444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom electric vehicle charging equipment market represents a rapidly evolving sector that has become fundamental to the nation’s sustainable transportation infrastructure. This dynamic market encompasses a comprehensive range of charging solutions, from residential wall-mounted units to high-powered commercial charging stations, supporting the UK’s ambitious transition toward electric mobility. The market demonstrates robust growth momentum driven by government initiatives, environmental consciousness, and technological advancements in charging infrastructure.

Market expansion is characterized by increasing deployment of charging points across urban and rural areas, with the UK government targeting 300,000 public charging points by 2030. The charging equipment market includes Level 1, Level 2, and DC fast charging solutions, each serving distinct user requirements and installation environments. Technological innovation continues to drive market evolution, with smart charging capabilities, wireless charging systems, and ultra-fast charging technologies gaining significant traction.

Regional distribution shows concentrated development in metropolitan areas like London, Manchester, and Birmingham, while rural charging infrastructure experiences accelerated expansion. The market benefits from substantial government support through grants, tax incentives, and regulatory frameworks designed to accelerate electric vehicle adoption. Private sector investment complements public initiatives, creating a comprehensive charging ecosystem that supports both individual consumers and commercial fleet operators.

The United Kingdom electric vehicle charging equipment market refers to the comprehensive ecosystem of hardware, software, and services designed to provide electrical energy to battery electric vehicles and plug-in hybrid electric vehicles throughout the UK. This market encompasses various charging technologies, installation services, network management systems, and supporting infrastructure required to enable widespread electric vehicle adoption across residential, commercial, and public charging applications.

Charging equipment includes alternating current (AC) chargers for home and workplace installations, direct current (DC) fast chargers for commercial and highway applications, and specialized charging solutions for fleet operations. The market also incorporates smart charging technologies that optimize energy consumption, grid integration capabilities, and payment processing systems that facilitate seamless user experiences. Infrastructure components extend beyond physical charging units to include network connectivity, cloud-based management platforms, and mobile applications that enhance charging accessibility and convenience.

Strategic market positioning reveals the UK electric vehicle charging equipment market as a critical enabler of the nation’s net-zero carbon emissions target by 2050. The market demonstrates exceptional growth potential driven by accelerating electric vehicle adoption, supportive government policies, and increasing private sector investment in charging infrastructure. Market dynamics indicate strong demand across residential, workplace, and public charging segments, with DC fast charging experiencing particularly robust expansion.

Key market drivers include the UK’s phase-out of internal combustion engine vehicle sales by 2030, substantial government funding for charging infrastructure, and growing consumer acceptance of electric vehicles. The market benefits from technological advancements in charging speed, smart grid integration, and user interface improvements that enhance the overall charging experience. Competitive landscape features established international players alongside emerging UK-based companies, creating a diverse ecosystem of charging solutions.

Investment trends show significant capital allocation toward charging network expansion, with both public and private funding supporting infrastructure development. The market experiences strong growth in workplace charging installations as employers seek to support employee electric vehicle adoption. Future projections indicate continued market expansion with increasing focus on ultra-fast charging capabilities and integrated energy management systems.

Market intelligence reveals several critical insights that define the UK electric vehicle charging equipment landscape. The following key insights demonstrate the market’s current state and future trajectory:

Government policy initiatives serve as the primary catalyst for UK electric vehicle charging equipment market expansion. The government’s commitment to ending the sale of new petrol and diesel cars by 2030 creates substantial demand for charging infrastructure. Financial incentives including grants for home charger installations, workplace charging schemes, and public charging infrastructure funding significantly accelerate market growth.

Environmental consciousness among UK consumers drives increasing electric vehicle adoption, directly translating to higher demand for charging equipment. Corporate sustainability commitments encourage businesses to install workplace charging facilities, supporting employee electric vehicle ownership. Technological advancements in battery technology extend electric vehicle range while reducing charging times, making electric vehicles more practical for diverse usage patterns.

