444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Arab Emirates (UAE) cloud accounting software market represents a rapidly evolving segment within the region’s digital transformation landscape. As businesses across the Emirates increasingly embrace cloud-based solutions, the demand for sophisticated accounting software platforms has experienced remarkable growth. The market demonstrates exceptional momentum, driven by the UAE’s strategic positioning as a regional business hub and its commitment to becoming a global leader in digital innovation.

Digital transformation initiatives across various sectors have catalyzed the adoption of cloud accounting solutions, with small and medium enterprises (SMEs) leading the charge. The market exhibits a compound annual growth rate (CAGR) of 12.5%, reflecting the strong appetite for automated financial management solutions. This growth trajectory is supported by favorable government policies, robust internet infrastructure, and increasing awareness of cloud computing benefits among UAE businesses.

Enterprise adoption patterns reveal significant shifts toward integrated financial management platforms that offer real-time reporting, multi-currency support, and compliance with local regulatory requirements. The market encompasses diverse industry verticals, including retail, hospitality, construction, and professional services, each driving unique requirements for cloud-based accounting solutions.

The UAE cloud accounting software market refers to the comprehensive ecosystem of web-based financial management applications and platforms designed to streamline accounting processes for businesses operating within the United Arab Emirates. These solutions enable organizations to manage their financial operations, including bookkeeping, invoicing, payroll processing, tax compliance, and financial reporting, through secure cloud-based platforms accessible from anywhere with internet connectivity.

Cloud accounting software fundamentally transforms traditional accounting practices by eliminating the need for on-premises hardware installations and providing real-time access to financial data. These platforms integrate seamlessly with banking systems, e-commerce platforms, and other business applications, creating a unified financial management environment that enhances operational efficiency and decision-making capabilities.

Key characteristics of UAE cloud accounting software include multi-language support, VAT compliance features, integration with local banking systems, and adherence to UAE accounting standards and regulations. The solutions cater to diverse business sizes, from freelancers and startups to large enterprises, offering scalable features that grow with organizational needs.

Market dynamics in the UAE cloud accounting software sector reveal a landscape characterized by rapid technological advancement and increasing business digitization. The convergence of government digitization initiatives, growing SME sector, and rising demand for automated financial processes has created a fertile environment for cloud accounting solution providers.

Adoption trends indicate that approximately 68% of UAE businesses are either currently using or planning to implement cloud accounting solutions within the next two years. This significant adoption rate reflects the market’s maturity and the compelling value proposition offered by cloud-based financial management platforms. The trend is particularly pronounced among businesses seeking to enhance operational efficiency while reducing IT infrastructure costs.

Competitive landscape features both international software giants and regional solution providers, creating a diverse ecosystem that caters to various market segments. The market benefits from strong government support for digital transformation, robust telecommunications infrastructure, and a business-friendly regulatory environment that encourages technology adoption.

Future projections suggest continued expansion driven by emerging technologies such as artificial intelligence, machine learning, and blockchain integration. The market is expected to witness increased consolidation as providers seek to offer comprehensive business management suites rather than standalone accounting solutions.

Strategic market analysis reveals several critical insights that define the UAE cloud accounting software landscape:

Government digitization initiatives serve as the primary catalyst for cloud accounting software adoption across the UAE. The nation’s comprehensive digital transformation strategy, including the UAE Vision 2071 and various smart city initiatives, creates a supportive environment for businesses to embrace cloud-based solutions. These initiatives provide both regulatory frameworks and financial incentives that encourage technology adoption.

Economic diversification efforts have led to the emergence of numerous SMEs across various sectors, creating a substantial market for accessible and affordable accounting solutions. The UAE’s focus on reducing oil dependency and fostering innovation-driven industries has resulted in a vibrant entrepreneurial ecosystem that relies heavily on efficient financial management tools.

Regulatory compliance requirements continue to drive market growth, particularly following the implementation of Value Added Tax (VAT) in 2018. Businesses require sophisticated solutions to manage tax calculations, reporting, and compliance, making cloud accounting software essential for maintaining regulatory adherence while minimizing administrative burden.

