444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom compact dishwasher market represents a dynamic and rapidly evolving segment within the broader home appliance industry. Compact dishwashers have gained significant traction among UK consumers, particularly those living in smaller homes, apartments, and urban environments where space optimization is crucial. The market has experienced substantial growth driven by changing lifestyle patterns, increasing urbanization, and growing awareness of water and energy efficiency.

Market dynamics indicate that the UK compact dishwasher sector is experiencing robust expansion, with adoption rates increasing by approximately 12% annually across various consumer segments. The market encompasses various product categories, including countertop dishwashers, slimline models, and portable units designed to meet diverse consumer needs and space constraints.

Consumer preferences have shifted significantly toward compact appliances that offer full-size functionality in smaller footprints. This trend has been particularly pronounced in metropolitan areas like London, Manchester, and Birmingham, where housing costs and space limitations drive demand for efficient, space-saving appliances. The market has also benefited from technological advancements that have improved cleaning performance while reducing water and energy consumption.

The United Kingdom compact dishwasher market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of space-efficient dishwashing appliances designed for smaller kitchens and households with limited space. These appliances typically feature reduced width, height, or depth compared to standard dishwashers while maintaining essential cleaning capabilities and modern features.

Compact dishwashers in the UK market include various configurations such as countertop models measuring 18 inches or less in width, slimline units designed for narrow spaces, and portable dishwashers that can be stored when not in use. These appliances serve households ranging from single-person apartments to small families seeking efficient dishwashing solutions without compromising kitchen space or functionality.

Market performance in the UK compact dishwasher sector demonstrates strong momentum driven by urbanization trends, changing demographics, and evolving consumer preferences. The market has witnessed significant transformation as manufacturers introduce innovative designs that maximize cleaning efficiency while minimizing space requirements.

Key growth drivers include the increasing number of single-person households, which now represent approximately 28% of all UK households, and the growing trend toward smaller living spaces in urban areas. Additionally, environmental consciousness has led consumers to seek energy-efficient appliances that reduce water consumption and electricity usage.

Technological advancement has played a crucial role in market expansion, with manufacturers incorporating smart features, improved wash cycles, and enhanced energy efficiency ratings. The integration of IoT connectivity and app-based controls has particularly appealed to younger demographics who prioritize convenience and technology integration in their home appliances.

Market segmentation reveals diverse consumer preferences across different product categories, with countertop models showing the highest growth rates due to their versatility and ease of installation. The rental market has also contributed significantly to demand, as landlords and tenants seek flexible appliance solutions that don’t require permanent installation.

Consumer behavior analysis reveals several critical insights that shape the UK compact dishwasher market landscape:

Urbanization trends represent the primary driver of compact dishwasher adoption in the UK market. As more consumers relocate to urban centers for employment opportunities, the demand for space-efficient appliances continues to grow. Housing density in major cities has increased substantially, with average apartment sizes decreasing by approximately 15% over the past decade.

Demographic changes significantly influence market dynamics, particularly the rise in single-person households and delayed family formation. Young professionals and students represent key consumer segments driving demand for compact appliances that fit their lifestyle and living situations. The trend toward smaller household sizes has created sustained demand for appropriately sized appliances.

Environmental consciousness has become a major market driver as consumers increasingly prioritize energy and water efficiency. Modern compact dishwashers offer superior resource efficiency compared to hand washing, with some models reducing water consumption by up to 75% compared to manual dishwashing. This efficiency appeal resonates strongly with environmentally conscious UK consumers.

Technological innovation continues to drive market growth through improved functionality and user experience. Smart features, sensor-based wash cycles, and app connectivity have transformed compact dishwashers from basic appliances into sophisticated home automation components that appeal to tech-savvy consumers.

Price sensitivity remains a significant market restraint, particularly among budget-conscious consumers who may view compact dishwashers as luxury items rather than necessities. The initial investment cost can be prohibitive for some segments, especially when combined with installation requirements and potential kitchen modifications.

Limited capacity concerns present ongoing challenges as some consumers perceive compact dishwashers as inadequate for their needs. Despite technological improvements, capacity limitations may deter larger households or consumers who frequently entertain guests and require higher dishwashing capacity.