Energy sector transformation toward renewable sources aligns with electric vehicle charging infrastructure development, creating synergies between clean energy generation and sustainable transportation. The integration of smart charging technologies enables grid optimization and demand management, supporting overall energy system efficiency. Urban planning initiatives increasingly incorporate charging infrastructure requirements into new developments and retrofitting projects.

Economic factors including declining battery costs and improving electric vehicle affordability expand the potential customer base for charging equipment. Fleet electrification trends driven by total cost of ownership advantages create substantial demand for commercial charging solutions. Consumer convenience expectations drive demand for faster charging speeds and more accessible charging locations throughout the UK.

High capital investment requirements for charging infrastructure installation present significant barriers for market participants, particularly smaller operators and property owners. The substantial upfront costs associated with DC fast charging equipment and electrical infrastructure upgrades can limit deployment rates in certain locations. Grid capacity constraints in some areas require expensive electrical infrastructure upgrades before high-power charging installations can proceed.

Regulatory complexity surrounding planning permissions, electrical safety standards, and grid connection requirements can slow charging infrastructure deployment. Different local authority requirements across the UK create inconsistent approval processes that may delay project implementation. Technical challenges related to integrating charging equipment with existing electrical systems and ensuring reliable grid connections pose ongoing obstacles.

Market fragmentation with multiple charging networks, payment systems, and connector standards creates user confusion and interoperability challenges. The lack of universal payment methods and network access can limit charging equipment utilization and customer satisfaction. Skilled workforce shortages in electrical installation and maintenance services constrain the pace of charging infrastructure deployment.

Property ownership complexities in multi-tenant buildings and leased commercial properties create barriers to charging equipment installation. Landlord-tenant relationships and shared electrical infrastructure present challenges for residential and workplace charging deployment. Competition for prime locations and limited suitable sites for public charging installations can restrict optimal network coverage.

Workplace charging expansion presents substantial opportunities as employers increasingly recognize the benefits of supporting employee electric vehicle adoption. Companies seeking to demonstrate environmental responsibility and attract talent create growing demand for workplace charging solutions. Retail integration opportunities emerge as shopping centers, supermarkets, and hospitality venues install charging equipment to attract customers and extend visit durations.

Smart charging technology development offers opportunities for companies to provide advanced solutions that optimize energy consumption, reduce costs, and support grid stability. Integration with renewable energy systems and energy storage creates value-added services for charging equipment providers. Vehicle-to-grid technology presents emerging opportunities for bidirectional charging systems that enable electric vehicles to support grid services.

Rural market development offers significant expansion opportunities as charging infrastructure extends beyond urban centers to support nationwide electric vehicle adoption. Tourism and hospitality sectors in rural areas create demand for destination charging solutions. Fleet electrification across delivery services, public transport, and commercial operations drives demand for specialized charging equipment and depot installations.

Residential market growth continues as electric vehicle ownership expands among homeowners seeking convenient charging solutions. Multi-unit dwelling developments present opportunities for shared charging infrastructure and innovative installation approaches. International expansion opportunities exist for UK-based charging equipment manufacturers and service providers to export solutions to global markets.

Supply chain evolution demonstrates increasing localization as UK manufacturers develop domestic production capabilities for charging equipment components. Global supply chain disruptions have accelerated efforts to establish resilient local supply networks. Technology convergence between charging equipment, energy management systems, and digital platforms creates integrated solutions that enhance user experiences and operational efficiency.

Competitive intensity increases as established automotive suppliers, energy companies, and technology firms enter the charging equipment market. Market consolidation trends emerge through strategic partnerships, acquisitions, and joint ventures aimed at expanding market presence. Innovation cycles accelerate with continuous improvements in charging speed, efficiency, and smart capabilities driving product differentiation.

