444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom geospatial imagery analytics market represents a rapidly evolving technological landscape that combines advanced satellite imagery, aerial photography, and sophisticated analytical tools to extract meaningful insights from geographic data. This dynamic sector has experienced remarkable growth driven by increasing demand for location-based intelligence across multiple industries including agriculture, urban planning, defense, environmental monitoring, and commercial real estate.

Market dynamics indicate that the UK’s geospatial imagery analytics sector is expanding at a compound annual growth rate (CAGR) of 12.8%, reflecting the growing recognition of spatial data’s strategic value in decision-making processes. The integration of artificial intelligence, machine learning, and cloud computing technologies has revolutionized how organizations process and interpret geospatial information, creating unprecedented opportunities for data-driven insights.

Government initiatives and public sector investments have significantly contributed to market expansion, with the UK Space Agency and Ordnance Survey leading efforts to modernize the country’s geospatial infrastructure. Private sector adoption has accelerated as businesses recognize the competitive advantages offered by location intelligence, particularly in supply chain optimization, risk assessment, and market analysis applications.

The market encompasses various technological components including satellite imagery processing, aerial drone analytics, geographic information systems (GIS), and specialized software platforms designed for spatial data interpretation. These technologies serve diverse applications ranging from precision agriculture and environmental compliance monitoring to infrastructure development and emergency response coordination.

The United Kingdom geospatial imagery analytics market refers to the comprehensive ecosystem of technologies, services, and solutions that capture, process, analyze, and interpret geographic and spatial data through various imaging techniques including satellite imagery, aerial photography, and drone-based sensors to generate actionable insights for commercial, government, and research applications.

Geospatial imagery analytics combines traditional geographic information systems with advanced analytical capabilities, enabling organizations to understand spatial relationships, monitor changes over time, and predict future trends based on location-specific data. This technology leverages high-resolution imagery from multiple sources including commercial satellites, government sensors, and unmanned aerial vehicles to create detailed maps, models, and analytical reports.

The market encompasses data acquisition platforms, processing software, analytical tools, and professional services that transform raw imagery into meaningful business intelligence. Key components include image preprocessing, feature extraction, pattern recognition, change detection, and predictive modeling capabilities that support decision-making across various industry verticals.

Strategic market positioning reveals that the United Kingdom has emerged as a leading European hub for geospatial imagery analytics, benefiting from strong government support, advanced technological infrastructure, and a robust ecosystem of innovative companies. The market demonstrates exceptional growth potential driven by increasing digitalization across industries and growing awareness of spatial data’s strategic value.

Technology adoption rates show that 78% of UK organizations in key sectors have implemented some form of geospatial analytics, with cloud-based solutions experiencing particularly rapid uptake. The integration of artificial intelligence and machine learning technologies has enhanced analytical capabilities, enabling real-time processing and automated insight generation that previously required extensive manual intervention.

Market segmentation indicates strong performance across multiple application areas, with agriculture, urban planning, and environmental monitoring representing the largest adoption segments. The defense and security sector continues to drive significant investment in advanced analytical capabilities, while commercial applications in retail, logistics, and insurance are experiencing accelerated growth.

Competitive landscape features a mix of established technology providers, specialized analytics companies, and emerging startups focused on niche applications. The market benefits from strong collaboration between academic institutions, government agencies, and private sector organizations, fostering innovation and knowledge transfer that accelerates technological advancement.

Primary market drivers demonstrate the transformative impact of geospatial imagery analytics across multiple sectors:

Technology integration trends highlight the convergence of multiple advanced technologies including artificial intelligence, edge computing, and 5G connectivity, creating new possibilities for real-time analysis and automated decision-making processes.

Government policy initiatives serve as primary catalysts for market expansion, with the UK government’s National Space Strategy and Geospatial Commission driving significant investment in spatial data infrastructure. These initiatives have created favorable conditions for innovation and adoption across public and private sectors.

Digital transformation acceleration across industries has increased demand for location-based insights, with organizations recognizing that spatial data provides critical context for business intelligence and operational optimization. The COVID-19 pandemic further emphasized the importance of geospatial analytics for tracking, monitoring, and response coordination.

