444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom HVAC market represents a dynamic and evolving sector that encompasses heating, ventilation, and air conditioning systems across residential, commercial, and industrial applications. Market dynamics in the UK are significantly influenced by stringent energy efficiency regulations, growing environmental consciousness, and the government’s commitment to achieving net-zero carbon emissions by 2050. The sector has experienced robust growth driven by increasing demand for energy-efficient solutions and smart building technologies.

Regional variations across England, Scotland, Wales, and Northern Ireland create diverse market opportunities, with London and the Southeast leading in commercial HVAC installations while northern regions focus heavily on residential heating solutions. The market demonstrates strong resilience despite economic uncertainties, with growth rates consistently outpacing many European counterparts at approximately 6.2% CAGR over recent years.

Technology adoption has accelerated significantly, particularly in smart HVAC systems and heat pump technologies, which now account for approximately 35% of new installations. The integration of Internet of Things (IoT) capabilities and artificial intelligence in HVAC systems has transformed the landscape, enabling predictive maintenance and optimized energy consumption patterns that appeal to both cost-conscious consumers and environmentally aware businesses.

The United Kingdom HVAC market refers to the comprehensive ecosystem of heating, ventilation, and air conditioning systems, services, and technologies operating within the UK’s diverse climate and regulatory environment. This market encompasses the design, manufacturing, installation, maintenance, and replacement of climate control systems across all building types and applications throughout England, Scotland, Wales, and Northern Ireland.

HVAC systems in the UK context include traditional gas boilers, modern heat pumps, advanced ventilation systems, smart thermostats, and integrated building management systems. The market extends beyond equipment to include professional services such as system design, installation, commissioning, maintenance, and energy optimization consulting that ensures compliance with UK building regulations and energy efficiency standards.

Market participants range from global manufacturers and distributors to local installation contractors and maintenance service providers, creating a complex value chain that serves diverse customer segments from individual homeowners to large commercial enterprises and public sector organizations seeking sustainable climate control solutions.

Strategic positioning of the UK HVAC market reflects a mature yet rapidly transforming industry driven by regulatory pressures, technological innovation, and changing consumer preferences toward sustainable solutions. The market demonstrates exceptional resilience with consistent growth patterns supported by government incentives for energy-efficient installations and the ongoing replacement cycle of aging HVAC infrastructure.

Key growth drivers include the UK’s ambitious climate targets, increasing awareness of indoor air quality, and the rapid adoption of smart building technologies. Heat pump installations have shown particularly strong momentum, with adoption rates increasing by approximately 42% annually as consumers and businesses seek alternatives to traditional gas heating systems.

Market segmentation reveals distinct opportunities across residential retrofits, new construction projects, and commercial building upgrades. The commercial sector leads in terms of system complexity and value, while the residential segment drives volume growth through replacement demand and new housing developments. Industrial applications, though smaller in volume, contribute significantly to overall market value through specialized system requirements.

Competitive dynamics feature a mix of established international players and innovative domestic companies, with increasing emphasis on service capabilities, digital integration, and sustainable technology offerings that align with UK environmental objectives and building performance standards.

Primary market insights reveal several critical trends shaping the UK HVAC landscape:

Market maturity varies significantly by segment, with traditional heating systems showing stable replacement demand while emerging technologies like air source heat pumps and smart controls experience rapid growth phases driven by both regulatory requirements and consumer preference shifts toward sustainable solutions.

Government initiatives serve as the primary catalyst for UK HVAC market expansion, with comprehensive policy frameworks supporting energy efficiency improvements and carbon emission reductions. The Green Homes Grant and similar programs provide financial incentives for homeowners to upgrade heating systems, while commercial building regulations mandate improved energy performance standards that drive HVAC system modernization.

Climate considerations unique to the UK create specific demand patterns for HVAC solutions capable of handling variable weather conditions and seasonal temperature fluctuations. The increasing frequency of extreme weather events has heightened awareness of indoor climate control importance, driving demand for more robust and efficient systems across all building types.

Energy cost pressures motivate consumers and businesses to invest in high-efficiency HVAC systems that reduce operational expenses over time. Rising energy prices have accelerated payback calculations for premium efficiency equipment, making advanced heat pump systems and smart controls increasingly attractive investment options for cost-conscious building owners.

