444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Arab Emirates portable air conditioning market represents a dynamic and rapidly expanding segment within the region’s broader cooling solutions industry. Driven by extreme climatic conditions, urbanization trends, and evolving consumer preferences, this market has experienced substantial growth across residential, commercial, and industrial applications. The UAE’s unique geographical position, characterized by desert climate and high temperatures reaching up to 50°C during summer months, creates an essential demand for flexible cooling solutions.

Market dynamics indicate robust expansion driven by several key factors including increasing construction activities, growing hospitality sector, and rising awareness about energy-efficient cooling technologies. The portable air conditioning segment has gained significant traction due to its versatility, cost-effectiveness, and ease of installation compared to traditional centralized systems. Growth projections suggest the market will continue expanding at a compound annual growth rate of 8.2% through the forecast period, reflecting strong underlying demand fundamentals.

Regional characteristics of the UAE market include high disposable income levels, rapid infrastructure development, and increasing adoption of smart home technologies. The market encompasses various product categories including single-hose units, dual-hose systems, and advanced inverter-based portable air conditioners. Consumer preferences are increasingly shifting toward energy-efficient models with smart connectivity features, driving innovation and product development across the industry.

The United Arab Emirates portable air conditioning market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of mobile cooling units designed for temporary or flexible climate control applications across the UAE region. These systems provide localized cooling solutions that can be easily relocated and installed without permanent modifications to building infrastructure.

Portable air conditioning units are self-contained cooling systems that typically include a compressor, condenser, evaporator, and fan assembly within a single mobile unit. Unlike traditional split or central air conditioning systems, these units offer flexibility in placement and operation, making them ideal for rental properties, temporary installations, supplemental cooling, and spaces where permanent installation is impractical or cost-prohibitive.

The market encompasses various stakeholders including international manufacturers, local distributors, retail chains, e-commerce platforms, installation services, and maintenance providers. Product categories range from basic cooling-only units to advanced models featuring heating capabilities, air purification, dehumidification, and smart home integration features tailored to meet diverse consumer requirements across the UAE’s varied climate zones and applications.

Strategic analysis reveals the UAE portable air conditioning market as a high-growth segment benefiting from favorable demographic trends, climatic necessities, and evolving consumer preferences. The market demonstrates strong fundamentals supported by increasing urbanization, expanding hospitality sector, and growing awareness of energy-efficient cooling solutions. Key performance indicators suggest sustained expansion with market penetration rates increasing by 12% annually across residential and commercial segments.

Competitive dynamics feature a mix of established international brands and emerging regional players, creating a diverse marketplace with varied product offerings and price points. The market benefits from strong distribution networks, including traditional retail channels, e-commerce platforms, and specialized HVAC dealers. Technology adoption trends indicate growing demand for smart-enabled units with IoT connectivity, representing approximately 35% of premium segment sales.

Market segmentation reveals residential applications dominating demand, followed by commercial and industrial use cases. The hospitality sector emerges as a significant growth driver, particularly in Dubai and Abu Dhabi, where temporary and supplemental cooling requirements create substantial opportunities. Regional distribution shows Dubai accounting for 45% of market demand, followed by Abu Dhabi and the Northern Emirates, reflecting population density and economic activity patterns.

Market intelligence reveals several critical insights shaping the UAE portable air conditioning landscape. The following key observations provide strategic understanding of market dynamics and growth opportunities:

Consumer behavior analysis indicates preferences for units offering multiple functionalities including cooling, heating, dehumidification, and air purification. Purchase decision factors prioritize energy efficiency, noise levels, cooling capacity, and brand reputation, with warranty and service support playing increasingly important roles in vendor selection processes.

Primary growth drivers propelling the UAE portable air conditioning market include several interconnected factors creating sustained demand across multiple sectors. The extreme desert climate serves as the fundamental driver, with temperatures regularly exceeding comfortable indoor levels for extended periods throughout the year.

Urbanization trends contribute significantly to market expansion, as rapid population growth and urban development create increased demand for flexible cooling solutions. The UAE’s position as a global business hub attracts international residents and businesses requiring adaptable climate control options. Construction activity remains robust, with new residential and commercial developments requiring temporary cooling during construction phases and flexible solutions for varying occupancy patterns.

