444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom auto loan market represents a dynamic and evolving financial sector that plays a crucial role in facilitating vehicle ownership across the nation. This comprehensive market encompasses various lending products including personal contract purchases (PCP), hire purchase agreements, and traditional auto loans offered by banks, credit unions, building societies, and specialized automotive finance companies. The market has experienced significant transformation in recent years, driven by changing consumer preferences, technological advancements, and evolving regulatory frameworks.

Market dynamics indicate robust growth potential, with the sector demonstrating resilience despite economic uncertainties. The increasing demand for vehicle financing solutions, coupled with competitive interest rates and flexible repayment terms, has contributed to sustained market expansion. Digital transformation initiatives have revolutionized the application and approval processes, making auto loans more accessible to a broader demographic of consumers.

Consumer behavior patterns show a growing preference for flexible financing options, with PCP agreements gaining particular traction among UK consumers. The market benefits from strong relationships between automotive dealers and finance providers, creating integrated sales and financing experiences. Additionally, the rise of electric and hybrid vehicles has introduced new financing considerations and opportunities within the market landscape.

The United Kingdom auto loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate vehicle purchases through various lending mechanisms. This market encompasses traditional installment loans, lease agreements, personal contract purchases, and hire purchase arrangements specifically tailored for automotive acquisitions. The sector includes diverse participants ranging from high street banks and building societies to specialized automotive finance companies and peer-to-peer lending platforms.

Auto loan products in the UK market typically feature competitive interest rates, flexible repayment terms, and various down payment options to accommodate different consumer financial profiles. The market operates within a robust regulatory framework overseen by the Financial Conduct Authority (FCA), ensuring consumer protection and fair lending practices. Modern auto loan offerings increasingly incorporate digital technologies, enabling streamlined application processes, instant credit decisions, and enhanced customer experiences throughout the lending lifecycle.

The United Kingdom auto loan market demonstrates strong fundamentals and growth prospects, supported by consistent consumer demand for vehicle financing solutions and innovative product offerings. The market has successfully adapted to changing consumer preferences, with approximately 78% of new car purchases now involving some form of financing arrangement. This high penetration rate reflects the market’s maturity and the effectiveness of available financing products in meeting diverse consumer needs.

Key market characteristics include the dominance of PCP agreements, which account for a significant portion of new vehicle financing, and the growing importance of digital channels in loan origination and management. The market benefits from competitive dynamics among traditional lenders, automotive manufacturers’ finance arms, and emerging fintech companies, resulting in improved terms and innovative products for consumers.

Strategic developments within the market include enhanced risk assessment capabilities through advanced analytics, expanded product portfolios to include electric vehicle financing incentives, and improved customer journey optimization through digital transformation initiatives. The market’s resilience during economic challenges demonstrates its fundamental importance to UK consumer mobility and automotive industry health.

Market intelligence reveals several critical insights that define the current landscape of the UK auto loan market:

Consumer mobility requirements serve as the primary driver for the UK auto loan market, with vehicle ownership remaining essential for employment, education, and lifestyle needs across urban and rural areas. The necessity of reliable transportation, combined with the high cost of vehicle purchases, creates sustained demand for financing solutions that make ownership accessible to diverse income levels.

Economic factors including historically low interest rates and competitive lending environments have made auto loans increasingly attractive to consumers. The availability of flexible repayment terms, including PCP options that reduce monthly payment burdens, has expanded the addressable market to include younger demographics and first-time buyers who might otherwise be unable to afford vehicle ownership.

Technological advancement in both vehicles and lending processes drives market growth through improved customer experiences and operational efficiencies. Digital application processes, instant credit decisions, and mobile account management capabilities have eliminated traditional barriers to loan origination while reducing processing costs for lenders.

Automotive industry partnerships between manufacturers, dealers, and finance providers create integrated sales experiences that drive loan origination volumes. These relationships enable promotional financing offers, streamlined approval processes, and comprehensive customer support throughout the vehicle ownership lifecycle.

Economic uncertainty poses significant challenges to the auto loan market, as consumers may delay vehicle purchases during periods of financial instability or employment concerns. Economic downturns can impact both loan demand and credit quality, requiring lenders to adjust risk management strategies and potentially tighten lending criteria.

Regulatory compliance costs associated with FCA requirements and consumer protection measures create operational burdens for lenders, particularly smaller institutions that may lack the resources to implement comprehensive compliance programs. These costs can impact profitability and limit market participation for some potential lenders.

