444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Arab Emirates electrocardiograph (ECG) market represents a dynamic and rapidly evolving healthcare technology sector that has experienced remarkable growth in recent years. As one of the most advanced healthcare systems in the Middle East, the UAE has positioned itself as a regional leader in medical device adoption and cardiovascular care excellence. The ECG market encompasses a comprehensive range of diagnostic equipment, from traditional 12-lead ECG machines to advanced portable and wireless monitoring systems that serve hospitals, clinics, and ambulatory care facilities across the seven emirates.

Market dynamics in the UAE reflect the country’s commitment to healthcare modernization and its Vision 2071 initiative, which emphasizes becoming a global hub for medical innovation. The electrocardiograph market has witnessed substantial expansion driven by increasing cardiovascular disease prevalence, growing awareness of preventive healthcare, and significant investments in healthcare infrastructure. With a compound annual growth rate (CAGR) of 8.2% projected over the forecast period, the market demonstrates robust momentum supported by both public and private sector initiatives.

Healthcare transformation initiatives across the UAE have created favorable conditions for ECG technology adoption. The integration of artificial intelligence, cloud-based monitoring systems, and telemedicine capabilities has revolutionized cardiac diagnostics, making ECG equipment more accessible and efficient. Major healthcare providers including Cleveland Clinic Abu Dhabi, American Hospital Dubai, and government facilities under the Department of Health Abu Dhabi have invested heavily in state-of-the-art electrocardiograph systems.

The United Arab Emirates electrocardiograph (ECG) market refers to the comprehensive ecosystem of cardiac diagnostic equipment, software solutions, and related services designed to measure and record the electrical activity of the heart within the UAE healthcare system. This market encompasses various ECG technologies including resting ECG machines, stress test systems, Holter monitors, event recorders, and mobile cardiac telemetry devices that enable healthcare professionals to diagnose and monitor cardiovascular conditions effectively.

ECG technology serves as a fundamental diagnostic tool in modern cardiology, providing non-invasive assessment of heart rhythm, rate, and electrical conduction patterns. In the UAE context, the market includes both traditional hospital-based systems and innovative portable solutions that support the country’s expanding telemedicine and home healthcare initiatives. The integration of digital health platforms and AI-powered interpretation algorithms has transformed ECG diagnostics from simple rhythm analysis to comprehensive cardiovascular risk assessment tools.

Strategic market positioning places the UAE electrocardiograph market at the forefront of Middle Eastern healthcare technology adoption. The market benefits from strong government support, robust healthcare infrastructure investments, and a growing population with increasing healthcare awareness. Key growth drivers include rising cardiovascular disease incidence, expanding elderly population, and the UAE’s strategic focus on becoming a medical tourism destination.

Technology advancement represents a critical market differentiator, with 65% of healthcare facilities implementing digital ECG systems equipped with cloud connectivity and remote monitoring capabilities. The market has experienced accelerated adoption of portable and wireless ECG devices, particularly following the COVID-19 pandemic, which highlighted the importance of remote patient monitoring and contactless healthcare delivery.

Competitive landscape features both international medical device manufacturers and emerging local distributors, creating a diverse ecosystem that serves various market segments. The integration of ECG technology with electronic health records (EHR) systems and population health management platforms has become increasingly important, driving demand for interoperable and scalable solutions across the UAE healthcare network.

Market segmentation reveals distinct patterns in ECG technology adoption across different healthcare settings and patient populations. The following key insights highlight the most significant market developments:

Cardiovascular disease prevalence serves as the primary driver for ECG market expansion in the UAE. The increasing incidence of heart disease, attributed to lifestyle factors, dietary changes, and an aging population, has created substantial demand for cardiac diagnostic equipment. Healthcare authorities report that cardiovascular conditions represent a leading cause of morbidity and mortality, necessitating enhanced diagnostic capabilities across all healthcare levels.

