444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Arab Emirates structural steel fabrication market represents a cornerstone of the nation’s ambitious construction and infrastructure development initiatives. This dynamic sector encompasses the manufacturing, processing, and assembly of steel components used in commercial buildings, residential complexes, industrial facilities, and mega infrastructure projects across the UAE. Market dynamics indicate robust growth driven by the country’s strategic position as a regional hub for construction and engineering excellence.

Construction activities throughout the UAE continue to accelerate, with structural steel fabrication playing a pivotal role in iconic developments such as smart cities, sustainable buildings, and world-class infrastructure projects. The market demonstrates significant expansion with growth rates reaching 8.2% CAGR as the nation prepares for major international events and continues its economic diversification strategy.

Regional demand remains particularly strong in Dubai, Abu Dhabi, and Sharjah, where large-scale construction projects require sophisticated steel fabrication solutions. The market benefits from advanced manufacturing capabilities, strategic location advantages, and increasing adoption of prefabricated steel solutions that offer superior construction efficiency and sustainability benefits.

The United Arab Emirates structural steel fabrication market refers to the comprehensive industry segment involved in the cutting, welding, bending, and assembly of steel components for construction and infrastructure applications throughout the UAE. This market encompasses various steel fabrication processes including beam fabrication, column manufacturing, truss assembly, and custom structural component production.

Structural steel fabrication involves transforming raw steel materials into finished structural elements that form the skeleton of buildings, bridges, industrial facilities, and infrastructure projects. The process includes detailed engineering, precision cutting, welding, surface treatment, and quality control measures to ensure structural integrity and compliance with international building standards.

Market participants include steel fabrication companies, engineering firms, construction contractors, and specialized manufacturers who provide comprehensive solutions from design consultation to final installation. The industry serves diverse sectors including commercial construction, residential development, industrial facilities, oil and gas infrastructure, and transportation projects across the UAE.

Strategic positioning of the UAE as a regional construction hub drives substantial demand for structural steel fabrication services. The market benefits from government initiatives promoting infrastructure development, sustainable construction practices, and economic diversification efforts that emphasize manufacturing excellence and technological innovation.

Key growth drivers include mega construction projects, increasing adoption of prefabricated solutions, and rising demand for sustainable building materials. The market demonstrates strong performance with fabrication capacity utilization rates exceeding 75% across major manufacturing facilities, indicating healthy demand conditions and operational efficiency.

Technological advancement plays a crucial role in market evolution, with companies investing in automated fabrication equipment, advanced welding technologies, and digital design tools. These innovations enhance production efficiency, improve quality standards, and reduce project timelines, making UAE fabricators increasingly competitive in regional markets.

Market outlook remains positive, supported by continued infrastructure investment, upcoming international events, and the nation’s commitment to becoming a global hub for advanced manufacturing and construction excellence.

Market intelligence reveals several critical insights that define the UAE structural steel fabrication landscape:

Government initiatives serve as primary catalysts for market expansion, with substantial investment in infrastructure projects, smart city developments, and economic diversification programs. The UAE’s Vision 2071 and various emirate-specific development plans create sustained demand for structural steel fabrication services across multiple sectors.

Construction boom continues to drive market growth, particularly in commercial and residential segments. Major developments including business districts, residential communities, and mixed-use projects require extensive structural steel components, creating consistent demand for fabrication services. The market benefits from project pipeline visibility extending several years into the future.

Industrial expansion contributes significantly to market demand, with manufacturing facilities, logistics centers, and processing plants requiring specialized structural steel solutions. The growth of free zones and industrial cities creates additional opportunities for fabricators specializing in industrial construction applications.

Technological advancement drives efficiency improvements and quality enhancements throughout the fabrication process. Companies investing in automated cutting systems, robotic welding equipment, and digital design tools achieve competitive advantages through improved productivity and reduced production costs.