Economic diversification initiatives drive growth in tourism, hospitality, and service sectors, creating demand for supplemental cooling in hotels, restaurants, event venues, and retail spaces. The expanding short-term rental market, particularly in Dubai and Abu Dhabi, requires flexible cooling solutions that can be easily installed and relocated. Energy efficiency awareness among consumers and businesses drives adoption of modern portable units offering superior performance compared to older fixed installations.

Technological advancement in portable air conditioning systems, including improved energy efficiency, reduced noise levels, and smart connectivity features, makes these solutions increasingly attractive to consumers. The growing emphasis on indoor air quality, particularly following health concerns, drives demand for units incorporating air purification and filtration capabilities alongside cooling functions.

Market constraints affecting the UAE portable air conditioning sector include several challenges that may limit growth potential or create operational difficulties for market participants. High initial investment costs for premium energy-efficient models can deter price-sensitive consumers, particularly in the residential segment where budget considerations often influence purchase decisions.

Energy consumption concerns present ongoing challenges, as portable units typically consume more electricity than equivalent-capacity fixed systems, leading to higher operational costs. This factor becomes particularly significant given the UAE’s focus on energy efficiency and sustainability initiatives. Installation complexity for certain models requiring external venting or drainage connections can limit adoption in some applications.

Seasonal demand fluctuations create inventory management challenges for retailers and distributors, with peak demand concentrated during summer months while off-season sales remain relatively low. This pattern affects cash flow and storage requirements throughout the supply chain. Maintenance requirements for portable units, including regular filter cleaning and refrigerant servicing, may deter some consumers preferring low-maintenance solutions.

Competition from alternative cooling solutions, including improved central air conditioning systems and energy-efficient split units, may limit market expansion in certain segments. Regulatory compliance requirements related to energy efficiency standards and environmental regulations can increase manufacturing costs and complexity, potentially affecting product pricing and availability in the market.

Emerging opportunities within the UAE portable air conditioning market present significant potential for growth and innovation across multiple dimensions. The increasing focus on smart home technology creates opportunities for manufacturers to develop IoT-enabled units with advanced connectivity features, remote monitoring capabilities, and integration with home automation systems.

Sustainability trends open avenues for eco-friendly portable air conditioning solutions utilizing natural refrigerants, solar power integration, and enhanced energy efficiency technologies. The growing emphasis on indoor air quality presents opportunities for multi-functional units combining cooling with air purification, humidity control, and pathogen elimination capabilities. Market penetration in underserved segments, including small businesses, outdoor events, and industrial applications, offers expansion potential.

Service sector growth creates opportunities for comprehensive maintenance and support services, including preventive maintenance programs, emergency repair services, and equipment rental options. The expanding e-commerce landscape provides opportunities for direct-to-consumer sales models, improved customer engagement, and enhanced distribution efficiency. Regional expansion within the GCC region leverages UAE market success to penetrate neighboring markets with similar climatic conditions and consumer preferences.

Technology partnerships with smart home platform providers, energy management companies, and building automation specialists create opportunities for integrated solutions addressing broader market needs. The growing hospitality and tourism sectors present opportunities for specialized portable cooling solutions designed for temporary accommodations, event venues, and outdoor hospitality applications.

Market dynamics within the UAE portable air conditioning sector reflect complex interactions between supply-side factors, demand drivers, competitive forces, and regulatory influences. The interplay of these elements creates a dynamic marketplace characterized by continuous evolution and adaptation to changing conditions.

Supply chain dynamics involve international manufacturing primarily concentrated in Asia, with products imported through established distribution networks serving the UAE market. Local assembly and customization activities are limited, making the market dependent on global supply chain efficiency and international trade conditions. Inventory management becomes critical given seasonal demand patterns and the need to balance stock levels with storage costs and working capital requirements.

Competitive dynamics feature intense competition among established international brands, regional distributors, and emerging online retailers. Price competition remains significant, particularly in the mid-market segment, while premium brands compete on technology features, energy efficiency, and service quality. Market consolidation trends indicate potential for strategic partnerships and acquisitions as companies seek to strengthen market positions and expand service capabilities.

