444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom ophthalmic equipment market represents a critical segment of the country’s healthcare infrastructure, encompassing a comprehensive range of diagnostic, surgical, and therapeutic devices designed to address various eye-related conditions. Market dynamics indicate robust growth driven by an aging population, increasing prevalence of eye diseases, and technological advancements in vision care solutions. The market demonstrates significant expansion with a projected compound annual growth rate (CAGR) of 6.2% through the forecast period, reflecting the growing demand for advanced ophthalmic technologies across both public and private healthcare sectors.

Healthcare infrastructure in the United Kingdom continues to evolve, with substantial investments in modernizing ophthalmic facilities and equipment. The market encompasses various product categories including diagnostic equipment, surgical instruments, vision care products, and advanced imaging systems. Technological innovation remains a key driver, with manufacturers introducing sophisticated devices that offer enhanced precision, improved patient outcomes, and streamlined clinical workflows.

Regional distribution shows concentrated market activity in major metropolitan areas, with London, Manchester, Birmingham, and Edinburgh serving as primary hubs for ophthalmic equipment adoption. The market benefits from strong government support for healthcare modernization initiatives and increasing private sector investments in specialized eye care facilities. Market penetration of advanced technologies reaches approximately 78% in urban areas, while rural regions show growing adoption rates as telemedicine and mobile ophthalmic units expand access to specialized care.

The United Kingdom ophthalmic equipment market refers to the comprehensive ecosystem of medical devices, instruments, and technologies specifically designed for the diagnosis, treatment, and management of eye-related conditions and diseases within the UK healthcare system. This market encompasses a broad spectrum of equipment ranging from basic diagnostic tools to sophisticated surgical systems used by ophthalmologists, optometrists, and other eye care professionals.

Market scope includes various categories such as diagnostic equipment (fundus cameras, optical coherence tomography systems, perimeters), surgical instruments (phacoemulsification systems, vitrectomy machines, laser systems), vision care products (contact lenses, intraocular lenses), and supportive technologies (electronic health records, practice management systems). The market serves multiple healthcare settings including hospitals, specialized eye clinics, optical retail chains, and community healthcare centers throughout the United Kingdom.

Strategic analysis reveals the United Kingdom ophthalmic equipment market as a dynamic and rapidly evolving sector characterized by technological innovation, demographic pressures, and changing healthcare delivery models. The market demonstrates strong fundamentals with consistent growth driven by multiple factors including population aging, increasing prevalence of diabetes-related eye complications, and rising awareness of preventive eye care.

Key market drivers include the growing incidence of age-related macular degeneration, cataracts, and diabetic retinopathy, which collectively affect approximately 42% of the population over 65 years. The market benefits from robust healthcare infrastructure, favorable reimbursement policies, and strong adoption of innovative technologies by healthcare providers. Digital transformation initiatives within the NHS and private healthcare sectors are accelerating the integration of advanced diagnostic and treatment technologies.

Competitive landscape features a mix of global multinational corporations and specialized regional players, with market leadership concentrated among established brands known for quality, reliability, and comprehensive service support. The market shows increasing consolidation as companies seek to expand their product portfolios and geographic reach through strategic acquisitions and partnerships.

Market intelligence reveals several critical insights that define the current state and future trajectory of the United Kingdom ophthalmic equipment market:

Demographic transformation serves as the fundamental driver of market growth, with the United Kingdom experiencing significant population aging that directly correlates with increased demand for ophthalmic services and equipment. The prevalence of age-related eye conditions continues to rise, creating sustained demand for diagnostic and treatment technologies across all healthcare settings.

Disease prevalence patterns show concerning trends in diabetes-related eye complications, with diabetic retinopathy affecting a growing portion of the population. This condition requires sophisticated screening and monitoring equipment, driving demand for advanced imaging systems and diagnostic tools. Lifestyle factors including increased screen time and digital device usage contribute to rising cases of dry eye syndrome and myopia, particularly among younger demographics.