Credit risk management challenges arise from changing economic conditions, evolving consumer credit profiles, and the need to balance accessibility with portfolio quality. Lenders must continuously refine risk assessment models while maintaining competitive approval rates and terms.

Market saturation concerns in certain segments may limit growth opportunities, particularly as vehicle ownership rates reach mature levels in many demographic categories. Competition for prime borrowers intensifies pricing pressure and margin compression across the market.

Electric vehicle financing presents substantial growth opportunities as the UK government’s commitment to carbon neutrality drives EV adoption. Specialized financing products, including green loans with preferential rates and extended terms, can capture this expanding market segment while supporting environmental objectives.

Digital innovation expansion offers opportunities to enhance customer experiences, streamline operations, and reduce costs through advanced technologies including artificial intelligence, machine learning, and blockchain applications. These innovations can improve risk assessment accuracy, automate decision-making processes, and create personalized lending solutions.

Underserved market segments including young adults, self-employed individuals, and those with limited credit history represent significant expansion opportunities. Alternative credit assessment methods, including open banking data and behavioral analytics, can enable responsible lending to these previously excluded populations.

Partnership development with automotive manufacturers, technology companies, and mobility service providers can create new distribution channels and integrated product offerings. These collaborations can enhance market reach while providing comprehensive transportation financing solutions.

Competitive dynamics within the UK auto loan market reflect intense rivalry among traditional banks, building societies, automotive finance companies, and emerging fintech lenders. This competition drives continuous innovation in product offerings, pricing strategies, and customer service capabilities, ultimately benefiting consumers through improved terms and experiences.

Consumer behavior evolution shows increasing preference for digital-first experiences, flexible repayment options, and transparent pricing structures. According to MarkWide Research analysis, consumers increasingly value speed and convenience in the application process, with over 82% of borrowers preferring online or mobile application channels over traditional branch-based processes.

Regulatory influence continues to shape market dynamics through FCA oversight, consumer protection requirements, and responsible lending guidelines. These regulations ensure market stability and consumer confidence while requiring ongoing compliance investments from market participants.

Technology integration transforms operational capabilities and customer interactions, enabling real-time credit decisions, automated documentation processing, and enhanced risk management. These technological advances create competitive advantages for early adopters while establishing new industry standards for service delivery.

Comprehensive market analysis for the UK auto loan market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research includes extensive surveys of consumers, lenders, and automotive dealers to understand market dynamics, preferences, and trends from multiple stakeholder perspectives.

Secondary research components encompass analysis of regulatory filings, industry reports, financial statements, and market data from authoritative sources including the Bank of England, FCA publications, and automotive industry associations. This approach provides quantitative foundations for market sizing and trend analysis.

Expert interviews with industry leaders, regulatory officials, and market analysts provide qualitative insights into market dynamics, competitive strategies, and future outlook considerations. These discussions offer valuable perspectives on emerging trends and potential market developments.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis verification, and expert review of findings. This rigorous approach maintains research integrity and reliability for strategic decision-making purposes.

London and Southeast England represent the largest regional market for auto loans, driven by high population density, elevated income levels, and significant automotive dealer presence. This region accounts for approximately 35% of national auto loan originations, reflecting both market size and consumer purchasing power. The concentration of financial services companies in London also contributes to competitive lending environments and innovative product development.

Northern England regions including Manchester, Liverpool, and Leeds demonstrate strong market activity supported by industrial economies and growing urban populations. These areas benefit from competitive lending rates and diverse product offerings from both national and regional financial institutions.

Scotland and Wales markets show distinct characteristics including higher reliance on used vehicle financing and preference for traditional lending relationships with local banks and building societies. Rural areas within these regions particularly value dealer-finance partnerships that provide convenient access to both vehicles and financing.

Regional variations in credit profiles, income levels, and vehicle preferences influence lending strategies and product offerings across different UK markets. Lenders increasingly tailor their approaches to address specific regional needs and opportunities while maintaining consistent risk management standards.

Market leadership in the UK auto loan sector includes diverse participants ranging from traditional high street banks to specialized automotive finance companies:

Competitive strategies focus on digital transformation, customer experience enhancement, and strategic partnerships to differentiate offerings and capture market share. Innovation in risk assessment, application processing, and customer service delivery creates competitive advantages in this dynamic market environment.

By Product Type:

By Vehicle Type:

By Customer Segment:

Personal Contract Purchase dominance reflects consumer preference for flexibility and lower monthly payments, with PCP agreements representing over 60% of new vehicle financing in the UK market. This product category’s success stems from its ability to provide affordable access to newer vehicles while offering end-of-term flexibility including vehicle return, purchase, or upgrade options.

