444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Arab Emirates (UAE) solar photovoltaic (PV) market has witnessed significant growth in recent years. As a country with abundant sunlight, the UAE has recognized the potential of solar energy as a renewable and sustainable power source. The adoption of solar PV technology has gained traction due to government initiatives, favorable policies, and the increasing need to diversify the energy mix.

Meaning

Solar photovoltaic (PV) technology involves the conversion of sunlight into electricity using solar panels made up of semiconductor materials. The UAE solar PV market focuses on harnessing solar energy through the installation of PV systems, allowing for the generation of clean electricity while reducing dependence on conventional energy sources.

Executive Summary

The UAE solar PV market has experienced steady growth, driven by factors such as decreasing solar PV module costs, technological advancements, and growing environmental consciousness. The market offers immense opportunities for both local and international players to contribute to the country’s renewable energy goals while benefiting from the expanding market potential.

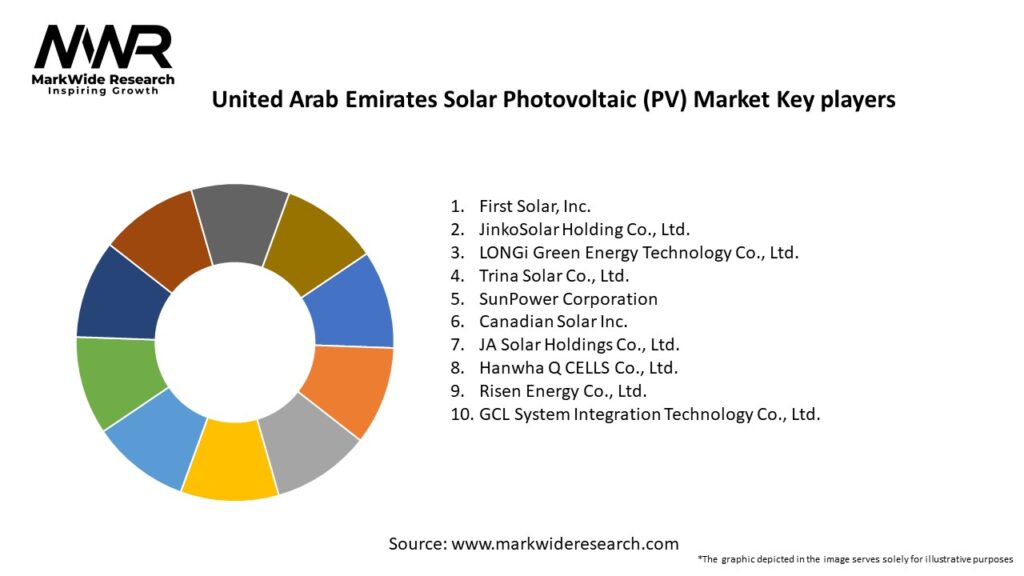

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UAE solar PV market is characterized by a dynamic and evolving landscape driven by government policies, market competition, technological advancements, and consumer awareness. The market dynamics are influenced by the interplay of various stakeholders, including solar PV manufacturers, installers, investors, policymakers, and end-users.

Regional Analysis

The UAE’s solar PV market exhibits regional variations due to differences in government policies, solar resources, and economic factors. Dubai and Abu Dhabi are the leading regions, with significant investments in solar PV installations and ambitious renewable energy targets. Other emirates, such as Sharjah and Fujairah, also show promising growth potential, driven by supportive policies and growing awareness of solar energy benefits.

Competitive Landscape

Leading Companies in the UAE Solar Photovoltaic (PV) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The UAE solar PV market can be segmented based on various factors, including system type (residential, commercial, utility-scale), end-user (residential, commercial, industrial), and technology type (monocrystalline, polycrystalline, thin-film).

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a temporary impact on the UAE solar PV market, causing delays in project execution and supply chain disruptions. However, the long-term prospects for the market remain positive as the government remains committed to renewable energy goals, and the need for clean, sustainable energy becomes increasingly apparent.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the UAE solar PV market looks promising, with increasing investments, technological advancements, and supportive government policies. The country’s commitment to renewable energy goals, coupled with the growing environmental consciousness among businesses and consumers, will fuel the demand for solar PV installations. The market is expected to witness continued growth, attracting both local and international players and contributing significantly to the UAE’s clean energy targets.

Conclusion

The United Arab Emirates solar photovoltaic (PV) market is undergoing significant growth driven by government initiatives, decreasing costs, and a commitment to renewable energy goals. With favorable policies, ample sunlight, and increasing awareness of environmental sustainability, solar PV adoption offers substantial benefits for industry participants, stakeholders, and the country as a whole. Embracing solar PV technology contributes to a cleaner energy mix, reduces dependence on conventional energy sources, and positions the UAE as a leader in renewable energy innovation.

What is Solar Photovoltaic (PV)?

Solar Photovoltaic (PV) refers to the technology that converts sunlight directly into electricity using solar cells. This technology is widely used in residential, commercial, and utility-scale applications to harness renewable energy.

What are the key players in the United Arab Emirates Solar Photovoltaic (PV) Market?

Key players in the United Arab Emirates Solar Photovoltaic (PV) Market include First Solar, JinkoSolar, and Abu Dhabi Future Energy Company (Masdar), among others. These companies are involved in manufacturing, project development, and installation of solar PV systems.

What are the growth factors driving the United Arab Emirates Solar Photovoltaic (PV) Market?

The growth of the United Arab Emirates Solar Photovoltaic (PV) Market is driven by increasing energy demand, government initiatives promoting renewable energy, and advancements in solar technology. Additionally, the declining costs of solar panels contribute to market expansion.

What challenges does the United Arab Emirates Solar Photovoltaic (PV) Market face?

The United Arab Emirates Solar Photovoltaic (PV) Market faces challenges such as high initial installation costs, regulatory hurdles, and competition from other energy sources. These factors can hinder the adoption of solar PV technologies.

What opportunities exist in the United Arab Emirates Solar Photovoltaic (PV) Market?

Opportunities in the United Arab Emirates Solar Photovoltaic (PV) Market include the potential for large-scale solar projects, increased investment in renewable energy, and the growing interest in energy storage solutions. These factors can enhance the market’s growth prospects.

What trends are shaping the United Arab Emirates Solar Photovoltaic (PV) Market?

Trends shaping the United Arab Emirates Solar Photovoltaic (PV) Market include the integration of smart grid technologies, the rise of decentralized energy systems, and innovations in solar panel efficiency. These trends are expected to influence future developments in the market.

United Arab Emirates Solar Photovoltaic (PV) Market

| Segmentation Details | Description |

|---|---|

| Technology | Monocrystalline, Polycrystalline, Thin-Film, Bifacial |

| End User | Residential, Commercial, Industrial, Utilities |

| Installation | Ground-Mounted, Roof-Mounted, Building-Integrated, Floating |

| Application | Power Generation, Off-Grid Systems, Grid-Tied Systems, Energy Storage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UAE Solar Photovoltaic (PV) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at