444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Arab Emirates data center physical security market represents a rapidly evolving sector driven by the nation’s ambitious digital transformation initiatives and growing cybersecurity awareness. As the UAE positions itself as a regional technology hub, the demand for comprehensive physical security solutions in data centers has experienced unprecedented growth, with the market expanding at a robust CAGR of 12.3% over recent years.

Physical security infrastructure in UAE data centers encompasses a comprehensive range of solutions including biometric access controls, surveillance systems, environmental monitoring, fire suppression systems, and perimeter security measures. The market’s expansion is primarily fueled by increasing data center investments across Dubai, Abu Dhabi, and other emirates, with enterprise adoption rates reaching approximately 78% among large-scale facilities.

Government initiatives such as the UAE Digital Government Strategy 2025 and Smart Dubai 2021 have significantly accelerated the deployment of advanced data center facilities, creating substantial opportunities for physical security providers. The market demonstrates strong momentum across various segments, with cloud service providers and financial institutions leading adoption rates at 85% and 82% respectively.

Regional dynamics indicate that Dubai maintains the largest market share at approximately 45%, followed by Abu Dhabi at 32%, while other emirates collectively represent the remaining market portion. The increasing focus on data sovereignty and compliance with international security standards continues to drive sophisticated physical security implementations across the region.

The United Arab Emirates data center physical security market refers to the comprehensive ecosystem of hardware, software, and services designed to protect data center facilities from physical threats, unauthorized access, environmental hazards, and operational disruptions within the UAE region. This market encompasses all tangible security measures that safeguard critical IT infrastructure, servers, networking equipment, and sensitive data housed within data center environments.

Physical security solutions in this context include multiple layers of protection ranging from perimeter security systems and access control mechanisms to environmental monitoring and disaster recovery infrastructure. The market covers both traditional security measures such as surveillance cameras and security personnel, as well as advanced technologies including biometric authentication, artificial intelligence-powered threat detection, and automated response systems.

Market participants include specialized security technology providers, system integrators, managed security service providers, and data center operators who collectively deliver comprehensive protection strategies. The scope extends beyond mere equipment provision to include consulting services, installation, maintenance, monitoring, and compliance management tailored to meet the unique regulatory and operational requirements of the UAE market.

Market dynamics in the UAE data center physical security sector reflect a mature yet rapidly evolving landscape characterized by increasing sophistication in threat detection and response capabilities. The convergence of traditional physical security with advanced digital technologies has created new opportunities for integrated security solutions that address both current and emerging threats.

Key growth drivers include the UAE’s strategic positioning as a regional data hub, increasing regulatory compliance requirements, and growing awareness of physical security vulnerabilities. The market benefits from strong government support through various digital transformation initiatives, with public sector adoption contributing approximately 35% to overall market growth.

Technology trends indicate a significant shift toward intelligent security systems incorporating artificial intelligence, machine learning, and IoT connectivity. These advanced solutions enable predictive threat analysis, automated incident response, and comprehensive security orchestration across multiple data center facilities.

Competitive landscape features both international security technology leaders and regional specialists, creating a dynamic environment that fosters innovation and competitive pricing. The market demonstrates strong potential for continued expansion, supported by increasing data center investments and evolving security requirements across various industry verticals.

Strategic insights reveal several critical factors shaping the UAE data center physical security market landscape:

Market maturity indicators suggest that while basic physical security measures are widely adopted, there remains significant opportunity for advanced security technologies and managed services. The increasing sophistication of threats and regulatory requirements continues to drive demand for more comprehensive and intelligent security solutions.

Digital transformation initiatives across the UAE serve as the primary catalyst for data center physical security market growth. The government’s commitment to becoming a global technology leader through programs like UAE Vision 2071 and the National AI Strategy 2031 has accelerated data center investments, consequently driving demand for sophisticated physical security solutions.

Regulatory compliance requirements continue to intensify, with organizations facing increasing pressure to meet both local and international security standards. The UAE’s Personal Data Protection Law and alignment with global frameworks such as GDPR have created mandatory requirements for comprehensive physical security measures in data center environments.

Cybersecurity threat evolution has expanded beyond digital attacks to include sophisticated physical threats targeting data center infrastructure. The recognition that physical security breaches can lead to significant data compromises has elevated the importance of comprehensive physical protection strategies among organizations across all sectors.

