444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom data center power market represents a critical infrastructure segment experiencing unprecedented growth driven by digital transformation, cloud adoption, and increasing data consumption across industries. Data center power systems encompass uninterruptible power supplies (UPS), power distribution units (PDUs), generators, and energy management solutions that ensure continuous operation of mission-critical facilities. The market demonstrates remarkable resilience with growth rates exceeding 8.5% CAGR as organizations prioritize reliable power infrastructure to support their digital operations.

Market dynamics indicate substantial expansion opportunities driven by hyperscale data center deployments, edge computing proliferation, and stringent regulatory requirements for energy efficiency. The UK’s strategic position as a European digital hub, combined with favorable government policies supporting data center investments, creates a conducive environment for power infrastructure development. Energy efficiency initiatives and sustainability mandates are reshaping power system designs, with organizations increasingly adopting renewable energy sources and advanced power management technologies.

Industry stakeholders benefit from technological advancements in lithium-ion battery systems, modular UPS designs, and intelligent power monitoring solutions. The market encompasses diverse applications from traditional enterprise data centers to hyperscale cloud facilities, colocation services, and emerging edge computing deployments. Regional distribution shows concentrated activity in London, Manchester, and emerging data center hubs across England, Scotland, and Wales, with power infrastructure investments supporting the nation’s digital economy growth.

The United Kingdom data center power market refers to the comprehensive ecosystem of electrical infrastructure, power protection systems, and energy management solutions specifically designed to support data center operations across the UK. This market encompasses critical power components including uninterruptible power supplies, backup generators, power distribution equipment, cooling systems, and monitoring technologies that ensure continuous uptime for digital infrastructure facilities.

Power infrastructure in data centers serves as the backbone for all computing operations, providing clean, reliable electricity to servers, storage systems, networking equipment, and cooling infrastructure. The market includes both primary power systems that deliver electricity from the grid and secondary backup systems that maintain operations during power outages or grid instabilities. Energy efficiency and sustainability considerations are increasingly integral to power system design and procurement decisions.

Market participants include power equipment manufacturers, system integrators, data center operators, colocation providers, and specialized service companies that design, install, and maintain power infrastructure. The scope extends from traditional raised-floor data centers to modern hyperscale facilities, edge computing deployments, and hybrid cloud infrastructure requiring diverse power solutions tailored to specific operational requirements and performance standards.

Strategic analysis reveals the United Kingdom data center power market positioned for sustained growth driven by accelerating digital transformation initiatives, cloud migration trends, and increasing demand for reliable computing infrastructure. The market benefits from the UK’s established position as a leading European technology hub, attracting significant investments from global hyperscale operators, colocation providers, and enterprise organizations expanding their digital capabilities.

Key growth drivers include the proliferation of artificial intelligence workloads requiring high-density computing power, edge computing deployments supporting 5G networks and IoT applications, and regulatory compliance requirements driving infrastructure modernization. Organizations are investing heavily in power infrastructure upgrades to support higher rack densities, with power requirements per rack increasing by approximately 35% annually in high-performance computing environments.

Market segmentation demonstrates diverse opportunities across UPS systems, power distribution equipment, backup generators, monitoring solutions, and energy management platforms. The competitive landscape features established global manufacturers alongside specialized UK-based providers offering tailored solutions for local market requirements. Sustainability initiatives are reshaping procurement decisions, with organizations prioritizing energy-efficient power systems and renewable energy integration to meet environmental commitments and reduce operational costs.

Market intelligence reveals several critical insights shaping the United Kingdom data center power market landscape:

Digital transformation acceleration serves as the primary catalyst driving unprecedented demand for data center power infrastructure across the United Kingdom. Organizations across all sectors are migrating workloads to cloud platforms, implementing artificial intelligence solutions, and deploying IoT technologies that require robust, scalable computing infrastructure supported by reliable power systems. Data consumption continues growing exponentially, with video streaming, social media, and digital commerce applications generating massive processing requirements.

