444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom commercial greenhouse market represents a dynamic and rapidly evolving sector within the country’s agricultural landscape. Commercial greenhouses have become essential infrastructure for modern farming operations, enabling year-round cultivation and maximizing crop yields despite the UK’s challenging climate conditions. The market encompasses various greenhouse technologies, from traditional glass structures to advanced climate-controlled facilities equipped with sophisticated automation systems.

Market dynamics indicate robust growth driven by increasing demand for locally grown produce, sustainability initiatives, and technological advancements in controlled environment agriculture. The sector has experienced significant expansion, with growth rates reaching 8.2% annually as more farmers and commercial growers recognize the benefits of protected cultivation. Climate change concerns and the need for food security have further accelerated adoption of commercial greenhouse solutions across England, Scotland, Wales, and Northern Ireland.

Technology integration has transformed traditional greenhouse operations into sophisticated agricultural facilities. Modern commercial greenhouses incorporate advanced heating systems, automated irrigation, climate control mechanisms, and energy-efficient lighting solutions. The market serves diverse applications including vegetable production, flower cultivation, nursery operations, and research facilities, with vegetable production accounting for approximately 62% of total greenhouse utilization in the UK.

The United Kingdom commercial greenhouse market refers to the comprehensive ecosystem of protected cultivation facilities designed for large-scale agricultural production within controlled environments. These structures enable farmers and growers to optimize growing conditions, extend growing seasons, and achieve higher yields compared to traditional open-field agriculture.

Commercial greenhouses encompass various structural types including glass houses, polytunnels, multi-span structures, and high-tech climate-controlled facilities. The market includes not only the physical structures but also associated equipment, technologies, and services required for successful greenhouse operations. Key components include heating and cooling systems, irrigation infrastructure, ventilation equipment, growing media, and automation technologies.

Market participants range from small-scale commercial growers to large agricultural enterprises, research institutions, and specialized greenhouse manufacturers. The sector supports the UK’s agricultural self-sufficiency goals while addressing consumer demand for fresh, locally produced food throughout the year. Environmental benefits include reduced water usage, minimized pesticide application, and lower transportation costs for locally grown produce.

Strategic analysis of the United Kingdom commercial greenhouse market reveals a sector experiencing unprecedented growth and transformation. The market has demonstrated remarkable resilience and adaptability, particularly following Brexit and the COVID-19 pandemic, which highlighted the importance of domestic food production capabilities.

Key growth drivers include government support for sustainable agriculture, increasing consumer preference for locally grown produce, and technological innovations that improve operational efficiency. The market benefits from favorable policies promoting agricultural modernization, with government incentives supporting approximately 35% of new greenhouse installations through various grant programs and sustainability initiatives.

Market segmentation reveals diverse applications across vegetable production, ornamental horticulture, and specialized crop cultivation. The sector has attracted significant investment in automation technologies, renewable energy integration, and precision agriculture solutions. Regional distribution shows concentrated activity in traditional agricultural areas, with emerging growth in urban and peri-urban locations driven by vertical farming initiatives.

Competitive landscape features both established greenhouse manufacturers and innovative technology providers offering integrated solutions. The market continues to evolve with increasing focus on sustainability, energy efficiency, and digital transformation of greenhouse operations.

Fundamental insights into the United Kingdom commercial greenhouse market reveal several critical trends shaping its development:

Market maturation has led to more sophisticated greenhouse designs and operational practices. The sector demonstrates strong potential for continued expansion, supported by favorable market conditions and increasing recognition of controlled environment agriculture benefits.

Primary market drivers propelling the United Kingdom commercial greenhouse market include multiple interconnected factors that create favorable conditions for sector growth and development.

Climate resilience represents a fundamental driver as greenhouse cultivation provides protection against increasingly unpredictable weather patterns. The UK’s variable climate conditions make controlled environment agriculture particularly attractive for ensuring consistent crop production. Food security concerns have intensified following Brexit, driving demand for domestic production capabilities that reduce reliance on imported fresh produce.

