444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Arab Emirates (UAE) Digital Out of Home (DOOH) market represents one of the most dynamic and rapidly evolving advertising sectors in the Middle East region. This innovative market encompasses digital billboards, interactive displays, transit advertising screens, and various other digital signage solutions that have transformed the traditional outdoor advertising landscape. The UAE’s strategic position as a global business hub, combined with its tech-savvy population and ambitious smart city initiatives, has created an exceptionally fertile environment for DOOH technology adoption.

Market dynamics in the UAE indicate robust growth driven by increasing urbanization, rising consumer spending, and the government’s commitment to digital transformation. The market is experiencing a compound annual growth rate (CAGR) of 12.8%, significantly outpacing traditional outdoor advertising formats. This growth trajectory is supported by the UAE’s Vision 2071 initiative, which emphasizes technological innovation and digital infrastructure development across all sectors.

Digital transformation has become a cornerstone of the UAE’s economic diversification strategy, with DOOH playing a crucial role in modernizing the advertising ecosystem. The integration of artificial intelligence, programmatic advertising, and real-time content management systems has elevated the sophistication of DOOH campaigns, enabling advertisers to deliver highly targeted and contextually relevant messages to diverse audiences across the Emirates.

The UAE Digital Out of Home (DOOH) market refers to the comprehensive ecosystem of digital advertising displays and interactive media solutions deployed in public spaces throughout the United Arab Emirates. This market encompasses various digital signage technologies, including LED billboards, LCD displays, interactive kiosks, transit screens, and emerging formats such as holographic displays and augmented reality installations.

DOOH technology represents a significant evolution from traditional static outdoor advertising, offering dynamic content capabilities, real-time updates, and sophisticated audience measurement tools. The market includes hardware manufacturers, software developers, content management platforms, media agencies, and advertising networks that collectively deliver comprehensive digital advertising solutions across the UAE’s urban landscape.

Key characteristics of the UAE DOOH market include high-resolution display technologies, weather-resistant installations designed for harsh desert conditions, multilingual content capabilities reflecting the country’s diverse population, and integration with smart city infrastructure. The market serves various sectors including retail, hospitality, transportation, government communications, and entertainment, making it an essential component of the UAE’s modern advertising infrastructure.

Strategic market positioning places the UAE as the leading DOOH market in the Gulf Cooperation Council (GCC) region, with Dubai and Abu Dhabi serving as primary growth centers. The market benefits from substantial government investment in smart city initiatives, robust tourism infrastructure, and a highly connected population that embraces digital innovation. MarkWide Research analysis indicates that the UAE accounts for approximately 45% of the total GCC DOOH market share, demonstrating its regional dominance.

Technology adoption in the UAE DOOH market is characterized by rapid integration of cutting-edge solutions, including programmatic advertising platforms, artificial intelligence-driven content optimization, and Internet of Things (IoT) connectivity. The market has witnessed a 78% increase in programmatic DOOH adoption over the past three years, reflecting advertisers’ growing preference for automated, data-driven campaign management.

Market segmentation reveals diverse applications across multiple sectors, with retail and transportation segments leading adoption rates. The integration of DOOH solutions with mobile advertising, social media platforms, and e-commerce systems has created new opportunities for omnichannel marketing strategies. The market’s resilience during global economic challenges demonstrates its strategic importance to the UAE’s advertising ecosystem and economic diversification goals.

Fundamental market insights reveal several critical trends shaping the UAE DOOH landscape:

Primary growth drivers propelling the UAE DOOH market include the government’s unwavering commitment to digital transformation and smart city development. The UAE’s National Innovation Strategy 2071 has allocated substantial resources to modernizing public infrastructure, creating unprecedented opportunities for DOOH deployment across transportation networks, government buildings, and public spaces.

Economic diversification initiatives have positioned the UAE as a global business hub, attracting multinational corporations seeking innovative advertising solutions to reach diverse, affluent audiences. The country’s strategic location connecting Europe, Asia, and Africa has created a unique market dynamic where DOOH serves both local residents and international visitors, driving demand for multilingual, culturally sensitive advertising content.

