444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Arab Emirates surveillance camera market represents one of the most dynamic and rapidly evolving security technology sectors in the Middle East region. Driven by ambitious smart city initiatives, increasing security concerns, and substantial government investments in infrastructure development, the UAE has emerged as a leading adopter of advanced surveillance technologies. The market encompasses a comprehensive range of products including IP cameras, analog cameras, thermal imaging systems, and intelligent video analytics solutions.

Government initiatives such as Dubai’s Smart City 2021 strategy and Abu Dhabi’s Vision 2030 have significantly accelerated the deployment of surveillance systems across various sectors. The integration of artificial intelligence, machine learning, and IoT technologies has transformed traditional surveillance into intelligent monitoring ecosystems. Growth projections indicate the market is expanding at a robust 12.5% CAGR, reflecting the nation’s commitment to becoming a global leader in smart infrastructure and security technology adoption.

Key market segments include commercial establishments, residential complexes, transportation hubs, government facilities, and critical infrastructure. The UAE’s strategic position as a global business hub and tourist destination has intensified the focus on comprehensive security solutions, driving demand for sophisticated surveillance technologies across multiple verticals.

The United Arab Emirates surveillance camera market refers to the comprehensive ecosystem of video monitoring and security technologies deployed across the seven emirates, encompassing hardware, software, and integrated solutions designed to enhance public safety, protect assets, and support smart city initiatives. This market includes traditional CCTV systems, advanced IP-based cameras, thermal imaging devices, and intelligent analytics platforms that provide real-time monitoring capabilities.

Modern surveillance systems in the UAE integrate cutting-edge technologies such as facial recognition, behavioral analytics, and cloud-based storage solutions. These systems serve multiple purposes including crime prevention, traffic management, crowd control, and emergency response coordination. The market encompasses both public sector deployments for city-wide security and private sector installations for commercial and residential protection.

Market dynamics in the UAE surveillance camera sector reflect a perfect convergence of technological advancement, government support, and increasing security awareness. The market has experienced unprecedented growth driven by mega-projects, smart city developments, and the nation’s preparation for hosting major international events. Digital transformation initiatives have accelerated the adoption of AI-powered surveillance solutions, with approximately 78% of new installations incorporating intelligent analytics capabilities.

Key growth drivers include the UAE’s Vision 2071 national strategy, increasing urbanization, rising security threats, and the integration of surveillance systems with broader smart infrastructure projects. The market benefits from strong government backing, substantial foreign investment, and a tech-savvy population that embraces innovative security solutions. Private sector adoption has surged by 65% over recent years, particularly in retail, hospitality, and residential segments.

Technological evolution has shifted market focus from basic monitoring to comprehensive security ecosystems that integrate video surveillance with access control, alarm systems, and emergency response protocols. Cloud-based solutions and mobile accessibility have become standard requirements, reflecting changing user expectations and operational needs.

Strategic market insights reveal several critical trends shaping the UAE surveillance camera landscape:

Government initiatives represent the primary catalyst driving surveillance camera market expansion in the UAE. The nation’s comprehensive smart city strategies, including Dubai Smart City 2021 and Abu Dhabi Vision 2030, have created substantial demand for integrated surveillance solutions. Public safety investments continue to prioritize advanced monitoring technologies as essential infrastructure components.

Security concerns stemming from the UAE’s position as a global business and tourism hub have intensified focus on comprehensive surveillance coverage. Major international events, diplomatic activities, and critical infrastructure protection requirements drive continuous technology upgrades and system expansions. Threat landscape evolution necessitates increasingly sophisticated monitoring capabilities.

Technological advancement has made surveillance systems more accessible, cost-effective, and feature-rich. The integration of AI, machine learning, and cloud computing has transformed surveillance from passive monitoring to proactive security management. Digital transformation across various sectors has created new applications and use cases for surveillance technologies.

Economic diversification efforts have led to increased commercial and industrial development, creating substantial demand for security solutions. New business districts, manufacturing facilities, and logistics hubs require comprehensive surveillance coverage. Foreign investment attraction strategies emphasize security and safety as key competitive advantages.