Healthcare policy initiatives within the NHS emphasize early detection and preventive care, leading to increased investments in screening programs and community-based eye care services. Government funding for healthcare modernization supports the adoption of advanced ophthalmic equipment in public facilities. Quality improvement mandates drive healthcare providers to invest in state-of-the-art equipment that enhances diagnostic accuracy and treatment outcomes.

Technological advancement continues to revolutionize ophthalmic care, with artificial intelligence, machine learning, and advanced imaging technologies creating new possibilities for diagnosis and treatment. These innovations attract healthcare providers seeking to improve efficiency and patient outcomes while reducing long-term healthcare costs.

Budget constraints within the NHS represent a significant challenge for market growth, as healthcare facilities must balance equipment investments with other operational priorities. Limited capital budgets often delay equipment upgrades and expansion plans, particularly for expensive surgical systems and advanced imaging technologies.

Regulatory complexity surrounding medical device approval and compliance creates barriers for new product introductions and market entry. The post-Brexit regulatory environment adds additional layers of complexity for manufacturers and distributors operating in the UK market. Compliance costs associated with meeting evolving regulatory requirements can be substantial, particularly for smaller companies.

Skills shortage in specialized ophthalmic technicians and support staff limits the effective utilization of advanced equipment. Training requirements for new technologies can be extensive and costly, creating implementation challenges for healthcare facilities. Workforce development needs often compete with equipment investment priorities in budget allocation decisions.

Economic uncertainty and inflation pressures affect healthcare spending decisions, with some facilities deferring non-essential equipment purchases. Currency fluctuations impact the cost of imported equipment, creating pricing volatility that complicates procurement planning and budget management.

Digital health integration presents substantial opportunities for equipment manufacturers to develop connected devices that seamlessly integrate with electronic health records and telemedicine platforms. The growing emphasis on remote monitoring and virtual consultations creates demand for portable diagnostic equipment and home-based monitoring solutions.

Artificial intelligence applications in ophthalmic diagnosis and treatment planning offer significant market potential. AI-powered diagnostic tools that can assist in early detection of eye diseases and treatment optimization represent high-growth opportunities for innovative companies. Machine learning algorithms integrated into imaging equipment can enhance diagnostic accuracy and reduce interpretation time.

Preventive care expansion creates opportunities for screening equipment and community-based diagnostic solutions. Mobile eye care units and portable diagnostic devices can address healthcare access challenges in rural and underserved areas. Corporate wellness programs increasingly include eye health screening, creating new market segments for occupational health-focused equipment.

Private healthcare growth continues to expand, with increasing numbers of patients seeking private eye care services. This trend creates opportunities for premium equipment and advanced treatment technologies that may not be readily available in public healthcare settings. Medical tourism potential in specialized eye care procedures could drive demand for cutting-edge surgical equipment.

Supply chain evolution reflects changing market dynamics as manufacturers adapt to post-Brexit trade requirements and global supply chain disruptions. Companies are increasingly focusing on local partnerships and regional distribution networks to ensure reliable equipment availability and service support. Inventory management strategies have evolved to account for longer lead times and potential supply disruptions.

Pricing dynamics show increasing pressure on equipment costs as healthcare providers seek value-based purchasing arrangements. Manufacturers are responding with flexible financing options, leasing programs, and comprehensive service packages that provide predictable total cost of ownership. Value-based care models are influencing equipment selection criteria, with emphasis on outcomes and efficiency metrics.

Innovation cycles are accelerating as companies compete to introduce next-generation technologies that offer improved performance and user experience. The market shows strong preference for equipment that combines multiple functions and reduces the need for separate devices. Interoperability has become a critical factor in equipment selection as healthcare facilities seek integrated solutions.