Consumer preferences increasingly favor locally grown, fresh produce with minimal environmental impact. This trend has created strong market demand for greenhouse-grown vegetables, herbs, and flowers that can be produced year-round near population centers. Quality advantages of greenhouse cultivation, including consistent product quality and extended shelf life, appeal to both retailers and consumers.

Government support through various agricultural policies and sustainability initiatives provides significant market stimulus. Grant programs and tax incentives encourage greenhouse investment, with support covering up to 40% of eligible project costs in some regions. Environmental regulations promoting sustainable agriculture practices favor greenhouse cultivation methods that optimize resource utilization.

Technological advancement continues to improve greenhouse efficiency and profitability. Innovations in automation, climate control, and energy management systems reduce operational costs while increasing productivity, making commercial greenhouse operations more economically viable.

Significant challenges face the United Kingdom commercial greenhouse market, creating barriers to expansion and operational efficiency that market participants must navigate carefully.

High capital investment requirements represent the most substantial market restraint. Modern commercial greenhouse facilities require significant upfront investment in structures, equipment, and technology systems. Construction costs have increased substantially, with advanced greenhouse systems requiring considerable financial resources that may be prohibitive for smaller operators.

Energy costs present ongoing operational challenges, particularly for heated greenhouse operations during winter months. Rising energy prices impact profitability and competitiveness, especially for energy-intensive crops requiring year-round climate control. Energy dependency on fossil fuels remains a concern despite increasing renewable energy adoption.

Skilled labor shortage affects the sector’s ability to operate sophisticated greenhouse systems effectively. The specialized knowledge required for modern greenhouse management, including technical expertise in automation systems and precision agriculture, creates recruitment and training challenges. Labor costs continue to rise, impacting overall operational economics.

Planning regulations and land availability constraints limit expansion opportunities in some regions. Complex approval processes for new greenhouse developments can delay projects and increase costs. Competition for land from other development uses, particularly near urban areas, affects site selection and costs.

Market competition from imported produce, despite transportation costs, continues to pressure domestic greenhouse operations on pricing and market positioning.

Emerging opportunities within the United Kingdom commercial greenhouse market present significant potential for growth, innovation, and market expansion across multiple dimensions.

Vertical farming integration offers substantial opportunities for maximizing production efficiency in limited spaces. Advanced vertical growing systems within greenhouse environments can increase yields per square meter while reducing resource consumption. Urban agriculture development near major population centers creates opportunities for fresh produce supply with minimal transportation requirements.

Renewable energy integration presents opportunities for reducing operational costs and improving sustainability credentials. Solar panel installation, geothermal heating systems, and biomass energy solutions can significantly reduce energy expenses while supporting environmental objectives. Energy storage systems enable optimization of renewable energy utilization throughout daily and seasonal cycles.

Specialty crop production offers higher-value opportunities compared to traditional greenhouse crops. Growing demand for organic produce, exotic vegetables, medicinal plants, and premium herbs creates niche markets with attractive profit margins. Contract growing arrangements with retailers and food service companies provide stable revenue streams.

Technology partnerships with agricultural technology companies create opportunities for developing innovative solutions and accessing new markets. Research collaborations with universities and research institutions can lead to breakthrough technologies and improved growing techniques.

Export opportunities to European and global markets leverage the UK’s reputation for high-quality agricultural products, with greenhouse-grown produce meeting stringent quality standards required for international trade.

Complex market dynamics shape the United Kingdom commercial greenhouse market through interconnected forces that influence supply, demand, pricing, and competitive positioning.

Supply chain evolution has transformed greenhouse market dynamics significantly. Direct-to-consumer sales channels, including farm shops and online platforms, have grown by 28% annually, enabling greenhouse operators to capture higher margins while building customer relationships. Retail partnerships with major supermarket chains provide stable demand but require consistent quality and supply reliability.

Seasonal demand patterns create dynamic pricing opportunities throughout the year. Greenhouse operators can capitalize on premium pricing during winter months when outdoor production is limited. Market timing strategies enable growers to optimize revenue by scheduling production cycles to meet peak demand periods.

