444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom full service restaurants market represents a dynamic and evolving sector within the country’s hospitality industry, characterized by establishments that provide table service, comprehensive dining experiences, and diverse culinary offerings. This market encompasses traditional restaurants, fine dining establishments, casual dining venues, and themed restaurants that cater to varying consumer preferences and dining occasions. Market dynamics indicate robust growth potential driven by changing consumer behaviors, urbanization trends, and increasing disposable income across key demographic segments.

Consumer preferences have shifted significantly toward experiential dining, with patrons seeking unique culinary experiences, authentic flavors, and memorable service encounters. The market demonstrates strong resilience following challenging periods, with operators adapting through innovative service models, technology integration, and enhanced safety protocols. Growth projections suggest the sector will expand at a compound annual growth rate of 6.2% over the forecast period, supported by tourism recovery, urban development, and evolving dining preferences.

Regional distribution shows concentrated activity in major metropolitan areas, with London accounting for approximately 35% of market activity, followed by Manchester, Birmingham, and other major cities. The market benefits from diverse demographic trends, including increasing multicultural populations driving demand for international cuisines, growing emphasis on sustainable dining practices, and rising popularity of premium casual dining concepts.

The United Kingdom full service restaurants market refers to the comprehensive ecosystem of dining establishments that provide complete table service experiences, including menu presentation, order taking, food preparation, service delivery, and payment processing within a seated dining environment. This market segment distinguishes itself from quick service restaurants through enhanced service levels, extended dining durations, and comprehensive hospitality offerings.

Full service restaurants encompass various operational formats including fine dining establishments offering premium culinary experiences, casual dining venues providing relaxed atmospheres with moderate pricing, family restaurants catering to diverse age groups, and specialty restaurants focusing on specific cuisines or dining themes. These establishments typically feature trained serving staff, comprehensive beverage programs, and curated dining environments designed to enhance customer experiences.

Market characteristics include higher average transaction values compared to quick service alternatives, longer customer dwell times, emphasis on ambiance and atmosphere, and integration of technology solutions for reservations, ordering, and payment processing. The sector plays a crucial role in the broader hospitality economy, supporting employment, tourism, and local community development across the United Kingdom.

Market performance demonstrates strong recovery momentum with increasing consumer confidence driving dining frequency and spending patterns. The United Kingdom full service restaurants market exhibits robust fundamentals supported by demographic trends, urbanization patterns, and evolving consumer preferences toward experiential dining. Key growth drivers include tourism recovery contributing approximately 22% to market expansion, technology adoption enhancing operational efficiency, and diversification of culinary offerings meeting multicultural demand.

Operational innovations have transformed service delivery models, with restaurants implementing digital ordering systems, contactless payment solutions, and enhanced reservation management platforms. The market benefits from strong brand recognition among established operators while simultaneously supporting emerging concepts and independent establishments. Consumer spending patterns indicate increased willingness to pay premium prices for quality experiences, with average spending per visit increasing by 18% year-over-year.

Competitive dynamics feature both established restaurant chains and independent operators competing through differentiated positioning, unique culinary offerings, and enhanced customer service. The market demonstrates resilience through adaptive strategies including expanded delivery services, outdoor dining capabilities, and flexible operating models that respond to changing consumer needs and regulatory requirements.

Strategic insights reveal fundamental shifts in consumer dining behaviors and preferences that are reshaping the United Kingdom full service restaurants market landscape. These insights provide critical understanding for stakeholders navigating market opportunities and challenges.

Economic recovery serves as a primary catalyst for market expansion, with improved consumer confidence translating into increased dining frequency and higher spending per visit. The gradual return of international tourism contributes significantly to market growth, particularly benefiting establishments in major metropolitan areas and tourist destinations. Disposable income growth across key demographic segments supports premium dining experiences and encourages consumers to explore diverse culinary offerings.

Urbanization trends create concentrated demand centers in major cities, supporting restaurant density and operational viability. Young professional demographics demonstrate strong preference for dining out as lifestyle choices, with millennials and Gen Z consumers accounting for approximately 42% of full service restaurant visits. These demographic groups prioritize convenience, experience quality, and social dining occasions that drive market demand.

Cultural diversity within the United Kingdom population creates sustained demand for international cuisines and authentic dining experiences. Immigration patterns and multicultural communities support specialized restaurants serving ethnic cuisines, while mainstream consumers increasingly embrace diverse culinary experiences. Tourism recovery provides additional demand stimulus, with international visitors seeking authentic British dining experiences alongside familiar international options.

