444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom data centre market represents a cornerstone of the nation’s digital infrastructure, experiencing unprecedented growth driven by cloud computing adoption, digital transformation initiatives, and increasing data generation across industries. Market dynamics indicate robust expansion as organizations migrate to cloud-first strategies and demand scalable, reliable data processing capabilities. The UK’s strategic position as a European digital hub, combined with favorable regulatory frameworks and advanced telecommunications infrastructure, positions the market for sustained growth at a compound annual growth rate (CAGR) of 8.2% through the forecast period.

Regional concentration remains heavily focused on London and the South East, accounting for approximately 65% of total market capacity, while emerging hubs in Manchester, Birmingham, and Edinburgh are gaining traction. The market encompasses hyperscale facilities, colocation services, edge computing infrastructure, and managed hosting solutions, serving diverse sectors including financial services, healthcare, retail, and government organizations. Sustainability initiatives are increasingly influencing market development, with operators investing in renewable energy sources and energy-efficient cooling technologies to meet environmental targets and regulatory requirements.

Investment patterns show significant capital allocation toward next-generation facilities capable of supporting artificial intelligence workloads, Internet of Things applications, and 5G network infrastructure. The market demonstrates resilience through economic uncertainties, with data centre services considered essential infrastructure supporting business continuity and digital operations across the UK economy.

The United Kingdom data centre market refers to the comprehensive ecosystem of facilities, services, and infrastructure dedicated to housing, managing, and processing digital information across the UK. This market encompasses purpose-built facilities that provide secure, climate-controlled environments for servers, storage systems, networking equipment, and associated technologies that enable digital operations for businesses, government entities, and service providers.

Core components include colocation services where multiple organizations share facility resources, managed hosting solutions providing dedicated infrastructure management, cloud services offering scalable computing resources, and edge computing facilities positioned closer to end users for reduced latency. The market serves as the backbone for digital transformation initiatives, supporting everything from basic web hosting to complex artificial intelligence and machine learning applications.

Service delivery models range from traditional rack space rental to comprehensive managed services including disaster recovery, backup solutions, and hybrid cloud integration. Modern data centres incorporate advanced technologies such as software-defined networking, virtualization platforms, and automated management systems to optimize performance and operational efficiency while maintaining the highest standards of security and reliability.

Strategic positioning of the UK data centre market reflects the nation’s role as a leading digital economy, with London serving as a primary gateway for international connectivity and European market access. The market demonstrates strong fundamentals driven by increasing digitalization across industries, with cloud adoption rates reaching 88% among UK enterprises, creating sustained demand for scalable infrastructure solutions.

Investment momentum continues accelerating as hyperscale cloud providers expand their UK presence, while colocation operators enhance capacity to meet growing enterprise requirements. The market benefits from robust fiber optic connectivity, stable political environment, and comprehensive data protection regulations that instill confidence among international investors and multinational corporations seeking European data residency solutions.

Technological evolution toward edge computing and 5G infrastructure is reshaping market dynamics, with operators developing distributed architectures to support low-latency applications and emerging use cases. Sustainability considerations are becoming paramount, with renewable energy adoption increasing by 45% annually among major operators, reflecting both regulatory pressure and corporate responsibility commitments.

Competitive landscape features a mix of global hyperscale providers, established colocation specialists, and emerging edge computing focused companies, creating a dynamic environment that fosters innovation and service differentiation while maintaining competitive pricing structures for end users.

Demand drivers encompass multiple converging trends that collectively strengthen the market foundation and growth trajectory:

Market maturity is evidenced by sophisticated service offerings, standardized operational practices, and established ecosystem partnerships that enable comprehensive solution delivery across diverse customer requirements and industry verticals.

Primary growth catalysts propelling the UK data centre market forward stem from fundamental shifts in how organizations approach technology infrastructure and digital service delivery. The accelerating pace of digital transformation across industries creates sustained demand for scalable, reliable data processing capabilities that can adapt to evolving business requirements.

