444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom OOH and DOOH market represents a dynamic and rapidly evolving advertising landscape that combines traditional out-of-home advertising with cutting-edge digital technologies. Out-of-home (OOH) advertising encompasses traditional billboards, transit advertising, and street furniture, while digital out-of-home (DOOH) leverages digital screens, interactive displays, and programmatic advertising capabilities to deliver targeted messaging to consumers outside their homes.

Market dynamics in the UK indicate robust growth driven by urbanization, technological advancement, and changing consumer behavior patterns. The sector has demonstrated remarkable resilience, particularly following the recovery from pandemic-related disruptions. Digital transformation continues to reshape the landscape, with DOOH experiencing accelerated adoption rates of approximately 15-18% annually across major metropolitan areas including London, Manchester, Birmingham, and Edinburgh.

Industry stakeholders are witnessing significant shifts toward programmatic buying, real-time content optimization, and data-driven campaign management. The integration of artificial intelligence, machine learning, and advanced analytics has enhanced targeting precision and campaign effectiveness. Consumer engagement metrics show improved recall rates and brand awareness, with digital formats achieving 65% higher engagement compared to traditional static displays.

Technological infrastructure development across the UK has facilitated widespread DOOH deployment, supported by improved connectivity, 5G networks, and cloud-based content management systems. Major cities have embraced smart city initiatives that incorporate digital advertising displays as integral components of urban infrastructure, creating new opportunities for advertisers and media owners.

The United Kingdom OOH and DOOH market refers to the comprehensive ecosystem of advertising platforms, technologies, and services that deliver promotional content to consumers in public spaces, transit systems, retail environments, and outdoor locations throughout England, Scotland, Wales, and Northern Ireland. This market encompasses both traditional static advertising formats and advanced digital display technologies that enable dynamic, targeted, and interactive advertising experiences.

Out-of-home advertising traditionally includes billboards, posters, transit advertising on buses and trains, street furniture such as bus shelters and phone boxes, and ambient advertising in various public spaces. Digital out-of-home advertising extends these capabilities through LED screens, LCD displays, interactive kiosks, projection mapping, and mobile digital units that can deliver real-time, contextually relevant content based on factors such as time of day, weather conditions, audience demographics, and location-specific data.

Market participants include media owners who operate advertising inventory, creative agencies that develop campaigns, technology providers that supply hardware and software solutions, and advertisers across various industries seeking to reach consumers outside their homes. The ecosystem also encompasses data providers, measurement companies, and programmatic platforms that facilitate automated buying and selling of advertising space.

Strategic analysis of the United Kingdom OOH and DOOH market reveals a sector undergoing fundamental transformation driven by digitalization, programmatic advertising adoption, and enhanced measurement capabilities. The market has demonstrated strong recovery momentum following pandemic-related challenges, with digital formats leading growth initiatives and traditional formats adapting to incorporate technological enhancements.

Key growth drivers include increasing urbanization, rising consumer mobility, enhanced targeting capabilities, and improved return on investment metrics. The shift toward programmatic buying has accelerated, with automated transactions now representing approximately 35% of total DOOH spending across major UK markets. This trend reflects advertiser demand for greater efficiency, transparency, and campaign optimization capabilities.

Market segmentation analysis indicates strong performance across multiple verticals, with retail, automotive, entertainment, and financial services leading advertising investment. Geographic distribution shows concentration in major metropolitan areas, while expansion into secondary cities and suburban locations presents significant growth opportunities. Technology adoption rates vary by region, with London and surrounding areas demonstrating the highest penetration of advanced DOOH solutions.

Competitive dynamics feature both established media companies and emerging technology-focused players competing for market share. Consolidation activities have created larger, more integrated organizations capable of offering comprehensive solutions across traditional and digital formats. Innovation continues to drive differentiation, with companies investing in artificial intelligence, augmented reality, and interactive technologies to enhance advertiser value propositions.

Market intelligence reveals several critical insights that define the current state and future trajectory of the UK OOH and DOOH sector. These insights provide strategic guidance for stakeholders seeking to understand market dynamics and identify growth opportunities.