Technology adoption enhances operational efficiency and customer convenience, enabling restaurants to serve larger customer volumes while maintaining service quality. Digital reservation systems, mobile ordering platforms, and integrated payment solutions improve customer experiences while providing valuable data insights for operators.

Operating cost pressures present significant challenges for full service restaurant operators, with rising labor costs, ingredient price inflation, and commercial rent increases impacting profitability margins. Staffing shortages across the hospitality sector create operational constraints, with many establishments struggling to maintain adequate service levels due to recruitment and retention challenges.

Regulatory compliance requirements add operational complexity and costs, including food safety standards, employment regulations, and health protocols that require ongoing investment and management attention. Economic uncertainty influences consumer discretionary spending, with dining out typically among the first expenses reduced during economic downturns or periods of financial stress.

Competition intensity from both traditional restaurant operators and alternative dining options creates pressure on market share and pricing power. The proliferation of delivery platforms and ghost kitchens provides consumers with convenient alternatives to traditional full service dining experiences. Consumer behavior changes toward home cooking and meal preparation, accelerated during recent years, continue to influence dining frequency patterns.

Supply chain disruptions affect ingredient availability and pricing stability, requiring restaurants to adapt menus and sourcing strategies frequently. Energy costs and utility expenses represent significant operational overhead, particularly for establishments with extensive kitchen operations and climate control requirements.

Technology integration presents substantial opportunities for operational enhancement and customer experience improvement. Restaurants can leverage artificial intelligence for demand forecasting, inventory management, and personalized customer recommendations. Digital transformation enables new revenue streams through online ordering, virtual dining experiences, and subscription-based meal programs that extend beyond traditional dining room operations.

Sustainability initiatives offer differentiation opportunities and appeal to environmentally conscious consumers. Restaurants implementing comprehensive sustainability programs, including waste reduction, renewable energy adoption, and local sourcing, can command premium pricing while building strong brand loyalty. Plant-based menu expansion addresses growing consumer demand for vegetarian and vegan options, representing a rapidly expanding market segment.

Experience enhancement through unique dining concepts, interactive elements, and entertainment integration creates competitive advantages and justifies premium pricing. Culinary tourism opportunities allow restaurants to partner with local tourism boards and hospitality providers to attract visitors seeking authentic dining experiences.

Franchise expansion and multi-location development enable successful concepts to scale operations and increase market presence. Delivery integration provides additional revenue channels while maintaining core dining room operations, particularly effective for establishments with strong brand recognition and menu portability.

Supply and demand dynamics within the United Kingdom full service restaurants market reflect complex interactions between consumer preferences, economic conditions, and operational capabilities. Demand patterns demonstrate seasonal variations with peak activity during holiday periods, summer months, and special occasions, while weekday lunch and weekend dinner services represent core revenue generators.

Competitive dynamics feature ongoing consolidation among larger operators while simultaneously supporting new market entrants with innovative concepts. Market fragmentation remains high with independent operators representing approximately 68% of establishments, creating diverse competitive landscapes across different geographic regions and price segments.

Price sensitivity varies significantly across consumer segments, with premium diners demonstrating lower price elasticity while value-conscious consumers respond strongly to promotional offers and pricing strategies. Service quality expectations continue rising as consumers become more sophisticated and experienced with diverse dining options.

Innovation cycles accelerate as restaurants experiment with new concepts, menu offerings, and service delivery models to differentiate themselves in competitive markets. Consumer loyalty becomes increasingly important as acquisition costs rise and retention strategies prove more cost-effective than constant customer acquisition efforts.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United Kingdom full service restaurants market. Primary research includes structured interviews with restaurant operators, industry executives, suppliers, and consumers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and financial filings from publicly traded restaurant companies. Data triangulation ensures accuracy by cross-referencing information from multiple sources and validating findings through different research approaches.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing establishment counts, average revenue per location, and consumer spending patterns to develop comprehensive market assessments. Trend analysis examines historical performance data and forward-looking indicators to identify growth patterns and market evolution trajectories.

Consumer surveys provide insights into dining preferences, spending behaviors, and satisfaction levels across different demographic segments and geographic regions. Expert interviews with industry analysts, restaurant consultants, and technology providers offer professional perspectives on market dynamics and future developments.

