444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom car rentals market represents a dynamic and evolving sector within the broader transportation and mobility landscape. This market encompasses traditional car rental services, peer-to-peer vehicle sharing platforms, and innovative mobility solutions that cater to diverse consumer needs across England, Scotland, Wales, and Northern Ireland. The UK car rental industry has demonstrated remarkable resilience and adaptability, particularly following the challenges posed by the global pandemic and subsequent recovery phases.

Market dynamics in the United Kingdom reflect a sophisticated ecosystem where established international brands compete alongside emerging domestic players and technology-driven platforms. The sector has experienced significant transformation with the integration of digital technologies, contactless services, and sustainable vehicle options. Growth patterns indicate a robust recovery trajectory with the market expanding at a compound annual growth rate of 8.2%, driven by increasing domestic tourism, business travel resumption, and evolving consumer preferences toward flexible mobility solutions.

Regional distribution shows concentrated activity in major metropolitan areas, with London accounting for approximately 35% of total market activity, followed by significant presence in Manchester, Birmingham, Edinburgh, and other key urban centers. The market’s geographic spread reflects the UK’s diverse transportation needs, from urban short-term rentals to leisure travel across the countryside and coastal regions.

The United Kingdom car rentals market refers to the comprehensive ecosystem of vehicle rental services operating within the UK territory, encompassing traditional car hire companies, peer-to-peer sharing platforms, corporate fleet services, and specialized mobility solutions. This market includes both short-term and long-term vehicle rental arrangements, serving individual consumers, business travelers, tourists, and corporate clients seeking flexible transportation alternatives.

Service categories within this market range from economy vehicle rentals for budget-conscious consumers to luxury car hire services, commercial vehicle rentals, and specialized transportation solutions including electric vehicles and premium automotive experiences. The market definition extends beyond simple vehicle provision to include comprehensive mobility services, insurance products, GPS navigation systems, and additional convenience features that enhance the overall customer experience.

Strategic positioning of the United Kingdom car rentals market reveals a sector undergoing significant modernization and expansion. The market has successfully navigated post-pandemic recovery challenges while embracing technological innovations and sustainability initiatives. Key performance indicators demonstrate strong momentum with domestic tourism driving 42% of rental demand and business travel contributing substantially to revenue generation.

Competitive landscape features a mix of established international operators, regional specialists, and innovative technology platforms. Major players including Hertz, Avis, Enterprise Rent-A-Car, and Europcar maintain significant market presence alongside emerging platforms like Zipcar and Turo. The market’s evolution toward digitalization has accelerated, with mobile applications and contactless services becoming standard offerings rather than premium features.

Future trajectory indicates continued growth driven by urbanization trends, changing work patterns, and increasing environmental consciousness among consumers. The integration of electric vehicles and hybrid options represents a significant opportunity for market expansion and differentiation.

Consumer behavior analysis reveals fundamental shifts in how UK residents and visitors approach vehicle rental services. The following insights highlight critical market developments:

Primary growth catalysts propelling the United Kingdom car rentals market forward encompass diverse economic, social, and technological factors. The resurgence of domestic tourism has emerged as a fundamental driver, with UK residents increasingly exploring local destinations and requiring flexible transportation solutions for weekend getaways and extended holidays.

Urbanization trends significantly impact market dynamics as city dwellers seek alternatives to vehicle ownership. Rising parking costs, congestion charges, and environmental regulations in major cities like London make car rental an attractive option for occasional transportation needs. Business travel recovery represents another crucial driver, with companies resuming face-to-face meetings, conferences, and client visits that require reliable transportation solutions.

Technological advancement serves as a powerful enabler, with smartphone applications, GPS integration, and digital payment systems making car rental more convenient and accessible. The emergence of contactless services has addressed health and safety concerns while improving operational efficiency. Environmental consciousness among consumers drives demand for electric and hybrid vehicle options, positioning car rental as a sustainable transportation alternative.

Economic factors including flexible work arrangements and changing lifestyle preferences contribute to market growth. The gig economy and remote work trends have created new patterns of mobility demand, with individuals requiring vehicles for specific periods rather than permanent ownership.

Operational challenges within the United Kingdom car rentals market present significant obstacles to growth and profitability. Vehicle acquisition costs and fleet management expenses represent substantial financial burdens, particularly during periods of supply chain disruption and semiconductor shortages affecting automotive manufacturing.

Regulatory compliance requirements impose additional operational complexities, with varying local regulations across different UK regions affecting service delivery and expansion strategies. Insurance costs and liability concerns create ongoing financial pressures, particularly for peer-to-peer platforms and smaller operators lacking economies of scale.

