444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom food flavor and enhancer market represents a dynamic and rapidly evolving sector within the broader food and beverage industry. This market encompasses a comprehensive range of natural and artificial flavoring agents, taste enhancers, and sensory modifiers that play crucial roles in food manufacturing and processing. Market dynamics indicate robust growth driven by changing consumer preferences, increasing demand for processed foods, and technological advancements in flavor chemistry.

Consumer behavior in the UK has shifted significantly toward premium and artisanal food products, creating substantial opportunities for innovative flavor solutions. The market experiences consistent expansion at a 6.2% CAGR, reflecting strong demand across multiple food categories including bakery products, beverages, dairy items, and confectionery. Industry participants are increasingly focusing on clean-label solutions and natural flavor alternatives to meet evolving consumer expectations.

Regulatory compliance remains a critical factor shaping market development, with stringent food safety standards and labeling requirements influencing product formulations. The market demonstrates remarkable resilience and adaptability, particularly in response to health-conscious consumer trends and sustainability concerns that are reshaping the entire food industry landscape.

The United Kingdom food flavor and enhancer market refers to the comprehensive industry segment encompassing all natural and synthetic compounds used to improve, modify, or enhance the taste, aroma, and overall sensory experience of food and beverage products. This market includes flavor concentrates, essential oils, aroma chemicals, taste modulators, and various enhancement technologies designed to create appealing and consistent flavor profiles in manufactured food products.

Flavor enhancers specifically function to amplify existing tastes without contributing distinct flavors themselves, while flavor compounds provide specific taste and aroma characteristics. The market serves diverse applications across food manufacturing, from basic seasoning solutions to complex flavor systems that recreate natural taste experiences in processed foods.

Market performance in the United Kingdom food flavor and enhancer sector demonstrates exceptional growth potential driven by evolving consumer preferences and technological innovation. The industry benefits from increasing demand for convenience foods, premium flavor experiences, and clean-label products that align with health-conscious consumer behavior.

Key growth drivers include the expanding ready-to-eat food segment, growing popularity of international cuisines, and rising consumer willingness to pay premium prices for enhanced flavor experiences. Natural flavors represent approximately 68% market preference among UK consumers, reflecting the broader clean-eating movement and transparency demands in food labeling.

Competitive dynamics feature both established multinational corporations and innovative specialty companies developing cutting-edge flavor solutions. The market shows particular strength in beverage applications, bakery products, and dairy alternatives, with plant-based food segments driving significant innovation in flavor technology.

Strategic analysis reveals several critical insights shaping the United Kingdom food flavor and enhancer market landscape:

Primary market drivers propelling growth in the United Kingdom food flavor and enhancer sector include fundamental shifts in consumer behavior and food industry dynamics. The increasing demand for processed and convenience foods creates substantial opportunities for flavor innovation, as manufacturers seek to deliver restaurant-quality taste experiences in packaged products.

Health consciousness among UK consumers drives demand for natural flavor alternatives and clean-label products. This trend influences product development strategies across all food categories, with manufacturers investing heavily in natural extraction technologies and sustainable sourcing practices. The growing popularity of plant-based diets creates additional demand for sophisticated flavor systems that can replicate traditional meat and dairy taste profiles.

Technological advancement in flavor chemistry enables the development of more effective and stable flavor systems. Innovations in encapsulation technology, controlled release mechanisms, and flavor masking solutions expand application possibilities and improve product performance. Consumer sophistication regarding flavor experiences drives demand for premium and artisanal taste profiles in mainstream food products.

Regulatory support for food innovation and safety creates a favorable environment for market expansion. UK food regulations encourage transparency and quality, benefiting companies that invest in high-quality flavor solutions and comprehensive testing protocols.

Significant challenges facing the United Kingdom food flavor and enhancer market include regulatory complexity and cost pressures that impact industry profitability. Stringent approval processes for new flavor compounds can delay product launches and increase development costs, particularly for smaller companies with limited regulatory expertise.

Supply chain vulnerabilities affect raw material availability and pricing stability, especially for natural flavor ingredients sourced from global markets. Climate change impacts on agricultural production create uncertainty in natural flavor supply chains, forcing manufacturers to develop alternative sourcing strategies and backup formulations.

Consumer skepticism regarding artificial additives and chemical-sounding ingredient names creates marketing challenges for synthetic flavor products. This perception issue requires significant investment in consumer education and transparent communication strategies to maintain market acceptance.

Economic pressures on food manufacturers drive demand for cost-effective flavor solutions, potentially limiting adoption of premium natural ingredients. Price sensitivity in retail markets constrains the ability of food companies to pass through higher flavor costs to consumers, creating margin pressure throughout the value chain.

Emerging opportunities in the United Kingdom food flavor and enhancer market center on innovation in natural flavor technology and expansion into high-growth food segments. The plant-based food revolution creates substantial demand for sophisticated flavor systems that can deliver authentic taste experiences in meat and dairy alternatives.