Government healthcare initiatives provide significant market momentum through strategic investments in medical infrastructure and technology modernization. The UAE’s commitment to achieving world-class healthcare standards has resulted in substantial funding for advanced medical equipment procurement, including state-of-the-art ECG systems. The UAE Vision 2071 emphasizes healthcare excellence as a national priority, driving continuous investment in diagnostic technologies.

Medical tourism growth creates additional demand for high-quality ECG equipment as the UAE positions itself as a regional healthcare destination. International patients seeking cardiac care expect access to the latest diagnostic technologies, compelling healthcare facilities to invest in advanced ECG systems that meet international standards and provide comprehensive cardiac assessment capabilities.

Population demographics contribute to market growth through an expanding elderly population and increasing health consciousness among younger demographics. The UAE’s diverse expatriate population brings varied cardiovascular risk profiles, requiring comprehensive screening and monitoring capabilities that drive ECG technology adoption across different healthcare settings.

High implementation costs represent a significant barrier for smaller healthcare facilities and private clinics seeking to upgrade their ECG capabilities. Advanced ECG systems with AI integration, cloud connectivity, and comprehensive monitoring features require substantial capital investment, potentially limiting adoption among cost-sensitive healthcare providers. The total cost of ownership, including software licensing, maintenance, and staff training, can be prohibitive for facilities with limited budgets.

Technical complexity poses challenges for healthcare facilities lacking specialized technical support and maintenance capabilities. Modern ECG systems require sophisticated IT infrastructure, cybersecurity measures, and ongoing software updates that may strain the resources of smaller healthcare providers. The integration with existing hospital information systems and electronic health records can be complex and time-consuming.

Regulatory compliance requirements create additional barriers through stringent approval processes and quality standards that medical device manufacturers must meet. The UAE health authorities maintain rigorous certification requirements that can delay product launches and increase market entry costs for new ECG technologies. Compliance with data privacy regulations and medical device standards adds complexity to market participation.

Skills shortage in specialized cardiac technicians and biomedical engineers limits the effective utilization of advanced ECG equipment. The rapid advancement of ECG technology requires continuous training and skill development, creating challenges for healthcare facilities in maintaining competent technical staff capable of operating and maintaining sophisticated diagnostic equipment.

Artificial intelligence integration presents substantial opportunities for ECG market expansion through enhanced diagnostic accuracy and automated interpretation capabilities. AI-powered ECG analysis systems can identify subtle cardiac abnormalities, predict cardiovascular events, and provide decision support for healthcare professionals. The development of machine learning algorithms specifically trained on Middle Eastern population data offers opportunities for more accurate and culturally relevant cardiac diagnostics.

Telemedicine expansion creates new market segments for remote ECG monitoring and consultation services. The COVID-19 pandemic accelerated adoption of telehealth solutions, creating opportunities for ECG manufacturers to develop integrated platforms that support remote patient monitoring, virtual consultations, and cloud-based data management. The UAE’s advanced telecommunications infrastructure provides an ideal foundation for telemedicine-enabled ECG services.

Home healthcare growth offers opportunities for portable and consumer-grade ECG devices that enable patients to monitor their cardiac health independently. The increasing focus on preventive healthcare and patient empowerment creates demand for user-friendly ECG devices that can be used outside traditional healthcare settings while maintaining clinical-grade accuracy and reliability.

Regional expansion opportunities exist for UAE-based healthcare providers and ECG technology companies to serve neighboring markets in the Gulf Cooperation Council (GCC) region. The UAE’s reputation for healthcare excellence and advanced medical technology creates opportunities for cross-border service delivery and technology transfer to other Middle Eastern markets.

Supply chain dynamics in the UAE ECG market reflect the country’s strategic position as a regional distribution hub for medical devices. Major international manufacturers maintain regional headquarters and distribution centers in the UAE, facilitating efficient product delivery and technical support across the Middle East. The presence of free trade zones and favorable import regulations supports competitive pricing and rapid technology adoption.

