444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom car insurance market represents one of the most mature and competitive automotive insurance sectors globally, characterized by stringent regulatory frameworks and evolving consumer demands. Market dynamics indicate substantial growth driven by increasing vehicle ownership, technological advancements in telematics, and changing demographic patterns across England, Scotland, Wales, and Northern Ireland. The sector demonstrates remarkable resilience with consistent annual growth rates of 4.2% CAGR projected through the forecast period.

Digital transformation continues reshaping the landscape as insurers increasingly adopt artificial intelligence, machine learning algorithms, and IoT-enabled devices to enhance risk assessment capabilities. Telematics-based insurance solutions have gained significant traction, particularly among younger demographics, with adoption rates reaching 23% of new policies in recent years. The market encompasses comprehensive coverage options including third-party liability, comprehensive policies, and specialized commercial vehicle insurance products.

Regulatory compliance remains paramount as the Financial Conduct Authority maintains strict oversight of pricing practices, claims handling procedures, and consumer protection measures. The sector’s evolution reflects broader trends toward personalized insurance products, sustainable mobility solutions, and enhanced customer experience through digital channels and streamlined claims processing systems.

The United Kingdom car insurance market refers to the comprehensive ecosystem of insurance providers, brokers, and regulatory bodies that facilitate motor vehicle insurance coverage across the UK. This market encompasses mandatory third-party liability insurance required by law, as well as optional comprehensive and third-party fire and theft policies that provide varying levels of protection for vehicle owners, drivers, and third parties.

Motor insurance in the UK operates under a compulsory insurance framework established by the Road Traffic Act, requiring all drivers to maintain minimum insurance coverage before operating vehicles on public roads. The market includes traditional insurers, direct writers, comparison websites, and emerging insurtech companies that leverage technology to deliver innovative insurance solutions and competitive pricing structures.

Market participants range from established multinational insurance corporations to specialized regional providers, each offering distinct value propositions through various distribution channels including online platforms, telephone sales, broker networks, and mobile applications that cater to diverse consumer preferences and risk profiles.

Strategic analysis reveals the UK car insurance market experiencing significant transformation driven by technological innovation, regulatory changes, and evolving consumer expectations. The sector demonstrates robust fundamentals with steady premium growth, expanding coverage options, and increasing penetration of usage-based insurance models that align pricing with actual driving behavior and risk exposure.

Key market drivers include rising vehicle ownership rates, particularly in urban areas, increased awareness of comprehensive coverage benefits, and growing demand for flexible insurance products that accommodate changing mobility patterns. Digital adoption accelerates across all demographic segments, with online policy purchases representing 67% of new business and mobile app usage for claims reporting increasing substantially.

Competitive dynamics intensify as traditional insurers face pressure from insurtech startups offering streamlined customer experiences, transparent pricing models, and innovative coverage options. The market benefits from strong regulatory oversight that promotes fair competition while protecting consumer interests through standardized disclosure requirements and claims handling protocols.

Future prospects remain positive with anticipated growth in electric vehicle insurance, autonomous vehicle coverage preparations, and enhanced personalization through advanced data analytics capabilities that enable more accurate risk assessment and pricing optimization strategies.

Market intelligence indicates several critical trends shaping the UK car insurance landscape. Consumer behavior analysis reveals increasing price sensitivity combined with growing demand for value-added services including breakdown assistance, legal protection, and courtesy car provisions that enhance overall policy attractiveness.

Demographic shifts significantly impact market dynamics as younger consumers demonstrate different purchasing behaviors, risk profiles, and technology adoption patterns compared to traditional customer segments, requiring tailored product offerings and communication strategies.

Primary growth drivers propelling the UK car insurance market include mandatory insurance requirements, increasing vehicle ownership across diverse demographic groups, and expanding coverage awareness among consumers seeking comprehensive financial protection. Economic factors such as rising disposable incomes, improved employment rates, and favorable financing options contribute to sustained market expansion.

Technological advancement serves as a crucial catalyst, enabling insurers to develop sophisticated risk assessment models, streamline claims processing, and offer personalized pricing based on individual driving patterns and vehicle usage data. Telematics technology adoption accelerates as consumers recognize potential premium savings and insurers benefit from enhanced risk visibility and fraud detection capabilities.

