerings and reach new customer segments without significant technology investments. These relationships enable banks to participate in the digital payment ecosystem while maintaining focus on core banking services. Revenue sharing models provide additional income streams from payment processing activities.

Technology Providers benefit from the growing demand for payment integration services and specialized solutions. The expanding market creates opportunities for API providers, security specialists, and analytics companies to serve the payment gateway ecosystem. Partnership opportunities enable technology companies to integrate their solutions with established payment platforms.

Regulatory Bodies achieve improved oversight and compliance monitoring through standardized payment gateway reporting and security requirements. Digital payment systems provide enhanced transaction visibility and audit trails compared to cash-based transactions. Consumer protection is strengthened through mandatory security standards and dispute resolution processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is revolutionizing payment gateway capabilities through advanced fraud detection, risk assessment, and customer behavior analysis. Machine learning algorithms enable real-time transaction scoring and adaptive security measures that reduce false positives while maintaining high security standards. Predictive analytics help merchants optimize payment flows and identify potential issues before they impact customer experiences.

Omnichannel Payment Orchestration has become essential as businesses seek to provide consistent payment experiences across web, mobile, and physical channels. Modern payment gateways offer unified platforms that manage multiple payment methods and channels through single integration points. Channel consistency ensures customers can seamlessly transition between different interaction methods without payment friction.

Real-Time Payment Processing is gaining momentum through initiatives such as Faster Payments and Request to Pay, enabling instant transaction settlement and improved cash flow management. These capabilities are particularly valuable for businesses requiring immediate payment confirmation and rapid fund availability. Settlement speed has become a key competitive differentiator in merchant selection processes.

Embedded Finance Solutions are expanding beyond traditional e-commerce applications to include marketplace platforms, software-as-a-service providers, and industry-specific applications. Payment gateways are evolving to support white-label implementations that enable non-financial companies to offer integrated payment services. API-first architectures facilitate seamless integration into diverse business applications.

Sustainability and ESG Considerations are influencing payment gateway selection as businesses seek to align with environmental and social responsibility goals. Carbon-neutral payment processing and sustainable technology practices are becoming important evaluation criteria. Green payment initiatives include energy-efficient data centers and paperless transaction processing.

Open Banking Evolution continues to reshape the payment landscape through expanded API capabilities and new service offerings. Recent developments include enhanced variable recurring payment (VRP) functionality and improved account information services that enable more sophisticated payment solutions. Regulatory support for open banking initiatives has accelerated innovation and market adoption.

Central Bank Digital Currency (CBDC) Preparation is influencing payment gateway development as providers prepare for potential digital pound implementation. Early research and pilot programs are exploring integration requirements and technical specifications for CBDC support. Infrastructure readiness may become a competitive advantage as CBDC deployment approaches.

Enhanced Security Standards including 3D Secure 2.0 implementation and advanced authentication methods have improved transaction security while maintaining user experience quality. These developments address regulatory requirements while reducing fraud rates and chargeback volumes. Biometric authentication integration is becoming more prevalent across payment platforms.

Cross-Border Payment Innovation has accelerated through partnerships between UK payment gateways and international providers, enabling seamless global transaction processing. These developments address the needs of businesses engaged in international trade while maintaining compliance with multiple regulatory frameworks. Currency conversion optimization and transparent pricing have become key features.

Marketplace Payment Solutions have evolved to address the complex requirements of multi-vendor platforms, including split payments, escrow services, and seller onboarding automation. According to MWR analysis, marketplace payment volume has grown by 35% annually, driving demand for specialized gateway capabilities.

Technology Investment Priorities should focus on artificial intelligence and machine learning capabilities that enhance fraud detection, optimize payment routing, and improve customer experiences. Payment gateway providers must balance innovation investment with operational efficiency to maintain competitive positioning. Cloud-native architectures provide the scalability and flexibility required for future growth.

Regulatory Compliance Strategy requires proactive engagement with regulatory bodies and continuous monitoring of evolving requirements. Providers should invest in compliance automation tools and maintain flexible architectures that can adapt to new regulations. Regulatory expertise should be considered a core competency rather than a support function.

Market Expansion Opportunities exist in underserved vertical markets and emerging payment methods. Providers should consider specialized solutions for industries such as healthcare, education, and government services that have unique requirements. Vertical expertise can provide sustainable competitive advantages and premium pricing opportunities.

Partnership Strategy Development should encompass fintech collaborations, banking relationships, and technology integrations that enhance service offerings and market reach. Strategic partnerships can provide access to new customer segments and specialized capabilities without significant internal investment. Ecosystem participation becomes increasingly important as payment solutions become more integrated.

Customer Experience Optimization must remain a primary focus as merchant expectations continue to evolve. Payment gateways should invest in user interface design, documentation quality, and customer support capabilities that differentiate their offerings. Developer experience is particularly important for technical decision-makers evaluating integration options.

Market evolution in the United Kingdom payment gateway sector will be characterized by continued innovation, regulatory adaptation, and competitive intensification over the forecast period. The market is expected to maintain robust growth momentum driven by ongoing digital transformation initiatives and evolving consumer payment preferences. Technology advancement will remain the primary differentiator as providers compete for market share across diverse industry segments.

Regulatory developments will continue to shape market dynamics through new requirements and standards that influence technology development priorities and competitive positioning. The implementation of digital pound infrastructure and enhanced open banking capabilities will create new opportunities while requiring significant adaptation investments. Compliance automation will become increasingly important for operational efficiency.

Innovation acceleration is expected to focus on artificial intelligence integration, real-time payment processing, and embedded finance solutions that address evolving business requirements. Payment gateways will need to balance feature sophistication with ease of use to serve diverse customer segments effectively. API-first development approaches will enable greater flexibility and integration capabilities.

