444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Arab Emirates infrastructure market represents one of the most dynamic and rapidly evolving sectors in the Middle East region. Strategic investments in transportation, utilities, telecommunications, and urban development have positioned the UAE as a regional hub for infrastructure excellence. The market demonstrates robust growth potential driven by ambitious national development programs, population expansion, and economic diversification initiatives.

Government commitment to infrastructure modernization has created substantial opportunities across multiple sectors. The UAE’s strategic location connecting Europe, Asia, and Africa has amplified the importance of world-class infrastructure systems. Smart city initiatives and sustainability-focused projects are reshaping the infrastructure landscape, with projected growth rates of 6.2% CAGR through the forecast period.

Private sector participation through public-private partnerships has accelerated infrastructure development across the emirates. The market encompasses traditional infrastructure segments alongside emerging technologies including smart grids, digital infrastructure, and renewable energy systems. Regional leadership in infrastructure quality rankings reflects the UAE’s commitment to maintaining competitive advantages in the global economy.

The United Arab Emirates infrastructure market refers to the comprehensive ecosystem of physical and digital systems that support economic activity, social development, and quality of life across the seven emirates. This market encompasses transportation networks, utilities, telecommunications, housing, commercial facilities, and emerging smart infrastructure technologies.

Infrastructure development in the UAE includes both greenfield projects creating new capabilities and brownfield upgrades modernizing existing systems. The market covers public infrastructure funded by government entities and private infrastructure developed through commercial investment. Integrated planning approaches ensure infrastructure systems work synergistically to support national development objectives.

Modern infrastructure in the UAE emphasizes sustainability, resilience, and technological innovation. The market includes traditional sectors like roads, bridges, and utilities alongside cutting-edge developments in smart cities, renewable energy, and digital connectivity. Strategic positioning as a global business hub drives continuous infrastructure enhancement and expansion initiatives.

Market dynamics in the UAE infrastructure sector reflect strong fundamentals driven by population growth, economic diversification, and strategic government initiatives. The market benefits from substantial public investment, favorable regulatory frameworks, and increasing private sector participation. Technology integration across infrastructure projects positions the UAE as a regional leader in smart infrastructure development.

Key growth drivers include mega-events preparation, tourism expansion, and industrial development programs. The infrastructure market demonstrates resilience through economic cycles, supported by long-term national vision programs and strategic planning initiatives. Sustainability focus has become increasingly important, with 35% of new projects incorporating green building standards and renewable energy components.

Competitive landscape features both international contractors and local developers, creating a dynamic ecosystem for infrastructure delivery. The market shows strong potential for continued expansion, supported by demographic trends, economic growth, and ongoing urbanization. Digital transformation initiatives are creating new infrastructure requirements and modernization opportunities across all sectors.

Strategic insights reveal several critical factors shaping the UAE infrastructure market landscape:

Market intelligence indicates strong correlation between infrastructure quality and economic competitiveness rankings. The UAE consistently demonstrates leadership in infrastructure development speed and quality compared to regional peers.

Population expansion represents the primary driver for infrastructure market growth across the UAE. Rapid demographic changes create sustained demand for housing, transportation, utilities, and social infrastructure. Urbanization trends concentrate development in key metropolitan areas, requiring sophisticated infrastructure solutions to support high-density living and working environments.

Economic diversification initiatives drive infrastructure requirements across emerging sectors including tourism, logistics, manufacturing, and technology. The UAE’s strategic focus on reducing oil dependency creates infrastructure needs for new industrial zones, free trade areas, and specialized facilities. Business hub positioning requires world-class infrastructure to attract international companies and investment.

Mega-event preparations accelerate infrastructure development timelines and quality standards. Major international events create opportunities for showcase projects that demonstrate UAE capabilities in infrastructure delivery. Legacy planning ensures event-driven infrastructure provides long-term benefits for residents and businesses. Tourism growth targets of 25 million visitors annually drive hospitality and transportation infrastructure expansion.

Technology advancement creates new infrastructure categories and upgrade requirements for existing systems. Smart city initiatives, IoT integration, and digital transformation programs require sophisticated infrastructure platforms. Sustainability commitments drive renewable energy infrastructure and green building adoption across development projects.

Capital intensity of infrastructure projects creates financial constraints that can limit development pace and scope. Large-scale infrastructure requires substantial upfront investment with extended payback periods, creating challenges for project financing and resource allocation. Budget constraints during economic downturns can delay or reduce infrastructure investment levels.