Regulatory dynamics include evolving energy efficiency standards, environmental regulations, and import requirements affecting product specifications and market entry strategies. Consumer dynamics show increasing sophistication in purchase decisions, with buyers conducting extensive research and comparing features, efficiency ratings, and total cost of ownership before making selections. According to MarkWide Research analysis, consumer awareness of energy efficiency features has increased by 28% over the past two years.

Research approach for analyzing the UAE portable air conditioning market employs comprehensive methodologies combining primary and secondary research techniques to ensure accurate and reliable market intelligence. The methodology encompasses quantitative analysis of market data, qualitative assessment of industry trends, and strategic evaluation of competitive dynamics.

Primary research involves direct engagement with key market stakeholders including manufacturers, distributors, retailers, service providers, and end-users across residential, commercial, and industrial segments. Structured interviews and surveys collect firsthand insights regarding market trends, consumer preferences, pricing dynamics, and growth opportunities. Secondary research utilizes industry reports, government statistics, trade publications, and company financial data to validate primary findings and provide comprehensive market context.

Data collection processes include market sizing analysis, competitive landscape assessment, technology trend evaluation, and regulatory impact analysis. Geographic coverage encompasses all seven emirates with particular focus on Dubai, Abu Dhabi, and Sharjah as primary market centers. Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and market segmentation studies providing strategic insights for industry participants.

Validation procedures ensure data accuracy through cross-referencing multiple sources, expert consultations, and statistical verification methods. The research timeline spans multiple quarters to capture seasonal variations and emerging trends affecting market dynamics. Quality assurance measures include peer review processes and industry expert validation to ensure findings accurately reflect market realities and provide actionable insights for stakeholders.

Geographic distribution of the UAE portable air conditioning market reveals distinct regional patterns reflecting population density, economic activity, and climatic variations across the seven emirates. Dubai emerges as the dominant market, accounting for approximately 45% of total demand, driven by its large population, extensive hospitality sector, and high concentration of commercial activities.

Dubai market characteristics include strong demand from residential high-rise buildings, hotels, restaurants, retail outlets, and temporary installations. The emirate’s position as a global business and tourism hub creates substantial requirements for flexible cooling solutions in various applications. Abu Dhabi represents the second-largest market segment with approximately 30% market share, driven by government sector demand, oil industry applications, and growing residential developments.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively account for the remaining 25% of market demand. These regions show growing adoption driven by industrial applications, residential developments, and increasing commercial activities. Sharjah demonstrates particular strength in manufacturing and logistics applications requiring temporary or supplemental cooling solutions.

Regional preferences vary based on local climate conditions, with coastal areas showing higher demand for dehumidification features while inland regions prioritize maximum cooling capacity. Distribution networks are well-established in Dubai and Abu Dhabi, while northern emirates rely more heavily on regional distributors and online channels for product access and service support.

Market competition in the UAE portable air conditioning sector features a diverse mix of international manufacturers, regional distributors, and specialized retailers creating a dynamic competitive environment. The landscape includes established global brands alongside emerging regional players, each targeting specific market segments with differentiated value propositions.

Leading market participants include:

Competitive strategies vary among participants, with premium brands emphasizing technology innovation, energy efficiency, and comprehensive service support. Mid-market competitors focus on value proposition, competitive pricing, and broad product availability. Market positioning reflects differentiation through features such as smart connectivity, energy efficiency ratings, noise reduction technology, and multi-functional capabilities including heating and air purification.

Market segmentation of the UAE portable air conditioning sector reveals distinct categories based on various classification criteria including application, technology, capacity, and price points. This segmentation provides strategic insights for market participants and helps identify specific growth opportunities within different market segments.

By Application:

By Technology:

By Capacity Range:

Residential segment analysis reveals strong growth driven by apartment dwellers and villa residents seeking supplemental cooling solutions. This category benefits from increasing awareness of energy-efficient models and growing preference for smart-enabled units offering remote control capabilities. Consumer preferences in residential applications prioritize quiet operation, aesthetic design, and ease of installation, with energy efficiency becoming increasingly important due to rising electricity costs.

