444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom medical aesthetic devices market represents a dynamic and rapidly evolving sector within the broader healthcare technology landscape. This market encompasses sophisticated equipment and technologies designed for non-invasive and minimally invasive cosmetic procedures, including laser systems, radiofrequency devices, ultrasound equipment, and injectable delivery systems. The UK market has experienced substantial growth driven by increasing consumer awareness, technological advancements, and growing acceptance of aesthetic procedures across diverse demographic segments.

Market dynamics indicate robust expansion with the sector demonstrating resilience and adaptability to changing consumer preferences. The integration of advanced technologies such as artificial intelligence, precision targeting systems, and enhanced safety protocols has positioned the UK as a leading market for medical aesthetic innovations. Growth projections suggest the market will continue expanding at a compound annual growth rate of 8.2% through the forecast period, reflecting strong underlying demand and technological progression.

Regional distribution shows concentrated activity in major metropolitan areas, with London, Manchester, Birmingham, and Edinburgh serving as primary hubs for aesthetic device adoption. The market benefits from the UK’s well-established healthcare infrastructure, regulatory framework, and high disposable income levels among target demographics. Adoption rates have accelerated significantly, with 73% of aesthetic clinics reporting increased investment in advanced device technologies over the past two years.

The United Kingdom medical aesthetic devices market refers to the comprehensive ecosystem of medical equipment, technologies, and systems specifically designed for cosmetic and aesthetic enhancement procedures within the UK healthcare sector. This market encompasses devices used for facial rejuvenation, body contouring, skin resurfacing, hair removal, and various other aesthetic treatments that improve physical appearance without requiring traditional surgical interventions.

Medical aesthetic devices include laser systems for hair removal and skin treatments, radiofrequency equipment for skin tightening, ultrasound devices for body contouring, injection systems for dermal fillers and neurotoxins, and advanced imaging systems for treatment planning. These technologies serve both medical practitioners and specialized aesthetic clinics, providing safe and effective solutions for patients seeking cosmetic improvements.

Market scope extends beyond device manufacturing to include service provision, training programs, maintenance contracts, and consumable supplies. The sector operates within strict regulatory frameworks established by the Medicines and Healthcare products Regulatory Agency (MHRA) and follows European CE marking requirements, ensuring high safety and efficacy standards for all marketed devices.

Strategic analysis reveals the United Kingdom medical aesthetic devices market as a high-growth sector characterized by technological innovation, expanding consumer acceptance, and increasing investment in advanced treatment modalities. The market demonstrates strong fundamentals with diverse application areas, robust regulatory support, and growing integration with digital health technologies.

Key market drivers include rising disposable income, changing beauty standards, social media influence, and technological advancements that have made aesthetic procedures more accessible and effective. The market benefits from demographic trends showing increased interest across age groups, with 42% of procedures now performed on patients under 35 years old, representing a significant shift from historical patterns.

Competitive landscape features established international manufacturers alongside emerging technology companies, creating a dynamic environment for innovation and market expansion. The sector has attracted significant investment, with venture capital funding increasing by 156% over the past three years, indicating strong investor confidence in market potential.

Future prospects remain highly positive, supported by continuous technological advancement, expanding treatment applications, and growing consumer sophistication. The integration of artificial intelligence, personalized treatment protocols, and enhanced safety features positions the market for sustained long-term growth.

Market intelligence reveals several critical insights that define the current state and future trajectory of the United Kingdom medical aesthetic devices sector:

Primary growth drivers propelling the United Kingdom medical aesthetic devices market include multifaceted factors that create sustained demand and market expansion opportunities. These drivers reflect both technological advancement and evolving consumer preferences that support long-term market growth.

Consumer awareness has increased dramatically through social media exposure, celebrity endorsements, and mainstream media coverage of aesthetic procedures. This heightened awareness has normalized aesthetic treatments and reduced stigma associated with cosmetic enhancement, leading to broader market acceptance across demographic segments.

