444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Kingdom Equity Management Software Market is a crucial segment within the broader financial technology (fintech) industry, providing essential tools and platforms for efficiently managing equity investments and portfolios. As the UK remains a global financial hub, with London at its center, the demand for sophisticated equity management solutions continues to grow. These software solutions cater to various stakeholders, including investment firms, asset managers, hedge funds, pension funds, and individual investors, seeking to optimize their equity investment strategies and maximize returns.

Meaning

Equity management software refers to specialized platforms and tools designed to streamline and automate the process of managing equity investments. These software solutions offer features such as portfolio management, performance tracking, risk analysis, compliance monitoring, and reporting. By leveraging advanced analytics, data visualization, and automation capabilities, equity management software enables investors to make informed decisions, mitigate risks, and achieve their financial objectives efficiently.

Executive Summary

The United Kingdom Equity Management Software Market has witnessed significant growth in recent years, driven by factors such as the increasing complexity of equity markets, regulatory requirements, and the growing adoption of technology in the financial services sector. Market participants are increasingly relying on sophisticated software solutions to enhance their investment processes, gain competitive advantages, and deliver superior returns to their clients. However, challenges such as data security concerns, regulatory compliance, and the need for seamless integration with existing systems remain key considerations for industry players.

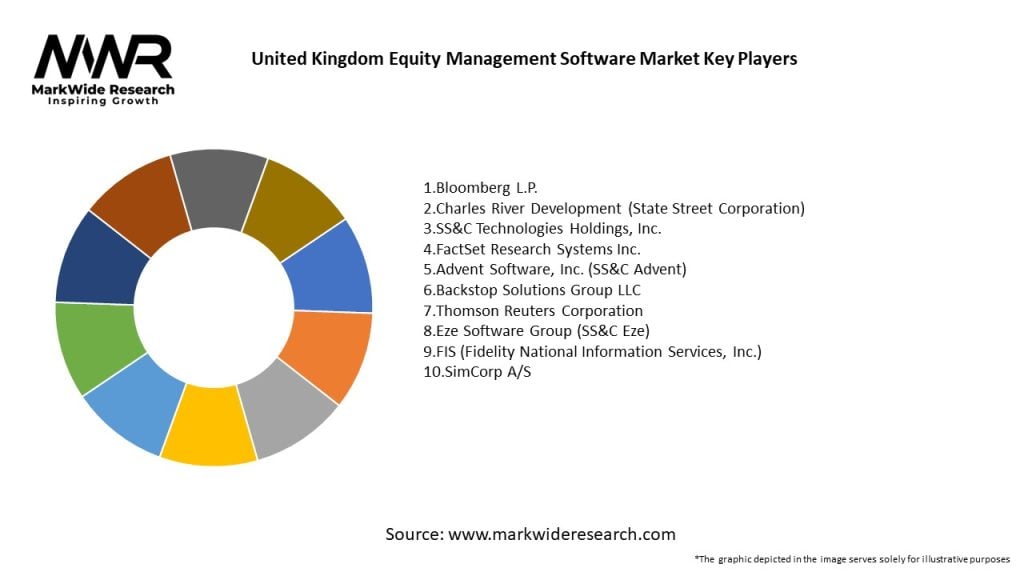

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United Kingdom Equity Management Software Market operates in a dynamic environment shaped by various factors, including technological advancements, regulatory changes, competitive pressures, and evolving investor preferences. These dynamics influence market trends, customer behavior, and the strategic decisions of industry participants. Understanding the market dynamics is essential for software vendors to adapt, innovate, and capitalize on emerging opportunities.

Regional Analysis

The United Kingdom Equity Management Software Market exhibits regional variations in terms of market size, growth potential, and competitive landscape. Key regions within the UK, such as London, Edinburgh, Manchester, and Birmingham, serve as major financial centers and hubs for investment management activities. London, in particular, is home to a diverse ecosystem of financial institutions, asset managers, and fintech companies, driving the demand for equity management software solutions.

Competitive Landscape

Leading Companies in the United Kingdom Equity Management Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The United Kingdom Equity Management Software Market can be segmented based on various factors such as:

Segmentation provides a more granular understanding of customer needs, preferences, and usage scenarios, enabling software vendors to tailor their offerings and marketing strategies accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The United Kingdom Equity Management Software Market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides an overview of the United Kingdom Equity Management Software Market’s strengths, weaknesses, opportunities, and threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated digital transformation trends in the United Kingdom Equity Management Software Market, with both challenges and opportunities arising from changes in market dynamics, investor behavior, and regulatory priorities:

Key Industry Developments

Analyst Suggestions

Future Outlook

The United Kingdom Equity Management Software Market is poised for continued growth and innovation, driven by factors such as digital transformation, regulatory evolution, technological advancements, and changing investor preferences. As the financial services industry becomes increasingly interconnected, complex, and competitive, the demand for sophisticated equity management solutions will continue to rise. Equity management software vendors that can anticipate market trends, address customer needs, and deliver value-added solutions will be well-positioned to succeed in the dynamic and evolving market landscape.

Conclusion

The United Kingdom Equity Management Software Market plays a pivotal role in supporting the investment management activities of financial institutions, asset managers, and individual investors. As the UK remains a global financial center and hub for innovation, the demand for advanced equity management solutions continues to grow. Despite challenges such as data security concerns, regulatory compliance, and integration complexities, the market presents significant opportunities for software vendors to innovate, differentiate, and deliver value to their customers. By embracing technological advancements, focusing on customer success, and collaborating with industry stakeholders, equity management software vendors can drive growth, profitability, and success in the dynamic and competitive UK market.

What is Equity Management Software?

Equity Management Software refers to tools and platforms that assist organizations in managing their equity investments, tracking performance, and ensuring compliance with regulations. These solutions are essential for investment firms, asset managers, and corporate finance departments.

What are the key players in the United Kingdom Equity Management Software Market?

Key players in the United Kingdom Equity Management Software Market include companies like SS&C Technologies, Eze Software, and FIS, which provide comprehensive solutions for equity management and investment tracking, among others.

What are the growth factors driving the United Kingdom Equity Management Software Market?

The growth of the United Kingdom Equity Management Software Market is driven by increasing demand for efficient portfolio management, the need for regulatory compliance, and the rise of digital transformation in financial services. Additionally, the growing complexity of investment strategies necessitates advanced software solutions.

What challenges does the United Kingdom Equity Management Software Market face?

Challenges in the United Kingdom Equity Management Software Market include the high cost of implementation, the need for continuous updates to comply with changing regulations, and the integration of new technologies with existing systems. These factors can hinder adoption among smaller firms.

What opportunities exist in the United Kingdom Equity Management Software Market?

Opportunities in the United Kingdom Equity Management Software Market include the increasing adoption of artificial intelligence and machine learning for predictive analytics, the expansion of cloud-based solutions, and the growing focus on sustainability in investment practices. These trends can enhance software capabilities and user experience.

What trends are shaping the United Kingdom Equity Management Software Market?

Trends shaping the United Kingdom Equity Management Software Market include the rise of automated trading systems, the integration of ESG factors into investment decisions, and the demand for real-time data analytics. These trends are influencing how firms manage their equity portfolios.

United Kingdom Equity Management Software Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portfolio Management, Trade Execution, Risk Management, Compliance Monitoring |

| End User | Asset Managers, Hedge Funds, Family Offices, Institutional Investors |

| Deployment | On-Premises, Cloud-Based, Hybrid, SaaS |

| Service Type | Consulting, Implementation, Support, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United Kingdom Equity Management Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at