High implementation costs associated with advanced surveillance systems can limit adoption, particularly among smaller businesses and residential users. While technology costs have decreased, comprehensive intelligent surveillance solutions still require significant capital investment. Budget constraints in certain sectors may delay or limit system deployments.

Privacy concerns and regulatory compliance requirements create complexity in surveillance system deployment and operation. Balancing security needs with individual privacy rights requires careful system design and operational protocols. Data protection regulations add compliance costs and operational complexity to surveillance programs.

Technical complexity of modern surveillance systems can create implementation and maintenance challenges. Integration with existing infrastructure, staff training requirements, and ongoing technical support needs may strain organizational resources. Cybersecurity risks associated with connected surveillance systems require additional security measures and expertise.

Market saturation in certain segments may limit growth opportunities as basic surveillance coverage becomes ubiquitous. Replacement cycles and upgrade requirements may extend over longer periods, affecting new equipment sales. Competitive pricing pressure from international suppliers can impact profit margins for local distributors and integrators.

Artificial intelligence integration presents substantial opportunities for market expansion and value creation. Advanced analytics, predictive capabilities, and automated response systems represent high-growth segments with significant potential. Machine learning applications in surveillance continue to evolve, creating new market categories and revenue streams.

Smart city expansion beyond current initiatives offers extensive growth potential as additional emirates and municipalities develop comprehensive technology strategies. Integration opportunities with traffic management, environmental monitoring, and public services create expanded market scope. Cross-platform integration capabilities become increasingly valuable.

Private sector adoption acceleration, particularly in retail, hospitality, and residential segments, represents significant untapped potential. Small and medium enterprises increasingly recognize surveillance system value propositions. Residential market penetration remains relatively low compared to commercial segments, indicating substantial growth opportunity.

Regional expansion opportunities exist as the UAE serves as a technology hub for broader Middle East and African markets. Local expertise and successful implementations create competitive advantages for regional market entry. Export potential for UAE-based surveillance solution providers continues to grow.

Supply chain dynamics in the UAE surveillance camera market reflect the nation’s strategic position as a global trading hub. Major international manufacturers maintain regional headquarters and distribution centers in the UAE, ensuring efficient product availability and technical support. Local assembly operations have emerged to serve regional markets while reducing costs and delivery times.

Competitive dynamics feature intense competition between international technology giants and emerging local solution providers. Market differentiation increasingly focuses on AI capabilities, integration expertise, and comprehensive service offerings rather than basic hardware specifications. Partnership strategies between technology providers and local integrators have become essential for market success.

Technology adoption cycles in the UAE tend to be shorter than global averages, reflecting the nation’s embrace of innovation and substantial investment capabilities. Early adoption of emerging technologies creates market opportunities for cutting-edge solutions. Upgrade frequency remains high as organizations seek to maintain technological leadership.

Regulatory dynamics continue to evolve as authorities balance security needs with privacy protection and data sovereignty requirements. New regulations and standards influence product specifications and deployment practices. Compliance requirements create both challenges and opportunities for solution providers.

Comprehensive market analysis for the UAE surveillance camera sector employs multiple research methodologies to ensure accuracy and reliability. Primary research includes extensive interviews with industry stakeholders, government officials, technology providers, and end-users across various sectors. Survey methodologies capture quantitative data on adoption rates, spending patterns, and technology preferences.

Secondary research encompasses analysis of government reports, industry publications, financial statements, and regulatory documents. Technology trend analysis examines patent filings, product launches, and innovation developments. Market sizing methodologies utilize multiple data sources and validation techniques to ensure accuracy.

Stakeholder engagement includes participation in industry conferences, trade shows, and professional associations to gather insights on market trends and future developments. Expert interviews with technology leaders, consultants, and analysts provide qualitative insights. Field research involves site visits and direct observation of surveillance system deployments.

Data validation processes include cross-referencing multiple sources, statistical analysis, and peer review procedures. Market projections utilize econometric modeling and scenario analysis to account for various growth factors. Quality assurance protocols ensure research findings meet professional standards and industry requirements.