Functional food development presents significant growth potential as consumers seek products that combine great taste with health benefits. Flavor companies can capitalize on this trend by developing solutions that mask bitter functional ingredients while enhancing overall palatability and consumer acceptance.

Export opportunities leverage the UK’s reputation for food quality and innovation to access international markets. British flavor companies can expand into emerging markets where demand for premium food ingredients is growing rapidly, particularly in Asia-Pacific and Middle Eastern regions.

Technology partnerships with food manufacturers enable co-development of customized flavor solutions that address specific market needs. These collaborative approaches create competitive advantages and strengthen customer relationships while driving innovation in flavor applications.

Complex market dynamics shape the United Kingdom food flavor and enhancer industry through interconnected factors affecting supply, demand, and competitive positioning. Consumer preferences continue evolving toward natural, sustainable, and health-conscious food choices, creating both challenges and opportunities for flavor manufacturers.

Competitive intensity increases as new entrants leverage innovative technologies and sustainable practices to gain market share. Established players respond through strategic acquisitions, research investments, and partnerships that strengthen their technological capabilities and market reach.

Regulatory evolution influences product development priorities and market strategies. Recent changes in UK food labeling requirements create opportunities for companies with clean-label expertise while challenging those dependent on traditional synthetic approaches. Market consolidation trends see larger companies acquiring specialized flavor houses to expand their technological capabilities and customer bases.

Supply chain optimization becomes increasingly critical as companies seek to reduce costs while maintaining quality standards. Vertical integration strategies and long-term supplier partnerships help ensure ingredient security and cost predictability in volatile commodity markets.

Comprehensive research methodology employed in analyzing the United Kingdom food flavor and enhancer market combines primary and secondary research approaches to ensure data accuracy and market insight reliability. Primary research includes extensive interviews with industry executives, flavor chemists, food manufacturers, and regulatory experts to gather firsthand market intelligence.

Secondary research encompasses analysis of industry publications, regulatory filings, patent databases, and trade association reports to understand market trends and competitive dynamics. MarkWide Research utilizes advanced analytical frameworks to process and validate market data from multiple sources, ensuring comprehensive coverage of market segments and applications.

Data validation processes include cross-referencing information from multiple sources, conducting expert interviews to verify findings, and applying statistical analysis to identify trends and patterns. Market sizing methodologies combine bottom-up and top-down approaches to ensure accuracy and reliability of growth projections.

Analytical tools include competitive benchmarking, SWOT analysis, Porter’s Five Forces assessment, and scenario modeling to provide comprehensive market insights and strategic recommendations for industry participants.

Regional market distribution across the United Kingdom reveals distinct patterns of consumption and growth potential in the food flavor and enhancer sector. Greater London represents approximately 28% market concentration due to high population density, diverse food culture, and concentration of food manufacturing facilities serving national distribution networks.

Northern England demonstrates strong growth in industrial food processing applications, with major manufacturing centers in Manchester, Leeds, and Liverpool driving demand for bulk flavor solutions. The region benefits from established food processing infrastructure and competitive operational costs that attract flavor manufacturing investments.

Scotland shows particular strength in beverage flavor applications, leveraging the region’s heritage in whisky and other alcoholic beverages to develop expertise in complex flavor profiles. Scottish companies increasingly focus on natural flavor extraction and sustainable sourcing practices that align with regional environmental priorities.

Wales and Southwest England benefit from agricultural production that supports natural flavor ingredient sourcing. These regions develop competitive advantages in farm-to-flavor supply chains that reduce costs and improve sustainability credentials for natural flavor products.

Competitive dynamics in the United Kingdom food flavor and enhancer market feature a diverse mix of multinational corporations, regional specialists, and innovative startups competing across different market segments and applications.

Market segmentation analysis reveals distinct categories within the United Kingdom food flavor and enhancer market, each characterized by unique growth drivers, applications, and competitive dynamics.

By Product Type:

By Application:

Beverage applications dominate the United Kingdom food flavor and enhancer market, representing the largest consumption category due to high volume production and frequent product innovation cycles. Soft drink manufacturers drive significant demand for both natural and artificial flavor systems, with increasing focus on reduced-sugar formulations that require sophisticated flavor enhancement to maintain taste appeal.

Confectionery segment demonstrates strong growth in premium and artisanal products that command higher margins and justify investment in expensive natural flavor ingredients. Chocolate applications particularly benefit from innovative flavor combinations and seasonal product launches that drive consumer interest and repeat purchases.

Bakery category shows increasing sophistication in flavor applications, moving beyond traditional vanilla and chocolate to include exotic and international flavor profiles. Heat stability requirements in baking applications create technical challenges that favor established flavor companies with advanced encapsulation technologies.