Technology advancement continues to expand market opportunities through improved system performance, enhanced user interfaces, and integration capabilities that appeal to tech-savvy consumers and facility managers seeking optimized building operations. The convergence of HVAC systems with building automation and energy management platforms creates new value propositions for comprehensive climate control solutions.

High initial costs associated with advanced HVAC systems, particularly heat pumps and smart building technologies, create barriers for price-sensitive consumers and small businesses operating with limited capital budgets. The significant upfront investment required for system replacement or major upgrades can delay purchasing decisions despite long-term operational benefits.

Skills shortage in the HVAC installation and maintenance workforce constrains market growth potential, particularly for emerging technologies requiring specialized training and certification. The complexity of modern systems demands higher skill levels, while traditional training programs struggle to keep pace with rapid technological advancement and evolving installation requirements.

Infrastructure limitations in older buildings present technical challenges for HVAC system upgrades, requiring costly modifications to electrical systems, structural elements, and distribution networks. These complications increase project complexity and costs, potentially discouraging building owners from pursuing comprehensive system modernization initiatives.

Regulatory complexity creates uncertainty for market participants navigating evolving building codes, energy efficiency standards, and environmental regulations. Frequent policy changes and varying regional requirements increase compliance costs and complicate product development strategies for manufacturers and service providers operating across multiple UK markets.

Retrofit market potential represents the largest growth opportunity within the UK HVAC sector, with millions of existing buildings requiring system upgrades to meet current energy efficiency standards and future regulatory requirements. This segment offers substantial revenue potential for companies capable of providing comprehensive retrofit solutions that address both performance and compliance objectives.

Smart technology integration creates new business models and revenue streams through connected HVAC systems that enable remote monitoring, predictive maintenance, and energy optimization services. The growing acceptance of subscription-based service models opens opportunities for recurring revenue generation beyond traditional equipment sales and basic maintenance contracts.

Heat pump market expansion offers significant growth potential as government policies and environmental concerns drive adoption across residential and commercial sectors. Companies investing in heat pump technology, installation capabilities, and supporting infrastructure are well-positioned to capture market share in this rapidly expanding segment showing strong growth momentum.

Commercial sector modernization presents opportunities for large-scale HVAC projects as businesses upgrade facilities to improve energy efficiency, enhance indoor air quality, and comply with evolving workplace standards. The post-pandemic focus on building health and safety creates additional demand for advanced ventilation and air purification systems.

Supply chain evolution within the UK HVAC market reflects broader industry trends toward localization and sustainability, with manufacturers increasingly establishing domestic production capabilities and service networks. MarkWide Research analysis indicates that supply chain resilience has become a critical competitive factor, particularly following recent global disruptions that highlighted dependency risks on international suppliers.

Competitive intensity varies across market segments, with established players dominating traditional heating systems while emerging technology segments attract new entrants and innovative business models. The market demonstrates healthy competition that drives continuous improvement in product performance, service quality, and customer value propositions.

Customer behavior patterns show increasing sophistication in HVAC system selection, with buyers conducting extensive research and seeking comprehensive solutions that address multiple building performance objectives. This trend favors companies offering integrated systems and comprehensive service capabilities over those focused solely on individual product sales.

Regulatory influence continues to shape market dynamics through evolving standards that favor high-efficiency systems and sustainable technologies. The regulatory environment creates both challenges and opportunities, requiring market participants to maintain flexibility while investing in compliance capabilities and future-ready product portfolios.

Comprehensive analysis of the UK HVAC market employs multiple research methodologies to ensure accurate and reliable insights into market trends, competitive dynamics, and growth opportunities. Primary research activities include extensive interviews with industry executives, technical specialists, and key stakeholders across the HVAC value chain from manufacturers to end users.

Secondary research incorporates analysis of government publications, industry reports, regulatory documents, and company financial statements to validate primary findings and provide comprehensive market context. Trade association data, building permit statistics, and energy consumption patterns contribute to quantitative market assessments and trend identification.

Market modeling techniques combine historical performance data with forward-looking indicators to develop growth projections and market size estimates across different segments and regions. Statistical analysis methods ensure data accuracy while scenario planning approaches account for potential market disruptions and policy changes.