London market dominates the United Kingdom full service restaurants landscape, accounting for the largest concentration of establishments and revenue generation. The capital city benefits from high population density, significant tourism activity, and diverse demographic composition that supports various restaurant concepts. Premium dining segments perform particularly well in London, with consumers demonstrating willingness to pay higher prices for quality experiences and unique culinary offerings.

Manchester and Birmingham represent major secondary markets with growing restaurant scenes supported by urban development, student populations, and business districts. These cities demonstrate strong growth potential with expanding consumer bases and increasing dining sophistication. Regional chains often use these markets as expansion platforms before entering the competitive London market.

Scotland and Wales markets show distinct characteristics with emphasis on local cuisine, traditional dining experiences, and tourism-driven demand. Edinburgh and Cardiff serve as primary markets within their respective regions, benefiting from government presence, tourism activity, and cultural attractions that support diverse restaurant operations.

Coastal regions demonstrate seasonal demand patterns with peak activity during summer months driven by domestic tourism and holiday dining. Market penetration varies significantly across regions, with urban areas showing higher restaurant density compared to rural locations where independent establishments often dominate local markets.

Market leadership features a combination of established restaurant chains, independent operators, and emerging concepts competing across different segments and price points. The competitive environment demonstrates significant diversity with no single operator dominating the overall market.

Competitive strategies focus on differentiation through unique menu offerings, exceptional service quality, strategic location selection, and effective marketing programs. Brand positioning varies significantly across operators, with some emphasizing premium experiences while others focus on value proposition and accessibility.

By Service Type:

By Cuisine Type:

By Location Type:

Fine Dining Segment demonstrates resilience with consumers willing to pay premium prices for exceptional experiences. This category benefits from special occasion dining, business entertainment, and culinary tourism. Average spending in fine dining establishments shows 15% year-over-year growth, indicating strong demand for premium experiences despite economic uncertainties.

Casual Dining Category represents the largest segment by establishment count and serves as the primary growth driver for the overall market. These restaurants balance quality and affordability while offering diverse menu options that appeal to broad consumer demographics. Technology adoption in casual dining reaches approximately 85% of establishments, enabling improved operational efficiency and customer convenience.

Family Restaurant Segment focuses on value proposition and child-friendly environments, benefiting from multi-generational dining occasions and celebration meals. This category emphasizes portion sizes, diverse menu options, and accommodating service that appeals to families with varying preferences and dietary requirements.

International Cuisine Categories show strong growth driven by cultural diversity and consumer interest in authentic dining experiences. Indian and Italian restaurants maintain strong market positions while emerging cuisines from Southeast Asia, Latin America, and Africa gain popularity among adventurous diners seeking new culinary experiences.

Restaurant Operators benefit from comprehensive market insights that inform strategic decision-making regarding location selection, menu development, pricing strategies, and operational improvements. Market intelligence enables operators to identify growth opportunities, understand competitive dynamics, and adapt to changing consumer preferences effectively.

Investors and Financial Institutions gain valuable insights into market performance, growth potential, and risk factors that inform investment decisions and portfolio management strategies. Financial analysis provides understanding of revenue trends, profitability patterns, and market valuation metrics that support due diligence processes.

Suppliers and Vendors benefit from market demand forecasting, supplier relationship insights, and understanding of procurement trends that inform product development and sales strategies. Supply chain optimization opportunities become apparent through analysis of restaurant operational needs and purchasing patterns.

Real Estate Developers and property managers gain insights into location preferences, space requirements, and market demand patterns that inform development decisions and leasing strategies. Site selection criteria and demographic analysis support optimal restaurant placement and tenant mix decisions.

Technology Providers understand market adoption trends, operational challenges, and technology integration opportunities that inform product development and marketing strategies. Digital transformation insights reveal specific technology needs and implementation priorities across different restaurant segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with restaurants implementing comprehensive environmental programs including waste reduction, energy efficiency, and sustainable sourcing practices. Consumer awareness of environmental impact drives demand for restaurants demonstrating genuine commitment to sustainability beyond marketing claims.

Technology-Enhanced Dining transforms customer experiences through digital menus, tableside ordering systems, and integrated payment solutions. Artificial intelligence applications include personalized menu recommendations, inventory optimization, and predictive analytics for demand forecasting and operational planning.

Health-Conscious Menus reflect growing consumer focus on nutrition, dietary restrictions, and wellness-oriented dining choices. Restaurants increasingly offer plant-based options, gluten-free alternatives, and transparent nutritional information to accommodate diverse dietary preferences and health requirements.

