444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom engineering plastics market represents a dynamic and rapidly evolving sector within the broader materials industry, characterized by exceptional growth potential and technological advancement. Engineering plastics have emerged as critical components across diverse industrial applications, from automotive manufacturing to aerospace engineering, demonstrating remarkable performance characteristics that surpass traditional materials in numerous applications.

Market dynamics indicate robust expansion driven by increasing demand for lightweight, durable, and high-performance materials across key industrial sectors. The UK market has experienced substantial growth, with adoption rates reaching 78% among automotive manufacturers seeking to reduce vehicle weight while maintaining structural integrity. This transformation reflects broader industry trends toward sustainability and performance optimization.

Regional positioning within Europe places the United Kingdom as a significant hub for engineering plastics innovation and application. The market encompasses various polymer types including polyamides, polycarbonates, polyoxymethylene, and thermoplastic polyesters, each serving specific industrial requirements. Manufacturing efficiency improvements of up to 35% have been documented across sectors implementing advanced engineering plastic solutions.

Industrial integration continues to accelerate as companies recognize the strategic advantages of engineering plastics over traditional materials. The market’s evolution reflects changing consumer preferences, regulatory requirements, and technological capabilities that collectively drive sustained growth momentum throughout the United Kingdom’s industrial landscape.

The United Kingdom engineering plastics market refers to the comprehensive ecosystem encompassing the production, distribution, and application of high-performance polymer materials specifically designed for demanding industrial applications requiring superior mechanical, thermal, and chemical properties compared to conventional plastics.

Engineering plastics distinguish themselves through exceptional durability, temperature resistance, dimensional stability, and mechanical strength, making them suitable for applications where traditional materials may fail or prove inadequate. These advanced polymers undergo specialized manufacturing processes to achieve enhanced performance characteristics essential for critical industrial components.

Market scope includes various polymer categories such as polyamide (nylon), polycarbonate, polyoxymethylene (POM), polybutylene terephthalate (PBT), and polyethylene terephthalate (PET), each offering unique properties tailored to specific application requirements. The market encompasses raw material suppliers, processors, distributors, and end-users across multiple industrial sectors.

Value chain integration extends from petrochemical feedstock suppliers through polymer manufacturers, compounders, processors, and ultimately to end-user industries including automotive, aerospace, electronics, healthcare, and industrial machinery. This comprehensive market structure supports innovation and technological advancement throughout the engineering plastics ecosystem.

Strategic positioning of the United Kingdom engineering plastics market demonstrates exceptional growth potential driven by technological innovation, industrial modernization, and increasing demand for high-performance materials across key sectors. The market has established itself as a critical component of the UK’s advanced manufacturing ecosystem.

Growth trajectory reflects sustained expansion with automotive applications representing the largest market segment, accounting for approximately 42% of total consumption. Electronics and electrical applications follow as the second-largest segment, driven by miniaturization trends and performance requirements in consumer electronics and industrial equipment.

Technological advancement continues to shape market evolution, with bio-based engineering plastics gaining traction as sustainable alternatives to petroleum-based polymers. Innovation in additive manufacturing applications has opened new market opportunities, with 3D printing applications experiencing growth rates exceeding 25% annually.

Competitive landscape features both international polymer manufacturers and specialized UK-based companies focusing on niche applications and custom formulations. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding technological capabilities and market reach throughout the region.

Future outlook suggests continued expansion driven by emerging applications in renewable energy, medical devices, and advanced manufacturing technologies. Regulatory support for sustainable materials and circular economy initiatives further reinforces positive market prospects for the United Kingdom engineering plastics sector.

Market segmentation reveals distinct patterns of demand and application across various industrial sectors, with each segment demonstrating unique growth characteristics and technological requirements. Understanding these patterns provides valuable insights for strategic planning and investment decisions.

Technology trends indicate increasing sophistication in polymer formulations, with custom compounds designed for specific applications becoming more prevalent. Advanced processing techniques enable enhanced performance characteristics and expanded application possibilities across diverse industrial sectors.

Automotive lightweighting initiatives serve as the primary driver for engineering plastics adoption, as manufacturers seek to reduce vehicle weight while maintaining safety and performance standards. Regulatory pressure for improved fuel efficiency and reduced emissions accelerates this trend, with weight reduction targets of 15-20% driving significant material substitution opportunities.

Electronics miniaturization creates substantial demand for high-performance plastics capable of withstanding thermal cycling, providing electrical insulation, and maintaining dimensional stability in compact electronic assemblies. The proliferation of smart devices and IoT applications further amplifies this demand across consumer and industrial markets.