Installation complexity can discourage potential buyers, particularly in rental properties where permanent modifications may not be permitted. While portable options exist, they may not offer the same convenience and integration as built-in models, creating a compromise that some consumers find unacceptable.

Market saturation in certain segments poses challenges for continued growth, as early adopters have already purchased compact dishwashers and replacement cycles are typically longer than initial adoption periods. This saturation effect is most pronounced in urban areas where adoption rates are highest.

Smart home integration presents significant opportunities for market expansion as consumers increasingly adopt connected home technologies. Manufacturers can capitalize on this trend by developing dishwashers with advanced IoT capabilities, voice control compatibility, and integration with popular smart home platforms.

Rental market expansion offers substantial growth potential as the UK rental sector continues to grow. Purpose-built rental properties and co-living spaces represent emerging market segments that require flexible, efficient appliance solutions. Build-to-rent developments have increased by approximately 35% in recent years, creating new opportunities for compact appliance manufacturers.

Sustainability focus creates opportunities for manufacturers to develop ultra-efficient models that exceed current energy standards. As environmental regulations become more stringent and consumer awareness increases, demand for the most efficient appliances will likely accelerate.

Product innovation in areas such as noise reduction, wash cycle customization, and space optimization can differentiate products in an increasingly competitive market. Manufacturers who successfully address specific consumer pain points through innovative design will likely capture market share.

Supply chain dynamics in the UK compact dishwasher market have evolved significantly, with manufacturers adapting to changing consumer demands and market conditions. The market has experienced increased competition as both established appliance manufacturers and new entrants recognize the growth potential in the compact segment.

Distribution channels have diversified beyond traditional appliance retailers to include online platforms, home improvement stores, and specialized compact appliance retailers. E-commerce has become particularly important, with online sales representing approximately 42% of total compact dishwasher purchases in recent years.

Pricing strategies vary significantly across market segments, with premium brands focusing on advanced features and build quality while value-oriented manufacturers compete on price and basic functionality. This segmentation allows the market to serve diverse consumer needs and budget constraints.

Innovation cycles have accelerated as manufacturers seek to differentiate their products through unique features, improved efficiency, and enhanced user experience. The rapid pace of technological advancement has shortened product lifecycles and increased the importance of continuous innovation.

Market analysis for the UK compact dishwasher sector employs comprehensive research methodologies combining primary and secondary data sources. MarkWide Research utilizes multi-faceted approaches to ensure accurate market assessment and trend identification.

Primary research includes consumer surveys, retailer interviews, and manufacturer consultations to gather firsthand insights into market dynamics, consumer preferences, and industry trends. This approach provides real-time market intelligence and validates secondary research findings.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and historical trends. This comprehensive data collection ensures robust market analysis and reliable projections.

Data validation processes include cross-referencing multiple sources, statistical analysis, and expert review to ensure accuracy and reliability of market insights. Quality control measures maintain research integrity and support confident decision-making for industry stakeholders.

London and Southeast England dominate the UK compact dishwasher market, accounting for approximately 38% of total market demand. This region’s high population density, elevated housing costs, and prevalence of smaller living spaces create ideal conditions for compact appliance adoption.

Northern England represents a growing market segment, particularly in cities like Manchester, Liverpool, and Leeds where urban regeneration projects have created numerous compact living spaces. The region shows strong growth potential as urbanization trends continue and housing developments emphasize efficient space utilization.

Scotland demonstrates steady market growth, with Edinburgh and Glasgow leading regional demand. The market benefits from strong environmental consciousness among Scottish consumers and government initiatives promoting energy-efficient appliances.

Wales and Northern Ireland represent smaller but stable market segments with growth driven primarily by urban centers like Cardiff and Belfast. These regions show increasing adoption rates as compact dishwasher awareness and availability improve.