Economic diversification efforts in the UAE have led to increased adoption of digital technologies across traditional industries such as oil and gas, healthcare, and manufacturing. This digital adoption creates new data center requirements and corresponding physical security needs, expanding the market beyond traditional technology sectors.

Regional hub positioning as organizations establish the UAE as their Middle East and Africa headquarters has increased the concentration of critical data center facilities. This geographic consolidation creates higher security requirements and greater investment in advanced physical security technologies to protect valuable regional operations.

High implementation costs associated with comprehensive physical security solutions present significant barriers for smaller organizations and emerging data center operators. The substantial capital investment required for advanced security technologies, combined with ongoing operational expenses, can limit market penetration among cost-sensitive segments.

Skills shortage in specialized security technologies creates implementation and operational challenges across the market. The limited availability of qualified professionals with expertise in advanced physical security systems, particularly those familiar with local regulations and cultural considerations, constrains market growth potential.

Technology complexity associated with integrating multiple security systems and platforms can create operational challenges for data center operators. The need to manage diverse security technologies while maintaining operational efficiency and ensuring seamless integration with existing infrastructure presents ongoing difficulties.

Regulatory uncertainty regarding evolving data protection and security requirements can create hesitation among organizations considering significant security investments. The dynamic nature of regulatory frameworks and potential changes in compliance requirements may delay decision-making processes for major security implementations.

Legacy system integration challenges affect organizations with existing data center infrastructure, as retrofitting advanced physical security solutions into older facilities can be technically complex and costly. The need to maintain operational continuity while upgrading security systems presents logistical and financial constraints.

Artificial intelligence integration presents substantial opportunities for security solution providers to develop advanced threat detection and response capabilities. The growing availability of AI technologies and increasing acceptance of automated security systems create significant potential for innovative physical security solutions that can predict and prevent security incidents.

Managed security services represent a rapidly expanding opportunity as organizations seek to outsource complex security operations to specialized providers. The growing preference for security-as-a-service models, particularly among smaller data center operators, creates substantial market potential for comprehensive managed security offerings.

Edge computing expansion across the UAE creates new requirements for distributed physical security solutions. As organizations deploy edge data centers and micro data centers closer to end users, the need for scalable and remotely manageable security solutions presents significant growth opportunities.

Sustainability integration offers opportunities for security solution providers to develop environmentally conscious products that align with the UAE’s sustainability goals. The increasing focus on green data centers creates demand for energy-efficient security systems and environmentally responsible security practices.

Cross-industry expansion beyond traditional technology sectors presents substantial growth potential. Industries such as healthcare, education, and government are increasingly recognizing the importance of data center physical security, creating new market segments for specialized security solutions.

Supply chain dynamics in the UAE data center physical security market reflect a complex ecosystem involving international technology providers, regional distributors, and local system integrators. The market benefits from the UAE’s strategic location as a trade hub, facilitating efficient access to global security technologies while supporting local expertise development.

Demand patterns demonstrate seasonal variations aligned with budget cycles and major technology refresh periods. Organizations typically increase security investments during the first and third quarters, creating predictable demand cycles that influence supplier strategies and resource allocation.

Technology adoption cycles show accelerating pace as organizations recognize the importance of staying current with evolving security threats. The typical technology refresh cycle has shortened from 5-7 years to 3-5 years, driven by rapid advancement in security technologies and changing threat landscapes.

Pricing dynamics reflect increasing commoditization of basic security technologies while premium pricing persists for advanced AI-powered and integrated security solutions. The market demonstrates price sensitivity among smaller operators while enterprise customers prioritize functionality and integration capabilities over cost considerations.

Partnership ecosystems continue to evolve as security providers form strategic alliances with data center operators, cloud service providers, and system integrators. These collaborative relationships enable comprehensive solution delivery and create competitive advantages through integrated service offerings.

Primary research for this market analysis involved comprehensive interviews with key stakeholders across the UAE data center physical security ecosystem, including security technology providers, data center operators, system integrators, and end-user organizations. The research methodology incorporated both quantitative surveys and qualitative discussions to gather comprehensive market insights.