Consumer behavior evolution reflects increasing digital engagement, with UAE residents spending significant time in public spaces equipped with digital displays. The integration of mobile connectivity and social media sharing capabilities has transformed DOOH from passive advertising medium to interactive brand experience platform. Additionally, the UAE’s young, tech-savvy population demonstrates high receptivity to digital advertising formats, creating favorable market conditions for continued DOOH expansion.

Infrastructure development projects, including the Dubai Expo 2020 legacy initiatives and ongoing mega-projects, have created substantial demand for sophisticated digital signage solutions. The construction of new shopping malls, transportation hubs, and mixed-use developments consistently incorporates DOOH technology as standard infrastructure, ensuring sustained market growth.

Regulatory challenges present significant constraints for DOOH market expansion, as different Emirates maintain varying approval processes and content guidelines for digital advertising installations. The complexity of obtaining permits for large-scale digital billboards, particularly in heritage areas and residential zones, can delay project implementation and increase operational costs for market participants.

Environmental factors unique to the UAE’s desert climate pose technical challenges for DOOH installations. Extreme temperatures, sandstorms, and high humidity levels require specialized equipment and frequent maintenance, increasing the total cost of ownership for digital displays. These environmental conditions also impact display visibility and longevity, requiring continuous technological improvements and higher initial investments.

Market saturation concerns in prime locations, particularly in Dubai and Abu Dhabi, have led to increased competition for premium advertising spaces. The limited availability of high-traffic locations suitable for large-format digital displays has driven up real estate costs and created barriers for new market entrants seeking to establish significant market presence.

Cultural sensitivity requirements necessitate careful content curation and approval processes, particularly during religious observances and cultural events. The need to accommodate diverse cultural backgrounds while maintaining advertising effectiveness requires sophisticated content management systems and cultural expertise, adding complexity to campaign planning and execution.

Emerging technology integration presents substantial opportunities for market expansion, particularly in artificial intelligence, machine learning, and augmented reality applications. The development of AI-powered content optimization systems that automatically adjust messaging based on real-time audience analysis and environmental conditions represents a significant growth opportunity for technology providers and media companies.

Smart transportation initiatives across the UAE offer extensive opportunities for DOOH integration within metro systems, bus networks, and autonomous vehicle infrastructure. The planned expansion of Dubai Metro and the development of hyperloop technology create new platforms for innovative digital advertising solutions that can enhance passenger experience while generating advertising revenue.

Retail sector transformation driven by e-commerce growth and omnichannel strategies creates opportunities for DOOH solutions that bridge online and offline shopping experiences. The integration of QR codes, near-field communication (NFC), and mobile app connectivity enables DOOH displays to serve as direct sales channels, creating new revenue models for advertisers and media owners.

Event and entertainment sector expansion, including the development of new entertainment districts and cultural venues, provides opportunities for specialized DOOH solutions. The integration of interactive displays with live events, concerts, and sporting activities creates unique advertising opportunities that can command premium pricing and deliver exceptional audience engagement.

Competitive dynamics in the UAE DOOH market are characterized by intense rivalry between international technology providers and regional media companies. The market has witnessed a 35% increase in new market entrants over the past two years, driven by attractive growth prospects and government support for digital innovation. This competitive intensity has accelerated technology advancement and improved service quality while maintaining pressure on pricing strategies.

Supply chain dynamics reflect the UAE’s position as a regional distribution hub, with many global DOOH technology providers establishing regional headquarters and distribution centers in Dubai and Abu Dhabi. This strategic positioning has reduced equipment costs and improved technical support capabilities, benefiting local market development and enabling faster deployment of new technologies.

Demand patterns show seasonal variations aligned with tourism cycles, cultural events, and shopping festivals. The market experiences peak demand during Dubai Shopping Festival, Ramadan, and major international events, requiring flexible capacity management and dynamic pricing strategies. MWR data indicates that seasonal demand fluctuations can reach 40% above baseline levels during peak periods.