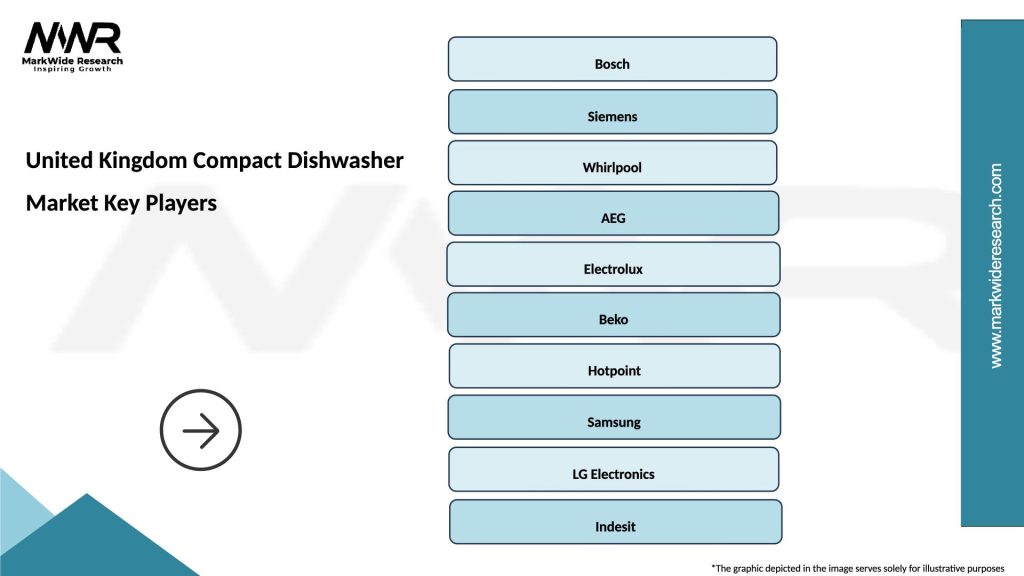

Market leadership in the UK compact dishwasher sector is distributed among several key players, each with distinct competitive advantages and market positioning strategies:

Competitive strategies vary significantly across market participants, with premium brands emphasizing quality, innovation, and brand heritage while value-oriented manufacturers focus on affordability and basic functionality. Market consolidation has occurred as larger appliance manufacturers acquire smaller specialized brands to expand their compact appliance portfolios.

By Product Type:

By Capacity:

By Price Range:

Countertop dishwashers represent the fastest-growing segment, with adoption rates increasing by approximately 18% annually. These units appeal to renters, students, and consumers seeking maximum flexibility without permanent installation requirements. The segment benefits from improved designs that maximize capacity while maintaining compact footprints.

Slimline built-in models maintain steady market share among homeowners seeking permanent solutions that integrate with existing kitchen designs. These models typically offer superior capacity and features compared to portable alternatives but require professional installation and kitchen modifications.

Portable dishwashers serve niche market segments, particularly consumers in temporary housing situations or those who frequently relocate. While offering maximum flexibility, these models may compromise on capacity and convenience compared to permanent installations.

Smart-enabled models across all categories show accelerating adoption as consumers embrace connected home technologies. Features such as remote monitoring, cycle customization, and energy usage tracking appeal to tech-savvy consumers willing to pay premium prices for advanced functionality.

Manufacturers benefit from expanding market opportunities as urbanization trends and demographic changes create sustained demand for compact appliances. The segment offers higher profit margins compared to standard dishwashers due to specialized engineering and premium positioning.

Retailers gain from increased foot traffic and higher-value transactions as compact dishwashers typically command premium prices relative to their size. The growing market also creates opportunities for specialized compact appliance retailers and online platforms.

Consumers benefit from improved quality of life through reduced manual dishwashing, water and energy savings, and optimized use of limited kitchen space. Modern compact dishwashers offer cleaning performance comparable to full-size models while fitting into smaller living spaces.

Property developers can enhance property appeal and rental potential by including compact dishwashers in smaller units, particularly in urban developments where space optimization is crucial for market competitiveness.

Environmental stakeholders benefit from reduced water consumption and improved energy efficiency compared to manual dishwashing, supporting broader sustainability goals and resource conservation efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration has emerged as a dominant trend, with manufacturers incorporating Wi-Fi connectivity, smartphone apps, and voice control compatibility. These features appeal to younger demographics and align with broader smart home adoption trends.

Energy efficiency optimization continues to drive product development as manufacturers strive to exceed existing standards and appeal to environmentally conscious consumers. Advanced sensor technology and optimized wash cycles contribute to improved resource efficiency.