Primary growth drivers propelling the United Kingdom OOH and DOOH market forward encompass technological, demographic, and economic factors that create favorable conditions for sustained expansion and innovation within the sector.

Urbanization trends continue to concentrate population density in major metropolitan areas, creating larger audiences for out-of-home advertising formats. Cities like London, Manchester, Birmingham, and Glasgow are experiencing continued growth in foot traffic, commuter volumes, and commercial activity that directly benefits OOH and DOOH advertising effectiveness. Public transportation usage remains robust, providing consistent exposure opportunities for transit-based advertising formats.

Digital technology advancement has dramatically reduced hardware costs while improving display quality, content management capabilities, and network connectivity. The rollout of 5G networks across the UK enables real-time content updates, interactive experiences, and enhanced data collection capabilities that were previously technically or economically unfeasible. Cloud computing infrastructure supports scalable content distribution and campaign management across extensive networks of digital displays.

Programmatic advertising adoption is transforming how advertisers plan, purchase, and optimize OOH and DOOH campaigns. Automated buying platforms provide efficiency gains, improved targeting precision, and enhanced campaign performance measurement. Real-time bidding capabilities enable advertisers to optimize spending based on audience availability, contextual factors, and campaign objectives.

Consumer behavior evolution reflects increased mobility, longer commute times, and greater receptivity to location-based advertising messages. Research indicates that consumers are spending more time outside their homes, creating expanded opportunities for OOH and DOOH engagement. Mobile device integration enables seamless connections between outdoor advertising and digital experiences, amplifying campaign reach and effectiveness.

Significant challenges within the United Kingdom OOH and DOOH market create headwinds that stakeholders must navigate to achieve sustainable growth and operational success. Understanding these restraints is essential for developing effective strategies and risk mitigation approaches.

Regulatory complexity presents ongoing challenges as local authorities, planning departments, and advertising standards organizations maintain varying requirements for outdoor advertising installations. Planning permission processes can be lengthy and uncertain, particularly for new digital installations or modifications to existing infrastructure. Compliance costs and administrative burdens can significantly impact project timelines and profitability, especially for smaller operators.

High capital requirements for digital infrastructure development create barriers to entry and limit expansion capabilities for many market participants. Technology investments in high-quality displays, content management systems, and network infrastructure require substantial upfront capital commitments with extended payback periods. Maintenance and upgrade costs add ongoing financial pressures that can strain operational budgets.

Economic uncertainty and fluctuating advertising spending patterns create revenue volatility that affects long-term planning and investment decisions. Economic downturns typically result in reduced advertising budgets, with OOH and DOOH often experiencing disproportionate impacts compared to digital channels. Currency fluctuations and inflation pressures add additional complexity to cost management and pricing strategies.

Competition from digital channels continues to intensify as online advertising platforms offer sophisticated targeting, measurement, and optimization capabilities. Social media and search advertising provide immediate feedback and performance metrics that can appear more attractive to advertisers seeking measurable results and flexible budget allocation options.

Emerging opportunities within the United Kingdom OOH and DOOH market present significant potential for growth, innovation, and competitive advantage. These opportunities span technological advancement, market expansion, and new business model development that can drive future success.

Artificial intelligence integration offers transformative potential for campaign optimization, audience targeting, and content personalization. Machine learning algorithms can analyze vast datasets to predict optimal content delivery timing, identify high-value audience segments, and automatically adjust campaigns based on performance metrics. Computer vision technologies enable real-time audience measurement and demographic analysis that enhances targeting precision and campaign effectiveness.

Smart city development initiatives across the UK create opportunities for integrated digital advertising solutions within urban infrastructure projects. Public-private partnerships can facilitate deployment of digital displays that serve both commercial advertising and public information functions. Transportation hubs, shopping centers, and mixed-use developments present opportunities for comprehensive DOOH networks that serve multiple stakeholders.

