444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Arab Emirates (UAE) glass packaging market refers to the industry involved in the manufacturing and distribution of glass containers for various products. Glass packaging has become an essential component of the packaging sector due to its numerous advantages, including its ability to preserve the quality and integrity of products, its eco-friendly nature, and its aesthetic appeal. The UAE, being a major hub for trade and commerce in the Middle East, has witnessed significant growth in the glass packaging market.

Meaning

Glass packaging refers to the use of glass containers for storing and transporting various products, such as beverages, food items, cosmetics, pharmaceuticals, and more. Glass containers are made from a special type of glass that is durable, impermeable, and chemically stable. The use of glass packaging provides several benefits, including the preservation of product quality, the ability to showcase products, and the environmentally friendly nature of glass as a recyclable material.

Executive Summary

The United Arab Emirates glass packaging market has experienced substantial growth in recent years. This growth can be attributed to the increasing demand for glass containers across various industries, including food and beverages, pharmaceuticals, and cosmetics. The UAE’s favorable business environment, coupled with its strategic location as a trading hub, has further contributed to the growth of the glass packaging market. However, the market also faces certain challenges, such as the rising competition from alternative packaging materials and the impact of the COVID-19 pandemic.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

1. Growing Demand: The UAE glass packaging market is driven by the increasing demand for glass containers across various industries, including alcoholic and non-alcoholic beverages, food products, and personal care items.

2. Sustainability and Recyclability: Glass packaging is preferred by environmentally conscious consumers due to its recyclability and eco-friendly properties. The demand for sustainable packaging solutions has fueled the growth of the glass packaging market.

3. Premium Branding: Glass containers are often associated with premium and high-end products. Many companies prefer glass packaging to enhance the perceived value of their products and create a premium brand image.

4. Technological Advancements: The glass packaging industry has witnessed technological advancements, such as lightweight glass containers, improved manufacturing processes, and innovative bottle designs. These advancements have increased the efficiency and appeal of glass packaging.

Market Drivers

1. Increasing Consumer Awareness: Consumers are becoming more conscious of the environmental impact of packaging materials. Glass packaging is considered more sustainable and recyclable, leading to increased consumer preference for glass containers.

2. Growing Industries: The food and beverages, pharmaceuticals, and cosmetics industries are experiencing significant growth in the UAE. These industries rely heavily on glass packaging for the storage and transportation of their products, thereby driving the demand for glass containers.

3. Favorable Business Environment: The UAE offers a favorable business environment with tax incentives, infrastructure development, and government support for the packaging industry. These factors attract both domestic and international players, leading to market growth.

4. Shift towards Premium Products: The demand for premium and luxury products is on the rise in the UAE. Glass packaging is often associated with high-quality and premium products, making it a preferred choice for companies targeting the premium segment.

Market Restraints

1. Competition from Alternative Packaging Materials: Glass packaging faces competition from alternative materials, such as plastic, metal, and flexible packaging. These materials offer cost advantages and lightweight properties, which can pose a challenge to the growth of the glass packaging market.

2. Fragility and Transportation Costs: Glass containers are fragile and require careful handling during transportation. The transportation costs associated with glass packaging can be higher compared to other materials, impacting the overall cost-effectiveness for manufacturers.

3. Energy Intensive Manufacturing Process: Glass production involves high energy consumption, which contributes to increased production costs. Rising energy prices can affect the profitability of glass packaging manufacturers and pose a barrier to market growth.

4. Limited Recycling Infrastructure: Although glass is a recyclable material, the availability of efficient recycling infrastructure in the UAE is limited. This can hinder the adoption of glass packaging and pose challenges in achieving sustainable practices.

Market Opportunities

1. Increasing Focus on Sustainability: The growing emphasis on sustainable practices presents an opportunity for the glass packaging market. Manufacturers can capitalize on the demand for eco-friendly packaging solutions and promote the recyclability and reusability of glass containers.

2. Innovation and Design: The glass packaging industry can explore opportunities for innovation and design. Unique bottle shapes, embossing, and other creative features can differentiate products in the market and attract consumer attention.