Technological advancement continues driving market growth through improved treatment efficacy, reduced downtime, and enhanced safety profiles. Modern devices offer precision targeting, customizable treatment parameters, and integrated safety systems that appeal to both practitioners and patients seeking optimal outcomes.

Economic factors support market expansion, including rising disposable income levels, increased spending on personal care and wellness, and growing investment in appearance enhancement. The UK’s strong economy and high employment rates provide favorable conditions for discretionary spending on aesthetic procedures.

Demographic trends contribute significantly to market growth, with aging population seeking anti-aging solutions and younger demographics embracing preventive treatments. The convergence of these age groups creates a broad and sustainable customer base for aesthetic device applications.

Market challenges present certain limitations that may impact growth trajectory and market development within the United Kingdom medical aesthetic devices sector. Understanding these restraints enables stakeholders to develop appropriate strategies for market navigation and risk mitigation.

Regulatory complexity poses ongoing challenges as device manufacturers and practitioners must navigate evolving safety requirements, certification processes, and compliance obligations. The post-Brexit regulatory landscape adds additional complexity requiring careful attention to changing requirements and standards.

High capital costs associated with advanced medical aesthetic devices create barriers for smaller clinics and independent practitioners seeking to upgrade equipment or expand service offerings. Initial investment requirements and ongoing maintenance costs can limit market accessibility for some potential participants.

Safety concerns and adverse event reporting continue influencing market perception and regulatory oversight. High-profile complications or safety issues can impact consumer confidence and lead to increased regulatory scrutiny affecting market dynamics.

Economic sensitivity affects market performance during economic downturns when consumers may reduce discretionary spending on aesthetic procedures. Market demand can fluctuate based on broader economic conditions and consumer confidence levels.

Competition intensity creates pricing pressure and margin compression as numerous manufacturers compete for market share. This competitive environment can limit profitability and require significant investment in differentiation and innovation.

Emerging opportunities within the United Kingdom medical aesthetic devices market present significant potential for growth, innovation, and market expansion. These opportunities reflect evolving consumer needs, technological capabilities, and market dynamics that create value creation possibilities.

Technology convergence offers substantial opportunities through integration of artificial intelligence, machine learning, and advanced imaging systems that enable personalized treatment protocols and improved outcomes. These technological advances can differentiate products and create competitive advantages.

Market expansion opportunities exist in underserved geographic regions and demographic segments where aesthetic device adoption remains limited. Regional expansion strategies and targeted marketing approaches can unlock significant growth potential.

Service integration presents opportunities for comprehensive aesthetic solutions combining devices, consumables, training, and ongoing support services. This integrated approach can create recurring revenue streams and strengthen customer relationships.

Digital health integration offers opportunities for telemedicine consultation, remote monitoring, and digital treatment planning that enhance patient experience and operational efficiency. The COVID-19 pandemic has accelerated adoption of digital health solutions creating new market possibilities.

Preventive aesthetics represents a growing opportunity as younger consumers seek early intervention treatments to prevent aging signs. This trend expands the addressable market and creates opportunities for new treatment protocols and device applications.

Market dynamics within the United Kingdom medical aesthetic devices sector reflect complex interactions between technological innovation, regulatory evolution, competitive pressures, and changing consumer preferences. These dynamics shape market structure and influence strategic decision-making across the value chain.

Supply chain dynamics have evolved significantly, with manufacturers focusing on direct distribution relationships and enhanced service capabilities. The shift toward comprehensive solution provision rather than simple device sales has transformed business models and customer engagement approaches.

Competitive dynamics show increasing consolidation among device manufacturers while new entrants continue introducing innovative technologies. This dual trend creates both opportunities and challenges for market participants seeking sustainable competitive positioning.

Regulatory dynamics continue evolving with enhanced safety requirements, post-market surveillance obligations, and increased scrutiny of marketing claims. According to MarkWide Research analysis, regulatory compliance costs have increased by 34% over the past two years, impacting operational strategies.

