444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Liquefied Natural Gas (LNG) bunkering is a rapidly growing segment within the United Kingdom’s energy market. As the shipping industry shifts towards cleaner and more sustainable fuel alternatives, LNG has emerged as a viable option due to its lower greenhouse gas emissions and compliance with stringent environmental regulations. LNG bunkering involves the transfer of liquefied natural gas from a supply vessel to a receiving vessel, which could be a cargo ship, ferry, or any other marine vessel. The United Kingdom LNG bunkering market has witnessed significant expansion in recent years, driven by increasing demand for eco-friendly marine fuels and the country’s efforts to reduce carbon emissions from the maritime sector.

Meaning

LNG bunkering refers to the process of supplying liquefied natural gas as fuel to marine vessels for propulsion and auxiliary power systems. It is a cleaner alternative to conventional marine fuels such as heavy fuel oil and marine diesel, as it produces lower emissions of sulfur dioxide (SOx), nitrogen oxides (NOx), and particulate matter. The bunkering process involves specialized infrastructure and vessels to handle the transfer of LNG safely and efficiently. This sustainable fuel solution is gaining traction as shipping companies seek to comply with international emissions regulations and reduce their environmental impact.

Executive Summary

The United Kingdom LNG bunkering market has experienced substantial growth in recent years, owing to the rising awareness of environmental sustainability and the shift towards greener marine fuels. This report provides a comprehensive analysis of the market dynamics, key trends, drivers, restraints, and opportunities influencing the industry’s growth. It also includes a detailed regional analysis, competitive landscape, and segmentation of the market. Additionally, the report evaluates the impact of the COVID-19 pandemic on the market and offers future outlooks and analyst suggestions to assist industry participants and stakeholders in making informed decisions.

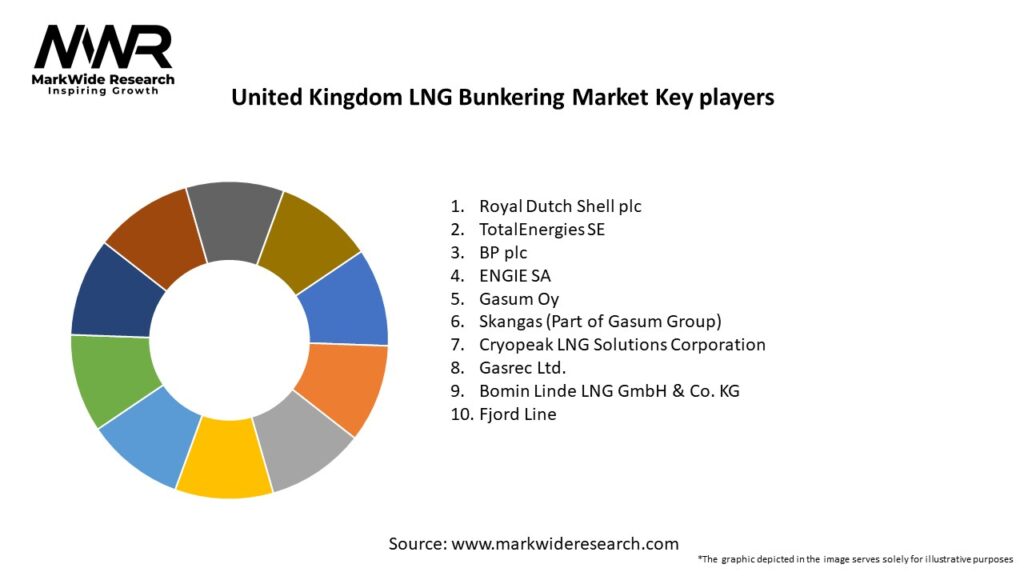

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United Kingdom LNG bunkering market is influenced by a combination of factors, including regulatory developments, technological advancements, and shifting consumer preferences. As the market continues to evolve, stakeholders need to adapt and innovate to remain competitive and meet the growing demand for cleaner marine fuels.

Regional Analysis

The regional analysis of the United Kingdom LNG bunkering market highlights the demand, supply, and growth trends in different regions across the country. The analysis assesses key port cities, marine traffic, infrastructure development, and government initiatives influencing the adoption of LNG bunkering.