Expert validation processes involve review and verification of research findings by industry professionals, academic researchers, and regulatory specialists to ensure accuracy and relevance of market insights and recommendations for stakeholders seeking strategic guidance in the UK HVAC market.

London and Southeast England dominate the UK HVAC market, accounting for approximately 38% of total market activity driven by high construction volumes, commercial development projects, and affluent residential markets with strong demand for premium HVAC solutions. The region’s focus on smart building technologies and sustainable construction practices creates opportunities for advanced system integration and energy management solutions.

Northern England represents a significant market segment characterized by industrial applications and residential heating system replacements, with particular strength in manufacturing facilities and commercial buildings requiring specialized climate control solutions. The region’s emphasis on energy efficiency improvements and building modernization drives steady demand for HVAC upgrades and replacements.

Scotland’s market dynamics reflect unique climate requirements and regulatory frameworks that favor high-efficiency heating systems and renewable energy integration. The Scottish government’s ambitious environmental targets create strong demand for heat pump systems and energy-efficient HVAC solutions across residential and commercial sectors, representing approximately 12% of UK market share.

Wales and Northern Ireland contribute specialized market segments with distinct characteristics shaped by local regulations, climate conditions, and economic factors. These regions show growing adoption of sustainable HVAC technologies while maintaining strong demand for traditional heating systems in rural and remote areas where infrastructure limitations influence technology choices.

Market leadership in the UK HVAC sector features a diverse mix of international corporations and specialized domestic companies competing across different market segments and geographic regions:

Competitive strategies increasingly emphasize service capabilities, digital integration, and sustainable technology offerings that align with UK market requirements and customer preferences for comprehensive building performance solutions.

By Product Type:

By Application:

By Technology:

Heating Systems Category represents the largest segment within the UK HVAC market, driven by the country’s climate requirements and extensive existing building stock requiring heating solutions. Heat pump adoption shows particularly strong growth with installation rates increasing approximately 28% annually as consumers and businesses seek alternatives to traditional gas heating systems.

Ventilation Systems have gained significant importance following increased awareness of indoor air quality and health considerations. The segment benefits from regulatory requirements for improved ventilation in commercial buildings and growing consumer demand for mechanical ventilation with heat recovery (MVHR) systems in residential applications.

Air Conditioning Market continues expanding despite the UK’s moderate climate, driven by commercial building requirements, increasing summer temperatures, and changing comfort expectations. Variable refrigerant flow (VRF) systems dominate commercial applications while residential demand grows for efficient cooling solutions.

Controls and Automation represents the fastest-growing category, with smart thermostats and building management systems experiencing rapid adoption across all market segments. The integration of artificial intelligence and machine learning capabilities creates new opportunities for energy optimization and predictive maintenance services.

Manufacturers benefit from strong market demand driven by regulatory requirements and replacement cycles, creating stable revenue streams and opportunities for premium product positioning. The emphasis on energy efficiency and smart technologies enables value-added offerings that command higher margins while supporting long-term customer relationships through service and support contracts.

Installation Contractors experience expanding business opportunities through increasing system complexity and service requirements that favor professional expertise over DIY approaches. The growing emphasis on system commissioning, maintenance, and optimization creates recurring revenue opportunities while specialized skills in emerging technologies command premium pricing.

Building Owners realize significant benefits through improved energy efficiency, reduced operational costs, and enhanced building performance that supports property values and tenant satisfaction. Modern HVAC systems provide better indoor environmental quality while meeting regulatory compliance requirements and supporting sustainability objectives.

End Users enjoy enhanced comfort, improved indoor air quality, and reduced energy costs through advanced HVAC technologies that provide precise climate control and intelligent operation. Smart system capabilities enable remote monitoring and control while predictive maintenance reduces unexpected failures and service disruptions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification trend dominates the UK HVAC market as building owners transition away from gas heating systems toward electric heat pumps and other renewable technologies. This shift reflects government policies targeting carbon emission reductions and growing consumer awareness of environmental impact, with heat pump installations showing exceptional growth rates across all building types.