Technology evolution continues to reshape market dynamics, with emerging trends including holographic displays, transparent LED screens, and integration with Internet of Things (IoT) sensors. These technological advances create new market segments while potentially disrupting existing business models, requiring continuous innovation and adaptation from market participants.

Comprehensive research approach employed for analyzing the UAE DOOH market combines primary and secondary research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, technology providers, media agencies, and end-users across different Emirates to capture diverse perspectives and market experiences.

Data collection methods encompass structured surveys with advertising agencies, in-depth interviews with DOOH network operators, and focus group discussions with consumers to understand audience preferences and engagement patterns. Secondary research involves analysis of government publications, industry reports, company financial statements, and regulatory documents to establish comprehensive market context.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing installation data, advertising spend patterns, and technology adoption rates across different market segments. The research incorporates analysis of permit data, construction projects, and infrastructure development plans to project future market growth and identify emerging opportunities.

Quality assurance measures include data triangulation from multiple sources, expert validation of findings, and continuous monitoring of market developments to ensure research accuracy and relevance. The methodology incorporates cultural and regional considerations specific to the UAE market, ensuring insights reflect local market dynamics and business practices.

Dubai dominance characterizes the UAE DOOH market, with the emirate accounting for approximately 62% of total market activity. Dubai’s position as a global business and tourism hub, combined with its ambitious smart city initiatives, has created the most developed DOOH ecosystem in the region. The emirate’s extensive transportation network, numerous shopping destinations, and high tourist traffic provide ideal conditions for digital advertising deployment.

Abu Dhabi emergence as a significant DOOH market reflects the capital’s growing focus on economic diversification and cultural development. The emirate’s investment in major infrastructure projects, including new museums, entertainment districts, and business centers, has created substantial opportunities for DOOH integration. Abu Dhabi accounts for approximately 28% of the UAE DOOH market, with strong growth potential driven by government initiatives and urban development projects.

Northern Emirates development in Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain represents emerging opportunities for DOOH expansion. These emirates are experiencing increased urbanization and infrastructure development, creating new markets for digital advertising solutions. While currently representing a smaller market share, the Northern Emirates show growth rates exceeding 15% annually, indicating significant future potential.

Cross-emirate integration initiatives are creating opportunities for unified DOOH networks that span multiple emirates, enabling advertisers to reach audiences across the entire UAE through coordinated campaigns. This integration is supported by improved transportation connectivity and shared digital infrastructure development projects.

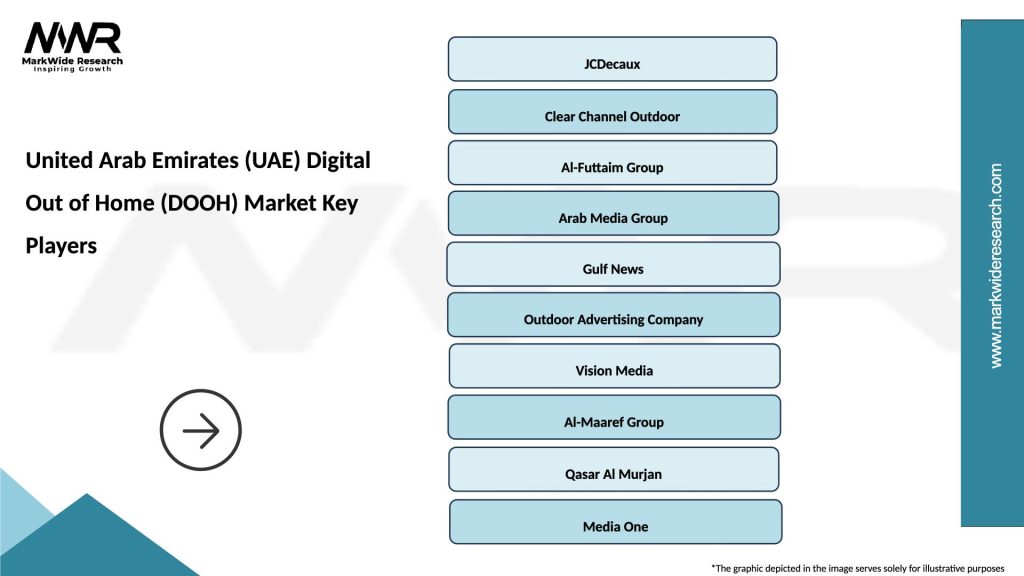

Market leadership in the UAE DOOH sector is distributed among several key players, each bringing unique strengths and specializations:

