444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom electric vehicle battery separator market represents a critical component within the nation’s rapidly expanding electric mobility ecosystem. Battery separators serve as essential safety barriers between the positive and negative electrodes in lithium-ion batteries, preventing short circuits while allowing ionic conductivity. The UK market has experienced remarkable transformation driven by government initiatives promoting electric vehicle adoption, stringent emission regulations, and substantial investments in domestic battery manufacturing capabilities.

Market dynamics indicate robust growth trajectory with the sector benefiting from the UK’s commitment to achieving net-zero emissions by 2050. The government’s ban on new petrol and diesel car sales by 2030 has accelerated demand for high-performance battery separators. Technological advancements in separator materials, including ceramic-coated polyethylene and polypropylene variants, have enhanced battery safety and performance characteristics. The market encompasses various separator types including wet-process separators, dry-process separators, and advanced composite materials designed for next-generation battery chemistries.

Regional concentration remains focused in the Midlands and Northern England, where major automotive manufacturers and battery production facilities are establishing operations. The market growth rate demonstrates significant expansion potential with increasing domestic production capabilities and strategic partnerships between UK companies and global battery manufacturers. Supply chain localization efforts have gained momentum as manufacturers seek to reduce dependency on Asian suppliers while building resilient domestic production networks.

The United Kingdom electric vehicle battery separator market refers to the comprehensive ecosystem encompassing the production, distribution, and application of specialized membrane materials used in electric vehicle battery systems throughout the UK. These separators function as microporous barriers that prevent physical contact between battery electrodes while facilitating ion transport during charging and discharging cycles, ensuring optimal battery performance and safety standards.

Battery separators represent sophisticated engineered materials typically manufactured from polyethylene, polypropylene, or advanced ceramic-coated polymers. The market includes various separator technologies such as single-layer separators, multi-layer configurations, and specialty coated variants designed for specific battery chemistries. Market participants include domestic manufacturers, international suppliers, automotive OEMs, battery cell producers, and research institutions developing next-generation separator technologies.

Commercial applications span across passenger electric vehicles, commercial electric fleets, energy storage systems, and emerging mobility solutions including electric buses and delivery vehicles. The market encompasses both original equipment manufacturing supply chains and aftermarket replacement components, supporting the UK’s transition toward sustainable transportation infrastructure.

Strategic positioning of the UK electric vehicle battery separator market reflects the nation’s ambitious electrification goals and commitment to building domestic battery supply chain capabilities. The market benefits from substantial government support through various funding programs, tax incentives, and regulatory frameworks promoting electric vehicle adoption. Industry consolidation trends indicate increasing collaboration between traditional automotive suppliers and specialized battery component manufacturers.

Technology evolution continues driving market expansion with advanced separator materials offering improved thermal stability, enhanced safety characteristics, and superior electrochemical performance. The market demonstrates strong growth momentum supported by major automotive manufacturers establishing UK production facilities and battery gigafactories coming online. Investment flows from both domestic and international sources have accelerated research and development activities focused on next-generation separator technologies.

Competitive landscape features a mix of established global suppliers and emerging UK-based companies developing innovative separator solutions. The market structure reflects increasing emphasis on supply chain resilience, sustainability considerations, and technological differentiation. Market penetration rates for advanced separator technologies continue expanding as battery manufacturers prioritize safety and performance optimization in their product offerings.

Market intelligence reveals several critical insights shaping the UK electric vehicle battery separator landscape. The sector demonstrates remarkable adaptability to evolving battery chemistries and automotive industry requirements while maintaining focus on safety and performance standards.

Government initiatives represent the primary catalyst driving UK electric vehicle battery separator market expansion. The commitment to ban internal combustion engine vehicle sales by 2030 has created unprecedented demand for electric vehicle components, including high-performance battery separators. Financial incentives through grants, tax benefits, and research funding have accelerated market development and technology advancement initiatives.

Environmental regulations continue strengthening market fundamentals as stricter emission standards compel automotive manufacturers to accelerate electric vehicle production. The UK’s net-zero commitment by 2050 has established clear policy direction supporting electric mobility infrastructure development. Consumer acceptance of electric vehicles has reached a tipping point, with growing awareness of environmental benefits and improving vehicle performance characteristics driving adoption rates.

