444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom digital transformation market represents one of Europe’s most dynamic and rapidly evolving technology landscapes, driven by unprecedented demand for modernization across industries. Digital transformation initiatives have become essential for UK businesses seeking to maintain competitive advantage in an increasingly connected global economy. The market encompasses comprehensive technology adoption strategies that integrate cloud computing, artificial intelligence, Internet of Things (IoT), and advanced analytics solutions.

Market growth in the UK digital transformation sector demonstrates remarkable momentum, with organizations across manufacturing, healthcare, financial services, and retail sectors embracing comprehensive digitization strategies. The acceleration has been particularly pronounced following the global pandemic, which highlighted the critical importance of digital resilience and operational agility. Enterprise adoption rates have surged by approximately 78% over the past three years, indicating widespread recognition of digital transformation as a business imperative rather than optional enhancement.

Government initiatives and regulatory frameworks continue to support digital transformation adoption across the UK, with substantial investments in digital infrastructure and skills development programs. The market benefits from strong technological foundations, including widespread 5G deployment, robust cybersecurity frameworks, and comprehensive data protection regulations that enhance consumer and business confidence in digital solutions.

The United Kingdom digital transformation market refers to the comprehensive ecosystem of technologies, services, and strategic initiatives designed to fundamentally reshape how organizations operate, deliver value, and engage with stakeholders through digital technologies. This market encompasses the integration of digital technology into all areas of business operations, fundamentally changing how companies operate and deliver value to customers.

Digital transformation extends beyond simple technology adoption to include cultural change, process optimization, and strategic realignment that enables organizations to leverage digital technologies for competitive advantage. The market includes cloud migration services, data analytics platforms, artificial intelligence implementations, automation solutions, and comprehensive digital strategy consulting services that guide organizations through complex transformation journeys.

Key components of the UK digital transformation market include infrastructure modernization, application development and integration, cybersecurity enhancement, data management and analytics, and change management services. These elements work synergistically to create comprehensive transformation solutions that address both immediate operational needs and long-term strategic objectives.

Market dynamics in the UK digital transformation sector reflect a mature yet rapidly evolving landscape characterized by increasing sophistication in technology adoption and implementation strategies. Organizations are moving beyond basic digitization efforts toward comprehensive transformation initiatives that reimagine business models, customer experiences, and operational frameworks.

Technology adoption patterns demonstrate significant momentum across multiple sectors, with financial services leading adoption rates at approximately 85% of organizations implementing comprehensive digital transformation strategies. Healthcare and manufacturing sectors follow closely, driven by regulatory requirements and operational efficiency demands that necessitate advanced digital capabilities.

Investment priorities have shifted toward integrated solutions that combine multiple technologies into cohesive transformation platforms. Cloud-first strategies dominate organizational approaches, with hybrid and multi-cloud architectures becoming standard implementations. Artificial intelligence and machine learning integration rates have increased by 62% year-over-year, reflecting growing confidence in advanced analytics capabilities.

Market maturation is evident in the evolution from technology-focused initiatives toward business outcome-driven transformation programs. Organizations increasingly prioritize solutions that demonstrate measurable impact on revenue generation, cost reduction, and customer satisfaction metrics, indicating a more strategic and results-oriented approach to digital transformation investments.

Strategic insights reveal fundamental shifts in how UK organizations approach digital transformation, with emphasis moving from isolated technology implementations toward comprehensive ecosystem transformations. The following key insights characterize the current market landscape:

Primary market drivers propelling UK digital transformation adoption stem from both external pressures and internal organizational needs that demand comprehensive technology modernization. These drivers create compelling business cases for transformation investments across industries and organizational sizes.

Competitive pressure represents the most significant driver, as organizations recognize that digital capabilities directly impact market position and customer retention. Companies that delay transformation initiatives risk losing market share to more agile, digitally-enabled competitors who can respond faster to market changes and customer demands.