Technological advancement in satellite imagery resolution and processing capabilities has made high-quality geospatial data more accessible and affordable. The emergence of small satellite constellations and improved sensor technologies has increased data availability while reducing costs, democratizing access to advanced imagery analytics.

Climate change concerns and environmental regulations have created substantial demand for monitoring and compliance solutions. Organizations across sectors require sophisticated tools to track environmental impact, monitor carbon footprints, and ensure regulatory compliance through continuous spatial monitoring.

Smart city initiatives throughout the UK have generated significant demand for urban analytics solutions. Local authorities are investing in geospatial technologies to optimize traffic management, improve public services, and enhance urban planning processes through data-driven decision making.

High implementation costs represent a significant barrier for smaller organizations seeking to adopt advanced geospatial imagery analytics solutions. The initial investment required for software licenses, hardware infrastructure, and specialized personnel can be prohibitive for companies with limited technology budgets.

Data privacy and security concerns create challenges for market expansion, particularly in applications involving sensitive locations or personal information. Regulatory compliance requirements and data protection obligations add complexity to implementation processes and may limit certain use cases.

Technical complexity and the need for specialized expertise pose adoption challenges for organizations lacking internal geospatial capabilities. The shortage of qualified professionals with combined expertise in geography, data science, and domain-specific knowledge creates bottlenecks in market growth.

Data quality and standardization issues can limit the effectiveness of analytical solutions. Inconsistent data formats, varying resolution levels, and integration challenges between different imagery sources create technical obstacles that require sophisticated preprocessing and harmonization efforts.

Regulatory uncertainty surrounding drone operations and data collection activities may constrain certain market segments. Evolving regulations regarding airspace usage, data ownership, and cross-border data transfer create compliance challenges that affect solution deployment and scalability.

Artificial intelligence integration presents substantial opportunities for market expansion through automated analysis capabilities, pattern recognition, and predictive modeling. The combination of AI technologies with geospatial imagery creates possibilities for real-time insights and autonomous decision-making systems.

Edge computing deployment enables local processing of imagery data, reducing latency and bandwidth requirements while improving response times for time-critical applications. This technological advancement opens new possibilities for field-based analytics and mobile applications.

Internet of Things (IoT) convergence with geospatial analytics creates opportunities for comprehensive monitoring solutions that combine imagery data with sensor networks. This integration enables more complete situational awareness and enhanced predictive capabilities across various applications.

Vertical market expansion into sectors such as renewable energy, telecommunications, and healthcare presents significant growth opportunities. These industries are beginning to recognize the value of location-based insights for operational optimization and strategic planning.

International market expansion leveraging UK expertise and technology solutions offers opportunities for growth beyond domestic boundaries. The country’s strong reputation in geospatial technologies positions UK companies well for global market penetration.

Supply chain evolution in the geospatial imagery analytics market reflects the increasing sophistication of data acquisition, processing, and delivery systems. Traditional linear supply chains are being replaced by dynamic ecosystems that integrate multiple data sources, processing platforms, and distribution channels to deliver customized solutions.

Competitive dynamics show increasing collaboration between technology providers, data suppliers, and end-user organizations. Strategic partnerships and joint ventures are becoming more common as companies seek to combine complementary capabilities and expand their market reach through integrated solutions.

Customer expectations are evolving toward real-time insights and automated analysis capabilities. Organizations increasingly demand solutions that provide immediate value with minimal manual intervention, driving innovation in automated processing and intelligent alert systems.

Technology convergence is reshaping market boundaries as geospatial analytics integrates with broader business intelligence and enterprise software platforms. This convergence creates new competitive dynamics and opportunities for cross-industry solutions.

Regulatory landscape changes continue to influence market development, with new policies regarding data sharing, privacy protection, and international cooperation affecting how solutions are designed and deployed across different sectors and geographic regions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United Kingdom geospatial imagery analytics market. Primary research includes extensive interviews with industry executives, technology providers, end-users, and government officials to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, government publications, academic studies, and company financial statements to establish market context and validate primary findings. This approach ensures comprehensive coverage of market dynamics and competitive landscape factors.