3. E-commerce Packaging: With the rise of e-commerce, there is a need for robust and secure packaging solutions. Glass containers can offer advantages in terms of product protection and aesthetic appeal, creating opportunities for the glass packaging market in the e-commerce sector.

4. Export Potential: The UAE’s strategic location and well-established trade relations present opportunities for glass packaging manufacturers to expand their reach and tap into international markets. Export-oriented strategies can help companies in the UAE leverage the growing global demand for glass containers.

Market Dynamics

The UAE glass packaging market is influenced by various dynamic factors. The industry’s growth is driven by the demand from key end-user sectors, such as food and beverages, pharmaceuticals, and cosmetics. Consumer preferences for sustainable and premium packaging solutions have also contributed to market expansion. However, the market faces challenges in terms of competition from alternative packaging materials, fragility-related transportation costs, and limited recycling infrastructure. To sustain growth, the industry must focus on innovation, sustainability, and exploring emerging opportunities in e-commerce and export markets.

Regional Analysis

The UAE glass packaging market is concentrated in major regions, including Dubai, Abu Dhabi, and Sharjah. These regions serve as major economic and industrial hubs in the country. Dubai, in particular, has witnessed significant growth in the glass packaging sector due to its well-developed infrastructure, international trade connections, and booming tourism industry. The presence of key manufacturers, suppliers, and distributors in these regions has contributed to the overall growth and competitiveness of the glass packaging market in the UAE.

Competitive Landscape

Leading Companies in the UAE Glass Packaging Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

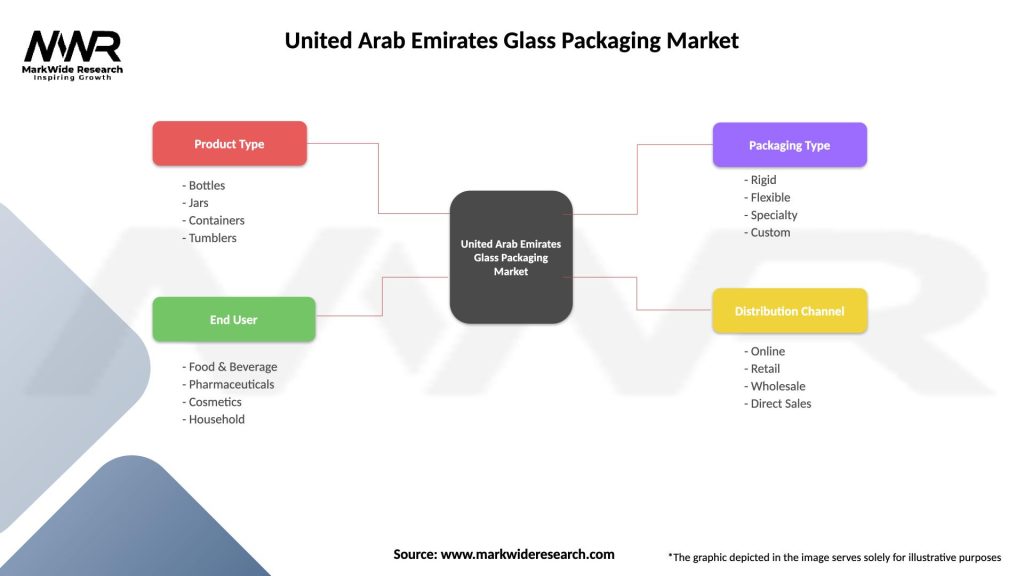

Segmentation

The UAE glass packaging market can be segmented based on various factors, including product type, end-use industry, and application. Common segmentation categories include:

1. Product Type: Bottles, jars, vials, ampoules, and others.

2. End-use Industry: Food and beverages, pharmaceuticals, cosmetics, and others.

3. Application: Alcoholic beverages, non-alcoholic beverages, food products, personal care products, and more.

Segmentation allows market participants to target specific customer segments, understand industry trends, and tailor their offerings to meet the diverse requirements of end-users.

Category-wise Insights

1. Bottles: Glass bottles are widely used in the food and beverages industry for packaging various products, including alcoholic beverages, juices, oils, and sauces. The demand for premium and craft beverages has contributed to the growth of glass bottle packaging in the UAE.