Technological innovation in battery chemistry and separator materials has enhanced performance capabilities while reducing costs. Advanced separator technologies offering improved thermal stability, enhanced safety features, and superior ionic conductivity are attracting significant investment. Manufacturing scale economies achieved through domestic production facilities are improving cost competitiveness and supply chain efficiency. The establishment of battery gigafactories in the UK has created substantial demand for locally sourced separator materials, supporting market growth and industrial development.

High capital requirements for establishing separator manufacturing facilities present significant barriers to market entry. The specialized equipment, clean room facilities, and quality control systems necessary for separator production require substantial upfront investment. Technical complexity associated with separator manufacturing processes demands specialized expertise and advanced production capabilities that may limit market participation.

Supply chain dependencies on raw materials and specialized chemicals create potential vulnerabilities for UK manufacturers. The concentration of key material suppliers in Asia presents logistical challenges and cost pressures that impact market competitiveness. Quality standards for automotive applications require extensive testing and certification processes that can delay product commercialization and increase development costs.

Market competition from established global suppliers with significant scale advantages and technological expertise creates challenges for emerging UK companies. The need for continuous research and development investment to maintain technological competitiveness strains resources for smaller market participants. Economic uncertainties and potential changes in government policy could impact investment decisions and market development trajectories, creating additional risk factors for industry participants.

Domestic manufacturing expansion presents substantial opportunities for UK companies to capture increasing market share in battery separator production. The government’s focus on building resilient supply chains creates favorable conditions for local manufacturers to establish competitive positions. Technology partnerships with international companies offer pathways for knowledge transfer and market access while maintaining domestic production capabilities.

Next-generation battery technologies including solid-state batteries and advanced lithium chemistries require specialized separator solutions, creating opportunities for innovative UK companies. The development of sustainable separator materials using recyclable polymers and bio-based components aligns with environmental objectives while differentiating products in the marketplace. Export potential to European markets provides growth opportunities as the continent accelerates electric vehicle adoption.

Research and development collaborations between universities, government agencies, and industry participants can accelerate technology advancement and commercial applications. The growing demand for energy storage systems beyond automotive applications, including grid storage and residential systems, expands market opportunities for separator manufacturers. Vertical integration strategies by battery manufacturers create opportunities for long-term supply partnerships and technology co-development initiatives.

Supply and demand dynamics in the UK electric vehicle battery separator market reflect the rapid expansion of domestic battery production capabilities and increasing electric vehicle manufacturing. The market demonstrates strong demand growth driven by automotive industry commitments to electrification and government policy support. Supply chain evolution toward greater domestic content has created opportunities for UK manufacturers while reducing dependency on international suppliers.

Pricing pressures from automotive manufacturers seeking cost optimization have intensified competition among separator suppliers. However, the emphasis on quality, safety, and performance has maintained premium pricing for advanced separator technologies. Technology cycles continue accelerating as battery manufacturers adopt new chemistries and cell designs requiring specialized separator solutions.

Market consolidation trends indicate increasing collaboration between separator manufacturers and battery producers to ensure supply security and technology alignment. The establishment of strategic partnerships has become essential for market participants to maintain competitive positions and access to growing market opportunities. Investment patterns show increasing focus on automation, quality control, and production capacity expansion to meet growing demand requirements.

Comprehensive analysis of the UK electric vehicle battery separator market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry executives, technical experts, and market participants across the value chain. Survey data collection from manufacturers, suppliers, and end-users provides quantitative insights into market trends and growth projections.

Secondary research encompasses analysis of industry reports, government publications, academic studies, and company financial statements. Market data validation through cross-referencing multiple sources ensures consistency and reliability of market intelligence. Technical literature review and patent analysis provide insights into technology trends and innovation patterns shaping market development.

Quantitative analysis includes statistical modeling of market trends, growth projections, and competitive dynamics. Qualitative assessment incorporates expert opinions, industry insights, and strategic analysis of market opportunities and challenges. The research methodology ensures comprehensive coverage of market segments, geographic regions, and technology categories within the UK electric vehicle battery separator market landscape.