Design aesthetics enhancement has become increasingly important as consumers seek appliances that complement modern kitchen designs. Sleek finishes, minimalist controls, and integrated designs help compact dishwashers blend seamlessly into contemporary living spaces.

Noise reduction technology addresses a key consumer concern, particularly in open-plan living spaces and apartments where noise transmission can be problematic. Advanced insulation and motor design improvements have significantly reduced operational noise levels.

Flexible installation options have expanded to accommodate diverse living situations and consumer preferences. Manufacturers now offer multiple mounting and connection options to simplify installation and increase market accessibility.

Product launches have accelerated as manufacturers recognize the growth potential in the compact dishwasher segment. Recent introductions feature advanced wash systems, improved energy ratings, and enhanced smart connectivity options.

Strategic partnerships between appliance manufacturers and property developers have emerged to integrate compact dishwashers into new residential developments. These collaborations help drive market adoption and create steady demand streams.

Technology licensing agreements have enabled smaller manufacturers to incorporate advanced features and compete more effectively with established brands. These partnerships accelerate innovation diffusion across the market.

Retail channel expansion has diversified distribution networks, with online platforms gaining prominence alongside traditional appliance retailers. This expansion improves market accessibility and consumer choice.

Sustainability initiatives have influenced product development priorities, with manufacturers investing in research and development to create more environmentally friendly appliances that exceed regulatory requirements.

Market positioning strategies should emphasize unique value propositions that differentiate compact dishwashers from both standard dishwashers and manual washing alternatives. MWR analysis suggests focusing on space efficiency, convenience, and environmental benefits to maximize market appeal.

Product development priorities should address key consumer concerns including capacity optimization, noise reduction, and installation simplicity. Manufacturers who successfully balance these factors while maintaining competitive pricing will likely gain market share.

Distribution strategy expansion should prioritize online channels and partnerships with property developers to reach target consumers effectively. The growing importance of e-commerce requires investment in digital marketing and online retail capabilities.

Consumer education initiatives can help overcome market barriers by demonstrating the benefits and capabilities of modern compact dishwashers. Educational marketing campaigns should address common misconceptions about capacity and performance limitations.

Innovation focus should emphasize smart connectivity, energy efficiency, and user experience improvements to maintain competitive differentiation and justify premium pricing in an increasingly competitive market.

Market trajectory for the UK compact dishwasher sector remains positive, with continued growth expected as urbanization trends persist and consumer acceptance increases. The market is projected to maintain robust expansion with growth rates of approximately 8-10% annually over the next five years.

Technology evolution will likely focus on artificial intelligence integration, predictive maintenance capabilities, and enhanced energy efficiency. These advancements will further differentiate compact dishwashers from manual washing alternatives and justify premium pricing.

Market maturation is expected in urban centers where adoption rates are highest, leading to increased focus on replacement sales and product upgrades. This shift will require manufacturers to emphasize durability, reliability, and advanced features to encourage consumer upgrades.

Regulatory environment changes may drive further innovation in energy efficiency and environmental performance. Manufacturers who anticipate and exceed regulatory requirements will likely gain competitive advantages and appeal to environmentally conscious consumers.

Consumer demographics will continue to favor compact appliance adoption as millennial and Generation Z consumers enter peak household formation years. These demographics typically prioritize convenience, technology integration, and environmental responsibility in their purchasing decisions.

The United Kingdom compact dishwasher market represents a dynamic and growing segment within the broader appliance industry, driven by urbanization trends, demographic changes, and evolving consumer preferences. The market has demonstrated resilience and adaptability, with manufacturers successfully addressing consumer needs through innovative product development and strategic positioning.

Key success factors include space optimization, energy efficiency, smart connectivity, and competitive pricing strategies that balance features with affordability. Companies that effectively address these priorities while maintaining product quality and reliability are well-positioned for continued growth and market share expansion.

Future prospects remain positive as underlying market drivers continue to strengthen, including increasing urbanization, growing environmental consciousness, and technological advancement. The market’s evolution toward smart, connected appliances aligns with broader consumer technology adoption trends and creates opportunities for premium positioning and enhanced customer value.