Cost optimization pressures motivate businesses to seek solutions that reduce operational expenses while improving efficiency. Cloud accounting software eliminates the need for expensive IT infrastructure, reduces maintenance costs, and provides scalable pricing models that align with business growth patterns.

Remote work trends accelerated by global events have highlighted the importance of accessible, cloud-based business solutions. The ability to manage financial operations from anywhere has become a critical business requirement, driving increased adoption of cloud accounting platforms.

Data security concerns remain a significant barrier to adoption, particularly among traditional businesses and enterprises handling sensitive financial information. Despite advances in cloud security, some organizations maintain reservations about storing critical financial data on external servers, preferring on-premises solutions they perceive as more secure.

Integration challenges with existing legacy systems pose obstacles for established businesses seeking to transition to cloud-based accounting solutions. The complexity and cost associated with data migration, system integration, and staff training can delay or prevent adoption, particularly among larger organizations with complex IT infrastructures.

Internet connectivity dependencies create operational risks for businesses in areas with unreliable internet infrastructure. While the UAE generally maintains excellent connectivity, concerns about system accessibility during network outages or connectivity issues can influence adoption decisions.

Customization limitations of standardized cloud accounting solutions may not meet the specific requirements of certain industries or business models. Organizations with unique accounting processes or specialized reporting needs may find generic cloud solutions insufficient for their operational requirements.

Subscription cost accumulation over time can become a concern for price-sensitive businesses, particularly when compared to one-time licensing fees for traditional software. The ongoing nature of cloud subscription costs requires careful budget planning and may deter some cost-conscious organizations.

Artificial intelligence integration presents substantial opportunities for cloud accounting software providers to differentiate their offerings and add significant value for users. AI-powered features such as automated data entry, intelligent expense categorization, and predictive financial analytics can transform accounting from a reactive to a proactive business function.

Blockchain technology adoption offers opportunities to enhance transaction security, improve audit trails, and streamline inter-company transactions. As the UAE positions itself as a blockchain innovation hub, accounting software providers can leverage this technology to offer enhanced security and transparency features.

Industry-specific solutions represent a significant growth opportunity, as businesses increasingly seek accounting software tailored to their sector’s unique requirements. Specialized solutions for industries such as construction, hospitality, healthcare, and retail can command premium pricing while providing superior value to users.

Regional expansion potential allows successful UAE-based solutions to expand into neighboring GCC markets, leveraging similar regulatory environments and business cultures. The UAE’s position as a regional business hub provides an ideal launching point for broader Middle East market penetration.

Integration ecosystem development offers opportunities to create comprehensive business management platforms that extend beyond basic accounting functionality. Partnerships with e-commerce platforms, CRM systems, and industry-specific applications can create powerful integrated solutions.

Competitive intensity within the UAE cloud accounting software market continues to escalate as both international and regional players vie for market share. This competition drives continuous innovation, feature enhancement, and competitive pricing strategies that ultimately benefit end users through improved solutions and value propositions.

Technology evolution rapidly transforms market dynamics, with emerging technologies such as machine learning, artificial intelligence, and advanced analytics becoming standard expectations rather than differentiating features. Providers must continuously invest in research and development to maintain competitive positioning and meet evolving user expectations.

Customer expectations have evolved significantly, with businesses now demanding comprehensive business management platforms rather than standalone accounting solutions. This shift requires providers to develop or integrate additional functionalities such as inventory management, project tracking, and customer relationship management capabilities.

Regulatory landscape changes create both opportunities and challenges for market participants. While new compliance requirements drive demand for sophisticated solutions, they also necessitate continuous platform updates and feature development to maintain regulatory adherence.

Market consolidation trends are emerging as larger players acquire specialized providers to expand their feature sets and market reach. This consolidation creates opportunities for comprehensive solution development while potentially reducing the number of independent providers in the market.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the UAE cloud accounting software market. The research approach combined primary and secondary data collection methods, providing a holistic view of market dynamics, trends, and growth opportunities.

Primary research activities included structured interviews with key industry stakeholders, including software providers, system integrators, end users, and industry experts. These interviews provided valuable insights into market challenges, opportunities, and future trends from various perspectives within the ecosystem.