Commercial segment dynamics show robust demand from small and medium businesses requiring flexible cooling solutions for varying occupancy patterns. Restaurants, retail stores, and office spaces utilize portable units for supplemental cooling during peak periods or in areas not adequately served by central systems. Purchase decisions in commercial applications emphasize reliability, service support, and total cost of ownership considerations.

Industrial applications demonstrate growing adoption in manufacturing facilities, warehouses, and construction sites where permanent installations are impractical or cost-prohibitive. These applications require robust units capable of operating in challenging environments with emphasis on durability and maintenance accessibility. Capacity requirements in industrial settings typically favor larger units with enhanced cooling capabilities and extended operational life.

Hospitality sector insights reveal significant opportunities driven by Dubai’s tourism industry and expanding short-term rental market. Hotels and serviced apartments utilize portable units for guest room supplemental cooling, event spaces, and temporary installations. Service requirements in hospitality applications emphasize quick installation, minimal noise operation, and reliable performance to ensure guest satisfaction and operational efficiency.

Market participation in the UAE portable air conditioning sector offers numerous advantages for various stakeholders including manufacturers, distributors, retailers, and service providers. These benefits create compelling value propositions supporting sustained market engagement and growth strategies.

For Manufacturers:

For Distributors and Retailers:

For End Users:

For Service Providers:

Strategic assessment of the UAE portable air conditioning market through SWOT analysis reveals key internal strengths and weaknesses alongside external opportunities and threats affecting market dynamics and growth potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the UAE portable air conditioning market reflect evolving consumer preferences, technological advancement, and changing market dynamics. These trends provide strategic insights for industry participants and indicate future market direction.

Smart Connectivity Adoption represents a significant trend with increasing consumer demand for IoT-enabled units offering remote control, energy monitoring, and integration with home automation systems. Market penetration of smart-enabled models has reached approximately 35% in the premium segment, indicating strong growth potential for connected solutions.

Energy Efficiency Focus continues gaining momentum as consumers become more conscious of operational costs and environmental impact. Inverter technology adoption and high-efficiency ratings increasingly influence purchase decisions, with energy-efficient models commanding premium pricing. Sustainability awareness drives demand for units utilizing eco-friendly refrigerants and incorporating energy-saving features.

Multi-Functional Capabilities trend toward units offering combined cooling, heating, dehumidification, and air purification functions. This convergence addresses diverse climate control needs while maximizing space utilization and investment value. Air Quality Concerns particularly following health awareness increases drive demand for units incorporating advanced filtration and purification technologies.

E-commerce Growth accelerates with online sales channels gaining significant market share, particularly among younger consumers comfortable with digital purchasing. Direct-to-consumer models enable manufacturers to improve margins while providing enhanced customer engagement and service delivery. Service Integration trends include comprehensive packages combining equipment sales with installation, maintenance, and warranty services.

Recent industry developments within the UAE portable air conditioning market demonstrate continuous evolution and adaptation to changing market conditions, technological advancement, and regulatory requirements. These developments shape competitive dynamics and market opportunities.

Technology Innovation initiatives include introduction of advanced inverter technology, improved energy efficiency ratings, and enhanced smart connectivity features. Leading manufacturers have launched new product lines incorporating artificial intelligence for optimized performance and predictive maintenance capabilities. Product Development focuses on noise reduction technology, compact designs, and improved aesthetic appeal addressing consumer preferences for unobtrusive cooling solutions.

Market Expansion activities include new retail partnerships, expanded distribution networks, and enhanced service capabilities. Several international brands have established local service centers and authorized dealer networks to improve customer support and market penetration. E-commerce Integration has accelerated with major retailers launching comprehensive online platforms offering product comparison, customer reviews, and home delivery services.

Regulatory Compliance developments include updated energy efficiency standards and environmental regulations affecting product specifications and market entry requirements. Manufacturers have invested in compliance programs ensuring products meet evolving regulatory standards while maintaining competitive positioning. Sustainability Initiatives include adoption of eco-friendly refrigerants, recyclable packaging, and energy-efficient manufacturing processes addressing growing environmental concerns.