Programmatic marketplace expansion continues to offer growth potential as more advertisers adopt automated buying processes and demand greater campaign transparency. Data integration capabilities that combine first-party advertiser data with location intelligence and audience insights create competitive advantages for media owners who can offer sophisticated targeting options.

Sustainability initiatives present opportunities for differentiation through environmentally responsible advertising solutions. Solar-powered displays, energy-efficient LED technology, and carbon-neutral content distribution can appeal to environmentally conscious advertisers and support corporate sustainability objectives. Green building certifications and sustainable development projects often prioritize environmentally responsible advertising partners.

Complex interactions between technological innovation, regulatory frameworks, economic conditions, and consumer behavior create dynamic market conditions that continuously reshape the United Kingdom OOH and DOOH landscape. Understanding these dynamics is crucial for strategic planning and competitive positioning.

Technology convergence is blurring traditional boundaries between OOH, DOOH, and digital advertising channels. Cross-platform integration enables advertisers to create cohesive campaigns that span outdoor displays, mobile devices, and online channels. This convergence is driving demand for unified measurement systems and integrated campaign management platforms that can optimize spending across multiple touchpoints.

Audience fragmentation and changing media consumption patterns require more sophisticated targeting and content strategies. Demographic shifts toward younger, more digitally native audiences demand interactive, engaging advertising experiences that traditional static formats cannot provide. Generational preferences for authentic, relevant messaging drive demand for contextually aware and personalized advertising content.

Economic cyclicality continues to influence advertising spending patterns, with OOH and DOOH experiencing both positive and negative impacts from broader economic trends. Recovery periods often see accelerated adoption of new technologies and formats as advertisers seek competitive advantages. Economic expansion typically correlates with increased experimentation and innovation in advertising approaches.

Competitive intensity is increasing as traditional media companies, technology providers, and new entrants compete for market share. Consolidation activities create larger, more capable organizations while also reducing the number of independent operators. Innovation cycles are accelerating as companies invest in differentiation through technology, service quality, and unique value propositions.

Comprehensive research methodology employed for analyzing the United Kingdom OOH and DOOH market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy, reliability, and actionable insights for industry stakeholders.

Primary research activities include structured interviews with industry executives, media owners, technology providers, and advertising agencies across England, Scotland, Wales, and Northern Ireland. Survey instruments capture quantitative data on market trends, technology adoption rates, spending patterns, and future investment intentions. Focus groups with advertising decision-makers provide qualitative insights into selection criteria, performance expectations, and emerging requirements.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and trade publication content to establish market context and validate primary research findings. Government statistics on transportation, urban development, and economic indicators provide supporting data for market sizing and trend analysis. Academic research on consumer behavior, advertising effectiveness, and technology adoption informs analytical frameworks.

Data validation processes include triangulation of multiple sources, expert review panels, and statistical analysis to ensure research quality and reliability. Market modeling techniques incorporate historical trends, current conditions, and forward-looking indicators to develop projections and scenario analyses. Regular updates and revisions maintain research currency and relevance as market conditions evolve.

Analytical frameworks combine quantitative analysis with qualitative assessment to provide comprehensive market understanding. MarkWide Research methodologies ensure consistent, professional standards across all research activities while maintaining objectivity and analytical rigor throughout the research process.

Geographic distribution of OOH and DOOH activity across the United Kingdom reveals significant variations in market development, technology adoption, and growth potential that reflect underlying economic, demographic, and infrastructure differences between regions.

London and Greater London dominate the UK market, accounting for approximately 45-50% of total advertising investment across both traditional and digital formats. The capital’s high population density, extensive transportation network, and concentration of commercial activity create optimal conditions for OOH and DOOH effectiveness. Digital penetration rates in London exceed national averages, with programmatic buying and advanced targeting capabilities widely adopted across premium inventory locations.

Northern England markets including Manchester, Liverpool, Leeds, and Newcastle represent significant growth opportunities with expanding urban populations and infrastructure development. Transportation investments in these regions are creating new advertising inventory while economic development initiatives attract increased commercial activity. Digital adoption rates are accelerating, though they remain below London levels.