Data triangulation methods combine quantitative and qualitative research approaches to verify findings and eliminate potential biases. Multiple data sources are cross-referenced to ensure accuracy and reliability of market insights and projections.

Expert validation processes involve consultation with industry specialists, academic researchers, and government officials to review findings and provide additional context for market analysis. This validation ensures that research conclusions accurately reflect current market conditions and future trends.

Continuous monitoring of market developments, technology announcements, and regulatory changes ensures that research findings remain current and relevant. Regular updates to market analysis reflect the dynamic nature of the geospatial imagery analytics sector.

London and Southeast England dominate the UK geospatial imagery analytics market, accounting for approximately 45% of market activity. This region benefits from concentration of technology companies, government agencies, and financial services organizations that drive demand for advanced spatial analytics solutions.

Scotland’s market presence has grown significantly, representing roughly 18% of national market share, driven by strong government support for space technology development and the presence of specialized research institutions. The Scottish space sector’s focus on small satellites and Earth observation creates synergies with imagery analytics applications.

Northern England contributes approximately 15% of market activity, with Manchester, Leeds, and Newcastle emerging as important centers for geospatial technology development. The region’s industrial heritage and ongoing urban regeneration projects create substantial demand for spatial analytics solutions.

Wales and Southwest England together account for about 12% of market share, with particular strength in agricultural applications and environmental monitoring. The region’s diverse geography and active farming sector drive adoption of precision agriculture and land management solutions.

Regional specialization patterns show distinct focus areas, with London emphasizing financial and commercial applications, Scotland leading in satellite technology development, and rural regions driving agricultural and environmental monitoring adoption.

Market leadership in the UK geospatial imagery analytics sector features a diverse ecosystem of established technology providers, specialized analytics companies, and innovative startups. The competitive landscape reflects the market’s maturity and the variety of applications served by different solution providers.

Major international players maintain significant presence in the UK market:

UK-based companies demonstrate strong innovation and market presence:

Emerging companies focus on specialized applications and innovative technologies, contributing to market dynamism and technological advancement through niche solutions and disruptive approaches.

By Technology Platform:

By Application Sector:

By Deployment Model:

Agricultural Applications represent the fastest-growing segment, with precision farming adoption rates reaching 62% among UK agricultural enterprises. Satellite-based crop monitoring, yield prediction, and resource optimization solutions are driving significant efficiency improvements and cost reductions for farming operations.

Urban Planning Solutions show strong growth driven by smart city initiatives and sustainable development requirements. Local authorities are increasingly adopting geospatial analytics for traffic optimization, green space planning, and infrastructure development, with 85% of major UK cities implementing some form of spatial analytics.

Environmental Monitoring applications have gained prominence due to climate change concerns and regulatory requirements. Organizations use imagery analytics for carbon footprint tracking, biodiversity monitoring, and environmental compliance, with adoption rates increasing by 23% annually across relevant sectors.

Defense and Security applications continue to drive technological advancement and market investment. Government agencies require sophisticated capabilities for border monitoring, threat assessment, and strategic planning, maintaining consistent demand for cutting-edge analytical solutions.

Commercial Real Estate analytics are experiencing rapid adoption as property developers and investors recognize the value of location intelligence for market analysis, site selection, and investment decision-making processes.

Enhanced Decision Making capabilities enable organizations to make more informed choices based on comprehensive spatial data analysis. The ability to visualize trends, patterns, and relationships in geographic context significantly improves strategic planning and operational efficiency across various business functions.

Cost Reduction Opportunities emerge through optimized resource allocation, improved asset management, and reduced field inspection requirements. Organizations report average cost savings of 25-35% in relevant operational areas through effective implementation of geospatial imagery analytics solutions.

Risk Mitigation benefits include improved hazard identification, better emergency preparedness, and enhanced compliance monitoring. Insurance companies and risk management professionals particularly value the ability to assess and monitor risk factors through continuous spatial analysis.

Competitive Advantage development through unique insights and faster response capabilities gives organizations significant market positioning benefits. Companies using advanced geospatial analytics often outperform competitors in market analysis, customer targeting, and operational efficiency.