Cloud computing adoption continues driving infrastructure demand as organizations migrate from on-premises systems to hybrid and multi-cloud architectures. This transition requires robust connectivity, security, and performance capabilities that specialized data centre facilities provide, particularly for mission-critical applications requiring guaranteed uptime and regulatory compliance.

Regulatory frameworks including GDPR and emerging UK data protection legislation create compelling reasons for data localization, driving international companies to establish UK-based infrastructure for European operations. Financial services regulations further mandate local data processing capabilities, particularly for trading systems and customer information management.

Emerging technologies such as artificial intelligence, machine learning, and Internet of Things applications generate unprecedented data volumes requiring specialized processing infrastructure. These workloads demand high-performance computing capabilities, advanced cooling systems, and low-latency connectivity that modern data centres provide.

5G network deployment necessitates edge computing infrastructure positioned throughout the UK to support ultra-low latency applications including autonomous vehicles, industrial automation, and augmented reality services. This creates opportunities for distributed data centre architectures and regional facility development.

Business continuity awareness has heightened following recent global disruptions, with organizations prioritizing disaster recovery, backup solutions, and operational resilience capabilities that professional data centre operators deliver through redundant systems and geographic diversity.

Infrastructure limitations present significant challenges for market expansion, particularly regarding power grid capacity and availability of suitable sites for large-scale facility development. The UK’s aging electrical infrastructure requires substantial upgrades to support hyperscale data centre power requirements, creating bottlenecks for rapid capacity expansion in key metropolitan areas.

Planning permission complexities and lengthy approval processes for new data centre construction can delay project timelines and increase development costs. Local community concerns regarding power consumption, environmental impact, and traffic generation sometimes result in opposition to proposed facilities, particularly in residential areas.

Skilled workforce shortages across technical specializations including data centre operations, network engineering, and cybersecurity create recruitment challenges and wage inflation pressures. The specialized nature of data centre operations requires extensive training and certification, limiting the available talent pool for rapid industry expansion.

Energy costs and sustainability pressures create operational challenges as data centres consume significant electricity for computing and cooling systems. Rising energy prices and carbon reduction mandates require substantial investments in renewable energy sources and energy-efficient technologies, impacting profitability margins.

Cybersecurity threats and evolving attack vectors necessitate continuous investments in security infrastructure, monitoring systems, and incident response capabilities. The critical nature of data centre operations makes them attractive targets for malicious actors, requiring comprehensive security measures that increase operational complexity and costs.

Economic uncertainties and potential recession risks may impact enterprise IT spending and delay infrastructure investments, particularly for discretionary projects and capacity expansion initiatives that organizations might defer during challenging economic conditions.

Edge computing expansion presents substantial growth opportunities as 5G networks enable new applications requiring ultra-low latency processing capabilities. The development of distributed data centre architectures throughout the UK can capture emerging demand from autonomous vehicles, industrial IoT, smart cities, and augmented reality applications that require local processing power.

Sustainability leadership opportunities exist for operators who invest early in renewable energy integration, advanced cooling technologies, and carbon-neutral operations. Organizations increasingly prioritize environmental considerations in vendor selection, creating competitive advantages for green data centre providers and potential premium pricing for sustainable services.

Artificial intelligence infrastructure specialization offers differentiation opportunities as AI workloads require specialized hardware configurations, high-performance networking, and optimized cooling systems. Data centres designed specifically for machine learning and AI applications can command premium pricing while serving rapidly growing market segments.

Government digitalization initiatives create opportunities for secure, compliant infrastructure serving public sector requirements. The UK government’s digital transformation agenda requires trusted data centre partners capable of meeting stringent security and compliance requirements while delivering cost-effective solutions.

International expansion opportunities exist for UK-based operators to leverage their expertise in European markets, particularly as Brexit creates demand for EU-based infrastructure alternatives. Established UK operators can expand into continental European markets while maintaining their UK operations as a competitive advantage.

Hybrid cloud integration services present opportunities to provide seamless connectivity between on-premises infrastructure, colocation facilities, and public cloud platforms. Organizations seeking flexible, integrated solutions create demand for data centre operators who can facilitate smooth hybrid cloud implementations and ongoing management.