Sustainability requirements increasingly influence material selection decisions, with companies seeking alternatives to traditional materials that offer improved environmental profiles. Bio-based engineering plastics and recycled content formulations address these requirements while maintaining performance characteristics essential for demanding applications.

Manufacturing automation drives demand for precision components that can withstand repetitive mechanical stress and maintain dimensional accuracy over extended service life. Engineering plastics provide cost-effective solutions for automated manufacturing equipment, reducing maintenance requirements and improving operational efficiency.

Regulatory compliance in sectors such as healthcare, food processing, and automotive creates demand for specialized engineering plastic formulations that meet stringent safety and performance standards. These requirements often necessitate custom formulations and specialized processing techniques.

Raw material price volatility presents significant challenges for engineering plastics manufacturers and end-users, with petroleum-based feedstock costs subject to global commodity market fluctuations. This volatility complicates long-term planning and pricing strategies throughout the value chain.

Technical complexity in processing engineering plastics requires specialized equipment and expertise, creating barriers to entry for smaller manufacturers and limiting adoption in some applications. Processing parameters must be precisely controlled to achieve optimal material properties and part quality.

Competition from alternative materials including advanced metals, composites, and ceramics challenges engineering plastics in certain high-performance applications. These alternatives may offer superior properties in specific applications, limiting market expansion opportunities.

Environmental concerns regarding plastic waste and end-of-life disposal create regulatory and market pressures that may limit growth in certain applications. Public perception of plastic materials can influence purchasing decisions and regulatory policies affecting market development.

Supply chain dependencies on global polymer manufacturers create vulnerability to disruptions and limit local supply security. Brexit-related trade considerations add complexity to supply chain management and may impact material availability and costs.

Renewable energy applications present substantial growth opportunities as the UK expands its renewable energy infrastructure. Wind turbine components, solar panel frames, and energy storage systems require high-performance materials capable of withstanding harsh environmental conditions over extended service life.

Medical device innovation creates demand for specialized engineering plastics meeting biocompatibility requirements and regulatory standards. An aging population and advancing medical technologies drive continued expansion in this high-value market segment.

Additive manufacturing growth opens new application possibilities for engineering plastics, enabling complex geometries and customized components previously impossible with traditional manufacturing methods. This technology trend creates opportunities for specialized material formulations and processing techniques.

Circular economy initiatives drive development of recycled and bio-based engineering plastics, addressing sustainability concerns while maintaining performance characteristics. Government support for circular economy principles creates favorable conditions for sustainable material development.

Infrastructure modernization projects across the UK create demand for durable, low-maintenance materials suitable for construction and infrastructure applications. Engineering plastics offer advantages in corrosion resistance, weight reduction, and installation efficiency.

Supply chain evolution reflects changing global trade patterns and regional manufacturing strategies, with companies seeking to reduce dependency on distant suppliers and improve supply security. Local and regional sourcing initiatives gain importance as companies prioritize supply chain resilience.

Technology integration accelerates as digital manufacturing technologies enable more precise control over material properties and processing parameters. Industry 4.0 concepts including predictive maintenance and real-time quality monitoring improve manufacturing efficiency and product consistency.

Customer collaboration intensifies as engineering plastics suppliers work more closely with end-users to develop custom formulations and optimize application performance. This collaborative approach drives innovation and creates competitive advantages for market participants.

Regulatory landscape continues to evolve with new standards for material safety, environmental impact, and performance requirements. Companies must adapt to changing regulations while maintaining competitiveness and profitability in dynamic market conditions.

Investment patterns show increasing focus on sustainable technologies and circular economy solutions, with venture capital and corporate investment supporting development of bio-based materials and recycling technologies. These investments drive innovation and market transformation throughout the engineering plastics ecosystem.

Comprehensive analysis of the United Kingdom engineering plastics market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, technical specialists, and key stakeholders across the value chain.

Data collection encompasses quantitative analysis of production statistics, trade data, and consumption patterns combined with qualitative insights from industry experts and market participants. Secondary research includes analysis of company reports, industry publications, and regulatory documents.

Market segmentation analysis examines demand patterns across application sectors, polymer types, and regional markets to identify growth opportunities and competitive dynamics. Statistical modeling techniques project future market trends based on historical data and identified market drivers.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert review of findings. Industry feedback sessions provide additional validation and insights into market dynamics and future trends.

Analytical framework incorporates macroeconomic factors, industry trends, and technological developments to provide comprehensive market understanding. Regular updates ensure research findings reflect current market conditions and emerging trends affecting the engineering plastics sector.