Customer expectations have evolved dramatically, with consumers and business clients expecting seamless, personalized, and instant digital experiences across all touchpoints. Organizations must invest in digital transformation to meet these heightened expectations and maintain customer satisfaction levels that support long-term business growth.

Operational efficiency demands drive transformation initiatives as organizations seek to reduce costs, improve productivity, and optimize resource utilization through automation and process optimization. Digital technologies enable significant efficiency gains that directly impact profitability and competitive positioning.

Regulatory requirements in sectors such as financial services, healthcare, and energy mandate digital capabilities for compliance, reporting, and risk management. These requirements create non-negotiable drivers for transformation investments that ensure regulatory adherence while enabling business growth.

Talent acquisition and retention challenges motivate digital workplace investments that attract skilled professionals who expect modern, flexible, and technology-enabled work environments. Organizations must transform their digital capabilities to compete effectively for top talent in competitive labor markets.

Significant restraints continue to challenge UK digital transformation initiatives, creating barriers that organizations must navigate carefully to achieve successful transformation outcomes. These constraints require strategic planning and resource allocation to overcome effectively.

Budget constraints represent the primary restraint for many organizations, particularly small and medium enterprises that face limited financial resources for comprehensive transformation initiatives. The substantial upfront investments required for technology infrastructure, software licensing, and implementation services can strain organizational budgets and delay transformation timelines.

Skills shortages in critical technology areas create significant implementation challenges, with organizations struggling to find qualified professionals in areas such as cloud architecture, cybersecurity, data science, and artificial intelligence. This talent gap increases project costs and extends implementation timelines while limiting transformation scope and effectiveness.

Legacy system complexity poses substantial technical challenges, as organizations must integrate new digital solutions with existing infrastructure that may be outdated, incompatible, or poorly documented. These integration challenges increase project complexity, costs, and risks while potentially limiting transformation benefits.

Change management resistance from employees and stakeholders can significantly impact transformation success, as cultural and process changes required for digital transformation often face internal opposition. Organizations must invest substantial resources in change management and training programs to ensure successful adoption.

Cybersecurity concerns create hesitation around digital transformation initiatives, as organizations worry about increased attack surfaces and security vulnerabilities associated with new technologies and expanded digital footprints. These concerns can slow decision-making and increase security investment requirements.

Substantial opportunities exist within the UK digital transformation market, driven by emerging technologies, evolving business models, and increasing recognition of digital transformation as a competitive necessity rather than optional enhancement.

Artificial intelligence integration presents significant opportunities for organizations to enhance decision-making, automate complex processes, and create new value propositions. AI-powered solutions enable predictive analytics, intelligent automation, and personalized customer experiences that drive competitive advantage and operational efficiency.

Edge computing adoption creates opportunities for organizations to process data closer to source points, reducing latency and improving real-time decision-making capabilities. This technology enables new applications in manufacturing, healthcare, and retail that require immediate data processing and response capabilities.

Sustainability-focused transformation opportunities align digital initiatives with environmental goals, creating solutions that reduce energy consumption, optimize resource utilization, and support circular economy principles. These initiatives appeal to environmentally conscious consumers and meet regulatory requirements for sustainability reporting.

Industry-specific solutions represent growing opportunities as technology providers develop specialized platforms that address unique sector requirements. Healthcare, financial services, manufacturing, and retail sectors offer substantial opportunities for tailored transformation solutions that address specific regulatory, operational, and customer requirements.

Small and medium enterprise markets present significant growth opportunities as cloud-based solutions and software-as-a-service models make advanced digital capabilities accessible to organizations with limited IT resources and budgets. These markets offer substantial volume opportunities for scalable transformation solutions.

Market dynamics in the UK digital transformation sector reflect complex interactions between technology evolution, business requirements, regulatory pressures, and competitive forces that shape adoption patterns and investment priorities across industries.

Technology convergence drives market dynamics as previously separate technologies integrate into comprehensive platforms that deliver enhanced capabilities and simplified management. Cloud computing, artificial intelligence, Internet of Things, and analytics technologies increasingly function as integrated ecosystems rather than standalone solutions.