Technology evolution drives continuous market transformation through the introduction of innovative ECG solutions that address specific healthcare challenges. The shift from analog to digital systems, integration of wireless connectivity, and development of AI-powered interpretation algorithms represent ongoing technological transitions that reshape market dynamics. MarkWide Research analysis indicates that technology refresh cycles have accelerated, with healthcare facilities upgrading ECG equipment more frequently to maintain competitive advantages.

Competitive intensity has increased as both established medical device manufacturers and emerging technology companies compete for market share. The market dynamics favor companies that can provide comprehensive solutions including equipment, software, training, and ongoing support services. Strategic partnerships between international manufacturers and local distributors have become essential for market success.

Regulatory evolution continues to shape market dynamics through updated standards for medical device safety, data privacy, and interoperability. The UAE health authorities work closely with international regulatory bodies to ensure that ECG equipment meets global standards while addressing local healthcare needs and cultural considerations.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the UAE electrocardiograph market. Primary research included structured interviews with key stakeholders including hospital administrators, cardiac specialists, biomedical engineers, and medical device distributors across all seven emirates. The research methodology incorporated both quantitative and qualitative approaches to capture market dynamics, technology trends, and competitive positioning.

Data collection processes involved systematic gathering of information from healthcare facilities, regulatory authorities, and industry associations. Market surveys were conducted among healthcare professionals to understand ECG technology preferences, adoption barriers, and future requirements. Secondary research included analysis of government healthcare reports, medical device registration databases, and industry publications to validate primary research findings.

Market sizing methodologies utilized bottom-up and top-down approaches to estimate market segments and growth projections. The research team analyzed healthcare facility databases, equipment procurement records, and technology adoption patterns to develop accurate market assessments. Cross-validation techniques ensured data consistency and reliability across different research sources.

Quality assurance measures included peer review processes, data triangulation, and expert validation to ensure research accuracy and credibility. The methodology incorporated feedback from medical device industry experts and healthcare technology consultants to refine analysis and conclusions.

Dubai emirate leads the UAE ECG market with approximately 35% market share, driven by its concentration of private hospitals, medical centers, and international healthcare providers. The emirate’s focus on medical tourism and healthcare excellence has resulted in significant investments in advanced ECG technology. Major facilities including American Hospital Dubai, Mediclinic City Hospital, and Dubai Hospital have implemented state-of-the-art ECG systems with AI integration and telemedicine capabilities.

Abu Dhabi emirate represents the second-largest market segment with 30% market share, supported by government healthcare initiatives and major medical institutions. The presence of Cleveland Clinic Abu Dhabi, Sheikh Khalifa Medical City, and other leading healthcare facilities drives demand for premium ECG equipment. The emirate’s focus on healthcare research and development creates opportunities for innovative ECG technologies and clinical applications.

Northern emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively account for 25% market share. These emirates show growing demand for ECG equipment driven by population growth, healthcare infrastructure development, and increasing health awareness. Government hospitals and private clinics in these regions increasingly adopt modern ECG systems to improve cardiac care capabilities.

Regional healthcare integration initiatives promote standardization of ECG technology across emirates, facilitating patient data sharing and coordinated care delivery. The UAE’s national health information system supports interoperability between different ECG systems and healthcare facilities, enhancing the overall effectiveness of cardiac care delivery.

Market leadership in the UAE ECG sector is characterized by a mix of established international manufacturers and specialized regional distributors. The competitive landscape reflects the diverse needs of UAE healthcare facilities, from large hospital systems requiring comprehensive ECG solutions to smaller clinics seeking cost-effective diagnostic equipment.

Strategic partnerships between international manufacturers and local distributors have become essential for market success. These collaborations provide comprehensive support including equipment installation, staff training, maintenance services, and regulatory compliance assistance.

Technology-based segmentation reveals distinct market preferences and adoption patterns across different ECG system categories. The UAE market demonstrates strong demand for advanced digital systems with integrated software solutions and connectivity features.