Regulatory complexity across multiple emirates and federal jurisdictions can create coordination challenges for large infrastructure projects. Different approval processes, standards, and requirements may extend project timelines and increase development costs. Permitting delays can impact project schedules and financial performance for infrastructure developers.

Skilled labor availability represents an ongoing challenge for infrastructure construction and maintenance activities. Specialized technical skills required for advanced infrastructure systems may face supply constraints in the regional labor market. Training requirements for new technologies and systems add complexity to project implementation.

Environmental considerations create additional requirements for infrastructure projects, potentially increasing costs and extending development timelines. Climate resilience requirements and sustainability mandates add complexity to project design and material selection. Resource constraints including water scarcity influence infrastructure planning and operational considerations.

Smart infrastructure development presents significant opportunities for technology integration and operational efficiency improvements. IoT sensors, data analytics, and automated systems create new possibilities for infrastructure monitoring, maintenance, and optimization. Digital twin technology enables advanced planning and predictive maintenance capabilities across infrastructure assets.

Renewable energy infrastructure offers substantial growth potential as the UAE pursues clean energy targets and sustainability goals. Solar power installations, energy storage systems, and smart grid development create opportunities for specialized infrastructure providers. Green building adoption rates of 40% for new construction drive demand for sustainable infrastructure solutions.

Transportation modernization creates opportunities across multiple modes including rail, metro, autonomous vehicles, and logistics infrastructure. The UAE’s position as a regional transportation hub drives continued investment in airports, ports, and connecting infrastructure. Hyperloop development and other advanced transportation technologies present emerging opportunities.

Healthcare infrastructure expansion addresses growing population needs and medical tourism objectives. Specialized facilities, research centers, and integrated healthcare campuses create opportunities for advanced infrastructure development. Education infrastructure growth supports the UAE’s knowledge economy development goals and international education hub aspirations.

Supply and demand dynamics in the UAE infrastructure market reflect strong underlying fundamentals with sustained growth drivers. Population growth, economic expansion, and strategic development initiatives create consistent demand for infrastructure services and capabilities. Government planning provides visibility into long-term infrastructure requirements and investment priorities.

Competitive dynamics feature both international and regional players competing across different infrastructure segments. Large international contractors bring advanced capabilities and financing options, while local companies provide regional expertise and government relationships. Partnership strategies often combine international technical capabilities with local market knowledge.

Technology disruption is reshaping infrastructure requirements and delivery methods across multiple sectors. Digitalization, automation, and smart systems integration create new performance standards and operational possibilities. Innovation adoption rates in UAE infrastructure projects exceed 55% for new technologies compared to regional averages.

Financial dynamics include diverse funding sources from government budgets, private investment, and international financing. PPP models are becoming increasingly important for large infrastructure projects, enabling risk sharing and accelerated delivery. Investment flows from sovereign wealth funds and international investors support major infrastructure initiatives.

Comprehensive analysis of the UAE infrastructure market employs multiple research methodologies to ensure accuracy and completeness. Primary research includes interviews with industry executives, government officials, and infrastructure users to gather firsthand insights into market conditions and trends. Secondary research incorporates government publications, industry reports, and statistical databases to provide quantitative foundation for market analysis.

Data collection processes focus on both quantitative metrics and qualitative insights to create a balanced market perspective. Infrastructure project databases, government spending records, and private investment tracking provide quantitative foundation. Expert interviews with industry leaders, consultants, and government officials provide qualitative insights into market dynamics and future trends.

Market segmentation analysis examines infrastructure categories, geographic distribution, and end-user applications to identify growth opportunities and competitive dynamics. Cross-sector analysis reveals interconnections between different infrastructure types and their combined impact on economic development. Trend analysis incorporates historical data patterns with forward-looking indicators to project market evolution.

Validation processes ensure research findings accuracy through multiple source verification and expert review. MarkWide Research methodology emphasizes data triangulation and peer review to maintain research quality standards. Regular updates incorporate new developments and changing market conditions to maintain research relevance and accuracy.

Dubai emirate leads infrastructure development with 45% market share driven by tourism, business hub positioning, and mega-event preparations. The emirate’s strategic focus on becoming a global city requires world-class infrastructure across transportation, hospitality, and commercial sectors. Smart city initiatives in Dubai set regional standards for technology integration and operational efficiency.