Secondary research encompassed extensive analysis of industry reports, regulatory documents, company financial statements, and technology trend analyses. The research team examined government publications, industry association reports, and academic studies to establish comprehensive market context and validate primary research findings.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews with key respondents, and utilizing triangulation methods to ensure accuracy and reliability of market data. The research methodology incorporated both bottom-up and top-down approaches to market sizing and trend analysis.

Market segmentation analysis utilized advanced statistical techniques to identify distinct market segments based on technology type, application area, organization size, and industry vertical. The segmentation approach enabled detailed analysis of market dynamics across different customer categories and use cases.

Trend analysis incorporated both historical data review and forward-looking projections based on identified market drivers, technological developments, and regulatory changes. The methodology included scenario analysis to account for potential market variations and uncertainty factors.

Dubai emirate maintains market leadership with approximately 45% market share, driven by its position as the UAE’s commercial and technology hub. The emirate benefits from extensive data center infrastructure, including major facilities operated by international cloud service providers and regional telecommunications companies. Dubai Internet City and Dubai South serve as primary clusters for data center development, creating concentrated demand for advanced physical security solutions.

Abu Dhabi represents the second-largest market segment with approximately 32% market share, supported by government data centers, financial institutions, and energy sector organizations. The emirate’s focus on becoming a regional technology center through initiatives like Abu Dhabi Global Market and the Hub71 startup ecosystem continues to drive data center investments and corresponding security requirements.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent approximately 23% of the market. These emirates demonstrate growing data center activity driven by cost advantages, strategic locations for regional connectivity, and government initiatives to diversify their economies through technology adoption.

Regional connectivity advantages position the UAE as a critical hub for international data traffic between Europe, Asia, and Africa. This strategic positioning drives demand for high-security data center facilities that can support international organizations and service providers requiring comprehensive physical security measures.

Free zone developments across multiple emirates create specialized environments for data center operations with streamlined regulatory frameworks and enhanced security requirements. These developments attract international organizations seeking secure, compliant data center facilities with advanced physical security capabilities.

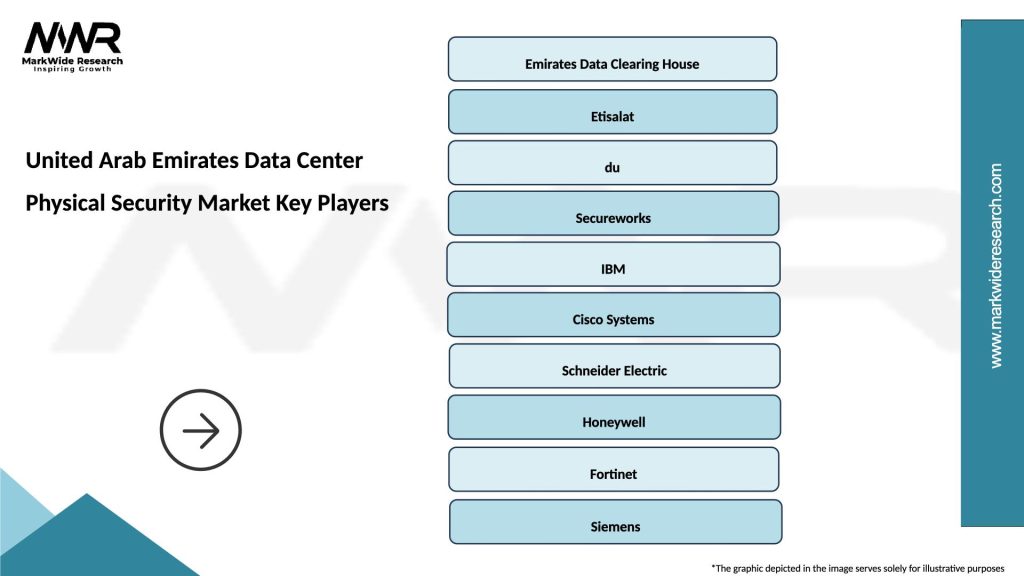

Market leaders in the UAE data center physical security sector include both international technology giants and specialized regional providers:

Regional specialists provide localized expertise and customized solutions tailored to UAE market requirements. These companies often partner with international technology providers to deliver comprehensive security implementations while providing local support and cultural understanding.