Customer expectations continue to evolve, with healthcare providers demanding comprehensive support services, training programs, and ongoing technical assistance. The shift toward outcome-based purchasing requires manufacturers to demonstrate clear clinical and economic benefits of their equipment.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework incorporates quantitative data analysis, qualitative assessments, and expert interviews to provide a complete picture of market dynamics and trends.

Primary research activities include structured interviews with key stakeholders across the ophthalmic equipment value chain, including healthcare providers, equipment manufacturers, distributors, and regulatory officials. Survey methodologies capture market sentiment, purchasing intentions, and technology adoption patterns among target customer segments. Field research involves direct observation of equipment utilization in clinical settings to understand real-world performance and user requirements.

Secondary research encompasses comprehensive analysis of industry reports, government healthcare statistics, regulatory filings, and company financial disclosures. Market data validation involves cross-referencing multiple sources to ensure accuracy and reliability. Database analysis includes examination of healthcare procurement records, equipment installation data, and service contract information.

Analytical frameworks employ statistical modeling techniques to project market trends and identify growth opportunities. Scenario analysis considers various market conditions and their potential impact on equipment demand and adoption patterns. Expert validation ensures research findings align with industry knowledge and market realities through consultation with recognized industry authorities.

London and Southeast England dominate the United Kingdom ophthalmic equipment market, accounting for approximately 38% of total market activity. This region benefits from the highest concentration of specialized eye care facilities, research institutions, and private healthcare providers. Market sophistication in this region drives demand for the most advanced equipment technologies and comprehensive service offerings.

Northern England represents a significant market segment with strong growth potential, particularly in Manchester, Liverpool, and Leeds metropolitan areas. The region shows increasing investment in healthcare infrastructure modernization and expansion of specialized eye care services. Regional healthcare networks are driving standardization of equipment procurement and service delivery models.

Scotland demonstrates robust market activity centered in Edinburgh and Glasgow, with strong government support for healthcare technology adoption. The region shows particular strength in research and development activities related to ophthalmic equipment innovation. Cross-border collaboration with Northern Ireland creates opportunities for shared procurement and service delivery initiatives.

Wales and Southwest England show growing market potential as healthcare infrastructure investments expand access to specialized eye care services. Rural healthcare initiatives in these regions drive demand for portable and mobile ophthalmic equipment solutions. Telemedicine integration is particularly strong in these areas, creating opportunities for connected diagnostic equipment.

Market leadership is concentrated among several key players who have established strong positions through comprehensive product portfolios, extensive service networks, and long-standing relationships with healthcare providers. The competitive environment reflects a mix of global corporations and specialized regional companies.

Competitive strategies focus on innovation, service excellence, and value-based partnerships with healthcare providers. Companies are investing heavily in research and development to maintain technological leadership and address evolving clinical needs. Market consolidation continues as companies seek to expand their capabilities and market reach through strategic acquisitions.

Product segmentation reveals distinct market categories with varying growth trajectories and competitive dynamics:

By Product Type:

By Application:

By End User:

Diagnostic equipment represents the foundation of the ophthalmic equipment market, with optical coherence tomography (OCT) systems showing the strongest growth trajectory. These advanced imaging systems enable early detection and monitoring of retinal diseases, driving adoption across all healthcare settings. Market preference increasingly favors multi-modal imaging systems that combine multiple diagnostic capabilities in a single platform.

Surgical equipment demonstrates robust growth driven by increasing cataract surgery volumes and adoption of premium intraocular lenses. Femtosecond laser systems for cataract surgery show particular promise as healthcare providers seek to improve surgical precision and patient outcomes. Technology integration between diagnostic and surgical platforms creates opportunities for comprehensive treatment solutions.

Vision care products benefit from growing consumer awareness of eye health and increasing demand for premium vision correction options. Daily disposable contact lenses and specialty lenses for presbyopia correction show strong market growth. Digital eye strain concerns drive demand for specialized lenses and protective eyewear solutions.