Innovation Acceleration occurs as organizations discover new applications and business models enabled by spatial data insights. The technology serves as a platform for developing innovative products, services, and operational approaches that create new revenue opportunities.

Regulatory Compliance support helps organizations meet environmental, safety, and reporting requirements more efficiently. Automated monitoring and reporting capabilities reduce compliance costs while improving accuracy and timeliness of regulatory submissions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming the geospatial imagery analytics market. Machine learning algorithms and deep learning models are enabling automated feature extraction, pattern recognition, and predictive analysis capabilities that dramatically reduce manual processing requirements while improving accuracy and insight quality.

Real-time Processing capabilities are becoming increasingly important as organizations demand immediate insights for time-critical applications. Edge computing deployment and improved connectivity infrastructure enable near-instantaneous analysis of imagery data, supporting applications such as emergency response, traffic management, and security monitoring.

Cloud-native Solutions are gaining prominence as organizations seek scalable, cost-effective alternatives to traditional on-premises systems. Cloud platforms offer improved accessibility, reduced infrastructure costs, and enhanced collaboration capabilities while providing the computational power needed for complex analytical processes.

Multi-sensor Fusion techniques combine imagery data with information from various sensors including LiDAR, radar, and IoT devices to create comprehensive situational awareness solutions. This trend enables more complete analysis and better decision-making support across multiple application areas.

Automated Reporting and alert systems are becoming standard features as organizations seek to reduce manual intervention and improve response times. Intelligent systems can automatically detect changes, identify anomalies, and generate reports or alerts based on predefined criteria and business rules.

Democratization of Technology through user-friendly interfaces and simplified deployment models is expanding market accessibility to smaller organizations and non-technical users. This trend is driving broader adoption across various sectors and creating new market opportunities.

Government Investment Initiatives have accelerated market development through substantial funding for research and development, infrastructure improvement, and public sector adoption. The UK Space Agency’s Earth Observation Programme and the Geospatial Commission’s National Geospatial Strategy represent significant commitments to market growth.

Technology Partnership Announcements between major providers and specialized companies are creating integrated solutions that combine complementary capabilities. These partnerships enable comprehensive offerings that address complex customer requirements while accelerating innovation and market expansion.

Regulatory Framework Updates including revised drone operation rules and data sharing guidelines are creating clearer operating environments for market participants. These developments reduce uncertainty and enable more confident investment in technology development and deployment.

Academic Research Collaborations between universities and industry partners are advancing fundamental research in areas such as computer vision, machine learning, and spatial analysis. These collaborations contribute to technological advancement while developing the skilled workforce needed for market growth.

International Standards Development efforts are improving interoperability and data sharing capabilities across different systems and organizations. Standardization initiatives reduce integration costs and complexity while enabling broader solution adoption.

Startup Ecosystem Growth in geospatial technology is fostering innovation and creating new solution categories. Venture capital investment in UK geospatial startups has increased significantly, supporting development of specialized applications and disruptive technologies.

MarkWide Research analysis indicates that organizations should prioritize cloud-based solutions and AI integration to maximize return on investment in geospatial imagery analytics. The convergence of these technologies offers the greatest potential for scalability, cost-effectiveness, and advanced analytical capabilities.

Strategic partnerships between technology providers and domain experts are essential for successful market penetration and solution development. Companies should focus on building ecosystems that combine technical capabilities with industry-specific knowledge to deliver comprehensive value propositions.

Investment in workforce development represents a critical success factor for market participants. Organizations should prioritize training programs and recruitment strategies that address the skills gap in geospatial analytics while building internal capabilities for solution deployment and optimization.

Data quality and integration capabilities should be fundamental considerations in technology selection and implementation planning. Organizations must invest in robust data management systems and standardization processes to ensure reliable analytical results and scalable operations.

Regulatory compliance planning should be integrated into solution design and deployment strategies from the beginning. Proactive approach to privacy, security, and regulatory requirements reduces implementation risks and ensures sustainable operations.

Vertical market specialization offers opportunities for differentiation and competitive advantage. Companies should consider focusing on specific industry applications where they can develop deep expertise and comprehensive solutions that address unique sector requirements.

