444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Kingdom Oil and Gas Market is a significant sector that plays a crucial role in the country’s economy. It encompasses exploration, production, refining, distribution, and consumption of oil and gas resources within the UK’s territorial boundaries. The industry has a rich history, dating back to the North Sea oil boom in the 1970s, which transformed the nation into a major oil producer. Over the years, the market has evolved, facing various challenges and opportunities, and remains a vital player in the global energy landscape.

Meaning

The United Kingdom Oil and Gas Market refers to the entire value chain involved in the extraction, processing, and distribution of oil and gas resources in the UK. This includes offshore drilling operations in the North Sea, onshore production, transportation, refining, and retailing of petroleum products to consumers. The market’s significance extends beyond energy supply; it impacts economic growth, employment, and international trade, making it a key sector in the UK’s overall economic development.

Executive Summary

The UK Oil and Gas Market continues to be a critical component of the nation’s economy, contributing significantly to its GDP and providing employment opportunities to thousands. Despite the challenges posed by the transition to renewable energy sources and increasing environmental concerns, the industry remains resilient. This report presents an in-depth analysis of the market, highlighting key insights, drivers, restraints, opportunities, and future outlook.

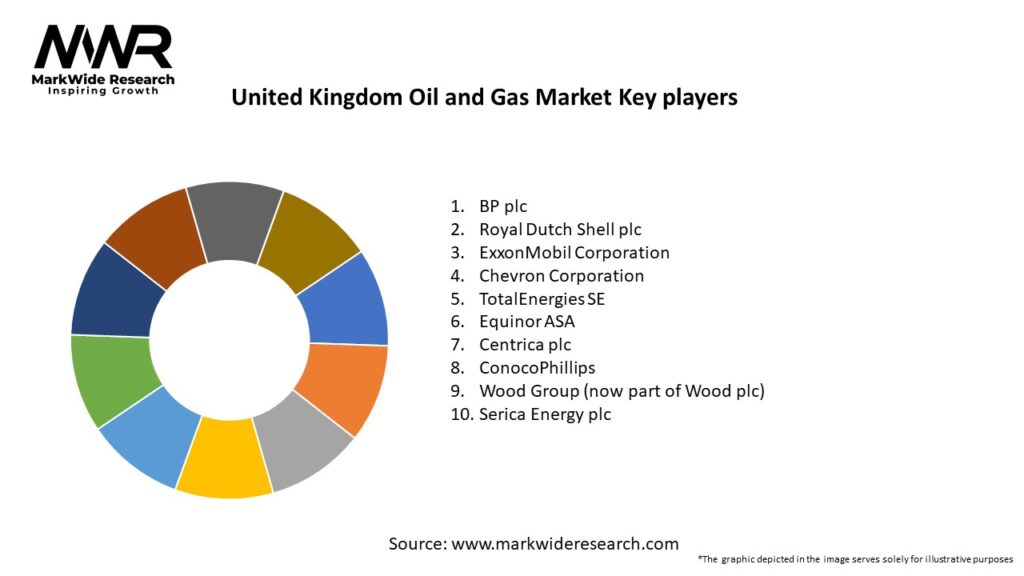

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UK Oil and Gas Market operates in a dynamic environment influenced by various factors, including global energy trends, geopolitical developments, and technological advancements. The industry’s adaptability to changing circumstances will determine its long-term sustainability and growth prospects.

Regional Analysis

The UK Oil and Gas Market is primarily concentrated in regions surrounding the North Sea. Scotland, in particular, is a key player in offshore oil and gas production, with Aberdeen often referred to as the “Oil Capital of Europe.” Additionally, onshore activities are distributed across various regions, contributing to regional economic development.

Competitive Landscape

Leading Companies in the United Kingdom Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The UK Oil and Gas Market can be segmented based on various factors, including upstream and downstream activities, product type, and geographic regions. The upstream segment involves exploration and production, while the downstream segment encompasses refining, distribution, and retailing of petroleum products.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the UK Oil and Gas Market. The global economic slowdown, travel restrictions, and decreased energy demand led to a decline in oil prices and affected exploration and production activities. However, the industry showed resilience and adapted to the changing circumstances.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the UK Oil and Gas Market will be shaped by its ability to adapt to changing energy trends, technological innovations, and regulatory developments. The market is expected to continue its gradual transition towards renewables while optimizing traditional oil and gas operations.

Conclusion

The United Kingdom Oil and Gas Market is a critical sector that has contributed significantly to the nation’s economic growth and energy security. While the industry faces challenges such as environmental concerns and competition from renewables, it also offers opportunities for diversification, digitalization, and international collaboration. By embracing sustainable practices, investing in renewable energy, and leveraging technological advancements, the UK Oil and Gas Market can continue to thrive in a rapidly evolving energy landscape.

What is Oil and Gas?

Oil and gas refer to natural resources that are extracted from the earth and used primarily for energy production, transportation, and manufacturing. In the context of the United Kingdom, these resources play a crucial role in the economy and energy supply.

What are the key players in the United Kingdom Oil and Gas Market?

Key players in the United Kingdom Oil and Gas Market include BP, Royal Dutch Shell, and TotalEnergies, among others. These companies are involved in various aspects of the industry, including exploration, production, and distribution.

What are the main drivers of growth in the United Kingdom Oil and Gas Market?

The main drivers of growth in the United Kingdom Oil and Gas Market include increasing energy demand, advancements in extraction technologies, and the need for energy security. Additionally, the transition towards cleaner energy sources is influencing investment in oil and gas.

What challenges does the United Kingdom Oil and Gas Market face?

The United Kingdom Oil and Gas Market faces challenges such as regulatory pressures, fluctuating oil prices, and environmental concerns. These factors can impact investment decisions and operational costs for companies in the sector.

What opportunities exist in the United Kingdom Oil and Gas Market?

Opportunities in the United Kingdom Oil and Gas Market include the development of offshore wind projects, carbon capture technologies, and the potential for new oil and gas discoveries. These areas present avenues for growth and innovation within the industry.

What trends are shaping the United Kingdom Oil and Gas Market?

Trends shaping the United Kingdom Oil and Gas Market include a shift towards digitalization, increased focus on sustainability, and the integration of renewable energy sources. Companies are adopting new technologies to enhance efficiency and reduce environmental impact.

United Kingdom Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Type | Exploration, Production, Refining, Distribution |

| Service Type | Drilling, Maintenance, Engineering, Consulting |

| End User | Utilities, Industrial, Commercial, Residential |

| Technology | Seismic, Hydraulic Fracturing, Enhanced Oil Recovery, Digital Oilfield |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United Kingdom Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at