Competitive strategies focus on technology innovation, strategic location acquisition, and development of comprehensive service offerings that combine hardware, software, and content management capabilities. Market leaders are investing heavily in programmatic advertising platforms and data analytics capabilities to differentiate their offerings and provide superior value to advertisers.

By Technology:

By Application:

By Location:

Transportation segment represents the largest application category, benefiting from the UAE’s extensive public transportation infrastructure and high commuter traffic. Dubai Metro’s expansion and the development of integrated transportation hubs create continuous opportunities for DOOH deployment. The segment shows particular strength in programmatic advertising adoption, with automated buying representing 55% of transportation DOOH inventory.

Retail category demonstrates strong growth driven by the UAE’s position as a regional shopping destination and the integration of digital displays with omnichannel retail strategies. Shopping malls increasingly incorporate interactive DOOH solutions that connect with mobile apps and social media platforms, creating seamless customer experiences that bridge online and offline shopping behaviors.

Corporate segment shows steady expansion as businesses recognize DOOH’s effectiveness for B2B communications and employee engagement. The development of new business districts and the growth of co-working spaces create opportunities for targeted professional audience advertising, particularly in financial services, technology, and consulting sectors.

Entertainment category benefits from the UAE’s growing entertainment industry and major event hosting capabilities. The integration of DOOH with live events, sports venues, and cultural attractions creates unique advertising opportunities that command premium pricing and deliver exceptional audience engagement rates.

Advertisers benefit from enhanced targeting capabilities, real-time campaign optimization, and measurable audience engagement metrics that traditional outdoor advertising cannot provide. The ability to update content instantly, test different creative approaches, and respond to market conditions in real-time significantly improves campaign effectiveness and return on investment.

Media owners gain operational efficiencies through reduced printing and installation costs, while benefiting from premium pricing for digital inventory. The ability to sell multiple advertisers on the same display through dayparting and programmatic platforms maximizes revenue potential and improves asset utilization rates.

Technology providers access a rapidly growing market with strong government support and minimal regulatory barriers. The UAE’s position as a regional hub creates opportunities for technology companies to establish Middle East operations and serve broader regional markets from a strategic location.

Consumers experience more relevant, timely, and engaging advertising content that can provide useful information about local events, weather, traffic, and promotional offers. Interactive DOOH installations enhance urban experiences by providing wayfinding, entertainment, and information services beyond traditional advertising.

Government stakeholders benefit from improved urban communication capabilities, enhanced smart city infrastructure, and economic development through technology sector growth. DOOH networks can serve public service functions during emergencies while generating revenue through commercial advertising partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Programmatic advertising adoption continues accelerating, with automated buying platforms becoming standard practice for DOOH inventory management. This trend enables real-time bidding, dynamic content optimization, and sophisticated audience targeting that significantly improves campaign effectiveness and operational efficiency for both advertisers and media owners.

Interactive technology integration is transforming DOOH from passive advertising medium to engaging brand experience platform. Touchscreen displays, gesture recognition, and augmented reality features are becoming increasingly common, particularly in retail and entertainment environments where consumer engagement is paramount.

Sustainability focus drives adoption of energy-efficient LED technologies, solar-powered installations, and environmentally responsible manufacturing practices. This trend aligns with the UAE’s commitment to environmental sustainability and helps reduce operational costs for DOOH network operators.

Data analytics advancement enables sophisticated audience measurement, engagement tracking, and campaign optimization capabilities. The integration of computer vision, mobile data, and IoT sensors provides unprecedented insights into audience behavior and advertising effectiveness, supporting premium pricing and improved advertiser satisfaction.