Used vehicle financing represents a substantial market segment driven by affordability considerations and diverse vehicle availability. Lenders have developed sophisticated valuation and risk assessment capabilities to serve this market effectively while managing higher depreciation and condition-related risks.

Electric vehicle financing emerges as a high-growth category supported by government incentives, environmental consciousness, and improving EV technology. Specialized products including extended warranty coverage and charging infrastructure financing address unique EV ownership considerations.

Digital-first lending categories show rapid expansion as consumers increasingly prefer online application and management experiences. These products typically feature streamlined processes, competitive rates, and enhanced customer service through digital channels.

For Consumers:

For Lenders:

For Automotive Dealers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping the auto loan market through artificial intelligence, machine learning, and automated decision-making systems. These technologies enable instant credit approvals, personalized product recommendations, and enhanced risk assessment capabilities that improve both operational efficiency and customer satisfaction.

Sustainable finance integration reflects growing environmental consciousness, with lenders developing green auto loan products that offer preferential rates for electric and hybrid vehicles. This trend aligns with UK government carbon reduction goals while addressing consumer demand for environmentally responsible financing options.

Open banking adoption transforms credit assessment processes by providing lenders access to comprehensive financial data with customer consent. This development enables more accurate risk evaluation, faster decision-making, and expanded access to credit for previously underserved populations.

Subscription-based mobility models emerge as alternatives to traditional ownership, with some lenders exploring all-inclusive packages that combine financing, insurance, maintenance, and services. These innovative approaches address changing consumer preferences for flexibility and convenience in vehicle access.

Regulatory evolution includes enhanced consumer protection measures and responsible lending guidelines that strengthen market integrity while ensuring fair access to credit. Recent FCA initiatives focus on affordability assessments, transparent pricing, and improved complaint handling procedures.

Technology partnerships between traditional lenders and fintech companies create hybrid solutions that combine established market presence with innovative digital capabilities. These collaborations accelerate digital transformation while maintaining regulatory compliance and risk management standards.

Electric vehicle infrastructure development supports specialized financing products that address EV-specific needs including charging equipment, extended warranties, and battery replacement coverage. These comprehensive solutions remove barriers to EV adoption while creating new revenue opportunities for lenders.

Data analytics advancement enables more sophisticated risk assessment and pricing models that improve portfolio performance while expanding credit access. MWR research indicates that advanced analytics have contributed to approximately 15% improvement in risk prediction accuracy across the market.

Digital capability investment remains crucial for market participants seeking competitive advantages in customer acquisition and operational efficiency. Lenders should prioritize mobile-first experiences, automated processing systems, and data-driven decision-making capabilities to meet evolving consumer expectations.

Partnership strategy development can enhance market reach and product innovation through collaborations with automotive manufacturers, technology providers, and mobility service companies. These strategic alliances enable comprehensive solutions while sharing development costs and risks.

Risk management enhancement through advanced analytics, alternative data sources, and continuous monitoring systems helps maintain portfolio quality while expanding market access. Lenders should invest in sophisticated risk assessment tools that balance growth objectives with prudent lending practices.

Customer experience optimization across all touchpoints creates competitive differentiation and supports customer retention. Focus areas include application simplification, transparent communication, and proactive account management throughout the loan lifecycle.

Market evolution over the next five years will be characterized by continued digital transformation, sustainable finance integration, and innovative product development. The sector is projected to maintain steady growth supported by consistent consumer demand for vehicle financing and ongoing technological advancement.

Electric vehicle financing is expected to represent over 25% of new vehicle loans by 2028, driven by government incentives, improving EV technology, and growing environmental consciousness. This transition will require specialized products and expertise from market participants.

Technological integration will deepen through artificial intelligence, blockchain applications, and Internet of Things connectivity that enable real-time vehicle monitoring, dynamic pricing, and enhanced customer services. These innovations will create new competitive advantages while improving operational efficiency.

Regulatory development may include enhanced consumer protection measures, open banking expansion, and sustainability reporting requirements that shape market operations and product offerings. According to MarkWide Research projections, regulatory compliance costs may increase by approximately 12% over the forecast period, requiring strategic planning and investment from market participants.

The United Kingdom auto loan market demonstrates robust fundamentals and promising growth prospects supported by strong consumer demand, technological innovation, and competitive market dynamics. The sector’s successful adaptation to digital transformation, regulatory requirements, and changing consumer preferences positions it well for continued expansion and evolution.