Dairy alternatives represent the fastest-growing category segment, driven by plant-based diet adoption and lactose intolerance awareness. These applications require sophisticated flavor masking and enhancement technologies to overcome inherent taste challenges in plant-based formulations.

Manufacturers in the United Kingdom food flavor and enhancer market benefit from access to advanced research facilities, skilled workforce, and favorable regulatory environment that supports innovation and quality development. The UK’s position as a global financial center facilitates access to capital for research investments and international expansion initiatives.

Food and beverage companies gain competitive advantages through partnerships with UK flavor houses that provide customized solutions, technical support, and rapid product development capabilities. Local sourcing opportunities reduce supply chain risks and support sustainability initiatives that resonate with environmentally conscious consumers.

Consumers benefit from improved taste experiences, greater product variety, and increased transparency in food labeling that enables informed purchasing decisions. Health-conscious formulations provide options for consumers seeking natural ingredients and functional benefits in their food choices.

Investors find attractive opportunities in a growing market with strong fundamentals, technological innovation potential, and export opportunities that leverage UK expertise in international markets. Regulatory stability and intellectual property protection create favorable conditions for long-term investment strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement represents the most significant trend shaping the United Kingdom food flavor and enhancer market, with consumers increasingly demanding natural ingredients and transparent labeling. This trend drives innovation in natural extraction technologies and sustainable sourcing practices that can deliver authentic flavor experiences without synthetic additives.

Functional flavoring emerges as a key growth area where flavor compounds provide health benefits beyond taste enhancement. Probiotic flavors, antioxidant-rich natural extracts, and vitamin-fortified flavor systems gain market traction as consumers seek products that combine great taste with nutritional benefits.

Sustainability focus influences sourcing decisions and manufacturing processes throughout the industry. Companies invest in carbon-neutral operations, sustainable packaging, and ethical sourcing practices that appeal to environmentally conscious consumers and corporate buyers.

Personalization technology enables customized flavor profiles based on individual preferences and dietary requirements. AI-driven flavor development and consumer preference analysis create opportunities for highly targeted product development and improved customer satisfaction.

Recent industry developments demonstrate the dynamic nature of the United Kingdom food flavor and enhancer market, with significant investments in research, technology, and sustainable practices reshaping competitive dynamics.

Technology partnerships between flavor companies and food manufacturers create collaborative innovation platforms that accelerate product development and market introduction timelines. These partnerships enable shared investment in expensive research equipment and specialized expertise that individual companies might not afford independently.

Acquisition activity increases as larger companies seek to acquire specialized capabilities in natural flavors, clean-label solutions, and emerging application areas. MWR analysis indicates that consolidation trends will continue as companies build comprehensive portfolios to serve diverse customer needs.

Regulatory approvals for new natural flavor compounds expand the palette of available ingredients while maintaining safety standards. Recent approvals for novel botanical extracts and fermentation-derived flavor compounds create new product development opportunities.

Sustainability initiatives include investments in renewable energy, waste reduction programs, and circular economy practices that reduce environmental impact while improving operational efficiency and cost structure.

Strategic recommendations for companies operating in the United Kingdom food flavor and enhancer market emphasize the importance of balancing innovation with operational efficiency to maintain competitive positioning in an evolving marketplace.

Investment priorities should focus on natural flavor technology development, sustainable sourcing capabilities, and advanced delivery systems that provide competitive differentiation. Companies should allocate approximately 15% of revenues to research and development activities to maintain technological leadership and market relevance.

Partnership strategies with food manufacturers, agricultural suppliers, and technology companies can accelerate innovation while sharing development costs and market risks. Vertical integration opportunities in natural ingredient sourcing may provide cost advantages and supply security in volatile commodity markets.

Market expansion strategies should prioritize high-growth segments including plant-based foods, functional beverages, and premium confectionery products where consumers demonstrate willingness to pay premium prices for superior flavor experiences.

Operational excellence initiatives should focus on supply chain optimization, quality consistency, and regulatory compliance to build customer confidence and support premium pricing strategies in competitive markets.

Future market prospects for the United Kingdom food flavor and enhancer industry appear highly favorable, driven by continued innovation in natural flavor technology and expanding applications in emerging food categories. Growth projections indicate sustained expansion at approximately 6.8% CAGR over the next five years, supported by strong fundamentals and favorable market conditions.

Technology advancement will continue driving market evolution through improved extraction methods, enhanced stability systems, and novel delivery mechanisms that expand application possibilities. Biotechnology applications in flavor production offer potential for more sustainable and cost-effective manufacturing processes.

Consumer trends toward health, sustainability, and authenticity will shape product development priorities and create opportunities for companies that can deliver natural, functional, and environmentally responsible flavor solutions. Plant-based food growth represents the largest single opportunity for flavor innovation and market expansion.