Omnichannel integration connects DOOH campaigns with mobile advertising, social media, and e-commerce platforms, creating seamless customer journeys that span multiple touchpoints. This integration enables more sophisticated attribution modeling and improved return on investment measurement for advertisers.

Smart city integration initiatives have accelerated DOOH deployment across government buildings, public spaces, and transportation infrastructure. Recent projects include the installation of interactive information kiosks in Dubai’s business districts and the integration of digital displays with traffic management systems to provide real-time information to commuters and visitors.

Technology partnerships between global providers and local companies have strengthened the UAE’s position as a regional DOOH hub. Recent collaborations include joint ventures for manufacturing LED displays locally and the establishment of regional software development centers to customize DOOH solutions for Middle Eastern markets.

Regulatory framework development has provided clearer guidelines for DOOH installations while maintaining flexibility for innovation. New regulations address content standards, technical specifications, and environmental considerations, creating a more predictable business environment for industry participants.

Major infrastructure projects continue creating opportunities for large-scale DOOH deployments. Recent developments include the integration of digital displays in new metro extensions, airport terminal expansions, and major retail developments that incorporate DOOH as standard infrastructure.

Investment activity has intensified, with both local and international investors recognizing the UAE DOOH market’s growth potential. Recent investments include funding for technology startups developing AI-powered content optimization platforms and expansion capital for regional DOOH network operators.

Strategic positioning recommendations emphasize the importance of securing premium locations before market saturation intensifies. MarkWide Research analysis suggests that companies should prioritize long-term location agreements in high-traffic areas while market conditions remain favorable for expansion.

Technology investment should focus on programmatic advertising platforms and data analytics capabilities that provide competitive differentiation. Companies that invest early in AI-powered content optimization and audience measurement systems will be better positioned to command premium pricing and attract sophisticated advertisers.

Partnership strategies should emphasize collaboration with government entities, transportation authorities, and major real estate developers to secure access to strategic locations and integrate DOOH solutions with urban infrastructure development projects.

Market expansion opportunities exist in the Northern Emirates and emerging urban developments where competition is less intense and real estate costs remain reasonable. Companies should consider establishing presence in these markets before they become saturated with competitors.

Sustainability initiatives should be integrated into business strategies to align with government environmental goals and reduce operational costs. Investment in energy-efficient technologies and renewable power sources will provide long-term competitive advantages and operational savings.

Growth trajectory for the UAE DOOH market remains strongly positive, supported by continued government investment in smart city infrastructure and the country’s position as a regional business hub. The market is projected to maintain robust growth rates exceeding 12% annually through the next five years, driven by technology advancement and expanding application areas.

Technology evolution will continue reshaping the market landscape, with artificial intelligence, augmented reality, and Internet of Things integration becoming standard features rather than premium options. These technological advances will enable new advertising formats and engagement opportunities that command premium pricing and deliver superior audience experiences.

Market maturation will likely result in consolidation among smaller players while creating opportunities for specialized service providers focusing on specific market segments or technologies. The development of industry standards and best practices will improve operational efficiency and reduce barriers to advertiser adoption.

Regional expansion potential remains significant, with the UAE serving as a launching point for DOOH network operators seeking to establish presence in broader Middle Eastern and African markets. The country’s strategic location and business-friendly environment make it an ideal regional headquarters for international companies.

Integration opportunities with emerging technologies such as 5G networks, autonomous vehicles, and smart building systems will create new applications and revenue streams for DOOH providers. These developments will expand the market beyond traditional advertising to include information services, entertainment, and urban management functions.

The UAE Digital Out of Home market represents a compelling growth opportunity characterized by strong government support, advanced infrastructure, and a tech-savvy population that embraces digital innovation. The market’s strategic importance extends beyond advertising to encompass smart city development, economic diversification, and technological leadership in the Middle East region.

Key success factors for market participants include securing premium locations, investing in advanced technology platforms, and developing comprehensive service offerings that address the diverse needs of advertisers and audiences. The integration of programmatic advertising, data analytics, and interactive technologies will continue driving market evolution and creating new opportunities for innovation and growth.