Technology adoption cycles influence competitive dynamics as early adopters of advanced greenhouse technologies gain operational advantages. Automation implementation has improved labor productivity by 45% on average in facilities utilizing robotic systems and AI-driven climate control.

Regulatory changes continue to impact market dynamics, particularly regarding environmental standards, food safety requirements, and agricultural support policies. Brexit implications have created both challenges and opportunities, with reduced competition from some European producers but increased complexity in supply chain management.

Investment flows into the sector reflect growing confidence in commercial greenhouse viability, with private equity and institutional investors increasingly recognizing the sector’s potential for sustainable returns.

Comprehensive research methodology employed for analyzing the United Kingdom commercial greenhouse market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights.

Primary research activities included extensive interviews with greenhouse operators, equipment manufacturers, technology providers, and industry associations across all regions of the United Kingdom. Field visits to representative commercial greenhouse facilities provided firsthand insights into operational practices, technology implementation, and market challenges.

Secondary research encompassed analysis of government agricultural statistics, industry reports, trade publications, and academic research papers. Data triangulation methods ensured consistency and accuracy across multiple information sources.

Market segmentation analysis utilized both quantitative and qualitative approaches to identify key market segments, growth patterns, and competitive dynamics. Regional analysis incorporated geographic variations in climate, agricultural practices, and market conditions across England, Scotland, Wales, and Northern Ireland.

Technology assessment involved evaluation of emerging technologies, innovation trends, and their potential impact on market development. Economic modeling analyzed cost structures, profitability factors, and investment requirements across different greenhouse types and operational scales.

Stakeholder consultation with government agencies, research institutions, and industry experts provided insights into policy developments, regulatory changes, and future market directions. Validation processes ensured research findings accurately reflect current market conditions and future prospects.

Regional distribution of the United Kingdom commercial greenhouse market reveals distinct patterns influenced by climate conditions, agricultural traditions, and market proximity factors.

England dominates the commercial greenhouse market, accounting for approximately 75% of total greenhouse area and production capacity. Southern England benefits from favorable climate conditions and proximity to major population centers, making it the preferred location for large-scale commercial operations. Counties including Kent, Sussex, and Hampshire host significant greenhouse clusters serving London and Southeast markets.

East Anglia represents a major greenhouse production region, leveraging its agricultural heritage and flat terrain suitable for large-scale facilities. Lincolnshire and Norfolk have experienced substantial growth in commercial greenhouse development, particularly for vegetable production serving national markets.

Scotland accounts for approximately 12% of UK greenhouse capacity, with operations concentrated in central and southern regions. Scottish greenhouse operations often focus on specialty crops and benefit from government support for agricultural diversification initiatives.

Wales contributes around 8% of national greenhouse capacity, with development concentrated in coastal areas and river valleys offering favorable microclimates. Welsh greenhouse operations often emphasize sustainable practices and organic production methods.

Northern Ireland represents approximately 5% of UK greenhouse market, with operations primarily serving local and Irish markets. Cross-border trade opportunities provide additional market access for Northern Irish greenhouse producers.

Urban and peri-urban greenhouse development is emerging across all regions, driven by demand for locally grown produce and reduced transportation costs.

Competitive dynamics within the United Kingdom commercial greenhouse market feature diverse participants ranging from established agricultural companies to innovative technology providers and specialized greenhouse manufacturers.

Market consolidation trends show increasing collaboration between greenhouse operators and technology providers to develop integrated solutions. Strategic partnerships enable smaller operators to access advanced technologies while larger companies expand their market reach.

Innovation competition focuses on energy efficiency, automation capabilities, and sustainable growing practices. Companies investing in research and development gain competitive advantages through improved operational efficiency and reduced environmental impact.

Market segmentation of the United Kingdom commercial greenhouse market reveals distinct categories based on structure type, application, technology level, and operational scale.

By Structure Type:

By Application:

By Technology Level:

By Operational Scale:

Detailed analysis of market categories reveals distinct characteristics, growth patterns, and opportunities within the United Kingdom commercial greenhouse market.