Secondary research encompassed extensive analysis of industry reports, government publications, company financial statements, and regulatory documentation. This approach ensured comprehensive coverage of market fundamentals, regulatory environment, and competitive landscape dynamics.

Data validation processes involved cross-referencing information from multiple sources, conducting follow-up interviews, and applying statistical analysis techniques to ensure data accuracy and reliability. The methodology included both quantitative and qualitative analysis components to provide balanced market insights.

Market segmentation analysis utilized advanced analytical frameworks to identify distinct market segments, user categories, and growth opportunities. This approach enabled detailed understanding of market dynamics across different business sizes, industries, and use cases.

Dubai emirate dominates the UAE cloud accounting software market, accounting for approximately 42% of total market adoption. The emirate’s position as a regional business hub, combined with its diverse economy and high concentration of SMEs, creates substantial demand for cloud-based financial management solutions. Dubai’s advanced digital infrastructure and business-friendly environment further support market growth.

Abu Dhabi represents the second-largest market segment with 28% market share, driven by government sector digitization initiatives and the presence of large enterprises and multinational corporations. The emirate’s focus on economic diversification and innovation has created favorable conditions for cloud technology adoption across various sectors.

Sharjah demonstrates significant growth potential, contributing 15% of market activity with strong adoption among manufacturing and trading companies. The emirate’s industrial focus and growing SME sector create demand for cost-effective accounting solutions that support business growth and operational efficiency.

Northern Emirates collectively represent 15% of market adoption, with Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain showing increasing interest in cloud accounting solutions. These emirates benefit from growing business activity and government support for digital transformation initiatives.

Free zone adoption patterns reveal high cloud accounting software utilization rates, with businesses in Dubai International Financial Centre (DIFC), Abu Dhabi Global Market (ADGM), and various free zones leading adoption due to their international business focus and regulatory requirements.

Market leadership is distributed among several key players, each offering distinct value propositions and targeting different market segments:

Competitive differentiation strategies focus on localization, industry specialization, integration capabilities, and pricing models. Successful providers emphasize UAE-specific features such as VAT compliance, Arabic language support, and integration with local banking systems.

By Business Size:

By Industry Vertical:

By Deployment Model:

Basic Accounting Solutions cater to freelancers and very small businesses requiring fundamental bookkeeping capabilities. These solutions typically offer invoicing, expense tracking, and basic reporting features at affordable price points. The category experiences steady growth driven by the UAE’s expanding gig economy and entrepreneurial activity.

Advanced Business Management Platforms serve growing SMEs and enterprises requiring comprehensive financial management capabilities. These solutions integrate accounting with inventory management, CRM, and project management features, providing holistic business management platforms. This category demonstrates the highest growth potential as businesses seek integrated solutions.

Industry-Specific Solutions address unique requirements of particular sectors such as construction, retail, or professional services. These specialized platforms offer tailored features, industry-specific reporting, and compliance capabilities that generic solutions cannot provide. The category commands premium pricing while delivering superior value for specialized use cases.

Enterprise Resource Planning (ERP) Integration represents the high-end market segment where cloud accounting forms part of comprehensive business management ecosystems. These solutions offer advanced features, extensive customization, and integration with multiple business systems, targeting large enterprises with complex requirements.

Mobile-First Solutions cater to businesses prioritizing mobility and remote access capabilities. These platforms optimize user experience for mobile devices while maintaining full functionality, appealing to modern businesses with distributed teams and mobile work patterns.

Business Owners gain significant advantages through cloud accounting software adoption, including real-time financial visibility, automated processes, and reduced administrative burden. The solutions enable better decision-making through instant access to financial data and comprehensive reporting capabilities, while eliminating the need for expensive IT infrastructure investments.

Accounting Professionals benefit from enhanced efficiency, reduced manual data entry, and improved accuracy through automated processes. Cloud platforms enable remote work capabilities, client collaboration, and streamlined workflow management, allowing professionals to focus on value-added advisory services rather than routine bookkeeping tasks.

Software Providers access a growing market with recurring revenue opportunities and scalable business models. The cloud delivery model enables continuous product improvement, rapid feature deployment, and global market reach without significant infrastructure investments.