Competitive strategies focus on technology innovation, comprehensive service offerings, and strategic partnerships with data center operators and system integrators. Market leaders invest heavily in research and development to maintain technological advantages while expanding their regional presence through local partnerships and direct operations.

Market consolidation trends indicate increasing merger and acquisition activity as larger security providers seek to expand their capabilities and market presence. This consolidation creates opportunities for enhanced solution integration and comprehensive service delivery while potentially reducing competitive pricing pressure.

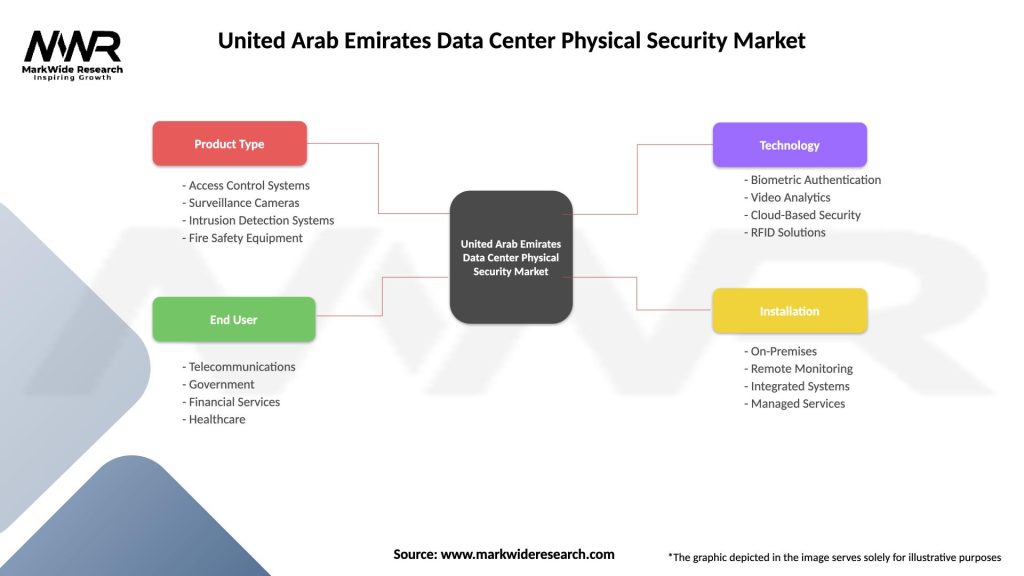

By Technology Type:

By Application Area:

By Organization Size:

By Industry Vertical:

Access Control Systems represent the largest market segment, driven by increasing sophistication in authentication technologies and regulatory requirements for controlled facility access. Biometric solutions demonstrate particularly strong growth, with adoption rates reaching 67% among enterprise data centers. The segment benefits from advancing technology capabilities and decreasing costs for advanced authentication methods.

Video Surveillance technologies show robust expansion fueled by AI-powered analytics capabilities and improved image quality. The integration of intelligent video analytics enables automated threat detection and behavioral analysis, creating significant value for data center operators seeking to optimize security operations while reducing staffing requirements.

Environmental Monitoring systems gain increasing importance as data centers focus on operational efficiency and equipment protection. These solutions provide critical insights into facility conditions while enabling predictive maintenance and energy optimization, creating dual benefits for security and operational management.

Fire Protection technologies continue to evolve with advanced detection capabilities and environmentally friendly suppression systems. The segment demonstrates steady growth driven by regulatory requirements and the critical importance of protecting valuable data center equipment from fire-related damage.

Integrated Security Platforms represent the fastest-growing category as organizations seek comprehensive solutions that combine multiple security technologies into unified management systems. These platforms enable centralized monitoring, automated response, and comprehensive reporting capabilities that enhance overall security effectiveness.

Data Center Operators benefit from comprehensive physical security solutions that protect valuable infrastructure investments while ensuring regulatory compliance and operational continuity. Advanced security systems enable operators to demonstrate security capabilities to customers while optimizing operational efficiency through automated monitoring and response capabilities.

Enterprise Customers gain confidence in data center security through visible and comprehensive physical protection measures. Robust security implementations support compliance requirements, protect sensitive data assets, and enable organizations to meet their own security obligations to customers and stakeholders.