Raw material costs represent a significant challenge for market participants, with steel prices subject to global commodity market fluctuations. Price volatility affects project profitability and requires sophisticated procurement strategies to manage cost risks effectively.

Skilled labor shortage poses ongoing challenges for the industry, particularly for specialized welding and fabrication positions. Competition for qualified technicians drives up labor costs and may impact project timelines when adequate skilled personnel are not available.

Regulatory compliance requirements add complexity and costs to fabrication operations. Adherence to building codes, safety standards, and environmental regulations requires continuous investment in training, equipment, and quality management systems.

Market competition intensifies as more players enter the sector, potentially pressuring profit margins and requiring differentiation strategies. Companies must invest in technology, quality improvements, and customer service excellence to maintain competitive positioning.

Export potential presents significant growth opportunities for UAE structural steel fabricators. The country’s strategic location and advanced manufacturing capabilities position local companies to serve regional markets in the GCC, Africa, and South Asia effectively.

Sustainable construction trends create new market segments for environmentally conscious fabrication solutions. Companies developing expertise in green building materials, energy-efficient fabrication processes, and recyclable steel solutions can capture premium market segments.

Prefabrication adoption offers substantial growth potential as construction companies seek faster project delivery and improved quality control. Modular construction techniques and off-site fabrication capabilities represent emerging market opportunities with significant growth potential.

Technology integration enables new service offerings including Building Information Modeling (BIM) integration, automated fabrication processes, and real-time project monitoring capabilities. These advanced services command premium pricing and enhance customer relationships.

Supply chain dynamics significantly influence market performance, with steel availability, transportation costs, and logistics efficiency affecting overall competitiveness. Companies with strong supplier relationships and efficient supply chain management achieve operational advantages and improved project delivery capabilities.

Demand fluctuations reflect broader construction market cycles, with fabricators experiencing varying capacity utilization based on project timing and market conditions. Successful companies develop diversified customer bases and flexible production capabilities to manage demand variability effectively.

Competitive dynamics evolve as market participants invest in technology upgrades, capacity expansion, and service enhancement initiatives. Market share distribution shows increasing concentration among larger, more technologically advanced fabricators who can handle complex projects efficiently.

Innovation cycles drive continuous improvement in fabrication techniques, materials utilization, and project delivery methods. Companies embracing technological advancement and process innovation achieve sustainable competitive advantages and improved profitability.

Comprehensive analysis of the UAE structural steel fabrication market employs multiple research approaches to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, fabrication specialists, construction professionals, and government officials involved in infrastructure development.

Data collection encompasses quantitative analysis of production statistics, project databases, import/export records, and industry performance metrics. Secondary research incorporates analysis of government publications, industry reports, trade association data, and construction market intelligence.

Market validation processes include cross-referencing multiple data sources, expert panel reviews, and statistical analysis to ensure data accuracy and reliability. MarkWide Research methodology emphasizes triangulation of findings through multiple research channels to provide comprehensive market insights.

Analytical framework incorporates both qualitative and quantitative assessment techniques, including trend analysis, competitive benchmarking, and market modeling to project future performance and identify key success factors.

Dubai emirate dominates the structural steel fabrication market, accounting for approximately 45% market share driven by extensive commercial construction, tourism infrastructure, and international business district developments. The emirate’s strategic focus on becoming a global business hub creates sustained demand for high-quality fabrication services.

Abu Dhabi region represents the second-largest market segment with 35% market share, supported by government infrastructure projects, industrial developments, and cultural initiatives. The capital’s emphasis on sustainable development and smart city initiatives drives demand for advanced fabrication solutions.

Sharjah and Northern Emirates collectively account for 20% market share, with growing industrial activity, residential developments, and infrastructure improvements creating additional market opportunities. These regions benefit from lower operational costs while maintaining access to skilled labor and transportation networks.