System Integrators and Consultants find new revenue opportunities in implementation services, customization, training, and ongoing support. The complexity of business system integration creates demand for specialized expertise and professional services.

Financial Institutions benefit from improved customer relationships through banking integration features that streamline transaction processing and reconciliation. Cloud accounting platforms create opportunities for value-added services and enhanced customer engagement.

Government Entities achieve improved tax compliance, reduced administrative burden, and enhanced economic visibility through widespread adoption of standardized accounting platforms. Digital financial records facilitate regulatory oversight and economic planning initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a transformative trend, with providers incorporating AI-powered features such as automated data entry, intelligent expense categorization, and predictive analytics. These capabilities enhance user experience while reducing manual effort and improving accuracy in financial management processes.

Mobile-First Design becomes increasingly important as businesses prioritize accessibility and remote work capabilities. Modern cloud accounting solutions emphasize responsive design, native mobile applications, and touch-optimized interfaces to accommodate the UAE’s mobile-centric business culture.

Industry Specialization gains momentum as providers develop sector-specific solutions tailored to unique business requirements. Specialized platforms for construction, retail, hospitality, and professional services offer enhanced value through industry-specific features and compliance capabilities.

Integration Ecosystem Expansion drives the development of comprehensive business management platforms that extend beyond basic accounting functionality. Providers focus on creating seamless connections with banking systems, e-commerce platforms, CRM solutions, and industry-specific applications.

Blockchain Technology Adoption begins to influence platform development, with early implementations focusing on enhanced security, improved audit trails, and streamlined inter-company transactions. The UAE’s blockchain strategy supports this trend through regulatory frameworks and innovation initiatives.

Subscription Model Evolution sees providers experimenting with flexible pricing structures, including usage-based billing, feature-specific pricing, and industry-tailored packages. These models aim to improve accessibility while maximizing revenue from different user segments.

Regulatory compliance enhancements have become a focal point for platform development, with providers continuously updating their solutions to address evolving UAE tax and accounting regulations. Recent developments include enhanced VAT reporting capabilities, improved audit trail functionality, and automated compliance checking features.

Strategic partnerships between cloud accounting providers and local financial institutions have created new integration opportunities and enhanced user experiences. These collaborations enable seamless banking connectivity, automated transaction import, and streamlined reconciliation processes that significantly reduce administrative burden.

Localization initiatives have intensified, with international providers investing heavily in Arabic language support, local currency handling, and UAE-specific business process adaptation. These efforts aim to better serve the local market while competing effectively with regional solution providers.

Acquisition activity has increased as larger players seek to expand their market presence and feature capabilities through strategic acquisitions of specialized providers. This consolidation trend creates opportunities for comprehensive solution development while potentially reducing market competition.

Innovation investments in emerging technologies such as machine learning, artificial intelligence, and blockchain have accelerated, with providers seeking to differentiate their offerings through advanced capabilities. According to MarkWide Research analysis, these technological investments represent a significant competitive factor in market positioning.

Market entry strategies should prioritize localization and regulatory compliance to succeed in the UAE market. New entrants must invest in Arabic language support, local banking integration, and UAE-specific compliance features to compete effectively with established providers.

Product development focus should emphasize mobile optimization, AI integration, and industry specialization to meet evolving customer expectations. Providers should prioritize user experience improvements and advanced analytics capabilities to differentiate their offerings in an increasingly competitive market.

Partnership development with local system integrators, accounting firms, and business consultants can accelerate market penetration and provide valuable customer support capabilities. These partnerships enable providers to leverage local market knowledge and established customer relationships.

Pricing strategy optimization should consider the diverse needs and budget constraints of different market segments. Flexible pricing models that accommodate small businesses while providing scalability for growing enterprises can maximize market penetration and revenue potential.

Customer education initiatives remain crucial for market development, particularly among traditional businesses hesitant to adopt cloud-based solutions. Comprehensive training programs, demonstration initiatives, and success story sharing can accelerate adoption rates across different market segments.

Market evolution toward comprehensive business management platforms will continue, with accounting functionality becoming one component of integrated business solutions. This trend requires providers to expand their capabilities or develop strategic partnerships to offer complete business management ecosystems.