Security Solution Providers access expanding market opportunities driven by increasing security awareness and regulatory requirements. The market provides opportunities for both technology innovation and service expansion, enabling providers to develop comprehensive offerings that address evolving customer needs.

System Integrators benefit from growing demand for complex security implementations that require specialized expertise and project management capabilities. The increasing sophistication of security requirements creates opportunities for value-added services and long-term customer relationships.

Government Stakeholders achieve enhanced national security and economic development objectives through improved data center security standards. Robust physical security implementations support the UAE’s positioning as a regional technology hub while protecting critical national infrastructure.

Insurance Providers can offer more competitive coverage terms for data centers with comprehensive physical security measures, creating mutual benefits for both insurers and data center operators through reduced risk exposure and improved loss prevention capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming data center physical security operations. AI-powered systems enable predictive threat analysis, automated incident response, and behavioral analytics that significantly enhance security effectiveness while reducing operational overhead. The integration of machine learning algorithms allows security systems to continuously improve their detection capabilities and reduce false alarms.

Zero Trust Security Models are increasingly adopted in data center environments, requiring comprehensive verification for all access requests regardless of location or user credentials. This approach drives demand for advanced authentication technologies and continuous monitoring solutions that can verify and validate all facility access attempts.

Cloud-based Security Management enables centralized monitoring and management of distributed data center facilities. This trend supports the growing number of edge computing deployments while providing scalable security operations that can adapt to changing facility requirements and organizational needs.

Sustainability Integration influences security technology selection as organizations prioritize energy-efficient solutions that align with environmental objectives. Green security technologies that minimize power consumption while maintaining comprehensive protection capabilities gain increasing market acceptance.

Convergence of Physical and Cybersecurity creates integrated security operations that address both digital and physical threats through unified platforms and coordinated response procedures. This convergence enables more comprehensive threat detection and response capabilities while optimizing security resource allocation.

Biometric Technology Advancement continues to enhance access control capabilities with improved accuracy, speed, and user experience. Advanced biometric solutions including multi-modal authentication and contactless recognition technologies address both security and operational efficiency requirements.

Technology Partnerships between international security providers and regional system integrators continue to expand, creating comprehensive solution delivery capabilities that combine global technology leadership with local market expertise. These partnerships enable more effective customer support and customized solution development.

Regulatory Enhancements including updates to data protection laws and security standards create new requirements for physical security implementations. Recent regulatory developments emphasize the importance of comprehensive security measures and regular compliance assessments for data center operations.

Infrastructure Investments by major cloud service providers and telecommunications companies drive demand for advanced physical security solutions. These investments create opportunities for security providers to participate in large-scale data center developments with comprehensive security requirements.

Innovation Centers established by security technology companies in the UAE enable local research and development activities focused on regional market needs. These facilities support technology customization and accelerate the development of solutions tailored to local requirements and preferences.

Training Programs developed by industry associations and educational institutions address the skills gap in physical security technologies. These programs support market growth by developing local expertise and reducing dependence on imported technical skills.

Standards Development through collaboration between government agencies, industry associations, and international organizations creates comprehensive frameworks for data center physical security. These standards provide guidance for security implementations while supporting market growth through increased clarity and consistency.

MarkWide Research analysis indicates that organizations should prioritize integrated security platforms that combine multiple protection technologies into unified management systems. This approach enables more effective security operations while reducing complexity and operational overhead associated with managing diverse security technologies.

Investment strategies should focus on scalable security solutions that can adapt to changing facility requirements and organizational growth. Organizations benefit from security architectures that support both current needs and future expansion while maintaining consistent protection standards across all facilities.

Vendor selection criteria should emphasize local support capabilities, integration expertise, and long-term partnership potential rather than focusing solely on technology features or pricing considerations. The complexity of data center security implementations requires ongoing support and continuous optimization to maintain effectiveness.

Compliance planning should anticipate evolving regulatory requirements and implement security solutions that exceed current minimum standards. This proactive approach reduces the risk of compliance gaps while positioning organizations to adapt quickly to new regulatory requirements.

Skills development investments in security technology training and certification programs provide long-term benefits through improved security operations and reduced dependence on external support. Organizations should prioritize building internal expertise in critical security technologies and operational procedures.