By Technology:

By End User:

Hospital segment analysis reveals strong preference for integrated ECG systems that connect seamlessly with hospital information systems and electronic health records. Major UAE hospitals prioritize ECG equipment with advanced interpretation algorithms, multi-language support, and comprehensive reporting capabilities. The segment shows 78% adoption rate for digital ECG systems with network connectivity, reflecting the emphasis on data integration and workflow efficiency.

Ambulatory care insights highlight growing demand for portable and handheld ECG devices that enable point-of-care diagnostics. Private clinics and diagnostic centers increasingly adopt compact ECG systems that provide hospital-grade accuracy while maintaining cost-effectiveness. The segment demonstrates strong interest in cloud-based ECG management platforms that support remote interpretation and consultation services.

Emergency medical services category shows increasing adoption of ruggedized portable ECG systems designed for pre-hospital cardiac care. Dubai Corporation for Ambulance Services and other emergency providers invest in advanced ECG equipment with wireless transmission capabilities, enabling real-time consultation with hospital-based cardiologists during patient transport.

Home healthcare segment represents an emerging category with significant growth potential. Consumer-grade ECG devices and professional home monitoring systems address the needs of patients with chronic cardiac conditions who require regular monitoring outside traditional healthcare settings. The category benefits from increasing health awareness and preference for convenient healthcare delivery.

Healthcare providers benefit from enhanced diagnostic capabilities, improved patient outcomes, and operational efficiency through advanced ECG technology adoption. Modern ECG systems enable faster diagnosis, reduce interpretation errors, and support evidence-based treatment decisions. Integration with electronic health records streamlines workflow and improves care coordination across different healthcare settings.

Patients experience improved access to cardiac care, faster diagnosis, and enhanced monitoring capabilities through advanced ECG technology. Remote monitoring options provide convenience and peace of mind while reducing the need for frequent hospital visits. Early detection of cardiac abnormalities through routine ECG screening can prevent serious cardiovascular events and improve long-term health outcomes.

Medical device manufacturers benefit from the UAE’s strategic location, advanced healthcare infrastructure, and growing market demand. The country serves as an ideal testing ground for new ECG technologies and provides access to diverse patient populations. Successful UAE market entry often facilitates expansion into other Middle Eastern and African markets.

Government stakeholders achieve healthcare system improvements, reduced cardiovascular disease burden, and enhanced population health outcomes through ECG technology advancement. Investment in modern diagnostic equipment supports the UAE’s vision of becoming a global healthcare destination and contributes to economic diversification goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the UAE ECG market. Healthcare facilities increasingly adopt AI-powered ECG interpretation systems that provide automated analysis, pattern recognition, and clinical decision support. These systems demonstrate 92% accuracy rates in detecting common cardiac abnormalities, reducing interpretation time and improving diagnostic consistency across different healthcare providers.

Wireless connectivity and cloud-based ECG management platforms are becoming standard features in new equipment installations. Healthcare facilities prefer ECG systems that enable real-time data transmission, remote monitoring, and centralized data management. The trend supports the UAE’s digital health transformation initiatives and facilitates telemedicine service delivery.

Portable and handheld devices show rapid adoption growth, particularly in ambulatory care settings and emergency medical services. These compact ECG systems provide hospital-grade diagnostic capabilities while offering enhanced mobility and ease of use. The trend aligns with the growing emphasis on point-of-care diagnostics and decentralized healthcare delivery.

Integration with wearable technology creates new opportunities for continuous cardiac monitoring and preventive healthcare. Consumer wearables with ECG capabilities complement professional medical devices, enabling seamless monitoring across different care settings. MWR data indicates increasing interest in hybrid monitoring solutions that combine professional and consumer-grade ECG technologies.

Strategic partnerships between international ECG manufacturers and UAE healthcare providers have accelerated technology adoption and market expansion. Recent collaborations include comprehensive service agreements that provide equipment, software, training, and ongoing support as integrated solutions. These partnerships enable healthcare facilities to access advanced ECG technology while managing implementation complexity and costs.