Monitoring systems represent an emerging high-growth category as healthcare providers emphasize preventive care and early intervention. Home monitoring devices and telemedicine-enabled diagnostic tools create new opportunities for patient engagement and remote care delivery. Artificial intelligence integration enhances the value proposition of monitoring systems through automated analysis and alert capabilities.

Healthcare providers benefit from improved diagnostic accuracy, enhanced treatment outcomes, and increased operational efficiency through adoption of advanced ophthalmic equipment. Modern systems reduce examination times while providing more comprehensive patient data, enabling better clinical decision-making. Workflow optimization features in contemporary equipment help healthcare facilities manage increasing patient volumes without compromising care quality.

Patients experience significant benefits including earlier disease detection, less invasive treatment options, and improved visual outcomes. Advanced diagnostic technologies enable identification of eye conditions before symptoms appear, allowing for preventive interventions that preserve vision. Treatment precision improvements reduce recovery times and enhance overall patient satisfaction with eye care services.

Equipment manufacturers gain access to a stable and growing market with strong demand fundamentals and opportunities for innovation-driven growth. The UK market provides an excellent platform for testing new technologies and developing relationships with key opinion leaders in ophthalmology. Regulatory environment supports innovation while maintaining high safety and efficacy standards.

Healthcare systems achieve better resource utilization and improved population health outcomes through strategic deployment of ophthalmic equipment. Early detection and treatment of eye diseases reduce long-term healthcare costs and improve quality of life for patients. Preventive care emphasis aligns with broader healthcare policy objectives of reducing disease burden and healthcare expenditures.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the ophthalmic equipment landscape. AI-powered diagnostic systems are becoming increasingly sophisticated, offering automated analysis of retinal images and early detection of disease patterns that might be missed by human observation. Machine learning algorithms continue to improve diagnostic accuracy and reduce interpretation time, making advanced diagnostics more accessible across all healthcare settings.

Telemedicine adoption has accelerated dramatically, driving demand for portable diagnostic equipment and remote monitoring solutions. The COVID-19 pandemic catalyzed the adoption of virtual consultations and remote patient monitoring, creating permanent changes in healthcare delivery models. Connected devices that can transmit diagnostic data securely to healthcare providers are becoming essential components of modern eye care delivery.

Minimally invasive procedures continue to gain popularity as patients and healthcare providers seek treatment options that reduce recovery time and improve outcomes. Advanced laser systems and micro-surgical instruments enable precise interventions with minimal tissue disruption. Surgical innovation focuses on improving precision while reducing procedure complexity and training requirements.

Personalized medicine approaches are influencing equipment design and functionality, with systems that can adapt treatment parameters based on individual patient characteristics. Genetic testing integration and biomarker analysis capabilities are being incorporated into diagnostic platforms. Precision treatment planning tools help healthcare providers optimize interventions for individual patients.

Regulatory harmonization efforts continue to evolve as the UK establishes its post-Brexit medical device regulatory framework. The Medicines and Healthcare products Regulatory Agency (MHRA) has implemented new approval pathways that aim to maintain high safety standards while supporting innovation. Regulatory clarity is improving as guidance documents and approval processes become more established.

NHS digitization initiatives are driving significant changes in equipment procurement and utilization patterns. The NHS Long Term Plan emphasizes digital transformation and integrated care delivery, creating opportunities for equipment manufacturers who can demonstrate interoperability and data integration capabilities. Standardization efforts are promoting common platforms and protocols across healthcare facilities.

Research collaborations between academic institutions, healthcare providers, and equipment manufacturers are accelerating innovation in ophthalmic technologies. According to MarkWide Research analysis, these partnerships are particularly strong in areas such as artificial intelligence, gene therapy delivery systems, and advanced imaging technologies. Innovation hubs in major cities are fostering entrepreneurship and technology development.