Vegetable Production Category represents the largest market segment, driven by consistent consumer demand and favorable economics. Tomato production leads this category, with UK greenhouse tomatoes achieving premium pricing due to superior quality and freshness. Cucumber and pepper production has expanded significantly, benefiting from year-round growing capabilities and reduced import dependency.

Leafy greens production has emerged as a high-growth subcategory, with lettuce, spinach, and herbs showing strong market demand. Hydroponic systems are particularly popular for leafy greens production, offering faster growing cycles and higher yields per square meter.

Ornamental Horticulture Category serves both domestic and export markets, with UK-grown flowers and plants enjoying strong reputation for quality. Seasonal demand patterns create opportunities for premium pricing during peak periods such as Valentine’s Day, Mother’s Day, and Christmas seasons.

Nursery Operations Category supports the broader agricultural and landscaping sectors by providing young plants and propagation services. Climate-controlled propagation enables year-round production and improved plant quality, supporting the growing landscaping and garden center markets.

Research Facilities Category contributes to innovation and development within the sector, with universities and private companies investing in advanced greenhouse research capabilities. Collaborative research projects between academic institutions and commercial operators drive technological advancement and best practice development.

Substantial benefits accrue to various stakeholders participating in the United Kingdom commercial greenhouse market, creating value across the agricultural supply chain.

For Growers:

For Retailers and Consumers:

For Technology Providers:

For Government and Society:

Comprehensive SWOT analysis reveals the strategic position of the United Kingdom commercial greenhouse market across internal and external factors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the United Kingdom commercial greenhouse market reflect evolving consumer preferences, technological advancement, and sustainability imperatives shaping sector development.

Automation and Digitalization represent the most significant trend transforming greenhouse operations. IoT sensors, artificial intelligence, and robotic systems are increasingly integrated into commercial facilities, enabling precise control of growing conditions and reducing labor requirements. Data-driven decision making has improved crop yields and resource efficiency across the sector.

Sustainable Growing Practices have gained prominence as environmental concerns influence consumer purchasing decisions and regulatory requirements. Organic certification has increased by 22% annually among greenhouse operators, while integrated pest management and biological control methods reduce chemical inputs.

Renewable Energy Integration has accelerated as greenhouse operators seek to reduce energy costs and environmental impact. Solar panel installations, biomass heating systems, and geothermal energy are increasingly common in new greenhouse developments. Energy storage systems enable optimization of renewable energy utilization throughout daily and seasonal cycles.

Vertical Growing Systems are emerging as a solution for maximizing production in limited spaces. Multi-tier growing systems within greenhouse environments can triple production capacity while maintaining controlled growing conditions.

Direct-to-Consumer Sales have expanded significantly, with greenhouse operators developing farm shops, online platforms, and subscription services to capture higher margins and build customer relationships. Agritourism activities provide additional revenue streams while educating consumers about greenhouse production methods.

Specialty Crop Production continues to grow as operators seek higher-value opportunities. Medicinal plants, exotic vegetables, and premium herbs offer attractive profit margins compared to traditional greenhouse crops.

Recent industry developments demonstrate the dynamic nature of the United Kingdom commercial greenhouse market and highlight significant investments, innovations, and strategic initiatives shaping its future.

Major Infrastructure Investments have transformed the sector landscape. Thanet Earth’s expansion project added substantial greenhouse capacity utilizing cutting-edge climate control technology and renewable energy systems. New facility developments across England and Scotland incorporate advanced automation and sustainable design principles.

Technology Partnerships between greenhouse operators and technology companies have accelerated innovation adoption. Collaborative projects with universities and research institutions have developed breakthrough growing techniques and equipment solutions. AI-powered climate control systems have demonstrated significant improvements in energy efficiency and crop yields.

Government Policy Initiatives have provided substantial support for sector development. Agricultural Transformation Fund allocations have supported greenhouse modernization projects, while sustainability grants encourage renewable energy adoption and environmental best practices.

Market Consolidation Activities have reshaped competitive dynamics through strategic acquisitions and partnerships. Vertical integration strategies have enabled companies to control supply chains from production through retail distribution.

International Expansion by UK greenhouse companies has demonstrated sector competitiveness in global markets. Export growth to European and Middle Eastern markets has validated the quality and reliability of UK greenhouse products.

