444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom oil and gas midstream market represents a critical component of the nation’s energy infrastructure, encompassing the transportation, storage, and processing of crude oil and natural gas between upstream production and downstream refining activities. This sector has undergone significant transformation in recent years, driven by evolving energy policies, technological advancements, and changing market dynamics. The UK’s strategic position as a major energy hub in Europe, combined with its extensive North Sea operations, positions the midstream sector as a vital link in the global energy supply chain.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 4.2% over the forecast period. This growth trajectory reflects increasing demand for efficient transportation and storage solutions, particularly as the UK transitions toward a more diversified energy portfolio. The midstream infrastructure includes an extensive network of pipelines, storage terminals, processing facilities, and transportation systems that facilitate the movement of hydrocarbons from production sites to end markets.

Technological innovation continues to reshape the landscape, with digital transformation initiatives improving operational efficiency by approximately 25-30% across major midstream operations. The integration of advanced monitoring systems, predictive maintenance technologies, and automated control systems has enhanced safety standards while reducing operational costs. These developments are particularly significant given the UK’s mature oil and gas fields, where maximizing efficiency and extending asset life cycles are paramount concerns.

The United Kingdom oil and gas midstream market refers to the comprehensive network of infrastructure, services, and operations that facilitate the transportation, storage, processing, and distribution of crude oil and natural gas between upstream production facilities and downstream refineries or end-user markets. This sector encompasses pipeline networks, storage terminals, processing plants, compression stations, and related logistics services that ensure the efficient flow of hydrocarbons throughout the UK’s energy system.

Midstream operations serve as the critical bridge connecting North Sea production platforms, onshore processing facilities, and distribution networks that supply domestic and international markets. The sector includes both onshore and offshore infrastructure, with specialized vessels, underwater pipelines, and coastal terminals playing essential roles in maintaining continuous energy supply chains. This infrastructure supports not only domestic energy security but also positions the UK as a significant player in European energy markets.

Strategic positioning of the UK oil and gas midstream market reflects the nation’s commitment to maintaining energy security while adapting to evolving market conditions. The sector demonstrates resilience through diversified infrastructure investments, technological upgrades, and strategic partnerships that enhance operational capabilities. Current market conditions indicate steady growth driven by infrastructure modernization initiatives and increasing demand for flexible transportation solutions.

Key performance indicators reveal that midstream operations contribute approximately 18-22% of the total oil and gas value chain in the UK, highlighting the sector’s economic significance. Investment patterns show renewed focus on digital transformation, with companies allocating substantial resources to automation and data analytics platforms. The sector’s ability to adapt to changing energy policies while maintaining operational excellence positions it favorably for sustained growth.

Market consolidation trends indicate strategic mergers and acquisitions aimed at optimizing operational efficiency and expanding geographic coverage. Major players are investing in next-generation infrastructure that supports both traditional hydrocarbon transportation and emerging energy sources, demonstrating the sector’s commitment to long-term sustainability and adaptability.

Infrastructure modernization emerges as a primary driver of market evolution, with significant investments in pipeline integrity management, storage capacity expansion, and processing facility upgrades. The following insights characterize current market dynamics:

Energy security concerns continue to drive substantial investments in midstream infrastructure, as the UK seeks to maintain reliable energy supplies amid geopolitical uncertainties. The government’s commitment to energy independence has resulted in policies that support domestic infrastructure development and strategic reserve capacity expansion. These initiatives create sustained demand for midstream services and infrastructure upgrades.

Technological advancement serves as a catalyst for market growth, with digitalization initiatives improving operational efficiency and reducing costs across the value chain. The adoption of Internet of Things (IoT) sensors, artificial intelligence, and machine learning technologies enables predictive maintenance strategies that extend asset life cycles while minimizing downtime. These technological improvements translate into enhanced profitability and competitive advantages for midstream operators.

Regulatory support from government agencies facilitates market expansion through streamlined permitting processes and infrastructure development incentives. The UK’s energy transition strategy recognizes the critical role of midstream infrastructure in supporting both traditional and renewable energy sources, leading to policies that encourage investment and innovation in the sector.

Market integration with European energy networks creates opportunities for expanded transportation and storage services. Cross-border pipeline projects and interconnector developments enhance the UK’s role as an energy hub, driving demand for sophisticated midstream capabilities that can handle diverse energy flows and market requirements.