Vendor landscape evolution demonstrates significant consolidation as major technology providers acquire specialized companies to offer comprehensive transformation solutions. This consolidation creates opportunities for integrated solutions while potentially reducing vendor choice and increasing dependency on major platform providers.

Customer sophistication has increased dramatically, with organizations developing internal expertise that enables more informed technology decisions and vendor negotiations. This sophistication drives demand for more advanced capabilities and customized solutions that address specific business requirements.

Implementation approaches have evolved from large-scale, multi-year projects toward agile, iterative transformation programs that deliver incremental value while reducing implementation risks. This shift enables organizations to adapt transformation strategies based on early results and changing business requirements.

Outcome-based pricing models are emerging as organizations seek to align technology investments with business results. These models shift risk from customers to vendors while creating incentives for solution providers to ensure successful transformation outcomes and ongoing value delivery.

Comprehensive research methodology employed for analyzing the UK digital transformation market combines quantitative data analysis with qualitative insights gathered from industry experts, technology vendors, and end-user organizations across multiple sectors.

Primary research activities include structured interviews with senior executives, IT leaders, and digital transformation specialists from organizations representing various industries and company sizes. These interviews provide insights into adoption patterns, implementation challenges, and future investment priorities that shape market dynamics.

Secondary research sources encompass industry reports, government publications, regulatory filings, and technology vendor announcements that provide comprehensive market context and validate primary research findings. This approach ensures research accuracy and completeness while identifying emerging trends and market shifts.

Data validation processes include cross-referencing multiple sources, statistical analysis of quantitative data, and expert review of findings to ensure research reliability and accuracy. These processes help identify potential biases and ensure that conclusions accurately reflect market realities.

Market segmentation analysis examines adoption patterns across industries, company sizes, and geographic regions within the UK to identify specific market characteristics and growth opportunities. This segmentation provides detailed insights that support strategic decision-making for market participants.

Regional distribution of digital transformation activity across the UK demonstrates significant concentration in major metropolitan areas, with London maintaining approximately 45% of total market activity due to its concentration of financial services, technology companies, and multinational corporations.

London market dynamics reflect the highest levels of digital transformation sophistication and investment, driven by competitive pressures in financial services, professional services, and technology sectors. The region benefits from extensive technology infrastructure, skilled workforce availability, and proximity to major technology vendors and consulting firms.

Manchester and Birmingham represent significant secondary markets with growing digital transformation activity, particularly in manufacturing, healthcare, and retail sectors. These regions benefit from lower operational costs compared to London while maintaining access to skilled technology professionals and comprehensive digital infrastructure.

Scotland and Wales demonstrate increasing digital transformation adoption, supported by government initiatives and regional development programs that encourage technology investment. These regions offer opportunities for organizations seeking cost-effective transformation solutions while accessing skilled workforces and supportive business environments.

Northern England regions show substantial growth in digital transformation activity, particularly in manufacturing and logistics sectors that benefit from the region’s industrial heritage and strategic transportation connections. Government investment in digital infrastructure and skills development supports continued growth in these areas.

Competitive dynamics in the UK digital transformation market feature a diverse ecosystem of global technology giants, specialized consulting firms, and emerging technology providers that compete across different market segments and customer requirements.

Market positioning strategies vary significantly among competitors, with some focusing on comprehensive platform solutions while others specialize in specific technologies or industry sectors. This diversity creates opportunities for organizations to select solutions that align with specific transformation requirements and budget constraints.

Market segmentation analysis reveals distinct patterns in digital transformation adoption and investment priorities across various organizational and technological dimensions that shape solution requirements and vendor strategies.

By Technology:

By Industry:

By Organization Size:

Technology category analysis reveals distinct adoption patterns and growth trajectories that reflect varying organizational priorities and implementation complexities across different digital transformation solution categories.