Midlands regions centered on Birmingham, Coventry, and Nottingham benefit from strategic geographic positioning and diverse economic bases that support sustained advertising demand. Manufacturing sector presence creates unique opportunities for B2B advertising applications, while retail and entertainment venues drive consumer-focused campaigns. Infrastructure modernization projects are expanding digital advertising opportunities.

Scotland and Wales markets demonstrate strong potential despite smaller population bases, with major cities like Edinburgh, Glasgow, and Cardiff showing robust advertising activity. Tourism sectors in these regions create seasonal demand patterns that benefit from flexible digital advertising capabilities. Rural and suburban expansion presents opportunities for strategic inventory development in underserved markets.

Market competition within the United Kingdom OOH and DOOH sector features a diverse mix of established media companies, technology specialists, and emerging players competing across traditional and digital advertising formats. Competitive dynamics continue to evolve as digitalization transforms business models and value propositions.

Competitive strategies increasingly focus on technology integration, data capabilities, and service differentiation rather than solely on inventory scale. Innovation investments in programmatic platforms, audience measurement, and creative capabilities are becoming essential for maintaining competitive positioning and attracting advertiser investment.

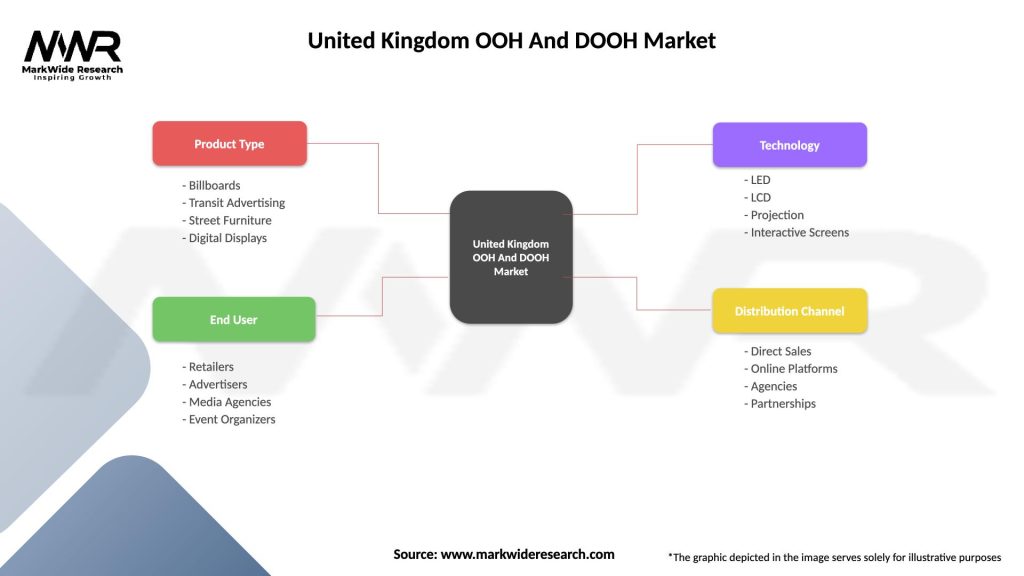

Market segmentation analysis reveals distinct categories within the United Kingdom OOH and DOOH market that serve different advertiser needs, audience targets, and campaign objectives. Understanding these segments is essential for strategic planning and resource allocation decisions.

By Format Type:

By Technology:

By Application:

Detailed analysis of individual market categories within the United Kingdom OOH and DOOH sector reveals unique characteristics, growth patterns, and strategic considerations that influence investment decisions and operational approaches.

Digital Billboard Category demonstrates the strongest growth momentum, with annual expansion rates significantly exceeding traditional format growth. Advertiser preference for flexible content scheduling, real-time optimization, and enhanced creative capabilities drives continued investment in digital infrastructure. Premium locations command substantial rate premiums while offering superior campaign performance metrics and advertiser satisfaction scores.