Environmental regulations impose significant compliance costs and operational constraints on midstream operators, requiring substantial investments in emission reduction technologies and environmental monitoring systems. The UK’s commitment to net-zero emissions by 2050 necessitates extensive infrastructure modifications and operational changes that impact profitability and investment returns.

Capital intensity of midstream infrastructure projects creates barriers to entry and limits expansion opportunities for smaller operators. The substantial upfront investments required for pipeline construction, storage facility development, and processing plant upgrades strain financial resources and require long-term commitment from investors and stakeholders.

Aging infrastructure presents ongoing challenges as many UK midstream assets require significant maintenance and modernization investments. The cost of upgrading legacy systems while maintaining operational continuity creates financial pressures that affect market growth and profitability across the sector.

Market volatility in oil and gas prices creates uncertainty that affects investment decisions and long-term planning initiatives. Price fluctuations impact the economic viability of infrastructure projects and influence capacity utilization rates, creating challenges for operators seeking to optimize returns on invested capital.

Energy transition initiatives create substantial opportunities for midstream operators to diversify service offerings and develop new revenue streams. The integration of hydrogen transportation, carbon capture and storage, and renewable energy logistics into existing infrastructure networks presents significant growth potential for forward-thinking companies.

International expansion opportunities emerge as UK-based midstream companies leverage their expertise and technology to participate in global energy infrastructure projects. The export of technical knowledge, operational best practices, and innovative solutions to international markets creates new business opportunities and revenue diversification.

Technology commercialization presents opportunities for companies that develop and implement innovative solutions for pipeline monitoring, storage optimization, and processing efficiency. The growing demand for advanced midstream technologies creates markets for specialized equipment, software solutions, and consulting services.

Strategic partnerships with renewable energy developers, technology companies, and international operators create opportunities for collaborative infrastructure development and shared investment initiatives. These partnerships enable risk sharing while expanding market reach and operational capabilities across diverse energy sectors.

Supply chain integration continues to evolve as midstream operators seek to optimize connections between upstream production and downstream markets. The development of integrated logistics solutions that combine transportation, storage, and processing services creates competitive advantages while improving overall system efficiency. These integrated approaches reduce costs and enhance service reliability for customers across the energy value chain.

Competitive pressures drive continuous improvement in operational efficiency and service quality, with companies investing in advanced technologies and process optimization initiatives. Market leaders maintain their positions through strategic investments in infrastructure modernization and digital transformation programs that enhance operational capabilities and customer service levels.

Regulatory evolution shapes market dynamics as government policies adapt to changing energy landscapes and environmental priorities. The implementation of new safety standards, environmental regulations, and energy transition policies creates both challenges and opportunities for midstream operators, requiring adaptive strategies and flexible operational approaches.

Customer demands for flexible, reliable, and environmentally responsible midstream services drive innovation and service development across the sector. Operators respond to these demands by developing customized solutions, enhancing service reliability, and implementing sustainable operational practices that align with customer environmental objectives.

Comprehensive analysis of the United Kingdom oil and gas midstream market employs multiple research methodologies to ensure accurate and reliable insights. Primary research involves direct engagement with industry stakeholders, including midstream operators, technology providers, regulatory agencies, and end-users, through structured interviews and surveys that capture current market conditions and future expectations.

Secondary research encompasses extensive review of industry reports, government publications, regulatory filings, and company financial statements to establish baseline market data and identify key trends. This approach ensures comprehensive coverage of market dynamics while providing historical context for current developments and future projections.

Data validation processes involve cross-referencing information from multiple sources and conducting expert interviews to verify findings and ensure accuracy. Statistical analysis techniques are applied to identify significant trends and correlations that inform market projections and strategic recommendations.

Market modeling utilizes advanced analytical frameworks to project future market conditions based on identified drivers, restraints, and opportunities. These models incorporate economic indicators, regulatory changes, and technological developments to provide realistic growth scenarios and market evolution pathways.

Scotland region dominates the UK oil and gas midstream market, accounting for approximately 45-50% of total infrastructure capacity due to its proximity to North Sea production facilities and extensive pipeline networks. The region benefits from established processing facilities, storage terminals, and transportation infrastructure that support both domestic and international energy flows. Aberdeen serves as a critical hub for midstream operations, with specialized facilities and services supporting offshore production activities.