Abu Dhabi represents the largest infrastructure market by government investment, accounting for 35% of total activity. As the capital emirate and oil industry center, Abu Dhabi drives major infrastructure projects in energy, transportation, and government facilities. Sustainability focus in Abu Dhabi infrastructure projects influences regional development standards and practices.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent 20% of infrastructure market activity. These emirates focus on specialized infrastructure including industrial facilities, ports, and tourism development. Economic diversification efforts in northern emirates create opportunities for targeted infrastructure investment.

Cross-emirate projects including federal highways, utilities, and telecommunications infrastructure create coordination opportunities and economies of scale. Integrated planning approaches ensure infrastructure systems work effectively across emirate boundaries. Regional connectivity projects enhance the UAE’s position as a unified economic zone and transportation hub.

Market leadership in UAE infrastructure features both international contractors and regional specialists competing across different project types and scales. The competitive environment encourages innovation, quality improvement, and cost efficiency in infrastructure delivery.

Partnership strategies often combine international technical expertise with local market knowledge and government relationships. Joint ventures and strategic alliances enable companies to compete effectively on large infrastructure projects requiring diverse capabilities.

By Infrastructure Type:

By Development Stage:

By Funding Source:

Transportation Infrastructure dominates market activity with 40% of total investment, driven by airport expansion, metro development, and road network enhancement. Dubai International Airport expansion and new Al Maktoum International Airport development represent major transportation infrastructure initiatives. Smart transportation systems integration creates opportunities for advanced technology adoption.

Utilities Infrastructure accounts for 25% of market activity with focus on water security, renewable energy, and smart grid development. The UAE’s water scarcity challenges drive investment in desalination, water recycling, and distribution efficiency. Solar power projects and energy storage systems support clean energy transition objectives.

Telecommunications Infrastructure represents 15% of market investment with emphasis on 5G networks, data centers, and smart city platforms. Digital transformation initiatives across government and business sectors drive demand for advanced telecommunications infrastructure. Fiber optic expansion and wireless network densification support connectivity requirements.

Social Infrastructure comprises 12% of market activity including healthcare facilities, educational institutions, and government buildings. Population growth and service quality improvements drive investment in social infrastructure across all emirates. Healthcare expansion supports medical tourism objectives and resident service enhancement.

Commercial Infrastructure accounts for 8% of total investment with focus on mixed-use developments, hospitality facilities, and business districts. Tourism growth and economic diversification drive demand for commercial infrastructure supporting various economic sectors.

Government entities benefit from improved service delivery, economic development support, and enhanced quality of life for residents. Infrastructure investment creates employment opportunities, attracts business investment, and supports long-term economic competitiveness. Strategic planning coordination across emirates maximizes infrastructure investment effectiveness and regional integration.

Private sector participants gain access to substantial project opportunities, long-term revenue streams, and partnership possibilities with government entities. Infrastructure development creates business opportunities across construction, technology, financing, and operations sectors. Innovation adoption in infrastructure projects provides competitive advantages and market differentiation.

Residents and businesses benefit from improved connectivity, service reliability, and quality of life enhancements. Modern infrastructure supports economic activity, reduces operational costs, and enables new business models and opportunities. Smart infrastructure features provide enhanced convenience, efficiency, and service quality.

International investors access stable, long-term investment opportunities with government backing and strategic importance. Infrastructure projects provide portfolio diversification and exposure to UAE economic growth. ESG compliance through sustainable infrastructure investment aligns with global investment criteria and objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping UAE infrastructure development. IoT integration, data analytics, and smart systems are becoming standard features in new infrastructure projects. Digital twin technology enables advanced planning, monitoring, and maintenance capabilities across infrastructure assets. Artificial intelligence applications in infrastructure management improve operational efficiency and predictive maintenance.

Sustainability integration has become mandatory for major infrastructure projects, with green building standards and renewable energy requirements. Climate resilience planning addresses long-term environmental challenges and extreme weather preparedness. Circular economy principles influence material selection, waste management, and lifecycle planning for infrastructure projects.

Modular construction and prefabrication techniques are gaining adoption for faster project delivery and quality control. Advanced manufacturing methods reduce construction time and improve consistency in infrastructure development. 3D printing technology shows potential for specialized infrastructure components and rapid prototyping applications.