Smart building integration transforms HVAC systems from standalone equipment into connected components of comprehensive building management platforms. The trend toward intelligent buildings drives demand for HVAC systems with advanced sensors, connectivity features, and integration capabilities that enable optimized building performance and energy management.

Indoor air quality focus has intensified following health concerns and regulatory developments that emphasize ventilation system performance and air purification capabilities. MWR analysis indicates that approximately 67% of commercial building upgrades now include enhanced ventilation systems designed to improve indoor environmental quality and occupant health outcomes.

Service-centric business models gain traction as HVAC companies expand beyond equipment sales to offer comprehensive service packages including maintenance, monitoring, and performance optimization. This trend creates recurring revenue opportunities while providing customers with predictable costs and improved system reliability through professional management services.

Government policy initiatives continue shaping the UK HVAC market through programs like the Boiler Upgrade Scheme and enhanced building regulations that mandate improved energy performance standards. These developments create market opportunities for high-efficiency systems while establishing clear direction for industry investment and product development strategies.

Technology partnerships between HVAC manufacturers and technology companies accelerate the development of smart building solutions and IoT-enabled systems. Recent collaborations focus on artificial intelligence integration, predictive analytics, and cloud-based management platforms that enhance system performance and user experience.

Manufacturing investments in UK production facilities reflect industry confidence in long-term market growth and desire to improve supply chain resilience. Several major manufacturers have announced facility expansions and new product development centers focused on heat pump technologies and smart system integration.

Skills development programs launched by industry associations and educational institutions address workforce challenges through specialized training in emerging technologies. These initiatives support market growth by ensuring adequate technical expertise for installation, commissioning, and maintenance of advanced HVAC systems.

Strategic positioning recommendations for HVAC market participants emphasize the importance of developing comprehensive capabilities across traditional and emerging technology segments. Companies should invest in heat pump expertise, smart system integration, and service capabilities to capture growth opportunities while maintaining competitive positioning in evolving market conditions.

Technology investment priorities should focus on IoT integration, energy management capabilities, and user interface development that align with customer demands for intelligent building systems. MarkWide Research suggests that companies prioritizing digital transformation and connectivity features will achieve stronger market positions and customer loyalty.

Market expansion strategies should consider regional variations in demand patterns, regulatory requirements, and competitive dynamics across different UK markets. Successful companies will adapt their offerings and go-to-market approaches to address local market characteristics while maintaining operational efficiency and brand consistency.

Partnership development opportunities exist in building automation, energy management, and renewable energy sectors where HVAC systems integrate with broader building performance solutions. Strategic alliances can accelerate technology development while providing access to new customer segments and distribution channels.

Long-term growth prospects for the UK HVAC market remain positive, supported by regulatory drivers, technology advancement, and ongoing building stock modernization requirements. The market is expected to maintain steady growth momentum with particular strength in heat pump systems, smart technologies, and comprehensive service offerings that address evolving customer needs.

Technology evolution will continue transforming the HVAC landscape through artificial intelligence integration, advanced materials, and improved system efficiency that enables better building performance and user experience. The convergence of HVAC systems with renewable energy, energy storage, and building automation creates new opportunities for integrated solutions.

Regulatory environment developments will likely accelerate the transition toward sustainable HVAC technologies while establishing more stringent performance standards for new installations and system replacements. These changes will favor companies with strong capabilities in high-efficiency systems and renewable heating technologies.

Market consolidation trends may emerge as companies seek scale advantages and comprehensive capability portfolios to compete effectively in an increasingly complex and technology-driven market environment. Strategic acquisitions and partnerships will likely shape competitive dynamics while supporting innovation and market development initiatives.

The United Kingdom HVAC market presents a compelling combination of stable demand fundamentals and dynamic growth opportunities driven by regulatory requirements, technology innovation, and evolving customer expectations. The market’s transformation toward sustainable and intelligent building systems creates substantial opportunities for companies capable of adapting to changing market conditions while delivering comprehensive value propositions.

Strategic success in this market requires balanced investment in traditional HVAC capabilities and emerging technologies, particularly heat pump systems and smart building integration. Companies that develop strong service capabilities, embrace digital transformation, and maintain flexibility in their market approach will be best positioned to capitalize on growth opportunities while navigating competitive challenges.