Customer expectations evolve toward demanding faster charging speeds, seamless payment experiences, and reliable network availability. User interface improvements and mobile application integration become critical differentiators in the competitive landscape. Service model transformation shifts from equipment sales toward comprehensive charging-as-a-service offerings that include installation, maintenance, and network management.

Regulatory landscape continues evolving with new standards for charging equipment safety, interoperability, and grid integration. Government policy updates and incentive program modifications influence market dynamics and investment decisions. Energy market integration deepens as charging infrastructure becomes integral to smart grid operations and renewable energy utilization strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UK electric vehicle charging equipment market. Primary research includes structured interviews with industry executives, charging network operators, equipment manufacturers, and end-users across residential, commercial, and public charging segments. Secondary research incorporates government publications, industry reports, regulatory filings, and academic studies to validate findings and provide comprehensive market context.

Data collection processes utilize both quantitative and qualitative approaches to capture market trends, competitive dynamics, and technological developments. Survey methodologies target diverse stakeholder groups including charging equipment installers, property developers, fleet operators, and electric vehicle owners. Market modeling incorporates statistical analysis, trend extrapolation, and scenario planning to project future market developments and growth trajectories.

Industry expert consultations provide specialized insights into technical developments, regulatory changes, and market opportunities. Focus groups with end-users reveal preferences, pain points, and emerging requirements that influence product development and market strategies. Competitive intelligence gathering includes analysis of company announcements, product launches, partnership agreements, and investment activities across the charging equipment ecosystem.

Validation procedures ensure data accuracy through cross-referencing multiple sources, fact-checking with industry participants, and continuous monitoring of market developments. Regional analysis incorporates local market conditions, regulatory environments, and infrastructure development patterns across different UK regions. Quality assurance measures include peer review processes and expert validation to maintain research integrity and reliability.

London and Southeast England dominate the UK electric vehicle charging equipment market with the highest concentration of charging infrastructure and electric vehicle adoption rates. The region benefits from supportive local policies, high population density, and strong economic conditions that drive both residential and commercial charging equipment demand. Greater London accounts for approximately 35% of UK charging points, reflecting the area’s leadership in sustainable transportation initiatives.

Northern England including Manchester, Liverpool, and Leeds demonstrates rapid charging infrastructure expansion supported by regional development programs and industrial electrification initiatives. The region’s manufacturing heritage translates to growing demand for commercial and fleet charging solutions. Scotland shows strong market growth driven by ambitious climate targets and government support for electric vehicle adoption, with particular strength in renewable energy integration.

Midlands region benefits from its central location and automotive industry presence, creating demand for both manufacturing-related charging infrastructure and consumer solutions. Birmingham and surrounding areas experience significant workplace charging growth as companies support employee electric vehicle adoption. Wales demonstrates increasing market activity with government initiatives supporting rural charging infrastructure development and tourism-related charging installations.

Southwest England shows growing market presence driven by tourism industry needs and rural electrification programs. The region’s focus on renewable energy creates opportunities for integrated charging and energy storage solutions. Northern Ireland represents an emerging market with increasing government support and cross-border charging network development initiatives that enhance regional connectivity.

Market leadership features a diverse mix of international technology companies, energy sector participants, and specialized charging equipment manufacturers. The competitive environment demonstrates increasing consolidation as companies seek to expand market presence and technological capabilities through strategic partnerships and acquisitions.

Competitive strategies emphasize technological innovation, network expansion, and customer experience improvements. Companies invest heavily in smart charging capabilities, mobile applications, and payment system integration to differentiate their offerings. Partnership approaches include collaborations with automotive manufacturers, property developers, and energy suppliers to expand market reach and enhance service offerings.

By Charging Type:

By Power Output:

By Application:

Residential charging equipment represents the largest market segment by volume, driven by increasing home electric vehicle ownership and government grants for domestic charging installations. Smart charging capabilities become increasingly important as homeowners seek to optimize energy costs and grid integration. Installation complexity varies significantly based on property type, electrical infrastructure, and local regulations, influencing equipment selection and pricing.