Public-private partnerships are expanding beyond traditional models to include innovative financing and risk-sharing arrangements. MWR analysis indicates 60% of major projects now incorporate some form of private sector participation. Performance-based contracting aligns contractor incentives with long-term infrastructure performance and user satisfaction.

Hyperloop development initiatives position the UAE as a global leader in advanced transportation infrastructure. Test facilities and commercial route planning demonstrate commitment to transportation innovation and regional connectivity enhancement. Autonomous vehicle infrastructure preparation includes smart traffic systems and dedicated transportation corridors.

Renewable energy projects including the Mohammed bin Rashid Al Maktoum Solar Park represent world-class clean energy infrastructure development. Energy storage integration and smart grid capabilities support renewable energy adoption and grid stability. Hydrogen infrastructure development positions the UAE for emerging clean energy technologies.

Smart city platforms integrate multiple infrastructure systems for coordinated management and optimization. Dubai Smart City initiative and Abu Dhabi smart city programs demonstrate comprehensive approaches to urban infrastructure integration. Data center expansion supports digital infrastructure requirements for smart city operations and business services.

Healthcare infrastructure expansion includes specialized medical facilities, research centers, and integrated healthcare campuses. Medical tourism infrastructure development supports economic diversification objectives and regional healthcare leadership. Telemedicine infrastructure enables remote healthcare delivery and improves service accessibility.

Strategic focus on technology integration and smart infrastructure capabilities will differentiate UAE infrastructure from regional competitors. Investment in digital platforms, IoT systems, and data analytics creates long-term competitive advantages and operational efficiency. Innovation partnerships with technology companies accelerate advanced capability development and implementation.

Sustainability leadership through green infrastructure and renewable energy integration positions the UAE for future regulatory requirements and investor preferences. Early adoption of sustainable practices creates expertise that can be exported to other markets. Climate resilience planning ensures infrastructure longevity and performance under changing environmental conditions.

Workforce development in specialized infrastructure skills reduces dependence on imported expertise and creates local capability. Training programs, educational partnerships, and knowledge transfer initiatives build sustainable infrastructure development capacity. Local content requirements can support domestic industry development while maintaining quality standards.

Regional integration opportunities through cross-border infrastructure projects enhance the UAE’s hub positioning and create economies of scale. Coordination with neighboring countries on transportation, utilities, and telecommunications infrastructure maximizes regional benefits. Export potential for UAE infrastructure expertise and project management capabilities creates additional economic opportunities.

Long-term growth prospects for the UAE infrastructure market remain highly positive, supported by demographic trends, economic diversification, and strategic development initiatives. Population growth projections and urbanization trends ensure sustained demand for infrastructure services and capabilities. Government vision programs provide clear direction and funding commitment for infrastructure development through 2071.

Technology evolution will continue reshaping infrastructure requirements and capabilities, with artificial intelligence, IoT, and automation becoming standard features. Smart infrastructure adoption rates are projected to reach 75% of new projects within the next decade. MarkWide Research forecasts indicate continued leadership in regional infrastructure innovation and quality.

Sustainability requirements will become increasingly stringent, driving innovation in green infrastructure and renewable energy integration. Climate change adaptation and resilience planning will influence all infrastructure development decisions. Carbon neutrality goals create opportunities for clean energy infrastructure and energy efficiency improvements.

Economic diversification success will create new infrastructure requirements across emerging sectors including space technology, advanced manufacturing, and biotechnology. The UAE’s position as a global business hub will drive continued investment in world-class infrastructure capabilities. Regional leadership in infrastructure quality and innovation creates opportunities for expertise export and international project participation.

The United Arab Emirates infrastructure market represents a dynamic and rapidly evolving sector with exceptional growth prospects and strategic importance. Strong government commitment, substantial investment resources, and clear long-term vision create favorable conditions for sustained infrastructure development. Technology integration and sustainability focus position the UAE as a regional leader in advanced infrastructure capabilities.

Market fundamentals remain robust, supported by population growth, economic diversification, and strategic positioning as a global business hub. The combination of public investment, private sector participation, and international expertise creates a competitive and innovative infrastructure development environment. Smart infrastructure adoption and digital transformation initiatives ensure the UAE maintains technological leadership in regional infrastructure development.