England’s contribution to the midstream market focuses primarily on storage, distribution, and processing facilities that serve domestic consumption and international trade. The region’s strategic location provides access to European markets through interconnector pipelines and shipping terminals. Major storage facilities and refineries in England create demand for sophisticated transportation and logistics services that connect production areas with consumption centers.

Wales region plays a specialized role in the midstream market through its coastal terminals and processing facilities that support both oil and gas operations. The region’s infrastructure includes important storage and distribution facilities that serve domestic markets while providing connectivity to international shipping routes.

Northern Ireland contributes to the overall midstream network through strategic pipeline connections and storage facilities that support regional energy security. The area’s infrastructure development focuses on ensuring reliable energy supplies while maintaining connections to broader UK and European energy networks.

Market leadership in the UK oil and gas midstream sector is characterized by a mix of international energy companies, specialized midstream operators, and infrastructure investment firms. The competitive environment reflects the capital-intensive nature of the industry and the importance of operational expertise in managing complex energy infrastructure systems.

Strategic positioning among competitors focuses on operational efficiency, safety performance, and technological innovation. Market leaders invest heavily in digital transformation initiatives and infrastructure modernization to maintain competitive advantages while meeting evolving customer requirements and regulatory standards.

By Infrastructure Type: The market segments into distinct categories based on the type of midstream infrastructure and services provided. Each segment addresses specific aspects of the hydrocarbon value chain and requires specialized expertise and equipment.

By Service Type: Market segmentation based on the range of services provided to upstream producers and downstream customers reflects the diverse operational requirements of the energy sector.

Pipeline Transportation represents the largest segment of the UK midstream market, with extensive networks carrying approximately 75-80% of domestic oil and gas production. This category benefits from established infrastructure and ongoing investments in capacity expansion and system optimization. Advanced monitoring technologies and predictive maintenance programs enhance operational reliability while reducing environmental risks.

Storage Operations play a critical role in market stability and energy security, with strategic petroleum reserves and commercial storage facilities providing essential buffer capacity. The UK maintains significant storage capacity that supports both domestic consumption and international trading activities. Investment in storage infrastructure focuses on capacity expansion and technology upgrades that improve operational efficiency.

Processing Facilities add substantial value to raw hydrocarbon production through gas processing, crude oil stabilization, and quality enhancement services. These facilities employ advanced separation technologies and environmental control systems that ensure product quality while minimizing environmental impact. The processing segment benefits from ongoing technology improvements and capacity optimization initiatives.

Terminal Operations facilitate international energy trade through sophisticated import/export facilities and marine terminals. These facilities handle diverse product types and provide essential connectivity between UK energy markets and international suppliers and customers. Investment in terminal infrastructure focuses on capacity expansion and technology upgrades that enhance operational efficiency and environmental performance.

Operational efficiency improvements through advanced midstream infrastructure provide significant benefits for upstream producers, downstream refiners, and end-users throughout the energy value chain. Modern transportation and storage systems reduce costs while improving reliability and safety performance across all market segments.

Market access enhancement through comprehensive midstream networks enables producers to reach diverse markets while providing consumers with reliable energy supplies. The extensive UK infrastructure network facilitates both domestic distribution and international trade, creating value for all market participants.

Risk mitigation through diversified transportation and storage options reduces supply chain vulnerabilities while providing operational flexibility during market disruptions. Multiple transportation routes and storage facilities ensure continued energy flows even during maintenance activities or unexpected operational challenges.

Technology advancement benefits all stakeholders through improved safety, environmental performance, and operational efficiency. Digital monitoring systems, predictive maintenance technologies, and automated control systems enhance overall system performance while reducing operational risks and environmental impact.

Economic development in regions with significant midstream infrastructure creates employment opportunities and generates tax revenues that support local communities. The sector’s capital investments and operational activities contribute substantially to regional economic growth and development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the most significant trend reshaping the UK oil and gas midstream market, with operators investing heavily in advanced monitoring systems, predictive analytics, and automated control technologies. These digital initiatives improve operational efficiency by approximately 20-25% while enhancing safety performance and reducing environmental impact. The integration of artificial intelligence and machine learning capabilities enables predictive maintenance strategies that extend asset life cycles and minimize unplanned downtime.