Customer dynamics reflect growing sophistication and higher expectations for treatment outcomes, safety, and overall experience. Patients increasingly research procedures extensively and seek practitioners with advanced technology and proven expertise.

Innovation dynamics drive continuous product development and technological advancement, with manufacturers investing heavily in research and development to maintain competitive positioning and meet evolving market needs.

Research approach for analyzing the United Kingdom medical aesthetic devices market employs comprehensive methodological frameworks combining primary research, secondary analysis, and expert consultation to ensure accurate and reliable market intelligence.

Primary research includes structured interviews with key market participants including device manufacturers, distributors, aesthetic practitioners, and industry experts. Survey methodologies capture quantitative data on market trends, adoption patterns, and future expectations across diverse stakeholder groups.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, trade publications, and academic research to provide comprehensive market context and historical perspective. This approach ensures thorough coverage of market dynamics and competitive landscape.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability of market insights. Triangulation methodologies confirm findings across different data sources and research approaches.

Market modeling employs sophisticated analytical techniques including regression analysis, scenario planning, and forecasting models to project future market trends and growth trajectories. These models incorporate multiple variables and assumptions to provide robust market projections.

Quality assurance protocols ensure research integrity through peer review processes, methodology validation, and continuous improvement of research practices. Regular updates and revisions maintain currency and relevance of market intelligence.

Geographic distribution of the United Kingdom medical aesthetic devices market shows distinct regional patterns reflecting population density, economic conditions, and healthcare infrastructure development. Understanding these regional dynamics provides crucial insights for market strategy and investment decisions.

London and Southeast England dominate market activity, accounting for approximately 45% of total market share due to high population density, elevated income levels, and concentration of aesthetic clinics. This region benefits from international connectivity, medical tourism, and access to cutting-edge technologies and training programs.

Northwest England represents the second-largest regional market, centered around Manchester and Liverpool, with strong growth in aesthetic device adoption. The region shows 12% annual growth in device installations, reflecting expanding consumer acceptance and increasing clinic density.

Scotland demonstrates robust market development, particularly in Edinburgh and Glasgow, with growing investment in advanced aesthetic technologies. Scottish market characteristics include strong regulatory compliance culture and emphasis on practitioner training and certification.

Wales and Northern Ireland show emerging market potential with increasing aesthetic clinic establishment and device adoption. These regions benefit from lower operational costs while maintaining access to advanced technologies and training resources.

Regional trends indicate convergence in treatment availability and technology access, with advanced devices becoming increasingly available outside traditional metropolitan centers. This geographic expansion creates new opportunities for market growth and service provision.

Market competition within the United Kingdom medical aesthetic devices sector features diverse participants ranging from established multinational corporations to innovative technology startups. This competitive environment drives innovation, service enhancement, and market expansion.

Leading market participants include:

Competitive strategies focus on technological differentiation, comprehensive service provision, practitioner training programs, and strategic partnerships with key opinion leaders. Market leaders invest heavily in research and development to maintain technological advantages and market positioning.

Market consolidation trends show increasing merger and acquisition activity as companies seek to expand product portfolios, geographic reach, and market share. This consolidation creates opportunities for enhanced service provision and operational efficiency.