Competition intensity from alternative transportation modes including public transit improvements, ride-sharing services, and micro-mobility solutions challenges traditional car rental models. The emergence of subscription-based vehicle services and long-term leasing options provides consumers with alternatives that may reduce short-term rental demand.

Economic uncertainties including inflation pressures, fuel cost volatility, and potential recession concerns affect consumer spending patterns and business travel budgets. Seasonal demand fluctuations create operational challenges with peak periods requiring significant fleet expansion while off-season periods result in underutilized assets and reduced revenue generation.

Emerging opportunities within the United Kingdom car rentals market present substantial potential for growth and innovation. The transition toward electric vehicles represents a transformative opportunity, with government incentives and environmental regulations creating favorable conditions for operators who invest in sustainable fleet options.

Technology integration offers multiple avenues for service enhancement and operational efficiency. Artificial intelligence and machine learning applications can optimize fleet management, predict demand patterns, and personalize customer experiences. Internet of Things connectivity enables real-time vehicle monitoring, predictive maintenance, and enhanced security features.

Partnership opportunities with hotels, airlines, and travel platforms create potential for integrated mobility solutions and expanded customer reach. Corporate services present significant growth potential as businesses seek flexible alternatives to traditional fleet ownership and management.

Rural market expansion represents an underserved opportunity, with improved digital infrastructure enabling service delivery to smaller communities and tourist destinations. Specialized vehicle segments including luxury cars, commercial vehicles, and recreational vehicles offer premium pricing opportunities and market differentiation.

Subscription models and flexible membership programs can create recurring revenue streams while addressing changing consumer preferences for access over ownership.

Competitive forces shaping the United Kingdom car rentals market create a complex ecosystem of traditional operators, technology platforms, and emerging service models. The market demonstrates significant consolidation trends with larger operators acquiring smaller regional players to expand geographic coverage and operational capabilities.

Pricing strategies have evolved toward dynamic models that adjust rates based on demand patterns, seasonal variations, and competitive positioning. Customer acquisition costs have increased as digital marketing becomes more competitive, requiring operators to focus on retention strategies and lifetime value optimization.

Supply chain management has become increasingly critical, with vehicle availability and fleet composition directly impacting service quality and revenue generation. The integration of electric vehicles requires infrastructure investments and operational adjustments that influence competitive positioning.

According to MarkWide Research analysis, market dynamics indicate a shift toward platform-based business models that leverage technology to optimize asset utilization and customer experience. Service differentiation increasingly focuses on convenience features, sustainability options, and integrated mobility solutions rather than purely price-based competition.

Comprehensive analysis of the United Kingdom car rentals market employs multiple research methodologies to ensure accuracy and reliability of insights. Primary research involves direct engagement with industry stakeholders including car rental operators, fleet managers, corporate clients, and individual consumers across diverse demographic segments.

Data collection methods encompass structured interviews with key industry executives, consumer surveys targeting different user segments, and observational studies of rental patterns and usage behaviors. Secondary research incorporates analysis of industry reports, government statistics, regulatory filings, and company financial statements to validate primary findings.

Quantitative analysis utilizes statistical modeling to identify trends, correlations, and predictive patterns within market data. Qualitative assessment provides contextual understanding of market dynamics, competitive strategies, and consumer motivations that influence rental decisions.

Geographic segmentation ensures representation across England, Scotland, Wales, and Northern Ireland, accounting for regional variations in demand patterns, regulatory environments, and competitive landscapes. Temporal analysis examines seasonal fluctuations, economic cycle impacts, and long-term trend developments.

London metropolitan area dominates the United Kingdom car rentals market, accounting for approximately 35% of total market activity due to its concentration of international airports, business districts, and tourist attractions. The capital’s complex transportation network and high vehicle ownership costs create substantial demand for flexible rental solutions.

Scotland region demonstrates strong growth potential driven by tourism to the Highlands, Edinburgh, and Glasgow. The scenic driving routes and rural destinations make car rental essential for visitors exploring beyond major cities. Regional market share for Scotland represents approximately 12% of national activity.

Northern England including Manchester, Liverpool, and Newcastle shows robust demand from both business and leisure segments. The region’s industrial heritage and emerging technology sectors create diverse rental requirements. Wales market presence benefits from natural tourism attractions and cross-border travel patterns.

Southwest England experiences significant seasonal variations with summer tourism driving peak demand for coastal and countryside exploration. Airport locations across regions serve as critical distribution points, with Heathrow, Gatwick, Manchester, and Edinburgh airports representing major rental hubs.