Regulatory compliance requirements are compelling organizations to invest in modern power infrastructure meeting stringent energy efficiency standards and environmental regulations. The UK’s commitment to net-zero carbon emissions by 2050 is driving adoption of renewable energy sources, high-efficiency power systems, and advanced energy management technologies. Government incentives supporting digital infrastructure development and green technology adoption are accelerating market growth.

Technological advancement in power systems is enabling higher efficiency levels, improved reliability, and reduced total cost of ownership, making infrastructure upgrades financially attractive. Edge computing proliferation driven by 5G network deployments, autonomous vehicles, and smart city initiatives is creating demand for distributed power infrastructure supporting smaller, localized data centers. Business continuity requirements are intensifying focus on power system redundancy and backup capabilities as organizations recognize the critical importance of uninterrupted digital operations.

Capital investment requirements represent a significant barrier for organizations considering data center power infrastructure upgrades or new facility deployments. High-quality power systems, including UPS equipment, backup generators, and distribution infrastructure, require substantial upfront investments that may strain organizational budgets, particularly for smaller enterprises and emerging technology companies. Installation complexity and extended implementation timelines can delay project completion and increase overall costs.

Skilled workforce shortage in specialized power system engineering, installation, and maintenance creates challenges for market expansion. The technical complexity of modern data center power infrastructure requires experienced professionals capable of designing, implementing, and maintaining sophisticated systems. Training requirements and certification processes add time and cost to workforce development initiatives, potentially constraining market growth rates.

Regulatory complexity surrounding electrical installations, environmental compliance, and safety standards can create implementation challenges and increase project costs. Planning permission processes for new data center facilities and power infrastructure upgrades may experience delays, particularly in urban areas with limited electrical grid capacity. Grid constraints in certain regions may limit the scale of data center deployments or require expensive grid infrastructure upgrades to support high-power facilities.

Sustainability initiatives present substantial opportunities for power system providers offering energy-efficient solutions, renewable energy integration capabilities, and advanced monitoring technologies. Organizations are increasingly prioritizing environmental performance alongside operational reliability, creating demand for innovative power systems that reduce carbon footprints while maintaining high availability standards. Green financing options and sustainability-linked loans are making eco-friendly power infrastructure investments more accessible.

Edge computing expansion creates opportunities for specialized power solutions designed for distributed computing environments. The proliferation of 5G networks, IoT applications, and autonomous systems requires localized data processing capabilities supported by efficient, compact power infrastructure. Micro data centers and edge facilities represent emerging market segments with unique power requirements and growth potential.

Technology integration opportunities exist for providers developing intelligent power management systems incorporating artificial intelligence, machine learning, and predictive analytics capabilities. These advanced systems can optimize energy consumption, predict maintenance requirements, and improve overall infrastructure efficiency. Service-based models including power-as-a-service offerings and comprehensive maintenance contracts provide recurring revenue opportunities while reducing customer capital expenditure requirements.

Competitive dynamics in the United Kingdom data center power market reflect a complex ecosystem of global manufacturers, regional specialists, and service providers competing across multiple technology segments and customer categories. Market leaders leverage extensive product portfolios, established customer relationships, and comprehensive service capabilities to maintain competitive advantages. Innovation cycles are accelerating as companies invest in research and development to address evolving customer requirements for efficiency, reliability, and sustainability.

Customer behavior is shifting toward integrated solutions that combine power equipment, monitoring systems, and comprehensive service packages. Organizations increasingly prefer working with suppliers capable of providing end-to-end power infrastructure solutions rather than managing multiple vendor relationships. Total cost of ownership considerations are becoming more important than initial purchase prices, with customers evaluating long-term operational costs, maintenance requirements, and energy efficiency benefits.

Supply chain dynamics are influencing market development, with global component shortages and logistics challenges affecting equipment availability and pricing. Companies are diversifying supplier networks and increasing inventory levels to ensure reliable product delivery. Technology convergence between power systems, cooling infrastructure, and IT equipment is creating opportunities for integrated solutions that optimize overall data center performance and efficiency.