Sustainability initiatives are becoming increasingly important as healthcare providers seek to reduce their environmental impact. Equipment manufacturers are responding with energy-efficient designs, recyclable materials, and take-back programs for end-of-life equipment. Green healthcare considerations are influencing procurement decisions and vendor selection criteria.

Strategic positioning recommendations for equipment manufacturers emphasize the importance of developing comprehensive solutions that address multiple clinical needs while providing clear economic value to healthcare providers. Companies should focus on creating integrated platforms that combine diagnostic, treatment, and monitoring capabilities in user-friendly systems. Value demonstration through clinical outcomes data and economic impact studies will be crucial for market success.

Market entry strategies should prioritize partnerships with established distributors and service providers who understand the UK healthcare landscape and regulatory requirements. New entrants should consider regional expansion approaches that build market presence gradually while developing local support capabilities. Relationship building with key opinion leaders and healthcare decision-makers remains essential for long-term success.

Innovation investment should focus on areas with the highest growth potential, including artificial intelligence, telemedicine integration, and personalized medicine applications. Companies should allocate resources to developing solutions that address specific UK market needs such as NHS integration requirements and rural healthcare access challenges. Technology roadmaps should align with evolving healthcare delivery models and patient expectations.

Service excellence will increasingly differentiate successful companies in a competitive market environment. Comprehensive training programs, responsive technical support, and proactive maintenance services are becoming essential components of the value proposition. Customer success initiatives that help healthcare providers maximize equipment utilization and outcomes will drive long-term partnerships and market loyalty.

Market trajectory indicates sustained growth driven by demographic trends, technological advancement, and evolving healthcare delivery models. The United Kingdom ophthalmic equipment market is positioned for continued expansion with projected growth rates of 6.2% CAGR over the next five years. Growth sustainability will depend on successful navigation of economic challenges and continued innovation in equipment technologies.

Technology evolution will focus on artificial intelligence integration, improved connectivity, and enhanced user experience. Next-generation equipment will feature more intuitive interfaces, automated analysis capabilities, and seamless integration with electronic health records. Digital transformation will continue to reshape how ophthalmic equipment is designed, deployed, and utilized in clinical practice.

Market consolidation is expected to continue as companies seek to expand their capabilities and market reach through strategic acquisitions and partnerships. MWR projects that market concentration will increase as leading companies acquire specialized technologies and regional players. Competitive dynamics will favor companies that can offer comprehensive solutions and superior service support.

Healthcare policy developments will continue to influence market dynamics, with emphasis on value-based care, population health management, and healthcare access equity. Equipment manufacturers must align their strategies with these policy priorities to ensure long-term market success. Regulatory evolution will require ongoing adaptation and compliance investment from all market participants.

The United Kingdom ophthalmic equipment market represents a dynamic and growing sector with strong fundamentals and promising future prospects. Market analysis reveals a complex ecosystem driven by demographic changes, technological innovation, and evolving healthcare delivery models that create both opportunities and challenges for industry participants.

Key success factors for companies operating in this market include technological innovation, comprehensive service offerings, strong regulatory compliance, and deep understanding of UK healthcare system requirements. The market rewards companies that can demonstrate clear clinical and economic value while providing excellent customer support and training services. Strategic positioning must balance innovation with practical implementation considerations and cost-effectiveness.

Future growth will be driven by continued population aging, increasing prevalence of eye diseases, and adoption of advanced technologies that improve diagnostic accuracy and treatment outcomes. The market shows particular promise in areas such as artificial intelligence integration, telemedicine solutions, and personalized medicine applications. Investment opportunities exist across all market segments, with the greatest potential in technologies that address unmet clinical needs and improve healthcare efficiency.

The United Kingdom ophthalmic equipment market stands as a testament to the intersection of healthcare needs, technological capability, and market opportunity, positioning itself for continued growth and innovation in the years ahead.

What is Ophthalmic Equipment?