Market penetration rates vary significantly by region, with urban areas showing higher adoption rates of 23% compared to rural areas where traditional vehicle ownership remains more prevalent.

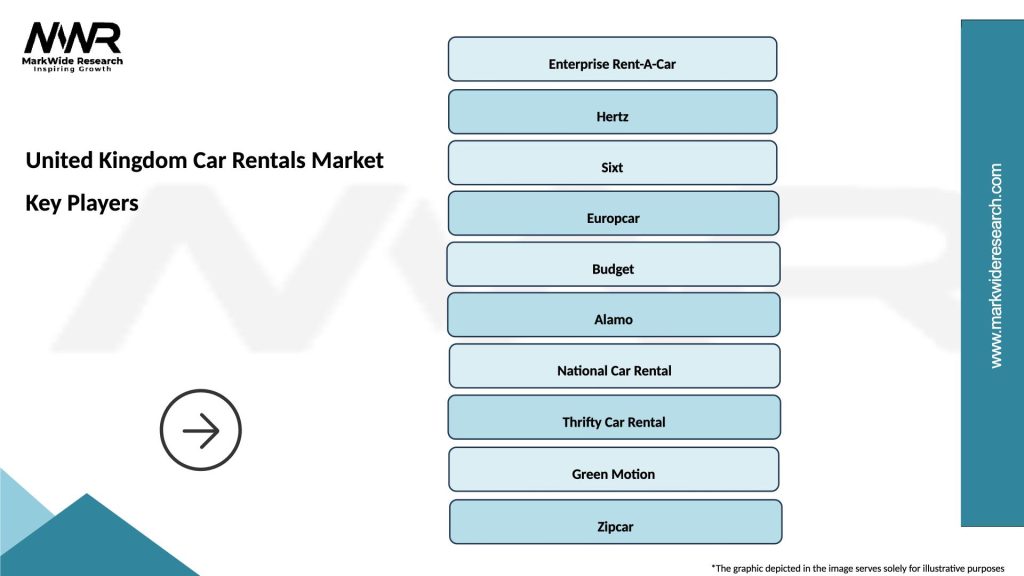

Market leadership in the United Kingdom car rentals sector reflects a diverse competitive environment featuring international brands, regional specialists, and innovative technology platforms. The competitive structure demonstrates significant consolidation trends while maintaining space for niche operators and emerging business models.

Competitive strategies increasingly focus on digital transformation, sustainability initiatives, and customer experience enhancement rather than purely price-based competition.

Market segmentation within the United Kingdom car rentals sector reveals distinct customer categories with specific needs, preferences, and usage patterns. Understanding these segments enables operators to develop targeted strategies and service offerings.

By Customer Type:

By Rental Duration:

By Vehicle Category:

Economy vehicle segment represents the largest category by volume, appealing to price-sensitive consumers and first-time renters. This segment benefits from high demand during peak tourist seasons and demonstrates strong growth in domestic travel markets. Fuel efficiency and basic reliability remain primary selection criteria for economy renters.

Premium vehicle category generates disproportionate revenue despite lower volume, with business travelers and luxury tourists driving demand. Brand preferences in this segment favor established luxury manufacturers, and customers show higher loyalty rates and longer rental durations.

Electric vehicle segment represents the fastest-growing category, with adoption rates increasing by 67% year-over-year. Environmental consciousness and government incentives drive demand, particularly among younger demographics and corporate clients with sustainability mandates.

Commercial vehicle rentals serve small businesses and individuals requiring temporary cargo capacity. This segment shows steady growth driven by e-commerce expansion and gig economy activities. Van rentals particularly benefit from home delivery services and small business logistics needs.

Specialty vehicles including convertibles, sports cars, and recreational vehicles cater to experiential travel and special occasions, commanding premium pricing and generating high customer satisfaction scores.

Rental operators benefit from diversified revenue streams, asset optimization opportunities, and scalable business models that can adapt to demand fluctuations. Technology integration enables operational efficiency improvements and enhanced customer experiences that drive loyalty and repeat business.

Consumers gain access to flexible transportation solutions without the financial burden of vehicle ownership, maintenance responsibilities, or depreciation concerns. Variety of options allows customers to select appropriate vehicles for specific needs, from economy cars for daily commuting to luxury vehicles for special occasions.

Corporate clients achieve cost optimization through flexible fleet solutions that eliminate capital investment requirements and reduce administrative overhead. Expense management becomes more predictable and controllable compared to traditional fleet ownership models.