Supply and demand equilibrium in the UK data centre market reflects a delicate balance between capacity expansion and growing infrastructure requirements. Current market conditions show utilization rates averaging 78% across major metropolitan areas, indicating healthy demand while maintaining sufficient capacity for near-term growth. London and surrounding areas experience tighter capacity constraints, driving development of alternative locations and edge computing facilities.

Pricing dynamics demonstrate market maturity with competitive rates for standard colocation services, while specialized offerings such as AI-optimized infrastructure and edge computing command premium pricing. The market shows resilience to economic pressures, with data centre services considered essential infrastructure that organizations maintain even during cost reduction initiatives.

Technology evolution continues reshaping market dynamics as operators invest in next-generation infrastructure supporting emerging workloads. Software-defined networking, automated management systems, and predictive maintenance capabilities enhance operational efficiency while reducing long-term costs for both operators and customers.

Customer behavior patterns show increasing preference for flexible, scalable solutions that can adapt to changing business requirements. Organizations favor providers offering comprehensive service portfolios including connectivity, security, and managed services rather than basic rack space rental, driving market consolidation toward full-service providers.

Regulatory influence shapes market dynamics through data protection requirements, environmental regulations, and planning policies. Operators must navigate complex compliance landscapes while maintaining competitive positioning, creating advantages for established players with proven regulatory expertise and compliance capabilities.

Investment flows continue favoring operators with strong sustainability credentials, advanced technology platforms, and strategic geographic positioning. Private equity and institutional investors show sustained interest in UK data centre assets, supporting continued market development and capacity expansion initiatives.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings across all market segments and geographic regions. Primary research involves direct engagement with industry stakeholders including data centre operators, enterprise customers, technology vendors, and regulatory bodies to gather firsthand insights on market trends, challenges, and opportunities.

Quantitative research utilizes structured surveys and data collection from representative samples of market participants, enabling statistical analysis of market size, growth rates, pricing trends, and customer preferences. Survey methodologies ensure geographic and sector representation across the UK market while maintaining respondent confidentiality and data integrity.

Qualitative research incorporates in-depth interviews with industry executives, technical specialists, and strategic decision-makers to understand market dynamics, competitive positioning, and future development plans. These discussions provide contextual insights that complement quantitative findings and reveal underlying market drivers and constraints.

Secondary research analyzes published industry reports, financial statements, regulatory filings, and academic studies to validate primary research findings and identify historical trends. Government statistics, industry association data, and technology vendor reports provide additional context for market analysis and forecasting.

Market modeling employs sophisticated analytical techniques including regression analysis, scenario planning, and Monte Carlo simulations to project future market development under various economic and technological conditions. These models incorporate multiple variables including economic indicators, technology adoption rates, and regulatory changes.

Data validation processes ensure research accuracy through triangulation of multiple sources, peer review by industry experts, and continuous monitoring of market developments. MarkWide Research maintains rigorous quality standards throughout the research process to deliver reliable, actionable market intelligence for strategic decision-making.

London and South East dominate the UK data centre landscape, accounting for approximately 65% of total market capacity and hosting the majority of hyperscale facilities and international connectivity hubs. The region benefits from extensive fiber optic infrastructure, proximity to financial services customers, and established ecosystem of technology vendors and service providers. However, power constraints and high real estate costs are driving some development toward alternative locations.

Manchester and North West represent the fastest-growing regional market, with capacity expansion rates of 12% annually driven by lower operational costs, available land for development, and strong connectivity to both London and international markets. The region attracts organizations seeking cost-effective alternatives to London while maintaining access to skilled workforce and transportation infrastructure.

Birmingham and Midlands offer strategic geographic positioning for organizations requiring central UK locations with good connectivity to all major population centers. The region shows steady growth in enterprise colocation demand and emerging interest from edge computing providers seeking to serve manufacturing and logistics sectors concentrated in the area.