Regional specialization emerges as different emirates focus on specific market segments, with Dubai emphasizing commercial and hospitality projects, Abu Dhabi concentrating on government and industrial applications, and northern emirates developing expertise in residential and smaller commercial projects.

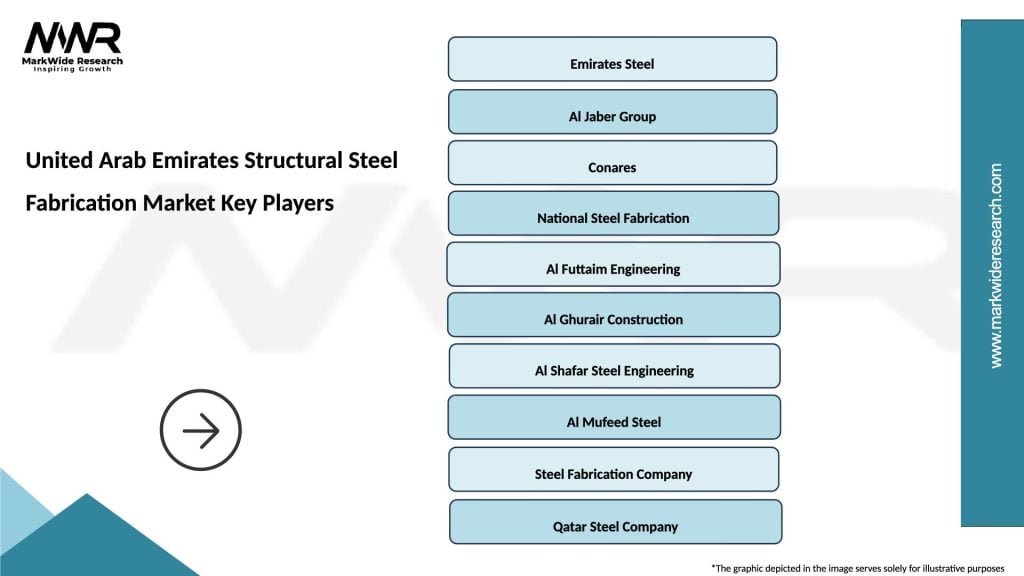

Market leadership is distributed among several key players who have established strong reputations for quality, reliability, and technical expertise:

Competitive differentiation occurs through technology investment, quality certifications, specialized capabilities, and customer service excellence. Leading companies maintain competitive advantages through continuous innovation and strategic market positioning.

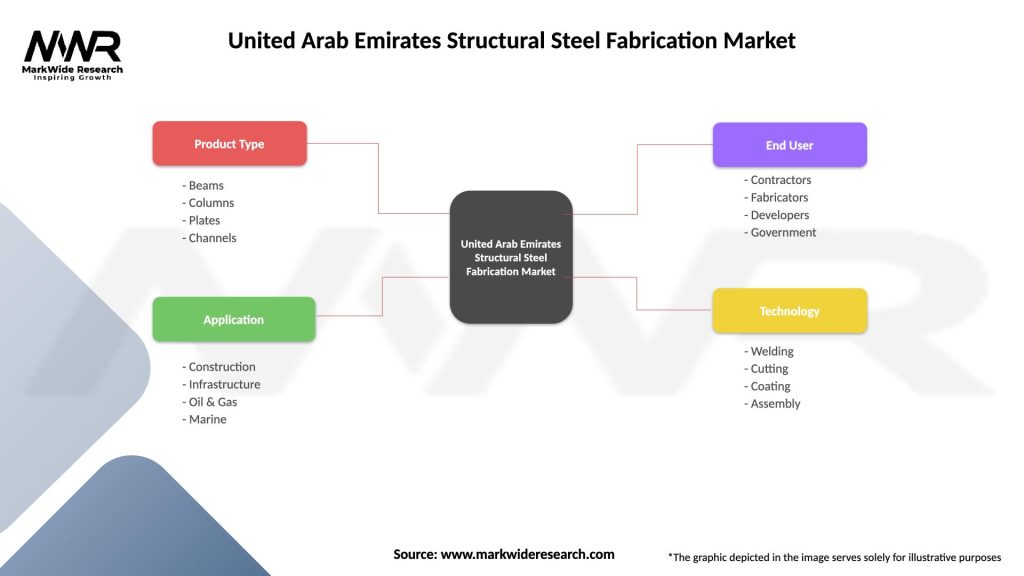

By Application:

By Product Type:

Commercial construction represents the largest market segment, driven by ongoing business district developments, hospitality projects, and retail infrastructure expansion. This segment demands high-quality fabrication with emphasis on architectural aesthetics and structural performance.

Industrial applications show strong growth potential as the UAE expands manufacturing capabilities and logistics infrastructure. Industrial fabrication requires specialized expertise in heavy structural components and compliance with industrial safety standards.

Infrastructure development creates significant opportunities for fabricators with expertise in transportation projects, utilities, and public works. Government investment in smart city initiatives and sustainable infrastructure drives demand for innovative fabrication solutions.

Residential market demonstrates steady growth with increasing population and urbanization trends. High-rise residential developments require efficient fabrication processes and cost-effective solutions while maintaining quality standards.

Fabrication companies benefit from sustained market demand, opportunities for technology investment, and potential for regional expansion. The market offers attractive returns for companies investing in advanced manufacturing capabilities and quality management systems.

Construction contractors gain access to high-quality structural components, improved project timelines through prefabrication, and enhanced construction efficiency. Local fabrication capabilities reduce import dependencies and provide greater project control.

Property developers achieve cost optimization through competitive fabrication pricing, faster project delivery, and access to sustainable construction solutions. Local fabrication capabilities support project customization and quality assurance requirements.

Government entities benefit from job creation, industrial development, technology transfer, and reduced infrastructure costs. The sector contributes to economic diversification objectives and enhances the UAE’s position as a regional manufacturing hub.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation integration emerges as a dominant trend, with fabricators investing in robotic welding systems, automated cutting equipment, and digital fabrication technologies. These investments improve production efficiency by approximately 40% while enhancing quality consistency and reducing labor dependency.

Sustainable fabrication practices gain prominence as environmental consciousness increases throughout the construction industry. Companies adopting green fabrication processes, waste reduction initiatives, and energy-efficient operations achieve competitive advantages and access premium market segments.

Prefabrication adoption accelerates as construction companies seek faster project delivery and improved quality control. Modular construction techniques and off-site fabrication capabilities represent significant growth areas with increasing market penetration rates.

Digital transformation reshapes industry operations through Building Information Modeling (BIM) integration, cloud-based project management, and real-time monitoring systems. These technologies enhance collaboration, reduce errors, and improve project delivery efficiency.

Technology investments by leading fabricators include advanced welding systems, automated material handling equipment, and integrated quality management systems. These developments enhance production capabilities and position companies for future growth opportunities.

Capacity expansion initiatives by major market participants reflect confidence in long-term market prospects. New fabrication facilities incorporate latest technologies and sustainable practices to meet evolving market requirements.

Strategic partnerships between fabricators and construction companies create integrated supply chain solutions and improve project delivery efficiency. These collaborations enhance market positioning and customer relationships.

Quality certifications achievement by UAE fabricators enhances international competitiveness and export potential. Companies obtaining ISO certifications, AWS welding standards, and other quality accreditations access premium market segments.

Technology investment should remain a priority for fabrication companies seeking competitive advantages. MWR analysis indicates that companies investing in automation and digital technologies achieve superior performance metrics and market positioning.

Market diversification strategies help reduce dependency on specific construction segments and improve business stability. Companies should explore opportunities in industrial fabrication, infrastructure projects, and export markets to balance portfolio risk.