Transit Advertising Segment benefits from consistent commuter patterns and captive audience exposure times that enhance message retention and brand recall. Digital integration within transport environments is expanding rapidly, with stations and vehicles incorporating interactive displays and real-time information systems. Programmatic buying adoption in transit advertising is accelerating as operators develop sophisticated audience targeting capabilities.

Street Furniture Category provides intimate audience engagement opportunities in pedestrian environments where dwell times and attention levels support detailed messaging and interactive experiences. Smart city integration is creating new opportunities for multifunctional displays that combine advertising with public information, wayfinding, and community services.

Retail Environment Segment leverages point-of-sale proximity and purchase intent timing to deliver highly relevant advertising messages. Integration capabilities with mobile devices, loyalty programs, and e-commerce platforms create comprehensive customer journey touchpoints that extend campaign effectiveness beyond initial exposure.

Strategic advantages available to participants in the United Kingdom OOH and DOOH market span operational efficiency, revenue optimization, competitive positioning, and customer satisfaction improvements that justify investment and participation in this dynamic sector.

For Media Owners:

For Advertisers:

For Technology Providers:

Comprehensive assessment of strengths, weaknesses, opportunities, and threats provides strategic context for understanding the current position and future prospects of the United Kingdom OOH and DOOH market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the United Kingdom OOH and DOOH market reflect broader technological, social, and economic developments that influence industry evolution and strategic planning requirements for market participants.

Programmatic Advertising Adoption continues accelerating as advertisers demand greater efficiency, transparency, and optimization capabilities. Real-time bidding platforms are becoming standard practice, with automated transactions representing an increasing share of total advertising spending. Integration with demand-side platforms and data management systems enables sophisticated targeting and campaign optimization that was previously unavailable in traditional OOH formats.

Artificial Intelligence Integration is transforming content optimization, audience targeting, and campaign performance analysis. Machine learning algorithms analyze vast datasets to predict optimal content delivery timing, identify high-value audience segments, and automatically adjust campaigns based on performance metrics. Computer vision technologies enable real-time audience measurement and demographic analysis that enhances targeting precision.

Sustainability Focus is driving adoption of environmentally responsible advertising technologies and practices. Energy-efficient displays, solar power integration, and carbon-neutral content distribution appeal to environmentally conscious advertisers and support corporate sustainability objectives. Green building certifications increasingly consider advertising infrastructure environmental impact.

Interactive Experience Development leverages touchscreen technology, augmented reality, and mobile device integration to create engaging, two-way communication opportunities. QR code integration and near-field communication enable seamless connections between outdoor advertising and digital experiences, extending campaign reach and providing measurable engagement metrics.

Cross-Channel Integration connects OOH and DOOH campaigns with social media, search advertising, and e-commerce platforms to create cohesive omnichannel experiences. Attribution modeling and unified measurement systems provide comprehensive campaign performance analysis across multiple touchpoints, enabling optimized budget allocation and strategic planning.

Recent developments within the United Kingdom OOH and DOOH market demonstrate continued innovation, investment, and strategic evolution as industry participants adapt to changing market conditions and emerging opportunities.

Infrastructure Modernization projects across major UK cities are incorporating digital advertising displays as integral components of urban development initiatives. Transportation hubs including airports, train stations, and bus terminals are upgrading to comprehensive digital networks that serve both commercial advertising and public information functions. These developments create new inventory opportunities while enhancing advertiser targeting capabilities.

Technology Platform Launches by major media owners and technology providers are expanding programmatic capabilities and automated campaign management options. Supply-side platforms specifically designed for OOH and DOOH inventory are improving market efficiency and enabling more sophisticated buying processes. Integration with existing demand-side platforms creates seamless cross-channel campaign management capabilities.

Measurement Innovation initiatives are addressing traditional limitations in outdoor advertising audience measurement and campaign attribution. Mobile data integration, computer vision systems, and artificial intelligence applications provide more accurate and actionable audience insights. Third-party verification services are establishing industry standards for measurement consistency and reliability.

Strategic Partnerships between media owners, technology providers, and data companies are creating comprehensive solution offerings that address advertiser requirements for integrated campaign management, advanced targeting, and performance optimization. MarkWide Research analysis indicates these partnerships are becoming essential for competitive positioning and market share growth.