Market consolidation trends are likely to continue as larger players acquire specialized capabilities and smaller providers seek strategic partnerships for competitive sustainability. This consolidation will create opportunities for innovative startups while potentially reducing overall market competition. Strategic positioning will become increasingly important for long-term success.

International expansion opportunities will grow as UK-based providers leverage their regulatory expertise and technology capabilities in other markets. The experience gained in navigating complex compliance requirements provides competitive advantages in similarly regulated jurisdictions. Global payment orchestration capabilities will become essential for serving multinational businesses effectively.

The United Kingdom payment gateway market represents a dynamic and rapidly evolving sector that continues to demonstrate strong growth potential despite increasing competitive intensity and regulatory complexity. Market participants benefit from a sophisticated regulatory framework, advanced digital infrastructure, and high consumer adoption of digital payment methods that create favorable conditions for continued expansion and innovation.

Technology advancement remains the primary catalyst for market evolution, with artificial intelligence, machine learning, and open banking capabilities driving the development of next-generation payment solutions. Providers that successfully integrate these technologies while maintaining focus on user experience and regulatory compliance will be best positioned to capture market opportunities and achieve sustainable competitive advantages.

Future success in the United Kingdom payment gateway market will require balanced investment in technology innovation, regulatory compliance, and customer experience optimization. The market outlook remains positive, with continued growth expected across all major segments as digital transformation initiatives accelerate and new payment methods gain mainstream adoption. Strategic positioning and adaptability will be essential for navigating the evolving competitive landscape and capitalizing on emerging opportunities in this critical financial technology sector.

What is Payment Gateway?

A payment gateway is a technology that facilitates the transfer of payment information between a customer and a merchant. It plays a crucial role in online transactions by ensuring secure processing of credit card and other payment types.

What are the key players in the United Kingdom Payment Gateway Market?

Key players in the United Kingdom Payment Gateway Market include PayPal, Stripe, Adyen, and Worldpay, among others. These companies provide various payment solutions tailored to different business needs and consumer preferences.

What are the growth factors driving the United Kingdom Payment Gateway Market?

The growth of the United Kingdom Payment Gateway Market is driven by the increasing adoption of e-commerce, the rise in mobile payments, and the demand for secure transaction methods. Additionally, advancements in technology and consumer preferences for seamless payment experiences contribute to this growth.

What challenges does the United Kingdom Payment Gateway Market face?

The United Kingdom Payment Gateway Market faces challenges such as regulatory compliance, cybersecurity threats, and the need for constant technological updates. These factors can hinder the growth and operational efficiency of payment gateway providers.

What opportunities exist in the United Kingdom Payment Gateway Market?

Opportunities in the United Kingdom Payment Gateway Market include the expansion of digital wallets, the integration of artificial intelligence for fraud detection, and the growth of subscription-based services. These trends can enhance customer experience and operational efficiency for businesses.

What trends are shaping the United Kingdom Payment Gateway Market?

Trends shaping the United Kingdom Payment Gateway Market include the rise of contactless payments, the increasing use of cryptocurrencies, and the focus on enhancing user experience through innovative payment solutions. These trends reflect changing consumer behaviors and technological advancements.

United Kingdom Payment Gateway Market

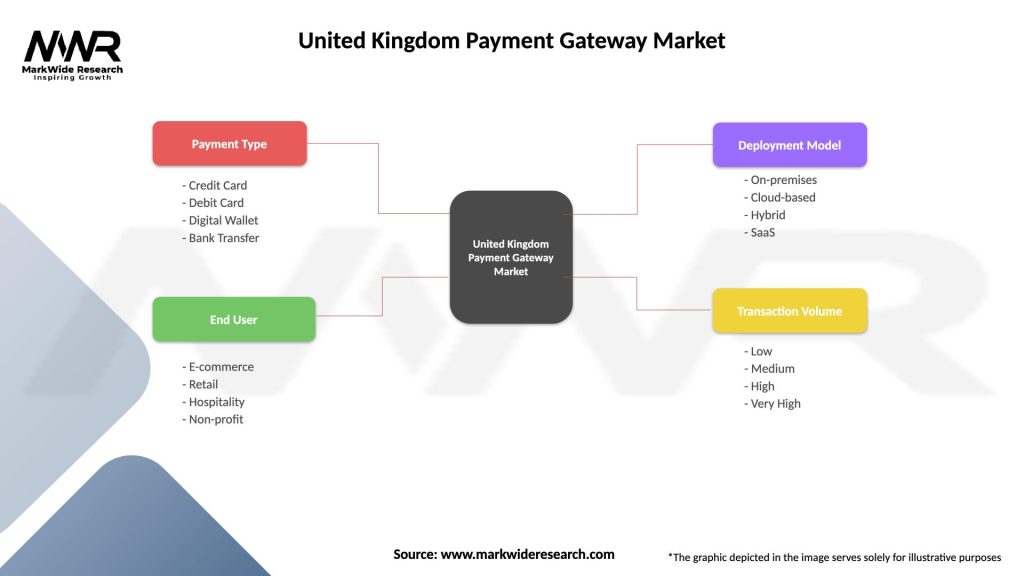

| Segmentation Details | Description |

|---|---|

| Payment Type | Credit Card, Debit Card, Digital Wallet, Bank Transfer |

| End User | E-commerce, Retail, Hospitality, Non-profit |

| Deployment Model | On-premises, Cloud-based, Hybrid, SaaS |

| Transaction Volume | Low, Medium, High, Very High |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Payment Gateway Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at