Tourism industry benefits from enhanced visitor mobility options that enable exploration of diverse destinations and attractions. Economic impact extends to hotels, restaurants, and local businesses that benefit from increased tourist accessibility and spending.

Environmental stakeholders see potential benefits from improved vehicle utilization rates and accelerated adoption of electric and hybrid vehicles through rental fleets that introduce consumers to sustainable transportation options.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the United Kingdom car rentals market. Mobile applications now handle the majority of bookings, with features including contactless pickup, digital key access, and real-time vehicle tracking becoming standard offerings rather than premium services.

Sustainability initiatives drive fleet electrification and environmental responsibility programs. MWR data indicates that electric vehicle availability in rental fleets has increased by 89% over the past two years, reflecting both operator investment and consumer demand for sustainable transportation options.

Subscription models emerge as alternatives to traditional rental arrangements, offering customers flexible access to vehicles through monthly membership programs. These models appeal particularly to urban residents who require occasional vehicle access without ownership commitments.

Contactless services have evolved from pandemic necessities to permanent operational improvements. Customers now expect seamless digital experiences from booking through vehicle return, with minimal human interaction requirements.

Integration partnerships between rental operators and travel platforms, hotels, and airlines create comprehensive mobility ecosystems that enhance customer convenience and operator reach.

Strategic acquisitions continue reshaping the competitive landscape, with major operators acquiring regional players and technology platforms to expand capabilities and market reach. Enterprise Holdings and other industry leaders pursue consolidation strategies to achieve economies of scale and operational synergies.

Technology investments focus on artificial intelligence applications for demand forecasting, dynamic pricing optimization, and customer service automation. Fleet management systems incorporate IoT sensors and predictive analytics to improve vehicle utilization and maintenance efficiency.

Sustainability commitments drive significant fleet transformation initiatives, with operators setting targets for electric vehicle adoption and carbon neutrality. Government partnerships support infrastructure development and incentive programs that accelerate sustainable transportation adoption.

Service expansion into adjacent markets includes delivery services, corporate mobility solutions, and integrated travel packages that leverage existing fleet assets and customer relationships.

Regulatory developments address emerging business models, particularly peer-to-peer sharing platforms and subscription services, creating clearer operational frameworks and consumer protections.

Investment priorities should focus on technology infrastructure development, particularly mobile applications and customer experience platforms that differentiate operators in an increasingly competitive market. Fleet electrification represents a critical strategic imperative, requiring substantial capital investment but offering long-term competitive advantages and regulatory compliance benefits.

Geographic expansion opportunities exist in underserved rural markets and secondary cities where competition remains limited and tourism potential is growing. Partnership strategies with hospitality, travel, and corporate clients can create sustainable competitive moats and recurring revenue streams.

Operational efficiency improvements through automation, predictive analytics, and optimized fleet management can significantly impact profitability and service quality. Customer retention programs become increasingly important as acquisition costs rise and market competition intensifies.

Sustainability positioning should extend beyond vehicle electrification to encompass comprehensive environmental programs that appeal to conscious consumers and corporate clients with ESG mandates.

Data monetization opportunities through customer insights, usage patterns, and predictive analytics can create additional revenue streams while improving service delivery and operational efficiency.

Growth trajectory for the United Kingdom car rentals market remains positive, with MarkWide Research projecting continued expansion driven by tourism recovery, business travel normalization, and evolving mobility preferences. Market evolution will likely favor operators who successfully integrate technology, sustainability, and customer experience innovations.

Electric vehicle adoption is expected to accelerate significantly, with rental fleets potentially achieving 40% electric vehicle composition within the next five years. This transition will require substantial infrastructure investment but offers opportunities for premium positioning and regulatory compliance advantages.

Technology integration will deepen with artificial intelligence, machine learning, and IoT applications becoming standard operational tools rather than competitive differentiators. Autonomous vehicle technology may begin influencing market dynamics, though widespread adoption remains several years away.

Market consolidation is likely to continue, with smaller operators either being acquired or forming strategic partnerships to compete effectively. Service diversification into adjacent mobility markets and integrated transportation solutions will create new revenue opportunities.

Consumer expectations will continue evolving toward seamless digital experiences, sustainable options, and flexible service models that adapt to changing lifestyle and work patterns.

The United Kingdom car rentals market stands at a transformative juncture, characterized by robust recovery momentum, technological innovation, and evolving consumer preferences. Market dynamics indicate strong growth potential driven by tourism resurgence, business travel normalization, and increasing adoption of flexible mobility solutions over traditional vehicle ownership models.