Technology advancement will drive significant improvements in automation, analytics, and user experience. MWR projects that AI-powered features will become standard expectations rather than premium offerings, requiring continuous innovation to maintain competitive positioning.

Regional expansion opportunities will emerge as successful UAE-based solutions leverage their local market success to penetrate broader GCC and Middle East markets. The UAE’s position as a regional business hub provides an ideal platform for international expansion initiatives.

Industry consolidation is expected to continue, with larger players acquiring specialized providers to enhance their feature sets and market reach. This consolidation may reduce the number of independent providers while creating more comprehensive solution offerings.

Regulatory evolution will continue to influence market development, with new compliance requirements creating both opportunities and challenges for solution providers. The ability to quickly adapt to regulatory changes will become a critical competitive factor.

Growth projections indicate sustained market expansion driven by continued business digitization, government support for technology adoption, and increasing recognition of cloud accounting benefits. The market is expected to maintain robust growth rates as adoption spreads across different business segments and industry verticals.

The United Arab Emirates cloud accounting software market represents a dynamic and rapidly evolving sector with substantial growth potential. Driven by government digitization initiatives, economic diversification efforts, and increasing business recognition of cloud computing benefits, the market demonstrates strong fundamentals and promising future prospects.

Key success factors for market participants include localization capabilities, regulatory compliance features, mobile optimization, and strategic partnership development. Providers that can effectively address the unique requirements of UAE businesses while delivering superior user experiences will be best positioned for long-term success.

Market challenges including data security concerns, integration complexities, and competitive intensity require strategic approaches and continuous innovation. However, the substantial opportunities presented by AI integration, industry specialization, and regional expansion potential outweigh these challenges for well-positioned providers.

Future market development will be characterized by continued technological advancement, industry consolidation, and expanding solution capabilities. The evolution toward comprehensive business management platforms presents both opportunities and challenges that will reshape the competitive landscape and customer expectations in the coming years.

What is Cloud Accounting Software?

Cloud Accounting Software refers to online accounting solutions that allow businesses to manage their financial data and processes over the internet. This software typically includes features such as invoicing, expense tracking, and financial reporting, making it accessible from anywhere with an internet connection.

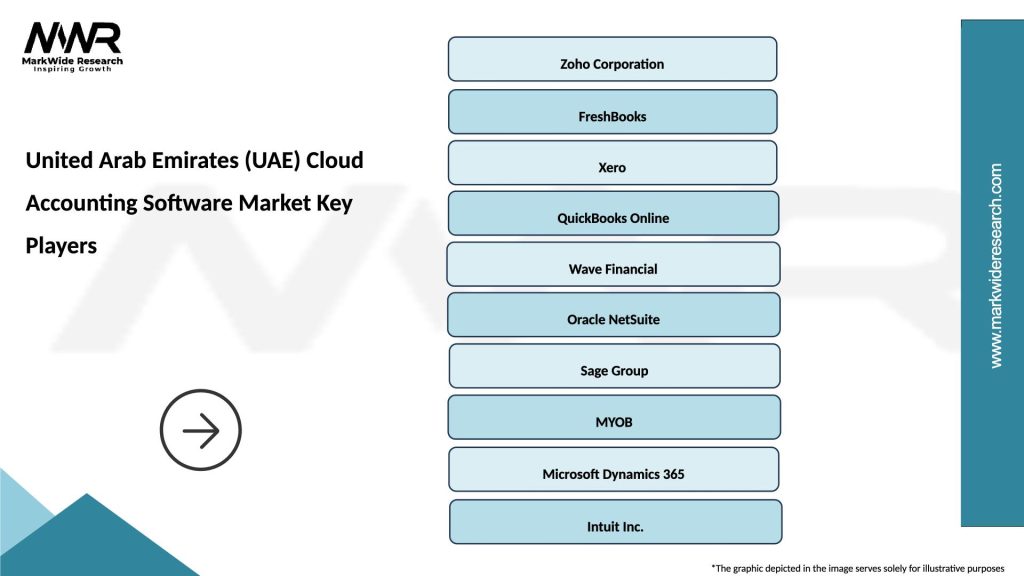

What are the key players in the United Arab Emirates (UAE) Cloud Accounting Software Market?