Future prospects remain exceptionally positive, with continued infrastructure development, major event hosting, and smart city initiatives providing sustained demand for sophisticated DOOH solutions. Companies that establish strong market positions now will be well-positioned to benefit from the UAE’s continued economic growth and technological advancement, while serving as platforms for broader regional expansion opportunities.

What is Digital Out of Home (DOOH)?

Digital Out of Home (DOOH) refers to digital advertising formats that are displayed in public spaces, such as digital billboards, transit displays, and interactive kiosks. This medium allows advertisers to reach consumers in high-traffic areas, enhancing engagement through dynamic content.

What are the key players in the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market?

Key players in the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market include companies like JCDecaux, Clear Channel Outdoor, and Al-Futtaim Group. These companies are known for their extensive networks and innovative advertising solutions, among others.

What are the growth factors driving the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market?

The growth of the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market is driven by increasing urbanization, the rise of smart cities, and advancements in digital technology. Additionally, the growing demand for targeted advertising and real-time data analytics enhances the effectiveness of DOOH campaigns.

What challenges does the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market face?

The United Arab Emirates (UAE) Digital Out of Home (DOOH) Market faces challenges such as regulatory restrictions, high competition among media owners, and the need for continuous technological upgrades. These factors can impact the profitability and operational efficiency of DOOH campaigns.

What opportunities exist in the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market?

Opportunities in the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market include the integration of augmented reality and interactive content, as well as the potential for programmatic advertising. These innovations can enhance consumer engagement and provide advertisers with more precise targeting capabilities.

What trends are shaping the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market?

Trends shaping the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market include the increasing use of data analytics for audience measurement, the rise of mobile integration, and the growing emphasis on sustainability in advertising practices. These trends are influencing how brands connect with consumers in public spaces.

United Arab Emirates (UAE) Digital Out of Home (DOOH) Market

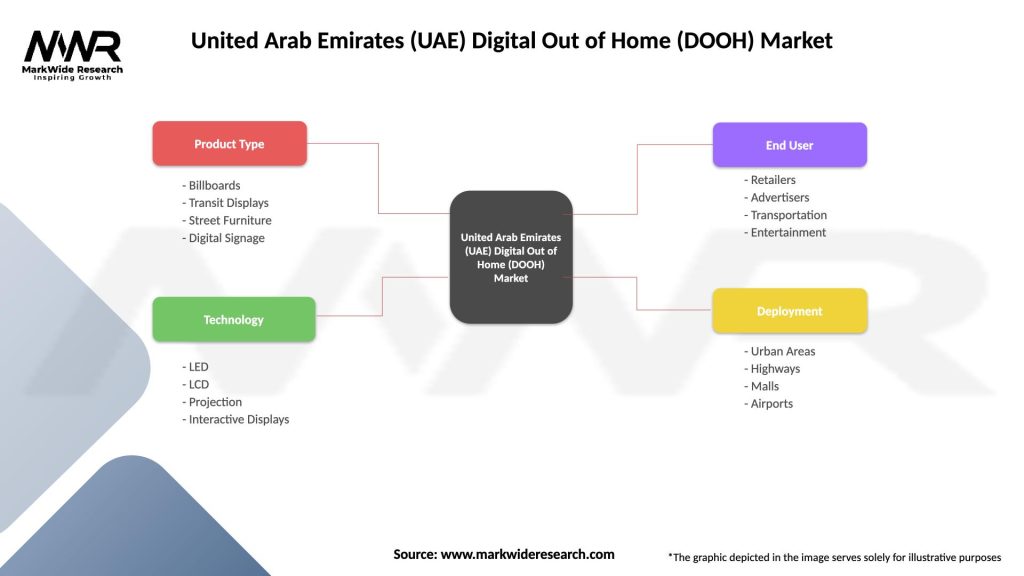

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Displays, Street Furniture, Digital Signage |

| Technology | LED, LCD, Projection, Interactive Displays |

| End User | Retailers, Advertisers, Transportation, Entertainment |

| Deployment | Urban Areas, Highways, Malls, Airports |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Arab Emirates (UAE) Digital Out of Home (DOOH) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at