Regulatory Developments including updated planning guidelines and advertising standards are providing greater clarity for digital installation approvals while maintaining community and environmental protection standards. Local authority initiatives in major cities are streamlining approval processes for digital advertising infrastructure that supports smart city objectives.

Strategic recommendations for United Kingdom OOH and DOOH market participants focus on positioning for sustained growth, competitive advantage, and operational excellence in an increasingly dynamic and technology-driven environment.

Investment Prioritization should emphasize digital infrastructure development, programmatic platform integration, and advanced measurement capabilities that enhance advertiser value propositions. Technology investments in artificial intelligence, data analytics, and automation systems provide competitive advantages and operational efficiency gains that justify capital allocation. Selective expansion into underserved geographic markets offers growth potential with manageable risk profiles.

Partnership Strategy Development enables access to complementary capabilities, expanded market reach, and shared investment risks. Strategic alliances with technology providers, data companies, and creative agencies create comprehensive solution offerings that address evolving advertiser requirements. Cross-industry partnerships with retail, transportation, and real estate organizations provide new inventory development opportunities.

Operational Excellence Focus on customer service, campaign performance, and technical reliability builds long-term advertiser relationships and supports premium pricing strategies. Service differentiation through specialized expertise, innovative solutions, and responsive account management creates competitive advantages that transcend purely cost-based competition.

Market Expansion Strategies should consider both geographic expansion into secondary cities and vertical expansion into specialized industry segments. Niche market development in sectors such as healthcare, education, and professional services offers growth potential with reduced competitive intensity. International expansion opportunities may provide additional growth avenues for established UK operators.

Long-term prospects for the United Kingdom OOH and DOOH market indicate continued growth driven by technological advancement, urbanization trends, and evolving advertiser requirements for measurable, targeted, and integrated advertising solutions.

Digital transformation will continue accelerating, with DOOH formats expected to represent an increasing share of total market activity. Programmatic adoption rates are projected to reach 60-70% of digital inventory within the next five years, driven by advertiser demand for efficiency and optimization capabilities. Traditional formats will increasingly incorporate digital elements or face continued market share erosion.

Technology integration will expand beyond current applications to include artificial intelligence, augmented reality, and Internet of Things connectivity that creates more engaging and responsive advertising experiences. 5G network deployment will enable real-time interactivity, high-definition content delivery, and seamless integration with mobile devices and other digital touchpoints.

Market consolidation is likely to continue as scale advantages become more pronounced and technology investment requirements increase. Vertical integration between media owners, technology providers, and service companies may create more comprehensive solution offerings while potentially reducing competitive intensity in certain market segments.

Regulatory evolution will likely address privacy concerns, environmental impact, and urban planning considerations while maintaining support for economic development and innovation. Industry self-regulation initiatives may preempt more restrictive government intervention while establishing best practices for responsible advertising deployment.

MWR projections suggest sustained growth momentum with periodic cyclical variations reflecting broader economic conditions and advertising spending patterns. Geographic expansion into secondary markets and international opportunities may provide additional growth drivers for established UK market participants.

The United Kingdom OOH and DOOH market represents a dynamic and evolving sector that successfully combines traditional advertising strengths with cutting-edge digital technologies to serve the changing needs of advertisers and consumers. Market analysis reveals a sector undergoing fundamental transformation driven by digitalization, programmatic automation, and enhanced measurement capabilities that create new opportunities for growth and innovation.

Key success factors for market participants include strategic technology investment, operational excellence, and adaptive business models that respond to rapidly changing market conditions. The shift toward digital formats, programmatic buying, and data-driven campaign optimization creates both opportunities and challenges that require careful strategic planning and execution. Companies that successfully navigate this transition while maintaining service quality and advertiser satisfaction are positioned for sustained competitive advantage.