Research Breakthroughs in plant genetics, growing media, and cultivation techniques continue to improve greenhouse productivity and sustainability. Precision agriculture applications enable optimized resource utilization and improved crop quality.

Strategic recommendations for stakeholders in the United Kingdom commercial greenhouse market focus on optimizing opportunities while addressing key challenges and market dynamics.

For Greenhouse Operators: MarkWide Research analysis suggests prioritizing technology investments that improve operational efficiency and reduce energy consumption. Automation systems should be implemented gradually, starting with climate control and irrigation before advancing to robotic harvesting systems. Energy management strategies including renewable energy integration and energy storage systems will become increasingly critical for long-term competitiveness.

Market positioning should emphasize quality, sustainability, and local production advantages. Direct marketing channels offer opportunities for premium pricing and customer relationship building. Specialty crop diversification can improve profitability while reducing market risks associated with commodity production.

For Technology Providers: Focus on developing integrated solutions that address multiple operational challenges simultaneously. Energy efficiency improvements and automation capabilities represent the highest priority areas for greenhouse operators. Service-based business models including maintenance contracts and performance guarantees can provide recurring revenue streams.

For Investors: The sector offers attractive opportunities for long-term capital appreciation driven by growing demand for locally produced food and technological advancement. Due diligence should focus on energy efficiency, technology integration, and market positioning of potential investments.

For Policymakers: Continued support for agricultural modernization and sustainability initiatives will enhance sector competitiveness. Skills development programs addressing technical expertise shortages should be prioritized to support sector growth.

Future prospects for the United Kingdom commercial greenhouse market appear highly favorable, with multiple growth drivers supporting continued expansion and technological advancement over the coming decade.

Market expansion is projected to continue at robust rates, driven by increasing consumer demand for locally grown produce and government support for agricultural sustainability. Technology adoption will accelerate as automation systems become more affordable and user-friendly, with AI integration expected to reach 60% of commercial facilities within the next five years.

Renewable energy integration will become standard practice as energy costs continue rising and environmental regulations tighten. Solar panel installations are projected to increase by 150% over the next decade, while innovative energy storage solutions will optimize renewable energy utilization.

Urban agriculture development will create new market opportunities as cities seek to improve food security and reduce transportation costs. Vertical farming integration within greenhouse facilities will maximize production efficiency in high-value urban locations.

Export opportunities will expand as UK greenhouse products gain recognition in international markets for quality and sustainability. Trade agreements and quality certifications will facilitate market access and premium positioning.

Innovation acceleration through research partnerships and technology development will continue improving greenhouse productivity and sustainability. Precision agriculture applications and biotechnology advances will enable more efficient resource utilization and higher crop yields.

Market consolidation trends will continue as successful operators expand through acquisition and partnership strategies, while technology integration creates competitive advantages for early adopters.

The United Kingdom commercial greenhouse market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, sustainability imperatives, and changing consumer preferences. Market analysis reveals a sector successfully adapting to challenges while capitalizing on emerging opportunities across multiple dimensions.

Key success factors include strategic technology adoption, energy efficiency optimization, and market positioning that emphasizes quality and sustainability advantages. The sector benefits from favorable government policies, strong research infrastructure, and proximity to major consumer markets that create competitive advantages for UK greenhouse operations.

Future development will be characterized by continued automation integration, renewable energy adoption, and expansion into urban agriculture applications. Market participants who invest in advanced technologies, develop sustainable operational practices, and build strong customer relationships will be best positioned for long-term success.

Strategic opportunities abound for stakeholders across the value chain, from greenhouse operators and technology providers to investors and policymakers. The sector’s contribution to food security, environmental sustainability, and rural economic development ensures continued support and investment in its growth and modernization.

The United Kingdom commercial greenhouse market stands poised for sustained expansion, technological advancement, and increased market sophistication that will enhance its role in the country’s agricultural future and food security objectives.

What is Commercial Greenhouse?