International expansion opportunities will leverage UK expertise and reputation for quality to access growing markets in Asia-Pacific, Middle East, and emerging economies where demand for premium food ingredients continues increasing rapidly.

The United Kingdom food flavor and enhancer market demonstrates exceptional resilience and growth potential despite facing various challenges including regulatory complexity, supply chain pressures, and intense competition. Market fundamentals remain strong, supported by consumer demand for natural ingredients, innovative flavor experiences, and sustainable food solutions.

Industry transformation toward clean-label products and functional applications creates substantial opportunities for companies that invest in appropriate technologies and market positioning strategies. The growing importance of plant-based foods and health-conscious formulations provides clear direction for future innovation and investment priorities.

Competitive success will increasingly depend on companies’ ability to balance innovation with operational efficiency while maintaining high quality standards and regulatory compliance. Strategic partnerships and technology investments will be critical for maintaining market relevance and capturing growth opportunities in an evolving marketplace that rewards authenticity, sustainability, and superior taste experiences.

What is Food Flavor and Enhancer?

Food Flavor and Enhancer refers to substances added to food products to enhance their taste, aroma, and overall sensory experience. These can include natural and artificial flavors, spices, and seasoning blends used across various food categories.

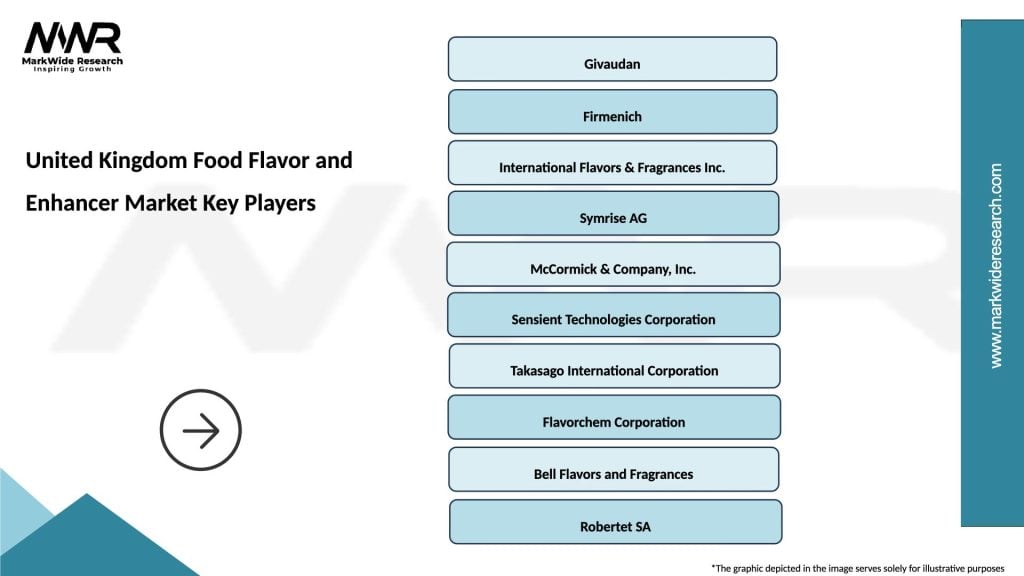

Who are the key players in the United Kingdom Food Flavor and Enhancer Market?

Key players in the United Kingdom Food Flavor and Enhancer Market include companies like Givaudan, Firmenich, and Symrise, which are known for their innovative flavor solutions and extensive product portfolios, among others.

What are the growth factors driving the United Kingdom Food Flavor and Enhancer Market?

The growth of the United Kingdom Food Flavor and Enhancer Market is driven by increasing consumer demand for natural flavors, the rise of plant-based food products, and the growing trend of gourmet cooking at home.

What challenges does the United Kingdom Food Flavor and Enhancer Market face?

Challenges in the United Kingdom Food Flavor and Enhancer Market include regulatory compliance regarding food safety, the high cost of natural ingredients, and competition from synthetic alternatives that may offer lower prices.

What opportunities exist in the United Kingdom Food Flavor and Enhancer Market?

Opportunities in the United Kingdom Food Flavor and Enhancer Market include the expansion of the organic food segment, the increasing popularity of ethnic cuisines, and the potential for innovative flavor combinations to attract health-conscious consumers.

What trends are shaping the United Kingdom Food Flavor and Enhancer Market?

Trends in the United Kingdom Food Flavor and Enhancer Market include a shift towards clean label products, the incorporation of functional ingredients for health benefits, and the growing use of technology in flavor development and customization.

United Kingdom Food Flavor and Enhancer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Flavors, Artificial Flavors, Flavor Enhancers, Seasonings |

| Application | Beverages, Bakery, Dairy, Snacks |

| End User | Food Manufacturers, Restaurants, Retailers, Catering Services |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Food Flavor and Enhancer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at