Future market development will likely be characterized by continued technological advancement, geographic expansion, and integration with broader digital marketing ecosystems. The sector’s resilience during economic challenges and ability to adapt to changing consumer behavior patterns demonstrate fundamental strength and long-term viability. Strategic investments in innovation, infrastructure, and talent development will determine competitive positioning and market share outcomes in this increasingly sophisticated and technology-driven industry.

What is OOH and DOOH?

OOH, or Out-Of-Home advertising, refers to any advertising that reaches the consumer while they are outside their home. DOOH, or Digital Out-Of-Home, is a subset of OOH that utilizes digital screens to display advertisements in public spaces.

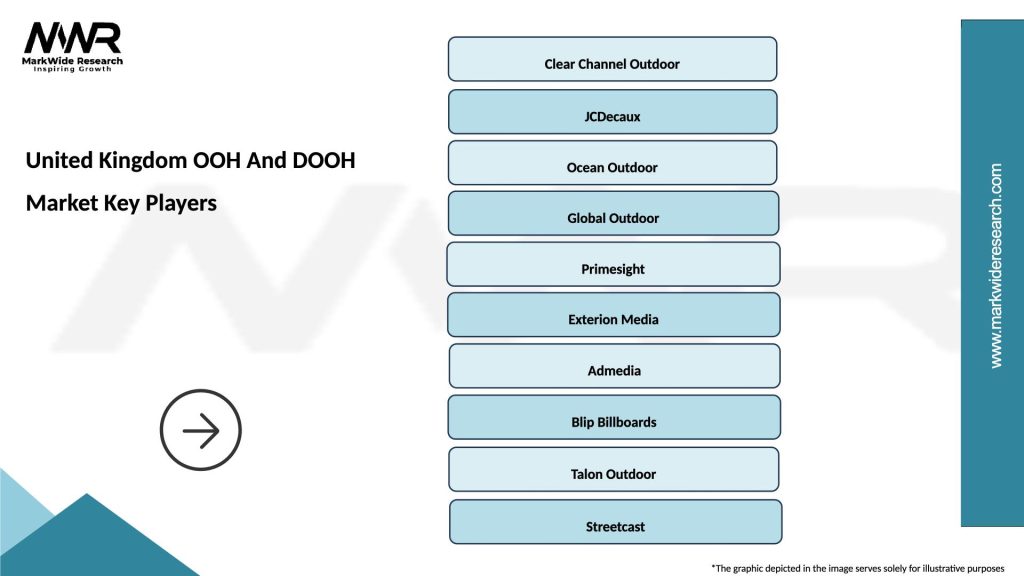

What are the key players in the United Kingdom OOH And DOOH Market?

Key players in the United Kingdom OOH And DOOH Market include companies like JCDecaux, Clear Channel Outdoor, and Ocean Outdoor, which are known for their extensive advertising networks and innovative digital solutions, among others.

What are the growth factors driving the United Kingdom OOH And DOOH Market?

The growth of the United Kingdom OOH And DOOH Market is driven by increasing urbanization, the rise of digital technology, and the effectiveness of targeted advertising strategies that engage consumers in high-traffic areas.

What challenges does the United Kingdom OOH And DOOH Market face?

The United Kingdom OOH And DOOH Market faces challenges such as regulatory restrictions on outdoor advertising, competition from digital media, and the need for continuous innovation to capture consumer attention.

What opportunities exist in the United Kingdom OOH And DOOH Market?

Opportunities in the United Kingdom OOH And DOOH Market include the integration of advanced technologies like augmented reality, the expansion of programmatic advertising, and the potential for personalized advertising experiences.

What trends are shaping the United Kingdom OOH And DOOH Market?

Trends shaping the United Kingdom OOH And DOOH Market include the increasing use of data analytics for audience targeting, the growth of interactive and immersive advertising formats, and a focus on sustainability in advertising practices.

United Kingdom OOH And DOOH Market

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Street Furniture, Digital Displays |

| End User | Retailers, Advertisers, Media Agencies, Event Organizers |

| Technology | LED, LCD, Projection, Interactive Screens |

| Distribution Channel | Direct Sales, Online Platforms, Agencies, Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom OOH And DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at