Geographic distribution of the UK electric vehicle battery separator market demonstrates concentration in key automotive and manufacturing regions. The Midlands region maintains approximately 35% market share due to its established automotive manufacturing base and proximity to major vehicle production facilities. Northern England accounts for roughly 28% of market activity with significant battery manufacturing investments and government support for industrial development.

Southeast England represents 22% of market presence driven by research institutions, technology companies, and proximity to European markets. The region benefits from strong innovation ecosystems and access to skilled technical talent. Scotland and Wales collectively contribute 15% of market activity with growing investments in renewable energy storage applications and specialized manufacturing capabilities.

Regional development patterns reflect government industrial strategy priorities and private sector investment decisions. The establishment of battery gigafactories has created regional clusters of separator demand and supply chain development. Infrastructure investments in transportation, utilities, and industrial facilities support regional market growth and competitiveness. Skills development programs and educational partnerships ensure adequate workforce availability to support market expansion across different regions.

Market leadership in the UK electric vehicle battery separator sector features a combination of international suppliers and emerging domestic companies. The competitive environment reflects ongoing industry transformation as traditional automotive suppliers adapt to electric vehicle requirements while specialized battery component manufacturers expand their market presence.

Competitive strategies focus on technology differentiation, supply chain optimization, and strategic partnerships with battery manufacturers and automotive companies. Market positioning emphasizes quality, safety, and performance characteristics while maintaining cost competitiveness in an increasingly price-sensitive market environment.

Technology segmentation of the UK electric vehicle battery separator market encompasses various material types and manufacturing processes. Wet-process separators dominate market share due to their superior porosity characteristics and established manufacturing infrastructure. Dry-process separators are gaining traction for specific applications requiring enhanced mechanical strength and thermal stability.

By Material Type:

By Application:

Passenger vehicle applications represent the largest category within the UK electric vehicle battery separator market, driven by rapid consumer adoption and automotive manufacturer electrification strategies. This segment demands high-performance separators with excellent safety characteristics and long-term reliability. Premium separator materials including ceramic-coated variants are increasingly specified for luxury and high-performance electric vehicles.

Commercial vehicle applications require specialized separator solutions capable of withstanding demanding operating conditions and frequent charging cycles. Heavy-duty separators with enhanced mechanical strength and thermal stability are essential for bus and truck applications. The segment demonstrates strong growth potential as fleet operators transition to electric powertrains for cost and environmental benefits.

Energy storage applications beyond automotive use are creating new market opportunities for separator manufacturers. Grid-scale storage systems require separators optimized for long-duration cycling and extended operational life. Residential energy storage applications demand cost-effective separator solutions while maintaining safety and performance standards. The category demonstrates significant diversification potential for separator manufacturers seeking to expand beyond automotive markets.

Automotive manufacturers benefit from access to high-quality separator materials that enhance battery safety, performance, and longevity. Reliable supply chains for separator materials support production planning and quality consistency across vehicle platforms. Technology partnerships with separator manufacturers enable co-development of optimized solutions for specific battery chemistries and vehicle applications.

Battery manufacturers gain competitive advantages through access to advanced separator technologies that improve cell performance and safety characteristics. Supply chain localization reduces logistics costs and delivery times while enhancing supply security. Technical collaboration with separator suppliers accelerates product development and time-to-market for new battery technologies.

Government stakeholders achieve policy objectives including emission reduction, industrial development, and energy security through a robust domestic separator supply chain. Economic benefits include job creation, technology development, and export potential. Strategic autonomy in critical battery supply chains enhances national security and reduces dependency on international suppliers. Innovation ecosystems developed around separator technology contribute to broader technological advancement and competitiveness in the global electric vehicle market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology advancement represents the most significant trend shaping the UK electric vehicle battery separator market. Ceramic-coated separators are gaining market acceptance due to their superior thermal stability and safety characteristics. The development of ultra-thin separators enables higher energy density batteries while maintaining safety standards. Functional coatings that enhance ionic conductivity and reduce internal resistance are becoming increasingly important for fast-charging applications.

Sustainability initiatives are driving demand for recyclable and environmentally friendly separator materials. Bio-based polymers and recycled content separators are attracting research investment and commercial interest. Circular economy principles are influencing product design and end-of-life considerations for separator materials. Life cycle assessment requirements are becoming standard practice for automotive applications.