Strategic Partnerships between manufacturers, distributors, and service providers create integrated solutions addressing comprehensive customer needs. MWR data indicates that strategic alliances have contributed to 15% improvement in customer satisfaction scores across the industry, reflecting enhanced service delivery and support capabilities.

Strategic recommendations for UAE portable air conditioning market participants focus on leveraging growth opportunities while addressing market challenges and competitive dynamics. These suggestions provide actionable insights for manufacturers, distributors, and service providers seeking to optimize market positioning and performance.

For Manufacturers: Prioritize development of energy-efficient models with smart connectivity features addressing evolving consumer preferences. Invest in local service infrastructure and authorized dealer networks to improve customer support and market penetration. Product differentiation through advanced features such as air purification, noise reduction, and aesthetic design can command premium pricing and strengthen brand positioning.

For Distributors and Retailers: Expand e-commerce capabilities and digital marketing strategies to capture growing online demand. Develop comprehensive service packages combining equipment sales with installation, maintenance, and warranty support. Inventory management optimization through predictive analytics and seasonal planning can improve cash flow and customer satisfaction.

For Service Providers: Establish specialized expertise in portable air conditioning systems to differentiate from general HVAC services. Develop preventive maintenance programs and emergency response capabilities addressing customer needs for reliable operation. Technology integration including remote monitoring and predictive maintenance can create competitive advantages and recurring revenue streams.

Market Entry Strategies: New entrants should focus on underserved segments such as industrial applications or specialized hospitality requirements. Partnership approaches with established distributors or retailers can accelerate market penetration while minimizing initial investment requirements. Emphasis on energy efficiency and smart features aligns with market trends and regulatory directions.

Long-term prospects for the UAE portable air conditioning market remain highly positive, supported by fundamental demand drivers including climatic necessities, economic growth, and technological advancement. The market is positioned for sustained expansion with projected growth rates of 8.2% CAGR through the forecast period, reflecting strong underlying demand fundamentals and favorable market conditions.

Technology evolution will continue driving market transformation with increasing adoption of smart connectivity, artificial intelligence, and energy-efficient technologies. Future developments may include integration with renewable energy systems, advanced air quality monitoring, and predictive maintenance capabilities. Consumer preferences will likely emphasize sustainability, energy efficiency, and multi-functional capabilities as environmental awareness and operational cost considerations gain importance.

Market expansion opportunities include penetration of underserved segments, geographic expansion within the GCC region, and development of specialized applications addressing unique customer requirements. The growing hospitality and tourism sectors present significant opportunities for portable cooling solutions designed for temporary and flexible installations. Service sector growth will create opportunities for comprehensive maintenance, rental, and support services addressing evolving customer needs.

Regulatory developments may include stricter energy efficiency standards, environmental regulations, and building codes affecting product specifications and market requirements. MarkWide Research projections suggest that compliance with evolving regulations will drive innovation and potentially consolidate market participation around companies with strong technical capabilities and regulatory expertise. The market outlook indicates continued growth with increasing sophistication in product offerings and service delivery models.

The United Arab Emirates portable air conditioning market represents a dynamic and rapidly expanding sector characterized by strong growth fundamentals, technological innovation, and evolving consumer preferences. Driven by extreme climatic conditions, urbanization trends, and economic prosperity, the market demonstrates sustained expansion potential with projected growth rates reflecting robust underlying demand across residential, commercial, and industrial applications.

Market dynamics reveal a competitive landscape featuring established international brands alongside emerging regional players, creating diverse opportunities for differentiation through technology innovation, energy efficiency, and comprehensive service delivery. The increasing emphasis on smart connectivity, sustainability, and multi-functional capabilities indicates market evolution toward more sophisticated and integrated cooling solutions addressing comprehensive customer requirements.

Strategic opportunities exist across multiple dimensions including technology advancement, market segment expansion, service sector development, and regional growth initiatives. The market benefits from well-established distribution networks, strong consumer purchasing power, and favorable regulatory environment supporting continued expansion and innovation. Future prospects remain highly positive with sustained growth expected through the forecast period, driven by fundamental demand drivers and emerging market opportunities in smart technology integration and sustainable cooling solutions.