2. Jars: Glass jars find applications in the food industry for packaging products like jams, pickles, spices, and baby food. The transparency and visual appeal of glass jars make them a popular choice for consumers.

3. Vials and Ampoules: The pharmaceutical industry extensively uses glass vials and ampoules for storing and dispensing medications. Glass packaging ensures the integrity and safety of pharmaceutical products.

4. Cosmetics Containers: Glass containers are favored in the cosmetics industry for their premium look and ability to preserve the quality of cosmetic products. Glass jars, bottles, and compacts are commonly used for packaging skincare and beauty products.

Understanding category-wise insights helps industry participants identify growth opportunities, develop targeted marketing strategies, and meet the specific demands of each product category.

Key Benefits for Industry Participants and Stakeholders

1. Sustainable and Eco-friendly Image: Glass packaging provides industry participants with the opportunity to promote their commitment to sustainability and eco-friendly practices. This can enhance brand reputation and appeal to environmentally conscious consumers.

2. Premium Branding and Product Differentiation: Glass containers are often associated with premium and high-quality products. By opting for glass packaging, industry participants can position their products as premium offerings and differentiate themselves from competitors.

3. Product Protection and Shelf Life Extension: Glass packaging offers excellent barrier properties, protecting products from external factors such as light, moisture, and oxygen. This helps extend the shelf life of perishable goods and maintains product quality.

4. Aesthetic Appeal and Consumer Perception: Glass packaging has a visually appealing and luxurious look, which can positively influence consumer perception and attract attention on store shelves. Well-designed glass containers can enhance the overall product experience.

5. Recyclability and Circular Economy: Glass is a recyclable material that can be reused multiple times without losing its quality. By adopting glass packaging, industry participants contribute to a circular economy and support sustainable practices.

SWOT Analysis

A SWOT analysis provides a comprehensive understanding of the strengths, weaknesses, opportunities, and threats faced by the UAE glass packaging market.

Strengths:

– High-quality manufacturing processes

– Strong demand from key industries

– Favorable business environment

– Recyclability and eco-friendly nature

Weaknesses:

– Fragility and transportation costs

– Energy-intensive production process

– Limited recycling infrastructure

Opportunities:

– Growing focus on sustainability

– Innovation in design and packaging solutions

– Expansion into e-commerce and export markets

Threats:

– Competition from alternative packaging materials

– Changing consumer preferences

– Economic uncertainties and market fluctuations

Market Key Trends

1. Lightweight Glass Containers: Manufacturers are focusing on producing lightweight glass containers to reduce transportation costs and improve sustainability. Advanced technologies enable the production of thinner glass without compromising strength and durability.

2. Customized and Premium Designs: Brands are opting for custom-designed glass packaging to create a unique and premium product experience. Embossing, custom shapes, and innovative closures are some of the trends in customized glass packaging.

3. Digital Printing: Digital printing technology is gaining traction in the glass packaging industry. It allows for high-quality and precise printing on glass surfaces, enabling brands to incorporate intricate designs, logos, and promotional messages.

4. Smart Packaging: With the rise of smart technologies, glass packaging is also witnessing advancements in this area. Smart packaging solutions, such as interactive labels, temperature indicators, and RFID tags, add value and convenience to consumers.

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the UAE glass packaging market. While the market experienced a temporary setback during the initial phase of the pandemic due to disruptions in the supply chain and reduced consumer spending, it quickly recovered as the economy reopened and consumer demand picked up. The pandemic highlighted the importance of hygienic and safe packaging, which further increased the demand for glass containers in the food and pharmaceutical industries. Additionally, the growing awareness of sustainability and the recyclability of glass packaging have become more pronounced during the pandemic, driving the preference for glass containers among environmentally conscious consumers.

Key Industry Developments

1. Technological Advancements: The glass packaging industry has witnessed advancements in manufacturing processes and machinery, enabling higher production efficiency and improved quality.