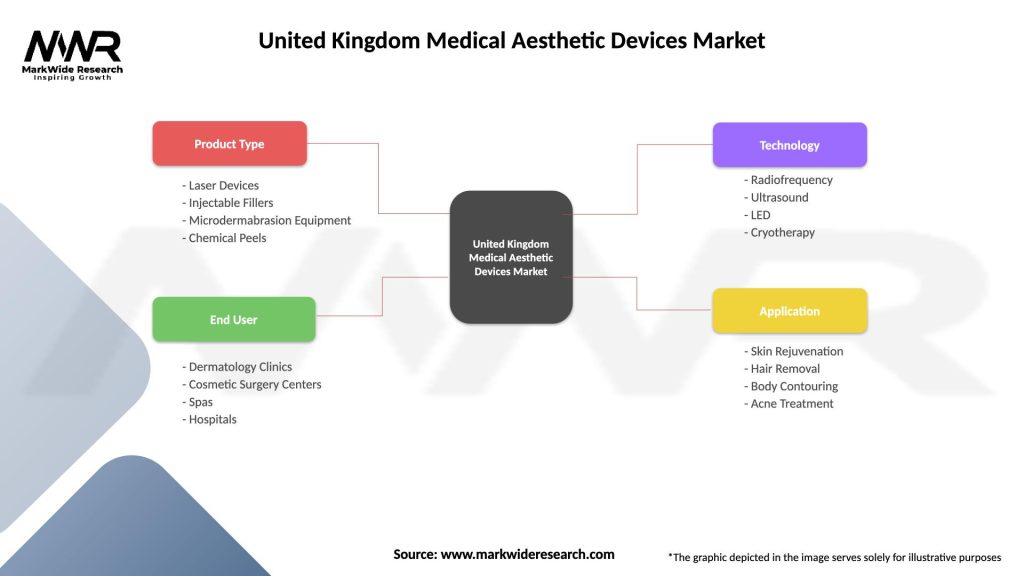

Market segmentation analysis reveals distinct categories within the United Kingdom medical aesthetic devices market, each characterized by specific technologies, applications, and growth dynamics. Understanding these segments enables targeted strategies and market positioning.

By Technology:

By Application:

By End User:

Laser systems represent the largest market segment, driven by versatility, proven efficacy, and broad application range. Advanced laser technologies including picosecond lasers and fractional systems continue gaining market share through superior treatment outcomes and reduced recovery times.

Radiofrequency devices show strong growth momentum, particularly in skin tightening and body contouring applications. These systems appeal to practitioners and patients seeking non-invasive alternatives to surgical procedures with minimal downtime requirements.

Injectable delivery systems benefit from growing demand for dermal fillers and neurotoxin treatments. Advanced injection technologies offering improved precision, comfort, and safety drive adoption among aesthetic practitioners seeking enhanced treatment capabilities.

Ultrasound technologies demonstrate significant potential in non-invasive lifting and tightening applications. High-intensity focused ultrasound systems gain acceptance for their ability to achieve surgical-like results without invasive procedures.

Combination platforms increasingly popular among practitioners seeking versatile systems capable of multiple treatment modalities. These integrated solutions offer operational efficiency and expanded service capabilities within single device investments.

Emerging technologies including cryolipolysis, electromagnetic muscle stimulation, and advanced imaging systems create new market opportunities and treatment possibilities. Innovation in these areas drives market expansion and competitive differentiation.

Device manufacturers benefit from robust market demand, technological advancement opportunities, and expanding application areas that support revenue growth and market expansion. The UK market provides access to sophisticated healthcare infrastructure and regulatory frameworks that facilitate product development and commercialization.

Healthcare practitioners gain access to advanced technologies that enhance treatment capabilities, improve patient outcomes, and expand service offerings. Modern aesthetic devices enable practitioners to provide comprehensive treatment solutions while maintaining high safety and efficacy standards.

Patients and consumers benefit from improved treatment options, enhanced safety profiles, and better outcomes through advanced device technologies. The competitive market environment drives innovation and service quality improvements that directly benefit end users.

Investors and stakeholders participate in a high-growth market with strong fundamentals, technological innovation, and expanding consumer acceptance. The sector offers attractive investment opportunities across device manufacturing, service provision, and technology development.

Regulatory bodies benefit from industry collaboration in developing appropriate safety standards, post-market surveillance systems, and practitioner training requirements that protect public health while enabling innovation.

Healthcare systems gain from reduced burden on surgical services as non-invasive alternatives become more effective and widely available. This shift supports healthcare efficiency and resource optimization while meeting patient demand for aesthetic treatments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological convergence represents a dominant trend with devices increasingly incorporating multiple treatment modalities within single platforms. This convergence enables practitioners to offer comprehensive treatment solutions while optimizing capital investment and operational efficiency.