Cloud computing solutions maintain the highest adoption rates, with 89% of UK organizations implementing some form of cloud technology. Hybrid cloud architectures dominate enterprise implementations, while small businesses increasingly adopt cloud-first strategies that eliminate traditional IT infrastructure requirements.

Artificial intelligence implementations show rapid growth across customer service, process automation, and predictive analytics applications. Organizations report average efficiency improvements of 34% following AI implementation, driving continued investment in machine learning and automation technologies.

Cybersecurity integration has become mandatory for transformation initiatives, with organizations allocating approximately 15% of transformation budgets to security solutions. Zero-trust architectures and integrated security platforms are becoming standard requirements for comprehensive transformation programs.

Data analytics platforms enable organizations to leverage transformation investments through improved decision-making and operational insights. Real-time analytics capabilities support agile business operations while predictive modeling enhances strategic planning and risk management.

Digital workplace solutions have gained prominence following remote work adoption, with collaboration platforms, productivity tools, and employee experience solutions becoming essential components of transformation strategies that support hybrid work models.

Comprehensive benefits from UK digital transformation initiatives extend across multiple stakeholder groups, creating value that justifies investment while supporting long-term competitive positioning and operational excellence.

For Organizations:

For Employees:

For Customers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends in the UK digital transformation market reflect evolving technology capabilities, changing business requirements, and shifting customer expectations that shape future investment priorities and solution development.

Artificial Intelligence Democratization represents a significant trend as AI capabilities become accessible to organizations of all sizes through cloud-based platforms and pre-built solutions. This democratization enables smaller organizations to leverage advanced analytics and automation capabilities previously available only to large enterprises.

Sustainability Integration has become a critical trend as organizations align digital transformation initiatives with environmental goals. Green computing practices, energy-efficient technologies, and carbon footprint reduction through digital optimization are becoming standard requirements for transformation projects.

Edge Computing Adoption accelerates as organizations require real-time data processing capabilities for IoT applications, autonomous systems, and latency-sensitive operations. This trend enables new applications while reducing bandwidth costs and improving system responsiveness.

Zero Trust Security architectures are becoming standard for transformation initiatives as organizations recognize that traditional perimeter-based security models are inadequate for modern digital environments. This approach requires comprehensive identity verification and continuous monitoring across all system components.

Low-Code Development platforms enable business users to create applications and automate processes without extensive programming knowledge. This trend accelerates transformation timelines while reducing dependence on scarce technical resources.

Hyper-Automation combines multiple automation technologies including robotic process automation, AI, and machine learning to automate complex business processes end-to-end. Organizations report productivity improvements of 42% through comprehensive automation implementations.

Significant industry developments continue to reshape the UK digital transformation landscape through technology innovations, strategic partnerships, and regulatory changes that influence market dynamics and adoption patterns.

Government Digital Strategy initiatives provide substantial support for digital transformation across public and private sectors. The National Digital Strategy includes investments in digital infrastructure, skills development, and innovation programs that create favorable conditions for transformation initiatives.

5G Network Deployment enables new transformation applications requiring high-speed, low-latency connectivity. Manufacturing, healthcare, and transportation sectors benefit from 5G capabilities that support IoT implementations, remote operations, and real-time data processing.

Quantum Computing Research positions the UK as a leader in next-generation computing technologies that will eventually transform cryptography, optimization, and scientific computing applications. Early investments in quantum technologies create competitive advantages for future transformation initiatives.

Data Protection Regulations continue evolving to address new technologies and use cases, requiring organizations to integrate compliance considerations into transformation planning from project inception. These regulations influence solution design and implementation approaches.

Industry Partnerships between technology vendors, consulting firms, and academic institutions accelerate innovation and skills development. These collaborations create comprehensive solution ecosystems that address complex transformation requirements across multiple industries.

Startup Ecosystem Growth contributes innovative solutions and specialized expertise to the transformation market. MarkWide Research analysis indicates that UK technology startups have introduced breakthrough solutions in areas such as AI, cybersecurity, and industry-specific applications that enhance transformation capabilities.