Future market development will be shaped by the continued evolution of building regulations, technology advancement, and customer preferences toward sustainable and intelligent HVAC solutions. The market’s resilience and growth potential make it an attractive sector for investment and strategic development, particularly for companies aligned with the UK’s environmental objectives and building performance standards.

What is HVAC?

HVAC stands for Heating, Ventilation, and Air Conditioning, which refers to the technology used for indoor environmental comfort. It encompasses systems that provide heating and cooling to residential, commercial, and industrial buildings.

What are the key players in the United Kingdom HVAC Market?

Key players in the United Kingdom HVAC Market include companies like Daikin, Mitsubishi Electric, and Baxi, which offer a range of heating and cooling solutions. These companies are known for their innovative technologies and energy-efficient products, among others.

What are the main drivers of growth in the United Kingdom HVAC Market?

The main drivers of growth in the United Kingdom HVAC Market include increasing demand for energy-efficient systems, rising awareness of indoor air quality, and government initiatives promoting sustainable building practices. Additionally, the growth of smart home technologies is also contributing to market expansion.

What challenges does the United Kingdom HVAC Market face?

The United Kingdom HVAC Market faces challenges such as regulatory compliance with environmental standards, high installation costs, and competition from alternative heating solutions. These factors can hinder market growth and adoption rates.

What opportunities exist in the United Kingdom HVAC Market?

Opportunities in the United Kingdom HVAC Market include the increasing adoption of smart HVAC systems, advancements in renewable energy technologies, and the growing trend of retrofitting existing buildings for improved energy efficiency. These factors present significant potential for innovation and market growth.

What trends are shaping the United Kingdom HVAC Market?

Trends shaping the United Kingdom HVAC Market include the rise of smart HVAC technologies, the integration of IoT for better system management, and a shift towards sustainable and eco-friendly solutions. Additionally, there is a growing focus on enhancing indoor air quality and comfort.

United Kingdom HVAC Market

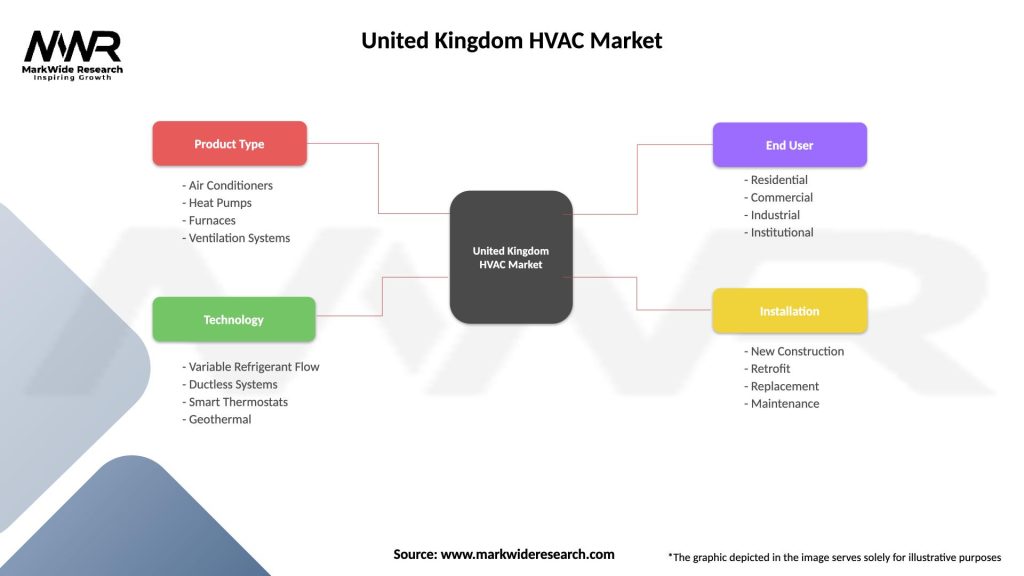

| Segmentation Details | Description |

|---|---|

| Product Type | Air Conditioners, Heat Pumps, Furnaces, Ventilation Systems |

| Technology | Variable Refrigerant Flow, Ductless Systems, Smart Thermostats, Geothermal |

| End User | Residential, Commercial, Industrial, Institutional |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom HVAC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at