Dubai emirate dominates the UAE surveillance camera market, accounting for approximately 45% of total installations due to its status as a global business hub and tourist destination. The emirate’s comprehensive smart city initiatives, major infrastructure projects, and high-density urban development drive substantial surveillance system demand. Commercial sector adoption in Dubai leads regional markets with sophisticated integrated solutions.

Abu Dhabi represents the second-largest market segment, with approximately 35% market share, driven by government facilities, oil and gas infrastructure, and major cultural institutions. The capital’s focus on critical infrastructure protection and diplomatic security creates demand for high-end surveillance solutions. Government spending in Abu Dhabi significantly influences market dynamics.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively account for 20% of market activity. These emirates show growing adoption rates as urbanization accelerates and economic development expands. Industrial and logistics sectors in northern emirates drive specific surveillance requirements.

Regional connectivity initiatives and cross-emirate integration projects create opportunities for comprehensive surveillance networks. Standardization efforts and shared technology platforms enhance efficiency and reduce costs. Inter-emirate coordination on security matters drives compatible system requirements and procurement strategies.

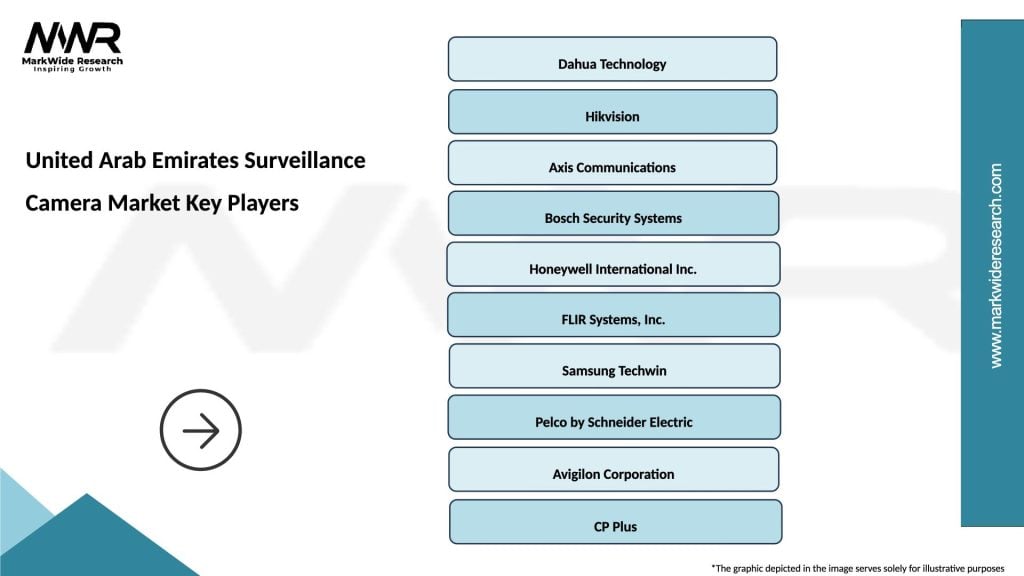

Market leadership in the UAE surveillance camera sector features a diverse mix of international technology giants and specialized regional providers. The competitive landscape reflects the market’s sophistication and demanding requirements:

Competitive strategies increasingly focus on AI capabilities, cloud integration, and comprehensive service offerings rather than hardware specifications alone. Local partnerships and technical support capabilities have become critical success factors. Innovation leadership in emerging technologies creates competitive advantages and market differentiation opportunities.

Technology segmentation reveals distinct market categories with varying growth trajectories and applications:

By Camera Type:

By Application Sector:

Government sector deployments emphasize comprehensive coverage, advanced analytics, and integration with emergency response systems. Public safety applications require high reliability, redundancy, and compliance with strict security standards. Smart city integration creates opportunities for cross-platform data sharing and coordinated response capabilities.

Commercial sector adoption focuses on loss prevention, customer analytics, and operational efficiency improvements. Retail applications increasingly utilize AI-powered analytics for customer behavior analysis and inventory management. Hospitality sector requirements emphasize guest safety while maintaining privacy and aesthetic considerations.