Regulatory support through consumer protection measures, standardized industry practices, and fair pricing initiatives creates a stable operating environment that encourages market participation and innovation. The Motor Insurance Database and continuous insurance enforcement strengthen market integrity while reducing uninsured driving incidents.

Urbanization trends drive demand for flexible insurance products that accommodate varying usage patterns, including pay-per-mile options, temporary coverage for occasional drivers, and specialized policies for ride-sharing and commercial vehicle applications that reflect changing mobility preferences and business models.

Significant challenges facing the UK car insurance market include intense price competition that pressures profit margins, rising claims costs due to increased vehicle repair expenses, and regulatory constraints that limit pricing flexibility and product differentiation opportunities. Economic uncertainty periodically affects consumer spending patterns and insurance purchasing decisions.

Fraud concerns continue imposing substantial costs on the industry, with organized fraud rings, exaggerated claims, and staged accidents requiring extensive investigation resources and sophisticated detection systems. Claims inflation outpacing premium growth creates ongoing profitability pressures, particularly in personal injury settlements and vehicle repair costs.

Regulatory complexity increases operational costs as insurers must comply with evolving FCA requirements, data protection regulations, and consumer duty obligations while maintaining competitive pricing and service quality standards. Brexit implications have created additional administrative burdens for cross-border operations and European coverage provisions.

Market saturation in certain segments limits organic growth opportunities, forcing insurers to compete aggressively for market share through price reductions, enhanced benefits, or innovative product features that may not always generate sustainable profitability improvements or customer loyalty.

Emerging opportunities within the UK car insurance market center on technological innovation, demographic shifts, and evolving mobility patterns that create new customer segments and coverage requirements. Electric vehicle adoption presents significant growth potential as specialized insurance products address unique risks, charging infrastructure coverage, and battery replacement considerations.

Data analytics advancement enables more sophisticated risk modeling, personalized pricing strategies, and proactive customer engagement that can improve retention rates while optimizing claims outcomes. Artificial intelligence applications in claims processing, fraud detection, and customer service delivery offer substantial operational efficiency gains and enhanced customer satisfaction levels.

Partnership opportunities with automotive manufacturers, technology companies, and mobility service providers create new distribution channels and integrated service offerings that add value beyond traditional insurance coverage. Usage-based insurance expansion addresses changing consumer preferences for pay-as-you-drive models and flexible coverage options.

Demographic targeting of underserved segments including young drivers, seniors, and gig economy workers presents growth opportunities through specialized products, alternative distribution methods, and innovative pricing models that reflect actual risk exposure rather than traditional demographic assumptions.

Complex interactions between regulatory requirements, competitive pressures, and technological capabilities shape the UK car insurance market’s evolutionary trajectory. Supply and demand dynamics reflect the mandatory nature of motor insurance balanced against consumer price sensitivity and coverage preference variations across different market segments.

Competitive intensity drives continuous innovation in product offerings, distribution strategies, and customer experience enhancement initiatives. Market leaders maintain positions through brand recognition, comprehensive coverage options, and efficient claims handling, while challenger brands compete through competitive pricing and digital-first approaches.

Regulatory influence significantly impacts market dynamics through pricing oversight, consumer protection measures, and industry conduct standards that promote fair competition while ensuring adequate consumer safeguards. MarkWide Research analysis indicates that regulatory changes account for approximately 35% of strategic planning considerations among major market participants.

Technology adoption accelerates market evolution as insurers invest in digital transformation initiatives, data analytics capabilities, and automated processing systems that improve operational efficiency while enhancing customer engagement and satisfaction levels across all touchpoints.

Comprehensive research approach employed for analyzing the UK car insurance market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights. Primary research includes extensive surveys of insurance consumers, industry executives, and regulatory stakeholders to capture current market sentiment and future expectations.

Secondary research encompasses analysis of regulatory filings, industry reports, financial statements, and market intelligence from authoritative sources including the Association of British Insurers, Financial Conduct Authority, and Department for Transport statistics. Data triangulation methods verify findings across multiple sources to enhance research credibility and analytical robustness.

Quantitative analysis utilizes statistical modeling techniques, trend analysis, and correlation studies to identify market patterns, growth drivers, and performance indicators that inform strategic recommendations. Qualitative assessment incorporates expert interviews, focus group discussions, and case study analysis to provide contextual understanding of market dynamics.