2. Sustainable Initiatives: Many glass packaging manufacturers in the UAE have adopted sustainable practices, such as reducing carbon emissions, implementing recycling programs, and using eco-friendly materials in packaging production.

3. Partnerships and Collaborations: Key players in the glass packaging market have formed strategic partnerships and collaborations with other industry stakeholders, including suppliers, distributors, and technology providers, to strengthen their market position and expand their product offerings.

4. Product Innovation: Companies are focusing on product innovation to meet changing consumer demands. This includes introducing new bottle designs, enhancing packaging functionality, and exploring emerging trends in the market.

Analyst Suggestions

1. Embrace Sustainability: Given the growing focus on sustainability, glass packaging industry participants should prioritize eco-friendly practices, such as energy-efficient manufacturing, using recycled glass, and promoting recycling initiatives.

2. Invest in Research and Development: Continuous investment in research and development can help industry participants stay ahead of the curve and develop innovative packaging solutions that meet the evolving needs of customers.

3. Collaborate with Stakeholders: Collaboration with suppliers, distributors, and retailers is crucial to strengthen the supply chain and ensure a smooth flow of products. Working closely with stakeholders can lead to improved efficiency and better market reach.

4. Focus on Digitalization: Adopting digital technologies, such as digital printing, data analytics, and automation, can enhance operational efficiency, improve product customization, and streamline processes in the glass packaging industry.

Future Outlook

The future outlook for the UAE glass packaging market is optimistic, with steady growth anticipated in the coming years. The increasing demand for sustainable packaging solutions, coupled with the country’s focus on innovation and technological advancements, will drive market expansion. The market is expected to witness further consolidation as key players aim to enhance their market share through strategic partnerships and acquisitions. Moreover, the rise of e-commerce and the growing export potential present new avenues for growth and market penetration. However, industry participants must continue to address challenges related to competition from alternative materials, transportation costs, and limited recycling infrastructure to sustain long-term growth.

Conclusion

The United Arab Emirates glass packaging market has experienced significant growth in recent years, driven by increasing demand from various industries and consumer preferences for sustainable and premium packaging solutions. While the market faces challenges such as competition from alternative materials and limited recycling infrastructure, it also presents opportunities for innovation, design, and expansion into e-commerce and export markets. By focusing on sustainability, investing in research and development, and embracing digitalization, industry participants can capitalize on market trends and ensure long-term success. The future outlook for the UAE glass packaging market remains positive, with steady growth expected in the coming years.

What is Glass Packaging?

Glass packaging refers to the use of glass containers for the storage and transportation of various products, including food, beverages, cosmetics, and pharmaceuticals. It is valued for its recyclability, inert nature, and ability to preserve product quality.

What are the key players in the United Arab Emirates Glass Packaging Market?

Key players in the United Arab Emirates Glass Packaging Market include companies like Ardagh Group, O-I Glass, and Emirates Glass. These companies are known for their innovative packaging solutions and commitment to sustainability, among others.

What are the growth factors driving the United Arab Emirates Glass Packaging Market?

The growth of the United Arab Emirates Glass Packaging Market is driven by increasing consumer demand for sustainable packaging solutions, the rise in the food and beverage industry, and the growing trend of premium packaging among brands.

What challenges does the United Arab Emirates Glass Packaging Market face?

The United Arab Emirates Glass Packaging Market faces challenges such as high production costs, competition from alternative packaging materials like plastics, and logistical issues related to the weight and fragility of glass products.

What opportunities exist in the United Arab Emirates Glass Packaging Market?

Opportunities in the United Arab Emirates Glass Packaging Market include the increasing focus on eco-friendly packaging, innovations in glass manufacturing technologies, and the expansion of e-commerce, which requires robust packaging solutions.

What trends are shaping the United Arab Emirates Glass Packaging Market?

Trends shaping the United Arab Emirates Glass Packaging Market include the growing popularity of personalized packaging, advancements in lightweight glass technology, and an increasing emphasis on circular economy practices in packaging.

United Arab Emirates Glass Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Tumblers |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Packaging Type | Rigid, Flexible, Specialty, Custom |

| Distribution Channel | Online, Retail, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UAE Glass Packaging Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at