Geographic distribution of engineering plastics demand across the United Kingdom reveals distinct regional patterns influenced by industrial concentrations, manufacturing capabilities, and infrastructure development. The Midlands region maintains its position as the largest consumer, accounting for approximately 38% of total market demand.

Midlands dominance reflects the region’s strong automotive manufacturing base, with major vehicle production facilities driving substantial demand for engineering plastics in automotive applications. The concentration of tier-one suppliers and component manufacturers further reinforces this regional strength.

Northern England represents the second-largest regional market, with 28% market share driven by aerospace manufacturing, industrial machinery, and chemical processing industries. The region’s manufacturing heritage and skilled workforce support continued growth in engineering plastics applications.

Southern England accounts for 22% of market demand, with electronics, healthcare, and high-technology applications driving consumption patterns. The region’s proximity to research institutions and technology companies supports innovation in specialized engineering plastic applications.

Scotland and Wales collectively represent 12% of market demand, with renewable energy applications and specialized manufacturing driving regional consumption. Government support for renewable energy development creates growth opportunities in these regions.

Regional development initiatives focus on strengthening manufacturing capabilities and supporting innovation in advanced materials. Investment in research and development facilities enhances regional competitiveness and supports market expansion throughout the United Kingdom.

Market structure features a combination of global polymer manufacturers, regional specialists, and custom compounding companies serving diverse customer requirements across multiple industrial sectors. Competition intensifies as companies seek to differentiate through technology innovation and customer service excellence.

Competitive strategies emphasize innovation, customer collaboration, and sustainability initiatives as companies seek to maintain market position and drive growth. Strategic partnerships and acquisitions enable companies to expand capabilities and access new market segments.

Technology leadership becomes increasingly important as customers demand higher performance and more specialized solutions. Companies investing in research and development capabilities gain competitive advantages through innovative product offerings and technical support services.

By Polymer Type: The market encompasses various engineering plastic categories, each serving specific application requirements and performance specifications. Polyamides represent the largest segment due to their versatility and cost-effectiveness across multiple applications.

By Application Sector: Market segmentation by end-use application reveals distinct demand patterns and growth characteristics across industrial sectors.

By Processing Method: Different processing techniques enable various product forms and applications, with injection molding representing the dominant processing method.

Automotive applications continue to drive the largest share of engineering plastics consumption, with under-the-hood components, interior systems, and structural elements benefiting from weight reduction and performance advantages. Fuel efficiency improvements of up to 8% result from strategic material substitution in vehicle applications.

Electronics segment demonstrates exceptional growth potential as device miniaturization and performance requirements drive demand for specialized engineering plastics. Thermal management, electrical insulation, and dimensional stability requirements create opportunities for high-performance polymer solutions.

Industrial machinery applications benefit from engineering plastics’ durability, chemical resistance, and precision capabilities. Wear parts, seals, and structural components in manufacturing equipment demonstrate extended service life and reduced maintenance requirements compared to traditional materials.

Healthcare applications represent a high-value market segment with stringent regulatory requirements and specialized performance needs. Biocompatibility, sterilization resistance, and precision manufacturing capabilities drive demand for specialized engineering plastic formulations.

Aerospace components require exceptional performance characteristics including temperature resistance, chemical compatibility, and weight reduction benefits. These demanding applications justify premium pricing and drive innovation in specialized polymer formulations.

Emerging applications in renewable energy, additive manufacturing, and smart materials create new growth opportunities for engineering plastics manufacturers. These applications often require custom formulations and specialized processing techniques.

Manufacturers benefit from engineering plastics through reduced production costs, improved product performance, and enhanced design flexibility. Weight reduction capabilities enable compliance with regulatory requirements while maintaining or improving product functionality.

Cost advantages include reduced tooling costs compared to metal components, simplified assembly processes, and elimination of secondary operations such as painting or coating. These benefits improve manufacturing efficiency and reduce total cost of ownership for end-users.

Design freedom enables complex geometries and integrated functionality impossible with traditional materials. Engineers can optimize component design for specific performance requirements while reducing part count and assembly complexity.

Performance benefits include superior chemical resistance, dimensional stability, and fatigue resistance compared to many traditional materials. These characteristics extend product service life and reduce maintenance requirements across various applications.

Sustainability advantages encompass reduced energy consumption during manufacturing, lower transportation costs due to weight reduction, and potential for recycling at end of life. These benefits align with corporate sustainability goals and regulatory requirements.

Innovation opportunities arise from ongoing material development and processing technology advancement. Companies can differentiate products through material selection and optimization, creating competitive advantages in target markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend shaping material selection and product development strategies. Companies increasingly prioritize bio-based feedstocks, recycled content, and circular economy principles in engineering plastics applications. This trend reflects both regulatory pressure and customer demand for environmentally responsible solutions.