Regulatory advancements by UAE health authorities have streamlined medical device approval processes while maintaining rigorous safety and quality standards. The introduction of fast-track approval pathways for innovative ECG technologies has reduced time-to-market for new products and encouraged manufacturer investment in the UAE market.

Research and development initiatives focusing on Middle Eastern population-specific cardiac risk factors have led to customized ECG interpretation algorithms and diagnostic protocols. Local research institutions collaborate with international manufacturers to develop ECG technologies that address regional health challenges and cultural considerations.

Infrastructure investments in healthcare IT systems and telecommunications networks have created favorable conditions for advanced ECG technology deployment. The UAE’s commitment to 5G network expansion and digital health platforms supports real-time ECG monitoring, telemedicine services, and integrated care delivery models.

Technology investment recommendations emphasize the importance of adopting ECG systems with AI integration, cloud connectivity, and interoperability features. Healthcare facilities should prioritize equipment that supports future technology upgrades and integrates seamlessly with existing hospital information systems. Investment in comprehensive training programs ensures maximum utilization of advanced ECG capabilities.

Market entry strategies for ECG manufacturers should focus on establishing strong local partnerships, providing comprehensive support services, and demonstrating clear value propositions for UAE healthcare providers. Success requires understanding local market dynamics, regulatory requirements, and cultural considerations that influence technology adoption decisions.

Service differentiation opportunities exist for companies that can provide integrated ECG solutions including equipment, software, training, maintenance, and clinical support. Healthcare facilities increasingly prefer vendors that offer comprehensive service packages rather than standalone equipment sales. Remote support capabilities and 24/7 technical assistance are becoming essential service components.

Innovation focus should address specific UAE market needs including multi-language support, integration with local health information systems, and adaptation to regional cardiac risk profiles. Manufacturers that invest in UAE-specific product development and clinical validation are likely to achieve stronger market positions and customer loyalty.

Market growth trajectory indicates continued expansion driven by healthcare infrastructure development, population growth, and increasing cardiovascular disease awareness. The UAE ECG market is projected to maintain strong growth momentum with compound annual growth rate of 8.2% over the next five years, supported by government healthcare initiatives and private sector investments.

Technology evolution will continue transforming ECG diagnostics through artificial intelligence advancement, machine learning integration, and predictive analytics capabilities. Future ECG systems will provide not only diagnostic information but also risk stratification, treatment recommendations, and population health insights. MarkWide Research projects that AI-powered ECG systems will achieve 85% market penetration by 2028.

Market consolidation trends suggest that successful ECG companies will be those offering comprehensive solutions rather than standalone products. Integration of ECG technology with broader cardiac care platforms, electronic health records, and population health management systems will become increasingly important for market competitiveness.

Regional expansion opportunities will emerge as UAE-based healthcare providers and technology companies leverage their market success to serve neighboring countries. The UAE’s position as a regional healthcare hub creates potential for cross-border service delivery and technology transfer to other Middle Eastern and African markets.

The United Arab Emirates electrocardiograph (ECG) market represents a dynamic and rapidly evolving sector that reflects the country’s commitment to healthcare excellence and technological innovation. With strong government support, advanced healthcare infrastructure, and growing demand for cardiac diagnostic services, the market demonstrates robust growth potential and significant opportunities for industry participants.

Key success factors in this market include technology innovation, comprehensive service delivery, and deep understanding of local healthcare needs and regulatory requirements. Companies that can provide integrated ECG solutions with AI capabilities, cloud connectivity, and seamless integration with existing healthcare systems are positioned for long-term success in this competitive market environment.

Future market development will be shaped by continued technological advancement, regulatory evolution, and changing healthcare delivery models. The integration of ECG technology with telemedicine, artificial intelligence, and population health management platforms will create new opportunities while requiring adaptation to evolving market demands and customer expectations. The UAE ECG market’s trajectory toward continued growth and innovation positions it as a key driver of regional healthcare technology advancement and a model for other emerging markets seeking to modernize their cardiac care capabilities.

What is Electrocardiograph (ECG)?