Experience-Driven Concepts emphasize unique dining environments, interactive elements, and Instagram-worthy presentations that encourage social media sharing and word-of-mouth marketing. Themed restaurants and immersive dining experiences gain popularity among consumers seeking memorable occasions beyond traditional meal consumption.

Local Sourcing Movement supports community connections and ingredient freshness while reducing transportation costs and environmental impact. Farm-to-table concepts and partnerships with local producers create competitive differentiation and appeal to consumers valuing authenticity and community support.

Digital Transformation Acceleration has fundamentally changed restaurant operations with widespread adoption of cloud-based point-of-sale systems, inventory management platforms, and customer relationship management tools. MarkWide Research analysis indicates that technology investment among full service restaurants increased by 45% over the past two years, reflecting industry recognition of digital solutions’ operational benefits.

Delivery Integration Evolution has moved beyond simple third-party partnerships to comprehensive omnichannel strategies that maintain brand control and customer relationships. Restaurants develop proprietary delivery capabilities while leveraging platform partnerships for market reach and customer acquisition.

Workforce Development Initiatives address staffing challenges through enhanced training programs, career development pathways, and improved compensation packages. Industry collaboration with educational institutions creates apprenticeship programs and professional development opportunities that support long-term workforce stability.

Sustainability Certification Programs gain traction as restaurants seek third-party validation of environmental practices and social responsibility initiatives. Green certification becomes a competitive differentiator and marketing advantage among environmentally conscious consumers.

Menu Innovation Cycles accelerate with restaurants frequently updating offerings to reflect seasonal ingredients, trending flavors, and dietary preferences. Limited-time offers and seasonal menus create customer excitement and encourage repeat visits while testing new concepts for permanent menu inclusion.

Strategic Focus Areas for restaurant operators should prioritize technology integration, sustainability initiatives, and workforce development to build competitive advantages and operational resilience. Investment priorities should emphasize customer experience enhancement, operational efficiency improvements, and brand differentiation strategies that create long-term value.

Market Positioning Strategies require clear value propositions that resonate with target demographics while differentiating from competitive alternatives. Brand development should emphasize authentic storytelling, community connections, and consistent quality delivery across all customer touchpoints and service channels.

Operational Excellence becomes increasingly critical as consumer expectations rise and competitive pressures intensify. Process optimization should focus on service consistency, quality control, and efficiency improvements that enhance profitability while maintaining customer satisfaction levels.

Financial Management requires careful attention to cost control, revenue optimization, and cash flow management in an environment of rising operational expenses and economic uncertainty. Pricing strategies should balance profitability requirements with market positioning and competitive dynamics.

Growth Strategies should consider both organic expansion and strategic partnerships that leverage existing strengths while accessing new markets or capabilities. Market expansion opportunities exist in underserved geographic areas and emerging demographic segments with specific dining preferences.

Market evolution will continue toward experience-driven dining concepts that combine exceptional food quality with unique atmospheres and memorable service encounters. Consumer expectations will increasingly emphasize sustainability, health consciousness, and technological convenience as standard rather than premium features.

Technology integration will deepen with artificial intelligence, robotics, and automation becoming standard operational tools rather than experimental innovations. Digital transformation will extend beyond customer-facing applications to comprehensive operational management, supply chain optimization, and predictive analytics capabilities.

Market consolidation may accelerate as successful concepts expand while struggling operators exit the market or seek acquisition opportunities. Brand strength and operational efficiency will become increasingly important competitive advantages in a mature market environment.

Sustainability requirements will evolve from consumer preferences to regulatory mandates, requiring comprehensive environmental programs and transparent reporting. MWR projections suggest that sustainability-focused restaurants will capture premium market positioning and customer loyalty advantages over the forecast period.

International expansion opportunities may emerge for successful UK restaurant concepts seeking growth beyond domestic markets, while international brands continue entering the UK market with adapted concepts for local preferences and regulatory requirements.

The United Kingdom full service restaurants market demonstrates strong fundamentals and promising growth prospects despite facing operational challenges and competitive pressures. Market resilience has been proven through successful adaptation to changing consumer preferences, economic conditions, and regulatory requirements while maintaining focus on quality service delivery and customer satisfaction.

Strategic opportunities exist for operators who embrace technology integration, sustainability practices, and experience-driven concepts that differentiate their offerings in competitive markets. Consumer trends toward health consciousness, environmental responsibility, and unique dining experiences create pathways for innovation and market positioning that support premium pricing and customer loyalty.