Strategic opportunities abound for operators who embrace digital transformation, sustainability initiatives, and customer-centric service models. The transition toward electric vehicles, integration of advanced technologies, and development of comprehensive mobility ecosystems will define competitive success in the coming years.

Market challenges including regulatory complexity, competition intensity, and economic uncertainties require strategic navigation and operational excellence. However, the fundamental value proposition of car rental services remains strong, supported by urbanization trends, changing work patterns, and environmental consciousness among consumers.

Future success will depend on operators’ ability to balance traditional service excellence with innovative technology integration, sustainable practices, and flexible business models that adapt to evolving market conditions and customer expectations. The United Kingdom car rentals market is positioned for continued growth and evolution as an essential component of the broader transportation and mobility ecosystem.

What is Car Rentals?

Car rentals refer to the service of renting vehicles for a short period, typically ranging from a few hours to several weeks. This service is popular among travelers and individuals needing temporary transportation solutions.

What are the key players in the United Kingdom Car Rentals Market?

Key players in the United Kingdom Car Rentals Market include companies like Enterprise Rent-A-Car, Hertz, and Avis Budget Group. These companies offer a variety of vehicles and services to cater to different customer needs, among others.

What are the growth factors driving the United Kingdom Car Rentals Market?

The growth of the United Kingdom Car Rentals Market is driven by factors such as increasing tourism, the rise of business travel, and the growing preference for flexible transportation options. Additionally, the expansion of ride-sharing services is influencing consumer behavior.

What challenges does the United Kingdom Car Rentals Market face?

The United Kingdom Car Rentals Market faces challenges such as regulatory compliance, fluctuating fuel prices, and competition from alternative transportation methods like ride-sharing. These factors can impact profitability and operational efficiency.

What opportunities exist in the United Kingdom Car Rentals Market?

Opportunities in the United Kingdom Car Rentals Market include the integration of electric vehicles into rental fleets, the expansion of digital booking platforms, and partnerships with travel agencies. These trends can enhance customer experience and operational efficiency.

What trends are shaping the United Kingdom Car Rentals Market?

Trends shaping the United Kingdom Car Rentals Market include the increasing demand for eco-friendly vehicles, the adoption of contactless rental processes, and the growth of subscription-based rental services. These innovations are transforming how consumers engage with car rental services.

United Kingdom Car Rentals Market

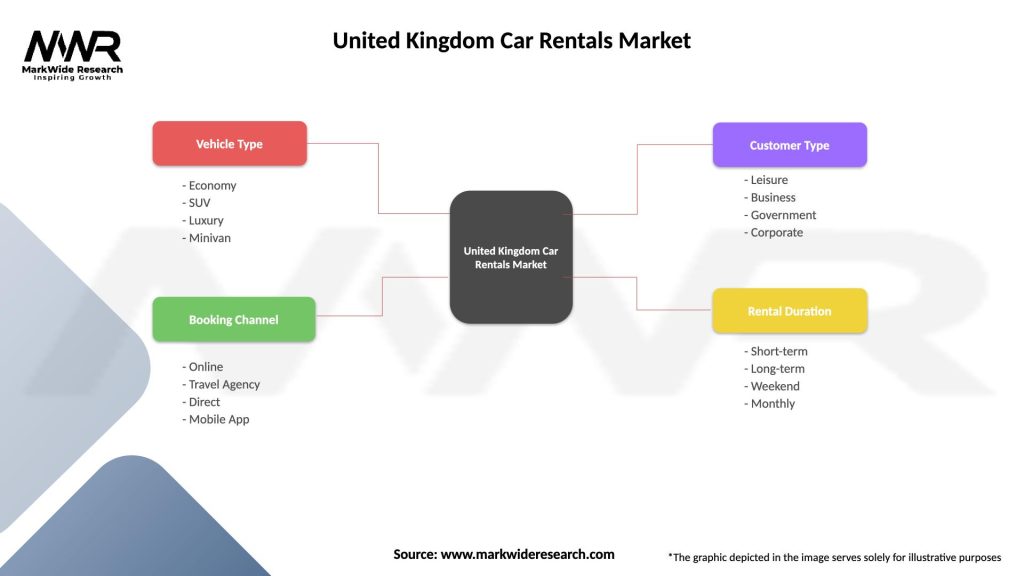

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Economy, SUV, Luxury, Minivan |

| Booking Channel | Online, Travel Agency, Direct, Mobile App |

| Customer Type | Leisure, Business, Government, Corporate |

| Rental Duration | Short-term, Long-term, Weekend, Monthly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Car Rentals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at