An Electrocardiograph (ECG) is a medical device that records the electrical activity of the heart over a period of time. It is commonly used to diagnose heart conditions, monitor heart health, and guide treatment decisions.

What are the key companies in the United Arab Emirates Electrocardiograph (ECG) Market?

Key companies in the United Arab Emirates Electrocardiograph (ECG) Market include GE Healthcare, Philips Healthcare, and Siemens Healthineers, among others.

What are the growth factors driving the United Arab Emirates Electrocardiograph (ECG) Market?

The growth of the United Arab Emirates Electrocardiograph (ECG) Market is driven by the increasing prevalence of cardiovascular diseases, advancements in ECG technology, and the rising demand for early diagnosis and preventive healthcare.

What challenges does the United Arab Emirates Electrocardiograph (ECG) Market face?

Challenges in the United Arab Emirates Electrocardiograph (ECG) Market include high costs of advanced ECG systems, a shortage of trained healthcare professionals, and regulatory hurdles that can delay product approvals.

What opportunities exist in the United Arab Emirates Electrocardiograph (ECG) Market?

Opportunities in the United Arab Emirates Electrocardiograph (ECG) Market include the integration of telemedicine solutions, the development of portable ECG devices, and increasing investments in healthcare infrastructure.

What trends are shaping the United Arab Emirates Electrocardiograph (ECG) Market?

Trends in the United Arab Emirates Electrocardiograph (ECG) Market include the rise of wearable ECG monitors, the use of artificial intelligence for data analysis, and a growing focus on preventive cardiology.

United Arab Emirates Electrocardiograph (ECG) Market

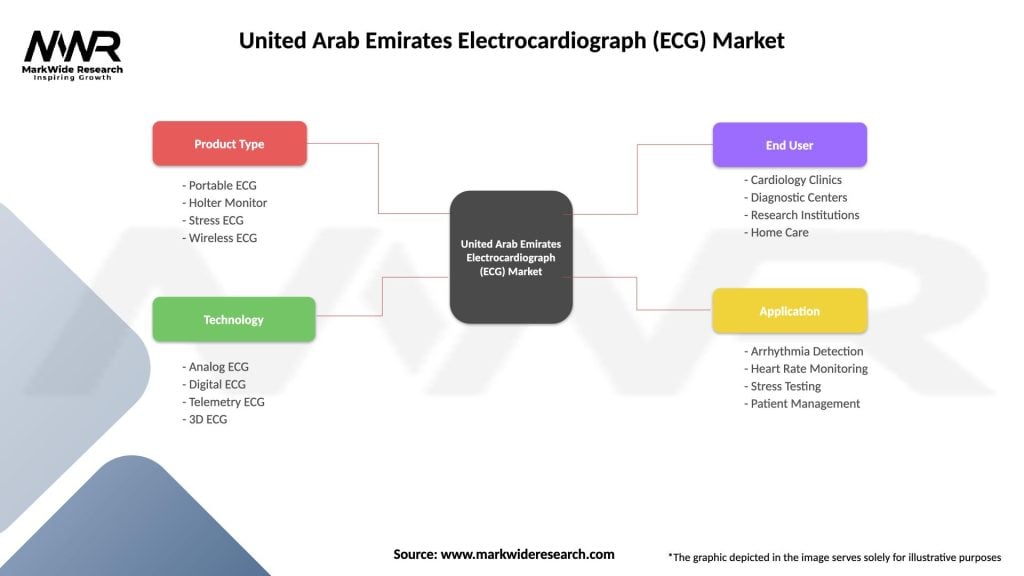

| Segmentation Details | Description |

|---|---|

| Product Type | Portable ECG, Holter Monitor, Stress ECG, Wireless ECG |

| Technology | Analog ECG, Digital ECG, Telemetry ECG, 3D ECG |

| End User | Cardiology Clinics, Diagnostic Centers, Research Institutions, Home Care |

| Application | Arrhythmia Detection, Heart Rate Monitoring, Stress Testing, Patient Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Arab Emirates Electrocardiograph (ECG) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at