Scotland, particularly Edinburgh and Glasgow, demonstrates strong growth potential driven by government digitalization initiatives, financial services presence, and renewable energy availability. The region offers competitive operational costs and increasingly attracts international companies seeking UK data residency with lower environmental impact through abundant renewable energy sources.

Wales and Northern Ireland represent emerging opportunities for specific use cases including disaster recovery, backup services, and cost-sensitive workloads. These regions offer significant cost advantages and renewable energy potential, though they currently maintain smaller market shares due to limited connectivity and customer concentration.

Regional development trends show increasing distribution of capacity away from London toward secondary markets, driven by cost considerations, sustainability requirements, and edge computing demand. This geographic diversification creates opportunities for regional economic development while reducing concentration risks for the overall market.

Market leadership is distributed among several categories of providers, each serving distinct customer segments and use cases within the broader UK data centre ecosystem:

Competitive differentiation occurs through service specialization, geographic coverage, sustainability credentials, and technology capabilities. Providers compete on factors including reliability, connectivity options, security certifications, and customer service quality rather than solely on pricing, indicating market maturity and customer sophistication.

Market consolidation trends show larger operators acquiring regional players and specialized providers to expand geographic coverage and service capabilities. This consolidation creates opportunities for remaining independent operators to serve niche markets while potentially commanding premium valuations from strategic acquirers.

By Service Type: The market segments into distinct service categories serving different customer requirements and use cases. Colocation services represent the largest segment, providing shared infrastructure and facilities management for organizations seeking to outsource data centre operations while maintaining control over their IT equipment. Managed hosting offers comprehensive infrastructure management including server administration, security monitoring, and technical support.

Cloud services encompass Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) offerings delivered from UK-based data centres. Edge computing services represent the fastest-growing segment, providing distributed processing capabilities for low-latency applications and 5G network support.

By Industry Vertical: Financial services constitute the largest customer segment, requiring high-availability, low-latency infrastructure for trading systems, risk management, and customer applications. Healthcare organizations demand secure, compliant infrastructure for electronic health records, medical imaging, and telemedicine applications.

Government and public sector customers require specialized security certifications and compliance capabilities for citizen services and administrative systems. Retail and e-commerce organizations need scalable infrastructure supporting seasonal demand variations and omnichannel customer experiences.

By Deployment Model: Private data centres serve single organizations requiring dedicated infrastructure and maximum control over security and performance. Hybrid deployments combine on-premises, colocation, and cloud resources for optimal flexibility and cost management. Multi-tenant facilities provide shared infrastructure with logical separation for cost-effective solutions.

By Technology: Traditional infrastructure serves established workloads and legacy applications, while hyperconverged infrastructure offers simplified management and scalability. AI-optimized infrastructure provides specialized hardware and cooling for machine learning workloads, representing a rapidly growing segment with adoption rates increasing 35% annually.

Hyperscale Data Centres represent the highest-growth category, driven by cloud service provider expansion and enterprise cloud adoption. These facilities require massive power capacity, advanced cooling systems, and high-density server configurations to support large-scale computing workloads efficiently. Hyperscale capacity is expanding at 15% annually as major cloud providers establish UK presence for data residency and latency optimization.

Colocation Facilities serve enterprise customers seeking to outsource infrastructure management while maintaining control over their IT equipment. This category emphasizes connectivity options, security certifications, and flexible space configurations to accommodate diverse customer requirements. Enterprise colocation demand shows steady growth driven by digital transformation initiatives and hybrid cloud strategies.

Edge Computing Infrastructure emerges as a transformative category supporting 5G networks, IoT applications, and ultra-low latency use cases. These smaller, distributed facilities position computing resources closer to end users and devices, enabling new applications in autonomous vehicles, industrial automation, and augmented reality services.

Managed Hosting Services provide comprehensive infrastructure management including server administration, security monitoring, backup services, and technical support. This category appeals to organizations lacking internal IT expertise or seeking to focus resources on core business activities rather than infrastructure management.