Personalization and customization drive development of advanced treatment protocols tailored to individual patient characteristics and desired outcomes. AI-powered treatment planning and personalized parameter selection enhance treatment efficacy and patient satisfaction.

Minimally invasive focus continues shaping market development as consumers seek effective treatments with minimal downtime and reduced risk profiles. This trend drives innovation in non-invasive and minimally invasive device technologies.

Digital integration accelerates across the market with telemedicine consultation, digital treatment planning, and remote monitoring capabilities becoming standard features. MWR data indicates 67% of clinics now utilize digital consultation platforms for initial patient assessments.

Sustainability considerations increasingly influence device selection and operational practices as environmental consciousness grows among consumers and practitioners. Energy-efficient devices and sustainable operational practices gain importance in purchasing decisions.

Male market expansion represents significant growth opportunity with increasing acceptance of aesthetic procedures among male demographics. Specialized marketing approaches and treatment protocols target this expanding market segment.

Preventive aesthetics gain momentum as younger consumers seek early intervention treatments to prevent aging signs. This trend expands the addressable market and creates opportunities for new treatment protocols and device applications.

Recent developments within the United Kingdom medical aesthetic devices market reflect ongoing innovation, regulatory evolution, and market expansion activities that shape industry trajectory and competitive dynamics.

Regulatory updates include enhanced post-market surveillance requirements, updated safety standards, and revised practitioner training obligations that strengthen market oversight and consumer protection. These developments support long-term market credibility and sustainable growth.

Technology launches feature advanced laser systems with improved precision and safety profiles, next-generation radiofrequency devices with enhanced efficacy, and innovative combination platforms offering multiple treatment modalities within single systems.

Market consolidation activities include strategic acquisitions, partnerships, and joint ventures that reshape competitive landscape and create opportunities for enhanced service provision and market reach expansion.

Investment activities show continued strong interest from venture capital and private equity investors in aesthetic device companies, particularly those developing innovative technologies and comprehensive service solutions.

Training and education initiatives expand with new certification programs, advanced training courses, and continuing education requirements that enhance practitioner competency and treatment quality standards.

Digital transformation accelerates with implementation of practice management systems, digital consultation platforms, and AI-powered treatment planning tools that enhance operational efficiency and patient experience.

Strategic recommendations for market participants focus on positioning for sustainable growth while navigating competitive pressures and regulatory requirements. These suggestions reflect comprehensive market analysis and industry expertise.

Technology investment should prioritize platforms offering multiple treatment modalities, advanced safety features, and integration capabilities with digital health systems. Manufacturers should focus on developing comprehensive solutions rather than single-purpose devices.

Market expansion strategies should target underserved geographic regions and demographic segments while maintaining focus on quality and safety standards. Regional expansion requires careful attention to local market dynamics and regulatory requirements.

Service differentiation becomes increasingly important as device capabilities converge. Companies should develop comprehensive service offerings including training, support, consumables, and ongoing education to create competitive advantages and customer loyalty.

Regulatory compliance requires proactive approach to evolving requirements and enhanced post-market surveillance obligations. Investment in compliance infrastructure and quality systems supports long-term market participation and risk mitigation.

Digital integration should be prioritized to meet evolving customer expectations and operational efficiency requirements. Investment in digital capabilities enhances competitive positioning and supports future market trends.

Partnership strategies can accelerate market access, technology development, and service provision capabilities. Strategic alliances with key opinion leaders, training organizations, and technology partners create synergistic opportunities.

Long-term prospects for the United Kingdom medical aesthetic devices market remain highly positive, supported by favorable demographic trends, technological advancement, and growing consumer acceptance of aesthetic procedures. The market is positioned for sustained growth across multiple dimensions.

Growth projections indicate continued market expansion with compound annual growth rates expected to maintain strong momentum through the forecast period. According to MarkWide Research analysis, the market will benefit from technological innovation, expanding applications, and demographic trends supporting increased procedure adoption.