Strategic recommendations for organizations pursuing digital transformation in the UK market emphasize comprehensive planning, phased implementation, and continuous adaptation to maximize transformation benefits while managing risks and costs effectively.

Develop Comprehensive Strategy: Organizations should create detailed transformation roadmaps that align technology investments with business objectives while considering industry-specific requirements and regulatory constraints. This strategic approach ensures that transformation initiatives deliver measurable business value rather than simply implementing new technologies.

Prioritize Change Management: Successful transformation requires substantial investment in change management programs that prepare employees for new processes, technologies, and ways of working. Organizations should allocate approximately 25% of transformation budgets to change management activities including training, communication, and support programs.

Implement Security-First Approach: Cybersecurity considerations should be integrated into transformation planning from inception rather than added as afterthoughts. Zero-trust architectures and comprehensive security frameworks protect transformation investments while enabling secure access to digital capabilities.

Focus on Data Strategy: Effective data management and analytics capabilities are essential for transformation success. Organizations should invest in data governance, quality management, and analytics platforms that enable data-driven decision-making across all business functions.

Choose Strategic Partners: Selecting experienced transformation partners with proven track records in relevant industries and technologies significantly improves project success rates. Partners should demonstrate expertise in both technology implementation and change management.

Plan for Scalability: Transformation solutions should be designed to accommodate future growth and changing requirements. Cloud-based architectures and modular solution designs enable organizations to adapt and expand digital capabilities as business needs evolve.

Future market prospects for UK digital transformation remain exceptionally positive, driven by continued technology innovation, increasing business digitization requirements, and supportive government policies that encourage comprehensive transformation initiatives across industries.

Technology evolution will continue accelerating transformation opportunities as artificial intelligence, quantum computing, and advanced automation technologies mature and become more accessible. These emerging technologies will enable new transformation applications while improving the effectiveness of existing digital solutions.

Market growth projections indicate sustained expansion with compound annual growth rates expected to reach 12.8% over the next five years. This growth reflects increasing recognition of digital transformation as essential for competitive survival rather than optional enhancement, driving continued investment across all sectors and organization sizes.

Industry digitization will expand beyond early adopters to encompass traditional sectors such as construction, agriculture, and professional services that have historically been slower to embrace digital technologies. These sectors represent substantial growth opportunities for transformation solution providers.

Skills development initiatives will address current talent shortages through expanded education programs, professional development opportunities, and immigration policies that attract international technology talent. These initiatives will support continued market growth while reducing implementation barriers.

Regulatory evolution will continue shaping transformation requirements as governments adapt policies to address emerging technologies and their societal impacts. Organizations must remain adaptable to regulatory changes while leveraging compliance requirements as drivers for transformation investments.

MarkWide Research projections suggest that the UK will maintain its position as a leading European digital transformation market, with London serving as a global hub for transformation innovation and expertise. The market’s maturity and sophistication will continue attracting international investment and technology partnerships that enhance capabilities and accelerate adoption.

The United Kingdom digital transformation market represents a dynamic and rapidly evolving landscape that offers substantial opportunities for organizations seeking to modernize operations, enhance customer experiences, and maintain competitive advantage in an increasingly digital economy. Market fundamentals remain strong, supported by advanced infrastructure, skilled workforce, supportive regulatory environment, and sophisticated customer base that drives continued innovation and adoption.

Growth prospects continue to be exceptionally positive as organizations across all sectors recognize digital transformation as essential for long-term success rather than optional enhancement. The convergence of cloud computing, artificial intelligence, IoT, and advanced analytics creates comprehensive transformation platforms that deliver measurable business value while enabling new capabilities and business models.

Success factors for transformation initiatives include comprehensive strategic planning, strong change management programs, security-first approaches, and partnerships with experienced solution providers who understand both technology capabilities and industry-specific requirements. Organizations that approach transformation strategically while remaining adaptable to evolving technologies and market conditions will achieve the greatest benefits from their digital investments in the thriving UK market.

What is Digital Transformation?