Key success factors for market participants include digital capability development, strategic partnership formation, and comprehensive risk management systems that balance growth objectives with prudent lending practices. The increasing importance of sustainable finance and electric vehicle adoption creates new opportunities while requiring specialized expertise and product innovation.

Future market development will be shaped by technological advancement, regulatory evolution, and changing mobility preferences that require adaptive strategies and continuous innovation from industry participants. The market’s resilience and growth potential make it an attractive sector for both established players and new entrants seeking opportunities in the evolving financial services landscape.

What is Auto Loan?

An auto loan is a type of financing that allows individuals to borrow money to purchase a vehicle. In the context of the United Kingdom, these loans are typically secured by the vehicle itself, meaning the lender can repossess the car if the borrower fails to repay the loan.

What are the key players in the United Kingdom Auto Loan Market?

Key players in the United Kingdom Auto Loan Market include major banks and financial institutions such as Lloyds Banking Group, Barclays, and Santander. These companies offer a variety of auto loan products to cater to different consumer needs, among others.

What are the growth factors driving the United Kingdom Auto Loan Market?

The growth of the United Kingdom Auto Loan Market is driven by factors such as increasing consumer demand for vehicles, competitive interest rates, and the rise of online lending platforms. Additionally, the growing trend of vehicle ownership among younger demographics contributes to market expansion.

What challenges does the United Kingdom Auto Loan Market face?

The United Kingdom Auto Loan Market faces challenges such as rising interest rates, economic uncertainty, and stricter lending regulations. These factors can impact consumer borrowing capacity and overall market growth.

What opportunities exist in the United Kingdom Auto Loan Market?

Opportunities in the United Kingdom Auto Loan Market include the increasing popularity of electric vehicles, which may lead to new financing options, and the potential for partnerships between lenders and automotive manufacturers. Additionally, advancements in technology can enhance the customer experience in loan applications.

What trends are shaping the United Kingdom Auto Loan Market?

Trends shaping the United Kingdom Auto Loan Market include the rise of digital lending platforms, which streamline the application process, and the growing emphasis on flexible repayment options. Furthermore, there is an increasing focus on sustainability, with more consumers considering eco-friendly vehicles.

United Kingdom Auto Loan Market

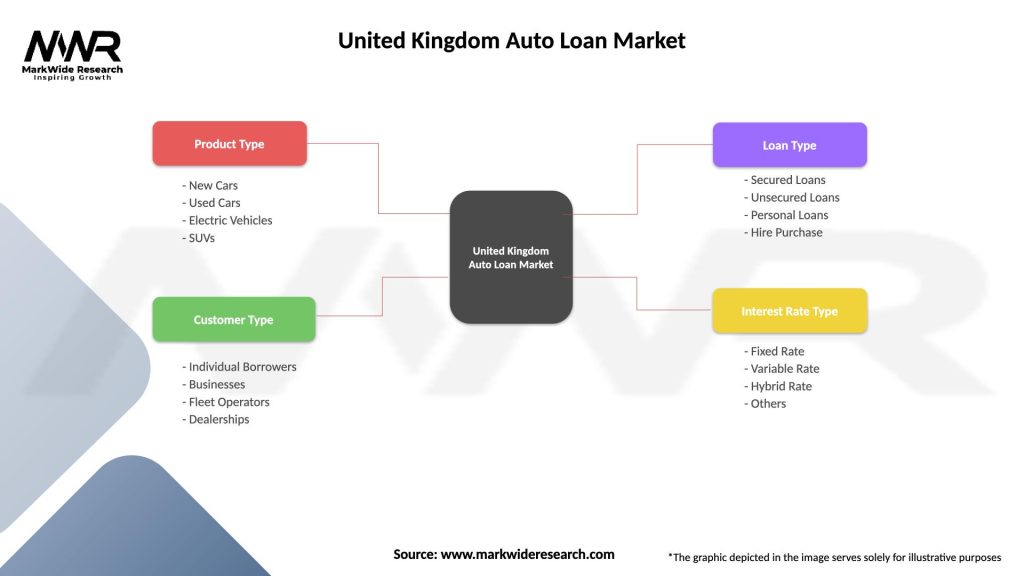

| Segmentation Details | Description |

|---|---|

| Product Type | New Cars, Used Cars, Electric Vehicles, SUVs |

| Customer Type | Individual Borrowers, Businesses, Fleet Operators, Dealerships |

| Loan Type | Secured Loans, Unsecured Loans, Personal Loans, Hire Purchase |

| Interest Rate Type | Fixed Rate, Variable Rate, Hybrid Rate, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Auto Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at