Workforce development initiatives are essential for addressing skilled labor shortages and maintaining quality standards. Investment in training programs, technical education partnerships, and employee retention strategies supports long-term competitiveness.

Sustainability integration becomes increasingly important for market positioning and customer relationships. Companies should develop expertise in green fabrication practices, waste reduction, and energy-efficient operations to capture emerging opportunities.

Market prospects remain positive through the forecast period, supported by continued infrastructure investment, economic diversification initiatives, and regional hub development strategies. The market is projected to maintain robust growth momentum with expanding applications and technological advancement.

Technology evolution will continue reshaping industry operations, with artificial intelligence, Internet of Things integration, and advanced materials creating new possibilities for fabrication excellence. Companies embracing these innovations will achieve sustainable competitive advantages.

Regional expansion opportunities will grow as UAE fabricators leverage strategic location advantages and advanced capabilities to serve broader Middle East and African markets. Export potential represents significant growth opportunity for established market participants.

Sustainability focus will intensify as environmental regulations strengthen and customer preferences shift toward green construction solutions. According to MarkWide Research projections, sustainable fabrication practices will become standard industry requirements rather than competitive differentiators.

The United Arab Emirates structural steel fabrication market demonstrates strong fundamentals and positive growth prospects driven by sustained infrastructure investment, technological advancement, and strategic positioning advantages. Market participants benefit from government support, advanced manufacturing infrastructure, and access to regional growth opportunities.

Success factors include technology investment, quality excellence, workforce development, and market diversification strategies. Companies that embrace automation, sustainable practices, and customer-centric approaches will achieve superior performance and market positioning in this dynamic industry.

Future growth will be supported by continued construction activity, export market development, and increasing adoption of advanced fabrication technologies. The market’s evolution toward greater sustainability, efficiency, and technological sophistication creates opportunities for innovative companies to establish market leadership and achieve long-term success.

What is Structural Steel Fabrication?

Structural steel fabrication refers to the process of cutting, shaping, and assembling steel structures to create frameworks for buildings, bridges, and other infrastructure. This process is essential in construction and engineering, ensuring that structures are durable and meet safety standards.

What are the key players in the United Arab Emirates Structural Steel Fabrication Market?

Key players in the United Arab Emirates Structural Steel Fabrication Market include Emirates Steel, Al Jaber Group, and Conares, among others. These companies are known for their significant contributions to various construction projects across the region.

What are the growth factors driving the United Arab Emirates Structural Steel Fabrication Market?

The growth of the United Arab Emirates Structural Steel Fabrication Market is driven by increasing construction activities, urbanization, and government investments in infrastructure projects. Additionally, the demand for sustainable building materials is also influencing market expansion.

What challenges does the United Arab Emirates Structural Steel Fabrication Market face?

The United Arab Emirates Structural Steel Fabrication Market faces challenges such as fluctuating raw material prices and skilled labor shortages. These factors can impact production costs and project timelines, affecting overall market performance.

What opportunities exist in the United Arab Emirates Structural Steel Fabrication Market?

Opportunities in the United Arab Emirates Structural Steel Fabrication Market include the growing demand for prefabricated structures and advancements in fabrication technologies. Additionally, the push for sustainable construction practices presents new avenues for innovation and growth.

What trends are shaping the United Arab Emirates Structural Steel Fabrication Market?

Trends in the United Arab Emirates Structural Steel Fabrication Market include the increasing use of automation and robotics in fabrication processes, as well as a focus on eco-friendly materials. These trends are enhancing efficiency and reducing the environmental impact of construction activities.

United Arab Emirates Structural Steel Fabrication Market

| Segmentation Details | Description |

|---|---|

| Product Type | Beams, Columns, Plates, Channels |

| Application | Construction, Infrastructure, Oil & Gas, Marine |

| End User | Contractors, Fabricators, Developers, Government |

| Technology | Welding, Cutting, Coating, Assembly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Arab Emirates Structural Steel Fabrication Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at