Future success will depend on continued innovation adoption, sustainability leadership, and workforce development to support advanced infrastructure capabilities. The UAE’s strategic approach to infrastructure planning and implementation provides a strong foundation for long-term economic competitiveness and quality of life enhancement. Regional integration opportunities and export potential for UAE infrastructure expertise create additional growth avenues beyond domestic market development.

What is Infrastructure?

Infrastructure refers to the fundamental facilities and systems serving a country, city, or area, including transportation, communication, sewage, water, and electric systems. In the context of the United Arab Emirates, it encompasses the development of roads, bridges, airports, and utilities that support economic growth and quality of life.

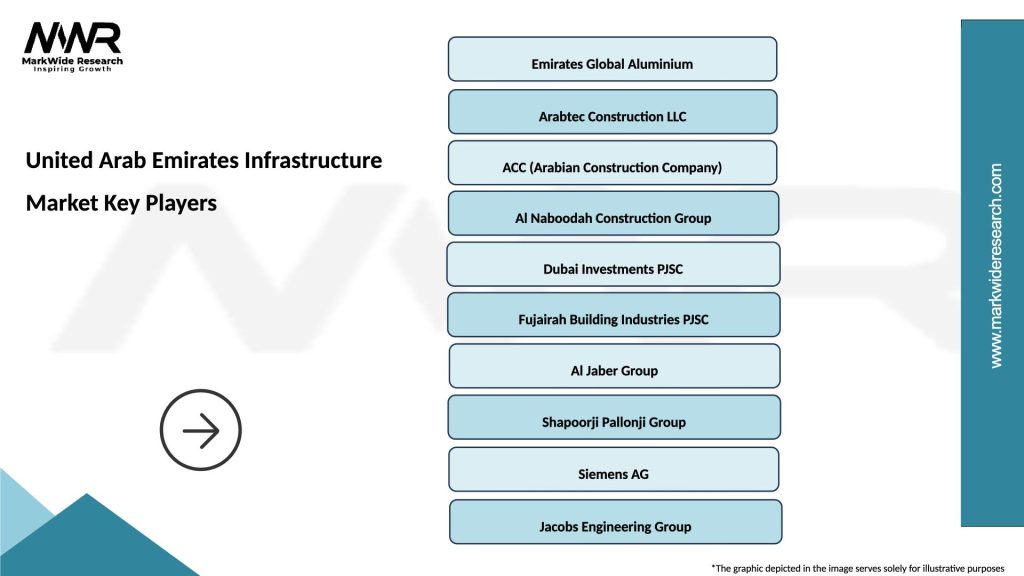

What are the key players in the United Arab Emirates Infrastructure Market?

Key players in the United Arab Emirates Infrastructure Market include companies like Arabtec Construction, ACC (Arabian Construction Company), and Dubai Investments, among others. These companies are involved in various projects ranging from residential developments to large-scale public infrastructure.

What are the main drivers of growth in the United Arab Emirates Infrastructure Market?

The main drivers of growth in the United Arab Emirates Infrastructure Market include rapid urbanization, government investment in mega projects, and the need for improved transportation networks. Additionally, the hosting of international events and a growing population contribute to increased infrastructure demands.

What challenges does the United Arab Emirates Infrastructure Market face?

The United Arab Emirates Infrastructure Market faces challenges such as fluctuating material costs, regulatory hurdles, and the need for sustainable practices. Additionally, project delays and labor shortages can impact the timely completion of infrastructure projects.

What opportunities exist in the United Arab Emirates Infrastructure Market?

Opportunities in the United Arab Emirates Infrastructure Market include investments in smart city technologies, renewable energy projects, and public-private partnerships. The focus on sustainability and innovation presents avenues for growth in various infrastructure segments.

What trends are shaping the United Arab Emirates Infrastructure Market?

Trends shaping the United Arab Emirates Infrastructure Market include the integration of digital technologies in construction, a shift towards sustainable building practices, and increased focus on public transportation systems. These trends aim to enhance efficiency and reduce environmental impact.

United Arab Emirates Infrastructure Market

| Segmentation Details | Description |

|---|---|

| Type | Roads, Bridges, Railways, Airports |

| Technology | Smart Grids, Renewable Energy, IoT Solutions, Automation |

| End User | Government, Construction Firms, Utilities, Transport Operators |

| Service Type | Consulting, Project Management, Maintenance, Design |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Arab Emirates Infrastructure Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at