Disaster Recovery Facilities offer specialized infrastructure for business continuity planning, providing geographically diverse backup capabilities and rapid recovery services. This category gains importance as organizations prioritize operational resilience and regulatory compliance requirements for data protection and service availability.

High-Performance Computing (HPC) facilities serve specialized workloads including scientific research, financial modeling, and artificial intelligence applications requiring massive parallel processing capabilities. These facilities incorporate advanced cooling systems, high-speed networking, and specialized hardware configurations optimized for compute-intensive applications.

For Enterprise Customers: Data centre services provide access to enterprise-grade infrastructure without the capital investment and operational complexity of building and maintaining private facilities. Organizations benefit from professional facility management, redundant power and cooling systems, advanced security measures, and 24/7 technical support that ensures high availability for critical business applications.

Cost optimization occurs through shared infrastructure costs, economies of scale, and elimination of capital expenditure for data centre construction and equipment. Customers can scale resources up or down based on actual requirements, avoiding over-provisioning and reducing total cost of ownership for IT infrastructure.

For Data Centre Operators: The market offers opportunities for recurring revenue streams, long-term customer contracts, and premium pricing for specialized services. Operators benefit from economies of scale in power procurement, equipment purchasing, and operational efficiency that create competitive advantages and improved profitability margins.

Risk mitigation advantages include geographic and customer diversification that reduces dependence on single markets or customer segments. Professional data centre operations provide superior reliability and security compared to enterprise-managed facilities, creating value propositions that justify service premiums.

For Technology Vendors: The growing data centre market creates demand for servers, storage systems, networking equipment, cooling technologies, and management software. Vendors benefit from large-scale deployments and standardized configurations that enable volume pricing and simplified product development cycles.

For Local Communities: Data centre development creates high-skilled employment opportunities, attracts technology companies, and generates significant tax revenue for local governments. Modern facilities incorporate environmental considerations and community engagement programs that minimize negative impacts while maximizing economic benefits.

For Investors: Data centre assets provide stable, long-term returns with inflation protection and growing demand fundamentals. The essential nature of data centre services creates resilient cash flows that perform well across economic cycles, making these assets attractive for institutional investment portfolios.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with operators investing heavily in renewable energy sources, advanced cooling technologies, and carbon-neutral operations. Renewable energy adoption among major operators increased 45% annually, driven by corporate sustainability commitments and regulatory pressure. Data centres are incorporating solar panels, wind power agreements, and innovative cooling systems using outside air and liquid cooling technologies.

Edge Computing Proliferation transforms market architecture as 5G networks enable new applications requiring ultra-low latency processing. Operators are developing distributed facility networks positioned throughout the UK to support autonomous vehicles, industrial IoT, and augmented reality applications that cannot tolerate traditional data centre latency levels.

Artificial Intelligence Optimization drives infrastructure specialization as AI and machine learning workloads require different hardware configurations, cooling systems, and power densities compared to traditional computing. Data centres are incorporating GPU clusters, high-speed interconnects, and advanced cooling solutions optimized for AI processing requirements.

Hybrid Cloud Integration becomes standard as organizations adopt multi-cloud strategies requiring seamless connectivity between on-premises infrastructure, colocation facilities, and public cloud platforms. Data centre operators are enhancing their connectivity offerings and developing cloud-neutral platforms that facilitate hybrid deployments.

Automation and AI Management revolutionize data centre operations through predictive maintenance, automated resource allocation, and intelligent cooling optimization. These technologies reduce operational costs, improve efficiency, and enable lights-out operations that minimize human intervention requirements.

Security Enhancement continues evolving with advanced threat detection, zero-trust architectures, and comprehensive compliance frameworks. Data centres are implementing biometric access controls, AI-powered security monitoring, and advanced encryption technologies to protect against sophisticated cyber threats.

Modular Construction gains adoption for faster deployment and improved flexibility, allowing operators to scale capacity incrementally based on demand patterns. Prefabricated modules reduce construction timelines and enable rapid response to market opportunities while maintaining quality standards.