Industry evolution will favor operators who invest in workforce development, operational excellence, and brand building while maintaining financial discipline and strategic focus. The market’s diversity and fragmentation provide opportunities for both large-scale operators and independent establishments to succeed through differentiated positioning and exceptional execution of their chosen market strategies.

What is Full Service Restaurants?

Full Service Restaurants refer to establishments that provide a complete dining experience, including table service, a diverse menu, and often a bar. These restaurants typically focus on customer service and ambiance, catering to various dining occasions such as casual meals, celebrations, and business meetings.

What are the key players in the United Kingdom Full Service Restaurants Market?

Key players in the United Kingdom Full Service Restaurants Market include well-known chains such as Restaurant Group, Mitchells & Butlers, and Whitbread. These companies compete on factors like menu variety, customer experience, and location, among others.

What are the growth factors driving the United Kingdom Full Service Restaurants Market?

The growth of the United Kingdom Full Service Restaurants Market is driven by factors such as increasing consumer spending on dining out, a growing trend towards experiential dining, and the rise of food delivery services. Additionally, the demand for diverse cuisine options and unique dining experiences contributes to market expansion.

What challenges does the United Kingdom Full Service Restaurants Market face?

The United Kingdom Full Service Restaurants Market faces challenges such as rising operational costs, labor shortages, and changing consumer preferences towards healthier eating. Additionally, economic fluctuations and competition from fast-casual dining options can impact profitability.

What opportunities exist in the United Kingdom Full Service Restaurants Market?

Opportunities in the United Kingdom Full Service Restaurants Market include the potential for growth in online reservations and delivery services, as well as the increasing popularity of plant-based and sustainable menu options. Furthermore, leveraging technology for enhanced customer engagement presents a significant opportunity.

What trends are shaping the United Kingdom Full Service Restaurants Market?

Trends shaping the United Kingdom Full Service Restaurants Market include a focus on sustainability, with many restaurants adopting eco-friendly practices. Additionally, the integration of technology, such as mobile ordering and contactless payments, is becoming increasingly prevalent, enhancing the overall dining experience.

United Kingdom Full Service Restaurants Market

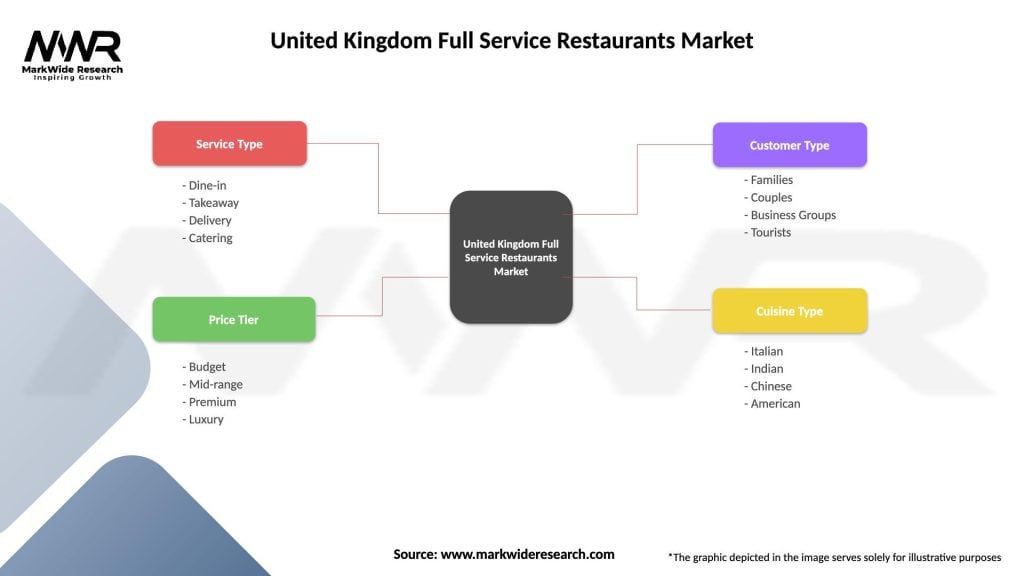

| Segmentation Details | Description |

|---|---|

| Service Type | Dine-in, Takeaway, Delivery, Catering |

| Price Tier | Budget, Mid-range, Premium, Luxury |

| Customer Type | Families, Couples, Business Groups, Tourists |

| Cuisine Type | Italian, Indian, Chinese, American |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Full Service Restaurants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at