Digitalization advancement transforms manufacturing processes through smart sensors, predictive analytics, and automated quality control systems. These technologies enable more precise control over material properties and processing parameters, improving product consistency and reducing waste.

Customization demand increases as customers seek specialized formulations tailored to specific application requirements. This trend drives collaboration between material suppliers and end-users, resulting in innovative solutions and competitive differentiation.

Additive manufacturing adoption creates new opportunities for engineering plastics in rapid prototyping, low-volume production, and complex geometries. Specialized filaments and powders designed for 3D printing applications represent a growing market segment.

Lightweighting acceleration continues across multiple industries as companies seek to improve energy efficiency and reduce environmental impact. This trend particularly benefits engineering plastics in automotive and aerospace applications where weight reduction provides significant performance advantages.

Regulatory evolution influences material selection through new standards for safety, environmental impact, and performance requirements. Companies must adapt to changing regulations while maintaining competitiveness and innovation capabilities.

Technology partnerships between material suppliers and end-users accelerate innovation and application development. These collaborations focus on developing specialized formulations and optimizing processing parameters for specific applications.

Capacity investments by major manufacturers enhance local supply capabilities and reduce dependency on imports. New production facilities and processing capabilities strengthen the UK’s position in the global engineering plastics market.

Acquisition activity consolidates market participants and creates synergies in technology, manufacturing, and distribution capabilities. Strategic acquisitions enable companies to expand product portfolios and access new market segments.

Research initiatives focus on sustainable materials, advanced processing technologies, and novel applications. University partnerships and government funding support innovation in bio-based polymers and recycling technologies.

Regulatory developments establish new standards for material safety, environmental impact, and performance requirements. Industry collaboration ensures standards reflect technical capabilities while supporting market development.

Digital transformation initiatives improve supply chain visibility, customer service, and operational efficiency. Companies invest in digital platforms to enhance customer experience and optimize business processes throughout the value chain.

MarkWide Research analysis indicates that companies should prioritize sustainability initiatives and circular economy principles to align with regulatory trends and customer expectations. Investment in bio-based materials and recycling technologies will create competitive advantages in evolving market conditions.

Technology investment in advanced processing capabilities and digital manufacturing systems will enable companies to differentiate through superior product quality and customer service. Companies should evaluate additive manufacturing opportunities and develop specialized materials for emerging applications.

Strategic partnerships with key customers and technology providers will accelerate innovation and market development. Collaborative relationships enable companies to develop custom solutions and access new application opportunities across diverse industrial sectors.

Supply chain optimization should focus on reducing dependency on distant suppliers and improving local sourcing capabilities. Companies should evaluate regional supply options and invest in supply chain resilience to mitigate disruption risks.

Market diversification across application sectors and geographic regions will reduce concentration risk and create growth opportunities. Companies should evaluate emerging applications in renewable energy, healthcare, and advanced manufacturing sectors.

Talent development in technical and commercial capabilities will support growth and innovation objectives. Investment in employee training and development ensures companies maintain competitive advantages in dynamic market conditions.

Growth trajectory for the United Kingdom engineering plastics market remains positive, driven by continued industrial modernization, sustainability initiatives, and technological advancement. MWR projections indicate sustained expansion across key application sectors over the forecast period.

Technology evolution will continue to create new application opportunities and improve material performance characteristics. Advanced polymer formulations and processing technologies will enable engineering plastics to compete effectively with alternative materials in demanding applications.

Sustainability focus will intensify as regulatory requirements and customer expectations drive adoption of bio-based and recycled materials. Companies investing in sustainable solutions will gain competitive advantages and access to premium market segments.

Market consolidation may accelerate as companies seek scale advantages and technology capabilities through strategic partnerships and acquisitions. This trend will create opportunities for specialized companies with unique technologies or market positions.

Regional development initiatives will strengthen the UK’s position in the global engineering plastics market through investment in manufacturing capabilities, research facilities, and workforce development. Government support for advanced manufacturing will enhance competitiveness.

Innovation acceleration in emerging applications such as renewable energy, medical devices, and smart materials will create new growth opportunities. Companies that successfully develop solutions for these applications will benefit from premium pricing and market leadership positions.

The United Kingdom engineering plastics market demonstrates exceptional potential for continued growth and development, supported by strong industrial demand, technological innovation, and favorable market dynamics. Key sectors including automotive, electronics, and aerospace continue to drive substantial demand for high-performance polymer solutions.