Supply chain transformation toward greater domestic content and regional sourcing continues accelerating. Vertical integration strategies by battery manufacturers are creating new market dynamics and partnership opportunities. Digital technologies including artificial intelligence and machine learning are being applied to separator manufacturing processes for quality optimization and predictive maintenance. Automation advancement is improving production efficiency and consistency while reducing manufacturing costs.

Manufacturing investments in UK battery separator production capabilities have accelerated significantly. Several international companies have announced plans to establish or expand separator manufacturing facilities in the UK to serve the growing domestic market. Technology partnerships between UK companies and international separator manufacturers are facilitating knowledge transfer and market entry strategies.

Research initiatives funded by government agencies and industry consortiums are advancing next-generation separator technologies. MarkWide Research analysis indicates increasing collaboration between universities and industry partners in developing innovative separator materials and manufacturing processes. Intellectual property development in separator technology has intensified with UK companies filing patents for novel materials and production methods.

Regulatory developments including updated safety standards and environmental regulations are influencing separator specifications and market requirements. Certification processes for automotive applications have been streamlined to accelerate product commercialization while maintaining safety standards. International standards harmonization is facilitating global market access for UK separator manufacturers and technology developers.

Strategic recommendations for UK electric vehicle battery separator market participants emphasize the importance of technology differentiation and supply chain positioning. Investment priorities should focus on advanced separator materials that offer superior performance characteristics and align with automotive industry requirements. Partnership strategies with battery manufacturers and automotive companies can provide market access and technology validation opportunities.

Market entry strategies for new participants should consider niche applications and specialized separator requirements where established competitors may have limited presence. Technology development efforts should prioritize sustainability, safety, and performance optimization to meet evolving market demands. Supply chain development including raw material sourcing and manufacturing capabilities requires careful planning and significant capital investment.

Risk management strategies should address potential supply chain disruptions, technology obsolescence, and competitive pressures from established global suppliers. Market intelligence and continuous monitoring of technology trends, regulatory changes, and competitive developments are essential for maintaining strategic positioning. Collaboration opportunities with research institutions, government agencies, and industry partners can accelerate technology development and market penetration while sharing development costs and risks.

Long-term prospects for the UK electric vehicle battery separator market remain highly positive, supported by government policy commitments and automotive industry electrification strategies. Market expansion is expected to continue at a robust pace as electric vehicle adoption accelerates and domestic battery production capabilities mature. Technology evolution will drive demand for advanced separator materials with enhanced performance characteristics.

Innovation trajectories point toward solid-state battery technologies that may require entirely new separator solutions, creating opportunities for UK companies to establish leadership positions in emerging technologies. MWR projections indicate that the market will experience significant transformation over the next decade as new battery chemistries and cell designs become commercially viable. Sustainability requirements will increasingly influence separator material selection and manufacturing processes.

Competitive dynamics will continue evolving as domestic manufacturing capabilities expand and international suppliers establish UK operations. Market consolidation through strategic partnerships and acquisitions is likely to accelerate as companies seek to achieve scale advantages and technology access. Export opportunities to European and global markets will become increasingly important for UK separator manufacturers as domestic production capabilities exceed local demand requirements. The market demonstrates strong fundamentals for sustained growth and technological advancement in the coming decade.

The United Kingdom electric vehicle battery separator market stands at a pivotal juncture, characterized by unprecedented growth opportunities and strategic importance within the nation’s broader electrification agenda. Government policy support, automotive industry commitments, and technological advancement have created favorable conditions for market expansion and domestic manufacturing development. The sector demonstrates strong fundamentals with increasing demand from battery manufacturers and automotive companies seeking reliable, high-performance separator solutions.

Market dynamics reflect the transition from import dependency toward domestic production capabilities, supported by significant investments in manufacturing infrastructure and technology development. Competitive positioning opportunities exist for UK companies willing to invest in advanced separator technologies and establish strategic partnerships within the battery supply chain. The emphasis on sustainability, safety, and performance optimization aligns with UK strengths in research, innovation, and advanced manufacturing.