What is Portable Air Conditioning?

Portable air conditioning refers to self-contained units that can be easily moved from one room to another, providing cooling without the need for permanent installation. These units are popular for residential and commercial use, especially in regions with high temperatures.

What are the key players in the United Arab Emirates Portable Air Conditioning Market?

Key players in the United Arab Emirates Portable Air Conditioning Market include LG Electronics, Daikin Industries, and Midea Group, among others. These companies are known for their innovative cooling solutions and energy-efficient products.

What are the growth factors driving the United Arab Emirates Portable Air Conditioning Market?

The growth of the United Arab Emirates Portable Air Conditioning Market is driven by increasing temperatures, rising urbanization, and a growing demand for energy-efficient cooling solutions. Additionally, the expansion of the hospitality and retail sectors contributes to market growth.

What challenges does the United Arab Emirates Portable Air Conditioning Market face?

Challenges in the United Arab Emirates Portable Air Conditioning Market include high energy consumption and the initial cost of portable units. Furthermore, competition from fixed air conditioning systems can limit market penetration.

What opportunities exist in the United Arab Emirates Portable Air Conditioning Market?

Opportunities in the United Arab Emirates Portable Air Conditioning Market include the development of smart and IoT-enabled units, which can enhance user experience and energy efficiency. Additionally, increasing awareness of climate change may drive demand for more sustainable cooling solutions.

What trends are shaping the United Arab Emirates Portable Air Conditioning Market?

Trends in the United Arab Emirates Portable Air Conditioning Market include a shift towards eco-friendly refrigerants and the integration of advanced technologies such as mobile app controls. There is also a growing preference for multifunctional units that provide both cooling and heating capabilities.

United Arab Emirates Portable Air Conditioning Market

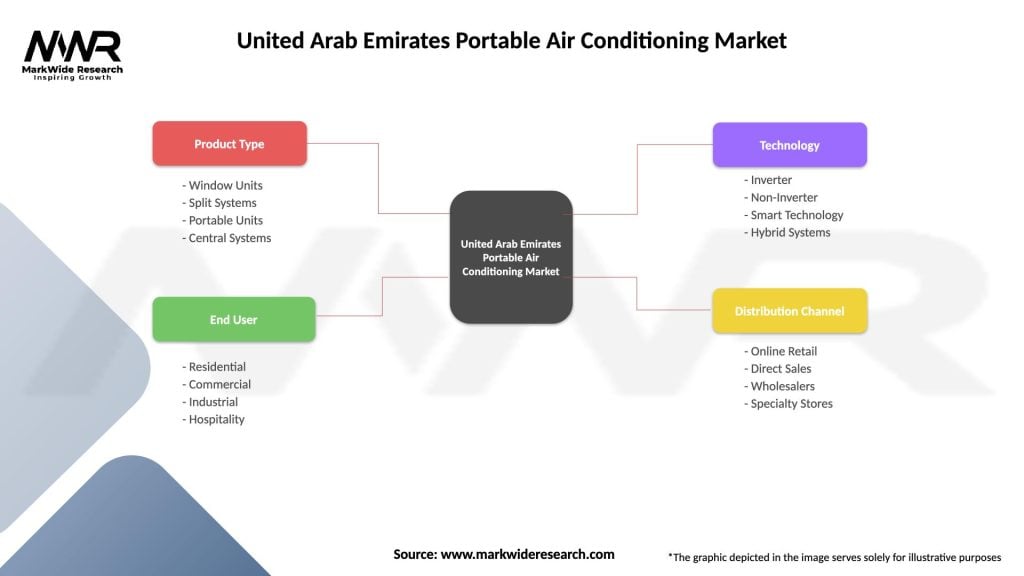

| Segmentation Details | Description |

|---|---|

| Product Type | Window Units, Split Systems, Portable Units, Central Systems |

| End User | Residential, Commercial, Industrial, Hospitality |

| Technology | Inverter, Non-Inverter, Smart Technology, Hybrid Systems |

| Distribution Channel | Online Retail, Direct Sales, Wholesalers, Specialty Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Arab Emirates Portable Air Conditioning Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at