Market segmentation analysis employs demographic, geographic, and behavioral criteria to identify distinct customer groups and their insurance preferences, purchasing patterns, and satisfaction levels that guide product development and marketing strategy formulation.

Geographic distribution across the United Kingdom reveals distinct regional characteristics in car insurance market dynamics, with England representing approximately 84% of total market activity, followed by Scotland, Wales, and Northern Ireland each contributing specific regional considerations and regulatory nuances.

London and Southeast England demonstrate the highest insurance penetration rates and premium levels, reflecting dense urban populations, higher vehicle values, and increased claims frequency associated with metropolitan driving conditions. Regional pricing variations account for local risk factors including crime rates, accident statistics, and repair cost differentials.

Scotland’s market characteristics include unique legal frameworks, weather-related risk factors, and rural driving patterns that influence coverage requirements and pricing structures. Welsh market dynamics reflect a combination of urban centers and rural communities with varying insurance needs and distribution channel preferences.

Northern Ireland presents distinct market conditions influenced by cross-border considerations, specific regulatory requirements, and demographic factors that create specialized insurance product demands. Regional competition varies significantly, with some areas dominated by national providers while others show strong local and regional insurer presence.

Market leadership in the UK car insurance sector is distributed among several major players, each employing distinct competitive strategies and market positioning approaches. Established insurers leverage brand recognition, comprehensive product portfolios, and extensive distribution networks to maintain market share while adapting to digital transformation requirements.

Competitive differentiation increasingly focuses on digital customer experience, claims handling efficiency, and value-added services rather than price competition alone. Insurtech companies challenge traditional models through innovative technology applications, streamlined processes, and transparent pricing approaches that appeal to digitally-native consumers.

Market consolidation trends continue as companies seek scale advantages, technological capabilities, and operational efficiencies through strategic acquisitions and partnerships that enhance competitive positioning and market reach across different customer segments.

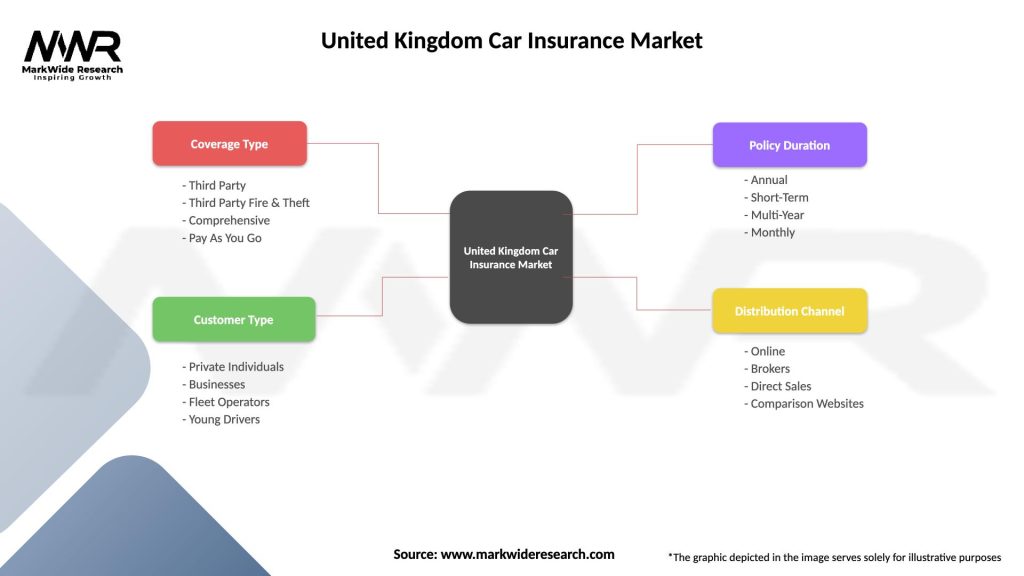

Market segmentation within the UK car insurance sector encompasses multiple classification criteria that enable targeted product development and marketing strategies. Coverage type segmentation includes third-party only, third-party fire and theft, and comprehensive policies, each serving different risk tolerance levels and budget considerations.

By Customer Type:

By Distribution Channel:

Geographic segmentation reflects regional risk variations, regulatory differences, and local market characteristics that influence product design, pricing strategies, and distribution approaches across England, Scotland, Wales, and Northern Ireland.