Strategic opportunities exist across multiple dimensions including sustainability initiatives, emerging applications, and technology advancement. Companies that successfully navigate these opportunities while addressing market challenges will achieve sustainable competitive advantages and profitable growth.

Market evolution toward more sustainable and specialized solutions creates both challenges and opportunities for industry participants. Success will depend on innovation capabilities, customer collaboration, and strategic positioning in high-value market segments.

The United Kingdom engineering plastics market is well-positioned to capitalize on global trends toward lightweighting, sustainability, and performance optimization across diverse industrial applications, ensuring continued relevance and growth in the evolving materials landscape.

What is Engineering Plastics?

Engineering plastics are a group of plastic materials that have superior mechanical and thermal properties compared to standard plastics. They are commonly used in applications such as automotive components, electrical housings, and industrial machinery due to their strength and durability.

What are the key players in the United Kingdom Engineering Plastics Market?

Key players in the United Kingdom Engineering Plastics Market include BASF, DuPont, and SABIC, among others. These companies are known for their innovative solutions and extensive product portfolios in engineering plastics.

What are the growth factors driving the United Kingdom Engineering Plastics Market?

The growth of the United Kingdom Engineering Plastics Market is driven by increasing demand from the automotive and aerospace industries, as well as the rising need for lightweight materials that enhance fuel efficiency. Additionally, advancements in manufacturing technologies are contributing to market expansion.

What challenges does the United Kingdom Engineering Plastics Market face?

The United Kingdom Engineering Plastics Market faces challenges such as fluctuating raw material prices and environmental regulations that promote the use of sustainable materials. These factors can impact production costs and market dynamics.

What opportunities exist in the United Kingdom Engineering Plastics Market?

Opportunities in the United Kingdom Engineering Plastics Market include the growing trend towards electric vehicles, which require advanced materials for battery housings and components. Additionally, the increasing focus on recycling and sustainability presents new avenues for innovation.

What trends are shaping the United Kingdom Engineering Plastics Market?

Trends shaping the United Kingdom Engineering Plastics Market include the development of bio-based engineering plastics and the integration of smart materials that respond to environmental changes. These innovations are expected to enhance product performance and sustainability.

United Kingdom Engineering Plastics Market

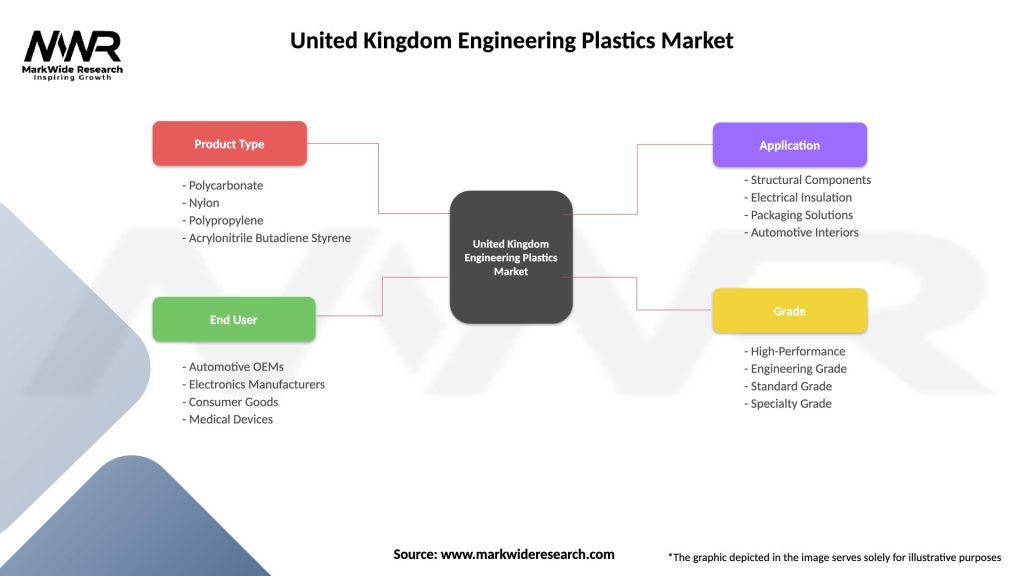

| Segmentation Details | Description |

|---|---|

| Product Type | Polycarbonate, Nylon, Polypropylene, Acrylonitrile Butadiene Styrene |

| End User | Automotive OEMs, Electronics Manufacturers, Consumer Goods, Medical Devices |

| Application | Structural Components, Electrical Insulation, Packaging Solutions, Automotive Interiors |

| Grade | High-Performance, Engineering Grade, Standard Grade, Specialty Grade |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Engineering Plastics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at