Environmental sustainability initiatives drive substantial changes in operational practices and infrastructure design, with companies implementing carbon reduction strategies and environmental monitoring systems. The adoption of cleaner technologies and operational practices aligns with UK climate commitments while improving regulatory compliance and stakeholder relationships.

Infrastructure integration trends focus on developing multi-purpose facilities that can handle diverse energy sources, including traditional hydrocarbons and emerging alternatives like hydrogen and biofuels. This flexibility enables operators to adapt to changing market conditions while maximizing asset utilization and investment returns.

Strategic partnerships between midstream operators, technology providers, and energy companies create collaborative approaches to infrastructure development and operational optimization. These partnerships enable risk sharing while accelerating innovation and market development across the energy sector.

Infrastructure investments continue to reshape the UK midstream landscape, with major operators announcing substantial capital commitments to pipeline expansion, storage capacity increases, and processing facility upgrades. These investments reflect confidence in long-term market growth and the importance of maintaining competitive infrastructure capabilities.

Technology partnerships between midstream operators and digital technology companies accelerate the adoption of advanced monitoring and control systems. Recent collaborations focus on implementing Internet of Things sensors, artificial intelligence analytics, and cloud-based management platforms that enhance operational efficiency and decision-making capabilities.

Regulatory developments include updated safety standards, environmental compliance requirements, and energy transition policies that influence operational practices and investment priorities. The implementation of new regulations creates both challenges and opportunities for midstream operators seeking to maintain competitive positions while meeting evolving requirements.

Market consolidation activities involve strategic mergers and acquisitions aimed at optimizing operational efficiency and expanding geographic coverage. Recent transactions reflect the industry’s focus on achieving economies of scale while building comprehensive service capabilities that address diverse customer requirements.

Investment prioritization should focus on digital transformation initiatives that deliver measurable improvements in operational efficiency and safety performance. MarkWide Research analysis indicates that companies investing in advanced monitoring and predictive maintenance technologies achieve superior returns while reducing operational risks and environmental impact.

Strategic diversification into emerging energy transportation and storage services creates opportunities for long-term growth and market positioning. Operators should evaluate investments in hydrogen transportation infrastructure, carbon capture and storage systems, and renewable energy logistics capabilities that align with UK energy transition objectives.

Partnership development with technology providers, renewable energy companies, and international operators enables risk sharing while accelerating innovation and market expansion. Collaborative approaches to infrastructure development and operational optimization provide competitive advantages in an increasingly complex energy landscape.

Regulatory engagement through proactive participation in policy development processes ensures that operational requirements and industry perspectives inform regulatory decisions. Active engagement with government agencies and regulatory bodies helps shape policies that support sustainable industry growth while meeting environmental and safety objectives.

Market evolution over the next decade will be characterized by continued infrastructure modernization, technology integration, and adaptation to changing energy policies. The UK oil and gas midstream market is projected to maintain steady growth, with a compound annual growth rate of 3.8-4.5% driven by ongoing infrastructure investments and operational efficiency improvements.

Technology advancement will continue to reshape operational practices, with artificial intelligence, machine learning, and advanced analytics becoming standard components of midstream operations. These technologies will enable more sophisticated asset management, predictive maintenance, and operational optimization that improve both efficiency and environmental performance.

Energy transition impacts will create new opportunities for midstream operators willing to adapt their infrastructure and services to support diverse energy sources. The integration of hydrogen transportation, carbon capture and storage, and renewable energy logistics into existing networks will create new revenue streams while supporting UK climate objectives.

International connectivity will remain important as the UK maintains its role as a European energy hub, with continued investments in cross-border pipeline projects and interconnector developments. These connections enhance market access while providing energy security benefits for both the UK and its European partners.

The United Kingdom oil and gas midstream market represents a dynamic and evolving sector that plays a critical role in the nation’s energy infrastructure and economic development. Current market conditions reflect a mature industry undergoing significant transformation driven by technological advancement, environmental considerations, and changing energy policies. The sector’s ability to adapt to these changes while maintaining operational excellence positions it favorably for sustained growth and continued relevance in the evolving energy landscape.

Strategic opportunities for market participants include digital transformation initiatives, infrastructure modernization projects, and diversification into emerging energy transportation and storage services. Companies that successfully navigate these opportunities while managing operational challenges and regulatory requirements will achieve competitive advantages and superior returns on invested capital. The integration of advanced technologies and sustainable operational practices will be essential for long-term success in this evolving market environment.