Market expansion is expected to continue at a robust pace, with growth rates projected to maintain double-digit annual increases through the next five years. The combination of technological advancement, increasing awareness, and expanding application areas creates favorable conditions for sustained market development.

Technology evolution will focus on enhanced automation, improved accuracy, and reduced complexity in solution deployment and operation. Advances in artificial intelligence, quantum computing, and sensor technology will create new possibilities for geospatial imagery analytics applications.

Market consolidation may occur as larger technology providers acquire specialized companies to expand their capabilities and market reach. This consolidation could accelerate innovation while creating more comprehensive solution offerings for end users.

International expansion opportunities will grow as UK companies leverage their technological expertise and market experience to enter global markets. The country’s reputation for innovation and quality positions UK providers well for international growth.

New application areas will emerge as organizations discover innovative uses for geospatial imagery analytics. Sectors such as healthcare, renewable energy, and telecommunications are expected to drive significant new demand for specialized analytical solutions.

Regulatory evolution will continue to shape market development, with new policies likely to address emerging technologies such as AI ethics, data sovereignty, and cross-border data sharing. Market participants must remain adaptable to regulatory changes while maintaining compliance standards.

The United Kingdom geospatial imagery analytics market stands at a pivotal moment of growth and transformation, driven by technological advancement, government support, and increasing recognition of spatial data’s strategic value across multiple sectors. The market’s robust expansion reflects the successful convergence of advanced imagery technologies, artificial intelligence, and cloud computing capabilities that enable unprecedented analytical insights.

Market fundamentals remain strong, with diverse application areas providing stability while emerging technologies create new growth opportunities. The combination of established players and innovative startups fosters a dynamic competitive environment that drives continuous improvement and innovation in solution capabilities.

Strategic positioning of the UK as a leader in geospatial technology development, supported by comprehensive government initiatives and world-class research institutions, creates sustainable competitive advantages that benefit the entire market ecosystem. The country’s expertise in combining technical innovation with practical applications positions it well for continued market leadership.

Future prospects indicate continued strong growth driven by expanding applications, technological advancement, and increasing global demand for location-based intelligence. Organizations that invest strategically in geospatial imagery analytics capabilities while addressing implementation challenges will be well-positioned to capitalize on the significant opportunities ahead in this rapidly evolving market landscape.

What is Geospatial Imagery Analytics?

Geospatial Imagery Analytics refers to the process of analyzing visual data captured from satellite or aerial imagery to extract meaningful insights. This technology is widely used in urban planning, environmental monitoring, and disaster management.

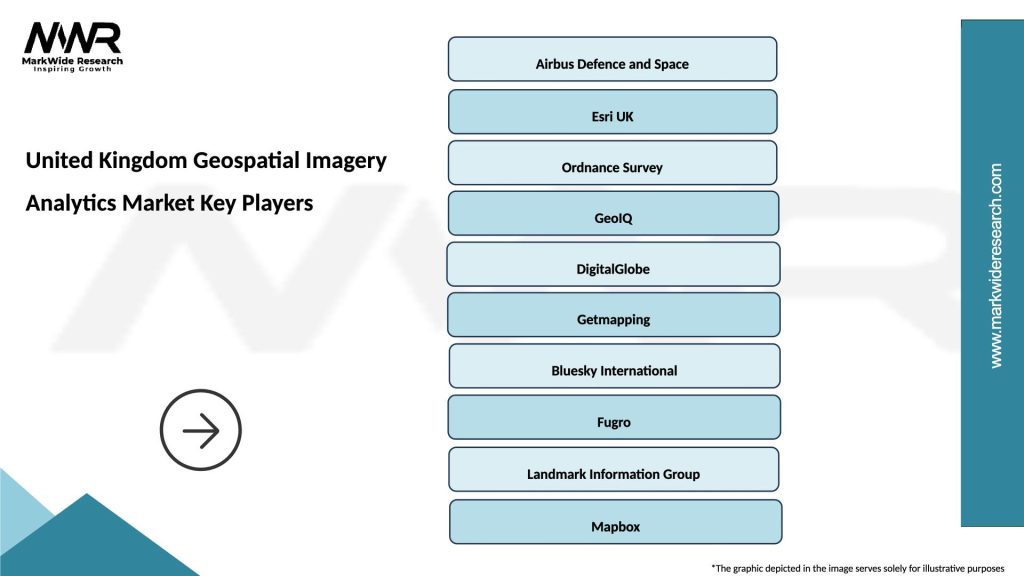

What are the key players in the United Kingdom Geospatial Imagery Analytics Market?