Comprehensive market analysis employs a multi-faceted research approach combining primary data collection, secondary research, and industry expert consultations to provide accurate, actionable insights into the United Kingdom data center power market. Primary research includes structured interviews with key market participants, including equipment manufacturers, system integrators, data center operators, and end-user organizations across diverse industry sectors.

Data collection methods encompass online surveys, telephone interviews, and in-person discussions with industry professionals to gather quantitative and qualitative information about market trends, competitive dynamics, and growth opportunities. Secondary research involves analysis of company financial reports, industry publications, government statistics, and regulatory documents to validate primary findings and identify additional market insights.

Analytical frameworks include market sizing methodologies, competitive positioning analysis, and trend identification techniques to ensure comprehensive market coverage. Research validation processes involve cross-referencing multiple data sources, conducting expert reviews, and applying statistical analysis methods to ensure data accuracy and reliability. Market forecasting utilizes econometric modeling and scenario analysis to project future market development under various economic and technological conditions.

London metropolitan area dominates the United Kingdom data center power market, accounting for approximately 45% of total market activity due to its concentration of financial services organizations, technology companies, and hyperscale cloud providers. The region benefits from robust electrical grid infrastructure, proximity to international connectivity hubs, and access to skilled technical workforce. Investment levels in London-area data centers continue growing as organizations establish primary and disaster recovery facilities to support business operations.

Manchester and surrounding regions represent the second-largest market segment, capturing approximately 18% market share through strategic positioning as an alternative to London-based facilities. The area offers competitive real estate costs, reliable power infrastructure, and government incentives supporting digital infrastructure development. Colocation providers are establishing significant facilities in Manchester to serve organizations seeking cost-effective alternatives to London deployments.

Scotland and Wales are emerging as attractive locations for data center investments, collectively representing 12% of market activity and growing rapidly due to favorable renewable energy availability, competitive operating costs, and supportive government policies. These regions particularly appeal to organizations prioritizing sustainability and seeking access to renewable energy sources for their data center operations. Regional development initiatives are supporting infrastructure investments and workforce development programs to attract additional data center projects.

Market leadership in the United Kingdom data center power market is characterized by a diverse ecosystem of global technology companies, specialized power equipment manufacturers, and regional service providers competing across multiple product categories and customer segments.

Technology segmentation reveals diverse market opportunities across multiple power system categories:

By Power System Type:

By Capacity Range:

By End-User Industry:

UPS systems category demonstrates the strongest growth momentum, with lithium-ion battery technology gaining 25% market adoption annually as organizations recognize superior performance characteristics including longer lifespan, reduced maintenance requirements, and improved energy density compared to traditional lead-acid systems. Modular UPS designs are becoming preferred solutions for organizations requiring scalable power protection capabilities that can expand with business growth.

Power distribution equipment is experiencing significant innovation driven by intelligent monitoring capabilities and remote management features. Smart PDUs incorporating real-time power monitoring, environmental sensing, and automated switching capabilities are capturing increased market share. Rack-level power distribution solutions are evolving to support higher power densities required by modern computing equipment and artificial intelligence workloads.

Backup generator systems are diversifying beyond traditional diesel-powered units to include natural gas, hydrogen fuel cells, and hybrid renewable energy systems. Organizations are increasingly prioritizing environmental sustainability while maintaining reliable backup power capabilities. Generator efficiency improvements and emissions reduction technologies are driving replacement cycles and new installations across the market.

Energy management platforms represent the fastest-growing category, with software-based solutions enabling optimization of power consumption, predictive maintenance, and regulatory compliance reporting. These systems integrate with building management platforms and cloud-based analytics services to provide comprehensive visibility into data center power infrastructure performance and efficiency metrics.

Data center operators benefit from advanced power infrastructure through improved operational reliability, reduced energy costs, and enhanced ability to meet service level agreements with customers. Modern power systems provide detailed monitoring and analytics capabilities enabling proactive maintenance, optimized energy consumption, and improved overall facility efficiency. Operational benefits include reduced downtime risks, lower maintenance costs, and improved scalability for future capacity expansion.