Future success in the UK oil and gas midstream market will depend on the ability to balance traditional operational excellence with innovative approaches to infrastructure development and service delivery. As the energy sector continues to evolve, midstream operators that demonstrate flexibility, technological sophistication, and environmental responsibility will be best positioned to capitalize on emerging opportunities while contributing to the UK’s energy security and economic prosperity.

What is Oil & Gas Midstream?

Oil & Gas Midstream refers to the sector involved in the transportation, storage, and processing of oil and gas products. This includes pipelines, terminals, and processing facilities that connect upstream production with downstream distribution.

What are the key players in the United Kingdom Oil & Gas Midstream Market?

Key players in the United Kingdom Oil & Gas Midstream Market include companies like National Grid, Enbridge, and BP. These companies are involved in various aspects of midstream operations, including transportation and storage, among others.

What are the growth factors driving the United Kingdom Oil & Gas Midstream Market?

The growth of the United Kingdom Oil & Gas Midstream Market is driven by increasing energy demand, the expansion of pipeline infrastructure, and the need for efficient transportation of natural gas. Additionally, investments in renewable energy sources are influencing midstream operations.

What challenges does the United Kingdom Oil & Gas Midstream Market face?

The United Kingdom Oil & Gas Midstream Market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating oil prices. These factors can impact investment decisions and operational efficiency.

What opportunities exist in the United Kingdom Oil & Gas Midstream Market?

Opportunities in the United Kingdom Oil & Gas Midstream Market include the development of new pipeline projects, advancements in technology for monitoring and maintenance, and the integration of renewable energy sources into existing infrastructure. These factors can enhance operational efficiency and sustainability.

What trends are shaping the United Kingdom Oil & Gas Midstream Market?

Trends shaping the United Kingdom Oil & Gas Midstream Market include the increasing adoption of digital technologies for asset management, a focus on sustainability practices, and the shift towards decarbonization in energy transportation. These trends are influencing how companies operate and invest in midstream assets.

United Kingdom Oil & Gas Midstream Market

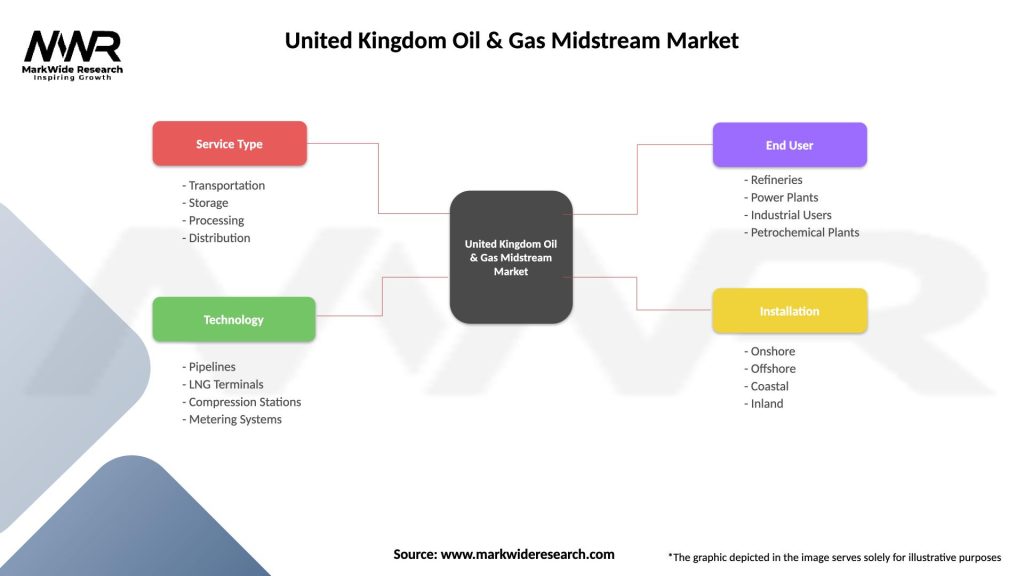

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Storage, Processing, Distribution |

| Technology | Pipelines, LNG Terminals, Compression Stations, Metering Systems |

| End User | Refineries, Power Plants, Industrial Users, Petrochemical Plants |

| Installation | Onshore, Offshore, Coastal, Inland |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Oil & Gas Midstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at