Digital transformation refers to the integration of digital technology into all areas of a business, fundamentally changing how it operates and delivers value to customers. It encompasses various aspects such as process automation, data analytics, and customer engagement strategies.

What are the key players in the United Kingdom Digital Transformation Market?

Key players in the United Kingdom Digital Transformation Market include Accenture, Capgemini, IBM, and Deloitte, among others. These companies provide a range of services from consulting to technology implementation, helping organizations navigate their digital transformation journeys.

What are the main drivers of the United Kingdom Digital Transformation Market?

The main drivers of the United Kingdom Digital Transformation Market include the increasing demand for enhanced customer experiences, the need for operational efficiency, and the rapid adoption of cloud technologies. Organizations are also motivated by the desire to leverage data for better decision-making.

What challenges does the United Kingdom Digital Transformation Market face?

Challenges in the United Kingdom Digital Transformation Market include resistance to change within organizations, the complexity of integrating new technologies with legacy systems, and concerns over data security and privacy. These factors can hinder the pace of transformation efforts.

What opportunities exist in the United Kingdom Digital Transformation Market?

Opportunities in the United Kingdom Digital Transformation Market include the growth of artificial intelligence and machine learning applications, the expansion of the Internet of Things (IoT), and the increasing focus on sustainability through digital solutions. These trends present avenues for innovation and competitive advantage.

What trends are shaping the United Kingdom Digital Transformation Market?

Trends shaping the United Kingdom Digital Transformation Market include the rise of remote work technologies, the integration of advanced analytics into business processes, and the emphasis on customer-centric digital experiences. Companies are increasingly adopting agile methodologies to respond to changing market demands.

United Kingdom Digital Transformation Market

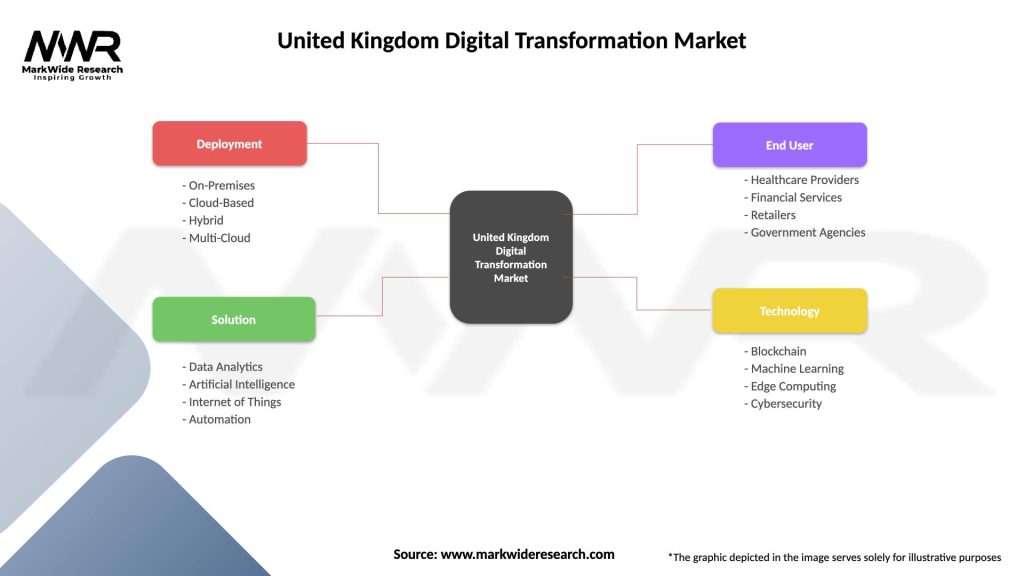

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Multi-Cloud |

| Solution | Data Analytics, Artificial Intelligence, Internet of Things, Automation |

| End User | Healthcare Providers, Financial Services, Retailers, Government Agencies |

| Technology | Blockchain, Machine Learning, Edge Computing, Cybersecurity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Digital Transformation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at