Key players in the United Kingdom Geospatial Imagery Analytics Market include companies like Airbus, Hexagon AB, and Esri, which provide advanced geospatial solutions and analytics services, among others.

What are the growth factors driving the United Kingdom Geospatial Imagery Analytics Market?

The growth of the United Kingdom Geospatial Imagery Analytics Market is driven by increasing demand for location-based services, advancements in satellite technology, and the rising need for data-driven decision-making in sectors like agriculture and urban development.

What challenges does the United Kingdom Geospatial Imagery Analytics Market face?

Challenges in the United Kingdom Geospatial Imagery Analytics Market include data privacy concerns, high costs of technology implementation, and the need for skilled professionals to interpret complex data.

What opportunities exist in the United Kingdom Geospatial Imagery Analytics Market?

Opportunities in the United Kingdom Geospatial Imagery Analytics Market include the integration of artificial intelligence for enhanced data analysis, the expansion of smart city initiatives, and the growing use of geospatial data in climate change research.

What trends are shaping the United Kingdom Geospatial Imagery Analytics Market?

Trends in the United Kingdom Geospatial Imagery Analytics Market include the increasing use of real-time data analytics, the rise of cloud-based geospatial solutions, and the growing importance of sustainability in urban planning.

United Kingdom Geospatial Imagery Analytics Market

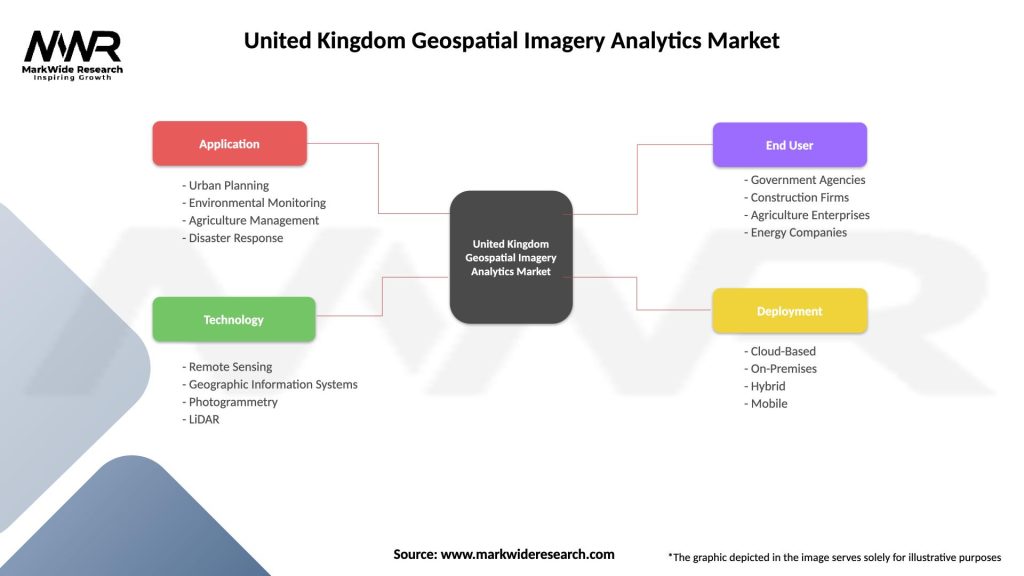

| Segmentation Details | Description |

|---|---|

| Application | Urban Planning, Environmental Monitoring, Agriculture Management, Disaster Response |

| Technology | Remote Sensing, Geographic Information Systems, Photogrammetry, LiDAR |

| End User | Government Agencies, Construction Firms, Agriculture Enterprises, Energy Companies |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Geospatial Imagery Analytics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at