Future success in the UK electric vehicle battery separator market will depend on continued technology advancement, supply chain development, and strategic collaboration among industry participants. The market offers substantial opportunities for companies that can navigate the technical complexities, capital requirements, and competitive challenges while delivering innovative solutions that meet evolving automotive industry needs. As the UK continues its journey toward sustainable transportation, the battery separator market will play an increasingly critical role in enabling the nation’s electric vehicle ambitions and industrial competitiveness.

What is Electric Vehicle Battery Separator?

Electric Vehicle Battery Separator refers to a critical component in lithium-ion batteries that prevents short circuits by separating the anode and cathode while allowing the flow of ions. This technology is essential for the performance and safety of electric vehicles.

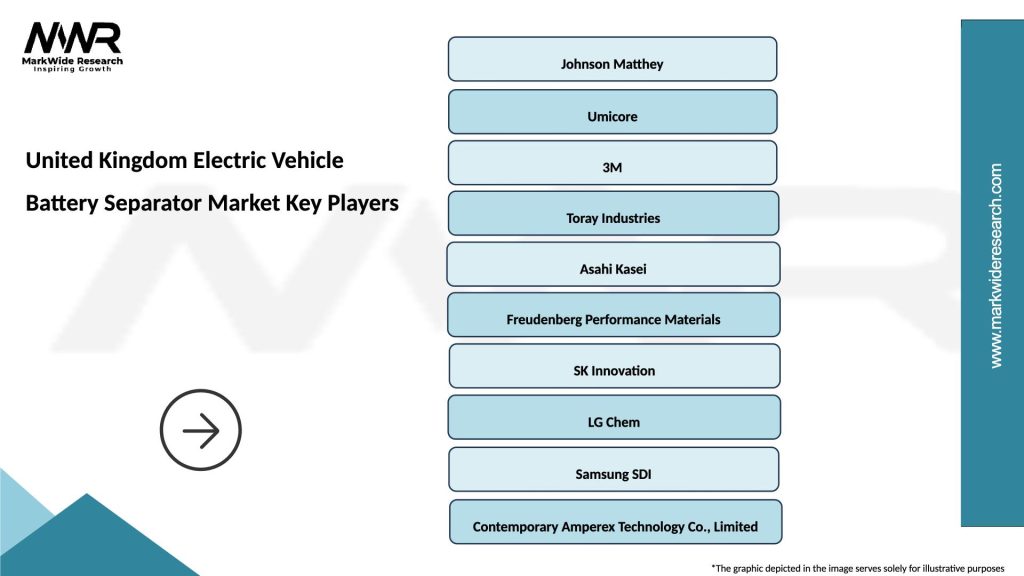

What are the key players in the United Kingdom Electric Vehicle Battery Separator Market?

Key players in the United Kingdom Electric Vehicle Battery Separator Market include companies like Asahi Kasei, Toray Industries, and Celgard, which are known for their innovations in battery separator technology and production capabilities, among others.

What are the growth factors driving the United Kingdom Electric Vehicle Battery Separator Market?

The growth of the United Kingdom Electric Vehicle Battery Separator Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation solutions.

What challenges does the United Kingdom Electric Vehicle Battery Separator Market face?

Challenges in the United Kingdom Electric Vehicle Battery Separator Market include the high cost of advanced materials, competition from alternative technologies, and the need for continuous innovation to meet evolving safety standards.

What opportunities exist in the United Kingdom Electric Vehicle Battery Separator Market?

Opportunities in the United Kingdom Electric Vehicle Battery Separator Market include the expansion of electric vehicle production, increasing investments in battery research and development, and the potential for new applications in energy storage systems.

What trends are shaping the United Kingdom Electric Vehicle Battery Separator Market?

Trends in the United Kingdom Electric Vehicle Battery Separator Market include the development of more efficient and thinner separators, the use of sustainable materials, and the integration of smart technologies to enhance battery performance.

United Kingdom Electric Vehicle Battery Separator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polypropylene, Polyethylene, Ceramic, Composite |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Battery Manufacturers |

| Technology | Dry Process, Wet Process, Coating Technology, Membrane Technology |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Electric Vehicle Battery Separator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at