Equipment manufacturers gain competitive advantages through innovation in power system design, energy efficiency improvements, and integrated solution offerings. The growing market provides opportunities for revenue expansion, technology differentiation, and long-term customer relationships through comprehensive service contracts. Market expansion enables manufacturers to leverage economies of scale and invest in research and development for next-generation power technologies.

System integrators and service providers benefit from increasing demand for specialized expertise in power system design, installation, and maintenance. The complexity of modern data center power infrastructure creates opportunities for value-added services including consulting, project management, and ongoing support. Service revenue streams provide stable, recurring income while building long-term customer relationships and market presence.

End-user organizations achieve significant benefits including improved business continuity, reduced operational risks, and enhanced ability to support digital transformation initiatives. Reliable power infrastructure enables organizations to confidently deploy mission-critical applications and services while meeting regulatory compliance requirements. Cost benefits include reduced energy expenses, lower maintenance costs, and improved total cost of ownership through efficient power system operation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend reshaping the United Kingdom data center power market, with organizations increasingly prioritizing renewable energy sources, carbon footprint reduction, and circular economy principles in power system procurement decisions. Green power purchase agreements and on-site renewable energy generation are becoming standard requirements for new data center developments, driving demand for power systems capable of integrating with variable renewable energy sources.

Artificial intelligence adoption in power management systems is transforming operational efficiency and predictive maintenance capabilities. AI-powered analytics platforms can optimize energy consumption patterns, predict equipment failures, and automatically adjust power distribution to maximize efficiency. Machine learning algorithms are enabling more sophisticated demand forecasting and load balancing across data center power infrastructure.

Edge computing proliferation is creating demand for smaller, more efficient power systems designed for distributed computing environments. These systems must provide enterprise-grade reliability in compact form factors suitable for deployment in retail locations, cell towers, and other edge computing sites. Micro data centers require specialized power solutions optimized for unmanned operation and remote monitoring capabilities.

Modular infrastructure design is gaining traction as organizations seek flexible, scalable power solutions that can adapt to changing business requirements. Containerized power systems and prefabricated electrical infrastructure enable faster deployment times and reduced installation costs while maintaining high reliability standards. Standardization efforts are simplifying procurement processes and improving interoperability between different power system components.

Technology partnerships between power equipment manufacturers and cloud service providers are accelerating innovation in hyperscale data center power systems. These collaborations focus on developing custom power solutions optimized for specific workload requirements and operational efficiency targets. Joint development programs are producing next-generation power systems with improved performance characteristics and reduced environmental impact.

Regulatory developments including updated energy efficiency standards and environmental regulations are driving power system upgrades across existing data center facilities. New requirements for power usage effectiveness (PUE) reporting and carbon emissions disclosure are compelling organizations to invest in more efficient power infrastructure. Compliance deadlines are creating market opportunities for power system providers offering retrofit solutions and efficiency upgrades.

Investment announcements from major hyperscale operators and colocation providers are driving demand for large-scale power infrastructure projects. These investments often involve multi-megawatt power systems and comprehensive electrical infrastructure supporting massive computing facilities. Market expansion by international data center operators is creating opportunities for local power system suppliers and service providers.

Acquisition activities within the power systems industry are consolidating market leadership and expanding technology portfolios. Strategic acquisitions enable companies to offer more comprehensive solutions while accessing new customer segments and geographic markets. Industry consolidation is creating larger, more capable organizations better positioned to serve complex data center power requirements.

Strategic positioning recommendations for market participants emphasize the importance of developing comprehensive sustainability strategies that align with customer environmental commitments and regulatory requirements. Companies should invest in renewable energy integration capabilities, energy efficiency improvements, and carbon footprint reduction technologies to maintain competitive relevance. MarkWide Research analysis indicates that sustainability credentials are becoming primary selection criteria for power system procurement decisions.

Technology investment priorities should focus on intelligent power management systems, predictive analytics capabilities, and integration with cloud-based monitoring platforms. Organizations that develop advanced software capabilities alongside traditional hardware offerings will capture greater market share and customer loyalty. Digital transformation of power system management represents a significant competitive differentiator in the evolving market landscape.