Key players in the United Arab Emirates (UAE) Cloud Accounting Software Market include companies like Zoho, QuickBooks, and Xero, which offer various features tailored to local businesses. These companies provide solutions that cater to different industries, enhancing financial management and compliance, among others.

What are the growth factors driving the United Arab Emirates (UAE) Cloud Accounting Software Market?

The growth of the United Arab Emirates (UAE) Cloud Accounting Software Market is driven by the increasing adoption of digital solutions by SMEs, the need for real-time financial data, and the growing emphasis on regulatory compliance. Additionally, the rise of e-commerce and remote work has accelerated the demand for cloud-based accounting solutions.

What challenges does the United Arab Emirates (UAE) Cloud Accounting Software Market face?

Challenges in the United Arab Emirates (UAE) Cloud Accounting Software Market include data security concerns, the need for reliable internet connectivity, and the potential for high competition among software providers. These factors can impact user trust and the overall adoption rate of cloud solutions.

What opportunities exist in the United Arab Emirates (UAE) Cloud Accounting Software Market?

Opportunities in the United Arab Emirates (UAE) Cloud Accounting Software Market include the potential for integration with other business management tools, the expansion of services tailored to specific industries, and the increasing demand for automated financial processes. These factors can lead to innovative solutions that enhance user experience.

What trends are shaping the United Arab Emirates (UAE) Cloud Accounting Software Market?

Trends shaping the United Arab Emirates (UAE) Cloud Accounting Software Market include the rise of artificial intelligence for predictive analytics, the integration of mobile applications for on-the-go access, and the growing focus on user-friendly interfaces. These trends are influencing how businesses approach financial management.

United Arab Emirates (UAE) Cloud Accounting Software Market

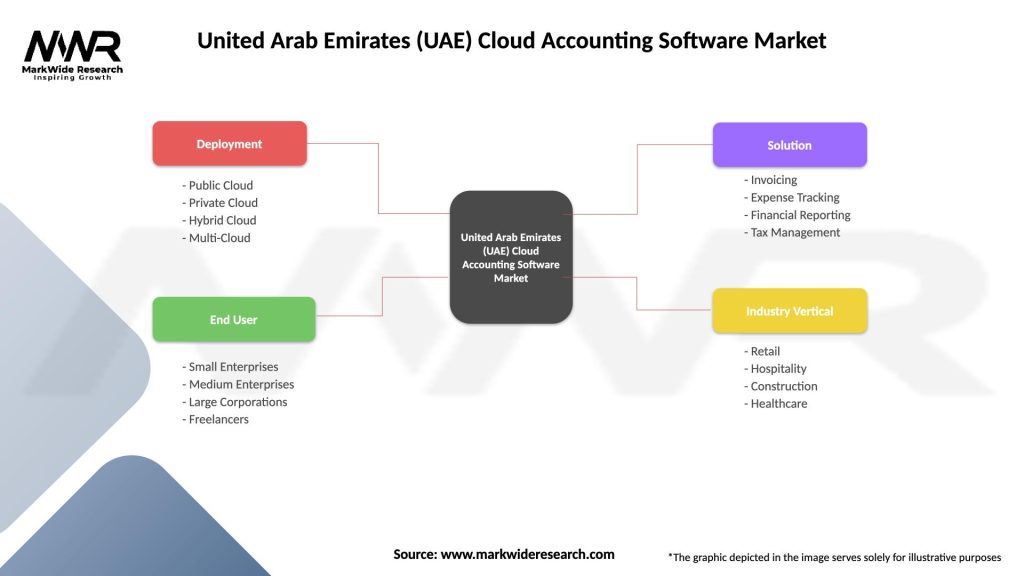

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| End User | Small Enterprises, Medium Enterprises, Large Corporations, Freelancers |

| Solution | Invoicing, Expense Tracking, Financial Reporting, Tax Management |

| Industry Vertical | Retail, Hospitality, Construction, Healthcare |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Arab Emirates (UAE) Cloud Accounting Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at