Ophthalmic equipment refers to the tools and devices used in the diagnosis, treatment, and management of eye-related conditions. This includes instruments for vision testing, surgical procedures, and therapeutic applications.

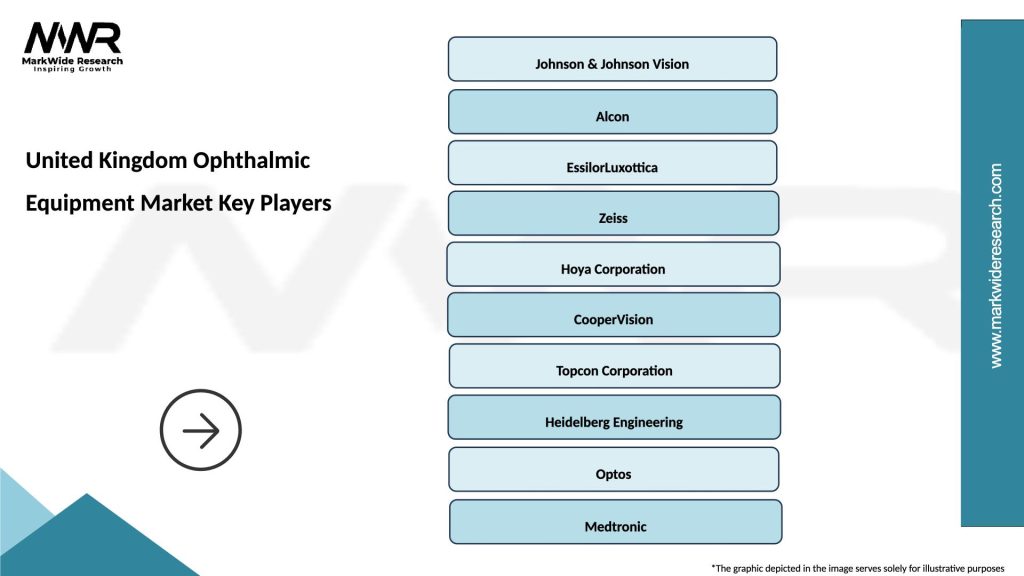

What are the key players in the United Kingdom Ophthalmic Equipment Market?

Key players in the United Kingdom Ophthalmic Equipment Market include Johnson & Johnson Vision, Alcon, Bausch + Lomb, and Zeiss, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the United Kingdom Ophthalmic Equipment Market?

The growth of the United Kingdom Ophthalmic Equipment Market is driven by an increasing prevalence of eye disorders, advancements in technology, and a growing aging population. Additionally, rising awareness about eye health contributes to market expansion.

What challenges does the United Kingdom Ophthalmic Equipment Market face?

The United Kingdom Ophthalmic Equipment Market faces challenges such as high costs of advanced equipment and stringent regulatory requirements. Additionally, the market is impacted by competition from alternative treatment options.

What opportunities exist in the United Kingdom Ophthalmic Equipment Market?

Opportunities in the United Kingdom Ophthalmic Equipment Market include the development of innovative technologies such as telemedicine and minimally invasive surgical techniques. There is also potential for growth in the pediatric ophthalmology segment.

What trends are shaping the United Kingdom Ophthalmic Equipment Market?

Trends shaping the United Kingdom Ophthalmic Equipment Market include the integration of artificial intelligence in diagnostic tools and the increasing use of portable devices for eye examinations. Additionally, there is a growing focus on personalized medicine in ophthalmology.

United Kingdom Ophthalmic Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Diagnostic Equipment, Surgical Instruments, Vision Correction Devices, Therapeutic Equipment |

| Technology | Laser Technology, Optical Coherence Tomography, Ultrasound Imaging, Digital Imaging |

| End User | Hospitals, Eye Clinics, Research Laboratories, Optical Retailers |

| Application | Vision Testing, Cataract Surgery, Glaucoma Treatment, Retinal Procedures |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Ophthalmic Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at