Market expansion strategies should consider emerging opportunities in edge computing, distributed data centers, and specialized applications requiring unique power solutions. Companies should develop partnerships with system integrators, consulting firms, and technology providers to access new customer segments and application areas. Service-based revenue models including maintenance contracts, monitoring services, and power-as-a-service offerings provide stable income streams and deeper customer relationships.

Workforce development initiatives are essential for addressing skills shortages and building technical capabilities required for advanced power system design and maintenance. Companies should invest in training programs, certification processes, and partnerships with educational institutions to develop specialized expertise. Technical competency in emerging technologies will determine long-term market success and customer satisfaction levels.

Market trajectory for the United Kingdom data center power market indicates sustained growth driven by accelerating digital transformation, artificial intelligence adoption, and edge computing proliferation. MWR projections suggest the market will maintain robust expansion rates exceeding 9.2% CAGR through the next five years as organizations continue investing in digital infrastructure and power system modernization initiatives.

Technology evolution will focus on energy efficiency improvements, sustainability integration, and intelligent management capabilities. Lithium-ion battery systems are expected to achieve 60% market penetration within three years, while AI-powered power management platforms will become standard features in new installations. Innovation cycles will accelerate as companies compete to develop next-generation power solutions meeting evolving customer requirements.

Market consolidation trends will continue as larger organizations acquire specialized technology companies and regional service providers to expand capabilities and geographic coverage. This consolidation will create more comprehensive solution providers capable of serving complex, multi-site data center deployments. Partnership strategies will become increasingly important for accessing specialized technologies and customer segments.

Regulatory influence will intensify as government policies supporting net-zero carbon emissions and digital infrastructure development shape market dynamics. New standards for energy efficiency, environmental reporting, and grid integration will drive technology development and replacement cycles. Compliance requirements will create ongoing opportunities for power system upgrades and service provider engagement throughout the market evolution.

The United Kingdom data center power market represents a dynamic, rapidly evolving sector positioned for sustained growth driven by digital transformation, sustainability imperatives, and technological innovation. Market participants benefit from strong fundamentals including established infrastructure, supportive regulatory environment, and growing demand from diverse industry sectors requiring reliable computing capabilities.

Strategic opportunities abound for organizations developing advanced power solutions that address evolving customer requirements for efficiency, reliability, and environmental performance. The convergence of artificial intelligence, edge computing, and sustainability initiatives is creating new market segments and application areas requiring specialized power infrastructure solutions.

Success factors include technology innovation, comprehensive service capabilities, sustainability leadership, and strategic partnerships that enable access to emerging opportunities and customer segments. Organizations that invest in next-generation power technologies while building strong customer relationships will capture disproportionate market share and revenue growth in this expanding sector.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, which house computer systems and associated components. This includes power distribution, backup systems, and energy efficiency measures.

What are the key players in the United Kingdom Data Center Power Market?

Key players in the United Kingdom Data Center Power Market include companies like Schneider Electric, Eaton, and Vertiv, which provide power management solutions and infrastructure for data centers, among others.

What are the main drivers of growth in the United Kingdom Data Center Power Market?

The main drivers of growth in the United Kingdom Data Center Power Market include the increasing demand for cloud computing services, the rise of big data analytics, and the need for enhanced energy efficiency in data center operations.

What challenges does the United Kingdom Data Center Power Market face?

Challenges in the United Kingdom Data Center Power Market include the high costs of energy, regulatory compliance related to energy consumption, and the need for continuous upgrades to meet evolving technology demands.

What opportunities exist in the United Kingdom Data Center Power Market?

Opportunities in the United Kingdom Data Center Power Market include the adoption of renewable energy sources, advancements in energy storage technologies, and the growing trend of edge computing, which requires localized power solutions.

What trends are shaping the United Kingdom Data Center Power Market?

Trends shaping the United Kingdom Data Center Power Market include the increasing focus on sustainability and energy efficiency, the integration of artificial intelligence for power management, and the shift towards modular data center designs.