Commercial workplace charging demonstrates rapid growth as employers recognize the benefits of supporting employee electric vehicle adoption. Companies install charging equipment to attract talent, demonstrate environmental responsibility, and prepare for fleet electrification. Load management systems become critical for workplace installations to optimize electrical capacity and control charging costs across multiple vehicles.

Public charging infrastructure focuses on high-utilization locations including retail centers, transportation hubs, and highway service areas. DC fast charging dominates public installations due to user expectations for rapid charging during travel and shopping activities. Network interoperability and payment system integration become crucial factors for public charging success and user satisfaction.

Fleet charging solutions require specialized equipment designed for high-utilization commercial applications. Depot charging installations support delivery services, public transportation, and commercial vehicle operations with emphasis on reliability and operational efficiency. Energy management systems optimize charging schedules to minimize electricity costs and support grid stability while meeting operational requirements.

Equipment manufacturers benefit from substantial market growth opportunities driven by government support and increasing electric vehicle adoption. The expanding market creates demand for diverse charging solutions across residential, commercial, and public applications. Technology innovation opportunities enable manufacturers to develop advanced products with smart capabilities, improved efficiency, and enhanced user experiences that command premium pricing.

Installation and service providers experience growing demand for specialized expertise in charging equipment deployment, maintenance, and network management. The market expansion creates opportunities for new business models including charging-as-a-service offerings. Skilled workforce development becomes a competitive advantage as companies build capabilities in electrical installation, software integration, and customer support services.

Property owners and developers enhance property values and attract tenants by installing charging infrastructure. Residential properties with charging capabilities command higher rental rates and sale prices. Commercial properties with charging facilities attract environmentally conscious businesses and provide additional revenue streams through charging services.

Energy companies expand service offerings and customer relationships through charging infrastructure investments. Integration with renewable energy systems and grid services creates new revenue opportunities. Utility companies benefit from increased electricity demand while supporting grid modernization and demand management initiatives through smart charging technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart charging integration emerges as a dominant trend with charging equipment incorporating advanced connectivity, load management, and grid optimization capabilities. These systems enable dynamic pricing, demand response participation, and renewable energy integration that benefit both users and grid operators. Artificial intelligence and machine learning technologies optimize charging schedules based on user patterns, electricity prices, and grid conditions.

Ultra-fast charging development accelerates with new installations featuring charging speeds exceeding 150kW to support long-distance travel and commercial applications. Technology improvements in cooling systems, power electronics, and battery compatibility enable faster charging without compromising safety or equipment lifespan. Charging time reduction becomes a critical competitive factor for public charging networks.

Integrated energy solutions combine charging infrastructure with renewable energy generation and battery storage systems. These installations provide grid services, reduce electricity costs, and enhance energy independence for commercial and residential applications. Solar-powered charging stations demonstrate particular growth in commercial and public installations seeking sustainable energy sources.

Subscription and service models replace traditional equipment sales approaches with comprehensive charging-as-a-service offerings. These models include equipment provision, installation, maintenance, and network management services under single contracts. Outcome-based pricing aligns service provider incentives with customer satisfaction and equipment performance metrics.

Government policy evolution includes the announcement of the Electric Vehicle Infrastructure Strategy outlining plans for comprehensive charging network development across the UK. New building regulations require charging infrastructure provision in residential and commercial developments. Grant program expansions increase funding availability for home, workplace, and public charging installations while extending eligibility criteria.

Technology partnerships between automotive manufacturers and charging infrastructure providers accelerate integrated solution development. Collaboration agreements focus on optimizing charging experiences, developing vehicle-specific charging protocols, and creating seamless user interfaces. Cross-industry alliances bring together energy companies, technology firms, and automotive suppliers to develop comprehensive charging ecosystems.