Strategic recommendations for industry participants emphasize the importance of continued innovation, expanded distribution channels, and consumer education initiatives to maximize market potential and overcome remaining adoption barriers in this promising and rapidly evolving market segment.

What is Compact Dishwasher?

A compact dishwasher is a smaller version of a traditional dishwasher, designed to fit in limited spaces while still providing efficient cleaning for dishes. These appliances are ideal for small households, apartments, or kitchens with restricted space.

What are the key players in the United Kingdom Compact Dishwasher Market?

Key players in the United Kingdom Compact Dishwasher Market include Bosch, Beko, and Whirlpool, among others. These companies are known for their innovative designs and energy-efficient models that cater to the needs of consumers in compact living spaces.

What are the growth factors driving the United Kingdom Compact Dishwasher Market?

The growth of the United Kingdom Compact Dishwasher Market is driven by increasing urbanization, the rise in small households, and a growing preference for energy-efficient appliances. Additionally, the convenience of compact dishwashers appeals to busy consumers seeking time-saving solutions.

What challenges does the United Kingdom Compact Dishwasher Market face?

The United Kingdom Compact Dishwasher Market faces challenges such as limited capacity compared to standard models and potential consumer reluctance due to higher upfront costs. Additionally, competition from alternative cleaning methods can impact market growth.

What opportunities exist in the United Kingdom Compact Dishwasher Market?

Opportunities in the United Kingdom Compact Dishwasher Market include the development of smart dishwashers with connectivity features and the introduction of eco-friendly models. As sustainability becomes a priority, manufacturers can capitalize on consumer demand for greener appliances.

What trends are shaping the United Kingdom Compact Dishwasher Market?

Trends in the United Kingdom Compact Dishwasher Market include the increasing popularity of built-in models and advancements in technology that enhance cleaning efficiency. Additionally, consumers are showing a preference for stylish designs that complement modern kitchen aesthetics.

United Kingdom Compact Dishwasher Market

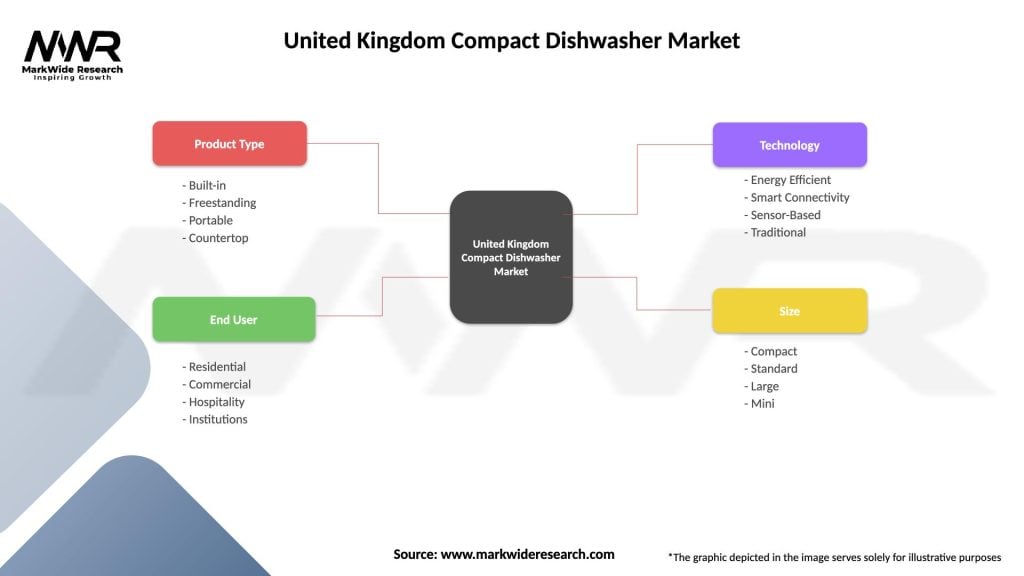

| Segmentation Details | Description |

|---|---|

| Product Type | Built-in, Freestanding, Portable, Countertop |

| End User | Residential, Commercial, Hospitality, Institutions |

| Technology | Energy Efficient, Smart Connectivity, Sensor-Based, Traditional |

| Size | Compact, Standard, Large, Mini |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Compact Dishwasher Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at