Comprehensive coverage represents the dominant category within the UK car insurance market, accounting for approximately 78% of all policies as consumers increasingly recognize the value of full protection against theft, fire, and accidental damage. Premium comprehensive policies include additional benefits such as legal protection, breakdown assistance, and courtesy car provisions.

Third-party fire and theft policies serve price-conscious consumers seeking coverage beyond minimum legal requirements while maintaining affordability. This category particularly appeals to owners of older vehicles where comprehensive coverage costs may exceed vehicle values, creating practical insurance solutions for budget-conscious demographics.

Commercial vehicle insurance demonstrates strong growth driven by e-commerce expansion, delivery service proliferation, and gig economy development. Fleet insurance solutions provide economies of scale for businesses operating multiple vehicles while offering centralized policy management and claims handling capabilities.

Specialist categories including classic car insurance, modified vehicle coverage, and temporary insurance policies address niche market segments with specific requirements and risk profiles that standard policies may not adequately cover, creating opportunities for specialized providers and premium pricing strategies.

Insurance providers benefit from stable demand driven by mandatory coverage requirements, opportunities for cross-selling additional products, and data-rich customer relationships that enable sophisticated risk modeling and personalized service delivery. Digital transformation investments yield operational efficiency gains and enhanced customer engagement capabilities.

Consumers gain access to competitive pricing through market transparency, comprehensive protection against financial losses, and increasingly sophisticated coverage options that align with individual risk profiles and usage patterns. Telematics-based policies offer potential premium savings for safe drivers while promoting responsible driving behaviors.

Regulatory authorities achieve consumer protection objectives through standardized industry practices, fair pricing oversight, and robust claims handling requirements that maintain market integrity. Economic benefits include reduced uninsured driving incidents and improved road safety outcomes through comprehensive coverage incentives.

Technology providers find substantial opportunities in supporting digital transformation initiatives, data analytics capabilities, and innovative insurance product development. Automotive industry stakeholders benefit from integrated insurance solutions that enhance vehicle sales processes and customer satisfaction levels.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues accelerating across the UK car insurance market as providers invest heavily in mobile applications, artificial intelligence, and automated claims processing systems. Customer expectations increasingly favor seamless digital experiences, instant quotes, and real-time policy management capabilities that traditional insurers must deliver to remain competitive.

Telematics adoption expands beyond young driver segments as insurers recognize the value of usage-based data for risk assessment and pricing optimization. Pay-per-mile insurance models gain traction among consumers with low annual mileage, reflecting changing mobility patterns and environmental consciousness.

Sustainability initiatives influence product development as insurers introduce carbon offset programs, green repair options, and specialized coverage for electric and hybrid vehicles. Environmental considerations increasingly factor into consumer purchasing decisions and corporate social responsibility strategies.

Personalization trends drive demand for customized coverage options, flexible policy terms, and value-added services that align with individual lifestyle preferences and risk profiles. MWR analysis indicates that personalized insurance products demonstrate 25% higher customer satisfaction rates compared to standard offerings.

Regulatory evolution significantly impacts market dynamics through FCA pricing reforms that promote fairer treatment of existing customers and increased transparency in renewal pricing practices. Consumer duty regulations require insurers to demonstrate positive customer outcomes and fair value delivery across all product offerings and service interactions.

Technology partnerships between traditional insurers and insurtech companies accelerate innovation adoption and digital capability development. Strategic acquisitions consolidate market positions while providing access to specialized technologies, customer segments, and distribution channels that enhance competitive advantages.

Electric vehicle infrastructure development influences insurance product evolution as charging network expansion, battery technology improvements, and autonomous vehicle preparations create new coverage requirements and risk assessment challenges that insurers must address proactively.

Data sharing initiatives improve fraud detection capabilities and risk assessment accuracy through industry collaboration and information exchange platforms. Claims automation advances reduce processing times and operational costs while improving customer satisfaction through faster settlement and reduced administrative burdens.

Strategic recommendations for UK car insurance market participants emphasize digital transformation acceleration, customer experience enhancement, and data analytics capability development as critical success factors. Investment priorities should focus on mobile-first platforms, artificial intelligence applications, and automated claims processing systems that deliver operational efficiency and competitive differentiation.

Product innovation opportunities exist in usage-based insurance expansion, electric vehicle coverage specialization, and flexible policy options that accommodate changing mobility patterns and consumer preferences. Partnership strategies with automotive manufacturers, technology providers, and mobility service companies can create new distribution channels and integrated value propositions.

