444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The United Kingdom Parametric Insurance Market represents a dynamic segment within the insurance industry that utilizes innovative risk transfer mechanisms based on predefined parameters rather than traditional loss assessment. Parametric insurance offers policyholders fast and transparent payouts triggered by specific, quantifiable events such as natural disasters, weather extremes, or market fluctuations. This market has gained traction due to its ability to provide rapid financial relief, reduce claims processing time, and mitigate uncertainty associated with traditional insurance products.

Meaning: Parametric insurance, also known as index-based or event-based insurance, is a risk management solution that pays out predetermined amounts upon the occurrence of predefined triggers, such as weather events, seismic activity, or economic indicators. Unlike traditional insurance policies that require claims investigation and loss assessment, parametric insurance automatically triggers payouts based on objective data, eliminating the need for lengthy claims processing and providing policyholders with timely financial support in the event of a covered loss.

Executive Summary: The United Kingdom Parametric Insurance Market is experiencing significant growth driven by increasing awareness of climate-related risks, advancements in technology, and evolving regulatory frameworks. Parametric insurance offers several advantages, including rapid claims settlement, enhanced risk transparency, and improved resilience against catastrophic events. However, challenges such as data availability, basis risk, and product complexity need to be addressed to unlock the full potential of parametric insurance in the UK market.

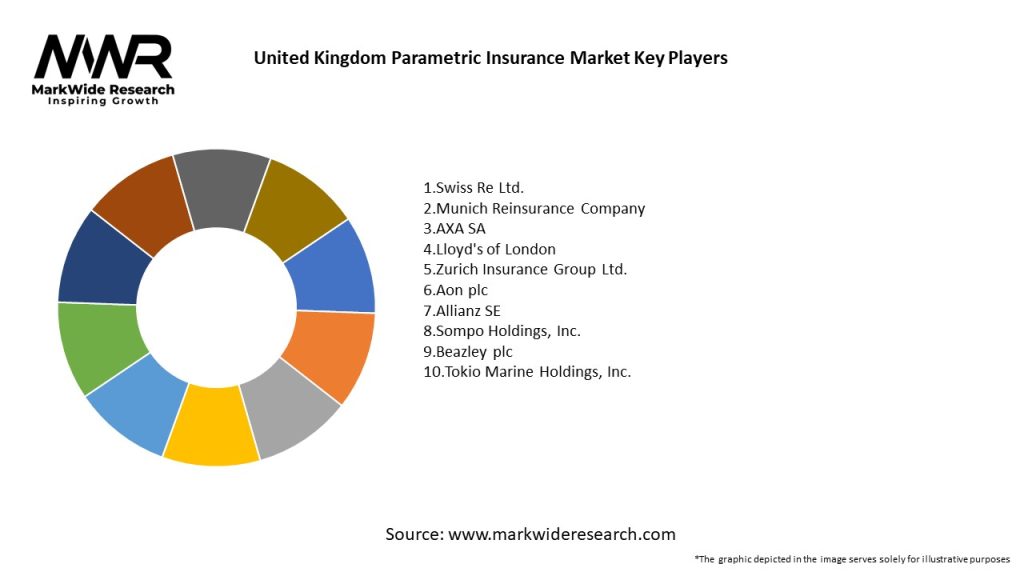

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The United Kingdom Parametric Insurance Market operates in a dynamic environment shaped by various factors, including technological advancements, regulatory developments, market trends, and climate change impacts. These dynamics influence market growth, product innovation, risk appetite, and customer preferences, requiring insurers to adapt and innovate to remain competitive and relevant in the evolving risk landscape.

Regional Analysis: The United Kingdom Parametric Insurance Market exhibits regional variations in demand, adoption, and regulatory landscape. While London serves as a global hub for insurance and reinsurance innovation, regional markets across the UK, including urban centers, coastal regions, and rural communities, have unique risk profiles and insurance needs that drive demand for parametric insurance solutions.

Competitive Landscape:

Leading Companies in the United Kingdom Parametric Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The United Kingdom Parametric Insurance Market can be segmented based on various factors, including:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the United Kingdom Parametric Insurance Market:

Market Key Trends:

Covid-19 Impact: The COVID-19 pandemic has highlighted the importance of parametric insurance as a rapid response tool for managing unforeseen risks and economic shocks. Parametric insurance products have been deployed for pandemic-related risks such as business interruption, event cancellations, and supply chain disruptions, demonstrating their relevance and value in crisis situations.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the United Kingdom Parametric Insurance Market is optimistic, with opportunities for growth driven by climate-related risks, technology innovation, regulatory support, and market expansion initiatives. Continued investment in risk management solutions, product innovation, and industry collaboration is expected to unlock the full potential of parametric insurance in addressing emerging risks and building resilience against future uncertainties.

Conclusion: In conclusion, the United Kingdom Parametric Insurance Market represents a promising growth opportunity within the insurance industry, offering innovative risk transfer solutions that provide rapid financial protection against climate-related risks, natural catastrophes, supply chain disruptions, and market volatility. Despite challenges such as basis risk, data quality, and product complexity, parametric insurance offers several benefits, including fast claims settlement, risk transparency, customized coverage, and resilience building. With ongoing advancements in technology, product innovation, and regulatory support, parametric insurance is poised to play a critical role in addressing emerging risks and promoting sustainable risk management practices in the UK market and beyond.

What is Parametric Insurance?

Parametric insurance is a type of insurance that provides coverage based on predefined parameters or triggers, such as weather events or natural disasters, rather than traditional loss assessments. This approach allows for quicker payouts and can be particularly useful in sectors like agriculture and disaster relief.

What are the key players in the United Kingdom Parametric Insurance Market?

Key players in the United Kingdom Parametric Insurance Market include companies like Zego, FloodFlash, and Parametrix, which specialize in innovative insurance solutions. These companies are leveraging technology to enhance risk assessment and improve customer experience, among others.

What are the growth factors driving the United Kingdom Parametric Insurance Market?

The growth of the United Kingdom Parametric Insurance Market is driven by increasing climate-related risks, the demand for faster claims processing, and the need for customized insurance solutions. Additionally, advancements in data analytics and technology are enabling more precise risk modeling.

What challenges does the United Kingdom Parametric Insurance Market face?

Challenges in the United Kingdom Parametric Insurance Market include regulatory hurdles, the complexity of designing effective parametric products, and the need for consumer education. Additionally, there may be skepticism regarding the reliability of trigger events.

What opportunities exist in the United Kingdom Parametric Insurance Market?

Opportunities in the United Kingdom Parametric Insurance Market include expanding into new sectors such as health and travel insurance, as well as developing products tailored for small businesses. The increasing awareness of climate change also presents a chance to innovate and attract new customers.

What trends are shaping the United Kingdom Parametric Insurance Market?

Trends shaping the United Kingdom Parametric Insurance Market include the integration of artificial intelligence for risk assessment, the rise of on-demand insurance products, and a growing focus on sustainability. These trends are influencing how insurers design and market their parametric offerings.

United Kingdom Parametric Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Weather Index, Natural Disaster, Crop Insurance, Travel Insurance |

| End User | Agriculture, Corporates, Individuals, Small Businesses |

| Application | Risk Management, Financial Protection, Business Continuity, Asset Coverage |

| Delivery Model | Direct Sales, Online Platforms, Brokers, Insurtech Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United Kingdom Parametric Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at