Transportation sector applications require specialized solutions for challenging environments, high-traffic areas, and integration with traffic management systems. Airport security demands the highest levels of reliability and performance. Port and logistics facilities require robust systems capable of monitoring large areas and cargo operations.

Residential sector growth reflects increasing security awareness and decreasing system costs. Smart home integration and mobile accessibility have become standard expectations. Community-wide systems in residential developments offer economies of scale and comprehensive coverage.

Technology providers benefit from the UAE’s position as a regional hub and early adopter of innovative solutions. The market offers opportunities to showcase cutting-edge technologies and establish regional presence. Revenue growth potential remains substantial as market penetration increases across various sectors.

System integrators and solution providers gain from increasing demand for comprehensive security ecosystems and ongoing maintenance requirements. Local expertise and customer relationships create competitive advantages. Service revenue opportunities continue to expand as systems become more complex and feature-rich.

End users across various sectors benefit from enhanced security, operational efficiency, and regulatory compliance capabilities. Advanced analytics provide valuable business insights beyond basic security functions. Cost reduction opportunities emerge through automated monitoring and reduced manual security requirements.

Government stakeholders achieve public safety objectives, smart city goals, and economic development targets through comprehensive surveillance infrastructure. Technology adoption supports the UAE’s innovation leadership aspirations. Social benefits include improved public safety and enhanced quality of life for residents and visitors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the UAE surveillance camera market. Advanced analytics capabilities including facial recognition, behavioral analysis, and predictive algorithms are becoming standard features. Machine learning applications enable systems to adapt and improve performance over time, creating more effective security solutions.

Cloud-based solutions are gaining rapid adoption as organizations seek scalable, cost-effective alternatives to traditional on-premise systems. Cloud storage, remote monitoring, and mobile accessibility have become essential requirements. Hybrid cloud architectures balance security concerns with operational flexibility and cost optimization.

Edge computing integration enables real-time processing and reduces bandwidth requirements for large-scale surveillance deployments. Local processing capabilities improve response times and reduce dependency on network connectivity. Intelligent edge devices can make autonomous decisions and trigger appropriate responses without central system involvement.

Privacy-by-design approaches are becoming mandatory as regulatory requirements and social expectations evolve. Surveillance systems must incorporate privacy protection features from initial design stages. Data minimization and anonymization technologies help balance security needs with privacy rights.

Integration convergence sees surveillance systems becoming components of broader security and building management ecosystems. Interoperability with access control, alarm systems, and emergency response platforms creates comprehensive solutions. Open standards adoption facilitates integration and reduces vendor lock-in concerns.

Government initiatives continue to drive major industry developments with new smart city projects and security infrastructure investments. Dubai’s announcement of comprehensive AI-powered surveillance networks and Abu Dhabi’s critical infrastructure protection programs represent significant market catalysts. Regulatory framework updates provide clearer guidelines for surveillance system deployment and operation.

Technology partnerships between international providers and local companies have accelerated market development and knowledge transfer. Joint ventures and strategic alliances enable technology localization and regional market expansion. Research and development investments in the UAE support innovation and competitive advantage development.

Major project completions including Expo 2020 Dubai infrastructure and various mega-developments have showcased advanced surveillance capabilities and created reference implementations. These projects demonstrate technology effectiveness and drive adoption in other sectors. Success stories from high-profile deployments influence market perceptions and purchasing decisions.

Industry standardization efforts have improved interoperability and reduced integration complexity. Common protocols and standards facilitate multi-vendor deployments and system upgrades. Certification programs ensure quality and compatibility across different solution components.

MarkWide Research analysis indicates that market participants should prioritize AI capabilities and cloud integration to maintain competitive positioning. Organizations investing in advanced analytics and machine learning technologies will capture the highest value segments. Technology differentiation becomes increasingly important as basic surveillance capabilities become commoditized.

Strategic partnerships with local integrators and service providers offer the most effective market entry and expansion strategies. Understanding local requirements, cultural considerations, and regulatory compliance needs requires regional expertise. Service capabilities including installation, maintenance, and ongoing support become critical success factors.