Major Infrastructure Investments continue reshaping the market landscape as leading operators announce significant capacity expansion projects across the UK. Recent developments include hyperscale facility announcements in Manchester, Birmingham, and Edinburgh, representing substantial capital commitments to meet growing demand for cloud services and enterprise colocation.

Sustainability Initiatives accelerate with operators committing to carbon-neutral operations and renewable energy procurement. Several major providers have announced comprehensive environmental programs including on-site renewable generation, power purchase agreements for wind and solar energy, and advanced cooling technologies that reduce overall energy consumption.

Technology Partnerships emerge as data centre operators collaborate with cloud providers, telecommunications companies, and technology vendors to deliver integrated solutions. These partnerships enable enhanced service offerings including direct cloud connectivity, edge computing capabilities, and specialized infrastructure for emerging technologies.

Regulatory Compliance Enhancements reflect evolving data protection and environmental requirements, with operators investing in advanced security systems, compliance monitoring, and environmental management capabilities. MarkWide Research analysis indicates that compliance-related investments account for approximately 12% of total capital expenditure across major operators.

Acquisition Activity continues as larger operators seek to expand geographic coverage and service capabilities through strategic acquisitions of regional providers and specialized service companies. This consolidation trend creates opportunities for remaining independent operators while potentially improving service quality and operational efficiency.

Innovation Centers and research facilities are being established by major operators to develop next-generation technologies including advanced cooling systems, energy storage solutions, and automated management platforms. These investments position UK operators as technology leaders while creating competitive advantages in global markets.

Strategic Positioning recommendations emphasize the importance of geographic diversification beyond London to capture emerging opportunities in regional markets while reducing concentration risks. Operators should consider developing edge computing capabilities and distributed architectures that can serve evolving customer requirements for low-latency applications and 5G network support.

Sustainability Leadership presents critical competitive advantages as environmental considerations increasingly influence customer vendor selection decisions. Early investment in renewable energy integration, advanced cooling technologies, and carbon reduction initiatives can create differentiation opportunities and potential premium pricing for environmentally conscious services.

Technology Specialization offers opportunities for market differentiation through AI-optimized infrastructure, high-performance computing capabilities, and specialized configurations for emerging workloads. Operators should evaluate customer demand patterns and invest selectively in technologies that align with their target market segments and competitive positioning strategies.

Partnership Development can enhance service offerings and market reach through strategic alliances with cloud providers, telecommunications companies, and technology vendors. These partnerships enable comprehensive solution delivery while sharing investment risks and expanding addressable market opportunities.

Operational Excellence remains fundamental for long-term success, requiring continuous investment in automation, predictive maintenance, and staff training programs. Operators should focus on achieving industry-leading uptime performance, energy efficiency, and customer service quality to maintain competitive advantages in mature market segments.

Market Intelligence and customer engagement programs can provide insights into evolving requirements and emerging opportunities. Regular customer surveys, technology trend analysis, and competitive benchmarking enable proactive service development and strategic planning that anticipates market changes rather than reacting to them.

Long-term growth prospects for the UK data centre market remain robust, supported by fundamental trends including continued digitalization, cloud adoption, and emerging technology deployment. Market expansion is projected to maintain a compound annual growth rate of 8.2% through the forecast period, driven by sustained demand across enterprise, government, and service provider customer segments.

Geographic expansion will continue beyond traditional London-centric development toward regional markets offering cost advantages, renewable energy access, and edge computing opportunities. Manchester, Birmingham, Edinburgh, and other secondary cities are expected to capture increasing market share as organizations seek alternatives to high-cost London facilities.

Technology evolution will reshape infrastructure requirements as artificial intelligence, quantum computing, and advanced networking technologies mature. Data centres will need to adapt their power, cooling, and connectivity capabilities to support these emerging workloads while maintaining compatibility with existing applications and systems.

Sustainability requirements will become increasingly stringent, with operators expected to achieve carbon neutrality and demonstrate measurable environmental improvements. This trend will favor operators who invest early in renewable energy, advanced cooling technologies, and comprehensive environmental management programs.