Market positioning should emphasize transparency, customer-centricity, and value delivery rather than price competition alone. Brand differentiation through superior claims handling, proactive customer communication, and comprehensive coverage options can justify premium pricing and improve customer retention rates.

Regulatory compliance requires proactive adaptation to evolving FCA requirements while maintaining operational efficiency and competitive pricing. Risk management strategies should incorporate fraud prevention, cyber security protection, and climate change adaptation measures that protect long-term business sustainability and profitability.

Long-term prospects for the UK car insurance market remain positive despite ongoing challenges from competitive pressures and regulatory evolution. Growth projections indicate sustained expansion driven by increasing vehicle ownership, technological innovation adoption, and evolving coverage requirements that create new market opportunities and customer segments.

Electric vehicle adoption will fundamentally reshape market dynamics as specialized insurance products address unique risks, charging infrastructure coverage, and battery replacement considerations. Autonomous vehicle development presents both opportunities and challenges as liability frameworks evolve and traditional risk assessment models require substantial modification.

Digital innovation will continue driving operational efficiency improvements and customer experience enhancements through artificial intelligence, machine learning, and IoT integration. MarkWide Research forecasts that digital-first insurers will capture 45% market share within the next five years through superior customer engagement and streamlined service delivery.

Sustainability considerations will increasingly influence consumer choices and regulatory requirements, creating opportunities for insurers that proactively address environmental concerns through green insurance products and carbon-neutral operations. Market evolution toward personalized, flexible, and technology-enabled insurance solutions will reward companies that successfully adapt to changing consumer expectations and regulatory landscapes.

The United Kingdom car insurance market demonstrates remarkable resilience and adaptability in navigating complex regulatory environments, intense competitive pressures, and rapidly evolving consumer expectations. Market fundamentals remain strong with mandatory coverage requirements ensuring consistent demand while technological innovation creates new opportunities for differentiation and growth.

Strategic success in this dynamic market requires balanced focus on digital transformation, customer experience excellence, and operational efficiency optimization. Companies that effectively leverage data analytics, embrace emerging technologies, and maintain regulatory compliance while delivering superior value propositions will capture disproportionate market share and profitability.

Future market evolution will be shaped by electric vehicle adoption, autonomous driving technology development, and changing mobility patterns that create new insurance requirements and risk assessment challenges. Industry participants must proactively adapt business models, product offerings, and operational capabilities to capitalize on emerging opportunities while managing traditional market risks and competitive pressures effectively.

What is Car Insurance?

Car insurance is a contract between a vehicle owner and an insurance company that provides financial protection against physical damage or bodily injury resulting from traffic collisions, theft, and other incidents. It typically covers liability, collision, and comprehensive damages.

What are the key players in the United Kingdom Car Insurance Market?

Key players in the United Kingdom Car Insurance Market include companies like Aviva, Direct Line, and Admiral. These companies offer a range of policies and services tailored to different customer needs, among others.

What are the main drivers of growth in the United Kingdom Car Insurance Market?

The main drivers of growth in the United Kingdom Car Insurance Market include the increasing number of vehicles on the road, rising awareness of the importance of insurance, and advancements in technology that enhance customer experience and policy management.

What challenges does the United Kingdom Car Insurance Market face?

Challenges in the United Kingdom Car Insurance Market include rising claims costs due to more expensive vehicle repairs, regulatory changes that impact pricing, and increased competition leading to price wars among insurers.

What opportunities exist in the United Kingdom Car Insurance Market?

Opportunities in the United Kingdom Car Insurance Market include the growing demand for telematics-based insurance policies, which offer personalized premiums based on driving behavior, and the potential for expansion into electric vehicle insurance as the market evolves.

What trends are shaping the United Kingdom Car Insurance Market?

Trends shaping the United Kingdom Car Insurance Market include the rise of digital platforms for policy management, the integration of artificial intelligence in claims processing, and a shift towards more flexible insurance options that cater to changing consumer preferences.

United Kingdom Car Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | Third Party, Third Party Fire & Theft, Comprehensive, Pay As You Go |

| Customer Type | Private Individuals, Businesses, Fleet Operators, Young Drivers |

| Policy Duration | Annual, Short-Term, Multi-Year, Monthly |

| Distribution Channel | Online, Brokers, Direct Sales, Comparison Websites |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Car Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at