Risk assessment processes should incorporate both current and emerging threats while considering the unique characteristics of the regional operating environment. Comprehensive risk analysis enables more effective security planning and resource allocation decisions.

Market expansion projections indicate continued robust growth driven by increasing data center investments and evolving security requirements. The market is expected to maintain strong momentum with projected growth rates of 11.8% CAGR over the next five years, supported by government digital transformation initiatives and increasing enterprise adoption of advanced security technologies.

Technology evolution will continue to drive market transformation through artificial intelligence, machine learning, and IoT integration. These advanced technologies will enable more sophisticated threat detection capabilities while reducing operational complexity and improving cost effectiveness of comprehensive security implementations.

Regional expansion opportunities beyond the UAE create potential for market participants to leverage local expertise and established relationships to serve broader Middle East and Africa markets. The UAE’s position as a regional hub provides strategic advantages for companies seeking to expand their geographic presence.

Sustainability requirements will increasingly influence security technology selection as organizations prioritize environmental responsibility alongside security effectiveness. This trend creates opportunities for innovative security solutions that minimize environmental impact while maintaining comprehensive protection capabilities.

MWR projections suggest that managed security services will represent the fastest-growing market segment, with adoption rates expected to reach 58% among mid-market data center operators within the next three years. This growth reflects increasing recognition of the complexity and specialized expertise required for effective security operations.

Integration capabilities will become increasingly important as organizations seek security solutions that seamlessly connect with existing IT infrastructure and business processes. Future market success will depend on providers’ ability to deliver comprehensive, integrated solutions rather than standalone security technologies.

The United Arab Emirates data center physical security market demonstrates exceptional growth potential driven by the nation’s strategic digital transformation initiatives, robust regulatory framework, and position as a regional technology hub. Market dynamics reflect increasing sophistication in security requirements alongside growing recognition of physical security’s critical importance in comprehensive data protection strategies.

Key success factors for market participants include technology innovation, local expertise development, and comprehensive service capabilities that address the full spectrum of data center security requirements. The market rewards providers who can deliver integrated solutions combining advanced technology with deep understanding of local regulatory and operational requirements.

Future opportunities remain substantial as the market continues to evolve through artificial intelligence integration, sustainability focus, and expanding edge computing requirements. Organizations that invest in advanced security capabilities while building local expertise and partnerships will be best positioned to capitalize on continued market growth and transformation in the United Arab Emirates data center physical security market.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

What are the key players in the United Arab Emirates Data Center Physical Security Market?

Key players in the United Arab Emirates Data Center Physical Security Market include companies like Schneider Electric, Cisco Systems, and Honeywell, which provide various security solutions and technologies for data centers, among others.

What are the main drivers of the United Arab Emirates Data Center Physical Security Market?

The main drivers of the United Arab Emirates Data Center Physical Security Market include the increasing demand for data storage, the rise in cyber threats, and the need for compliance with regulatory standards. These factors are pushing organizations to invest in robust physical security measures.

What challenges does the United Arab Emirates Data Center Physical Security Market face?

Challenges in the United Arab Emirates Data Center Physical Security Market include the high costs associated with advanced security technologies and the complexity of integrating various security systems. Additionally, the rapid evolution of threats requires continuous updates and training.

What opportunities exist in the United Arab Emirates Data Center Physical Security Market?

Opportunities in the United Arab Emirates Data Center Physical Security Market include the growing trend of cloud computing and the increasing adoption of IoT devices, which require enhanced security measures. Furthermore, the expansion of data centers in the region presents significant growth potential.

What trends are shaping the United Arab Emirates Data Center Physical Security Market?

Trends shaping the United Arab Emirates Data Center Physical Security Market include the integration of AI and machine learning for threat detection, the use of biometric access controls, and the emphasis on sustainability in security solutions. These innovations are enhancing the overall security landscape.

United Arab Emirates Data Center Physical Security Market

| Segmentation Details | Description |

|---|---|

| Product Type | Access Control Systems, Surveillance Cameras, Intrusion Detection Systems, Fire Safety Equipment |

| End User | Telecommunications, Government, Financial Services, Healthcare |

| Technology | Biometric Authentication, Video Analytics, Cloud-Based Security, RFID Solutions |

| Installation | On-Premises, Remote Monitoring, Integrated Systems, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Arab Emirates Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at