Edge computing deployment will accelerate as 5G networks reach maturity and enable new applications requiring distributed processing capabilities. This trend will create opportunities for smaller, specialized facilities positioned throughout the UK to serve local demand while complementing traditional centralized data centres.

Market consolidation is likely to continue as larger operators acquire regional players and specialized providers to expand their service capabilities and geographic coverage. This consolidation may reduce the number of independent operators while potentially improving service quality and operational efficiency across the market.

Investment flows are expected to remain strong, with institutional investors and private equity firms continuing to view UK data centre assets as attractive long-term investments offering stable returns and growth potential in an increasingly digital economy.

The United Kingdom data centre market demonstrates exceptional resilience and growth potential, positioning itself as a cornerstone of the nation’s digital infrastructure and economic competitiveness. Market fundamentals remain strong, supported by sustained digitalization trends, cloud adoption acceleration, and emerging technology deployment across diverse industry sectors.

Strategic advantages including geographic positioning, regulatory stability, advanced telecommunications infrastructure, and skilled workforce availability create sustainable competitive benefits for UK-based operations. The market’s evolution toward sustainability leadership, edge computing capabilities, and specialized infrastructure for artificial intelligence applications reflects successful adaptation to changing technology requirements and customer expectations.

Growth trajectory projections indicate continued expansion driven by fundamental demand drivers that show no signs of abating. Digital transformation initiatives, cloud migration strategies, regulatory compliance requirements, and emerging technology adoption create multiple growth vectors that support long-term market development and investment attractiveness.

Challenges including power grid constraints, planning permission complexities, and operational cost pressures require strategic responses from market participants. However, these challenges also create opportunities for innovative solutions, geographic diversification, and operational excellence that can provide competitive advantages for forward-thinking operators.

The future outlook for the UK data centre market remains highly positive, with continued investment, technology innovation, and market expansion expected throughout the forecast period. Organizations that position themselves strategically across geographic markets, technology capabilities, and sustainability initiatives are well-positioned to capitalize on the substantial opportunities that lie ahead in this dynamic and essential market sector.

What is Data Centre?

A data centre is a facility used to house computer systems and associated components, such as telecommunications and storage systems. It is essential for managing and storing large amounts of data for various applications, including cloud computing, big data analytics, and enterprise IT operations.

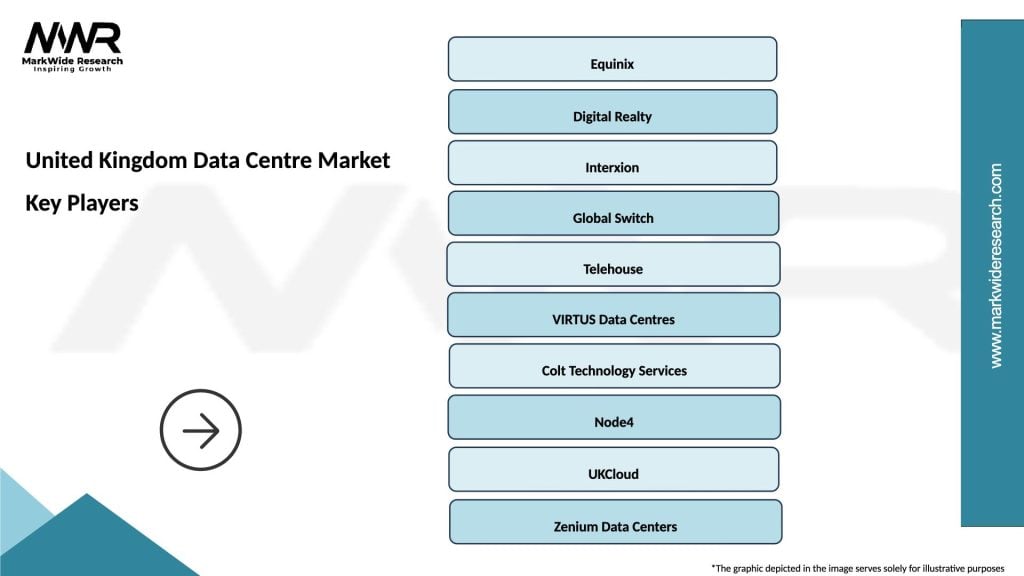

What are the key players in the United Kingdom Data Centre Market?