United Kingdom Data Center Power Market

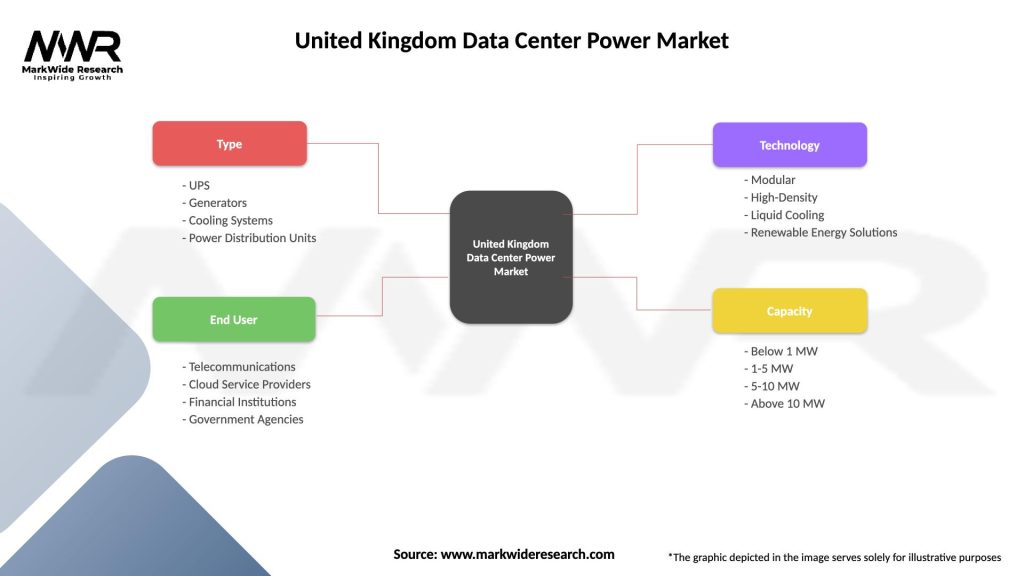

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generators, Cooling Systems, Power Distribution Units |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Technology | Modular, High-Density, Liquid Cooling, Renewable Energy Solutions |

| Capacity | Below 1 MW, 1-5 MW, 5-10 MW, Above 10 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

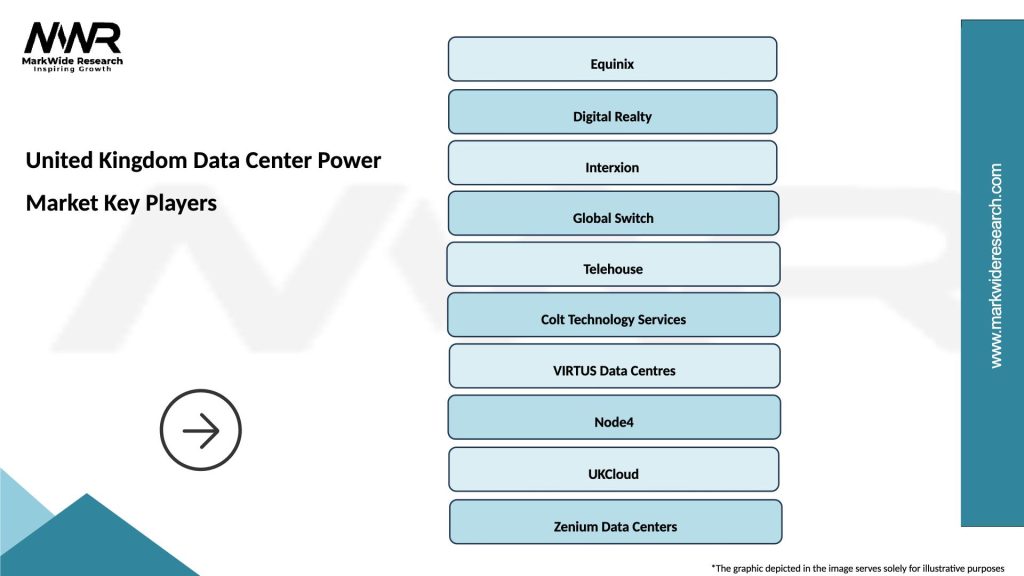

Leading companies in the United Kingdom Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at