Infrastructure investments by major energy companies include substantial commitments to charging network expansion and technology development. According to MarkWide Research analysis, private sector investment in charging infrastructure has increased significantly, with companies allocating substantial capital to network development and technology innovation. Public-private partnerships leverage combined resources to accelerate charging infrastructure deployment in strategic locations.

Standardization initiatives advance interoperability between different charging networks and payment systems. Industry collaboration develops common standards for charging protocols, connector types, and user authentication methods. Regulatory harmonization efforts create consistent technical requirements and safety standards across different regions and applications.

Strategic positioning recommendations emphasize the importance of developing comprehensive charging solutions that address diverse customer needs across residential, commercial, and public applications. Companies should invest in smart charging technologies and grid integration capabilities to differentiate their offerings and capture emerging market opportunities. Partnership strategies with automotive manufacturers, energy companies, and property developers can accelerate market penetration and expand service capabilities.

Technology investment priorities should focus on ultra-fast charging capabilities, wireless charging development, and vehicle-to-grid integration features. Companies must balance innovation investments with practical deployment considerations including cost, reliability, and user acceptance. Software development becomes increasingly important for creating seamless user experiences and enabling advanced energy management capabilities.

Market expansion approaches should prioritize underserved segments including rural areas, multi-unit dwellings, and specialized commercial applications. Geographic diversification within the UK can reduce market concentration risks while capturing regional growth opportunities. International expansion strategies should leverage UK market experience and technology development for global market entry.

Operational excellence requires investment in skilled workforce development, supply chain optimization, and customer service capabilities. Companies must build scalable operations that can support rapid market growth while maintaining quality and reliability standards. Financial planning should account for substantial capital requirements and extended payback periods typical of infrastructure investments.

Market trajectory indicates continued robust growth driven by accelerating electric vehicle adoption and supportive government policies. The UK charging equipment market is projected to experience sustained expansion through 2030 as infrastructure development keeps pace with vehicle adoption rates. Technology evolution will continue improving charging speeds, efficiency, and user experiences while reducing equipment costs and installation complexity.

Infrastructure density is expected to increase significantly with charging points becoming ubiquitous across urban and rural areas. The transition from range anxiety to charging convenience will drive demand for faster, more accessible charging solutions. Smart grid integration will become standard as charging infrastructure plays an increasingly important role in energy system management and renewable energy utilization.

Market maturation will bring consolidation among charging network operators and equipment manufacturers as companies seek scale advantages and comprehensive service capabilities. Successful companies will demonstrate strong technology platforms, extensive geographic coverage, and superior customer experiences. MWR projections suggest that market leaders will emerge through strategic acquisitions, technology innovation, and operational excellence.

Regulatory environment evolution will continue supporting market development while ensuring safety, interoperability, and consumer protection. Future policies may address grid integration requirements, cybersecurity standards, and environmental sustainability criteria for charging infrastructure. International competitiveness of UK charging technology and services will create export opportunities as global markets expand their electric vehicle infrastructure.

The United Kingdom electric vehicle charging equipment market represents a transformative sector that will play a crucial role in the nation’s transition to sustainable transportation. Market dynamics demonstrate strong growth potential driven by government support, technological innovation, and increasing consumer acceptance of electric vehicles. The comprehensive analysis reveals substantial opportunities across residential, commercial, and public charging segments, with particular strength in smart charging technologies and integrated energy solutions.

Strategic success factors include technology leadership, comprehensive service offerings, and strategic partnerships that enable market participants to capture emerging opportunities while addressing diverse customer needs. The market’s evolution toward smart, integrated charging solutions creates competitive advantages for companies that invest in advanced technologies and user experience improvements. Future market development will be characterized by continued infrastructure expansion, technology advancement, and increasing integration with renewable energy systems and smart grid operations, positioning the UK as a leader in global electric vehicle charging infrastructure development.

What is Electric Vehicle Charging Equipment?

Electric Vehicle Charging Equipment refers to the devices and infrastructure used to charge electric vehicles, including home chargers, public charging stations, and fast chargers. These systems are essential for supporting the growing adoption of electric vehicles in various sectors.