Key players in the United Kingdom Data Centre Market include Digital Realty, Equinix, and Telehouse, which provide a range of services from colocation to cloud solutions. These companies are pivotal in supporting the growing demand for data storage and processing capabilities, among others.

What are the growth factors driving the United Kingdom Data Centre Market?

The growth of the United Kingdom Data Centre Market is driven by the increasing demand for cloud services, the rise of big data analytics, and the expansion of IoT applications. Additionally, the need for enhanced data security and compliance with regulations is propelling investments in data centre infrastructure.

What challenges does the United Kingdom Data Centre Market face?

The United Kingdom Data Centre Market faces challenges such as high energy costs, regulatory compliance issues, and the need for sustainable practices. Additionally, the rapid pace of technological change requires continuous investment in infrastructure and skills.

What opportunities exist in the United Kingdom Data Centre Market?

Opportunities in the United Kingdom Data Centre Market include the growing demand for edge computing, advancements in energy-efficient technologies, and the increasing adoption of hybrid cloud solutions. These trends present avenues for innovation and investment in new data centre designs and services.

What trends are shaping the United Kingdom Data Centre Market?

Trends shaping the United Kingdom Data Centre Market include the shift towards modular data centres, the integration of artificial intelligence for operational efficiency, and a focus on sustainability through renewable energy sources. These trends are influencing how data centres are designed and operated.

United Kingdom Data Centre Market

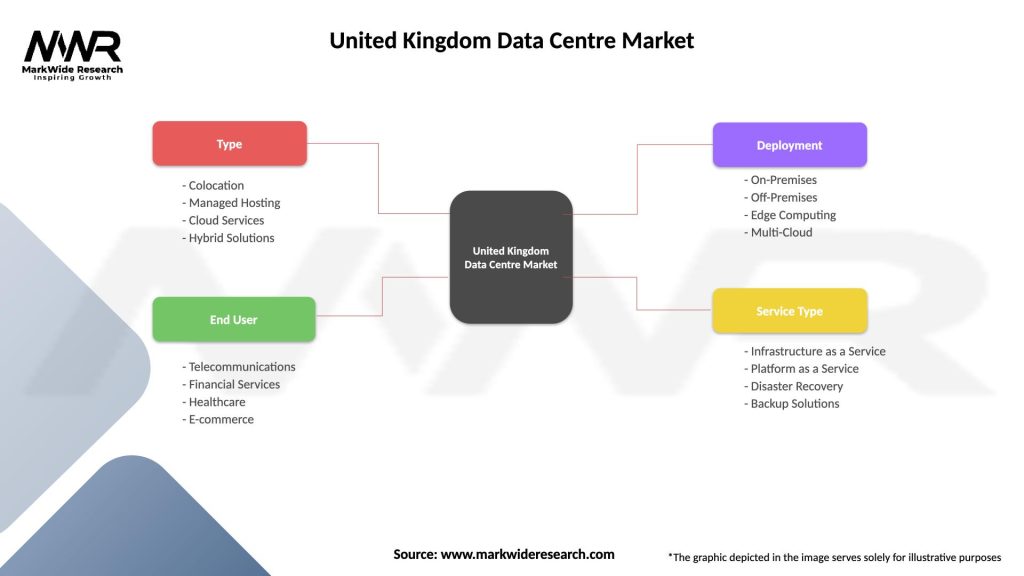

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Managed Hosting, Cloud Services, Hybrid Solutions |

| End User | Telecommunications, Financial Services, Healthcare, E-commerce |

| Deployment | On-Premises, Off-Premises, Edge Computing, Multi-Cloud |

| Service Type | Infrastructure as a Service, Platform as a Service, Disaster Recovery, Backup Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Data Centre Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at