Competitive Landscape

Leading Companies in the United Kingdom LNG Bunkering Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

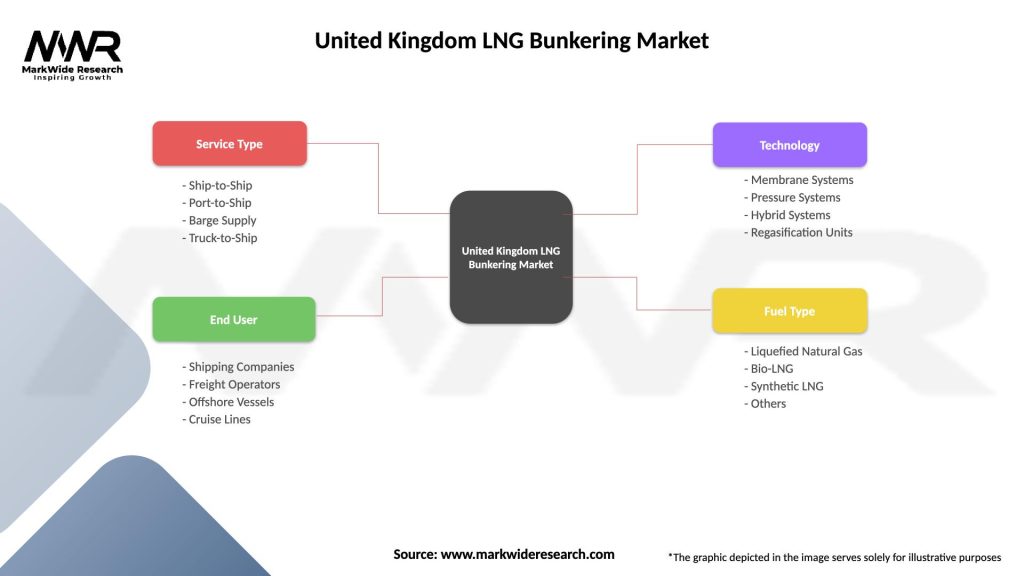

Segmentation

The market segmentation categorizes the United Kingdom LNG bunkering market based on factors such as type of vessel, bunkering method, end-user, and geographical location. This segmentation provides valuable insights into specific market segments and their growth prospects.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had both short-term and long-term impacts on the United Kingdom LNG bunkering market. The disruption in global trade and shipping activities during the pandemic influenced the demand for marine fuels, including LNG bunkering. However, the pandemic also highlighted the importance of sustainable and resilient shipping practices, which could drive further interest in LNG bunkering in the post-pandemic period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the United Kingdom LNG bunkering market appears promising, driven by the growing focus on environmental sustainability and the push towards greener shipping practices. The market is expected to witness continued expansion of LNG bunkering infrastructure and an increasing number of LNG-powered vessels operating within UK waters.

Conclusion

The United Kingdom LNG bunkering market is at the forefront of the maritime industry’s transition towards sustainable and eco-friendly practices. The market’s growth is underpinned by stringent environmental regulations, the adoption of cleaner marine fuels, and investments in LNG bunkering infrastructure. As the demand for LNG bunkering services continues to rise, stakeholders should seize the opportunities presented by this burgeoning market and collaborate to drive a greener and more sustainable future for the UK’s maritime sector.

What is LNG Bunkering?

LNG Bunkering refers to the process of supplying liquefied natural gas (LNG) as fuel to ships and vessels. This method is gaining traction due to its environmental benefits and compliance with international emissions regulations.

What are the key players in the United Kingdom LNG Bunkering Market?

Key players in the United Kingdom LNG Bunkering Market include companies like Shell, TotalEnergies, and Gasum, which are actively involved in developing LNG infrastructure and services, among others.

What are the growth factors driving the United Kingdom LNG Bunkering Market?

The growth of the United Kingdom LNG Bunkering Market is driven by increasing demand for cleaner marine fuels, stringent emissions regulations, and the expansion of LNG infrastructure in ports.

What challenges does the United Kingdom LNG Bunkering Market face?

Challenges in the United Kingdom LNG Bunkering Market include high initial investment costs for infrastructure, regulatory hurdles, and competition from alternative fuels such as hydrogen and ammonia.

What opportunities exist in the United Kingdom LNG Bunkering Market?

Opportunities in the United Kingdom LNG Bunkering Market include the potential for technological advancements in LNG fueling systems, partnerships for infrastructure development, and increasing adoption of LNG by shipping companies.

What trends are shaping the United Kingdom LNG Bunkering Market?

Trends in the United Kingdom LNG Bunkering Market include the growing focus on sustainability, the development of small-scale LNG terminals, and the integration of digital technologies for efficient operations.

United Kingdom LNG Bunkering Market

| Segmentation Details | Description |

|---|---|

| Service Type | Ship-to-Ship, Port-to-Ship, Barge Supply, Truck-to-Ship |

| End User | Shipping Companies, Freight Operators, Offshore Vessels, Cruise Lines |

| Technology | Membrane Systems, Pressure Systems, Hybrid Systems, Regasification Units |

| Fuel Type | Liquefied Natural Gas, Bio-LNG, Synthetic LNG, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United Kingdom LNG Bunkering Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at