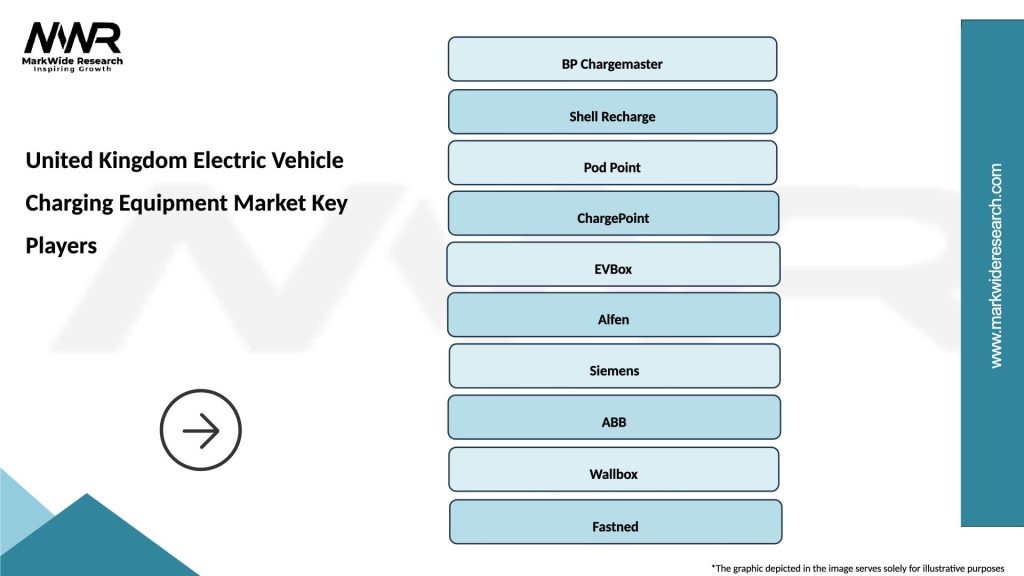

What are the key players in the United Kingdom Electric Vehicle Charging Equipment Market?

Key players in the United Kingdom Electric Vehicle Charging Equipment Market include companies like BP Chargemaster, Pod Point, and ChargePoint, which are actively involved in developing and deploying charging solutions across the country, among others.

What are the main drivers of the United Kingdom Electric Vehicle Charging Equipment Market?

The main drivers of the United Kingdom Electric Vehicle Charging Equipment Market include the increasing adoption of electric vehicles, government incentives for EV infrastructure, and the growing focus on reducing carbon emissions in transportation.

What challenges does the United Kingdom Electric Vehicle Charging Equipment Market face?

Challenges in the United Kingdom Electric Vehicle Charging Equipment Market include the high costs of installation, the need for extensive infrastructure development, and concerns about the reliability and speed of charging stations.

What opportunities exist in the United Kingdom Electric Vehicle Charging Equipment Market?

Opportunities in the United Kingdom Electric Vehicle Charging Equipment Market include advancements in charging technology, the expansion of renewable energy integration, and the potential for smart charging solutions that enhance grid management.

What trends are shaping the United Kingdom Electric Vehicle Charging Equipment Market?

Trends shaping the United Kingdom Electric Vehicle Charging Equipment Market include the rise of ultra-fast charging stations, the integration of charging solutions with mobile apps for user convenience, and the increasing collaboration between automotive manufacturers and charging network providers.

United Kingdom Electric Vehicle Charging Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | AC Chargers, DC Fast Chargers, Wireless Chargers, Portable Chargers |

| Technology | Level 1, Level 2, DC Fast Charging, Inductive Charging |

| End User | Residential, Commercial, Fleet Operators, Public Charging Stations |

| Installation | On-Street, Off-Street, Home Installation, Workplace Charging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Electric Vehicle Charging Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at