Commercial Greenhouse refers to structures designed for the cultivation of plants in a controlled environment, optimizing conditions such as temperature, humidity, and light. These facilities are essential for producing vegetables, flowers, and other crops year-round, particularly in regions with variable climates.

What are the key players in the United Kingdom Commercial Greenhouse Market?

Key players in the United Kingdom Commercial Greenhouse Market include companies like Glasshouse Crops Limited, The Greenhouse People, and Stalwart Greenhouses, among others. These companies are involved in the design, manufacturing, and supply of greenhouse structures and related technologies.

What are the growth factors driving the United Kingdom Commercial Greenhouse Market?

The growth of the United Kingdom Commercial Greenhouse Market is driven by increasing demand for locally grown produce, advancements in greenhouse technology, and the rising popularity of sustainable farming practices. Additionally, the need for year-round crop production contributes to market expansion.

What challenges does the United Kingdom Commercial Greenhouse Market face?

Challenges in the United Kingdom Commercial Greenhouse Market include high initial investment costs, regulatory hurdles related to environmental impact, and competition from imported produce. These factors can hinder the growth and profitability of local greenhouse operations.

What opportunities exist in the United Kingdom Commercial Greenhouse Market?

Opportunities in the United Kingdom Commercial Greenhouse Market include the integration of smart farming technologies, such as automation and IoT, and the potential for expanding organic and specialty crop production. Additionally, increasing consumer interest in sustainable and locally sourced food presents growth avenues.

What trends are shaping the United Kingdom Commercial Greenhouse Market?

Trends in the United Kingdom Commercial Greenhouse Market include the adoption of vertical farming techniques, the use of renewable energy sources, and the implementation of advanced climate control systems. These innovations aim to enhance efficiency and reduce the environmental footprint of greenhouse operations.

United Kingdom Commercial Greenhouse Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hydroponics, Aeroponics, Soil-Based, Vertical Farming |

| Technology | LED Lighting, Climate Control, Irrigation Systems, Automation |

| End User | Commercial Growers, Research Institutions, Retailers, Wholesalers |

| Application | Vegetable Production, Flower Cultivation, Herb Growing, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

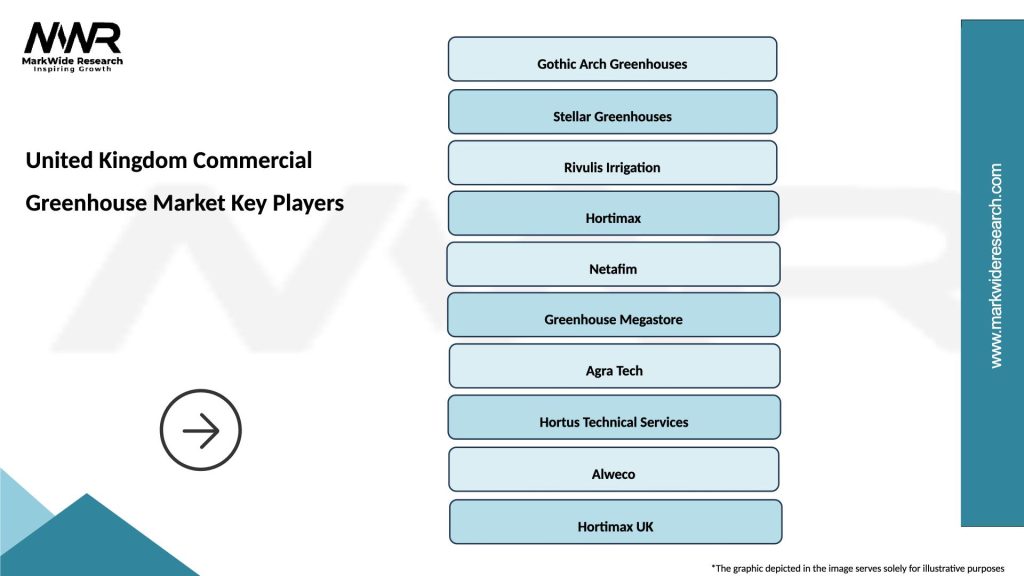

Leading companies in the United Kingdom Commercial Greenhouse Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at