Technology evolution will drive market transformation through AI integration, personalized treatment protocols, and enhanced safety systems. These advances will expand treatment capabilities while improving outcomes and patient satisfaction levels.

Market maturation will bring increased standardization, enhanced training requirements, and improved quality standards that strengthen overall market credibility and consumer confidence. This maturation supports sustainable long-term growth and market stability.

Demographic trends including aging population and growing acceptance among younger consumers create expanding addressable market and diverse growth opportunities. The convergence of preventive and corrective aesthetic treatments broadens market potential.

Innovation pipeline promises continued technological advancement with new treatment modalities, improved device capabilities, and enhanced integration with digital health systems. These innovations will drive market expansion and competitive differentiation.

Regulatory evolution will continue enhancing safety standards and market oversight while supporting innovation and market development. Balanced regulatory approaches will facilitate continued growth while protecting consumer interests.

The United Kingdom medical aesthetic devices market represents a dynamic and rapidly evolving sector with strong growth fundamentals, technological innovation, and expanding consumer acceptance. Market analysis reveals robust demand drivers, favorable demographic trends, and continuous technological advancement that support sustained long-term growth.

Key success factors include technological differentiation, comprehensive service provision, regulatory compliance, and strategic market positioning. Companies that invest in innovation, quality, and customer relationships will be best positioned to capitalize on market opportunities and achieve sustainable competitive advantages.

Market challenges including regulatory complexity, competitive pressure, and economic sensitivity require careful navigation and strategic planning. However, the underlying market fundamentals remain strong with growing consumer demand, technological capability, and expanding application areas supporting continued market development.

Future outlook remains highly positive with multiple growth drivers converging to create sustained market expansion opportunities. The integration of advanced technologies, expanding demographic acceptance, and evolving treatment capabilities position the United Kingdom medical aesthetic devices market for continued success and innovation leadership in the global aesthetic device industry.

What is Medical Aesthetic Devices?

Medical Aesthetic Devices refer to equipment and tools used in non-surgical cosmetic procedures aimed at enhancing physical appearance. These devices include lasers, injectables, and skin rejuvenation technologies, among others.

What are the key players in the United Kingdom Medical Aesthetic Devices Market?

Key players in the United Kingdom Medical Aesthetic Devices Market include Allergan, Merz Pharmaceuticals, and Galderma, which are known for their innovative products in the aesthetic field, among others.

What are the growth factors driving the United Kingdom Medical Aesthetic Devices Market?

The growth of the United Kingdom Medical Aesthetic Devices Market is driven by increasing consumer demand for non-invasive procedures, advancements in technology, and a growing awareness of aesthetic treatments among the population.

What challenges does the United Kingdom Medical Aesthetic Devices Market face?

Challenges in the United Kingdom Medical Aesthetic Devices Market include regulatory hurdles, the need for skilled practitioners, and potential safety concerns associated with certain procedures and devices.

What opportunities exist in the United Kingdom Medical Aesthetic Devices Market?

Opportunities in the United Kingdom Medical Aesthetic Devices Market include the expansion of product offerings, increasing adoption of advanced technologies, and the rising trend of personalized aesthetic treatments tailored to individual needs.

What trends are shaping the United Kingdom Medical Aesthetic Devices Market?

Trends in the United Kingdom Medical Aesthetic Devices Market include the growing popularity of minimally invasive procedures, the integration of artificial intelligence in treatment planning, and an increasing focus on sustainability in product development.

United Kingdom Medical Aesthetic Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Laser Devices, Injectable Fillers, Microdermabrasion Equipment, Chemical Peels |

| End User | Dermatology Clinics, Cosmetic Surgery Centers, Spas, Hospitals |

| Technology | Radiofrequency, Ultrasound, LED, Cryotherapy |

| Application | Skin Rejuvenation, Hair Removal, Body Contouring, Acne Treatment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Medical Aesthetic Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at