Market timing for new technology introductions should align with government initiative cycles and major project developments. Early engagement with key stakeholders and decision-makers creates competitive advantages. Pilot project participation provides valuable reference credentials and market credibility.

Investment focus should emphasize emerging segments including residential markets, small and medium enterprises, and specialized applications. These segments offer higher growth potential and less intense competition. Value-added services including analytics, consulting, and managed services provide recurring revenue opportunities and customer retention benefits.

Market projections indicate sustained growth driven by ongoing smart city developments, increasing security awareness, and technology advancement. The integration of 5G networks will enable new surveillance applications and improve system performance. Growth acceleration is expected to continue at approximately 11.8% CAGR through the forecast period.

Technology evolution will focus on autonomous systems, predictive analytics, and seamless integration with smart city platforms. Artificial intelligence capabilities will become more sophisticated and accessible across various market segments. Innovation cycles will accelerate as competition intensifies and customer expectations increase.

Market expansion into new applications and sectors will drive volume growth and revenue diversification. Residential adoption rates are expected to increase significantly as costs decrease and awareness grows. Regional influence will expand as the UAE serves as a technology hub for broader Middle East and African markets.

Regulatory development will continue to shape market dynamics with enhanced privacy protection and data sovereignty requirements. Compliance capabilities will become competitive differentiators and market entry requirements. MWR forecasts suggest that regulatory alignment will create opportunities for compliant solution providers while challenging non-compliant competitors.

The United Arab Emirates surveillance camera market represents a dynamic and rapidly evolving sector positioned for sustained growth and technological advancement. Government commitment to smart city initiatives, increasing security awareness, and substantial infrastructure investments create a favorable environment for market expansion. Technology integration with AI, cloud computing, and IoT platforms transforms traditional surveillance into comprehensive security ecosystems.

Market opportunities span multiple sectors and applications, from government and commercial deployments to emerging residential and specialized industrial segments. The UAE’s position as a regional technology hub and early adopter of innovative solutions creates competitive advantages for market participants. Strategic positioning and technology differentiation will determine success in this increasingly competitive landscape.

Future success will depend on organizations’ ability to adapt to evolving customer needs, regulatory requirements, and technological capabilities. The convergence of surveillance with broader smart city and security platforms creates new value propositions and market opportunities. Sustained investment in innovation, partnerships, and local market development will be essential for capturing the full potential of this dynamic and promising market sector.

What is Surveillance Camera?

Surveillance cameras are devices used to monitor and record activities in a specific area for security and safety purposes. They are commonly utilized in various settings, including public spaces, businesses, and residential properties.

What are the key players in the United Arab Emirates Surveillance Camera Market?

Key players in the United Arab Emirates Surveillance Camera Market include Hikvision, Dahua Technology, Axis Communications, and Bosch Security Systems, among others. These companies are known for their innovative products and extensive distribution networks.

What are the main drivers of growth in the United Arab Emirates Surveillance Camera Market?

The growth of the United Arab Emirates Surveillance Camera Market is driven by increasing security concerns, government initiatives for smart city projects, and the rising adoption of advanced technologies such as AI and IoT in surveillance systems.

What challenges does the United Arab Emirates Surveillance Camera Market face?

Challenges in the United Arab Emirates Surveillance Camera Market include privacy concerns, high installation costs, and the need for skilled personnel to manage and maintain surveillance systems effectively.

What opportunities exist in the United Arab Emirates Surveillance Camera Market?

Opportunities in the United Arab Emirates Surveillance Camera Market include the integration of AI for enhanced analytics, the expansion of cloud-based surveillance solutions, and the growing demand for smart home security systems.

What trends are shaping the United Arab Emirates Surveillance Camera Market?

Trends in the United Arab Emirates Surveillance Camera Market include the shift towards high-definition and 4K cameras, the increasing use of thermal imaging technology, and the rise of mobile surveillance solutions for remote monitoring.

United Arab Emirates Surveillance Camera Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, Thermal Cameras |

| Technology | Analog, IP, HD-SDI, Wireless |

| End User | Government, Retail, Transportation, Hospitality |

| Installation | Indoor, Outdoor, Covert, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Arab Emirates Surveillance Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at